Manila Electric SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Manila Electric Bundle

Manila Electric (Meralco) boasts significant strengths in its established market dominance and robust infrastructure, but faces challenges from evolving energy regulations and the growing adoption of renewable energy. Understanding these dynamics is crucial for navigating the future of the Philippine power sector.

Want the full story behind Meralco's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Meralco's dominant market position is a significant strength, stemming from its exclusive franchise covering Metro Manila and surrounding provinces, the economic heartland of the Philippines. This near-monopoly in a densely populated and high-demand region ensures a consistent and substantial customer base.

This exclusive franchise, in place for decades, has allowed Meralco to build an extensive and reliable distribution network. As of the first quarter of 2024, Meralco served over 7.7 million customers, highlighting the sheer scale of its operations and the difficulty for any potential competitor to replicate such infrastructure.

The regulatory environment and the sheer capital investment required to build a competing electricity distribution network create a substantial barrier to entry. This entrenched position provides Meralco with a stable revenue stream and a strong foundation for future growth and investment.

Meralco's position as an essential service provider is a significant strength, as it distributes electricity to millions of residential, commercial, and industrial customers across its franchise area. This fundamental service ensures a consistent and reliable demand for its offerings. For instance, in 2024, Meralco reported serving over 7.7 million customers, highlighting the vast reach of its indispensable service.

The inelastic nature of electricity demand provides Meralco with a stable revenue stream, even during economic downturns. This means that regardless of economic fluctuations, households and businesses will continue to require electricity, underpinning Meralco's financial resilience. This characteristic makes Meralco a defensive investment, offering a degree of stability in a volatile market.

Meralco boasts an extensive and well-established power distribution network covering its vast franchise area, a critical strength that acts as a significant barrier to entry for potential competitors. Replicating this vast infrastructure, which represents immense sunk costs, would demand substantial capital and considerable time, making it exceptionally difficult for new players to challenge Meralco's market position. This robust grid ensures efficient and reliable power delivery to millions of customers, including major industrial hubs, underpinning its operational advantage.

Diversified Business Interests

Meralco's strength lies in its diversified business interests, extending beyond its core electricity distribution. Through strategic investments and subsidiaries, the company has built a significant presence in power generation, contributing to a more robust revenue stream. For instance, Meralco PowerGen Corporation (MGen) is a key player in their generation portfolio.

This diversification into generation and retail electricity supply allows Meralco to manage risks more effectively. By not solely depending on distribution revenues, they can buffer against fluctuations in any single segment of the power value chain. This integrated approach enables them to capture value at multiple points, from generation to the end consumer.

The company's expansion into different facets of the energy sector also presents opportunities for vertical integration. This can lead to optimized operations and cost efficiencies. Meralco's commitment to this strategy is evident in its ongoing projects and investments aimed at strengthening its position across the entire power value chain.

Key aspects of Meralco's diversified strengths include:

- Expansion into Power Generation: Meralco PowerGen Corporation (MGen) operates several power plants, contributing significantly to the national grid.

- Retail Electricity Supply: The company actively participates in the retail electricity market, offering competitive plans to commercial and industrial customers.

- Risk Mitigation: Diversification reduces reliance on a single revenue source, enhancing financial stability.

- Vertical Integration: Control over generation and distribution allows for greater operational synergy and efficiency.

Stable and Growing Customer Base

Meralco's service area in the Philippines is experiencing robust economic expansion and increasing urbanization. This trend fuels a consistent rise in its customer base across residential, commercial, and industrial sectors, directly contributing to revenue growth.

For instance, Meralco reported a 3.7% increase in billed energy volume for the first nine months of 2023 compared to the same period in 2022, reaching 37,686 gigawatt-hours. This growth is a testament to the expanding demand driven by the nation's development.

- Growing Demand: The Philippines' economic trajectory and urbanization ensure a sustained increase in electricity consumption.

- Customer Acquisition: Meralco benefits from organic customer growth as new households and businesses are established within its franchise area.

- Revenue Stability: This expanding customer base provides a stable foundation for consistent revenue generation and future earnings.

Meralco's dominant market position, secured by its exclusive franchise in the Philippines' economic heartland, Metro Manila, and surrounding provinces, is a formidable strength. This near-monopoly, serving over 7.7 million customers as of Q1 2024, ensures a vast and consistent customer base, supported by an extensive and reliable distribution network built over decades. The immense capital and regulatory hurdles effectively create a significant barrier to entry, solidifying Meralco's entrenched market dominance and providing a stable revenue foundation.

The company's strategic diversification into power generation, notably through Meralco PowerGen Corporation (MGen), and its active participation in the retail electricity supply market, bolster its overall strength. This multi-faceted approach not only expands revenue streams but also allows for effective risk mitigation by reducing reliance on any single segment of the power value chain. Such vertical integration fosters operational synergies and cost efficiencies, enhancing its competitive edge.

Meralco benefits significantly from the robust economic expansion and increasing urbanization within its service area, which drives consistent growth in demand across all customer segments. For instance, billed energy volume saw a 3.7% increase in the first nine months of 2023 compared to the prior year, reaching 37,686 gigawatt-hours. This expanding customer base, fueled by economic development, provides a stable and growing foundation for the company's revenue generation and future financial performance.

| Metric | Value (Q1 2024 or latest available) | Significance |

|---|---|---|

| Customers Served | Over 7.7 million | Demonstrates extensive reach and market penetration. |

| Billed Energy Volume Growth (Jan-Sep 2023 vs 2022) | +3.7% | Indicates increasing demand driven by economic activity. |

| Exclusive Franchise Area | Metro Manila & surrounding provinces | Secures a near-monopoly in a high-demand economic hub. |

What is included in the product

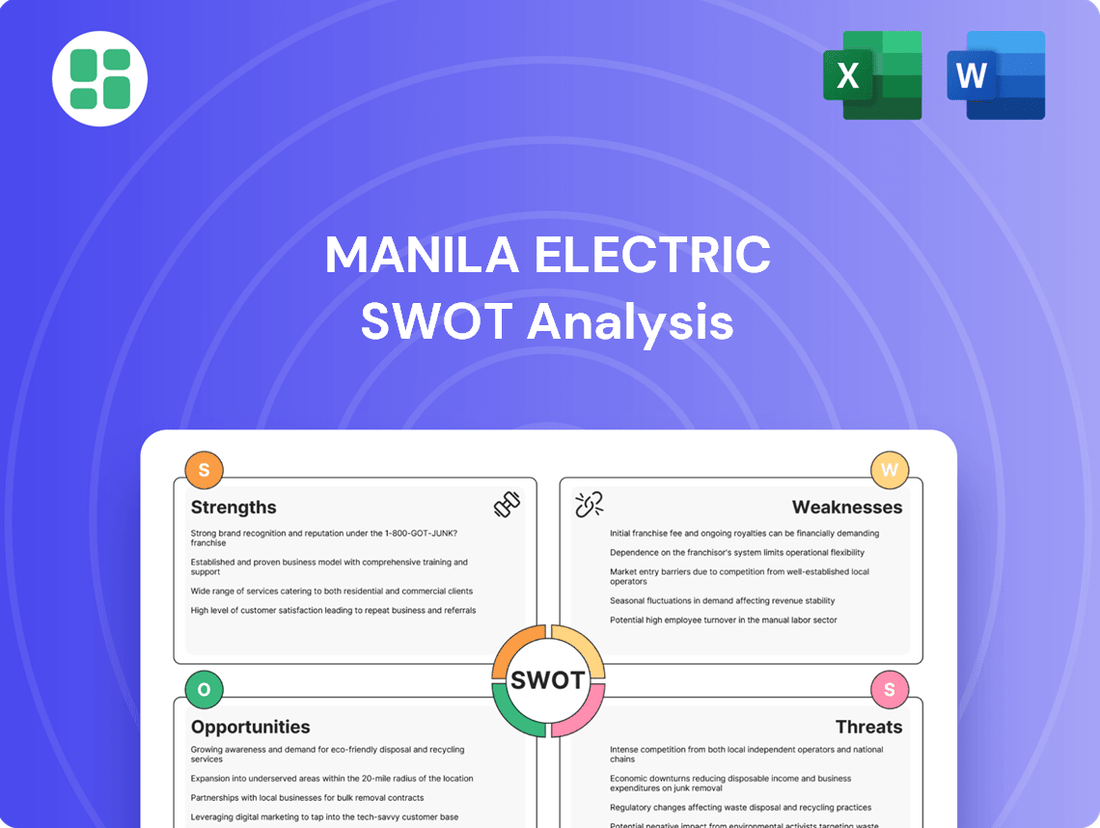

Analyzes Manila Electric’s competitive position through key internal and external factors, detailing its strengths, weaknesses, opportunities, and threats.

Provides a concise SWOT matrix for fast, visual strategy alignment, helping Meralco quickly identify and address operational challenges.

Weaknesses

Meralco's operations are heavily influenced by government regulations, particularly from the Energy Regulatory Commission (ERC). Changes in tariff structures, mandated investments, or even political pressure for lower rates can directly affect the company's financial performance. For instance, in 2023, the ERC reviewed Meralco's performance and approved a slight decrease in the overall electricity rate for residential customers, highlighting the commission's power to influence pricing.

Meralco's significant reliance on coal and natural gas for power generation exposes it directly to the unpredictable swings in global fuel prices. For instance, in 2024, coal prices have seen considerable volatility, impacting the cost of electricity production. Even with pass-through mechanisms, sharp increases in these input costs can strain consumer budgets and attract closer attention from regulators.

Meralco faces a significant challenge with its aging infrastructure, demanding continuous and substantial capital expenditures to maintain and upgrade its vast distribution network. A substantial portion of Meralco's infrastructure could be considered dated, requiring considerable investment for modernization, enhanced resilience against environmental factors, and overall efficiency improvements. For instance, in 2023, Meralco allocated PHP 25.3 billion for capital expenditures, with a significant portion directed towards network upgrades and improvements, highlighting the ongoing need for such investments to prevent service disruptions and customer dissatisfaction.

Dependence on External Power Suppliers

While Manila Electric Company (Meralco) has been increasing its own generation capacity, a significant portion of its power supply still comes from independent power producers (IPPs) and the Wholesale Electricity Spot Market (WESM). This reliance means Meralco is susceptible to supply chain issues and price fluctuations in the broader energy market. For instance, in 2024, a substantial percentage of Meralco's energy requirements were sourced from IPPs, highlighting this ongoing dependency.

This dependence on external suppliers creates inherent risks, including potential supply disruptions and contractual vulnerabilities. Furthermore, Meralco's exposure to the WESM exposes it to the volatility of real-time electricity prices, which can impact operational costs and, consequently, consumer tariffs. Managing these external factors is crucial for maintaining a stable and cost-effective power supply.

The challenge for Meralco lies in balancing its need for diverse power sources with the goal of securing consistent and affordable electricity. This involves navigating complex supply agreements and market dynamics to mitigate risks associated with external power providers. Ensuring a stable and cost-effective power supply remains a continuous challenge for the company.

Public Perception and Customer Complaints

Meralco faces significant challenges with public perception, particularly concerning electricity rates and service reliability. In 2024, the company has been under scrutiny for rate adjustments, with consumer groups frequently voicing concerns about the impact on household budgets. This can translate into increased regulatory pressure, as seen in past instances where public outcry led to investigations into pricing structures.

Customer complaints, often related to billing accuracy or service interruptions, directly impact Meralco's reputation. For example, during periods of extreme weather in 2024, widespread outages led to a surge in customer service calls and social media complaints, highlighting areas where service quality needs improvement. Effectively addressing these issues is crucial for maintaining customer trust and mitigating negative sentiment.

- Public Scrutiny: Meralco is consistently evaluated on its electricity rates and service dependability.

- Rate Sensitivity: High electricity costs in 2024 have intensified public and regulatory concern.

- Service Interruptions: Outages, especially during peak demand or adverse weather, generate significant customer dissatisfaction and complaints.

- Reputational Risk: Negative perceptions can lead to increased regulatory oversight and diminished customer loyalty.

Meralco's significant reliance on government regulation, particularly from the Energy Regulatory Commission (ERC), poses a weakness. Changes in tariff structures or mandated investments can directly impact financial performance, as seen with the ERC's 2023 review that approved a slight rate decrease for residential customers.

The company's dependence on external power suppliers, including independent power producers (IPPs) and the Wholesale Electricity Spot Market (WESM), exposes it to supply chain risks and price volatility. In 2024, a substantial portion of Meralco's energy requirements were sourced from IPPs, underscoring this ongoing dependency.

Meralco faces public scrutiny regarding its electricity rates and service reliability. High electricity costs in 2024 have intensified public and regulatory concern, and service interruptions, like those experienced during extreme weather in 2024, generate significant customer dissatisfaction and complaints.

Same Document Delivered

Manila Electric SWOT Analysis

This is the same Manila Electric SWOT analysis document included in your download. The full content is unlocked after payment.

You’re previewing the actual analysis document. Buy now to access the full, detailed report on Meralco's Strengths, Weaknesses, Opportunities, and Threats.

This preview reflects the real document you'll receive—professional, structured, and ready to use for strategic planning.

Opportunities

The global and national drive towards cleaner energy presents a significant opportunity for Meralco. The Philippines, for instance, aims to increase the share of renewables in its energy mix to 35% by 2030, a target Meralco can actively contribute to and benefit from.

By expanding its investments in solar, wind, and other renewable energy projects, Meralco can bolster its generation portfolio and explore distributed generation solutions. This strategic move not only supports sustainability objectives but also diversifies its energy sources away from volatile fossil fuel markets, potentially unlocking new revenue streams and enhancing its competitive edge in the evolving energy landscape.

Investing in smart grid technologies, like advanced metering infrastructure (AMI) and grid automation, offers Manila Electric a significant opportunity to boost operational efficiency. These upgrades can directly tackle system losses, which for the Philippine power sector, have historically been a concern, impacting overall profitability. By enabling better load management and new services, Meralco can also unlock cost savings and enhance customer satisfaction.

Meralco is actively expanding its digital footprint to improve customer interactions. In 2024, they are focusing on enhancing their online self-service options for billing and payments, aiming to reduce customer wait times and increase convenience. This digital push is designed to foster greater customer loyalty by offering more accessible and responsive service channels.

Growth in Retail Electricity Supply (RES)

The ongoing liberalization of the Philippine power sector, specifically through the Retail Competition and Open Access (RCOA) program, creates a significant avenue for Meralco to bolster its Retail Electricity Supply (RES) business. This regulatory shift allows for greater competition, pushing companies like Meralco to innovate and offer more attractive packages.

Meralco can capitalize on this by providing competitive pricing and unique value-added services tailored to large consumers. This strategic approach is key to attracting and retaining contestable customers, thereby expanding Meralco's market share within this growing segment. For instance, as of the first quarter of 2024, the RCOA program has seen a steady increase in participation, with more businesses actively choosing their electricity suppliers.

- Expanding RES Market Share: The RCOA program allows Meralco to directly engage with large industrial and commercial customers, moving beyond its traditional distribution role.

- Competitive Service Offerings: Meralco can differentiate itself by bundling RES with smart grid technologies, energy efficiency solutions, and flexible payment options.

- Customer Acquisition: By focusing on customer-centric strategies, Meralco aims to onboard a larger portion of the estimated 3,000+ contestable customers in its franchise area.

- Revenue Diversification: Growth in RES contributes to a more diversified revenue stream, reducing reliance on regulated distribution charges.

Regional Expansion and New Ventures

Meralco has a significant opportunity to expand its reach beyond its established franchise. This could involve securing new distribution franchises in underserved Philippine provinces, potentially tapping into areas with growing industrial and residential demand. For instance, as of early 2024, several regions in Mindanao and Visayas continue to experience robust economic activity and infrastructure development, presenting fertile ground for such expansion.

Furthermore, Meralco could investigate international ventures, particularly in Southeast Asian nations experiencing rapid economic growth and increasing energy consumption. This might include participating in competitive bidding for power distribution concessions or investing in renewable energy projects in countries like Vietnam or Indonesia, where energy demand is projected to rise substantially through 2025. Such diversification would not only broaden Meralco's revenue streams but also mitigate risks tied to reliance on a single market.

Exploring new energy-related services presents another avenue. This could encompass offering smart grid solutions, energy efficiency consulting, or even venturing into electric vehicle charging infrastructure development. The Philippine government's push towards sustainable energy and electrification, with targets for EV adoption by 2025, creates a supportive environment for these innovative ventures.

Key opportunities include:

- Securing new distribution franchises in underserved Philippine regions experiencing economic growth.

- Investing in power generation projects, particularly renewable energy, in emerging Southeast Asian markets.

- Expanding into ancillary energy services like smart grid technology and EV charging infrastructure.

- Leveraging its expertise to participate in international energy tenders and partnerships.

The global shift towards renewable energy offers Meralco a prime opportunity to expand its generation portfolio, aligning with the Philippines' goal of increasing renewables to 35% by 2030. By investing in solar and wind, Meralco can diversify its energy sources and tap into new revenue streams, enhancing its competitive position.

Investing in smart grid technologies like advanced metering infrastructure presents a chance to significantly improve operational efficiency and reduce system losses, a persistent challenge in the Philippine power sector. This modernization can lead to cost savings and better customer service.

The liberalization of the power sector through the Retail Competition and Open Access (RCOA) program allows Meralco to grow its Retail Electricity Supply (RES) business by offering competitive packages to large consumers, aiming to capture a larger share of the over 3,000 contestable customers in its franchise area.

Meralco can also explore expanding its distribution network into underserved Philippine provinces and potentially international markets in Southeast Asia, capitalizing on growing energy demand. Furthermore, venturing into new energy services like EV charging infrastructure aligns with government initiatives and creates diversified income opportunities.

Threats

The increasing adoption of rooftop solar and other distributed generation sources presents a significant threat to Manila Electric Company (Meralco). These technologies empower consumers to produce their own electricity, directly diminishing their need for grid-supplied power. This trend, while currently nascent, could lead to a notable reduction in Meralco's customer base and overall electricity demand, impacting its revenue streams.

Manila Electric Company (Meralco) faces significant risks from shifts in energy regulations and government policies. For instance, changes in tariff-setting mechanisms or new environmental compliance mandates could increase operational costs or limit revenue streams. A notable example from recent years is the ongoing review of power supply agreements and the potential for regulatory intervention in pricing structures.

Political pressure to keep electricity rates low, irrespective of economic realities or cost recovery needs, poses a persistent threat. Such pressures can directly impact Meralco's ability to achieve its target returns on investment and maintain financial stability. For example, in 2023, discussions around potential government subsidies or price caps on electricity could have significantly altered Meralco's earnings outlook if implemented.

As a vital utility, Meralco faces significant cybersecurity risks, with the energy sector increasingly targeted by sophisticated cyberattacks aiming to disrupt operations or steal sensitive customer data. In 2024, the International Energy Agency reported a notable increase in attempted cyber intrusions against energy grids globally, highlighting the persistent threat to critical infrastructure like Meralco's. Such attacks could lead to widespread power outages, impacting millions of customers and causing substantial economic losses.

Beyond digital threats, Meralco's physical infrastructure remains vulnerable to sabotage or attacks that could compromise service continuity and damage valuable assets. While physical attacks are less common than cyber threats, their potential impact on grid stability and Meralco's operational integrity is severe. Maintaining robust defenses against both digital and physical threats requires continuous investment in advanced security systems and protocols, which represent a significant ongoing cost for the company.

Impact of Climate Change and Natural Disasters

The Philippines' inherent vulnerability to natural disasters like typhoons and floods presents a significant threat to Meralco's operations. These events can severely damage its extensive distribution network, resulting in prolonged power outages and substantial repair expenses. For instance, Typhoon Odette in December 2021 caused widespread devastation, impacting Meralco's service areas and requiring significant capital for restoration efforts.

Climate change is anticipated to intensify the frequency and severity of such extreme weather phenomena. This escalating risk poses continuous operational and financial challenges for Meralco, necessitating ongoing investment in resilient infrastructure and robust disaster preparedness strategies. The economic impact of these disruptions can be substantial, affecting both the company's bottom line and the communities it serves.

- Increased frequency and intensity of typhoons and floods due to climate change.

- Potential for significant damage to Meralco's distribution infrastructure, leading to widespread power outages.

- High costs associated with infrastructure repair and restoration following natural disasters.

- Operational disruptions and potential revenue losses due to prolonged power interruptions.

Economic Slowdown and Reduced Demand

An economic slowdown in the Philippines, especially in Meralco's core service territories, poses a significant threat. This downturn could curb industrial and commercial operations, directly translating to lower electricity consumption. For instance, if the Philippine economy experiences a growth rate significantly below the projected 5.5% for 2024, as some analysts suggest, Meralco's sales volumes would likely contract.

This reduction in demand would inevitably impact Meralco's revenue streams and overall financial health. Higher inflation, potentially reaching 4.5% in 2024 according to government forecasts, coupled with elevated interest rates, could further dampen business investment and consumer spending, exacerbating the impact on electricity usage.

Key impacts include:

- Reduced Sales Volumes: Lower industrial output and commercial activity directly decrease electricity consumption, impacting Meralco's core business.

- Revenue Pressure: A decline in electricity sales translates to lower revenue, potentially affecting profitability and cash flow.

- Dampened Investment: Inflationary pressures and high interest rates can discourage new business ventures and expansions within Meralco's service area, hindering future demand growth.

The increasing adoption of distributed generation, like rooftop solar, directly challenges Meralco's traditional business model by reducing demand for grid power. This trend, while still developing, could significantly erode Meralco's customer base and revenue. For example, if distributed generation capacity grows by 15% annually, as some industry projections suggest, it could represent a substantial portion of peak demand within the next decade.

Manila Electric Company (Meralco) faces substantial threats from evolving energy regulations and government policy shifts. Changes in tariff structures or new environmental compliance requirements can directly increase operational expenses or limit revenue generation. For instance, ongoing reviews of power supply agreements and potential regulatory interventions in pricing mechanisms are critical factors to monitor.

Manila Electric Company (Meralco) faces a persistent threat from political pressures to maintain low electricity rates, even when faced with rising costs. This can hinder the company's ability to achieve targeted returns on investment and maintain financial stability. For example, discussions around potential price caps or subsidies in 2023 highlighted the sensitivity of Meralco's revenue to political considerations.

Cybersecurity threats pose a significant risk to Meralco's operations, as the energy sector is increasingly targeted by sophisticated attacks. The International Energy Agency noted a rise in attempted cyber intrusions against energy grids globally in 2024, underscoring the vulnerability of critical infrastructure. Such breaches could lead to widespread outages, impacting millions and causing substantial economic damage.

Natural disasters, particularly typhoons and floods, represent a significant threat to Meralco's extensive distribution network. Events like Typhoon Odette in December 2021 caused widespread damage, leading to prolonged outages and substantial repair costs. Climate change is expected to increase the frequency and intensity of these events, demanding continuous investment in resilient infrastructure and disaster preparedness.

An economic slowdown in the Philippines could significantly impact Meralco's sales volumes, as industrial and commercial activity declines. If the Philippine economy grows slower than the projected 5.5% for 2024, Meralco's electricity consumption would likely contract. High inflation, potentially around 4.5% in 2024, and elevated interest rates could further dampen business investment and consumer spending, exacerbating this effect.

| Threat Category | Specific Threat | Potential Impact | Example/Data Point |

|---|---|---|---|

| Technological Disruption | Rise of Distributed Generation (Rooftop Solar) | Reduced demand for grid power, loss of customer base and revenue. | Projections suggest 15% annual growth in distributed generation capacity. |

| Regulatory & Policy Changes | Shifts in Tariff Setting and Environmental Mandates | Increased operational costs, limited revenue streams, potential regulatory intervention in pricing. | Ongoing reviews of power supply agreements and pricing structures. |

| Socio-Political Factors | Political Pressure for Low Electricity Rates | Hindered ability to achieve target returns, financial instability. | Past discussions on potential price caps or subsidies in 2023. |

| Cybersecurity | Sophisticated Cyberattacks on Energy Grids | Disruption of operations, data breaches, widespread power outages, economic losses. | Increased global cyber intrusions against energy grids reported in 2024. |

| Natural Disasters & Climate Change | Intensified Typhoons and Floods | Damage to distribution network, prolonged outages, significant repair costs, operational disruptions. | Typhoon Odette (December 2021) caused widespread damage and restoration costs. |

| Economic Conditions | Economic Slowdown and High Inflation | Reduced industrial/commercial activity, lower electricity consumption, revenue pressure, dampened investment. | Philippine economic growth below 5.5% projection for 2024; inflation around 4.5% for 2024. |

SWOT Analysis Data Sources

This Manila Electric SWOT analysis is built upon a foundation of robust data, drawing from official company financial filings, comprehensive market research reports, and expert industry analyses to provide a thoroughly informed strategic overview.