Manila Electric Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Manila Electric Bundle

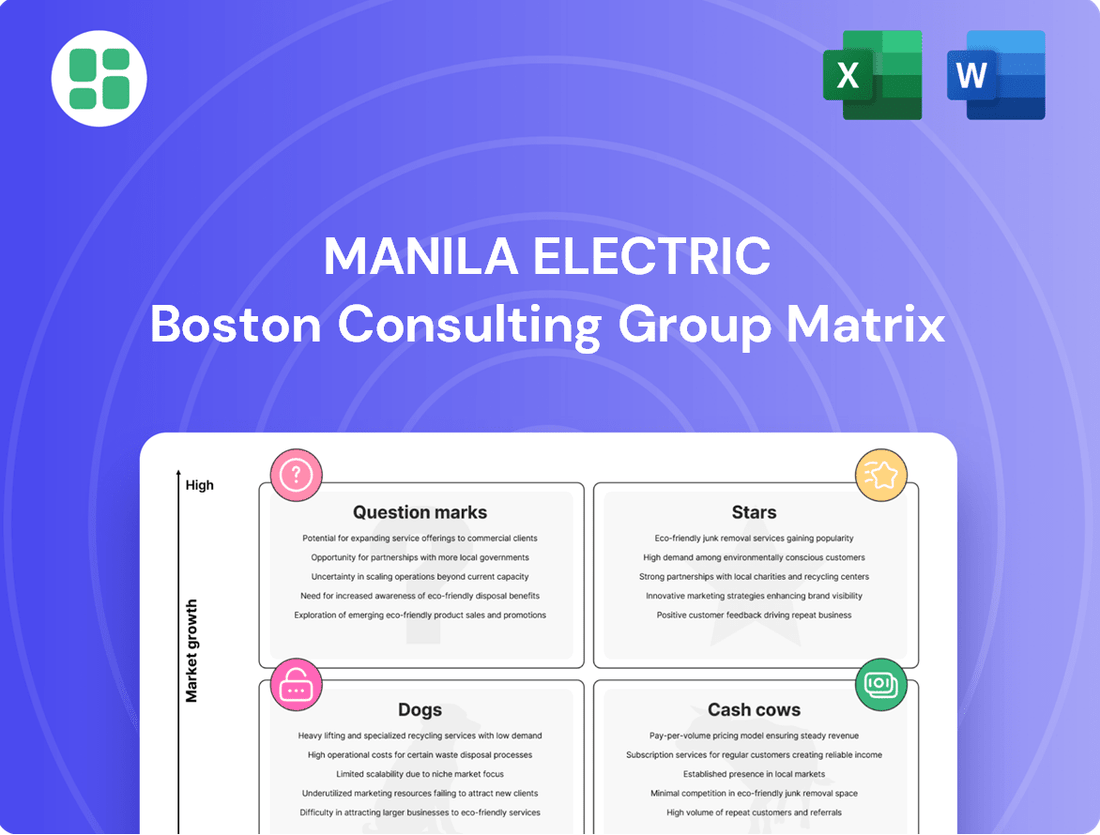

Uncover the strategic positioning of Manila Electric's diverse portfolio with our insightful BCG Matrix preview. See which of their offerings are fueling growth and which require careful consideration.

Dive deeper into this company’s BCG Matrix and gain a clear view of where its products stand—Stars, Cash Cows, Dogs, or Question Marks. Purchase the full version for a complete breakdown and strategic insights you can act on.

Stars

Meralco's power generation arm, MGen, is making substantial commitments to large-scale renewable energy, exemplified by the MTerra Solar Project. This ambitious undertaking, slated for launch in November 2024, is set to become the Philippines' largest clean energy facility. It will integrate 3,500 MWp of solar power with 4,500 MWh of battery storage, a significant investment in the nation's energy future.

This strategic move by Meralco places it at the forefront of the burgeoning renewable energy sector. The MTerra Solar Project is anticipated to power millions of homes with clean electricity. Financial projections indicate a substantial contribution to Meralco's EBITDA by 2027, underscoring the economic viability of such large-scale green initiatives.

Meralco, via its subsidiary Movem Electric Inc., is making significant strides in expanding the Philippines' electric vehicle (EV) charging infrastructure. This expansion, including a notable partnership with Polish firm ChargeEuropa, directly supports the nation's Electric Vehicle Industry Development Act and the increasing demand for EVs.

This strategic focus on EV charging positions Meralco in a high-growth market where it is actively building a dominant presence. The company intends to further bolster its charging network in 2025, adding to its already established infrastructure.

Meralco's extensive Advanced Metering Infrastructure (AMI) rollout, targeting 11 million smart meters over ten years, is a pivotal strategic move. This initiative significantly boosts grid efficiency and reliability by enabling real-time data for better management and customer engagement.

The AMI program directly supports customer choice initiatives, such as retail aggregation, by providing the necessary data infrastructure. This investment positions Meralco at the forefront of digital energy transformation, enhancing its competitive standing in the evolving utility sector.

Digital Customer Service Platforms

Meralco is significantly boosting its digital customer service platforms, recognizing their importance in the evolving utility landscape. By 2024, digital channels were already handling more than 60% of all customer interactions, demonstrating a strong shift towards online engagement.

The company's forward-looking 7Ds Digital Transformation Strategy, announced at MWC 2025, underscores a commitment to leveraging digital tools for enhanced customer experiences and operational improvements. This strategy is designed to integrate AI for smarter decision-making across the board.

These digital advancements are crucial for Meralco's market position. They ensure customers have easy access to information and services in real-time, which is key to maintaining high satisfaction levels and leadership in a sector rapidly embracing digital solutions.

- Digital Transaction Dominance: Over 60% of Meralco's customer transactions occurred via digital channels in 2024.

- 7Ds Digital Transformation Strategy: Launched at MWC 2025, focusing on customer experience, efficiency, and AI.

- Key Objectives: Improve accessibility, provide real-time information, and drive AI-driven decision-making.

- Strategic Importance: Vital for customer satisfaction and maintaining market leadership in the digital utility space.

Strategic Acquisition of Natural Gas Power Plants

Manila Electric Company (Meralco) is actively enhancing its power generation capabilities through strategic acquisitions, notably securing a 60% interest in Chromite Gas Holdings Inc. (CGHI) in January 2025. This move grants Meralco significant stakes in two operational natural gas power plants, collectively boasting a substantial 2.6 gigawatts (GW) of capacity.

These strategic plays, coupled with ongoing development of new liquefied natural gas (LNG) fired power projects, are crucial for Meralco's objective of diversifying its energy sources and ensuring a reliable supply of baseload power. This expansion solidifies Meralco's standing as a comprehensive power utility, well-positioned to meet escalating energy demands.

- Acquisition of CGHI: Meralco acquired a 60% stake in CGHI in January 2025.

- Natural Gas Capacity: The acquisition includes interests in two operational natural gas plants totaling 2.6 GW.

- Diversification Strategy: This move supports Meralco's goal to diversify its energy mix.

- Baseload Power Security: The natural gas assets are key to securing stable baseload power supply.

Meralco's investments in large-scale renewable energy, like the MTerra Solar Project, position it as a leader in the Philippines' clean energy transition. This project, the nation's largest clean energy facility, will integrate 3,500 MWp of solar power with 4,500 MWh of battery storage, set to launch in November 2024. Financial projections show a significant EBITDA contribution by 2027, highlighting the economic benefits of these green initiatives.

Meralco's expansion of the EV charging infrastructure, including a partnership with ChargeEuropa, directly supports the Electric Vehicle Industry Development Act. The company plans to further expand its charging network in 2025, solidifying its presence in this high-growth market.

The company's digital transformation, with over 60% of customer interactions via digital channels in 2024 and the 7Ds strategy launched at MWC 2025, is crucial for customer satisfaction and market leadership. This focus on AI and real-time information enhances customer experience and operational efficiency.

Meralco's acquisition of a 60% stake in Chromite Gas Holdings Inc. in January 2025, adding 2.6 GW of natural gas capacity, diversifies its energy sources and secures baseload power. This strategic move complements its development of new LNG-fired projects, reinforcing its role as a comprehensive power utility.

What is included in the product

This analysis highlights Meralco's business units, categorizing them into Stars, Cash Cows, Question Marks, and Dogs.

It provides strategic recommendations on investment, holding, or divestment for each Meralco business unit.

A clear BCG Matrix visualization for Meralco's business units simplifies complex strategic decisions, relieving the pain of uncertainty.

Cash Cows

Meralco's core electricity distribution franchise is a classic Cash Cow. It serves the vast Metro Manila region and surrounding provinces, a market with over 8 million customers as of the close of 2024. This dominant position in an essential service sector guarantees steady, significant cash flow.

The company's franchise has been renewed through 2053, ensuring its continued market leadership in a mature industry. This long-term stability allows Meralco to generate substantial profits from its core operations, which can then be reinvested in other business ventures.

The residential customer segment remains a cornerstone for Manila Electric Company (Meralco), demonstrating robust performance in 2024. This segment is a primary contributor to Meralco's overall energy sales, experiencing notable expansion driven by elevated household electricity usage and warmer weather patterns throughout the year.

With a substantial and dependable customer base across its franchise, the residential sector offers predictable demand and consistent revenue. Meralco benefits from this stability, as electricity is an essential service, requiring minimal incremental marketing spend to maintain engagement.

Meralco's commercial and industrial customer segments are indeed its cash cows, representing a substantial portion of its energy sales volume. These sectors, particularly in the bustling economic centers of Metro Manila, demonstrate consistent and robust demand for electricity. For instance, in 2024, commercial sales saw a notable uptick, fueled by ongoing business expansion, including significant mall redevelopments and the continuous opening of new retail outlets across its franchise area.

Established Billing and Collection Services

Meralco's established billing and collection services are a prime example of a Cash Cow within its business portfolio. These operations benefit from the company's deeply entrenched market position, ensuring a steady and reliable stream of revenue from its extensive customer base.

This mature segment, while exhibiting low growth prospects, is crucial for its high cash-generating capabilities. These funds are vital for maintaining Meralco's financial stability and providing the necessary capital to invest in and support other business units with higher growth potential.

- Dominant Market Share: Meralco's extensive network and long-standing presence give it a significant advantage in billing and collections.

- High Cash Flow Generation: The efficiency and scale of these services translate into consistent and substantial cash inflows.

- Digital Transformation: Over 60% of customer transactions are now handled through Meralco's digital channels, enhancing efficiency and reducing operational costs.

- Financial Stability: The predictable revenue from these services underpins the company's overall financial health.

Existing Baseload Power Generation Assets

Manila Electric Company (Meralco), through its generation arm MGen, possesses a robust portfolio of existing baseload power generation assets, primarily coal and natural gas plants. These facilities, like the significant Ilijan natural gas plant, are crucial for providing a stable and reliable power supply, underpinning Meralco's operations and contributing substantially to its financial performance.

These established power plants function as Meralco's cash cows, consistently generating strong earnings. In 2023, Meralco's consolidated core net income reached PHP 25.2 billion, with its power generation segment playing a pivotal role in this robust financial outcome. The consistent operational performance of these assets ensures a steady stream of revenue, solidifying their position as key profit drivers.

- Stable Earnings: Existing baseload assets like coal and gas plants provide predictable revenue streams.

- Significant Contribution: These assets are major contributors to Meralco's consolidated core net income, which was PHP 25.2 billion in 2023.

- Reliability: They ensure a consistent and reliable power supply, a critical factor in the energy market.

- Mature Assets: As established facilities, they represent mature investments with proven operational track records.

Meralco's established power generation assets, particularly its baseload plants, are prime examples of cash cows. These mature, reliable facilities consistently generate substantial revenue, contributing significantly to the company's overall profitability. For instance, Meralco's consolidated core net income stood at PHP 25.2 billion in 2023, with generation playing a crucial role.

| Asset Type | Contribution to Revenue (Illustrative) | Growth Outlook | Cash Flow Generation |

| Baseload Power Plants (Coal, Gas) | High | Low | Very High |

| Distribution Network | High | Low | High |

| Billing & Collections | Moderate | Low | High |

Preview = Final Product

Manila Electric BCG Matrix

The Manila Electric BCG Matrix preview you are currently viewing is the exact, fully formatted report you will receive immediately after purchase. This comprehensive document, meticulously prepared with industry-standard analysis, will be delivered without any watermarks or demo content, ensuring you get a professional, ready-to-use strategic tool.

Dogs

Obsolete or high-cost legacy power generation assets within Meralco's portfolio, perhaps older plants nearing the end of their operational lifespan or those with lower efficiency ratings, would fall into the 'Dogs' category of the BCG Matrix. These assets typically demand significant maintenance expenditures and struggle to compete on cost and environmental standards against newer, more efficient facilities. For instance, while Meralco has been actively investing in renewable energy and modern gas-fired plants, any remaining older coal or oil-fired units, if they exist and are underperforming, would represent this segment.

Manila Electric Company (Meralco), a leading utility provider, might have certain non-core, underperforming ancillary services that could be classified as 'Dogs' in a BCG Matrix analysis. These would be niche offerings that haven't achieved significant market penetration or operate in stagnant, low-demand sectors. Such services would likely require continued investment without generating commensurate returns or contributing to Meralco's overall strategic expansion.

While specific details on such services are not readily available in public disclosures, it's plausible for a large, diversified utility like Meralco to possess minor segments that are not meeting performance expectations. For instance, if Meralco had a highly specialized energy storage solution that faced intense competition or regulatory hurdles, it might fall into this category. The company’s 2024 financial reports would be crucial in identifying any such segments, though these are often not broken down to that granular level.

Outdated manual customer service processes, like paper-based billing inquiries or in-person meter reading requests, would fall into the Dogs category for Manila Electric. These methods were historically common but are now seen as inefficient and costly, leading to lower customer satisfaction in today's fast-paced digital world.

Meralco's significant shift towards digital channels, handling over 60% of its transactions in 2024 through these platforms, clearly demonstrates a strategic move away from these legacy, low-performing customer service approaches. This transition is crucial for improving operational efficiency and meeting modern customer expectations.

Non-Strategic Small Investments in Stagnant Industries

Non-strategic small investments in stagnant industries would be classified as Dogs in Meralco's BCG Matrix. These are typically businesses with low growth and low market share, offering minimal returns and tying up valuable capital. For instance, if Meralco had a small stake in a legacy telecommunications infrastructure provider that is being rapidly overtaken by newer technologies, this would fit the Dog category. Such ventures do not align with Meralco's strategic focus on core electricity distribution, generation, and the burgeoning new energy sector.

These investments represent a drain on resources that could be better allocated to Meralco's Stars or Question Marks, which offer higher growth potential. The company's 2024 strategy emphasizes expanding its renewable energy portfolio and modernizing its distribution network. For example, Meralco's investments in solar and wind power projects are designed to capture high-growth market segments, a stark contrast to the characteristics of Dog investments.

- Low Growth Potential: Investments in industries with minimal expected expansion, such as traditional landline telephone services or outdated manufacturing processes.

- Negligible Market Share: Meralco's presence in these sectors is insignificant, meaning it has little influence or competitive advantage.

- Capital Tie-up: Funds are locked in these underperforming assets, preventing reinvestment in more promising areas like electric vehicle charging infrastructure or smart grid technologies.

- Lack of Strategic Alignment: These ventures do not contribute to Meralco's long-term vision of becoming a leading integrated power utility and energy solutions provider.

Legacy IT Systems Requiring High Maintenance

Older, legacy IT systems that are difficult to integrate with newer technologies and require substantial maintenance costs without providing modern functionalities or significant operational advantages could be considered Dogs in the BCG Matrix. While Meralco is investing in digital transformation, the continued existence of such systems, if not actively being replaced, would represent a drain on resources. Meralco's digital transformation strategy aims to address these by moving towards cloud enablement and integrated resource management.

These legacy systems often incur high operational expenditures due to their age and the specialized skills needed for their upkeep. For instance, in 2024, many utilities worldwide are still grappling with the costs associated with maintaining outdated infrastructure, which can divert capital from more strategic investments. Meralco's focus on modernizing its IT landscape is crucial to avoid this resource drain.

- High Maintenance Costs: Legacy IT systems often require significant spending on upkeep, repairs, and specialized personnel, reducing funds available for innovation.

- Integration Challenges: Difficulty in integrating older systems with new technologies hinders operational efficiency and the adoption of advanced digital solutions.

- Lack of Modern Functionalities: These systems typically do not offer the advanced features and data analytics capabilities needed for competitive operations in the current market.

- Resource Drain: Continued reliance on such systems diverts financial and human resources away from Meralco's strategic digital transformation initiatives.

Within Meralco's portfolio, "Dogs" represent underperforming assets or services with low market share and growth potential, demanding resources without significant returns. These could include older, inefficient generation assets or non-core ancillary services that face intense competition or regulatory hurdles. Meralco's strategic focus on digital transformation and renewable energy expansion in 2024 highlights a clear effort to divest from or modernize these legacy segments, aiming to reallocate capital towards high-growth opportunities.

| Category | Description | Meralco Example (Illustrative) | Strategic Implication |

| Dogs | Low market share, low growth | Outdated IT systems, legacy manual customer service processes | Divest, harvest, or phase out to reallocate resources |

| Underperforming niche services | |||

| Small, non-strategic investments in stagnant industries |

Question Marks

Meralco PowerGen (MGen) is actively investing in early-stage Battery Energy Storage Systems (BESS), exemplified by its 49MW project in Cebu slated for completion by 2027. This segment represents a high-growth area vital for grid reliability and incorporating more renewable energy sources.

While Meralco's current market share in BESS is still taking shape, the significant capital expenditure involved positions these ventures as potential Stars within the BCG matrix. As the BESS market matures and Meralco solidifies its presence, these early investments are poised for substantial growth and market leadership.

Meralco's strategic investments in grid modernization are paving the way for distributed energy resources (DERs) like microgrids. These localized, resilient power solutions are a burgeoning sector with significant future growth potential in the Philippines.

Despite this investment, the widespread adoption of microgrids in the Philippines is still in its nascent stages. Consequently, Meralco's current market share within this specific emerging segment is likely minimal, positioning microgrids as a Question Mark in its BCG Matrix – a high-potential area requiring further development and market penetration.

While Meralco Group leads in customer count for Retail Electricity Supply (RES) in the Philippines, the Competitive Retail Electricity Market (CREM) is still developing, with other entities holding substantial demand share in specific areas. This suggests that Meralco's presence in certain niche or emerging RES segments, where its market share is still being established, could be viewed as a question mark. For instance, as of the first quarter of 2024, the CREM saw various suppliers vying for market share beyond the traditional large industrial customers, indicating a dynamic landscape.

Meralco's expansion into these less established RES segments requires continued strategic investment to solidify its position and potentially achieve dominant market share. The evolving regulatory framework and increasing customer demand for specialized energy solutions necessitate ongoing evaluation of these niche markets. For example, the growth in demand for green energy solutions among commercial clients presents an opportunity that Meralco is actively pursuing, but it remains a segment where market leadership is not yet guaranteed.

Green Hydrogen Initiatives

Meralco's green hydrogen initiatives would likely fall into the Stars or Question Marks category of the BCG matrix, depending on the scale of investment and market development. Early-stage exploration in green hydrogen, a nascent but high-potential sector, aligns with Meralco's long-term energy transition strategy. While currently representing a very small market share, these ventures could become significant future growth drivers.

These investments are inherently speculative, mirroring the characteristics of Question Marks. However, if Meralco secures early technological advantages or key partnerships in the burgeoning green hydrogen market, these initiatives could evolve into Stars. For instance, if global green hydrogen production costs were to significantly decrease by 2024, Meralco's early investments would be better positioned for growth.

- Green Hydrogen as a Future Growth Driver: Meralco's potential investments in green hydrogen are aimed at capturing future market share in a rapidly evolving energy landscape.

- Early-Stage Investment Profile: These ventures are characterized by high innovation and high growth potential, but with very low current market penetration, fitting the Question Mark profile.

- Strategic Alignment: Such initiatives are crucial for Meralco's stated commitment to a balanced energy mix and sustainable energy solutions, aligning with global decarbonization trends.

- Market Uncertainty: The success of green hydrogen hinges on technological advancements, cost reductions, and supportive regulatory frameworks, introducing significant market uncertainty.

Initial Deployment of AI for Network Operations

Manila Electric Company (Meralco) is actively integrating Artificial Intelligence (AI) into its network operations as part of a broader digital transformation. This initiative aims to achieve a 50% boost in network and service efficiency through advanced data visualization and integrated resource management.

While AI in grid operations represents a rapidly expanding technological frontier, Meralco's current market position or established dominance directly attributable to its AI deployments is still in its nascent stages. This positions AI for network operations as a Question Mark within Meralco's strategic portfolio, indicating substantial potential for future growth and impact.

- AI Integration: Meralco is deploying AI to enhance decision-making in network operations.

- Efficiency Goals: The company targets a 50% increase in network and service efficiency.

- Market Position: AI's impact on Meralco's market share is still developing.

- Strategic Classification: AI in network operations is considered a Question Mark due to high growth potential and evolving market dominance.

Meralco's ventures into emerging energy technologies like microgrids and green hydrogen, while holding significant future promise, currently represent nascent markets with limited established market share for the company. These areas are characterized by high growth potential but also substantial uncertainty regarding technological adoption and competitive positioning. Consequently, they are classified as Question Marks within Meralco's strategic portfolio.

The company's investments in AI for network operations also fit the Question Mark profile, as the benefits are still being realized and Meralco's market leadership derived from these specific deployments is yet to be firmly established. These segments require continued investment and strategic development to potentially transition into Stars or Cash Cows in the future.

BCG Matrix Data Sources

Our Manila Electric BCG Matrix is built on verified market intelligence, combining financial data, industry research, official reports, and expert commentary to ensure reliable, high-impact insights.