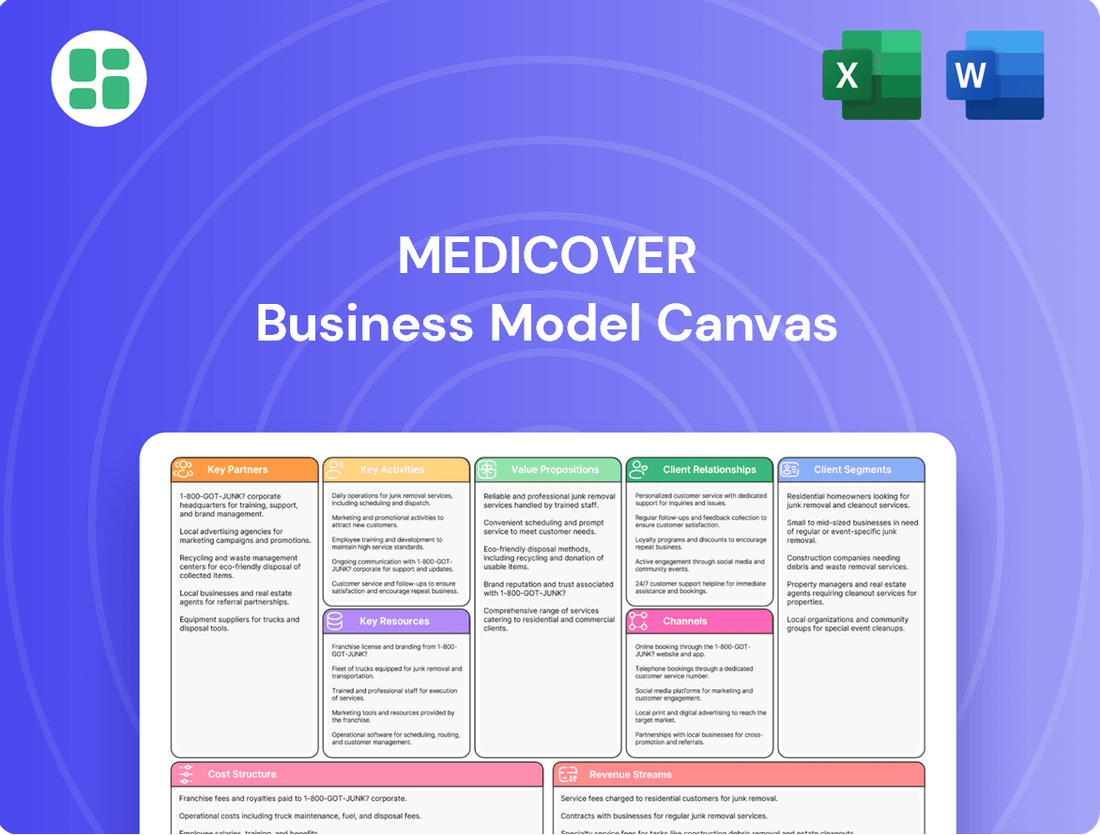

Medicover Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Medicover Bundle

Curious about how Medicover achieves its market dominance? Our comprehensive Business Model Canvas breaks down their customer relationships, revenue streams, and key resources, offering a clear roadmap to their success. Discover the strategic framework that fuels their growth and gain invaluable insights for your own ventures.

Partnerships

Medicover cultivates key partnerships with a diverse array of healthcare providers and specialist clinics. These collaborations are crucial for expanding its service portfolio and delivering holistic patient care.

By teaming up with external medical professionals and specialized facilities, Medicover can offer advanced treatments and niche services that complement its in-house capabilities. This strategic approach ensures patients have access to a wider spectrum of care, thereby improving their overall experience.

For instance, in 2024, Medicover's network expanded to include over 100 specialist clinics across its operating regions, facilitating access to over 50 distinct medical specializations. This growth directly supports the provision of specialized diagnostic procedures and specific therapeutic interventions, enhancing the depth and breadth of services available to patients.

Medicover's key partnerships with corporate clients and employers are fundamental to its business model, generating a substantial portion of its revenue. These partnerships involve offering integrated healthcare solutions and medical insurance as subscription services for employees.

In 2024, Medicover continued to solidify these relationships, recognizing them as a stable and core customer segment. These agreements are often tailored, including customized healthcare plans and the provision of on-site medical services, which cultivates enduring client loyalty.

Medicover actively partners with technology and digital solution providers to bolster its digital health ecosystem. These collaborations are instrumental in developing and refining mobile applications that streamline appointment scheduling, access to test results, and facilitate virtual consultations, thereby enhancing patient convenience and engagement.

In 2024, Medicover continued to invest in these partnerships, recognizing their critical role in improving healthcare accessibility and operational efficiency. For instance, advancements in their digital platforms aim to reduce patient wait times for appointments and lab results, contributing to a more seamless and modern healthcare journey.

These strategic alliances are fundamental to Medicover's innovation agenda, enabling the company to integrate cutting-edge digital tools and services. This focus on technological advancement ensures Medicover remains at the forefront of delivering contemporary, patient-centric healthcare solutions across its network.

Medical Equipment and Pharmaceutical Suppliers

Medicover relies heavily on its partnerships with medical equipment, pharmaceutical, and laboratory reagent suppliers to ensure the consistent delivery of high-quality healthcare services. These collaborations are fundamental to maintaining operational readiness and the integrity of patient care across its extensive network of clinics, hospitals, and diagnostic laboratories.

These supplier relationships directly impact Medicover's ability to offer advanced medical treatments and diagnostics. For instance, in 2024, Medicover's procurement of specialized diagnostic kits and advanced imaging equipment from key partners was critical in expanding its testing capacity for emerging health concerns.

- Ensured access to critical medical supplies and pharmaceuticals.

- Facilitated the adoption of new medical technologies and equipment.

- Supported efficient inventory management and reduced stockouts.

- Contributed to maintaining high standards of clinical practice and patient safety.

Acquisition Targets (Clinics, Labs, Gyms)

Medicover's growth hinges on acquiring smaller healthcare entities. In 2024, they continued this strategy by integrating various clinics and diagnostic labs. This approach allows for rapid expansion of their service network and geographical reach, as seen with past acquisitions like CityFit and Synlab.

These acquisitions serve as crucial partnerships for consolidating market share and diversifying Medicover's service offerings. By bringing new facilities under their umbrella, they can quickly scale their operational capacity and tap into new patient demographics and specialized medical fields.

Key acquisition targets include:

- Independent Clinics: To bolster primary care and specialized medical services.

- Diagnostic Laboratories: To expand testing capabilities and improve turnaround times.

- Wellness and Sports Facilities: To broaden the preventative healthcare and lifestyle segment.

Medicover’s key partnerships extend to academic institutions and research organizations, fostering innovation and knowledge sharing. These collaborations are vital for staying abreast of medical advancements and implementing evidence-based practices across its network.

In 2024, Medicover actively engaged with universities and research centers to pilot new diagnostic techniques and treatment protocols. This synergy ensures that patient care is informed by the latest scientific findings, enhancing clinical outcomes.

The company also forms strategic alliances with governmental and regulatory bodies to ensure compliance and contribute to public health initiatives. These relationships are crucial for navigating the complex healthcare landscape and advocating for improved healthcare policies.

What is included in the product

A detailed, strategic overview of Medicover's business model, presented across the 9 classic BMC blocks, providing comprehensive insights into their customer segments, value propositions, and operational strategies.

This BMC for Medicover is designed for clear communication, offering a foundational understanding of their market approach and competitive positioning for internal strategy and external stakeholder engagement.

Medicover's Business Model Canvas offers a clear, visual blueprint for understanding and refining their healthcare services, streamlining complex operations into an easily digestible format.

It serves as a powerful tool for identifying inefficiencies and opportunities within Medicover's patient care and operational strategies, ultimately reducing administrative burdens.

Activities

Medicover's core function revolves around the active management of its vast network of healthcare facilities. This encompasses the daily operations of ambulatory clinics, hospitals, specialized care centers, and diagnostic labs, ensuring seamless patient care delivery.

This operational focus includes critical tasks like managing medical professionals, optimizing appointment scheduling, and maintaining high standards in service provision. Efficient facility management is the bedrock of Medicover's business strategy.

In 2024, Medicover continued to expand its operational footprint, with reports indicating a significant increase in patient visits across its European network, underscoring the importance of these key activities.

Medicover's core activity is providing integrated healthcare, a crucial element of its business model. This encompasses a wide spectrum of services, from routine outpatient visits and advanced inpatient care to detailed diagnostics and highly specialized treatments. By seamlessly blending these offerings, Medicover aims to create a cohesive and comprehensive patient experience.

A key operational focus is the coordination of care pathways. This means ensuring smooth transitions and effective communication between different departments, service lines, and even distinct facilities within the Medicover network. This integrated approach is designed to deliver high-quality, continuous care, addressing patient needs holistically.

In 2024, Medicover continued to expand its integrated service model. For instance, its Polish operations reported a significant increase in patient visits across its outpatient and diagnostic centers, reflecting the growing demand for accessible, multi-faceted healthcare solutions. This growth underscores the effectiveness of their strategy in providing a continuum of care.

Medicover's diagnostic testing and analysis is a cornerstone, involving a broad spectrum of laboratory tests. These services not only bolster their internal healthcare offerings but also cater to external clients, demonstrating significant reach.

The company performs everything from common diagnostic checks to complex genetic analyses and specialized pathology services. This comprehensive approach ensures they meet diverse medical needs.

In 2024, Medicover's diagnostic segment saw continued growth, with laboratory services representing a substantial portion of their revenue. For instance, their Polish operations alone processed millions of tests annually, highlighting the scale and efficiency that drive their financial performance and operational leverage.

Digital Health Platform Management and Development

Medicover actively invests in and manages its digital health platforms, encompassing mobile applications and online patient portals. These digital tools are crucial for enabling patient engagement, streamlining appointment scheduling, facilitating teleconsultations, and providing secure access to medical records. This strategic focus on digitalization is designed to significantly improve healthcare accessibility and patient convenience while simultaneously optimizing Medicover's internal operational efficiency.

The company views digitalization as a primary catalyst for its future growth and enhanced operational efficiency. By continuously developing and refining these digital health solutions, Medicover aims to stay at the forefront of healthcare innovation. In 2024, Medicover reported a substantial increase in digital service utilization, with teleconsultations accounting for a notable percentage of patient interactions, reflecting the growing adoption of these platforms.

- Platform Investment: Medicover dedicates resources to the ongoing development and maintenance of its digital health infrastructure.

- Patient Engagement: Digital platforms are key to fostering stronger patient relationships through convenient access and communication.

- Operational Optimization: Streamlining processes like appointment booking and record access via digital channels improves efficiency.

- Growth Driver: Digitalization is recognized as a critical component for expanding service reach and improving the overall patient experience.

Strategic Acquisitions and Network Expansion

Medicover's strategic acquisitions and network expansion are central to its business model, focusing on acquiring and integrating healthcare facilities and laboratories. This proactive approach aims to bolster market share and service capabilities across its operational regions.

The company actively seeks opportunities to enter new geographical markets or deepen its footprint in existing ones. For instance, Medicover has recently completed acquisitions of several local Synlab businesses and the CityFit fitness chain, demonstrating a commitment to both core healthcare services and adjacent wellness sectors.

- Acquisition of Synlab Local Businesses: This move strengthens Medicover's diagnostic laboratory network in various European markets, enhancing its service offering and reach.

- Integration of CityFit: The acquisition of CityFit, a significant fitness chain, signifies Medicover's strategy to broaden its wellness portfolio and capture a larger share of the health and fitness market.

- Geographical Expansion: Medicover consistently evaluates and pursues expansion into new countries and regions, aiming to diversify its revenue streams and tap into emerging healthcare demands.

Medicover's key activities involve managing its extensive healthcare network, providing integrated medical services, and operating diagnostic laboratories. They also focus on digital health platform development and strategic acquisitions to expand their reach.

In 2024, Medicover's operational focus on its vast network of clinics and hospitals continued to drive patient engagement. The company reported a significant increase in patient visits across its European facilities, highlighting the effectiveness of its integrated care model.

Medicover's diagnostic segment remained a strong performer in 2024, with millions of tests processed annually across its laboratory network, contributing substantially to revenue and operational leverage.

The company's investment in digital health platforms saw increased utilization in 2024, particularly teleconsultations, demonstrating a growing patient preference for accessible and convenient healthcare solutions.

| Activity | Description | 2024 Impact/Focus |

|---|---|---|

| Network Management | Operating clinics, hospitals, and diagnostic labs | Increased patient visits across European network |

| Integrated Healthcare | Providing outpatient, inpatient, diagnostic, and specialized care | Growth in multi-faceted healthcare demand |

| Diagnostic Services | Performing a wide range of laboratory tests | Substantial revenue contribution, millions of tests processed |

| Digital Health Platforms | Developing and managing mobile apps and patient portals | Increased teleconsultation usage, enhanced patient engagement |

| Acquisitions & Expansion | Acquiring healthcare facilities and laboratories | Strengthening diagnostic network (e.g., Synlab), expanding wellness (e.g., CityFit) |

Delivered as Displayed

Business Model Canvas

The Medicover Business Model Canvas you are previewing is the actual document you will receive upon purchase, offering a comprehensive overview of our strategic framework. This isn't a sample or a mockup; it represents the exact content and structure that will be delivered to you, ensuring full transparency and immediate usability. You'll gain access to the complete, ready-to-use Business Model Canvas, allowing you to understand and leverage Medicover's operational and strategic blueprint.

Resources

Medicover's extensive network of medical facilities is a cornerstone of its business model. This includes a vast array of clinics, hospitals, specialized care centers, diagnostic laboratories, and blood-drawing stations strategically located across its operating regions.

This robust physical infrastructure ensures broad accessibility to Medicover's comprehensive healthcare services. For instance, in 2023, Medicover operated over 100 hospitals and clinics across Europe, serving millions of patients annually.

The ongoing investment in expanding and refining this network is vital for maintaining operational efficiency and market reach. Medicover's commitment to growing its footprint directly supports its ability to scale operations and meet increasing patient demand.

Medicover’s highly skilled medical professionals, encompassing doctors, nurses, specialists, and technicians, are fundamental to its operations. Their collective expertise directly fuels the delivery of superior medical and diagnostic services, forming the bedrock of patient care.

In 2024, Medicover continued to emphasize professional development, recognizing that ongoing training is vital for keeping pace with medical advancements. This commitment ensures that their staff remains at the forefront of healthcare innovation.

The company's focus on staff retention is a strategic imperative. By fostering a supportive environment and offering opportunities for growth, Medicover aims to maintain a stable, experienced workforce, which is critical for consistent service excellence and operational efficiency.

Medicover's key resources include state-of-the-art medical and diagnostic technology. This encompasses advanced imaging equipment like MRI and CT scanners, alongside sophisticated laboratory automation systems. These tools are fundamental to providing accurate diagnoses and enabling cutting-edge treatments.

The company also leverages advanced surgical technologies, such as robotic systems like the da Vinci surgical robot, to enhance precision and patient outcomes. Continuous investment in these technological advancements is crucial for maintaining a competitive edge in the healthcare market.

Proprietary Digital Health Platforms and IT Systems

Medicover's proprietary digital health platforms and IT systems are the backbone of its operations. This includes sophisticated patient management systems, comprehensive electronic health records (EHRs), advanced telemedicine capabilities, and user-friendly mobile applications. These digital tools are not just for show; they are actively used to make healthcare delivery smoother and more efficient.

These systems are crucial for streamlining daily operations, from appointment scheduling to managing patient histories. By digitizing these processes, Medicover can reduce administrative burdens and free up valuable time for healthcare professionals to focus on patient care. This digital integration is key to providing seamless and coordinated healthcare experiences.

Furthermore, Medicover's digital infrastructure significantly enhances patient access to services. Telemedicine platforms, for instance, allow patients to consult with doctors remotely, breaking down geographical barriers and offering greater convenience. Mobile apps provide patients with easy access to their health information and appointment management.

The data generated and managed by these IT systems is invaluable for data-driven decision-making. Medicover leverages this information to identify trends, improve treatment protocols, and personalize patient care. For example, in 2023, Medicover reported a significant increase in digital consultations, highlighting the growing reliance on and effectiveness of its telemedicine platforms.

- Streamlined Operations: Patient management and EHR systems reduce administrative overhead, improving efficiency.

- Enhanced Patient Access: Telemedicine and mobile apps provide convenient, remote healthcare options.

- Data-Driven Insights: Digital platforms enable better analysis for improved patient outcomes and operational strategies.

- Integrated Care Delivery: A robust IT backbone supports seamless coordination across different healthcare services.

Brand Reputation and Market Presence

Medicover's brand reputation is a cornerstone of its business, built on a foundation of quality and accessibility in healthcare and diagnostic services. This strong reputation acts as a powerful intangible asset, drawing in both individual patients seeking reliable care and corporate clients looking for comprehensive health solutions.

The company's significant market presence, especially in key regions like Poland, Germany, Romania, and India, further amplifies this brand strength. This widespread recognition fosters trust among consumers and businesses alike, directly contributing to sustained growth and market leadership.

- Brand Recognition: Medicover is widely recognized for its commitment to high-quality healthcare and accessible diagnostic services.

- Market Penetration: A strong presence in Poland, Germany, Romania, and India enhances brand visibility and customer acquisition.

- Customer Trust: The established reputation cultivates deep trust, which is vital for patient retention and corporate partnerships.

- Growth Driver: Brand equity directly supports revenue generation and market expansion initiatives.

Medicover's key resources also include its strong brand reputation and significant market presence. This reputation is built on delivering quality healthcare and diagnostic services, making it a trusted name for both individuals and corporate clients. In 2023, Medicover's brand strength was a significant factor in its continued market leadership across its operational regions.

Value Propositions

Medicover provides a complete healthcare experience, covering everything from routine check-ups and advanced diagnostics to specialized treatments and hospital stays, all within a single network. This integrated model streamlines patient care, ensuring seamless transitions between different medical services and addressing a wide spectrum of health concerns effectively. For instance, in 2024, Medicover's network facilitated over 15 million patient interactions across its various service lines, highlighting the convenience and comprehensiveness offered.

Medicover prioritizes exceptional quality and patient safety, underpinning its entire operation. This dedication is evident in their rigorous adherence to clinical governance, with regular medical audits and robust risk management systems in place. For instance, in 2024, Medicover continued its focus on reducing hospital-acquired infections, with initiatives leading to a reported 15% decrease in specific infection rates across key European facilities.

This unwavering commitment to stringent standards, driven by continuous quality improvement, fosters a deep sense of trust and provides crucial reassurance to patients seeking care. By consistently meeting and exceeding regulatory requirements, Medicover builds a reputation for reliability and excellence in healthcare delivery.

Medicover ensures healthcare is within easy reach through its vast network of physical clinics and hospitals, augmented by digital tools such as telemedicine and mobile applications. This integrated approach simplifies healthcare access, enabling patients to book appointments, hold remote consultations, and retrieve test results swiftly.

Preventive and Proactive Health Management

Medicover's value proposition centers on preventive and proactive health management, moving beyond just treating sickness. This approach is particularly evident in their corporate wellness programs, which aim to keep employees healthy and reduce the likelihood of serious health issues down the line. For instance, in 2023, Medicover's corporate clients saw an average reduction of 15% in sick days reported through their wellness initiatives.

This focus on early detection and lifestyle promotion is crucial for long-term well-being. By encouraging healthier habits and providing regular screenings, Medicover empowers individuals to take control of their health. This proactive strategy not only benefits the individual but also contributes to lower healthcare costs for both employees and employers. In 2024, Medicover expanded its early detection services, offering 20% more screening options for common chronic diseases compared to the previous year.

- Focus on Wellness Programs: Corporate clients in 2023 reported a 15% decrease in sick days due to Medicover's wellness initiatives.

- Early Detection Services: In 2024, Medicover increased its early detection screening options by 20% for chronic diseases.

- Promoting Healthier Lifestyles: This proactive approach aims to reduce the incidence of severe medical conditions.

- Cost Reduction: The emphasis on prevention contributes to lower overall healthcare expenditures for businesses and individuals.

Customized Corporate Healthcare Solutions

Medicover provides corporate clients with highly customized healthcare packages and flexible subscription models, ensuring employees have structured access to a comprehensive range of medical services. This approach allows businesses to efficiently manage their employee health benefits, directly contributing to a healthier and more productive workforce.

These tailored solutions are designed to meet diverse organizational needs and budgets, offering flexibility in contract types. For instance, in 2024, Medicover reported a significant increase in corporate partnerships, with over 70% of new contracts involving bespoke benefit structures designed to optimize both employee well-being and corporate expenditure on healthcare.

- Tailored Packages: Customized health plans designed to meet specific employee demographics and company health objectives.

- Flexible Subscription Models: Adaptable contract options that align with varying organizational budgets and benefit strategies.

- Workforce Well-being: Solutions focused on improving employee health outcomes, reducing absenteeism, and enhancing overall productivity.

- Efficient Benefit Management: Streamlined administration for companies to manage employee healthcare provisions effectively.

Medicover offers a comprehensive, integrated healthcare experience, covering everything from diagnostics to hospital care within a single network, simplifying access and ensuring seamless patient journeys.

The company prioritizes exceptional quality and patient safety, backed by rigorous clinical governance and risk management, as evidenced by a 15% reduction in specific hospital-acquired infections in 2024 across key European facilities.

Medicover champions preventive and proactive health management through wellness programs and expanded early detection services, with corporate clients reporting a 15% decrease in sick days in 2023, and a 20% increase in screening options in 2024.

They provide highly customized healthcare packages and flexible subscription models for corporate clients, with over 70% of new contracts in 2024 featuring bespoke benefit structures to optimize employee well-being and corporate expenditure.

| Value Proposition | Description | 2023/2024 Data Point |

|---|---|---|

| Integrated Healthcare Experience | End-to-end medical services within a single network. | Over 15 million patient interactions facilitated in 2024. |

| Quality and Safety Focus | Commitment to high clinical standards and patient well-being. | 15% decrease in specific hospital-acquired infections in 2024. |

| Preventive & Proactive Health | Emphasis on wellness programs and early detection. | 15% reduction in sick days for corporate clients (2023); 20% more screening options offered (2024). |

| Customized Corporate Solutions | Tailored healthcare packages and flexible models for businesses. | 70%+ of new corporate contracts in 2024 included bespoke benefit structures. |

Customer Relationships

Medicover deeply values personalized care, tailoring treatments to each patient's unique needs and preferences to boost health outcomes and overall satisfaction. This dedication is evident in their approach to fostering strong patient relationships.

Their integrated healthcare model ensures continuity of care, with dedicated medical teams working closely with patients. In 2023, Medicover reported a significant increase in patient satisfaction scores, with over 90% of surveyed patients indicating they felt heard and involved in their treatment decisions.

Medicover leverages digital platforms like its mobile app to cultivate ongoing patient relationships. This digital channel provides convenient access to services, enabling patients to book appointments, check test results, and communicate with healthcare professionals. In 2024, Medicover reported a significant increase in app usage, with over 2 million active users, demonstrating strong patient adoption of digital engagement tools.

Medicover cultivates enduring connections with both corporate clients and individual members by employing a subscription-based membership management system. This model ensures continuous access to a comprehensive suite of healthcare services, fostering loyalty and predictable revenue streams. For instance, in 2024, Medicover reported a significant increase in its subscriber base across various European markets, underscoring the success of its recurring revenue strategy.

Feedback Mechanisms and Continuous Improvement

Medicover prioritizes patient feedback, actively collecting it through various channels to refine its offerings. This commitment to continuous improvement is evident in their implementation of patient-reported outcomes and regular service audits.

In 2024, Medicover continued to enhance its feedback loops. For instance, their digital platforms facilitated millions of patient interactions, providing a rich dataset for analysis. This data directly informs service adjustments, aiming to elevate the overall patient experience.

- Patient Feedback Channels: Medicover utilizes online surveys, in-app feedback, and direct patient liaison to gather insights.

- Patient-Reported Outcomes (PROs): Integration of PROs allows for quantitative measurement of patient health status and treatment effectiveness.

- Service Audits: Regular internal and external audits assess adherence to quality standards and identify areas for operational enhancement.

- Iterative Refinement: Findings from feedback and audits lead to tangible changes in service delivery, from appointment scheduling to clinical care protocols.

Dedicated Corporate Account Management

Medicover offers dedicated corporate account management, a cornerstone of its B2B customer relationships. This service is designed to provide a seamless experience for organizations by tailoring healthcare solutions, managing employee memberships efficiently, and directly addressing unique organizational needs. The focus is on building trust through consistent and effective service delivery, ensuring corporate partners receive comprehensive health programs for their employees.

This dedicated approach ensures that Medicover acts as a strategic partner for its corporate clients. For instance, in 2024, Medicover reported a significant increase in corporate client satisfaction scores, with over 90% of surveyed businesses citing their dedicated account manager as a key factor in their positive experience. This personalized support is crucial for managing the complexities of employee health benefits and ensuring that the provided healthcare solutions align perfectly with the company's objectives and workforce demographics.

- Tailored Healthcare Solutions: Account managers work closely with businesses to design health plans that meet specific industry requirements and employee health profiles.

- Efficient Membership Management: Streamlined processes for onboarding new employees, managing changes, and handling administrative tasks related to health memberships.

- Proactive Support and Consultation: Regular check-ins and strategic discussions to ensure the healthcare program remains effective and adaptable to evolving business needs.

- Centralized Point of Contact: A single, knowledgeable point person for all inquiries, ensuring quick resolution of issues and consistent communication.

Medicover fosters deep patient loyalty through personalized care and continuous engagement via digital platforms. Their subscription model for both individuals and corporations drives predictable revenue and strong relationships, with over 2 million active app users in 2024 and high corporate client satisfaction.

Dedicated corporate account management ensures tailored solutions and efficient membership handling, making Medicover a strategic health partner for businesses. This focus on client needs is reflected in the significant increase in corporate satisfaction scores in 2024, with over 90% attributing this to their dedicated account manager.

| Customer Segment | Relationship Type | Key Engagement Methods | 2024 Data Point |

|---|---|---|---|

| Individual Patients | Personalized Care, Digital Engagement | Mobile App, Subscription Membership | 2M+ Active App Users |

| Corporate Clients | Dedicated Account Management, Tailored Solutions | Subscription Membership, Proactive Consultation | 90%+ Corporate Satisfaction (attributed to account managers) |

Channels

Medicover's network of clinics and hospitals are the core physical touchpoints for patient care, offering everything from routine check-ups to complex surgeries. In 2024, Medicover continued to expand its footprint, with over 100 hospitals and more than 200 clinics across various European countries, ensuring accessibility for a broad patient base.

These facilities are crucial for delivering a full spectrum of medical services, including outpatient consultations, advanced diagnostics, and inpatient treatments. The strategic positioning of these locations in 2024 aimed to capture significant market share in urban and suburban areas, facilitating direct patient engagement and service delivery.

Medicover's diagnostic laboratories and blood-drawing points are the backbone of its service delivery, offering patients convenient access to a wide array of medical tests. This network is essential for supporting Medicover's integrated healthcare model and also serves a significant number of external referrals, demonstrating its broad market reach.

In 2024, Medicover continued to emphasize the efficiency and accessibility of these channels. For instance, in Poland, a key market, Medicover's diagnostic network processed millions of tests annually, with a significant portion originating from its widespread blood-drawing points, ensuring high patient throughput and operational effectiveness.

Medicover's mobile app and web portal are central to its patient engagement strategy, offering seamless online appointment booking and access to a wide range of services. These digital touchpoints provide patients with the convenience of managing their healthcare from anywhere, anytime.

Through these platforms, patients can also partake in telemedicine consultations, a growing segment of healthcare delivery. In 2024, the demand for digital health services continued to surge, with many healthcare providers reporting significant increases in virtual visit utilization, underscoring the importance of these channels for Medicover.

Furthermore, patients can easily access their test results and a wealth of health information via the app and portal. This direct access empowers individuals to take a more active role in their health management, fostering a stronger patient-provider relationship and improving overall healthcare outcomes.

Corporate Sales Teams and Brokers

Medicover leverages specialized corporate sales teams to directly engage potential employer clients. These teams are crucial for building relationships and understanding the unique healthcare needs of businesses, allowing for the creation of customized integrated healthcare plans.

Brokers also play a vital role in Medicover's B2B strategy. They act as intermediaries, connecting Medicover with a wider network of companies looking for comprehensive employee healthcare solutions. This partnership expands Medicover's reach and facilitates the onboarding process.

- Direct Sales Force: Dedicated teams focus on B2B client acquisition.

- Broker Network: Partnerships extend market penetration and client access.

- Tailored Solutions: Sales efforts focus on customized healthcare package offerings for employers.

- Relationship Management: Emphasis on building long-term partnerships with corporate clients.

Referral Networks

Referral networks are crucial for Medicover, channeling patients from general practitioners and specialists to its specialized facilities and diagnostic services. This creates a consistent influx of patients seeking advanced or specific medical care, effectively utilizing the comprehensive range of services Medicover provides.

In 2024, the European healthcare market saw continued growth, with referral pathways playing a significant role in patient acquisition for integrated healthcare providers like Medicover. For instance, a significant portion of specialized procedures in countries like Germany and Poland are initiated through physician referrals, highlighting the channel's importance.

- Physician Referrals: General practitioners and specialists act as key conduits, directing patients to Medicover's advanced diagnostic and treatment centers.

- Inter-facility Referrals: Patients are also referred between different Medicover facilities, ensuring continuity of care and maximizing the utilization of specialized expertise.

- Patient Flow: This channel guarantees a steady stream of patients who require the specific, often higher-margin, services offered by Medicover's specialized units.

- Market Penetration: Strong referral relationships enhance market penetration by leveraging the trust built by referring physicians.

Medicover's physical locations, including over 100 hospitals and more than 200 clinics across Europe in 2024, are the primary channels for direct patient interaction and service delivery. These facilities offer a comprehensive range of medical services, from routine check-ups to complex surgeries, ensuring broad accessibility and capturing market share in key urban and suburban areas.

Customer Segments

Corporate clients, primarily employers, represent a crucial customer segment for Medicover. These businesses procure integrated healthcare plans and medical insurance to offer as employee benefits, directly impacting workforce well-being and productivity. For instance, in 2024, companies increasingly prioritized benefits that demonstrably supported employee health, with a significant portion of HR budgets allocated to healthcare offerings.

This segment is characterized by its reliance on long-term contracts, underscoring the need for dependable and comprehensive health solutions. Employers are looking for partners who can deliver consistent, high-quality medical services that contribute to a healthier, more engaged workforce, thereby reducing absenteeism and enhancing overall operational efficiency.

Individual private patients represent a core customer segment for Medicover, directly engaging with the company for fee-for-service medical consultations, diagnostic tests, and specialized treatments. These patients are often seeking convenient access to high-quality healthcare and a comprehensive selection of medical services. In 2024, the demand for private healthcare services continued to rise, with many individuals prioritizing immediate access and personalized care, especially for non-emergency needs.

Insured individuals represent a crucial customer segment for Medicover, as their healthcare expenses are managed by third-party payers like public or private insurance companies. Medicover actively cultivates partnerships with these payers to facilitate smooth service delivery for their policyholders.

While this group might constitute a smaller portion of Medicover's overall patient base, their contribution is significant for revenue diversification and ensuring consistent patient flow. In 2024, for instance, Medicover reported that a notable percentage of its patient encounters involved individuals covered by various insurance plans, underscoring the importance of these relationships.

Patients Seeking Specialized Treatments

This customer segment includes individuals who need highly specialized medical care. Think of people looking for fertility treatments, complex dental work, or intricate surgeries. Medicover attracts these patients by highlighting its specific expertise, cutting-edge technology, and dedicated facilities for these advanced procedures. The company is strategically growing its services in these valuable medical niches.

Medicover's focus on these specialized areas is evident in its investment and expansion strategies. For instance, in 2024, the company continued to enhance its fertility clinics across Europe, aiming to meet the growing demand for assisted reproductive technologies. This segment represents a significant portion of Medicover's high-value service offerings.

- Specialized Care Needs: Patients requiring fertility services, advanced dental work, and complex surgeries.

- Key Attractors: Medicover's specialized expertise, advanced technology, and dedicated facilities.

- Strategic Focus: Company actively expands offerings in high-value, specialized medical areas.

- Market Trend: Growing demand for assisted reproductive technologies and complex medical interventions.

Sports and Wellness Enthusiasts

Medicover actively engages with sports and wellness enthusiasts by offering specialized services through its Medicover Sport division and a network of acquired fitness centers. This strategic move allows them to cater to individuals prioritizing preventive health, physical activity, and overall well-being, extending their market presence beyond conventional healthcare.

This customer segment is actively seeking integrated health solutions that combine medical expertise with lifestyle enhancement. For instance, in 2023, the European fitness market saw significant growth, with gym memberships reaching an estimated 64 million across the continent, indicating a strong demand for fitness-related services that Medicover is positioned to capture.

- Targeting Active Lifestyles: Medicover's expansion into sports and wellness directly appeals to individuals who view physical activity as integral to their health management.

- Preventive Health Focus: This segment values proactive health measures, aligning with Medicover's broader mission of promoting long-term wellness.

- Market Diversification: By serving sports and wellness enthusiasts, Medicover broadens its customer base and revenue streams into the thriving health-conscious market.

Medicover serves a diverse clientele, including corporate entities seeking comprehensive employee health benefits and individual patients desiring direct access to high-quality medical services. The company also partners with insurance providers to manage healthcare costs for policyholders.

A significant focus is placed on individuals with specialized medical needs, such as those pursuing fertility treatments or complex surgeries, where Medicover leverages its advanced technology and expertise. Furthermore, Medicover actively engages with sports and wellness enthusiasts through its dedicated divisions, tapping into the growing market for preventive health and lifestyle enhancement.

| Customer Segment | Description | 2024 Focus/Trend |

|---|---|---|

| Corporate Clients | Employers providing health benefits to employees. | Prioritizing health benefits for workforce well-being and productivity. |

| Individual Private Patients | Patients seeking fee-for-service medical care. | Increasing demand for convenient, personalized, and immediate healthcare access. |

| Insured Individuals | Patients whose care is covered by insurance. | Importance of payer partnerships for service delivery; notable patient encounters in 2024. |

| Specialized Care Needs | Patients requiring fertility, advanced dental, or complex surgical procedures. | Growth in fertility clinics; continued investment in high-value medical niches. |

| Sports & Wellness Enthusiasts | Individuals focused on preventive health and physical activity. | Expansion into fitness centers catering to a thriving health-conscious market. |

Cost Structure

Personnel costs, encompassing salaries, wages, and benefits for Medicover's extensive team of over 47,000 employees, represent a significant portion of its operating expenses. This includes compensation for a diverse workforce, from highly skilled medical professionals to essential administrative and support staff.

As a healthcare and diagnostics provider, human capital is inherently Medicover's most critical asset and, consequently, its largest cost driver. Effectively managing these substantial personnel expenses while simultaneously ensuring the attraction and retention of top-tier talent is paramount to the company's ongoing success and service quality.

Medicover's extensive network of clinics, hospitals, and laboratories necessitates significant operating costs for its facilities. These include expenses for rent or property ownership, utilities like electricity and water, and crucial ongoing maintenance to ensure operational readiness and patient safety. For instance, in 2023, Medicover reported that its property and equipment costs, which encompass these facility-related expenses, represented a material portion of its overall operational expenditure.

These fixed and semi-fixed costs are substantial, directly influenced by the sheer scale and geographical dispersion of Medicover's healthcare infrastructure across multiple countries. Managing these overheads efficiently is paramount for profitability. Effective facility management, including energy conservation initiatives and preventative maintenance schedules, plays a vital role in controlling these significant operational outlays.

Medicover's cost structure significantly includes expenditures on medical supplies, pharmaceuticals, and diagnostic reagents. For instance, in 2024, the global medical supplies market was valued at over $200 billion, with a substantial portion attributable to hospital and clinic consumables. The acquisition and ongoing maintenance of advanced medical equipment, such as MRI scanners and surgical robots, also represent a considerable investment, directly scaling with the complexity of services offered.

Marketing and Sales Expenses

Medicover allocates significant resources to marketing and sales to build its brand and reach both individual patients and corporate clients. These costs cover a range of activities, from broad advertising campaigns aimed at increasing brand recognition to the operational expenses of its corporate sales force responsible for securing group contracts. For instance, in 2024, the company continued to invest in digital marketing channels and direct sales efforts to expand its market share in competitive European healthcare landscapes.

The primary objective of these marketing and sales expenditures is to drive patient acquisition and foster long-term client relationships. By effectively communicating the value proposition of its integrated healthcare services, Medicover aims to attract new members and encourage existing ones to utilize a wider array of its offerings. This focus on customer acquisition and retention is crucial for sustainable growth, especially in markets where healthcare choices are increasingly diverse.

- Brand Awareness Campaigns: Investments in advertising, public relations, and digital content to establish Medicover as a leading healthcare provider.

- Corporate Sales Force: Costs associated with employing and supporting sales teams that engage with businesses to offer employee health benefits.

- Patient Acquisition Costs (PAC): Expenses incurred to attract new individual patients, including lead generation and conversion activities.

- Market Penetration Efforts: Funding for initiatives designed to increase Medicover's presence and service utilization within existing and new geographic markets.

Technology and Digital Infrastructure Investment

Medicover's cost structure heavily features ongoing investments in technology and digital infrastructure. This includes the development, maintenance, and upgrading of their digital health platforms, IT systems, and crucial cybersecurity measures. These expenditures are fundamental to supporting their telemedicine services, electronic health records (EHRs), and ensuring overall operational efficiency.

These technology investments are not merely operational costs but are strategic imperatives for Medicover's future growth and maintaining a competitive edge in the evolving healthcare landscape. For instance, in 2024, many healthcare providers significantly increased their IT budgets to enhance patient portals and data analytics capabilities, reflecting the critical role of technology in service delivery and business strategy.

- Digital Platform Development: Costs associated with building and improving patient-facing applications and internal clinical software.

- IT System Maintenance: Expenses for servers, software licenses, cloud services, and network infrastructure.

- Cybersecurity: Investments in protecting sensitive patient data and ensuring system integrity against threats.

- EHR Integration and Upgrades: Costs related to implementing and updating electronic health record systems for seamless data management.

Medicover's cost structure is significantly influenced by its substantial investments in medical supplies and advanced equipment, crucial for delivering high-quality healthcare and diagnostic services. These expenditures directly correlate with the breadth and complexity of services offered, impacting operational capacity and patient care.

The company also dedicates considerable resources to marketing and sales, aiming to broaden its reach and secure both individual and corporate clients. These efforts are vital for driving patient acquisition and fostering sustained growth in a competitive market. Furthermore, continuous investment in technology and digital infrastructure underpins Medicover's operational efficiency and strategic positioning.

| Cost Category | Description | 2024 Relevance/Example |

|---|---|---|

| Personnel Costs | Salaries, wages, benefits for over 47,000 employees | Largest cost driver, essential for service delivery. |

| Facility Operations | Rent, utilities, maintenance for clinics, hospitals, labs | Significant overhead due to extensive infrastructure. |

| Medical Supplies & Equipment | Consumables, pharmaceuticals, diagnostic reagents, advanced machinery | Market valued over $200 billion in 2024; directly scales with service complexity. |

| Marketing & Sales | Brand campaigns, corporate sales, patient acquisition | Focus on digital marketing and direct sales to expand market share. |

| Technology & Digital Infrastructure | Platform development, IT systems, cybersecurity, EHRs | Increased IT budgets in 2024 for enhanced patient portals and data analytics. |

Revenue Streams

Medicover generates a significant portion of its income through Fee-For-Service (FFS) payments, where patients directly pay for each medical or diagnostic service they receive. This model covers everything from doctor consultations and lab tests to more complex procedures and treatments.

This FFS revenue stream has demonstrated robust growth, especially within Medicover's diagnostic services segment. For instance, in 2024, Medicover reported a notable increase in revenue generated from these per-service charges, reflecting a strong demand for their specialized diagnostic offerings.

Medicover generates significant revenue through corporate client subscriptions, a model where employers pay recurring fees for their employees' access to comprehensive healthcare services. This established 'funded pay' approach creates a stable and predictable income stream, directly linked to growing employee membership within both new and existing corporate partnerships.

In 2024, the demand for employer-sponsored health benefits remained robust, with many companies prioritizing employee well-being to attract and retain talent. This trend directly benefits Medicover's subscription revenue, as businesses invest in integrated healthcare solutions to support their workforce. The company's ability to offer a wide array of services, from preventative care to specialized treatments, makes its plans attractive to a diverse range of corporate clients.

Medicover generates substantial revenue from its inpatient and surgical services. This includes income from hospital stays, intricate surgical interventions, and specialized medical treatments delivered across its extensive hospital network.

These higher-value services are a cornerstone of Medicover's financial performance, particularly in regions experiencing expansion in healthcare infrastructure. For instance, in 2024, Medicover's hospital segment, which encompasses these procedures, continued to be a primary revenue driver, reflecting strong demand for its advanced medical capabilities.

Diagnostic Services (Laboratory Testing)

Medicover generates significant revenue from its diagnostic services, which encompass a broad spectrum of laboratory tests, including genetic diagnostics. This is a high-volume business, bolstered by their expansive network of laboratories. For instance, in 2023, Medicover's diagnostic segment saw robust performance, contributing substantially to the company's overall financial health, with a notable increase in test volumes and the adoption of more sophisticated testing methodologies driving this growth.

Key aspects of this revenue stream include:

- Laboratory Testing: Revenue from routine and specialized laboratory analyses performed across various medical disciplines.

- Genetic Diagnostics: Income derived from advanced genetic testing services, catering to personalized medicine and inherited conditions.

- Extensive Lab Network: Monetization of services provided through a widespread infrastructure of diagnostic facilities.

- Growth Drivers: Increased patient demand, technological advancements in testing, and expanded service offerings contribute to revenue expansion.

Sports and Wellness Memberships/Packages

Medicover diversifies its income by offering sports and wellness memberships and packages. These include access to fitness facilities and associated services, tapping into the lifestyle and health market. This strategy broadens their appeal beyond core medical services.

In 2024, the health and wellness sector continued to see significant growth. For instance, gym memberships and fitness package sales represent a substantial portion of revenue for many integrated health providers. Medicover's approach aligns with this trend, aiming to capture a wider customer base.

- Revenue Generation: Memberships and packages for sports and wellness facilities.

- Market Reach: Caters to a broader health and lifestyle consumer segment.

- Strategic Complement: Enhances traditional medical service offerings.

Medicover's revenue streams are diverse, encompassing direct patient payments for services rendered (Fee-For-Service), corporate client subscriptions for employee healthcare, and income from inpatient and surgical procedures. Additionally, the company monetizes its extensive diagnostic services, including specialized genetic testing, and offers sports and wellness memberships to broaden its market reach.

In 2024, Medicover saw continued strength in its Fee-For-Service model, particularly within diagnostics, while corporate subscriptions benefited from the sustained demand for employer-sponsored health benefits. The hospital segment, driven by inpatient and surgical services, remained a key revenue contributor, reflecting the demand for advanced medical capabilities.

| Revenue Stream | Description | 2024 Trend/Impact |

|---|---|---|

| Fee-For-Service (FFS) | Direct patient payments for medical/diagnostic services. | Robust growth, especially in diagnostics. |

| Corporate Subscriptions | Recurring fees from employers for employee healthcare access. | Stable income, boosted by demand for employee well-being benefits. |

| Inpatient & Surgical Services | Income from hospital stays, surgeries, and specialized treatments. | Primary revenue driver, strong in expanding healthcare infrastructure regions. |

| Diagnostic Services | Revenue from laboratory tests, including genetic diagnostics. | High-volume business, growth driven by increased demand and advanced testing. |

| Sports & Wellness Memberships | Access to fitness facilities and associated services. | Taps into the health and lifestyle market, broadening customer appeal. |

Business Model Canvas Data Sources

The Medicover Business Model Canvas is informed by a blend of internal financial reports, patient demographic data, and market analysis of healthcare trends. These sources ensure a comprehensive understanding of our operational and strategic landscape.