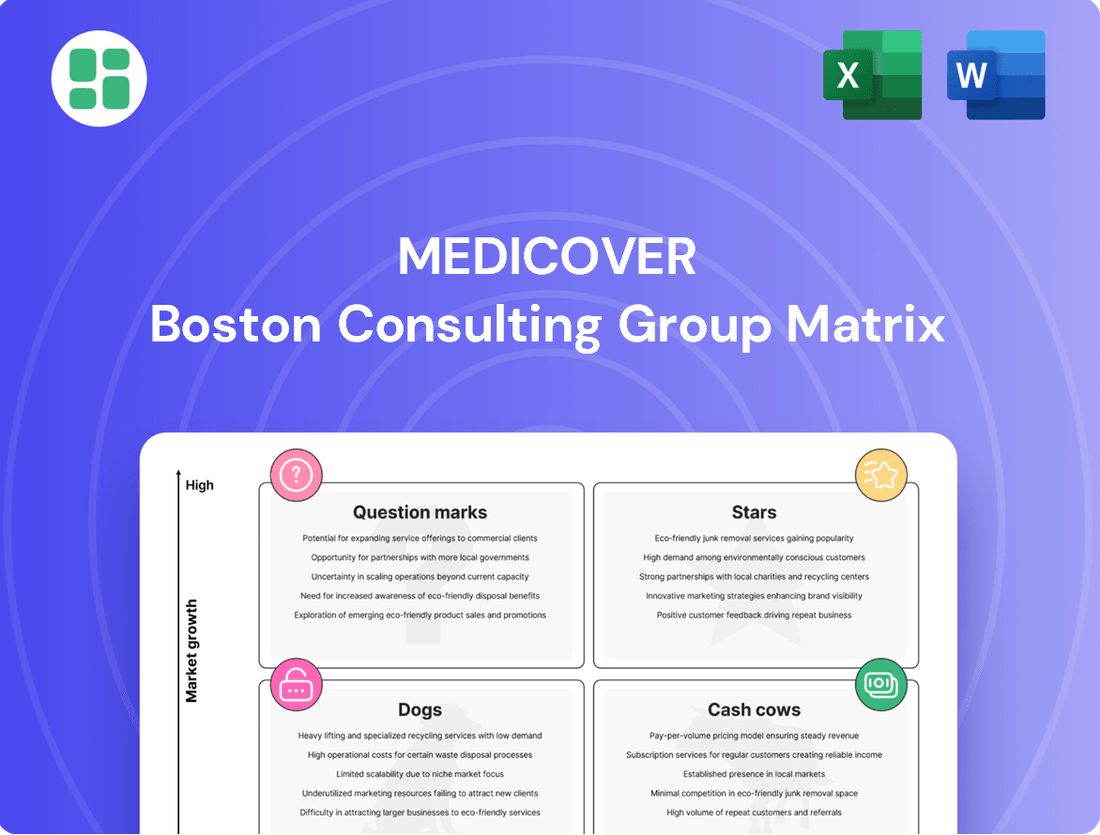

Medicover Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Medicover Bundle

Unlock the strategic potential of Medicover's product portfolio with a glance at its BCG Matrix. See which offerings are driving growth and which require a closer look.

This preview is just the beginning. Get the full BCG Matrix report to uncover detailed quadrant placements, data-backed recommendations, and a roadmap to smart investment and product decisions.

Stars

Medicover's Diagnostic Services division is a star performer, especially in advanced testing. Areas like genetic diagnostics and immunology are really taking off. In 2024, these advanced tests brought in 44% of the division's total revenue, showing they've captured a significant piece of a rapidly expanding market.

This strong performance is driven by Medicover's strategic investments in high-demand diagnostic fields. Their focus on proprietary tests, such as Non-Invasive Prenatal Testing (NIPT), further solidifies their leading position. This commitment to innovation in a high-growth segment is a key reason for their star status.

Medicover Hospitals India is positioned as a Star within the BCG Matrix due to its aggressive expansion strategy and high growth potential in the Indian healthcare market. The opening of new facilities in Warangal and Bangalore in 2024, with further expansion planned for 2025 and early 2026, underscores this growth trajectory. This rapid development, coupled with discussions around a potential separate listing for the Indian subsidiary, signals strong market share gains in a burgeoning sector.

Medicover Hospital in Cluj, Romania, has emerged as a significant player in liver tumor treatment, leveraging the da Vinci surgical robot. This strategic focus on advanced, specialized medical services in a growing market like Romania highlights a strong competitive advantage.

The adoption of robotic surgery positions Medicover as a leader in a high-demand niche, attracting patients nationwide and signaling substantial growth prospects. This specialization is crucial for its positioning within the high-growth quadrant of the BCG matrix.

Integrated Healthcare Solutions for Employer-Funded Members in Poland

Medicover's integrated healthcare solutions for employer-funded members in Poland represent a significant strength, consistently demonstrating robust growth. This segment is the largest contributor to the Healthcare Services division's revenue and earnings, underscoring its importance to Medicover's overall performance.

The Polish market for employer-funded healthcare is stable and expanding, allowing Medicover to leverage its integrated offerings as key growth drivers. As of the first half of 2024, Medicover reported a substantial increase in membership for its employer-funded segment in Poland, contributing to an overall revenue growth of 15% in the Polish market.

- Strong Market Position: Poland's employer-funded healthcare segment is a mature yet growing market where Medicover holds a leading position.

- Revenue Contribution: This segment is the largest revenue generator within Medicover's Healthcare Services division, highlighting its financial impact.

- Membership Growth: In the first half of 2024, Medicover saw a notable uptick in new employer contracts, adding over 10,000 members to its Polish portfolio.

- Profitability Driver: The integrated nature of these solutions, encompassing preventative care, diagnostics, and treatment, leads to strong operational efficiencies and profitability.

Acquired Local Businesses (e.g., Synlab acquisitions)

Medicover's growth strategy heavily relies on acquiring local businesses, exemplified by its purchases of Synlab operations in Romania, Turkey, Cyprus, Slovenia, Croatia, and North Macedonia. These acquisitions, along with the purchase of CityFit in Poland, have been instrumental in boosting Medicover's revenue and laboratory test volumes. For instance, the Synlab acquisitions alone significantly expanded Medicover's footprint and service offerings in key European markets.

These strategic moves underscore Medicover's commitment to rapidly increasing its market share in promising regions. By integrating these acquired entities into its existing infrastructure, Medicover effectively leverages economies of scale and operational synergies to drive further growth and profitability.

- Acquired Synlab businesses in RO, TR, CY, SI, HR, MK

- Acquired CityFit in Poland

- Significantly contributed to revenue growth and laboratory test volumes

- Demonstrates strategy of rapid market share expansion

Medicover's Diagnostic Services, particularly in advanced testing like genetics and immunology, are stars. In 2024, these advanced tests contributed 44% of the division's revenue, reflecting strong market capture in a growing sector. Medicover Hospitals India is also a star, driven by aggressive expansion and high growth potential, with new facilities opened in 2024 and more planned. The Cluj hospital's specialization in liver tumor treatment using robotic surgery further solidifies its star status by addressing a high-demand niche.

| Business Unit | Market Position | Growth Rate | Revenue Contribution (2024 Est.) | Strategic Focus |

|---|---|---|---|---|

| Diagnostic Services (Advanced Testing) | Star | High | 44% of division revenue | Genetic & Immunology, NIPT |

| Medicover Hospitals India | Star | High | Significant growth | Aggressive expansion |

| Medicover Hospital Cluj | Star | High | Growing niche | Robotic surgery (liver tumors) |

| Healthcare Services (Poland) | Star | Moderate to High | Largest contributor to division | Integrated employer solutions |

What is included in the product

The Medicover BCG Matrix categorizes business units by market share and growth, guiding strategic decisions.

Medicover's BCG Matrix provides a clear, actionable overview of its portfolio, simplifying complex strategic decisions.

Cash Cows

Medicover's established general outpatient clinics in Poland and Romania are clear cash cows. These facilities boast a high market share in mature segments, consistently delivering significant revenue and demonstrating margin improvements, especially within the Polish and Romanian operations.

The stable cash flow from these clinics is a direct result of their long-standing presence, substantial patient volumes, and streamlined operational efficiency. In 2024, these segments are projected to continue their strong performance, underpinning Medicover's financial stability.

Medicover's routine laboratory testing services are a prime example of a Cash Cow within its Diagnostic Services division. These services consistently deliver strong revenue and healthy profit margins, thanks to their high volume and operational efficiency.

In 2024, Medicover performed an impressive 136.2 million tests, highlighting the significant scale of its routine laboratory operations. This high throughput allows the company to leverage economies of scale, further enhancing profitability and ensuring a stable cash flow in a well-established market segment.

Medicover's traditional inpatient care facilities in mature markets, such as Poland and Romania, are prime examples of cash cows. These established hospitals consistently generate substantial revenue due to high patient volumes and strong occupancy rates, contributing significantly to the company's overall profitability. For instance, in 2023, Medicover reported a notable EBITDA margin from its hospital segment, underscoring the robust cash-generating power of these mature operations.

Corporate Healthcare Membership Programs

Medicover's corporate healthcare membership programs, particularly in Poland, represent a significant cash cow. This employer-funded model boasts a substantial member base, exceeding 1.8 million individuals in 2024, underscoring its stability and reach within the corporate health services sector.

These programs are characterized by long-term contracts, which translate into predictable and consistent revenue streams for Medicover. The high retention rates associated with these memberships further solidify their status as a mature and reliable income generator, reflecting a strong market position.

Key aspects of these cash cows include:

- Employer-funded model: A stable revenue source driven by corporate clients.

- Large member base: Over 1.8 million members in Poland as of 2024.

- Predictable income: Secured through long-term contracts.

- High retention rates: Indicative of strong customer loyalty and market penetration.

Dental Care Network in Poland and Germany

Medicover's dental care networks in Poland and Germany are prime examples of Cash Cows within its business portfolio. The company's strategic acquisitions, such as Natrodent Group and Vivadental Institute in Poland, alongside the Ddent clinic in Germany, underscore a deliberate expansion in this sector.

These established dental operations, once fully integrated, generate steady fee-for-service revenue. Their contribution to Medicover's overall profitability is significant, particularly in mature and well-developed markets where demand for dental services remains robust.

- Revenue Generation: The dental segment consistently delivers reliable fee-for-service income, benefiting from established patient bases and recurring treatments.

- Market Penetration: Acquisitions in Poland and Germany have strengthened Medicover's position in key European dental markets.

- Profitability Driver: These operations are noted for their strong profitability, contributing positively to Medicover's financial performance.

Medicover's established general outpatient clinics in Poland and Romania are clear cash cows. These facilities boast a high market share in mature segments, consistently delivering significant revenue and demonstrating margin improvements, especially within the Polish and Romanian operations.

The stable cash flow from these clinics is a direct result of their long-standing presence, substantial patient volumes, and streamlined operational efficiency. In 2024, these segments are projected to continue their strong performance, underpinning Medicover's financial stability.

Medicover's routine laboratory testing services are a prime example of a Cash Cow within its Diagnostic Services division. These services consistently deliver strong revenue and healthy profit margins, thanks to their high volume and operational efficiency. In 2024, Medicover performed an impressive 136.2 million tests, highlighting the significant scale of its routine laboratory operations.

Medicover's traditional inpatient care facilities in mature markets, such as Poland and Romania, are prime examples of cash cows. These established hospitals consistently generate substantial revenue due to high patient volumes and strong occupancy rates, contributing significantly to the company's overall profitability. In 2023, Medicover reported a notable EBITDA margin from its hospital segment, underscoring the robust cash-generating power of these mature operations.

Medicover's corporate healthcare membership programs, particularly in Poland, represent a significant cash cow with over 1.8 million members in 2024. These employer-funded programs benefit from long-term contracts and high retention rates, ensuring predictable and consistent revenue streams.

Medicover's dental care networks in Poland and Germany, strengthened by strategic acquisitions, are also cash cows. These established operations generate steady fee-for-service revenue with strong profitability, particularly in mature markets with robust demand for dental services.

| Business Segment | Market Position | Revenue Driver | Profitability | 2024 Data Point |

|---|---|---|---|---|

| General Outpatient Clinics (PL, RO) | High Market Share, Mature | High Patient Volumes | Margin Improvement | Consistent Revenue Delivery |

| Routine Laboratory Testing | Established Segment | High Throughput, Operational Efficiency | Healthy Profit Margins | 136.2 million tests performed |

| Traditional Inpatient Care (PL, RO) | Mature Markets | High Patient Volumes, Strong Occupancy | Robust Profitability | Notable EBITDA Margin (2023) |

| Corporate Healthcare Memberships (PL) | Significant Reach | Employer-Funded Model, Long-Term Contracts | Predictable Income, High Retention | Over 1.8 million members |

| Dental Care Networks (PL, DE) | Strengthened Market Penetration | Fee-for-Service, Established Patient Base | Strong Profitability | Strategic Acquisitions Driving Growth |

Full Transparency, Always

Medicover BCG Matrix

The Medicover BCG Matrix you are currently previewing is the identical, fully completed document you will receive immediately after your purchase. This ensures you get a professionally designed, analysis-ready report without any watermarks or placeholder content. You can confidently use this preview as a direct representation of the strategic tool that will be yours to edit, present, and implement for your business planning.

Dogs

Underperforming smaller clinics situated in intensely competitive urban markets often find themselves in the 'Dogs' category of the BCG Matrix. These facilities typically struggle with low patient volumes and operational inefficiencies, making profitability a significant challenge.

For instance, a hypothetical smaller clinic in a major metropolitan area, facing competition from numerous larger, well-established healthcare providers, might experience declining patient numbers. In 2024, such a clinic could be seeing a year-over-year decrease in patient visits of 15-20%, with occupancy rates falling below 50%, necessitating substantial investment for minimal return prospects.

These 'Dogs' are characterized by their inability to capture meaningful market share and their tendency to drain resources. Without a clear strategy for differentiation or a significant capital injection for expansion and modernization, their long-term viability is questionable, often leading to a review for divestment or consolidation.

Services relying on outdated diagnostic technologies, now surpassed by newer, more efficient methods, often find themselves in this category. Think of older imaging techniques or lab tests that have been largely replaced. These services typically have a low market share because fewer healthcare providers or patients are opting for them.

The demand for these older technologies is generally declining. For instance, the market for certain types of film-based X-rays has shrunk significantly as digital radiography became the standard. This reduced demand directly impacts revenue generation, making these services less profitable.

In 2024, companies still offering services dependent on technologies like basic analog electrocardiogram (ECG) machines, which have been largely superseded by digital and portable versions, might see a sharp drop in utilization. The maintenance costs for these older systems can also become a burden, further eroding any minimal revenue they might still generate.

Niche specialized treatments with a limited patient pool often fall into the Dogs category of the BCG Matrix. These services, while potentially offering high margins, struggle with scalability due to their small target audience or intense competition from specialized independent clinics. For instance, a rare genetic disorder treatment might only serve a few hundred patients globally, making significant market share acquisition difficult.

These treatments can become resource drains if demand is stagnant or if they aren't efficiently integrated into a broader healthcare offering. In 2024, many such specialized oncology treatments, while groundbreaking, faced challenges in patient access and reimbursement, impacting their revenue generation potential. Without a clear growth strategy or a way to leverage existing infrastructure, these services risk becoming unprofitable.

Operations in Politically or Economically Unstable Regions (e.g., Ukraine basic low-priced tests)

Medicover's provision of basic, low-priced tests for Ukraine's public health fund, initiated as a trial in 2024 and expected to normalize in 2025, represents an operation with inherently low margins. While fulfilling a crucial social role, this activity in a politically unstable region carries significant operational risk. For instance, the ongoing conflict in Ukraine has impacted supply chains and labor availability across various sectors, including healthcare services, potentially affecting the cost-effectiveness and reliability of such operations.

Considering Medicover's BCG Matrix, these low-margin, high-risk activities in Ukraine might be categorized as Dogs. The limited profitability, coupled with the substantial geopolitical and economic instability, suggests a potentially low return on investment, especially if private service offerings do not significantly offset the costs and risks. The Ukrainian healthcare market, while large, is heavily influenced by external factors, making predictable revenue streams challenging.

- Low Profitability: Operations focused on basic, low-priced public health services often yield minimal profit margins.

- High Operational Risk: The unstable geopolitical and economic environment in Ukraine presents considerable challenges to consistent and cost-effective service delivery.

- Limited Private Service Growth: If these operations do not foster significant growth in higher-margin private services, their strategic value diminishes.

- Potential for Divestment: Businesses might consider divesting or reducing involvement in such 'Dog' segments to reallocate resources to more promising areas.

Divested or Underperforming Non-Core Assets (e.g., Hungary insurance business exit)

Medicover's strategic decision to divest its Hungarian insurance business in 2023, resulting in a reduction of its member base, clearly signals the removal of an underperforming or non-core asset. This move aligns with the characteristics of a Dog in the BCG Matrix, where such units often drain resources without generating significant returns or fitting into the company's broader strategic vision.

The Hungarian insurance operation likely represented a business that had plateaued or was in decline, consuming capital and management attention that could be better allocated to more promising areas within Medicover's portfolio. For instance, in 2023, Medicover reported a focus on integrating its acquisitions in Poland and Germany, areas representing Stars or Cash Cows, further underscoring the shift away from less strategic segments.

- Divestiture of Hungarian Insurance Business: Medicover exited the Hungarian insurance market in 2023.

- Impact on Member Base: This exit led to a decrease in the total number of members.

- Strategic Rationale: The divestment suggests the Hungarian insurance business was either underperforming or not strategically aligned with Medicover's core growth objectives.

- BCG Matrix Classification: Such an asset would typically be categorized as a Dog, characterized by low market share and low market growth.

Dogs represent business units or services with low market share in a low-growth industry. These are often cash traps, consuming more resources than they generate. For Medicover, this could include older, less utilized diagnostic services or operations in highly saturated, low-margin markets.

For example, a clinic specializing in a niche diagnostic test that has been largely superseded by newer technologies might struggle to attract patients. In 2024, such a service might see its revenue decline by 10% year-over-year, with utilization rates falling below 30%.

These segments typically require significant investment for modernization or repositioning to escape the Dog category. Without a clear path to increased market share or improved profitability, divestment is often the most prudent strategy.

Medicover's strategic divestment of its Hungarian insurance business in 2023 exemplifies the handling of a Dog. This move freed up capital and management focus for more promising ventures.

| Business Unit/Service Example | Market Share | Market Growth | Profitability | Strategic Recommendation |

|---|---|---|---|---|

| Outdated Diagnostic Services | Low | Low/Declining | Low/Negative | Divestment or Modernization |

| Niche Treatment with Limited Demand | Low | Low | Variable (potentially high margin but low volume) | Evaluate for integration or divestment |

| Hungarian Insurance Business (2023) | Low (post-divestment impact) | Low | Low (implied by divestment) | Divested |

Question Marks

Medicover is likely categorizing its emerging digital health platforms and telemedicine expansion as Stars or Question Marks within the BCG Matrix. These sectors are experiencing rapid growth, with global telemedicine market expected to reach $250 billion by 2026, according to some projections. However, Medicover's market share in these nascent areas might still be developing, requiring substantial investment for platform development, user acquisition, and regulatory compliance.

Medicover's strategy includes entering new geographic markets with the aim of building significant market share, even if initial penetration is low. This approach is evident in their newer Indian hospitals, which are still in the early stages of development and represent a long-term growth opportunity.

These nascent operations, alongside recently established facilities like the Romanian hospital opened in late Q2 2023, are currently classified as 'immature units'. While they are a short-term drag on EBITDAaL due to ongoing investment and market development, they are positioned in high-growth potential areas where Medicover is actively cultivating its presence.

Medicover Integrated Clinical Services (MICS) is making significant strides in precision medicine and companion diagnostics. This focus positions MICS as a high-growth segment, particularly in its support of clinical trials. The company is leveraging its existing strengths to tap into this promising market.

While the future potential for precision medicine and companion diagnostics is substantial, these specialized services are still in their nascent stages of development. MICS recognizes the need for considerable investment to scale these operations and capture a larger market share. This strategic investment underscores a commitment to long-term growth in a rapidly evolving field.

Advanced Genetic Testing for New or Rare Diseases

Medicover Genetics is strategically increasing its presence in the genetic testing sector, particularly focusing on high-demand areas such as diagnostics for new or rare diseases. This expansion aligns with a growing market for personalized medicine and advanced diagnostics.

While the market for rare disease genetic testing shows significant growth potential, the development and commercialization of these specialized tests are resource-intensive. This includes substantial investment in research and development, as well as navigating the complexities of market adoption for novel diagnostic solutions.

- High R&D Investment: Developing sophisticated genetic tests for rare conditions often requires cutting-edge technology and extensive research, demanding significant capital outlay.

- Market Adoption Challenges: Educating healthcare providers and patients about new diagnostic tools for rare diseases is crucial for uptake, which can be a lengthy process.

- Regulatory Hurdles: Bringing novel genetic tests to market involves stringent regulatory approvals, adding to development timelines and costs.

- Specialized Expertise: A deep understanding of genetics and rare diseases is necessary, requiring highly skilled personnel and specialized laboratory infrastructure.

AI-Driven Diagnostic Tools and Decision Support Systems

AI-driven diagnostic tools, particularly in areas like radiology and pathology, are seeing new CPT codes emerge, signaling growing industry acceptance and potential for reimbursement. For Medicover, investing in these advanced AI solutions positions them at the forefront of a rapidly evolving healthcare landscape. These technologies represent high-potential growth areas, though they currently face challenges such as low market penetration and significant upfront development expenses.

The market for AI in healthcare diagnostics is projected for substantial growth. For instance, the global AI in healthcare market was valued at approximately $15.3 billion in 2023 and is expected to reach over $100 billion by 2030, demonstrating a compound annual growth rate (CAGR) of around 31%. This rapid expansion underscores the opportunity for companies like Medicover that are embracing these innovations.

- High Potential: AI diagnostics offer improved accuracy and efficiency in medical imaging and pathology analysis.

- Low Market Penetration: Despite rapid advancements, widespread adoption of these AI tools is still in its early stages.

- High Development Costs: Significant investment is required for research, development, and regulatory approval of AI diagnostic systems.

- Evolving Reimbursement: The introduction of new CPT codes indicates a move towards better financial viability for AI-driven diagnostic services.

Question Marks in Medicover's portfolio represent business units with low market share in rapidly growing markets. These units require significant investment to increase their market share and move towards becoming Stars. For instance, Medicover's investments in new geographic markets and nascent digital health platforms fit this description, demanding capital for expansion and development.

Medicover's strategy acknowledges the high investment needed for these emerging areas. The company is actively cultivating its presence in high-growth potential sectors, understanding that initial returns may be limited due to ongoing market development and the need to build scale.

The classification as Question Marks highlights a strategic decision to invest in future growth opportunities, even if they currently represent a short-term drag on profitability. This approach is common in industries experiencing rapid technological change and evolving consumer needs.

Medicover's focus on areas like AI-driven diagnostics and precision medicine, while promising, falls into the Question Mark category due to their early stage of market penetration and substantial development costs. The global AI in healthcare market's projected growth to over $100 billion by 2030, with a CAGR of around 31%, underscores the potential, but also the investment required.

BCG Matrix Data Sources

Our BCG Matrix is built on verified market intelligence, combining financial data, industry research, official reports, and expert commentary to ensure reliable, high-impact insights.