Deutsche Lufthansa PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Deutsche Lufthansa Bundle

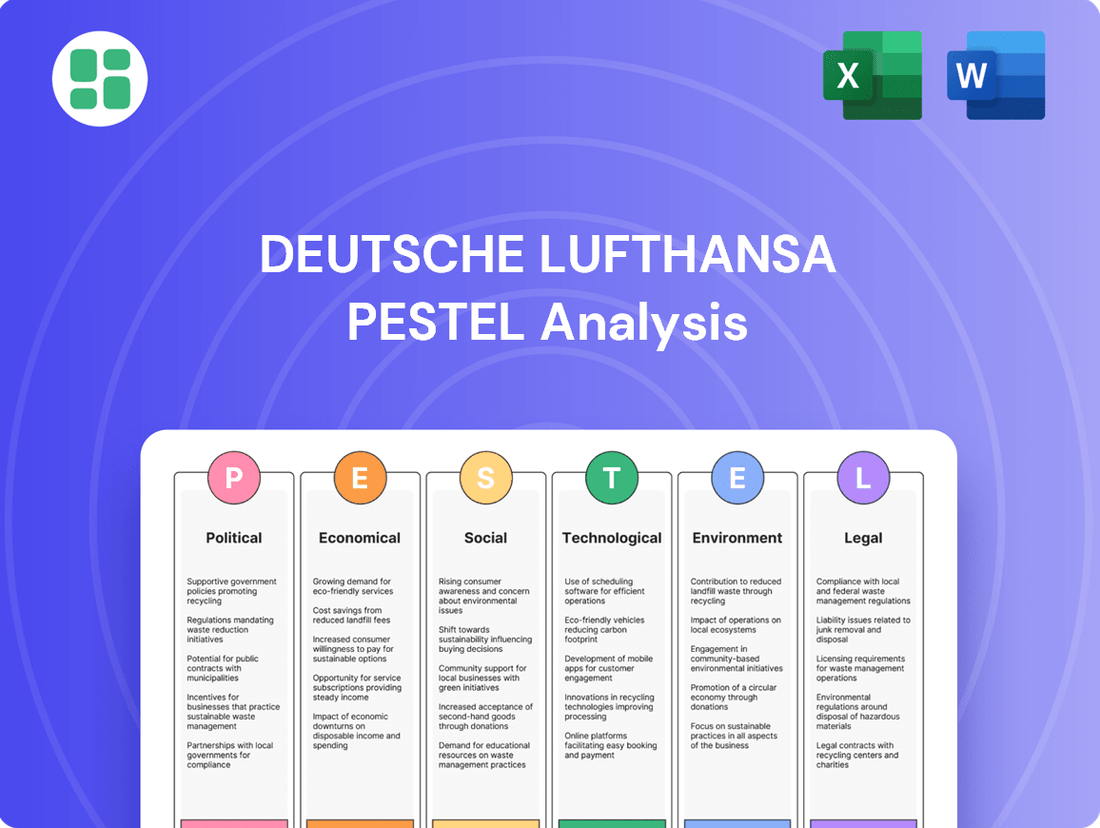

Navigate the complex global landscape affecting Deutsche Lufthansa with our thorough PESTLE analysis. Understand the political, economic, social, technological, legal, and environmental factors that are shaping the airline's future. Gain a competitive edge by leveraging these critical insights for your own strategic planning. Download the full PESTLE analysis now for actionable intelligence.

Political factors

Government regulations are a huge deal for airlines like Lufthansa. Think about things like who gets to fly where, when they can land and take off at busy airports, and all the rules about emissions. These policies, whether they're from Germany, the EU, or other countries Lufthansa flies to, can really shape how profitable a route is or if they can even start new ones. For instance, the EU's Emissions Trading System (ETS) directly affects operating costs, and in 2024, the aviation sector continued to navigate evolving carbon pricing mechanisms.

International agreements between countries are also super important. These bilateral air service agreements determine how much access airlines have to foreign markets and how much competition they face. Lufthansa's ability to expand its network, especially into growing markets, often hinges on these agreements. For example, the ongoing discussions around liberalizing air traffic rights within the EU and with key international partners continue to be a focal point for strategic planning in 2024 and looking into 2025.

Geopolitical stability is crucial for Lufthansa's operations. Global events and regional conflicts directly impact travel demand and the routes airlines can fly. For instance, the ongoing conflict in Eastern Europe in 2024 continued to affect European air traffic, forcing rerouting and impacting fuel costs for carriers like Lufthansa.

Instability in key markets poses a significant risk. Lufthansa, with its extensive global network, is particularly vulnerable to disruptions that can lead to flight cancellations or reduced passenger confidence. This susceptibility can translate into substantial financial losses and elevated operational expenses, as seen with the impact of regional tensions on travel patterns throughout 2024.

International trade relations and the increasing trend towards protectionism significantly impact Lufthansa's operations. For instance, trade disputes can dampen global economic activity, directly affecting air cargo volumes. In 2023, air cargo demand saw a slight recovery, but geopolitical tensions, such as those impacting trade routes, continue to pose risks to freight volumes.

Protectionist policies, like tariffs or import restrictions, can also curb international business travel. Companies facing higher costs due to trade barriers may reduce discretionary spending, including business class flights. This necessitates Lufthansa to potentially adjust its premium service capacity and explore strategies to mitigate the impact on passenger demand.

Government Support and Subsidies

The aviation sector, including Lufthansa, often benefits from government backing, particularly during economic downturns or for fostering strategic growth. For instance, the German government provided significant financial aid to Lufthansa during the COVID-19 pandemic, with a €9 billion stabilization package announced in June 2020. This support was crucial for the airline's survival and operational continuity.

The extent of government assistance, such as subsidies for environmental programs or financial lifelines during crises, can significantly influence Lufthansa's competitive standing. These measures can offer a vital advantage or a necessary safety net. For example, ongoing support for the development of sustainable aviation fuels (SAF) could directly benefit Lufthansa's decarbonization efforts.

Conversely, any reduction or cessation of such governmental aid can present considerable challenges for Lufthansa.

- Government Aid: The German government's €9 billion stabilization package in June 2020 was critical for Lufthansa's COVID-19 recovery.

- Strategic Development: Subsidies for sustainable aviation fuels (SAF) can provide a competitive edge in environmental initiatives.

- Economic Impact: Changes in government support levels directly affect Lufthansa's financial stability and strategic planning.

International Aviation Agreements

Deutsche Lufthansa's global operations are deeply intertwined with international aviation agreements. These accords, ranging from bilateral air service agreements to broader multilateral frameworks like those facilitated by the International Civil Aviation Organization (ICAO), dictate market access, route rights, and operational standards. For instance, the EU's "Open Skies" agreements with countries like the United States have significantly shaped transatlantic routes and pricing, directly influencing Lufthansa's competitive landscape.

The ongoing evolution of these agreements presents both opportunities and challenges. Renegotiations or the introduction of new terms can alter competitive dynamics, potentially affecting passenger traffic and cargo volumes. In 2024, discussions around updated aviation pacts continue globally, with a focus on sustainability and fair competition, which could necessitate adjustments in Lufthansa's strategic planning and operational models.

- Open Skies Agreements: Facilitate expanded market access and competitive pricing on key international routes.

- ICAO Standards: Ensure adherence to global safety, security, and environmental regulations, impacting operational costs and procedures.

- Bilateral Agreements: Govern specific route authorities and traffic rights between countries, influencing network development.

Government regulations significantly impact Lufthansa's operational costs and market access, especially concerning emissions and route approvals. The EU's Emissions Trading System (ETS) continues to be a key factor, with aviation's inclusion impacting profitability. In 2024, the focus remained on navigating evolving carbon pricing mechanisms and environmental compliance.

International agreements and geopolitical stability are critical for Lufthansa's global network. Bilateral air service agreements determine market access, while regional conflicts in 2024, like the one in Eastern Europe, affected air traffic and fuel costs, necessitating route adjustments.

Government support, such as the €9 billion stabilization package provided during the COVID-19 pandemic, has been vital for Lufthansa's recovery and continued operations. Ongoing subsidies for sustainable aviation fuels (SAF) also play a role in the airline's environmental strategy and competitive positioning.

Trade relations and potential protectionist policies can influence both air cargo volumes and international business travel. In 2023, while air cargo saw a slight recovery, geopolitical tensions impacting trade routes remained a risk factor for freight demand.

What is included in the product

This PESTLE analysis provides a comprehensive examination of the external macro-environmental factors influencing Deutsche Lufthansa, covering Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It offers forward-looking insights and actionable strategies for stakeholders to navigate the complex aviation landscape and capitalize on emerging opportunities.

A concise PESTLE analysis of Deutsche Lufthansa provides a clear overview of external factors, acting as a pain point reliver by simplifying complex market dynamics for strategic decision-making.

This analysis offers a structured approach to understanding Lufthansa's operating environment, alleviating the pain of navigating multifaceted political, economic, social, technological, legal, and environmental challenges.

Economic factors

Global economic growth is a crucial driver for Lufthansa's performance. For instance, the International Monetary Fund (IMF) projected global growth to be around 3.2% in 2024, a slight slowdown from previous years but indicating continued expansion. This generally supports demand for air travel, both for leisure and business purposes.

However, recession risks remain a significant concern. Persistent inflation and geopolitical instability, particularly in 2024 and projected into 2025, could dampen consumer spending and corporate travel budgets. A downturn would likely lead to reduced passenger numbers and downward pressure on fares, impacting Lufthansa's revenue and profitability.

Lufthansa closely monitors economic forecasts to adjust its capacity and pricing strategies. The airline's ability to adapt to fluctuating demand, whether driven by growth or recessionary fears, is key to navigating the economic landscape effectively. For example, in anticipation of potential economic headwinds, airlines often adjust their fleet deployment and route networks to optimize efficiency.

Fuel price volatility is a critical economic factor for Lufthansa. Jet fuel represents a significant portion of their operating expenses, and its price is notoriously unpredictable, influenced by global events and the balance of oil supply and demand. For instance, in late 2023 and early 2024, fluctuating crude oil prices, driven by geopolitical tensions in the Middle East and OPEC+ production decisions, directly impacted jet fuel costs.

These price swings can substantially affect Lufthansa's bottom line. In 2023, the airline group reported a substantial increase in fuel expenses compared to pre-pandemic levels, necessitating careful financial planning. To mitigate these risks, Lufthansa employs hedging strategies to lock in fuel prices for future purchases and may implement fuel surcharges to pass on some of the increased costs to passengers.

Consequently, efficient fleet management and the continuous integration of more fuel-efficient aircraft are paramount for Lufthansa's long-term financial health. Investing in newer, more aerodynamic planes and optimizing flight routes helps reduce overall fuel consumption, providing a buffer against market volatility. The company's commitment to fleet modernization, with orders for new generation aircraft like the Airbus A350 and Boeing 787, underscores this strategic imperative.

As a global carrier, Lufthansa's financial performance is significantly influenced by exchange rate volatility. For instance, a stronger Euro can make its services more expensive for customers in countries with weaker currencies, potentially reducing demand. Conversely, a weaker Euro can boost its competitiveness abroad but increase the cost of imported goods and services, like aircraft parts or fuel.

In 2024, the Euro's performance against major currencies like the US Dollar and the British Pound will be a key factor. For example, if the Euro strengthens significantly against the Dollar, Lufthansa's revenues earned in Dollars will translate into fewer Euros, impacting its reported profits. This highlights the critical need for robust currency hedging strategies to smooth out earnings and maintain cost predictability.

The impact extends to operational costs as well. Many of Lufthansa's aircraft and components are purchased or leased in US Dollars. A depreciating Euro against the Dollar would therefore directly increase the cost of these essential assets, squeezing profit margins if not adequately hedged. This makes proactive management of currency exposure a vital component of Lufthansa's financial strategy.

Consumer Disposable Income and Spending Habits

Consumer confidence and disposable income are pivotal for airlines like Lufthansa, particularly impacting demand for leisure travel, especially longer journeys and premium offerings. In 2024, a resilient global economy with moderate inflation is expected to support disposable incomes, though regional variations will exist. For instance, the International Monetary Fund (IMF) projected global GDP growth of 3.2% for 2024, suggesting a generally supportive environment for consumer spending.

Shifts in consumer spending habits present a dynamic challenge and opportunity. A growing trend towards budget-conscious travel, or a noticeable pivot towards domestic tourism, could necessitate adjustments in Lufthansa's market segmentation and pricing strategies. The luxury travel segment, a key area for airlines, is especially susceptible to economic downturns or changes in discretionary spending priorities.

- Consumer Confidence: Fluctuations in consumer sentiment directly correlate with willingness to spend on non-essential travel.

- Disposable Income Growth: Rising real disposable incomes generally translate to increased demand for air travel, especially in higher-income brackets.

- Spending Prioritization: Consumers may reallocate budgets, favoring experiences over goods, or vice-versa, impacting the travel sector.

- Luxury Segment Sensitivity: High-end travel services are often the first to be affected by economic uncertainty or reduced discretionary spending.

Inflation and Interest Rates

Rising inflation in 2024 and into 2025 directly impacts Lufthansa's operational expenses. For instance, fuel costs, a significant variable expense, are susceptible to inflationary pressures. Similarly, labor costs, especially for pilots and cabin crew, are likely to see upward adjustments to keep pace with the cost of living. These increased operating costs can compress profit margins if not effectively managed or passed on.

Higher interest rates, a common response to inflation, pose a challenge for Lufthansa's capital-intensive business model. Financing new aircraft acquisitions or managing existing debt becomes more expensive. For example, if interest rates rise by 1%, the cost of servicing a multi-billion Euro aircraft fleet could increase substantially, impacting free cash flow and potentially delaying investment in fleet modernization or sustainability initiatives.

Lufthansa's ability to pass these rising costs onto customers is constrained by a highly competitive airline market. Intense competition from legacy carriers and low-cost airlines limits pricing power. This means that even with increased operating expenses, Lufthansa may struggle to raise ticket prices sufficiently to maintain its profit margins, especially during periods of economic uncertainty or subdued travel demand.

- Inflationary pressures in 2024-2025 are expected to increase operating costs for Lufthansa, particularly in areas like fuel, labor, and airport fees.

- Higher interest rates will increase the cost of financing Lufthansa's extensive aircraft fleet and servicing existing debt.

- Competitive market conditions limit Lufthansa's ability to pass on increased costs to consumers, potentially squeezing profit margins.

Global economic conditions significantly influence Lufthansa's revenue streams, with growth fostering demand for air travel while recessionary fears dampen spending. For instance, the IMF projected global growth at 3.2% for 2024, indicating continued, albeit moderate, expansion. However, persistent inflation and geopolitical instability in 2024-2025 could curtail corporate and leisure travel budgets, impacting passenger numbers and fare levels.

Fuel price volatility is a critical economic factor, as jet fuel constitutes a substantial operating expense. Fluctuations in crude oil prices, influenced by global events, directly affect these costs. Lufthansa's 2023 financial reports highlighted increased fuel expenses, prompting the use of hedging strategies and fuel surcharges to mitigate impacts.

Exchange rate fluctuations also play a vital role, with a stronger Euro potentially reducing demand from international travelers. Conversely, a weaker Euro increases the cost of dollar-denominated expenses like aircraft parts. Lufthansa actively manages currency exposure through hedging to maintain earnings stability.

Consumer confidence and disposable income are paramount, especially for leisure travel. While projected global growth in 2024 supports spending, shifts towards budget travel or domestic tourism can necessitate strategic adjustments. The luxury segment, a key revenue driver, is particularly sensitive to economic downturns and changes in discretionary spending.

Inflationary pressures in 2024-2025 are expected to raise Lufthansa's operating costs, including fuel and labor. Higher interest rates will also increase financing costs for its aircraft fleet. The competitive airline market limits Lufthansa's ability to fully pass these increased costs onto consumers, potentially impacting profit margins.

| Economic Factor | Impact on Lufthansa | Key Data/Considerations (2024-2025) |

|---|---|---|

| Global Economic Growth | Drives demand for air travel. | IMF projected 3.2% global growth in 2024. Recession risks could reduce travel budgets. |

| Fuel Price Volatility | Significant operating expense. | Jet fuel costs impacted by crude oil prices and geopolitical events. Hedging and surcharges are mitigation strategies. |

| Exchange Rate Fluctuations | Affects revenue and costs. | Stronger Euro can reduce international demand; weaker Euro increases dollar-denominated costs. Active hedging is crucial. |

| Consumer Confidence & Disposable Income | Impacts leisure travel demand. | Resilient economy supports spending, but shifts to budget travel or domestic tourism are potential challenges. |

| Inflation & Interest Rates | Increases operating and financing costs. | Higher costs for fuel, labor, and aircraft financing. Limited pricing power due to competition. |

Preview the Actual Deliverable

Deutsche Lufthansa PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use, offering a comprehensive PESTLE analysis for Deutsche Lufthansa. This detailed report covers Political, Economic, Social, Technological, Legal, and Environmental factors impacting the airline industry, providing valuable strategic insights.

Sociological factors

Modern travelers, especially those born after 1981, increasingly value convenience and personalized journeys. Lufthansa's adaptation to this trend is crucial, with a focus on seamless digital booking and in-flight connectivity becoming paramount. In 2024, over 70% of travelers reported using mobile devices for booking flights, highlighting the need for robust digital platforms.

Beyond convenience, a significant and growing segment of consumers, particularly millennials and Gen Z, are actively seeking unique and experiential travel over standard package tours. This shift means Lufthansa needs to consider partnerships or offerings that cater to niche interests, adventure, or cultural immersion, reflecting a broader societal move towards authentic experiences.

Global demographic shifts significantly impact air travel demand. For instance, the aging population in Europe and North America may lead to different travel preferences, potentially favoring leisure and long-haul routes, while a growing middle class in Asia, projected to reach over 1.7 billion by 2030 according to some forecasts, presents a substantial opportunity for increased leisure and business travel. Lufthansa must adapt its offerings to these evolving passenger bases, considering their varying income levels and travel needs.

Heightened health consciousness following events like the COVID-19 pandemic significantly influences passenger behavior. Lufthansa, like other airlines, faces ongoing demand fluctuations tied to public health perceptions and government travel advisories. In 2024, continued vigilance on health protocols remains crucial for rebuilding and maintaining passenger trust.

The industry’s preparedness for future public health crises is a key determinant of operational resilience. Lufthansa’s investment in advanced air filtration and sanitation measures, alongside flexible booking policies, directly addresses passenger concerns. This proactive stance is vital for ensuring passenger confidence and mitigating the impact of potential future health-related disruptions.

Work-Life Balance and Remote Work Trends

The increasing emphasis on work-life balance is driving a significant shift towards flexible work arrangements, including remote and hybrid models. This trend directly impacts business travel demand, as companies re-evaluate the necessity of in-person meetings and conferences. Lufthansa must closely monitor how evolving corporate travel policies and the normalization of remote work affect business travel volumes.

For instance, a 2024 survey indicated that over 60% of employees prefer hybrid work arrangements, suggesting a sustained reduction in routine business trips. Lufthansa's strategy needs to adapt by potentially focusing on different traveler segments or developing new service models that cater to the evolving needs of business travelers, such as premium leisure offerings or solutions supporting blended travel.

- Impact on Business Travel: Flexible work models reduce the frequency of traditional business trips.

- Corporate Policy Evolution: Companies are updating policies to reflect remote and hybrid work, influencing travel budgets and approvals.

- Lufthansa's Adaptation: The airline may need to pivot towards premium leisure or hybrid travel solutions to capture new market demands.

- 2024 Data Point: Over 60% of employees favor hybrid work, signaling a persistent change in travel patterns.

Cultural and Social Norms Around Travel

Societal attitudes towards travel are evolving, with a growing emphasis on sustainability. This shift means Lufthansa must increasingly demonstrate its commitment to environmental responsibility to resonate with travelers. For instance, a 2024 survey indicated that over 60% of European travelers consider sustainability when booking flights, influencing perceptions of air travel.

The perception of air travel, whether as a luxury or a necessity, directly impacts demand for Lufthansa's services. While business travel remains a core segment, leisure travel is also influenced by economic conditions and disposable income. Cultural events and holidays also play a significant role, driving seasonal demand peaks for airlines like Lufthansa.

- Growing environmental consciousness: A significant portion of the traveling public now prioritizes eco-friendly options, impacting airline choices.

- Perception of air travel: The view of flying as either a discretionary luxury or an essential mode of transport shapes booking behavior.

- Influence of cultural events: Major holidays and international events create predictable surges in travel demand.

- Brand alignment: Lufthansa's ability to align its services with prevailing social values is crucial for maintaining customer appeal.

Societal expectations regarding environmental responsibility are reshaping travel choices, with sustainability becoming a key factor for many consumers. Lufthansa's commitment to eco-friendly practices, such as investing in sustainable aviation fuels and modernizing its fleet, is vital for attracting environmentally conscious travelers. By 2024, a significant percentage of travelers, particularly in Europe, indicated that sustainability influences their booking decisions.

The evolving perception of air travel, influenced by factors like economic conditions and cultural trends, also plays a crucial role in demand. While business travel remains important, the growth in leisure travel, driven by disposable income and a desire for experiences, presents significant opportunities. Major holidays and global events continue to create predictable peaks in passenger traffic, requiring careful capacity management.

The increasing demand for personalized and convenient travel experiences, especially among younger demographics, necessitates Lufthansa's focus on digital solutions and seamless journeys. Furthermore, shifting demographic patterns, such as an aging population in some regions and a growing middle class in others, require tailored service offerings. Health and safety concerns, heightened by recent global events, continue to influence passenger confidence and travel behavior.

Technological factors

Innovations like more fuel-efficient engines and lighter materials are crucial for Lufthansa, directly impacting operational costs and environmental targets. For instance, the airline's ongoing fleet modernization, including the introduction of the Airbus A350, significantly reduces fuel burn compared to older models, with the A350 offering up to 25% lower fuel consumption.

Investing in cutting-edge aircraft technology enhances passenger experience and lowers maintenance expenses. Lufthansa's commitment to a modern fleet, which saw significant investment in 2023 and planned for 2024, provides a competitive advantage by offering superior comfort and reliability, thereby reducing unscheduled maintenance events.

Lufthansa is heavily investing in digital transformation and AI to streamline its operations. In 2024, the airline continued to expand its use of AI for predictive maintenance, aiming to reduce aircraft downtime and associated costs. This digital push is crucial for optimizing complex processes like route planning and crew scheduling, directly impacting efficiency and cost management.

AI-powered analytics are becoming central to Lufthansa's revenue management strategies, allowing for more dynamic pricing and personalized offers to customers. By leveraging data, the airline aims to enhance customer experience and boost ancillary revenues. This focus on data-driven decision-making is intended to improve overall operational resilience in a competitive market.

The advancement and widespread adoption of Sustainable Aviation Fuels (SAF) are paramount for reducing the aviation sector's carbon footprint. Lufthansa's strategic approach to sourcing and integrating SAF directly influences its capacity to meet ambitious environmental goals and adhere to evolving regulatory landscapes, thereby shaping its long-term sustainability vision and brand reputation.

In 2023, Lufthansa Group aimed to increase its SAF usage to 0.5% of its total fuel consumption, a significant step from previous years, with plans to further scale this in 2024 and beyond. This commitment is crucial as SAF can reduce lifecycle greenhouse gas emissions by up to 80% compared to conventional jet fuel. The availability and cost of SAF remain key challenges, with the industry actively seeking government support and technological innovation to drive down prices and increase production capacity, a factor Lufthansa closely monitors.

Cybersecurity and Data Protection

As a major global airline, Lufthansa manages extensive sensitive passenger and operational data, necessitating robust cybersecurity. In 2024, the aviation industry faced increasing cyber threats, with reports indicating a significant rise in ransomware attacks targeting airlines and travel companies. Protecting against these threats and ensuring data privacy is paramount for maintaining customer trust, adhering to stringent data protection regulations like GDPR, and preventing costly operational disruptions.

Lufthansa's commitment to cybersecurity is evident in its ongoing investments and adherence to industry best practices. The company likely employs multi-layered security protocols, including advanced threat detection systems, encryption, and regular security audits. Failure to adequately protect this data could lead to severe reputational damage and financial penalties, underscoring the critical nature of these technological factors.

- Data Breach Impact: A single significant data breach could cost airlines millions in recovery, fines, and lost business.

- Regulatory Compliance: Strict data protection laws require significant technological investment to ensure adherence.

- Operational Resilience: Cybersecurity failures can cripple flight operations, leading to widespread cancellations and delays.

- Customer Trust: Maintaining passenger confidence relies heavily on the perceived security of their personal information.

Enhanced Passenger Experience Technologies

Lufthansa is investing heavily in technologies that make flying more enjoyable. Think about things like facial recognition for faster boarding, which is becoming more common. They're also upgrading the entertainment systems on flights and ensuring passengers can stay connected with Wi-Fi. These advancements are key to keeping customers happy and choosing Lufthansa over competitors.

In 2024, many airlines, including Lufthansa, are focusing on digital transformation to streamline operations and improve the customer experience. This includes rolling out more advanced mobile apps that offer personalized services and easier booking management. For instance, the integration of AI-powered chatbots for customer service is a growing trend, aiming to provide instant support. Lufthansa's commitment to these innovations directly impacts passenger satisfaction, a critical factor in airline loyalty.

The airline industry is seeing significant technological shifts. For Lufthansa, this translates to:

- Biometric boarding: Enhancing speed and security at the gate.

- Advanced in-flight entertainment: Offering more content and interactive features.

- Seamless connectivity: Providing reliable Wi-Fi for work and leisure.

- Personalized mobile apps: Delivering tailored travel information and services.

Technological advancements are reshaping Lufthansa's operational efficiency and customer engagement. The airline's fleet modernization, including the introduction of fuel-efficient aircraft like the Airbus A350, which offers up to 25% lower fuel consumption, directly tackles rising fuel costs and environmental mandates. Furthermore, Lufthansa's significant investment in digital transformation, particularly in AI for predictive maintenance and revenue management, aims to optimize operations and enhance personalized customer offerings throughout 2024.

The increasing focus on Sustainable Aviation Fuels (SAF) presents both an opportunity and a challenge, with Lufthansa aiming to scale its SAF usage. In 2023, the group targeted 0.5% SAF blend, a crucial step towards reducing its carbon footprint, as SAF can cut lifecycle emissions by up to 80%. The availability and cost of SAF remain critical factors influencing Lufthansa's environmental strategy and long-term sustainability.

Cybersecurity remains a paramount technological concern for Lufthansa, given the sensitive data it handles. The rise in cyber threats throughout 2024 necessitates robust protection measures to prevent operational disruptions and maintain customer trust, especially with stringent data protection regulations like GDPR in place.

Lufthansa is enhancing the passenger experience through technologies like biometric boarding and advanced in-flight entertainment, alongside improved connectivity. These digital initiatives, including more sophisticated mobile apps and AI-powered customer service, are central to improving passenger satisfaction and loyalty in the competitive aviation market.

Legal factors

Lufthansa navigates a complex web of aviation safety and security rules, governed by bodies like the European Union Aviation Safety Agency (EASA), the International Civil Aviation Organization (ICAO), and various national aviation authorities. Staying compliant with these ever-changing standards is absolutely critical for protecting passengers and crew, keeping operational permits valid, and sidestepping hefty fines.

In 2024, the aviation industry continues to see increased scrutiny on cybersecurity threats to flight operations, with regulators like EASA issuing updated guidance for airlines to bolster their digital defenses. Lufthansa’s investment in advanced security protocols directly impacts its ability to maintain its safety record and operational integrity in this evolving threat landscape.

Lufthansa navigates a dense web of antitrust and competition laws worldwide, impacting its strategic decisions. These regulations scrutinize airline alliances, mergers, and pricing, shaping how Lufthansa competes and collaborates in the global aviation landscape.

For instance, the European Union's competition authorities closely monitor airline partnerships to prevent monopolistic practices. In 2024, the EU continued its focus on fair competition within the aviation sector, which directly affects Lufthansa's ability to form alliances and expand its market share, particularly after its acquisition of a stake in ITA Airways.

Lufthansa navigates a complex web of labor laws across its global operations, impacting everything from employee contracts and compensation to working hours and benefits. In 2023, the airline faced significant industrial action, with strikes by ground staff and pilots leading to thousands of flight cancellations and an estimated financial impact in the hundreds of millions of euros. This highlights the critical need for robust industrial relations management and adherence to diverse national labor regulations.

Data Privacy Regulations (e.g., GDPR)

Deutsche Lufthansa navigates a complex legal landscape, particularly concerning data privacy. The General Data Protection Regulation (GDPR) in Europe, and comparable legislation worldwide, mandates stringent handling of extensive passenger data. Lufthansa must implement robust data protection measures, ensure transparency in how data is used, and maintain secure storage to prevent significant penalties and preserve customer confidence. For instance, in 2023, the EU saw significant fines levied under GDPR, with companies facing penalties that can reach up to 4% of global annual turnover.

Key legal considerations for Lufthansa include:

- Compliance with GDPR and similar global data protection laws: Ensuring lawful processing of passenger information.

- Data security and breach notification: Implementing measures to protect data and report breaches promptly.

- Consumer protection laws: Adhering to regulations regarding fair advertising and service provision.

- Aviation-specific regulations: Meeting international and national aviation safety and operational standards.

Consumer Protection and Passenger Rights

Lufthansa operates under stringent consumer protection laws, notably EU Regulation 261/2004, which grants passengers significant rights. This regulation mandates compensation for flight delays exceeding three hours, cancellations, and denied boarding, impacting airline operational costs and customer service strategies. In 2023, European airlines paid out an estimated €2.7 billion in compensation under EU261, highlighting the financial implications of these passenger rights.

Effectively managing these passenger rights is crucial for Lufthansa to ensure customer satisfaction and mitigate legal risks. Non-compliance can lead to substantial fines and damage to the airline's reputation. For instance, a single significant delay or cancellation event could result in thousands of individual claims, requiring robust administrative processes.

- EU261 mandates compensation for delays, cancellations, and denied boarding.

- Lufthansa must adhere to these regulations to avoid financial penalties and reputational harm.

- In 2023, European airlines paid approximately €2.7 billion in EU261 compensation.

- Proactive management of passenger rights is key to customer loyalty and operational integrity.

Lufthansa must navigate a complex landscape of international and national aviation laws, including stringent safety regulations from bodies like EASA and ICAO. In 2024, cybersecurity remains a major focus, with updated guidance for airlines to bolster digital defenses, directly impacting operational integrity.

The airline also faces scrutiny under antitrust laws, particularly concerning alliances and market share, as highlighted by EU competition authorities monitoring fair practices. Lufthansa’s 2024 acquisition of a stake in ITA Airways underscores the ongoing need to comply with these regulations.

Labor laws present significant challenges, as evidenced by the 2023 strikes by ground staff and pilots, which caused widespread cancellations and substantial financial losses. Adherence to diverse national labor regulations and effective industrial relations management are therefore paramount.

Data privacy laws, such as GDPR, impose strict requirements on handling passenger data, with potential fines reaching up to 4% of global annual turnover, as seen with significant penalties levied in the EU during 2023.

Consumer protection laws, like EU Regulation 261/2004, mandate compensation for flight disruptions, impacting operational costs. European airlines paid an estimated €2.7 billion in EU261 compensation in 2023, emphasizing the financial implications of passenger rights.

Environmental factors

The aviation industry, including Lufthansa, faces significant pressure to curb carbon emissions, a critical aspect of addressing climate change. Lufthansa is committed to reducing its environmental footprint, aligning with ambitious global and national climate targets. This commitment translates into concrete actions like investing in newer, more fuel-efficient aircraft and exploring sustainable aviation fuels (SAFs).

In 2023, Lufthansa Group continued its fleet modernization, receiving 32 new aircraft, including fuel-efficient models. The company aims to achieve net-zero CO2 emissions by 2050, a goal that requires substantial investment in SAFs, which currently represent a small but growing portion of their fuel mix. For instance, Lufthansa aims to source 10% of its jet fuel as SAF by 2030.

Noise pollution from aircraft is a major environmental issue, especially for those living near airports. Lufthansa faces increasing pressure to reduce its noise impact, requiring significant investment in quieter aircraft and operational adjustments. For instance, in 2023, the German government continued to discuss potential noise-related landing fee surcharges for airlines, impacting operational costs and strategic fleet planning.

Lufthansa is focusing on managing the significant waste generated from its extensive flight operations, catering services, and maintenance activities. This includes everything from cabin waste to materials used in aircraft upkeep, all of which require careful handling to meet environmental standards.

In 2023, the airline group reported a continued emphasis on reducing waste, with initiatives aimed at increasing recycling rates across its fleet and ground operations. Their commitment to circular economy principles is evident in efforts to reuse and recycle materials, aiming to divert a substantial portion of waste from landfills.

Biodiversity and Ecosystem Impact

Lufthansa's extensive global network, involving airport infrastructure and flight routes, inevitably interacts with diverse ecosystems. This can range from land use for new facilities to noise pollution affecting wildlife. For instance, airport expansion projects, while crucial for operations, often require careful environmental impact assessments to minimize habitat fragmentation.

The airline is committed to responsible environmental stewardship, which includes assessing and mitigating the potential adverse effects of its operations on natural habitats. This involves strategies to reduce emissions and manage waste, aiming to lessen the overall ecological footprint. By 2024, Lufthansa Group has set targets to further reduce its CO2 emissions per passenger-kilometer, a key metric for environmental performance.

Key considerations for Lufthansa's biodiversity impact include:

- Habitat Disruption: Airport construction and expansion can lead to the loss and fragmentation of natural habitats, impacting local flora and fauna.

- Noise Pollution: Aircraft noise can disturb wildlife behavior, affecting breeding patterns and migration routes.

- Resource Consumption: Operations require significant water and energy, with potential impacts on local water tables and ecosystems.

- Waste Management: Proper disposal of waste generated from flights and ground operations is critical to prevent environmental contamination.

Water Resource Management

Lufthansa's operations, from aircraft cleaning and maintenance to catering and passenger facilities, inherently involve significant water consumption. This makes effective water resource management a crucial environmental factor. In 2023, the airline continued to focus on reducing its water footprint by optimizing cleaning processes and investing in water-efficient technologies across its ground infrastructure.

The company's commitment to sustainability includes implementing robust water conservation strategies. These efforts are designed not only to meet regulatory requirements but also to foster responsible resource stewardship. Lufthansa aims to minimize its impact on local water supplies, particularly in water-scarce regions where it operates.

- Water Consumption: Aircraft maintenance, catering services, and extensive ground operations are key areas of water usage for Lufthansa.

- Conservation Efforts: Implementing water-saving technologies and optimizing cleaning procedures are ongoing priorities.

- Environmental Footprint: Efficient water management directly contributes to reducing the airline's overall environmental impact.

- 2024/2025 Focus: Continued investment in water-efficient infrastructure and enhanced water recycling initiatives are expected.

Lufthansa is actively addressing its environmental impact, particularly carbon emissions, by investing in fuel-efficient aircraft and sustainable aviation fuels (SAFs). The airline group aims for net-zero CO2 emissions by 2050, with a target of sourcing 10% of its jet fuel as SAF by 2030.

Noise pollution remains a significant concern, prompting Lufthansa to invest in quieter aircraft and adapt operational strategies. The company also focuses on waste management, increasing recycling rates across its fleet and ground operations to promote circular economy principles.

Biodiversity impact is managed through careful assessment of land use for infrastructure and mitigation of noise pollution affecting wildlife. Furthermore, Lufthansa is committed to responsible water resource management, optimizing cleaning processes and investing in water-efficient technologies to reduce its overall environmental footprint.

| Environmental Factor | Lufthansa's Actions/Targets | Key Data/Goals |

|---|---|---|

| Carbon Emissions | Fleet modernization, SAF investment | Net-zero CO2 by 2050; 10% SAF by 2030 |

| Noise Pollution | Quieter aircraft, operational adjustments | Ongoing discussions on noise surcharges impacting planning |

| Waste Management | Increased recycling, circular economy | Focus on diverting waste from landfills |

| Water Consumption | Water-efficient technologies, optimized processes | Reducing water footprint in operations |

PESTLE Analysis Data Sources

Our Deutsche Lufthansa PESTLE analysis is built on a robust foundation of data from official aviation authorities, international financial institutions, and leading market research firms. We incorporate regulatory updates, economic forecasts, and technological advancements to provide a comprehensive view.