Deutsche Lufthansa Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Deutsche Lufthansa Bundle

Lufthansa's strategic positioning is laid bare in its BCG Matrix, revealing a dynamic portfolio of services. Understand which of their offerings are driving growth and which require careful consideration for future investment.

This preview offers a glimpse into Lufthansa's market share and growth potential across its various business units. To truly grasp the strategic implications and unlock actionable insights for your own business, dive deeper into the full BCG Matrix analysis.

Gain a comprehensive understanding of Lufthansa's Stars, Cash Cows, Dogs, and Question Marks. Purchase the complete BCG Matrix report to equip yourself with the strategic clarity needed to navigate the competitive aviation landscape and make informed decisions.

Stars

Lufthansa Cargo's e-commerce solutions have been a key driver of its improved 2024 performance, contributing to a 10% revenue increase and a 15% rise in Adjusted EBIT. This success stems from a swift adaptation to market trends and a robust offering tailored for online retail logistics.

The airline is strategically expanding its freighter capacity into Asia, a region experiencing significant e-commerce growth. This move underscores Lufthansa Cargo's commitment to capturing market share in this burgeoning sector, aligning with its 'BOLD MOVES' strategy to become a global top-five cargo carrier.

Lufthansa's Allegris product, featuring new First Class and Business Class cabins, is a significant investment aimed at solidifying its position in the premium travel market. By 2028, 90% of the long-haul fleet will be equipped with this enhanced offering, directly targeting a high-yield segment with sustained demand. This strategic move revitalizes the Lufthansa brand, making it a clear Star in the BCG matrix.

In 2024, while the broader Lufthansa Group navigated a complex environment, its subsidiaries SWISS, Austrian Airlines, and Brussels Airlines showcased remarkable financial resilience. SWISS, in particular, stood out by surpassing €800 million in Adjusted EBIT, a testament to its effective operational management and strong market positioning.

Brussels Airlines also achieved a significant milestone, reporting its highest profit ever. These strong performances underscore the value of the Lufthansa Group's multi-hub strategy, with each airline leveraging its high market share within specific, profitable regional niches to contribute substantially to the group's overall financial health and demonstrating considerable growth prospects.

Sustainable Aviation Fuel (SAF) Initiatives

Deutsche Lufthansa is making substantial strides in Sustainable Aviation Fuel (SAF) initiatives, a key area for its future growth and market positioning. The airline group is investing heavily, with up to USD 250 million earmarked for the ongoing procurement of SAF. This commitment is further underscored by the expansion of its Green Fare tariff to include long-haul flights, directly addressing the increasing demand for sustainable travel options.

These efforts are central to Lufthansa's ambitious environmental targets. The company aims to cut its net carbon emissions by half by the year 2030 and achieve complete carbon neutrality by 2050. Such clear objectives signal a strong leadership stance in environmentally responsible aviation, attracting both individual travelers and corporate clients who prioritize sustainability.

- Investment in SAF: Lufthansa Group is investing up to USD 250 million for continuous procurement of Sustainable Aviation Fuel.

- Green Fare Expansion: The Green Fare tariff has been extended to cover long-haul routes, enhancing sustainable travel options.

- Emission Reduction Targets: The airline aims to halve net carbon emissions by 2030 and achieve carbon neutrality by 2050.

- Market Leadership: These initiatives position Lufthansa as a leader in the burgeoning sustainable aviation segment.

Digital Transformation and AI Integration

Lufthansa's commitment to digital transformation, particularly its integration of AI, positions it in a high-growth potential quadrant. The airline is actively leveraging AI-driven insights to optimize operations and personalize customer experiences. This strategic focus is crucial for staying competitive in the evolving aviation sector.

The airline is investing in cutting-edge technologies, such as Meta Quest 3 headsets for its Allegris Business Class passengers, offering an immersive entertainment experience. This move highlights a dedication to enhancing customer satisfaction through innovative digital solutions. Furthermore, Lufthansa's establishment of a Global Capability Center with Infosys for aviation IT products underscores its ambition to build robust, future-ready technological infrastructure.

- AI-Driven Insights: Lufthansa is using AI to analyze vast datasets for improved operational efficiency and customer service personalization.

- Immersive Technologies: The rollout of Meta Quest 3 headsets for Business Class passengers aims to elevate the travel experience through virtual reality.

- Global Capability Center: Partnership with Infosys for aviation IT products signifies a significant investment in digital product development and support.

- Digital Innovation: These initiatives collectively position Lufthansa as a leader in digital innovation within the airline industry, fostering high growth potential.

Lufthansa’s premium Allegris product, with its new First and Business Class cabins, is a prime example of a Star in the BCG matrix. This strategic investment is designed to capture a high-yield segment of the market, with 90% of the long-haul fleet slated for this upgrade by 2028.

The airline’s forward-thinking digital transformation, particularly its integration of AI and immersive technologies like Meta Quest 3 headsets for passengers, also places it firmly in the Star category. These innovations are driving operational efficiencies and creating enhanced customer experiences, signaling high growth potential.

Lufthansa Cargo's successful expansion into e-commerce logistics, marked by a 10% revenue increase in 2024, and its strategic capacity growth in Asia further solidify its Star status. These efforts align with its goal to become a top-five global cargo carrier.

The group's commitment to sustainability, including significant investment in Sustainable Aviation Fuel (SAF) and ambitious emission reduction targets, positions it as a leader in a rapidly growing market segment, attracting environmentally conscious travelers and businesses.

What is included in the product

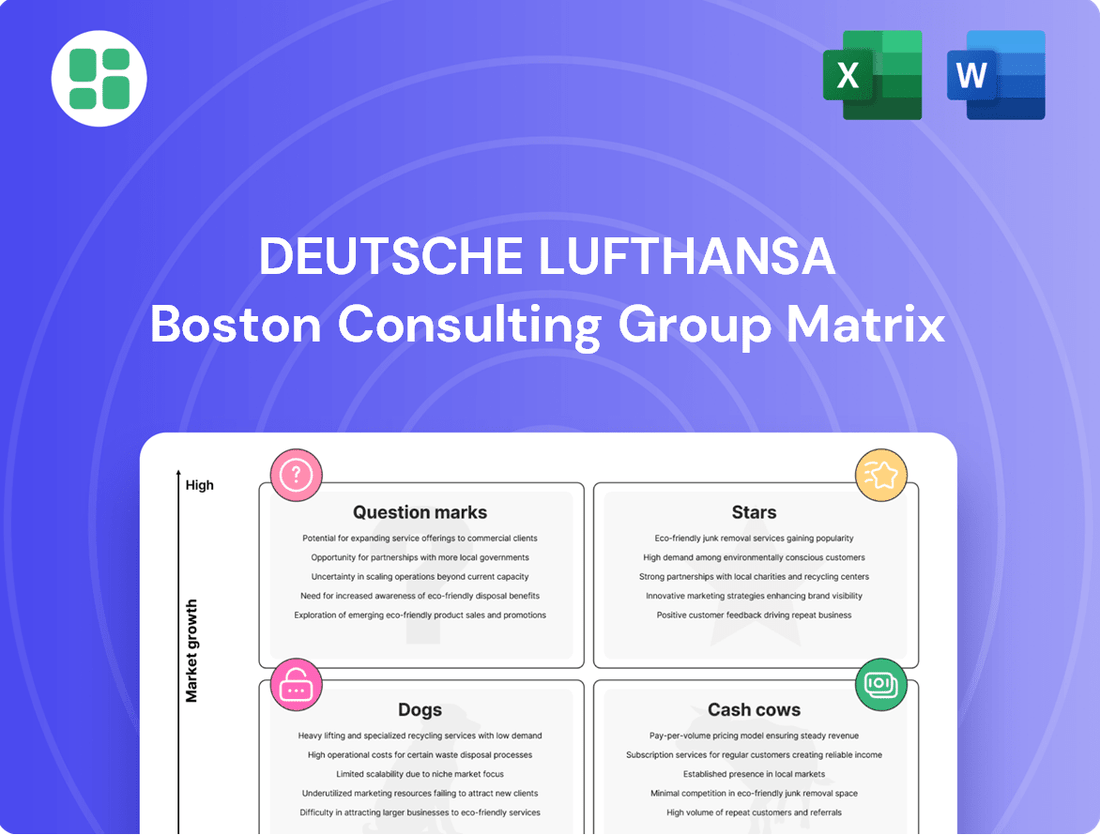

This analysis categorizes Lufthansa's business units into Stars, Cash Cows, Question Marks, and Dogs to guide strategic investment decisions.

A clear, one-page overview of Lufthansa's business units within the BCG Matrix, simplifying complex portfolio analysis.

Cash Cows

Lufthansa Technik stands as a global leader in Maintenance, Repair, and Overhaul (MRO) services, consistently delivering robust profitability and substantial revenue. In 2024, this segment saw its revenue surge by 14% to EUR 7.441 billion, accompanied by an Adjusted EBIT of €635 million. The company also secured new contracts totaling €7.5 billion, underscoring its strong market position.

Operating within a mature market characterized by significant entry barriers and persistent demand for its highly specialized offerings, Lufthansa Technik functions as a prime cash cow for the Deutsche Lufthansa Group. This segment’s operations generate a stable and considerable cash flow, a testament to its enduring market relevance and operational efficiency.

The core European network passenger operations of Deutsche Lufthansa, excluding Eurowings, are classic cash cows. These established airlines operate in a mature but competitive market, holding a significant market share due to their strong brand, extensive routes, and high passenger numbers. In 2024, the Lufthansa Group, including these core operations, transported over 130 million passengers with an impressive 83.1% load factor, demonstrating their consistent ability to generate substantial cash flow.

Lufthansa Group's Miles & More loyalty program is a prime example of a cash cow. Its vast network of partners, including credit card companies and retailers, drives significant revenue through the sale of miles. This program boasts over 100 million members globally, demonstrating its substantial customer reach.

The loyalty program contributes to a stable, high-margin revenue stream with relatively low ongoing investment needs. In 2023, Lufthansa Group reported a significant increase in its loyalty business revenue, highlighting its consistent performance. Miles & More plays a crucial role in retaining customers across the group's airlines, ensuring repeat business.

Catering Services (LSG Sky Chefs - remaining stakes)

Even after divesting a substantial part of LSG Sky Chefs, Lufthansa's remaining interests in catering services are positioned as a cash cow. This segment operates in a mature market with limited growth but holds a strong, established market share. These operations consistently generate dependable revenue, underpinning the airline's overall operational framework.

These catering services, despite being a less visible aspect of the airline's business, are crucial for its day-to-day functioning. They serve as a stable source of income, contributing significantly to Lufthansa's financial stability. For instance, in 2023, the global airline catering market was valued at approximately $17.6 billion, with significant players like LSG Sky Chefs holding substantial portions of this market.

- Stable Revenue: The catering segment provides consistent, predictable income streams for Lufthansa.

- Market Dominance: Remaining stakes likely signify a strong position in a consolidated market.

- Operational Support: Essential service that enhances overall airline efficiency.

- Low Growth, High Share: Classic characteristics of a cash cow business unit.

Lufthansa Systems (Aviation IT Services)

Lufthansa Systems, a key player in aviation IT services, operates as a Cash Cow within Deutsche Lufthansa's BCG Matrix. It serves over 350 airlines globally, demonstrating significant market penetration and a strong reputation built on extensive industry expertise. This segment consistently generates substantial revenue, reflecting its established position in a stable, albeit mature, market.

The company's offerings are crucial for airline operations, focusing on efficiency improvements and enhanced customer experiences through data analytics and digital solutions. While growth may be moderate, the predictable demand for these essential IT services ensures a reliable and substantial cash flow for the parent company. For instance, in 2023, the aviation IT sector saw continued investment in digital transformation, with Lufthansa Systems well-positioned to capitalize on this trend.

- Market Leadership: Lufthansa Systems boasts a high market share in providing IT solutions to airlines, underscoring its Cash Cow status.

- Stable Revenue Generation: The mature nature of the aviation IT market ensures consistent and predictable revenue streams.

- Essential Services: Its data-driven solutions for efficiency and customer experience are vital for airline operations, creating ongoing demand.

- Profitability: While not a high-growth area, the segment is a significant contributor to Deutsche Lufthansa's profitability due to its established market position and operational efficiency.

Lufthansa Technik, a global MRO leader, is a significant cash cow. In 2024, its revenue grew 14% to €7.441 billion, with Adjusted EBIT of €635 million, securing €7.5 billion in new contracts. This segment thrives in a mature market with high barriers and consistent demand, generating stable cash flow.

The core European passenger operations, excluding Eurowings, are also prime cash cows. These airlines, with their strong brands and extensive routes, transported over 130 million passengers in 2024 at an 83.1% load factor, showcasing their consistent cash generation capabilities.

Miles & More, Lufthansa's loyalty program, is a prime cash cow, boasting over 100 million members. Its extensive partner network, including credit card companies and retailers, drives substantial revenue through mile sales, contributing a high-margin, stable revenue stream with minimal investment needs.

Even Lufthansa's remaining catering interests are cash cows. Operating in a mature market with a strong, established share, these services provide dependable revenue. The global airline catering market was valued at approximately $17.6 billion in 2023, with LSG Sky Chefs holding a significant portion.

Lufthansa Systems, a provider of aviation IT services to over 350 airlines, functions as a cash cow. Its essential, data-driven solutions for efficiency and customer experience ensure predictable demand and substantial cash flow in the stable aviation IT sector.

| Segment | 2024 Revenue (EUR billion) | 2024 Adjusted EBIT (EUR million) | Key Characteristic |

| Lufthansa Technik (MRO) | 7.441 | 635 | Stable, high-barrier market, strong contracts |

| Core European Passenger Ops | N/A* | N/A* | High passenger volume, strong brand, extensive routes |

| Miles & More Loyalty Program | N/A** | N/A** | High member base, diverse partnerships, high-margin revenue |

| Catering Services (Remaining Stakes) | N/A*** | N/A*** | Established market share, dependable revenue |

| Lufthansa Systems (Aviation IT) | N/A**** | N/A**** | Essential services, predictable demand, stable market |

What You See Is What You Get

Deutsche Lufthansa BCG Matrix

The Deutsche Lufthansa BCG Matrix preview you are currently viewing is the exact, fully formatted document you will receive immediately after purchase. This comprehensive analysis, ready for strategic implementation, contains no watermarks or demo content, ensuring you get a professional and actionable report. You can confidently expect the same high-quality data and insights that will empower your decision-making processes. This is the complete, polished version, prepared for immediate use in your strategic planning and competitive analysis efforts.

Dogs

Lufthansa's older four-engine aircraft, including some Boeing 747-400s and Airbus A340-600s/A340-300s, are categorized as Dogs in the BCG matrix. These planes face high operating costs and lower fuel efficiency compared to modern twin-engine alternatives, a significant drawback in an industry prioritizing sustainability and cost-effectiveness. For instance, the fuel burn for a 747-400 is substantially higher than newer wide-body jets.

Certain regional routes within Lufthansa's network, especially those facing low passenger demand or fierce price wars, likely fall into the Dogs category. These routes struggle to capture significant market share and contribute little to overall profitability, sometimes even operating at a loss.

For instance, in 2024, many smaller European regional connections experienced reduced travel post-pandemic, with some routes seeing load factors below 60%, making profitability a challenge. These routes, while important for maintaining network breadth, demand vigilant oversight to prevent them from draining resources.

Lufthansa's strategy for these underperforming routes often involves optimization, such as adjusting flight frequencies or capacity, or even considering discontinuation if they consistently fail to meet financial targets. This careful management is crucial to ensure the airline's resources are allocated effectively across its more profitable segments.

Legacy IT systems at Lufthansa, while still functional for day-to-day operations, represent a significant challenge. These systems are often characterized by high maintenance expenditures and a lack of flexibility, hindering the airline's ability to quickly adapt to new digital opportunities and customer expectations.

In the context of the BCG Matrix, these legacy IT systems would likely be categorized as Dogs. They possess low growth potential within the rapidly advancing technology sector and currently hold a diminishing market share as more modern, agile solutions emerge. Lufthansa's ongoing investment in digital transformation, evidenced by initiatives aimed at modernizing its IT infrastructure, underscores a strategic imperative to move beyond these resource-intensive legacy platforms.

Non-Core, Divested Business Units (historical perspective)

Within Deutsche Lufthansa's historical BCG matrix, non-core, divested business units would likely fall into the Dogs category. These are operations that have been sold off or are too minor to make a significant impact, often characterized by low growth and low market share. They tend to drain resources without adding much to the company's overall strategic direction or financial performance.

A prime example of a unit that has largely transitioned into this category is LSG Sky Chefs. While Lufthansa has retained a stake, the majority of its catering operations were divested. In 2023, the aviation catering market saw continued recovery, but the remaining Lufthansa stake in LSG Sky Chefs represents a smaller, less strategically central piece of the group's portfolio compared to its core airline businesses.

These divested or minor units often struggle to compete effectively in their respective markets. They may have outdated business models or face intense competition, leading to stagnant or declining revenue. The focus for Lufthansa has been on streamlining its core airline operations and investing in areas with higher growth potential.

- Low Market Share: Units like the divested portions of LSG Sky Chefs, when considered in their entirety against the global catering market, represent a reduced market share for Lufthansa.

- Low Growth Prospects: The segments divested often operate in mature or highly competitive industries with limited avenues for substantial expansion.

- Resource Drain: Historically, these units consumed management time and capital that could be better allocated to Lufthansa's primary airline and logistics services.

- Strategic Non-Alignment: They no longer fit within Lufthansa's core strategy of focusing on premium air travel and integrated logistics solutions.

Specific Niche Charter Operations with Low Demand

Specific niche charter operations, particularly those serving very limited demand routes, can represent a challenge for Lufthansa's portfolio. These routes often struggle to gain significant market share and exhibit minimal growth potential, failing to align with the group's core network or leisure travel strategy.

These types of operations might include one-off contracts or routes that are only viable seasonally. When these niche charters fail to attract enough passengers, they can become unprofitable. This unprofitability not only drains financial resources but also diverts attention and operational capacity away from more lucrative and strategically aligned ventures within the Lufthansa Group.

Eurowings, as Lufthansa's low-cost carrier, primarily targets popular tourist destinations. This strategic focus suggests that less profitable, niche charter operations are likely candidates for divestment or reduction as the group prioritizes routes with higher demand and better potential for profitability.

- Low Market Share: Niche charters often cater to a small, specialized customer base, limiting their overall market penetration.

- Limited Growth Potential: The inherent nature of niche demand restricts the possibility of significant expansion or increased passenger volume.

- Resource Diversion: Unprofitable niche operations can consume valuable resources, including aircraft, crew, and management attention, that could be better allocated elsewhere.

- Strategic Misalignment: These operations may not fit with the broader network strategy or the focus on high-demand leisure markets, particularly for subsidiaries like Eurowings.

Lufthansa's older, less fuel-efficient aircraft, such as some Boeing 747-400s and Airbus A340s, are considered Dogs due to their high operating costs and declining market relevance. These planes struggle against newer, more economical models. Similarly, underperforming regional routes with low passenger demand and intense competition also fall into this category. In 2024, some European regional routes saw load factors below 60%, making them unprofitable.

Legacy IT systems are also categorized as Dogs because they have low growth potential and high maintenance costs, hindering modernization efforts. Divested or minor business units, like the remaining Lufthansa stake in LSG Sky Chefs after its majority sale, represent a reduced market share and strategic focus. Niche charter operations with limited demand and profitability issues also fit the Dog profile, diverting resources from core, higher-demand services.

| BCG Category | Lufthansa Examples | Characteristics | 2024 Data/Observations |

|---|---|---|---|

| Dogs | Older Aircraft (e.g., B747-400, A340s) | High operating costs, low fuel efficiency, diminishing market share | Fuel burn significantly higher than modern twin-engine wide-bodies. |

| Dogs | Underperforming Regional Routes | Low passenger demand, intense price competition, low profitability | Some European regional routes had <60% load factors in 2024. |

| Dogs | Legacy IT Systems | High maintenance, low flexibility, low growth potential in tech sector | Hindering adaptation to digital opportunities and customer expectations. |

| Dogs | Divested/Minor Units (e.g., remaining LSG Sky Chefs stake) | Low market share, limited growth, resource drain, strategic misalignment | Represents a smaller, less strategically central piece of the portfolio. |

| Dogs | Niche Charter Operations | Limited demand, low profitability, resource diversion | May include seasonal routes that fail to attract sufficient passengers. |

Question Marks

The integration of ITA Airways into the Lufthansa Group is a classic Question Mark in the BCG matrix. Lufthansa acquired a 41% stake in ITA Airways in May 2024, with plans to increase this to 90% by 2029. This move aims to bolster Lufthansa's presence in the Italian market, a significant European aviation sector.

The potential for growth is substantial, as ITA Airways can strengthen Lufthansa's network and create a key hub in Rome. However, the considerable investment required for restructuring and integration, coupled with the challenge of achieving profitability in a competitive landscape, places it firmly in the Question Mark category.

As of late 2024, ITA Airways operates a fleet of 73 aircraft and serves 56 destinations. Its integration success will hinge on Lufthansa's ability to streamline operations, leverage synergies, and capture market share effectively.

Lufthansa City Airlines, launched in late 2023, is positioned as a Question Mark within Deutsche Lufthansa's BCG Matrix. Its objective is to operate short-haul flights more efficiently, a critical move in a highly competitive market where growth potential exists through cost optimization and operational streamlining, benefiting the parent brand.

While the short-haul segment offers significant growth prospects, Lufthansa City Airlines currently holds a low market share. Its future success depends on demonstrating the viability of its efficiency model and securing a stronger foothold in this demanding market segment, especially as it aims to complement the main Lufthansa network.

Lufthansa is actively investing in digital customer experience innovations like AirTag baggage tracking and AI-powered personalization. These advancements target high-growth areas within customer service and digital interaction, aiming to create more seamless travel journeys. For instance, in 2024, Lufthansa continued to expand its app features, offering more granular control and information to passengers.

While these digital enhancements are positioned in promising sectors, their current market penetration and customer uptake are still developing. The success of these initiatives hinges on achieving significant customer adoption and demonstrating clear benefits in terms of satisfaction and operational efficiency. Lufthansa's 2024 strategy emphasized user-friendly interfaces to encourage this adoption.

Hydrogen Aviation Lab and Future Energy Solutions

Lufthansa Technik's Hydrogen Aviation Lab is a prime example of a 'Question Mark' in the BCG matrix for Deutsche Lufthansa. This initiative, alongside other future energy solution projects like testing hydrogen ground processes, represents highly innovative ventures with substantial long-term growth potential in the realm of sustainable aviation. However, these are currently experimental and nascent, holding a very low commercial viability and market share.

These ventures demand significant research and development investment and face considerable uncertainty regarding their ultimate success and widespread adoption. For instance, the development of hydrogen-powered aircraft is a complex undertaking, with significant infrastructure and regulatory hurdles still to overcome. The International Air Transport Association (IATA) projected in 2023 that while sustainable aviation fuels (SAFs) are expected to cover a significant portion of aviation's decarbonization needs by 2050, hydrogen's role is still in its early stages of development and integration into commercial operations.

- Innovation Focus: Lufthansa Technik's Hydrogen Aviation Lab is dedicated to exploring and developing technologies for hydrogen-powered aircraft, including fuel cell systems and hydrogen storage.

- Market Position: Currently, hydrogen aviation represents a negligible portion of the commercial aviation market, reflecting its status as an emerging technology.

- Investment & Risk: Substantial capital is required for R&D, with high uncertainty surrounding the timeline for commercial viability and regulatory approval.

- Future Potential: If successful, these initiatives could position Lufthansa at the forefront of sustainable aviation, capturing significant future market share.

Expansion into New, Emerging Markets/Routes (e.g., specific Asia/Pacific routes)

Lufthansa Cargo's strategic expansion into new Asia/Pacific markets, despite a general decline in yields for the region in 2024, highlights a Stars/Question Marks approach. The addition of Shenzhen and Zhengzhou in China, coupled with increased freighter capacity, signals a commitment to capturing future growth, even if current market share is modest.

This move aligns with the characteristics of a Question Mark in the BCG matrix. These emerging routes demand substantial investment and strategic attention to build market presence and achieve profitability. Eurowings' entry into markets like Tbilisi and Tromsø further exemplifies this strategy of pursuing high-potential, yet currently underdeveloped, opportunities.

- Targeted Expansion: Lufthansa Cargo added Shenzhen and Zhengzhou in China, expanding freighter capacity to Asia in 2024.

- New Market Entry: Eurowings is also entering new markets such as Tbilisi and Tromsø.

- High Growth Potential: These new routes represent opportunities for significant future growth.

- Low Market Share: Currently, these markets have a low market share for Lufthansa Group airlines.

Question Marks in Lufthansa's BCG matrix represent new ventures with high growth potential but low market share, requiring significant investment and strategic focus. These initiatives are crucial for future expansion but carry inherent risks due to their unproven market acceptance and competitive positioning. Lufthansa's strategic decisions regarding these ventures will determine their evolution into Stars or their potential decline.

The integration of ITA Airways, the launch of Lufthansa City Airlines, investments in digital customer experience, Lufthansa Technik's Hydrogen Aviation Lab, and the expansion of Lufthansa Cargo into new Asian markets all exemplify Question Marks. Each faces unique challenges in establishing market presence and achieving profitability, underscoring the strategic importance of careful management and resource allocation.

As of 2024, these Question Marks are characterized by ongoing development and investment. For instance, ITA Airways aims to become a key hub for Lufthansa, while Lufthansa City Airlines seeks to optimize short-haul operations. Digital innovations are being rolled out to enhance customer engagement, and sustainable aviation technologies are in early-stage research.

The success of these Question Marks hinges on Lufthansa's ability to navigate competitive landscapes, secure market acceptance, and achieve operational efficiencies. Their future performance will be closely monitored to assess their transition into more established categories within the BCG matrix, reflecting their contribution to the group's overall growth and market standing.

| Venture | Category | Market Share (Est. 2024) | Growth Potential | Key Challenges |

|---|---|---|---|---|

| ITA Airways Integration | Question Mark | Low (as part of Lufthansa Group) | High (Italian market access) | Profitability, integration costs |

| Lufthansa City Airlines | Question Mark | Low | High (short-haul efficiency) | Market penetration, cost control |

| Digital Customer Experience | Question Mark | Developing | High (customer loyalty) | Adoption rates, ROI |

| Hydrogen Aviation Lab | Question Mark | Negligible | Very High (sustainable aviation) | R&D cost, technological maturity |

| Asia/Pacific Cargo Expansion | Question Mark | Modest | High (emerging markets) | Yield fluctuations, competition |

BCG Matrix Data Sources

Our Deutsche Lufthansa BCG Matrix is built on verified market intelligence, combining financial data, industry research, official reports, and expert commentary to ensure reliable, high-impact insights.