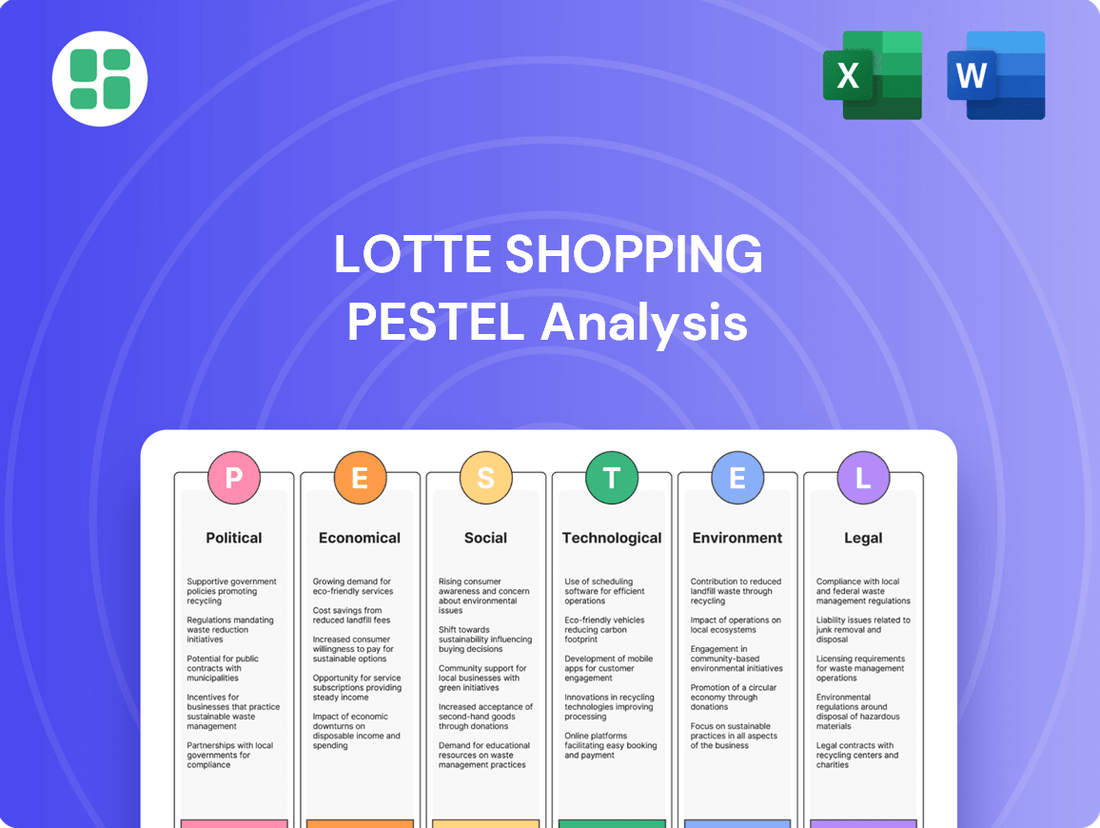

Lotte Shopping PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Lotte Shopping Bundle

Uncover the critical political, economic, social, technological, legal, and environmental factors shaping Lotte Shopping's future. This comprehensive PESTLE analysis provides actionable intelligence to identify opportunities and mitigate risks in the dynamic retail landscape. Download the full report now to gain a strategic advantage and make informed decisions.

Political factors

Government regulations significantly shape Lotte Shopping's operational landscape, particularly concerning consumer protection and fair trade. For instance, amendments to South Korea's Electronic Commerce Act, set to take effect in February 2025, will impose stricter rules on online marketing, compelling Lotte Shopping to refine its digital strategies to avoid penalties and uphold consumer confidence.

The Korea Fair Trade Commission (KFTC) is actively enhancing consumer safeguards, including plans to publicly list platforms with recurring customer complaints. This initiative places a premium on Lotte Shopping's customer service and operational transparency, as a high complaint rate could impact its market reputation and regulatory standing.

South Korea's trade policies, particularly its Free Trade Agreements (FTAs) with countries like the United States and China, significantly shape Lotte Shopping's ability to source goods internationally and expand its retail footprint. These agreements can reduce tariffs on imported products, lowering costs for Lotte Shopping and potentially making its offerings more competitive.

Geopolitical risks, such as trade disputes or the imposition of protectionist measures, pose a direct threat to Lotte Shopping's supply chain stability and profitability. For instance, increased tariffs on goods from key manufacturing hubs could escalate the cost of inventory, impacting margins, especially for electronics and apparel which are significant categories for Lotte Shopping.

Lotte Shopping's ambitious expansion into Southeast Asia, including markets like Vietnam and Indonesia, is heavily contingent on the political stability and favorable bilateral trade relations within these regions. In 2023, Vietnam continued to be a key growth market for South Korean retail, with Lotte Mart expanding its presence there, underscoring the importance of stable political environments for such ventures.

Domestic political stability plays a significant role in shaping consumer sentiment and spending habits, which are vital for Lotte Shopping's retail operations. When the political landscape is stable, consumers tend to feel more confident about the future, leading to increased discretionary spending. Conversely, periods of political uncertainty can dampen this confidence.

Economic uncertainties, often exacerbated by political instability, directly impact consumer spending. For instance, the South Korean retail market experienced a noticeable slowdown in consumer spending during parts of 2024 and early 2025, partly attributed to lingering economic concerns influenced by political developments. This can translate to reduced sales across Lotte Shopping's diverse formats, from its premium department stores to its everyday hypermarkets and supermarkets.

Lotte Shopping must remain agile and responsive to these fluctuating consumer sentiments. The company's ability to adapt its strategies, promotions, and product offerings in line with consumer confidence levels is crucial for mitigating the impact of political and economic volatility on its overall market performance.

Support for Small Businesses and Competition

Government initiatives designed to bolster small and medium-sized enterprises (SMEs) and ensure fair market competition directly shape the operating environment for major players like Lotte Shopping. These policies, while intended to create a more balanced marketplace, can also impose new regulatory demands and sharpen competition from nimble, niche businesses. For instance, the Korea Fair Trade Commission (KFTC) has outlined plans for 2025 that prioritize strengthening SME economic power, a move that could result in heightened oversight of large corporate conglomerates.

The KFTC's focus on SME support in 2025 is a significant political factor. This strategy aims to foster a more diverse retail ecosystem. Such efforts can translate into:

- Increased regulatory scrutiny on large retailers' market practices to prevent unfair advantages.

- Potential for preferential treatment or subsidies for SMEs, enabling them to compete more effectively on price or innovation.

- New compliance requirements for Lotte Shopping related to fair trade and SME engagement, potentially impacting operational costs.

Tourism Policy and Foreign Visitors

Government initiatives to stimulate tourism are a significant tailwind for Lotte Shopping, particularly its duty-free operations and department stores located in popular tourist destinations. For instance, in 2023, South Korea saw a notable increase in foreign tourist arrivals, reaching approximately 11 million visitors, a substantial jump from the 2.4 million in 2022, indicating a positive trend for retail sectors catering to international shoppers.

Policy adjustments, such as reductions in patent fees for airport duty-free shops and the relaxation of import restrictions on duty-free alcoholic beverages, are designed to further invigorate the tourism retail landscape. These measures aim to enhance the competitiveness and offerings available to foreign visitors, potentially driving higher spending.

Conversely, geopolitical tensions or advisory warnings against travel to South Korea can have a detrimental effect on foreign visitor numbers. Such events can lead to a sharp decline in sales for Lotte Shopping's tourist-focused segments, as seen during periods of heightened regional instability.

- Increased Tourist Arrivals: South Korea welcomed around 11 million foreign tourists in 2023, a significant recovery and growth from previous years.

- Policy Support: Reductions in patent fees for airport duty-free shops and eased import limits for duty-free alcohol are direct government efforts to boost tourism retail.

- Geopolitical Sensitivity: Lotte Shopping's performance in duty-free and tourist-centric stores remains vulnerable to international relations and travel advisories.

Government regulations concerning consumer protection and fair trade significantly impact Lotte Shopping's operations. For instance, upcoming changes to South Korea's Electronic Commerce Act in February 2025 will necessitate adjustments to Lotte Shopping's digital marketing strategies to ensure compliance and maintain consumer trust.

The Korea Fair Trade Commission's (KFTC) initiative to publicly list platforms with recurring customer complaints underscores the importance of Lotte Shopping's customer service and operational transparency to safeguard its market reputation.

South Korea's trade policies and FTAs, such as those with the US and China, influence Lotte Shopping's international sourcing and expansion capabilities by potentially lowering tariffs on imported goods.

Geopolitical risks, including trade disputes and protectionist measures, can disrupt Lotte Shopping's supply chain and profitability, particularly impacting categories like electronics and apparel due to potential tariff increases.

Lotte Shopping's international expansion, notably into Vietnam in 2023, highlights the critical role of political stability and favorable bilateral trade relations in driving growth for its retail formats.

Domestic political stability directly affects consumer sentiment and spending, crucial for Lotte Shopping's retail performance, with stable environments generally fostering increased discretionary spending.

Economic uncertainties, often linked to political developments, can dampen consumer spending, as observed in the South Korean retail market during parts of 2024 and early 2025, impacting Lotte Shopping's sales across various store types.

Government initiatives supporting small and medium-sized enterprises (SMEs) in 2025, as outlined by the KFTC, may lead to increased regulatory scrutiny on large retailers like Lotte Shopping and potentially new compliance demands.

Government efforts to boost tourism, including the 11 million foreign visitors to South Korea in 2023, directly benefit Lotte Shopping's duty-free and department store operations.

Policy adjustments, such as reduced patent fees for airport duty-free shops, aim to further enhance the tourism retail sector, positively impacting Lotte Shopping's offerings to international shoppers.

Geopolitical tensions or travel advisories pose a risk to Lotte Shopping's tourist-focused retail segments by potentially reducing foreign visitor numbers and sales.

| Political Factor | Impact on Lotte Shopping | 2024/2025 Relevance |

|---|---|---|

| Consumer Protection Regulations | Requires adherence to e-commerce laws, impacting digital strategies. | Amendments to Electronic Commerce Act effective Feb 2025. |

| Fair Trade Commission (KFTC) Actions | Emphasis on customer service and transparency due to complaint listing. | KFTC plans to strengthen SME power, potentially increasing oversight. |

| Trade Policies & FTAs | Facilitates international sourcing and market expansion by reducing tariffs. | Continued influence of FTAs with major economies like US and China. |

| Geopolitical Risks | Threatens supply chain stability and profitability through tariffs. | Ongoing global trade tensions can impact inventory costs. |

| Political Stability in Expansion Markets | Crucial for successful international ventures, e.g., Vietnam expansion. | Vietnam remains a key growth market for South Korean retail. |

| Domestic Political Stability | Influences consumer confidence and discretionary spending. | Periods of uncertainty can dampen consumer spending. |

| Tourism Promotion Policies | Boosts sales for duty-free and tourist-centric stores. | 11 million foreign tourists in 2023, with policy support for duty-free. |

What is included in the product

This PESTLE analysis offers a comprehensive examination of the external macro-environmental forces influencing Lotte Shopping, covering Political, Economic, Social, Technological, Environmental, and Legal factors.

It provides actionable insights and forward-looking perspectives to aid strategic decision-making and identify potential opportunities and threats.

A concise PESTLE analysis for Lotte Shopping provides a clear overview of external factors, acting as a pain point reliver by offering actionable insights for strategic decision-making.

Economic factors

Lotte Shopping's success is intrinsically linked to South Korea's economic health and how much consumers are spending. When the economy is growing and people feel confident, they tend to open their wallets more readily for a wider range of goods.

However, the South Korean retail sector has been experiencing a slowdown. For 2024 and into 2025, growth is expected to be modest. This is largely because of economic uncertainty and a general trend towards recessionary consumption, meaning people are being more careful with their money.

This cautious consumer behavior translates to a focus on necessities and value-driven purchases. Lotte Shopping, like other retailers, will need to adapt to this environment where consumers prioritize essential items or seek out the best deals and quality for their money.

High inflation in 2023 and early 2024 significantly impacted consumer sentiment, leading to reduced discretionary spending which directly affected Lotte Shopping's sales performance. For instance, South Korea's consumer price index (CPI) saw an increase of 3.6% in 2023. While inflation is projected to moderate to around 2.5% in 2025, the lingering effects of elevated interest rates, with the Bank of Korea's policy rate remaining at 3.50% as of early 2025, continue to dampen domestic demand and increase Lotte Shopping's borrowing costs.

To navigate these economic headwinds, Lotte Shopping has been actively pursuing internal operational efficiencies. This includes optimizing inventory management and streamlining supply chains to control costs. The company's focus on enhancing the in-store experience and expanding its online presence also aims to offset the impact of slower consumer spending, as evidenced by their continued investment in digital transformation initiatives throughout 2024.

The e-commerce sector is experiencing robust expansion, with global online retail sales projected to reach $7.5 trillion by 2024. This surge, driven by increasing internet penetration and smartphone usage, directly influences Lotte Shopping's strategy. Mobile commerce, in particular, is a dominant force, accounting for over half of all e-commerce sales.

Digital payment solutions are integral to this shift, with a growing preference for contactless and mobile payment methods. In 2023, digital payments represented over 75% of all retail transactions in many developed markets. This necessitates Lotte Shopping to further enhance its digital payment infrastructure and integrate seamless online checkout experiences to capture market share.

Disposable Income and Purchasing Power

Disposable income is a key driver for Lotte Shopping. In South Korea, household disposable income has shown steady growth, with a projected increase in real terms for 2024 and 2025, although the pace may vary. This rise, particularly among younger demographics and higher-income households, translates to greater spending potential on discretionary items, a core area for Lotte's department stores and e-commerce platforms.

However, economic headwinds can significantly impact purchasing power. Inflationary pressures and potential interest rate hikes in 2024 and 2025 could erode real disposable income, leading consumers to prioritize essentials and seek more value-oriented options. Lotte Shopping needs to be agile, potentially adjusting its merchandise mix and promotional activities to cater to this shift towards more cautious spending.

- Rising Disposable Income: South Korea's household disposable income is expected to see moderate growth in 2024-2025, boosting consumer confidence and spending on non-essential goods.

- Purchasing Power Sensitivity: Economic uncertainties and inflation can dampen consumer purchasing power, leading to a preference for value and essential items.

- Strategic Adaptation: Lotte Shopping must align its product assortment and pricing strategies with evolving consumer spending habits to maintain market share.

- Segmented Focus: Growth in disposable income is not uniform; targeting affluent segments and value-conscious consumers with tailored offerings will be crucial.

Competition and Market Polarization

The South Korean retail landscape is a battleground, dominated by giants like Lotte, Shinsegae, and Hyundai, creating a highly concentrated market. This intense competition fuels market polarization, where established players fight for dominance and smaller entities struggle to gain traction. For instance, Lotte Shopping's revenue in 2023 reached approximately 17.7 trillion KRW, highlighting its significant market share amidst this rivalry.

The traditional department store model is facing significant pressure, necessitating restructuring to adapt. Meanwhile, discount stores and convenience chains are strategically venturing into niche formats, seeking to carve out unique market positions and retain customer loyalty. This trend underscores the need for agility and targeted strategies in a dynamic retail environment.

- Market Concentration: South Korea's retail sector is characterized by a high degree of market concentration, with Lotte, Shinsegae, and Hyundai holding substantial shares.

- Polarization Effects: Intense competition leads to market polarization, impacting the strategies of all players, from large conglomerates to smaller specialty retailers.

- Restructuring Needs: Department stores are actively exploring restructuring to remain competitive against evolving retail formats and consumer preferences.

- Niche Strategies: Discount and convenience stores are adopting niche strategies, focusing on specialized offerings to differentiate themselves and capture specific customer segments.

South Korea's economic outlook for 2024-2025 points to modest growth, with consumers exhibiting cautious spending due to lingering inflation and interest rate impacts. This environment necessitates Lotte Shopping to focus on value-driven offerings and operational efficiencies to maintain its market position.

While disposable income is projected to grow, its impact on Lotte Shopping's performance will be tempered by economic uncertainties, pushing consumers towards essentials and value-conscious purchases.

The company's strategic adaptation, including digital expansion and cost control measures, is crucial for navigating these economic headwinds and capitalizing on evolving consumer behaviors.

| Economic Factor | 2023 Data | 2024 Projection | 2025 Projection |

|---|---|---|---|

| South Korea CPI Growth | 3.6% | ~2.8% | ~2.5% |

| Bank of Korea Policy Rate | 3.50% | 3.50% | 3.50% |

| Global E-commerce Sales | N/A | ~$7.5 trillion | N/A |

| Lotte Shopping Revenue | ~17.7 trillion KRW | N/A | N/A |

What You See Is What You Get

Lotte Shopping PESTLE Analysis

The preview you see here is the exact Lotte Shopping PESTLE Analysis document you’ll receive after purchase—fully formatted and ready to use.

This is a real screenshot of the product you’re buying, providing a comprehensive look at the Political, Economic, Social, Technological, Legal, and Environmental factors impacting Lotte Shopping. It’s delivered exactly as shown, no surprises.

The content and structure shown in this preview is the same Lotte Shopping PESTLE Analysis document you’ll download after payment, offering valuable strategic insights.

Sociological factors

South Korean consumers are increasingly seeking personalized shopping journeys, with a notable emphasis on value and cost-effectiveness, as highlighted by the YONO (You Only Need One) concept. This shift means Lotte Shopping needs to refine its marketing strategies and product assortments to align with these evolving consumer priorities. For instance, a growing segment of consumers, particularly younger demographics, are showing a stronger preference for unique, ethically sourced, and sustainable products, influencing purchasing decisions beyond just price.

To effectively cater to these changing preferences, Lotte Shopping is leveraging data analytics to offer more tailored recommendations and promotions. This data-driven approach helps in understanding individual customer needs and curating product selections that resonate with the demand for both value and unique offerings. The company's ability to adapt its in-store and online experiences to reflect these nuanced behaviors will be crucial for maintaining market relevance and driving sales growth in the competitive South Korean retail landscape.

South Korea is experiencing a dramatic demographic shift, moving towards becoming a super-aged society. By 2025, projections indicate the proportion of individuals aged 65 and over will continue to rise significantly, placing a strain on social services and altering consumer behavior. This trend, coupled with a persistently low birth rate, means a shrinking pool of younger consumers and a growing segment with different purchasing priorities.

The aging population directly influences consumer spending, with an increasing demand for products and services focused on health, wellness, and convenience. Lotte Shopping must adapt its offerings to meet these evolving needs, potentially expanding its range of health supplements, accessible retail environments, and specialized services. Simultaneously, it's crucial to acknowledge the continued, albeit smaller, purchasing power and influence of younger demographics.

The pervasive global reach of K-Culture, encompassing everything from K-Pop music to K-dramas and Korean beauty, offers significant avenues for retailers like Lotte Shopping. By integrating these cultural elements into their offerings, Lotte can tap into a massive, engaged consumer base. For instance, Lotte Department Store's "K-Wave Zone" in its main branch saw a notable increase in foot traffic and sales from international visitors, particularly those drawn to Korean fashion and beauty products during 2024.

Lotte Shopping can strategically capitalize on this by forging partnerships with popular K-Pop groups or K-drama production houses for exclusive merchandise launches and in-store events. Curated product selections that reflect current K-Culture trends, such as specific skincare routines or fashion styles, can further enhance brand appeal and drive international sales. This cultural synergy is a powerful tool for boosting brand recognition and attracting a younger, globally-minded demographic, as evidenced by the strong performance of Lotte's online platforms in Southeast Asian markets during the first half of 2025, attributed in part to K-Culture related promotions.

Urbanization and Convenience Seeking

South Korea's highly urbanized population, with over 90% living in cities, fuels a strong demand for convenience. This trend is particularly evident in the 2024/2025 period, where consumers increasingly favor quick access to goods and services. Lotte Shopping's strategy must align with this, focusing on smaller, easily accessible retail formats and robust online platforms to meet the need for immediate gratification.

The drive for convenience translates into a preference for omnichannel retail experiences. Lotte Shopping's hypermarkets and supermarkets are adapting by integrating with their e-commerce operations, offering services like click-and-collect and faster delivery options. This approach is crucial as convenience stores, a key beneficiary of this trend, saw their market share grow significantly in recent years.

- Urban Concentration: Over 90% of South Korea's population resides in urban areas, creating dense consumer bases.

- Convenience Preference: Consumers increasingly prioritize speed and ease in their shopping habits.

- Retail Format Shift: Growth in smaller formats like convenience stores and online channels outpaces traditional large-format retail.

- Omnichannel Imperative: Lotte Shopping must leverage its physical and digital assets to provide seamless, convenient shopping journeys.

Sustainability and Ethical Consumption

Consumer awareness regarding environmental impact and social responsibility is significantly shaping purchasing decisions. This growing consciousness fuels a strong demand for products that are both sustainable and ethically produced. For instance, a 2024 survey indicated that over 70% of South Korean consumers consider a brand's sustainability practices when making a purchase, a notable increase from previous years.

Younger generations, especially Gen Z, are at the forefront of this movement, demonstrating a clear willingness to invest more in eco-friendly goods and actively support companies demonstrating a commitment to sustainability. In 2024, Lotte Shopping reported a 15% year-over-year increase in sales for its eco-certified product lines, reflecting this consumer preference.

Lotte Shopping's ongoing Environmental, Social, and Governance (ESG) initiatives are therefore vital for capturing and maintaining the loyalty of these ethically-minded consumers. These efforts include implementing reduced plastic packaging across its private label brands and expanding waste reduction programs in its retail outlets. By prioritizing these aspects, Lotte Shopping can better align with evolving consumer values and secure a competitive edge.

- Growing Demand for Sustainable Goods: Over 70% of South Korean consumers consider sustainability in purchasing decisions (2024 data).

- Gen Z's Influence: Younger consumers are willing to pay a premium for eco-friendly products.

- Lotte Shopping's ESG Performance: Sales of eco-certified products saw a 15% increase in 2024.

- Key Initiatives: Focus on eco-friendly packaging and waste reduction strategies.

South Korea's demographic shifts, particularly its rapid aging and low birth rate, are reshaping consumer behavior. By 2025, the proportion of citizens aged 65 and over will continue to climb, impacting demand towards health, wellness, and convenience-focused products and services.

The pervasive influence of K-Culture continues to be a significant driver, with international consumers particularly drawn to Korean fashion and beauty. Lotte Shopping's strategic integration of these cultural trends, evidenced by its online platform performance in Southeast Asia during the first half of 2025, highlights its potential to attract a global, younger demographic.

Urbanization, with over 90% of South Koreans living in cities, fuels a strong preference for convenience and omnichannel shopping experiences. This trend is reflected in the growing market share of convenience stores and Lotte Shopping's own efforts to integrate online and offline operations for faster delivery and click-and-collect services.

Consumer awareness of environmental and social responsibility is growing, with over 70% of South Koreans considering sustainability in their purchasing decisions as of 2024. Lotte Shopping's sales of eco-certified products increased by 15% in 2024, demonstrating a positive response to this trend, further supported by initiatives like reduced plastic packaging.

Technological factors

Lotte Shopping's commitment to its e-commerce platforms is paramount, fueled by South Korea's booming online retail sector. This strategic focus involves refining digital user experiences, bolstering delivery infrastructure for swift fulfillment, and incorporating cutting-edge functionalities to maintain a competitive edge against dominant online players.

The e-commerce landscape in South Korea is experiencing robust expansion, with online channels capturing an ever-increasing share of total retail sales. Projections indicate this growth trajectory will persist, underscoring the necessity of Lotte Shopping's ongoing digital investments to capture a significant portion of this expanding market.

Mobile commerce is king in South Korea, with mobile devices accounting for a significant majority of online shopping. Lotte Shopping needs to double down on mobile-first approaches, ensuring their apps are top-notch and offering a wide array of digital payment choices to stay competitive.

The digital payment landscape is booming, especially with digital wallets set to capture an even larger slice of the market. This trend is projected to continue its upward trajectory, making it crucial for Lotte Shopping to integrate these payment solutions seamlessly into their operations.

Lotte Shopping is increasingly leveraging data analytics and AI to understand its customers better. This allows for more personalized shopping experiences, with tailored product recommendations and targeted promotions. For instance, in 2024, many leading retailers reported significant increases in conversion rates, sometimes by as much as 15-20%, by implementing AI-driven personalization engines.

By analyzing vast amounts of customer data, Lotte Shopping can optimize its inventory and procurement strategies, ensuring it stocks products that are in high demand. This data-driven approach is crucial for cost optimization and improving overall operational efficiency in the competitive retail landscape.

Omnichannel Integration

Omnichannel integration is paramount for Lotte Shopping, as consumers increasingly expect a fluid transition between online and offline shopping. By seamlessly connecting its department stores, hypermarkets, supermarkets, and e-commerce operations, Lotte aims to create a unified customer experience. This strategy is crucial for boosting engagement and driving sales.

This approach directly addresses evolving consumer behavior, where convenience and consistency across all touchpoints are key. For example, Lotte's investment in digital platforms and in-store technology aims to facilitate services like click-and-collect and personalized recommendations, enhancing customer loyalty.

- Seamless Integration: Lotte Shopping is actively working to connect its diverse retail formats, from physical department stores to its online marketplace, to offer a unified customer journey.

- Enhanced Customer Experience: By enabling features like in-store returns for online purchases and personalized digital offers accessible in-store, Lotte aims to improve customer satisfaction and convenience.

- Sales Growth: A well-executed omnichannel strategy is projected to drive significant sales growth, with reports indicating that companies with strong omnichannel capabilities achieve higher customer retention rates and increased revenue. For instance, in 2024, the global retail e-commerce sales are expected to reach over $6.3 trillion, highlighting the importance of a robust online presence integrated with physical stores.

Supply Chain Automation and Logistics

Lotte Shopping's commitment to supply chain automation and logistics is a key technological driver. Investments in advanced warehousing and automated sorting systems are critical for handling the increasing volume of e-commerce orders and meeting customer expectations for rapid delivery. For instance, many leading retailers are investing heavily; Amazon, a benchmark, has reported that its robotics and automation initiatives have led to significant improvements in delivery speeds and operational efficiency.

These technological upgrades directly translate to better inventory management, reducing stockouts and overstock situations. By streamlining the flow of goods from supplier to customer, Lotte Shopping can lower operational costs associated with manual handling and expedite order fulfillment. This enhanced efficiency is vital in the competitive retail landscape, where customer satisfaction hinges on product availability and delivery speed.

The impact of these advancements is measurable. For example, companies that have implemented advanced automation in their distribution centers often see a reduction in order processing times by as much as 30-50%. This focus on technology allows Lotte Shopping to:

- Improve inventory accuracy and reduce carrying costs.

- Accelerate order fulfillment and delivery times.

- Lower labor costs through automation of repetitive tasks.

- Enhance the overall customer experience with reliable and fast shipping.

Lotte Shopping is heavily investing in its e-commerce capabilities, recognizing South Korea's rapid digital retail growth. This includes enhancing user experience on its platforms and optimizing delivery networks to compete effectively. The company is also prioritizing mobile-first strategies, as mobile devices dominate online shopping in the region, and is integrating a wider range of digital payment options, including digital wallets, which are projected for significant market share growth.

Legal factors

South Korea maintains strong consumer protection laws, with the Korea Fair Trade Commission (KFTC) actively amending and enforcing them. These regulations address issues like deceptive online marketing, product labeling accuracy, and effective dispute resolution mechanisms.

Lotte Shopping must diligently adhere to these evolving legal requirements, which are crucial for avoiding fines and fostering consumer confidence. For instance, KFTC's ongoing efforts to curb unfair practices in e-commerce, which saw a significant increase in online transactions in 2024, directly impact Lotte Shopping's digital operations.

Lotte Shopping's operations, particularly its growing e-commerce ventures, are heavily influenced by data privacy and security laws. With digital transactions becoming the norm, safeguarding customer information and maintaining transaction records is critical. In 2024, global spending on cybersecurity solutions was projected to reach over $200 billion, highlighting the significant investment required to comply with these evolving regulations.

Adherence to stringent data protection laws, such as the Personal Information Protection Act (PIPA) in South Korea, is non-negotiable for Lotte Shopping. These regulations mandate robust measures to prevent data breaches and ensure the responsible handling of sensitive customer data. Failure to comply can result in substantial fines and reputational damage, impacting customer trust and loyalty.

Labor laws, including minimum wage stipulations and employee benefit mandates, directly influence Lotte Shopping's operational expenses and its approach to managing its workforce. For example, in 2024, South Korea's minimum wage saw an increase, impacting the cost of labor for Lotte Shopping's extensive retail operations, particularly in its convenience store segment. Adhering to these legal frameworks is critical for fostering equitable employment conditions and ensuring a consistent, motivated workforce.

Competition and Anti-Monopoly Laws

Lotte Shopping, as a major player in the South Korean retail sector, faces significant oversight from competition authorities. The Korea Fair Trade Commission (KFTC) actively monitors large business groups to prevent monopolistic tendencies and ensure a level playing field for all market participants. This regulatory environment necessitates Lotte Shopping to carefully manage its market share and business practices to avoid potential anti-monopoly investigations.

In 2024, the KFTC continued its focus on fostering innovative competition and enhancing the operational transparency of large conglomerates. Lotte Shopping's strategy must therefore align with these objectives, ensuring that its market conduct promotes, rather than hinders, fair competition. For instance, the KFTC's ongoing review of retail market concentration and its potential impact on consumer choice remains a key area of focus.

Key considerations for Lotte Shopping include:

- Compliance with fair trade regulations: Adhering to KFTC guidelines on pricing, promotions, and supplier relationships is paramount.

- Market share monitoring: Proactively assessing its market dominance across various retail segments to preempt concerns about monopolistic behavior.

- Adapting to evolving competition policies: Staying informed about new KFTC initiatives and adapting business strategies accordingly to maintain compliance and foster healthy market competition.

Environmental Regulations and ESG Disclosures

Lotte Shopping faces growing legal obligations concerning environmental protection and Environmental, Social, and Governance (ESG) reporting. These regulations are becoming more stringent, requiring companies to be transparent about their environmental impact. For instance, in South Korea, the Carbon Neutrality Act, which came into effect in 2023, mandates reporting and reduction of greenhouse gas emissions for many businesses.

The company's proactive approach to ESG, including setting greenhouse gas reduction targets and publishing sustainability reports, is crucial for compliance and reputation. Lotte Shopping has publicly committed to reducing its carbon footprint, aligning with evolving legal frameworks and investor expectations. Failure to meet these environmental standards can lead to penalties and damage brand image.

Key legal and ESG considerations for Lotte Shopping include:

- Compliance with South Korea's Carbon Neutrality Act and associated emission reporting mandates.

- Adherence to evolving waste management and recycling regulations impacting retail operations.

- Meeting disclosure requirements for ESG performance, as seen in global trends and potential future domestic legislation.

- Ensuring supply chain partners also comply with environmental laws, as liability can extend to the company.

Lotte Shopping operates under a robust consumer protection framework in South Korea, with the Korea Fair Trade Commission (KFTC) actively enforcing regulations against deceptive online marketing and ensuring product labeling accuracy. The KFTC's focus on curbing unfair e-commerce practices, particularly relevant given the surge in online transactions in 2024, directly impacts Lotte Shopping's digital strategies and necessitates strict adherence to prevent penalties and maintain consumer trust.

Data privacy and security laws, such as South Korea's Personal Information Protection Act (PIPA), are critical for Lotte Shopping's extensive e-commerce operations. With global cybersecurity spending projected to exceed $200 billion in 2024, the company must invest significantly in robust measures to protect customer data and prevent breaches, which could lead to substantial fines and reputational damage.

Labor laws, including minimum wage adjustments, directly affect Lotte Shopping's operational costs. The 2024 minimum wage increase in South Korea, for instance, impacts the labor expenses across its vast retail network, highlighting the need for compliance to ensure fair employment and workforce stability.

The company also faces scrutiny from competition authorities like the KFTC, which monitors large business groups to prevent monopolistic tendencies. Lotte Shopping must manage its market share and practices to align with the KFTC's 2024 objectives of fostering innovation and transparency, avoiding potential anti-monopoly investigations.

Environmental regulations, including South Korea's Carbon Neutrality Act effective from 2023, mandate greenhouse gas emission reporting and reduction. Lotte Shopping's ESG commitments and sustainability reporting are crucial for compliance and reputation, as failure to meet environmental standards can result in penalties.

| Legal Factor | Impact on Lotte Shopping | Relevant Data/Trend (2023-2025) |

|---|---|---|

| Consumer Protection | Ensuring fair marketing, accurate product information, and effective dispute resolution. | KFTC actively amending e-commerce regulations. Online transaction growth accelerated in 2024. |

| Data Privacy and Security | Protecting sensitive customer data and ensuring transaction security. | Global cybersecurity spending projected over $200 billion in 2024. PIPA compliance is mandatory. |

| Labor Laws | Managing workforce costs and ensuring equitable employment conditions. | South Korea's minimum wage increased in 2024, impacting labor expenses. |

| Competition Law | Preventing monopolistic practices and ensuring fair market competition. | KFTC focus on large conglomerates and market concentration in 2024. |

| Environmental Regulations | Reporting and reducing greenhouse gas emissions, waste management. | Carbon Neutrality Act effective 2023; ESG reporting becoming standard. |

Environmental factors

Lotte Shopping is actively pursuing carbon neutrality by 2040, a commitment underscored by its approved greenhouse gas reduction targets from the Science Based Targets initiative (SBTi). This ambitious plan requires substantial investments in renewable energy sources and enhanced energy efficiency across its extensive retail network.

The company's strategy focuses on reducing both direct and indirect emissions, a crucial step in addressing its environmental footprint. For instance, Lotte Shopping aims to cut its Scope 1 and Scope 2 emissions by 42% by 2030 compared to a 2019 baseline, demonstrating a clear, data-driven approach to sustainability.

The retail landscape is increasingly prioritizing sustainability, with a significant focus on reducing waste and adopting eco-friendly packaging solutions. This trend is directly influencing companies like Lotte Shopping.

In response, Lotte Shopping has been actively implementing initiatives such as the introduction of biodegradable packaging materials and a commitment to eliminating overpackaging. Furthermore, they are expanding their range of eco-friendly private brand products to meet growing consumer expectations for environmentally conscious choices.

These strategic moves are not only driven by a rising consumer demand for greener products but also by mounting regulatory pressures aimed at minimizing the environmental footprint of retail operations. For instance, by 2025, many regions are expected to have stricter regulations on single-use plastics, impacting packaging choices across the board.

Lotte Shopping is committed to resource circulation and eco-friendly product development, a strategy that resonates with growing environmental awareness. For instance, in 2023, the company expanded its eco-friendly private brand offerings, with a notable increase in products carrying Environmental Product Declaration (EPD) verification, aiming to reduce the environmental footprint across its value chain.

These efforts are not just about environmental stewardship; they directly impact consumer perception. A 2024 survey indicated that over 60% of Korean consumers consider a company's environmental practices when making purchasing decisions, highlighting the business imperative behind Lotte Shopping's green initiatives.

Climate Change Impact and Adaptation

Climate change is increasingly shaping the retail landscape, introducing volatility that directly impacts Lotte Shopping's operations. Worsening weather events can disrupt supply chains, from agricultural products to manufactured goods, leading to potential stock shortages and increased costs. For instance, extreme weather in Southeast Asia, a key sourcing region for many consumer products, could significantly affect availability and pricing. Lotte Shopping must therefore actively assess and adapt to these environmental shifts to mitigate operational risks and maintain a stable supply of goods for its customers.

Adapting to climate change is no longer optional but a strategic imperative for retailers like Lotte Shopping. This includes building resilience in supply chains, particularly for perishable goods like groceries, where disruptions can lead to significant losses and customer dissatisfaction. Furthermore, changing weather patterns can influence consumer behavior and demand. For example, prolonged heatwaves might boost sales of cooling products but decrease demand for winter apparel, requiring dynamic inventory management. Lotte Shopping's commitment to incorporating climate resilience into its business model, such as diversifying sourcing locations and investing in more robust logistics, is crucial for long-term sustainability and competitiveness in the face of an unpredictable climate.

Key considerations for Lotte Shopping regarding climate change adaptation include:

- Supply Chain Resilience: Diversifying sourcing locations and building stronger relationships with suppliers to buffer against climate-related disruptions.

- Consumer Demand Shifts: Analyzing and responding to changing consumer purchasing patterns driven by weather events and growing environmental awareness.

- Operational Risk Management: Implementing strategies to protect physical assets and operations from extreme weather, such as investing in climate-resilient infrastructure for stores and warehouses.

- Sustainability Reporting: Enhancing transparency and reporting on climate-related risks and adaptation strategies, aligning with growing investor and regulatory expectations, especially in markets like South Korea where ESG (Environmental, Social, and Governance) factors are gaining prominence.

Consumer Environmental Awareness

South Korean consumers, especially younger demographics, are increasingly factoring environmental impact into their buying choices, showing a willingness to spend more on eco-friendly goods. This growing consciousness directly influences retailers like Lotte Shopping to adopt more sustainable operations and transparent sourcing.

For instance, a 2024 survey indicated that over 70% of Korean millennials and Gen Z consider a brand's environmental policies when making purchasing decisions. This trend translates into a tangible demand for greener product assortments and supply chain practices.

- Increased demand for sustainable products: Consumers are actively seeking out and favoring items with eco-certifications or those produced with minimal environmental footprint.

- Willingness to pay a premium: A significant portion of consumers are prepared to allocate more funds for products that align with their environmental values.

- Impact on brand perception: Retailers demonstrating a clear commitment to environmental responsibility, such as Lotte Shopping, can expect to see enhanced brand loyalty and a stronger competitive position in the market.

Lotte Shopping's commitment to carbon neutrality by 2040, validated by SBTi, necessitates significant investment in renewable energy and efficiency across its retail network. The company targets a 42% reduction in Scope 1 and 2 emissions by 2030 from a 2019 baseline, demonstrating a data-driven sustainability approach.

Growing consumer demand, with over 60% of Korean consumers in a 2024 survey considering environmental practices, drives Lotte Shopping's adoption of eco-friendly packaging and private brands. This aligns with regulatory pressures, such as impending 2025 restrictions on single-use plastics.

Climate change poses operational risks, impacting supply chains and necessitating adaptation strategies like diversified sourcing and resilient infrastructure to manage consumer behavior shifts due to weather patterns.

Environmental factors are increasingly shaping Lotte Shopping's strategy, from emission reduction targets to product sourcing and consumer engagement, reflecting a broader industry shift towards sustainability.

PESTLE Analysis Data Sources

Our PESTLE analysis for Lotte Shopping is constructed using a blend of publicly available data from government statistics bureaus, reputable financial news outlets, and industry-specific market research reports. This ensures a comprehensive understanding of the political, economic, social, technological, legal, and environmental factors impacting the company.