Lotte Shopping Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Lotte Shopping Bundle

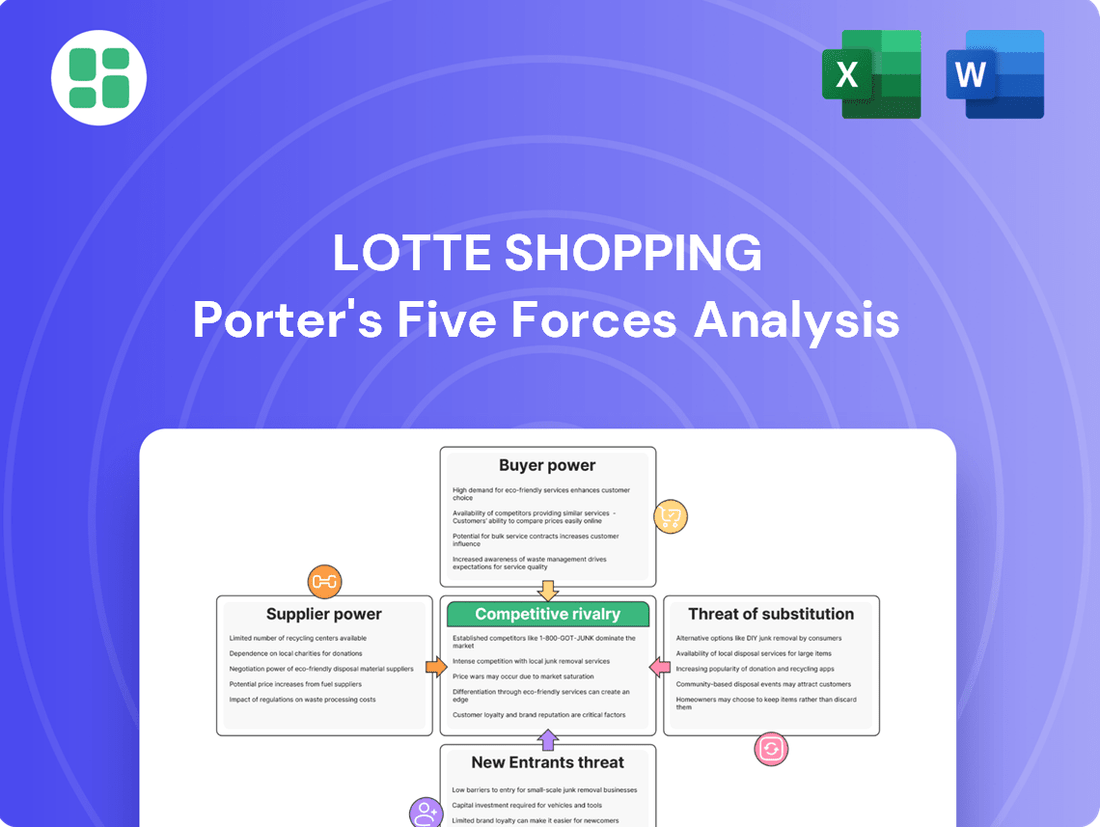

Lotte Shopping faces significant competitive pressures, with intense rivalry and the constant threat of new entrants shaping its market landscape. Understanding the bargaining power of both its buyers and suppliers is crucial for navigating this dynamic retail environment.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Lotte Shopping’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

Lotte Shopping sources from a wide array of suppliers, from international powerhouses to local artisans. In niche markets, such as high-end fashion or specialized electronics, where few manufacturers exist, these suppliers wield considerable influence. This concentration can lead to higher input costs and stricter terms for Lotte, impacting profitability.

For common groceries, household items, and standard consumer goods, Lotte Shopping benefits from a highly fragmented supplier market. This means there are many different companies that can supply these products, which is great for Lotte. In 2023, the South Korean grocery market alone was valued at over $100 billion, with numerous domestic and international suppliers contributing.

The abundance of alternative suppliers in these categories significantly reduces the leverage of any single supplier. This allows Lotte Shopping, with its extensive network of hypermarkets and supermarkets, to negotiate favorable bulk pricing and terms. For instance, Lotte's sheer purchasing volume allows it to command better deals than smaller retailers, directly impacting its cost of goods sold.

For many suppliers, particularly smaller or newer brands, securing a spot on Lotte Shopping's shelves or its online platform is a vital gateway to reaching a broad customer base. This extensive reach means Lotte Shopping is a significant buyer for these producers, which in turn diminishes the suppliers' ability to dictate terms.

In 2023, Lotte Shopping's total sales reached approximately 18.5 trillion Korean Won, highlighting its substantial purchasing power. This scale makes it difficult for individual suppliers to exert significant leverage, as their sales volume through Lotte Shopping often represents a considerable portion of their revenue.

Potential for Backward Integration or Private Labels

Lotte Shopping can effectively counter supplier power by developing its own private label brands. This strategy is particularly potent in high-volume categories like groceries and everyday household items, where brand loyalty can be cultivated through quality and price. For instance, by introducing Lotte's own-brand coffee or cleaning supplies, the company gains more control over product specifications and pricing.

This backward integration directly impacts cost structures and profit margins. By cutting out the middleman, Lotte Shopping can achieve more competitive pricing for consumers while simultaneously improving its own profitability. In 2023, private label penetration in the South Korean retail sector continued to grow, with some estimates placing it around 25-30% in major hypermarkets, demonstrating a clear consumer acceptance and a significant opportunity for Lotte.

- Private Label Growth: Lotte Shopping can leverage the increasing consumer acceptance of private label goods in South Korea, which saw significant growth in 2023.

- Cost Control: Developing in-house brands allows Lotte to directly manage production costs, reducing reliance on external supplier pricing.

- Margin Enhancement: By controlling the supply chain, Lotte can improve profit margins on its private label offerings compared to branded goods.

- Reduced Supplier Dependence: A strong private label portfolio diminishes Lotte Shopping's vulnerability to price hikes or supply disruptions from external manufacturers.

Impact of Logistics and Technology Providers

Lotte Shopping's reliance extends beyond product vendors to crucial logistics and technology partners who underpin its omnichannel strategy and supply chain. These providers, particularly those offering specialized tech or highly efficient logistics, can exert some bargaining power. For instance, a provider of advanced warehouse management systems or a logistics network with exclusive reach in key regions might hold an advantage.

However, Lotte Shopping's substantial market presence and operational scale enable it to negotiate effectively and solicit competitive bids from multiple suppliers. This leverage helps mitigate the suppliers' power. As of 2024, Lotte Shopping's extensive network of physical stores and online platforms, totaling over 1,000 locations across various formats, provides significant volume, allowing for more favorable terms with its logistics and technology partners.

- Logistics Providers: Companies offering last-mile delivery, warehousing, and inventory management solutions are essential for Lotte's integrated retail model.

- Technology Providers: Firms supplying e-commerce platforms, data analytics, and supply chain management software are critical for operational efficiency and customer experience.

- Negotiating Power: Lotte's large transaction volumes and diverse supplier base allow for robust negotiation, often securing competitive pricing and service level agreements.

- Scale Advantage: The sheer size of Lotte Shopping's operations (e.g., handling millions of SKUs and customer transactions annually) translates into considerable bargaining leverage with its support service providers.

In sectors with few suppliers, such as specialized electronics, Lotte Shopping faces higher input costs and stricter terms due to supplier concentration. Conversely, for common goods, Lotte benefits from a fragmented supplier market, allowing for favorable bulk pricing. In 2023, the South Korean grocery market alone was valued at over $100 billion, indicating a vast supplier base for Lotte.

Lotte Shopping's substantial purchasing volume, with 2023 sales around 18.5 trillion Korean Won, significantly reduces supplier leverage. Developing private labels further strengthens Lotte's position, as seen in the 2023 South Korean retail sector where private labels captured an estimated 25-30% of hypermarket sales.

| Category | Supplier Market Concentration | Lotte Shopping's Bargaining Power |

| Niche/Specialty Goods | Low (Few Suppliers) | Lower |

| Groceries/Common Goods | High (Many Suppliers) | Higher |

| Private Labels | Internal Control | Highest |

What is included in the product

This analysis dissects the competitive landscape for Lotte Shopping, examining the intensity of rivalry, the bargaining power of buyers and suppliers, the threat of new entrants, and the impact of substitute products.

Easily identify the most impactful competitive forces on Lotte Shopping, allowing for targeted strategies to mitigate threats and capitalize on opportunities.

Customers Bargaining Power

Customers at Lotte Mart and Lotte Super are quite sensitive to price, especially when it comes to everyday necessities. This means they have a lot of sway in where they shop because they can easily check prices elsewhere and promotions are common.

In 2024, the retail sector in South Korea saw intense competition, with major players like Lotte Shopping frequently engaging in price wars and offering significant discounts to attract and retain customers. For instance, during major shopping seasons, hypermarket price differentials on staple goods could be as low as 1-2%, directly impacting customer loyalty and purchase decisions.

South Korea's e-commerce market is booming, with mobile shopping now dominating. In 2023, the value of mobile transactions reached approximately 221 trillion Korean won, highlighting how easily customers can compare prices and access product details across numerous platforms. This digital shift significantly amplifies customer bargaining power.

Lotte Shopping's own e-commerce ventures, such as Lotte ON, are directly impacted by this trend. With a vast array of online retailers readily available, customers can effortlessly switch to competitors offering better deals or superior convenience. This readily available choice intensifies price pressure and demands greater value from Lotte Shopping.

For many of Lotte Shopping's core retail offerings, customers can easily switch to a competitor with little to no cost or effort. This is particularly true in sectors with many established players, both online and in brick-and-mortar stores.

In 2024, the retail landscape continues to be characterized by abundant choices. For instance, in South Korea, where Lotte Shopping operates extensively, the e-commerce penetration rate reached approximately 70% by the end of 2023, indicating a highly competitive digital environment. This high penetration means consumers can readily compare prices and product selections across numerous platforms, further reducing switching barriers.

Customer loyalty in such a market is therefore primarily cultivated through competitive pricing, superior convenience, a wide product selection, and engaging customer experiences, rather than through any inherent difficulty in changing retailers.

Influence of Customer Loyalty Programs and Personalized Offers

Lotte Shopping actively manages customer bargaining power through its L.POINT loyalty program, which boasted over 14 million members as of late 2023. By analyzing purchase data, Lotte provides personalized promotions and discounts, aiming to foster repeat business and reduce price sensitivity among its customer base. This strategy directly addresses the inherent power customers hold by offering tangible benefits for continued patronage.

While customers can easily switch between retailers, especially in the competitive South Korean market, Lotte’s integrated loyalty system across its various business units, including department stores and e-commerce, creates a stickier customer relationship. The perceived value of accumulated points and exclusive offers can make it less attractive for loyal customers to seek alternatives solely based on minor price differences.

- L.POINT Membership Growth: Lotte's L.POINT program has consistently grown, indicating successful customer acquisition and engagement strategies.

- Personalized Marketing Impact: Data analytics enable targeted campaigns, increasing conversion rates and customer satisfaction for personalized offers.

- Customer Retention through Loyalty: The loyalty program aims to mitigate customer bargaining power by creating switching costs and enhancing perceived value, encouraging continued engagement with Lotte Shopping's diverse offerings.

Demand for Omnichannel and Seamless Experiences

Modern shoppers expect a smooth journey whether they're browsing online or visiting a physical store. This demand for omnichannel experiences significantly impacts customer loyalty.

Lotte Shopping's success in integrating its various retail formats, offering services like click-and-collect, and ensuring fast delivery directly influences a customer's decision-making process. When these needs are consistently met, customers are less likely to look elsewhere.

- Consumer Expectations: A 2024 report indicated that over 70% of consumers expect a consistent experience across all channels, influencing their purchasing decisions.

- Integration Benefits: Companies with strong omnichannel strategies have seen an average increase in customer retention rates by up to 10% compared to those with siloed approaches.

- Convenience Factors: In 2024, 65% of online shoppers cited convenience as a primary reason for choosing a retailer, highlighting the importance of services like fast delivery and easy returns.

- Bargaining Power Influence: By providing these seamless experiences, Lotte Shopping can mitigate the bargaining power of customers, as their needs are being met effectively, reducing the incentive to seek alternatives.

Customers at Lotte Shopping possess significant bargaining power due to high price sensitivity and the ease of switching between numerous retailers, particularly in South Korea's competitive market. In 2024, intense competition meant price differentials on staple goods could be as low as 1-2%, directly impacting customer loyalty.

The booming e-commerce sector, with mobile transactions reaching approximately 221 trillion Korean won in 2023, further amplifies this power by enabling easy price comparison across platforms. Lotte's loyalty program, L.POINT, with over 14 million members by late 2023, aims to counter this by offering personalized promotions and fostering repeat business.

Meeting modern shopper expectations for seamless omnichannel experiences, like click-and-collect and fast delivery, is crucial. A 2024 report noted over 70% of consumers expect consistent cross-channel experiences, and 65% of online shoppers cite convenience as a primary decision factor.

| Factor | Impact on Lotte Shopping | Mitigation Strategy |

| Price Sensitivity | High; customers easily switch for lower prices. | Competitive pricing, promotions, loyalty program benefits. |

| Ease of Switching | Very high due to numerous online and offline competitors. | Integrated loyalty program, personalized offers, superior customer experience. |

| E-commerce Growth | Amplifies price comparison and access to alternatives. | Enhancing Lotte ON's offerings, ensuring competitive online pricing and convenience. |

| Omnichannel Expectations | Customers demand seamless experiences across channels. | Investing in click-and-collect, fast delivery, and consistent branding. |

Preview the Actual Deliverable

Lotte Shopping Porter's Five Forces Analysis

This preview showcases the comprehensive Porter's Five Forces analysis for Lotte Shopping, detailing the competitive landscape and strategic implications. The document displayed here is the part of the full version you’ll get—ready for download and use the moment you buy. You can trust that the insights into buyer power, supplier power, threat of new entrants, threat of substitutes, and industry rivalry are precisely what you will receive.

Rivalry Among Competitors

Lotte Shopping navigates a fiercely competitive South Korean retail landscape, contending with rivals across its department stores, hypermarkets, supermarkets, and burgeoning e-commerce channels. Major conglomerates such as Shinsegae, with its E-Mart and Shinsegae Department Store brands, and Hyundai Department Store present significant challenges, alongside agile, specialized online players.

The South Korean retail market is facing a period of slower growth, with expectations for only a modest expansion in 2024 and 2025. This environment naturally escalates the competition among players vying for a larger slice of the market.

This subdued demand, amplified by economic uncertainties and cautious consumer spending, compels retailers to engage in more aggressive pricing strategies and promotional activities. For instance, the overall retail sales in South Korea saw a 2.5% increase in 2023, a figure expected to moderate to around 2.0% in 2024, highlighting the intensifying competitive pressures.

The e-commerce sector is a fierce battleground, with Lotte ON facing off against formidable rivals such as Coupang and SSG.com. This intense competition necessitates substantial investments in technology, logistics, and customer-centric services as companies vie for digital market dominance.

Differentiation Through Store Renovation and Experiential Retail

To stand out in a crowded market, Lotte Shopping is actively renovating its stores and pioneering new experiential retail concepts like 'Time Villas' for its department stores. This focus on unique shopping experiences goes beyond just selling products, aiming to draw in and retain customers.

This strategic investment in store modernization and experiential retail is a direct response to the fierce competition within the retail sector. By offering more than just merchandise, Lotte Shopping seeks to create a memorable customer journey that traditional competitors may not provide.

- Store Renovations: Lotte Shopping's commitment to upgrading physical spaces aims to enhance the overall shopping atmosphere and functionality.

- Experiential Retail: Concepts like 'Time Villas' are designed to offer unique activities or services, transforming shopping into a leisure pursuit.

- Differentiation Strategy: This approach directly addresses competitive rivalry by creating a distinct brand identity and value proposition.

Focus on Cost Efficiency and Profitability Amid Challenges

Lotte Shopping and its competitors are intensely focused on cost efficiency and profitability. This is driven by declining revenues in some traditional retail areas and heightened competition. For instance, in the first quarter of 2024, Lotte Shopping reported a slight decrease in revenue compared to the previous year, underscoring the need for operational improvements.

To navigate these challenges, companies are streamlining operations, which can involve closing underperforming stores. Lotte Shopping has been actively managing its store portfolio, aiming to optimize its physical footprint. Furthermore, leveraging centralized purchasing is a key strategy for offering competitive pricing to consumers while maintaining healthier profit margins.

- Cost Efficiency Focus: Retailers are implementing measures to reduce operational expenses across the board.

- Supply Chain Optimization: Efforts are underway to make supply chains more agile and cost-effective.

- Profitability Improvement: Strategies target enhancing profit margins through better pricing and cost management.

- Store Portfolio Management: Underperforming stores are being reviewed and potentially closed to improve overall financial health.

The competitive rivalry within South Korea's retail sector is intense, with Lotte Shopping facing significant pressure from established conglomerates like Shinsegae and Hyundai, as well as agile online players. This rivalry is exacerbated by a projected modest retail sales growth of around 2.0% for 2024, forcing companies into aggressive pricing and promotional tactics.

The digital space, particularly e-commerce, represents a critical battleground where Lotte ON competes fiercely with giants like Coupang and SSG.com, necessitating continuous investment in technology and logistics.

Lotte Shopping is actively differentiating itself through store renovations and experiential retail concepts such as 'Time Villas,' aiming to create unique customer journeys beyond mere transactions.

The drive for cost efficiency and profitability is paramount, with retailers like Lotte Shopping focusing on streamlining operations, optimizing store portfolios, and leveraging centralized purchasing to maintain competitive pricing and margins amid declining revenues in some traditional segments.

| Competitor | Key Retail Formats | Market Share (Estimated 2023/2024) | Recent Strategic Focus |

|---|---|---|---|

| Shinsegae (E-Mart, Shinsegae Dept. Store) | Hypermarkets, Department Stores, Online | Significant Share | Digital expansion, Private label development |

| Hyundai Department Store | Department Stores, Online | Significant Share | Premiumization, Experiential retail |

| Coupang | E-commerce (General Merchandise) | Dominant Online Player | Logistics network enhancement, Subscription services |

| SSG.COM | E-commerce (Grocery, General Merchandise) | Strong Online Player | Integration of Shinsegae/E-Mart online offerings |

SSubstitutes Threaten

The growing prevalence of direct-to-consumer (DTC) brands and specialized online retailers presents a substantial threat of substitutes for Lotte Shopping, especially in competitive sectors like fashion, beauty, and electronics. These agile businesses often cater to specific consumer needs with unique product offerings and can leverage lower overheads to provide more attractive pricing, directly challenging Lotte’s traditional retail model.

For instance, the global DTC e-commerce market was projected to reach over $323 billion in 2024, highlighting the significant shift in consumer purchasing habits. These online-first entities can quickly adapt to market trends and offer personalized experiences, a capability that traditional brick-and-mortar retailers like Lotte must increasingly emulate to remain competitive.

The rise of informal markets and second-hand platforms presents a significant threat of substitutes for Lotte Shopping. Consumers increasingly turn to platforms like eBay, Depop, and local buy-sell groups for fashion, electronics, and home goods, often at lower price points. This trend is particularly strong among younger, budget-conscious demographics.

In 2024, the global second-hand apparel market alone was projected to reach over $35 billion, demonstrating substantial consumer adoption. This growth indicates a clear shift in purchasing habits, where the perceived value of pre-owned items competes directly with the appeal of new merchandise offered by traditional retailers like Lotte Shopping.

The burgeoning popularity of food delivery services and meal kit subscriptions presents a significant threat of substitution for Lotte Shopping's hypermarket and supermarket formats, Lotte Mart and Lotte Super. Consumers are increasingly opting for the convenience of having prepared meals or pre-portioned ingredients delivered directly to their homes, bypassing the need for traditional grocery store visits. This trend directly impacts Lotte's in-store foot traffic and sales volume.

In 2024, the global online food delivery market was projected to reach over $200 billion, with meal kits also experiencing substantial growth. For instance, South Korea, Lotte's primary market, has seen a significant uptake in these services, with platforms like Baemin and Coupang Eats dominating the food delivery landscape. This shift in consumer behavior means that Lotte Mart and Lotte Super face competition not just from other physical retailers, but from digital-first food solutions that cater to a desire for convenience and variety.

Shift to Experiences Over Product Ownership

The growing preference for experiences over owning physical goods presents a significant threat of substitution for retailers like Lotte Shopping. Consumers are increasingly directing their disposable income towards travel, entertainment, and personal services. For instance, global spending on travel and tourism saw a substantial rebound in 2023, with many markets exceeding pre-pandemic levels, indicating a shift in consumer priorities.

This societal trend means that discretionary spending that might have gone towards apparel, electronics, or home goods could instead be allocated to a vacation or a concert. This indirect competition impacts Lotte Shopping’s sales across its department stores, hypermarkets, and even its e-commerce platforms as consumers re-evaluate where their money is best spent.

- Societal Shift: Consumers increasingly prioritize experiences like travel and entertainment over acquiring physical products.

- Spending Allocation: Discretionary income is being diverted from retail purchases to experiential spending.

- Impact on Retail: This trend poses a threat to Lotte Shopping's revenue streams across all its business formats.

- Market Data: Global spending on experiences, such as tourism, continues to grow, highlighting this consumer preference.

Cross-Border E-commerce and Overseas Direct Purchases

South Korean consumers are increasingly turning to cross-border e-commerce and overseas direct purchases, bypassing traditional domestic retailers. This shift is fueled by the allure of lower prices and access to a broader selection of goods not readily available locally. For instance, in 2024, the value of overseas direct purchases by South Koreans reached an estimated 6.7 trillion KRW, a significant increase from previous years, particularly impacting categories like fashion and electronics where Lotte Shopping has a strong presence.

This growing reliance on international online platforms presents a substantial threat of substitutes for Lotte Shopping. Consumers can readily find comparable or even superior products from global sellers, often at a more attractive price point. This directly erodes Lotte Shopping's market share and sales volume, forcing the company to adapt its pricing strategies and product offerings to remain competitive against these international alternatives.

- Growing Overseas Direct Purchase Market: South Korea's overseas direct purchase market is expanding rapidly, with estimates suggesting continued growth through 2024.

- Price Sensitivity: A primary driver for consumers is the significant price advantage offered by international e-commerce platforms compared to domestic retail.

- Product Variety: Cross-border shopping provides access to a wider array of brands and niche products, a key factor for consumers seeking unique items.

- Impact on Lotte Shopping: This trend directly substitutes Lotte Shopping's sales, particularly in high-demand categories like apparel and consumer electronics.

The increasing popularity of online marketplaces and social commerce platforms offers a significant threat of substitutes for Lotte Shopping. Consumers can easily find a vast array of products from numerous sellers, often with competitive pricing and user reviews, directly challenging Lotte's curated offerings.

In 2024, the global social commerce market was projected to exceed $1.2 trillion, demonstrating a massive shift towards community-driven purchasing. These platforms foster direct engagement between buyers and sellers, creating a more personalized and often faster shopping experience than traditional retail channels.

The rise of subscription box services, particularly in niche markets like beauty, fashion, and gourmet foods, presents another potent threat of substitutes. These services offer curated selections delivered regularly, providing convenience and discovery that can divert consumer spending from Lotte's general merchandise categories.

For instance, the global subscription e-commerce market was estimated to be worth over $27 billion in 2024. This model fosters customer loyalty through convenience and personalized curation, directly competing with Lotte Shopping's traditional retail approach by offering a predictable and tailored purchasing experience.

| Threat of Substitutes | Description | Market Data (2024 Projections) | Impact on Lotte Shopping |

| Direct-to-Consumer (DTC) & Online Retailers | Agile online businesses offering unique products and competitive pricing. | Global DTC e-commerce market projected over $323 billion. | Challenges Lotte's traditional retail model, especially in fashion, beauty, electronics. |

| Informal & Second-hand Markets | Platforms like eBay, Depop offering lower-priced alternatives. | Global second-hand apparel market projected over $35 billion. | Appeals to budget-conscious consumers, diverting sales from new merchandise. |

| Food Delivery & Meal Kits | Convenient home delivery of prepared meals or ingredients. | Global online food delivery market projected over $200 billion. | Impacts Lotte Mart and Lotte Super sales by offering alternatives to grocery shopping. |

| Experiences over Goods | Consumer spending shifting towards travel, entertainment, services. | Global tourism spending saw a strong rebound in 2023, exceeding pre-pandemic levels. | Reduces discretionary spending on physical products across all Lotte formats. |

| Cross-Border E-commerce | South Korean consumers purchasing directly from overseas sellers. | Overseas direct purchases by South Koreans estimated at 6.7 trillion KRW. | Erodes market share and sales volume, particularly in fashion and electronics. |

| Online Marketplaces & Social Commerce | Platforms offering vast product selections and competitive pricing. | Global social commerce market projected to exceed $1.2 trillion. | Challenges Lotte's curated offerings with a wider, often cheaper, selection. |

| Subscription Box Services | Curated product deliveries in niche markets. | Global subscription e-commerce market estimated over $27 billion. | Competes by offering convenience and personalization, diverting spending. |

Entrants Threaten

The threat of new entrants for Lotte Shopping's traditional retail segments, like department stores and hypermarkets, is significantly dampened by high capital requirements. Establishing a new physical store necessitates massive upfront investment in prime real estate, sophisticated store infrastructure, and extensive initial inventory, often running into hundreds of millions of dollars.

Existing giants such as Lotte Shopping leverage considerable economies of scale, which new entrants struggle to match. Their sheer purchasing volume allows for better negotiation power with suppliers, leading to lower per-unit costs for goods. This procurement advantage, combined with optimized logistics networks, creates a cost structure that is difficult for newcomers to replicate, thereby posing a substantial barrier.

Lotte Shopping, deeply embedded within the Lotte Group, leverages decades of brand building and a vast, loyal customer network cultivated across its varied retail channels and robust loyalty programs. This strong brand equity presents a significant barrier, requiring new competitors to invest heavily in marketing and customer acquisition to even approach Lotte's established trust and recognition.

Building robust supply chains and widespread distribution networks in South Korea is inherently challenging and capital-intensive. Lotte Shopping's established logistics capabilities, developed over years of operation, present a significant hurdle for any newcomer aiming to replicate its market penetration and operational efficiency.

Intense Competition from Existing Online and Offline Players

The South Korean retail landscape is a crowded arena, with both established domestic giants and formidable international players already holding significant market sway. This saturation means newcomers must contend with deeply entrenched competitors who are continuously innovating and aggressively defending their existing market share across all retail segments.

For any new entrant, the challenge isn't just entering the market, but rather the immense difficulty of gaining traction against these established forces. Companies like Shinsegae and E-Mart, for instance, have a long history and deep customer loyalty, making it hard for others to chip away at their dominance. In 2023, the Korean e-commerce market alone was valued at over 220 trillion KRW, showcasing the scale of competition.

- Market Saturation: South Korea's retail sector is highly competitive, with numerous strong domestic and international brands.

- Entrenched Competitors: Existing players have established customer bases and are actively investing in innovation and market defense.

- High Entry Barriers: Significant capital investment and brand recognition are required to compete effectively.

- Price Sensitivity: Consumers are often price-conscious, putting pressure on new entrants to offer competitive pricing from the outset.

Regulatory Hurdles and Government Policies

While South Korea generally fosters a pro-business atmosphere, specific regulations concerning large-scale retail operations, land utilization, and the burgeoning e-commerce sector can present significant challenges for new players looking to enter the market. These regulatory frameworks, designed to manage market competition and consumer protection, can act as a barrier to entry.

Navigating this intricate web of rules and securing the requisite permits for establishing new retail ventures or expanding existing ones is often a protracted and financially demanding process. For instance, obtaining permits for large hypermarkets or new shopping complexes can involve extensive environmental impact assessments and zoning approvals, adding considerable time and cost to the initial investment.

The Korean government's policies, including those aimed at supporting small and medium-sized enterprises (SMEs) and promoting fair competition, can indirectly impact the threat of new entrants. These policies might include preferential treatment for local businesses or restrictions on the market share of large corporations, making it harder for newcomers to gain a foothold.

- Regulatory Compliance Costs: New entrants must budget for legal fees, permit applications, and potential consulting services to ensure adherence to South Korean retail laws.

- Land Use Restrictions: Zoning laws and urban planning regulations can limit where new large-scale retail outlets can be established, potentially increasing real estate acquisition costs.

- E-commerce Regulations: Specific rules governing online sales, data privacy, and consumer rights in South Korea require new e-commerce entrants to invest in compliant platforms and operational procedures.

- Government Support for SMEs: Policies favoring smaller domestic businesses might create an uneven playing field for international or larger new entrants.

The threat of new entrants for Lotte Shopping remains moderate, largely due to substantial capital requirements and established brand loyalty in South Korea's competitive retail market. While the online space offers lower entry barriers, physical retail still demands significant investment in prime locations and inventory. For instance, opening a new hypermarket can easily cost hundreds of millions of dollars.

Existing players, including Lotte Shopping, benefit from significant economies of scale and robust supply chains, making it difficult for newcomers to achieve comparable cost efficiencies. The Korean e-commerce market alone saw over 220 trillion KRW in transactions in 2023, highlighting the scale of competition and the need for efficient operations.

Brand recognition and customer loyalty are critical, with established giants like Shinsegae and E-Mart commanding strong consumer trust. New entrants must invest heavily in marketing and customer acquisition to challenge these entrenched players, a costly endeavor in a saturated market.

| Barrier Type | Description | Impact on New Entrants |

|---|---|---|

| Capital Requirements | High costs for real estate, infrastructure, and inventory. | Significant hurdle for physical retail. |

| Economies of Scale | Lower per-unit costs due to high purchasing volumes. | New entrants struggle to match cost structures. |

| Brand Loyalty | Established trust and customer networks. | Requires substantial marketing investment to overcome. |

| Supply Chain & Distribution | Efficient logistics networks developed over time. | Difficult and costly for newcomers to replicate. |

| Market Saturation | Crowded retail landscape with strong incumbents. | Intense competition makes market penetration challenging. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Lotte Shopping leverages data from Lotte's annual reports, investor presentations, and Korean stock exchange filings. We also incorporate industry reports from market research firms and economic data from government agencies to provide a comprehensive view.