Lifeway SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Lifeway Bundle

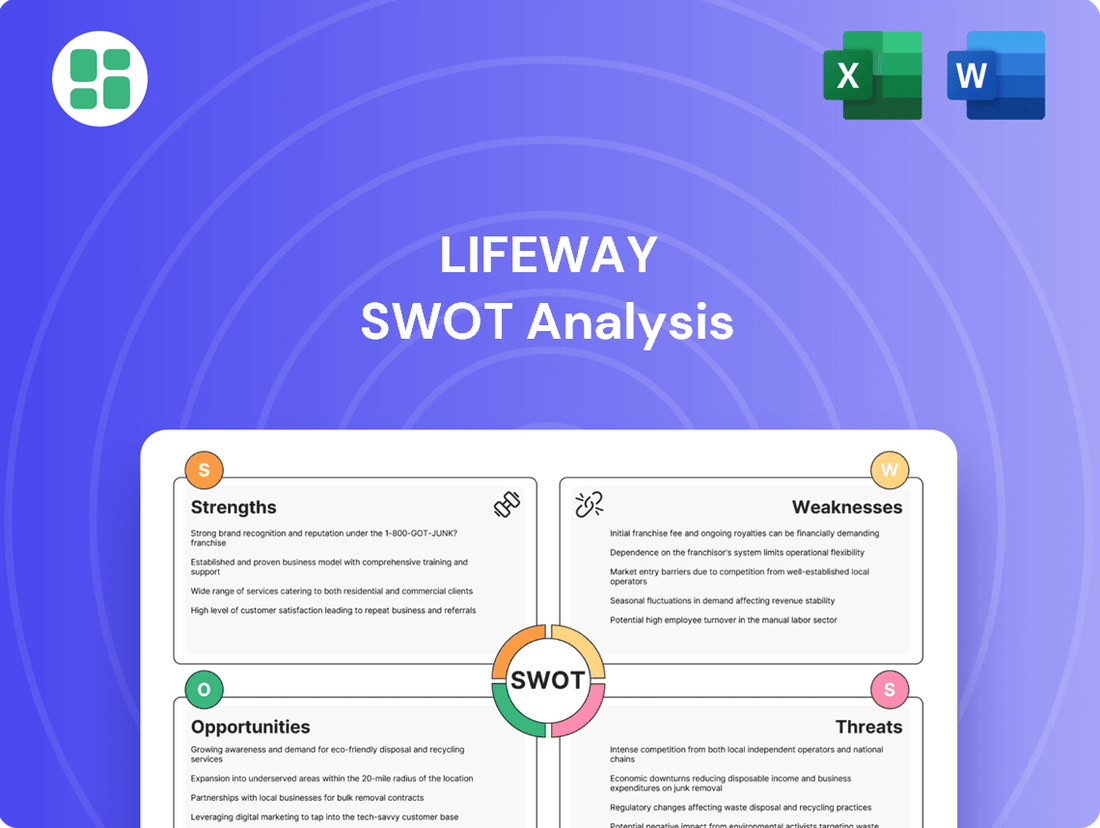

Lifeway's strengths lie in its established brand and loyal customer base, but it faces challenges from evolving consumer preferences and intense competition. Our full SWOT analysis delves into these factors, providing a comprehensive understanding of their market position.

Want the full story behind Lifeway's opportunities for innovation and potential threats from new market entrants? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support your strategic planning and investment decisions.

Strengths

Lifeway Foods is a dominant force in the U.S. kefir market, a position that translates into a substantial competitive edge. This leadership allows them to capitalize on strong brand awareness and well-developed distribution networks, ensuring their products reach consumers efficiently.

Their significant market share in kefir not only underpins consistent sales but also solidifies their standing against competitors. For instance, in 2023, Lifeway Foods reported net sales of $145.2 million, with their flagship kefir products forming the backbone of this revenue, demonstrating their market penetration.

Lifeway's core strength lies in its specialization in probiotic, cultured, and functional dairy products. This focus directly taps into the surging consumer interest in health and wellness, a trend that shows no signs of slowing down. In 2023, the global functional foods market was valued at over $230 billion, with probiotics being a significant driver.

This alignment with gut health, immunity, and overall well-being resonates with a broad and growing consumer base. As consumers become more proactive about their health, products like Lifeway's kefir and other cultured dairy offerings are increasingly sought after. This positions Lifeway favorably to capture market share in this expanding segment.

Lifeway Foods boasts a strong and diverse product lineup that extends well beyond its foundational kefir. The company has successfully expanded into organic and non-dairy alternatives, alongside farmer cheese, demonstrating a commitment to meeting varied consumer demands. This broadens their appeal significantly within the health and wellness sector.

Recent product introductions, such as probiotic salad dressings and an expanded array of kefir flavors including lactose-free options, underscore Lifeway's dedication to innovation. These additions are strategically designed to capture evolving consumer preferences and tap into growing market segments, further solidifying their presence.

For instance, in the first quarter of 2024, Lifeway Foods reported net sales of $42.3 million, a 10.1% increase year-over-year, partly driven by new product introductions and expanded distribution. This growth highlights the positive market reception to their diversified and innovative offerings.

Strong Financial Performance and Growth

Lifeway Foods has shown impressive financial strength. In 2024, the company achieved record annual net sales of $186.8 million, marking a substantial 17% jump from the previous year. This performance extends to its 21st consecutive quarter of year-over-year growth, highlighting consistent operational success.

Further bolstering its financial standing, Lifeway Foods reported a record net income in the first quarter of 2025. This sustained upward trend in both sales and profitability points to well-executed business strategies and a strong market reception for its product offerings.

- Record 2024 Net Sales: $186.8 million, up 17% year-over-year.

- Consistent Growth: Achieved 21 consecutive quarters of year-over-year growth.

- Q1 2025 Performance: Reported a record high net income for the fiscal quarter.

Established Distribution and Expanding Retail Footprint

Lifeway Foods leverages a robust distribution network, utilizing a direct sales force, brokers, and distributors to ensure its products reach a broad customer base. This multi-channel approach guarantees wide availability of their kefir and other health-focused products.

The company significantly bolstered its market presence in 2025 by announcing expanded distribution agreements. These new placements, numbering in the thousands, were secured with major U.S. retailers such as Amazon Fresh and BJ's Wholesale Club.

- Extensive Sales Channels: Direct sales force, brokers, and distributors ensure broad product availability.

- 2025 Retail Expansion: Thousands of new placements secured with key retailers like Amazon Fresh and BJ's Wholesale Club.

- Enhanced Accessibility: Expanded footprint directly improves product accessibility for consumers.

- Strengthened Market Penetration: Increased retail presence drives deeper market penetration and brand visibility.

Lifeway Foods' leadership in the U.S. kefir market is a significant strength, supported by strong brand recognition and efficient distribution channels. This market dominance, evidenced by their $145.2 million in net sales in 2023, allows them to consistently capture consumer demand for their core products.

The company's specialization in probiotic and cultured dairy products aligns perfectly with the growing global demand for functional foods, a market valued at over $230 billion in 2023, with probiotics being a key growth driver. This focus on health and wellness trends positions Lifeway to capitalize on increasing consumer interest in gut health and immunity.

Lifeway's diverse product portfolio, including organic and non-dairy options, alongside recent innovations like lactose-free kefir and probiotic salad dressings, broadens its appeal and taps into evolving consumer preferences. This product diversification is a key factor in their sustained financial growth, with net sales reaching $186.8 million in 2024, a 17% increase year-over-year, and marking their 21st consecutive quarter of growth.

The company's robust financial performance, including record net sales in 2024 and record net income in Q1 2025, underscores effective business strategies and strong market acceptance. Their expanding distribution network, highlighted by thousands of new placements in 2025 with major retailers like Amazon Fresh and BJ's Wholesale Club, further enhances product accessibility and market penetration.

| Metric | 2023 | 2024 | Q1 2025 |

|---|---|---|---|

| Net Sales | $145.2 million | $186.8 million (up 17%) | $42.3 million (up 10.1% YoY) |

| Growth Quarters | - | 21 consecutive quarters YoY | Continued trend |

| Net Income | - | - | Record high |

What is included in the product

Delivers a strategic overview of Lifeway’s internal and external business factors, identifying key strengths, weaknesses, opportunities, and threats.

Simplifies complex strategic challenges by offering a clear, actionable framework for identifying and addressing critical business issues.

Weaknesses

Lifeway Foods' strength in the kefir market, while significant, also represents a key weakness due to its niche concentration. This focus on cultured dairy beverages, though a leader in its segment, inherently limits the overall addressable market size when compared to more mainstream food and beverage categories.

This reliance on a specific product type poses a considerable risk. For instance, if consumer tastes were to pivot away from fermented drinks, Lifeway's primary revenue stream could be significantly impacted, unlike more diversified competitors.

As a company deeply rooted in dairy, Lifeway Foods faces inherent challenges due to the unpredictable nature of raw milk prices. These fluctuations can directly squeeze their profitability, making it harder to maintain healthy gross profit margins. For example, in the first quarter of 2025, higher milk costs were a contributing factor to a modest dip in their gross profit margin, highlighting the ongoing impact of this volatility on their financial performance.

The health food market, particularly for probiotic and functional foods, is incredibly crowded. Lifeway faces stiff competition not only from specialized brands but also from giants like Danone and Nestlé, who have significant resources and established distribution networks. This intense rivalry can squeeze profit margins and necessitate higher marketing investments to stand out.

Perception of Premium Pricing

Lifeway's focus on health-conscious and organic products can lead to a perception of premium pricing. This higher price point might deter budget-conscious consumers, potentially limiting broader market penetration, especially during economic downturns. For instance, in 2024, reports indicated that consumers were increasingly prioritizing value, with over 60% of shoppers actively seeking discounts and promotions for everyday essentials, including food items.

This perception of being a premium brand could hinder Lifeway's ability to capture market share from competitors offering more affordable alternatives. As consumers become more discerning about their spending, the perceived cost-benefit of Lifeway's offerings will be a critical factor in purchasing decisions. The trend towards seeking accessible healthy options means that price sensitivity remains a significant consideration for a large segment of the market.

- Price Sensitivity: A significant portion of consumers, particularly in 2024, demonstrated increased price sensitivity, actively seeking out deals and value-oriented products.

- Market Accessibility: The premium pricing strategy could inadvertently create a barrier to entry for consumers with tighter budgets, limiting Lifeway's overall market accessibility.

- Competitive Landscape: The market features numerous competitors offering healthier options at lower price points, intensifying the challenge for Lifeway to justify its premium positioning.

Potential Supply Chain Disruptions

Lifeway Foods, like many in the dairy sector, is susceptible to supply chain disruptions. These can stem from a variety of issues, including extreme weather events impacting milk production, geopolitical instability affecting ingredient sourcing, and persistent labor shortages across the industry. For instance, in 2024, the U.S. experienced significant weather-related disruptions affecting agricultural output, a trend that continued into early 2025, potentially impacting raw material availability for dairy processors.

These operational risks can directly translate into production delays, increased transportation costs due to fuel price volatility or carrier availability, and difficulties in ensuring timely product delivery to retailers. Such interruptions could lead to stockouts, frustrating consumers and potentially causing Lifeway to miss sales opportunities.

The financial implications are also considerable. Increased costs associated with expedited shipping, sourcing alternative materials, or managing inventory to buffer against delays can erode profit margins. For example, the average cost of trucking services saw an increase of approximately 5-7% in 2024 compared to the previous year, a factor that could be exacerbated by supply chain inefficiencies.

- Weather Events: Continued adverse weather patterns in key agricultural regions can reduce milk yields and impact transportation infrastructure.

- Geopolitical Factors: Global events can disrupt the availability and cost of essential packaging materials or specialized ingredients.

- Labor Shortages: Ongoing challenges in attracting and retaining skilled labor in manufacturing and logistics can slow down operations and increase labor costs.

Lifeway's concentrated product portfolio, primarily focused on kefir, presents a significant weakness. This niche specialization, while a strength in its segment, limits the company's overall market reach compared to more diversified food and beverage companies. A shift in consumer preferences away from cultured dairy could disproportionately impact Lifeway's revenue streams.

The company's profitability is directly vulnerable to fluctuations in raw milk prices. For instance, in Q1 2025, higher milk costs contributed to a slight decrease in gross profit margins, underscoring the ongoing challenge of managing input cost volatility. This makes maintaining consistent profitability more difficult.

Intense competition within the health food sector, including from larger players like Danone and Nestlé, puts pressure on Lifeway's profit margins and necessitates substantial marketing investment to maintain brand visibility. The crowded market means Lifeway must continuously work to justify its premium positioning against more affordable alternatives.

Lifeway's premium pricing strategy, while appealing to its target demographic, can limit broader market penetration, especially among budget-conscious consumers. In 2024, a significant portion of consumers prioritized value, with over 60% actively seeking discounts, indicating price sensitivity remains a key factor in purchasing decisions.

Same Document Delivered

Lifeway SWOT Analysis

The preview you see is the actual Lifeway SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality and comprehensive insights.

This is a real excerpt from the complete Lifeway SWOT analysis. Once purchased, you’ll receive the full, editable version, ready for your strategic planning.

You’re viewing a live preview of the actual Lifeway SWOT analysis file. The complete, detailed version becomes available immediately after checkout.

Opportunities

The global market for probiotic foods is on a significant upward trajectory, with projections indicating it will reach an impressive $140.7 billion by 2034, expanding at a compound annual growth rate of 6.5%. This surge is largely fueled by a growing consumer consciousness around gut health and overall well-being.

Lifeway Foods is well-positioned to leverage this expanding market. By highlighting the inherent health advantages of its kefir and other cultured dairy products, the company can effectively tap into this burgeoning consumer interest. The increasing adoption of preventative healthcare strategies further bolsters the appeal of products like Lifeway's.

The dairy alternatives market is booming, with projections indicating it could reach $59.8 billion by 2030. Plant-based milk is a major driver of this growth. Lifeway's existing non-dairy offerings position it well to capitalize on this trend.

By expanding its plant-based kefir and other product lines, Lifeway can attract lactose-intolerant, vegan, and flexitarian consumers. This strategic move allows the company to tap into a wider and growing consumer base, increasing market penetration and sales opportunities.

Lifeway Foods has a significant opportunity to expand its product line beyond its core beverage offerings. Introducing more kefir-infused snacks, ingredients, and functional food formulations, like their recent probiotic salad dressings, taps into growing consumer demand for convenient, health-conscious options. This diversification can unlock new revenue streams by catering to different consumption occasions.

Leveraging their existing farmer cheese product more broadly presents another avenue for growth. By developing new applications or product formats for farmer cheese, Lifeway can capitalize on its established brand recognition and consumer trust. This strategic move could significantly broaden their market reach and increase overall consumer engagement with their product portfolio.

Leveraging E-commerce and Digital Marketing Channels

Lifeway Foods can significantly boost its reach by expanding its e-commerce operations and investing in digital marketing. This approach allows access to a growing online retail market for kefir and other functional foods. For instance, the U.S. e-commerce market is projected to reach over $1.7 trillion by 2024, indicating substantial potential for brands with a strong online presence.

By leveraging social media campaigns and targeted digital advertising, Lifeway can effectively connect with a younger, health-conscious demographic. This demographic is increasingly seeking out convenient and informative ways to manage their diet and health. The global digital health market is also expanding rapidly, with AI-driven health management tools expected to play a larger role.

- Expanded E-commerce Reach: Tap into the growing online retail market for functional foods.

- Targeted Digital Marketing: Engage younger, health-savvy consumers through social media and AI-powered strategies.

- Data-Driven Insights: Utilize digital analytics to refine marketing efforts and understand consumer preferences in the evolving health and wellness sector.

Geographic Expansion and New Market Penetration

Lifeway Foods can capitalize on the burgeoning global demand for kefir by strategically expanding into new geographic territories. While North America currently represents Lifeway's primary market, the Asia-Pacific region is projected to exhibit the most rapid growth in the kefir sector. For instance, the global kefir market was valued at approximately $1.8 billion in 2023 and is anticipated to reach over $3.5 billion by 2030, with Asia-Pacific expected to drive a significant portion of this expansion.

This presents a clear opportunity for Lifeway to penetrate emerging economies where increasing health awareness and rising disposable incomes are creating a fertile ground for functional beverages. By establishing a presence in these markets, Lifeway can not only diversify its revenue streams and reduce its dependence on the U.S. market but also tap into a substantial, as-yet-underserved consumer base.

- Asia-Pacific as a High-Growth Frontier: This region is forecast to be the fastest-growing market for kefir, driven by increasing health consciousness.

- Emerging Market Potential: Rising disposable incomes in developing economies create new avenues for kefir consumption.

- Market Diversification: International expansion reduces Lifeway's reliance on the mature North American market.

- Untapped Consumer Base: Entering new territories allows Lifeway to reach consumers unfamiliar with or new to kefir products.

Lifeway Foods can capitalize on the growing global demand for probiotics and dairy alternatives by expanding its product lines and e-commerce presence. The company can also explore international markets, particularly in the rapidly growing Asia-Pacific region, to diversify its revenue streams and tap into new consumer bases. By leveraging digital marketing and data analytics, Lifeway can effectively reach health-conscious consumers and refine its strategies for maximum impact.

| Opportunity Area | Key Driver | Projected Market Growth (CAGR) | Lifeway's Strategic Advantage |

|---|---|---|---|

| Probiotic Foods Market | Increased consumer focus on gut health | 6.5% (to $140.7B by 2034) | Leveraging kefir's inherent health benefits |

| Dairy Alternatives Market | Rising demand for plant-based options | (Projected to reach $59.8B by 2030) | Expanding non-dairy kefir and product lines |

| E-commerce & Digital Marketing | Growth of online retail and digital engagement | (U.S. e-commerce > $1.7T by 2024) | Targeting younger demographics, data-driven insights |

| International Expansion (Asia-Pacific) | Rising health awareness and disposable incomes | (Global kefir market to reach $3.5B by 2030) | Penetrating emerging economies, market diversification |

Threats

Major food conglomerates are increasingly entering or expanding their presence in the functional dairy and probiotic markets, posing a significant threat to Lifeway's market share. For instance, Danone, a global leader in dairy, has been actively investing in its probiotic offerings, with its Activia brand alone generating billions in annual sales worldwide.

These large companies often have greater financial resources for marketing, R&D, and distribution, which could challenge Lifeway's competitive edge. In 2023, companies like Danone and General Mills reported revenues in the tens of billions of dollars, dwarfing Lifeway's revenue, which was reported at $131.9 million for the fiscal year 2023.

While the current market strongly favors probiotics, a significant threat lies in the potential for rapid shifts in consumer preferences within the dynamic health food sector. For instance, a sudden decline in kefir's popularity or the emergence of entirely new health trends could directly impact Lifeway's core product demand. In 2023, the global functional foods market, which includes probiotics, was valued at over $200 billion, demonstrating its sensitivity to evolving consumer tastes.

Lifeway Foods, like many in the food industry, faces a dynamic regulatory landscape. New rules under the Food Safety Modernization Act (FSMA) and evolving labeling standards, such as updated definitions for 'healthy' claims and potential PFAS restrictions, present ongoing challenges. For instance, the FDA's proposed changes to the Nutrition Facts label, which became mandatory for most businesses by January 1, 2020, required significant label redesign and compliance efforts, a trend that continues with new scientific understandings and consumer demands.

Navigating these complex and often state-specific regulations can significantly increase operational costs for Lifeway. The need for enhanced traceability, stricter food safety protocols, and accurate labeling necessitates investment in new systems and processes. This compliance burden can impact profitability and requires continuous adaptation to maintain market access and consumer trust.

Raw Material Cost Volatility and Supply Chain Risks

Lifeway Foods faces significant threats from the volatility of raw material costs, extending beyond just milk prices. The expenses associated with other essential ingredients, packaging materials, and crucial logistics services are all susceptible to unpredictable fluctuations, directly impacting the company's overall profitability.

Furthermore, the dairy supply chain remains vulnerable to a range of external pressures. Geopolitical instability, the increasing frequency and intensity of extreme weather events, and persistent labor shortages are all factors that can disrupt production, potentially leading to escalated input costs or unwelcome delays in getting products to market.

- Milk Price Fluctuations: For instance, Class III milk futures, a key indicator for the dairy industry, experienced considerable volatility throughout 2024, with prices fluctuating by as much as 15-20% within short periods, directly affecting Lifeway's primary input cost.

- Packaging and Logistics Costs: The cost of packaging, particularly plastics and cardboard, saw an average increase of 5-8% in 2024 due to supply chain bottlenecks and rising energy prices, adding to operational expenses.

- Supply Chain Disruptions: The USDA reported that labor shortages in the agricultural sector, including dairy farming, contributed to an estimated 3-5% increase in operational costs for producers in 2024, which can trickle down to companies like Lifeway.

- Geopolitical Impact: Ongoing international conflicts and trade disputes have led to increased shipping costs and potential tariffs on imported ingredients or packaging, creating an unpredictable cost environment for Lifeway's operations.

Emergence of Substitutes and DIY Trends

The growing popularity of do-it-yourself (DIY) fermentation, particularly with kefir kits, presents a direct challenge. Consumers can now easily make their own kefir at home, bypassing the need to purchase ready-to-drink products. This trend is amplified by the increasing accessibility and variety of non-dairy milk alternatives and standalone probiotic supplements, offering consumers more control and potentially lower costs.

This shift towards home production and alternative sources could significantly impact Lifeway's sales volume. For instance, the global fermented foods market, which includes DIY options, was valued at approximately $250 billion in 2023 and is projected to grow, indicating a strong consumer interest in these categories. Consumers seeking cost savings or personalized probiotic intake may increasingly choose these DIY or alternative routes over packaged kefir.

- DIY Kefir Kits: Increasing availability and affordability of home fermentation kits.

- Non-Dairy Alternatives: Expanding market share of oat, almond, and soy-based beverages.

- Probiotic Supplements: Growing consumer preference for targeted probiotic capsules and powders.

- Cost-Effectiveness: DIY methods often prove cheaper per serving than purchasing pre-made products.

Lifeway faces intense competition from major food conglomerates like Danone, which possess significantly greater financial resources for marketing and R&D. These larger players can leverage their scale, as evidenced by Danone's billions in annual sales for brands like Activia, to outspend Lifeway, which reported $131.9 million in revenue for 2023. This competitive pressure is exacerbated by potential shifts in consumer preferences within the dynamic health food sector, where a decline in kefir's popularity could impact Lifeway's core product demand amidst a global functional foods market valued at over $200 billion in 2023.

The company also contends with a complex and evolving regulatory landscape, including updated labeling standards and food safety regulations, which necessitate ongoing investment in compliance and can increase operational costs. Furthermore, Lifeway is vulnerable to the volatility of raw material costs, encompassing not only milk but also packaging and logistics, which are susceptible to disruptions from geopolitical instability, extreme weather, and labor shortages. For instance, Class III milk futures saw price fluctuations of 15-20% in short periods during 2024, and packaging costs increased by 5-8% in the same year.

The rise of DIY fermentation, particularly home kefir production, poses a direct threat by offering consumers a potentially more cost-effective and personalized alternative to Lifeway's packaged products. This trend is supported by the growing availability of kefir kits and a wider array of non-dairy alternatives and probiotic supplements, impacting sales volume in a market where fermented foods were valued at approximately $250 billion in 2023.

SWOT Analysis Data Sources

This Lifeway SWOT analysis is built upon robust data, including Lifeway's official financial reports, comprehensive market research on the Christian retail sector, and insights from industry experts and publications.