Lifeway Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Lifeway Bundle

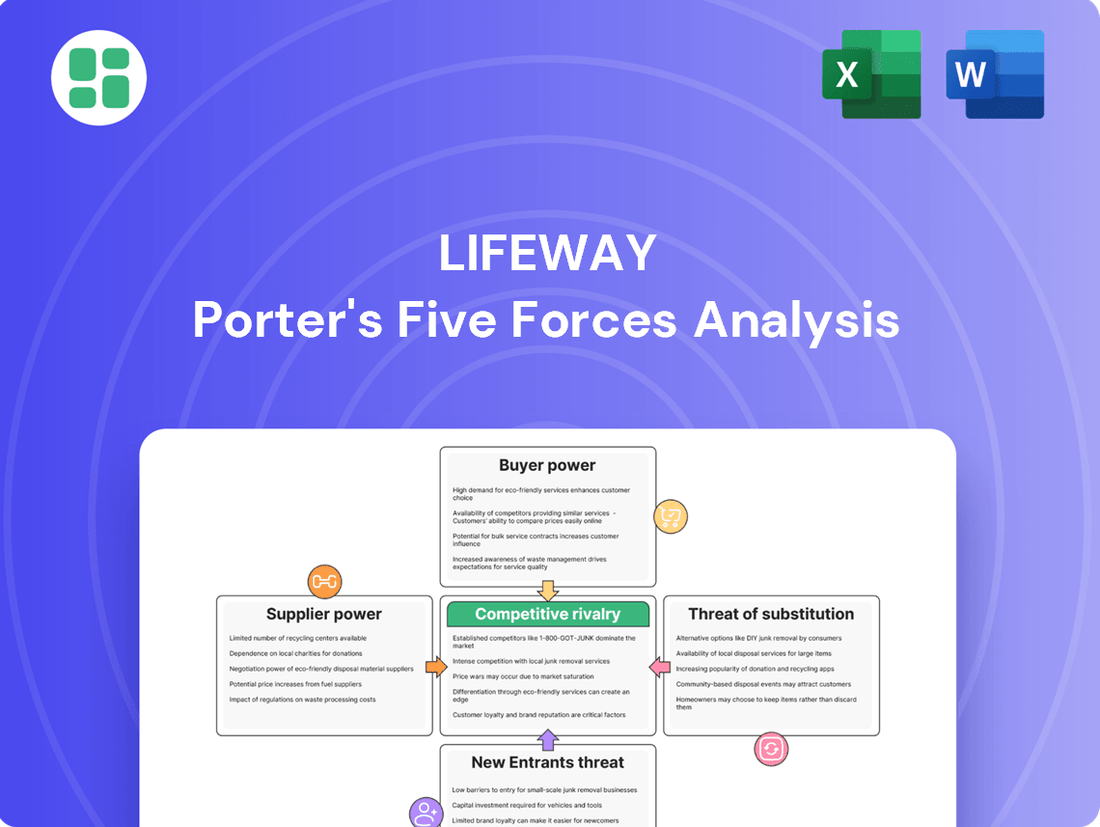

Lifeway's competitive landscape is shaped by intense rivalry, the bargaining power of its buyers and suppliers, and the constant threat of new entrants and substitutes. Understanding these forces is crucial for navigating the market effectively.

The complete report reveals the real forces shaping Lifeway’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

The bargaining power of suppliers for Lifeway Foods, specifically dairy farmers, can be influenced by regional concentration. In areas where a few large dairy farms dominate raw milk supply, these suppliers gain considerable leverage, potentially impacting Lifeway's input costs. For instance, in 2024, reports highlighted that the average U.S. dairy farm size continued to grow, with larger operations becoming more prevalent, which could consolidate supplier power.

Lifeway Foods' core product, kefir, is heavily dependent on specialized probiotic cultures. The availability and uniqueness of these cultures, particularly proprietary strains, can significantly influence supplier bargaining power. For instance, if only a few suppliers can provide high-quality, effective probiotic strains, Lifeway might encounter increased costs or reduced negotiation flexibility.

Beyond the core components of milk and cultures, Lifeway Foods relies on a variety of other key ingredients, such as fruits for its flavored kefir products, and essential packaging materials. The cost of these additional inputs significantly influences the bargaining power of their respective suppliers. For instance, if the price of berries used in popular kefir flavors or the plastic for bottles and caps experiences a sharp increase, this directly impacts Lifeway's cost structure.

Global events, persistent inflation, and ongoing supply chain challenges can all contribute to price volatility for these commodities, thereby amplifying supplier leverage. The food and beverage sector has seen widespread reports of escalating operational expenses throughout 2024, encompassing energy, transportation, and packaging. Suppliers are likely to pass these increased costs onto companies like Lifeway, directly affecting their profitability and necessitating careful cost management.

Switching Costs for Lifeway

The bargaining power of suppliers for Lifeway is significantly influenced by switching costs. When Lifeway faces high expenses or considerable complexity in finding and integrating new suppliers, especially for specialized items like unique probiotic strains or specific dairy sources, existing suppliers gain leverage. These costs can include the time and resources needed for reformulation, obtaining new certifications, or potential disruptions to production schedules.

For instance, if Lifeway needs to replace a supplier of a proprietary probiotic culture, the process might involve extensive testing and validation to ensure product efficacy and safety, which can be both time-consuming and costly. This inherent difficulty in switching empowers suppliers who can offer these specialized ingredients, as it limits Lifeway's ability to negotiate prices down or demand more favorable terms.

In 2024, the dairy industry, a key supplier base for Lifeway, experienced fluctuations. For example, U.S. farm milk prices saw considerable volatility, impacting the cost structure for dairy processors. Lifeway's reliance on specific dairy types means that if a particular supplier controls a unique or high-quality source, their bargaining power increases due to the associated switching costs for Lifeway.

- High Switching Costs: The expense and effort involved in changing suppliers for specialized ingredients like probiotic cultures or specific dairy types directly benefit existing suppliers.

- Reformulation and Recertification: The need for Lifeway to reformulate products and undergo new certifications when switching suppliers adds to the overall switching cost, strengthening supplier power.

- Production Disruption: Potential interruptions to Lifeway's production processes during a supplier transition further enhance the bargaining power of incumbent suppliers.

- Dairy Price Volatility (2024): Fluctuations in dairy commodity prices, such as U.S. farm milk prices, can amplify the impact of switching costs for Lifeway if specialized dairy sources are involved.

Threat of Forward Integration by Suppliers

The threat of forward integration by suppliers, while not a dominant concern for Lifeway's raw milk inputs, remains a theoretical consideration. Large dairy cooperatives or specialized probiotic culture producers could potentially venture into producing cultured dairy products themselves, thereby competing directly with Lifeway.

Such a move would significantly enhance their bargaining power, as they would control both the supply of raw materials and the finished product. For instance, if a major probiotic supplier decided to launch its own kefir brand, it could leverage its existing infrastructure and customer relationships to gain market share.

- Theoretical Forward Integration: Dairy cooperatives or probiotic culture manufacturers could enter cultured dairy production.

- Increased Bargaining Power: Suppliers producing kefir themselves would gain leverage over Lifeway.

- Market Dynamics: This scenario would introduce direct competition from a key input provider.

The bargaining power of suppliers for Lifeway Foods is significantly shaped by the concentration of suppliers, particularly for key ingredients like dairy and specialized probiotic cultures. In 2024, the trend of larger dairy farms continued, potentially consolidating power among milk suppliers. Furthermore, the unique nature of certain probiotic strains means Lifeway may face limited options, increasing supplier leverage.

Switching costs also play a crucial role; the expense and effort required to change suppliers for specialized ingredients can be substantial, empowering existing providers. This is particularly true for proprietary probiotic cultures where reformulation and recertification processes are complex and time-consuming. For example, the U.S. farm milk prices experienced volatility in 2024, impacting Lifeway's raw material costs and highlighting the importance of supplier relationships.

| Factor | Impact on Lifeway | 2024 Context |

|---|---|---|

| Supplier Concentration | Increased leverage for dominant suppliers | Growing average U.S. dairy farm size |

| Switching Costs (Probiotics) | Higher costs and complexity for Lifeway | Need for extensive testing and validation |

| Commodity Price Volatility | Amplified impact on input costs | Inflation affecting energy, transport, and packaging |

| Forward Integration Threat | Potential for direct competition from suppliers | Theoretical risk for dairy co-ops or culture producers |

What is included in the product

Lifeway's Porter's Five Forces Analysis dissects the competitive intensity and profitability potential within its market, examining threats from new entrants, the bargaining power of buyers and suppliers, the threat of substitutes, and existing rivalry.

Effortlessly identify and mitigate competitive threats with a visual breakdown of industry pressures, empowering strategic action.

Customers Bargaining Power

The concentration of retailers significantly impacts Lifeway Foods' bargaining power with its customers. Major U.S. retailers, such as supermarkets and health food stores, represent a substantial portion of Lifeway's sales channels. These large chains, due to their sheer volume of purchases, wield considerable influence over pricing and product placement.

In 2024, Lifeway Foods continued to leverage its relationships with these concentrated retail partners. The company’s expanded retail footprint, reported in its 2024 filings, underscores the ongoing reliance on and negotiation with these powerful buyers who can dictate terms due to their market dominance and ability to shift consumer demand through prominent shelf space and promotional activities.

Customer price sensitivity is a significant factor for Lifeway, especially in the current economic climate. Despite kefir being a health-focused product, consumers are showing increased awareness of price points. For instance, reports from early 2024 indicated that a majority of consumers were actively seeking out deals and discounts, impacting purchasing decisions for many grocery items.

If Lifeway's pricing strategy is not competitive, both retailers and individual consumers have alternatives. This could lead to a shift towards other probiotic beverages or even house brands, thereby increasing the bargaining power of these buyers. The availability of affordable substitutes means customers can easily switch if they perceive Lifeway's products as too expensive.

Customers considering Lifeway's kefir products face a market brimming with alternatives. Beyond other dedicated kefir brands, they can readily choose from a vast selection of yogurts, including Greek, regular, and plant-based varieties, as well as a growing number of functional beverages like kombucha and probiotic drinks. This wide availability of substitutes significantly amplifies customer bargaining power.

The increasing consumer focus on gut health further empowers customers. If Lifeway's pricing, product quality, or availability doesn't meet expectations, consumers can effortlessly pivot to a competitor or a different product category. For instance, the U.S. yogurt market alone was valued at approximately $10.5 billion in 2023, showcasing the sheer scale of readily available alternatives to kefir.

Low Switching Costs for Consumers

For the everyday consumer, switching from Lifeway kefir to a different brand or even a substitute like yogurt or other fermented dairy products involves minimal financial or practical hurdles. This low barrier to entry for consumers means they can easily explore alternatives if they find Lifeway's pricing too high or its product quality lacking.

This dynamic directly impacts Lifeway's ability to command premium prices. For instance, in 2024, the average price of a 32-ounce container of kefir hovered around $4.50 to $6.00, with significant variation based on flavor and retailer. Consumers can readily compare these prices and opt for a competitor if a better deal is available.

- Low Switching Costs: Consumers face negligible costs when moving from Lifeway kefir to another brand or substitute.

- Price Sensitivity: This ease of switching makes consumers more sensitive to price fluctuations, pressuring Lifeway to remain competitive.

- Product Differentiation: Lifeway must continually innovate and maintain high quality to retain customers in a market where alternatives are readily accessible.

- Brand Loyalty: Building and sustaining strong brand loyalty is crucial to counteract the inherent ease with which consumers can explore other options.

Information Availability and Transparency

Consumers today have unprecedented access to information regarding product ingredients, health benefits, and pricing, largely driven by online resources and widespread health awareness campaigns. This heightened transparency significantly empowers customers, enabling them to readily compare Lifeway's products with those of its competitors. As a result, consumers are better equipped to demand greater value, thereby amplifying their bargaining power.

This increased customer knowledge directly influences Lifeway's pricing strategies and product development. For instance, in 2024, the global online health and wellness market saw continued growth, with consumers actively seeking detailed product information before making purchasing decisions. This trend means Lifeway must clearly articulate the benefits and value proposition of its kefir and other dairy products to stand out.

- Informed Consumers: Access to online reviews, ingredient lists, and nutritional information allows consumers to make more discerning choices.

- Price Sensitivity: Transparency in pricing across the market makes consumers more sensitive to price differences, potentially leading them to switch brands if value isn't perceived.

- Demand for Quality: Health-conscious consumers are increasingly scrutinizing ingredients and production methods, pushing companies like Lifeway to maintain high standards.

- Competitive Landscape: The ease with which consumers can compare offerings intensifies competition, forcing Lifeway to offer competitive pricing and superior product quality.

Lifeway's customers, both individual consumers and large retailers, possess significant bargaining power due to the availability of numerous alternatives and low switching costs. Retailers, particularly major grocery chains, can leverage their purchasing volume to negotiate favorable terms, impacting Lifeway's pricing and distribution strategies. In 2024, the competitive landscape for probiotic beverages remained robust, with consumers actively comparing prices and benefits, making them highly sensitive to cost and quality.

The sheer volume of yogurt and other functional beverages available means consumers can easily substitute Lifeway kefir. For instance, the U.S. yogurt market alone was valued at approximately $10.5 billion in 2023, illustrating the vast array of choices. This abundance of alternatives directly empowers customers to demand better pricing and value from Lifeway.

| Factor | Impact on Lifeway | Supporting Data (2024 Context) |

| Retailer Concentration | High bargaining power for major chains | Large retailers account for a substantial portion of Lifeway's sales. |

| Availability of Substitutes | Amplifies customer power | U.S. yogurt market valued at ~$10.5 billion (2023), plus kombucha and other probiotics. |

| Price Sensitivity | Pressure on Lifeway's pricing | Consumers actively seeking deals in early 2024. Average kefir price ~$4.50-$6.00/32oz. |

| Consumer Information Access | Increased demand for value | Growth in online health information empowers comparison shopping. |

Full Version Awaits

Lifeway Porter's Five Forces Analysis

This preview showcases the complete Lifeway Porter's Five Forces Analysis, offering a detailed examination of the competitive landscape within its industry. The document you see here is the exact, professionally formatted analysis you will receive immediately upon purchase, ensuring no discrepancies or missing information. You can confidently proceed with your acquisition, knowing you are getting the full, ready-to-use strategic tool.

Rivalry Among Competitors

Lifeway Foods operates in a crowded marketplace. The cultured dairy and broader healthy beverage sectors are packed with competitors, from global giants like Danone and Nestlé to niche, health-focused brands. This means Lifeway is up against not just other kefir makers, but also a vast range of yogurt and functional drink companies vying for consumer attention.

The global kefir market is on a strong upward trajectory, with projections indicating it will reach substantial figures by 2025 and continue its growth. This expansion is largely fueled by increasing consumer awareness of health benefits and a growing appetite for foods packed with probiotics.

While a robust industry growth rate can often temper direct competition by creating ample room for all participants, it also acts as a magnet for new businesses looking to enter the market. Furthermore, it incentivizes established companies to pursue aggressive expansion strategies, potentially intensifying rivalry.

Lifeway Foods distinguishes itself by focusing on kefir, highlighting its probiotic advantages and health-oriented image. This strong brand identity, coupled with offerings like organic and non-dairy kefir, helps secure customer loyalty and reduces pressure from direct price wars.

While Lifeway emphasizes differentiation, the competitive landscape is crowded with other brands also prioritizing health benefits and product innovation. For instance, in 2024, the global probiotic market, a key segment for Lifeway, was valued at approximately $60 billion and is projected to grow significantly, indicating intense competition to capture market share through unique product attributes.

Exit Barriers

High exit barriers in the cultured dairy sector, like specialized production equipment for items such as kefir or yogurt, can trap companies in a competitive landscape. These specialized facilities represent substantial sunk costs, making it financially unviable for many to simply shut down operations. For instance, a significant portion of the $3.5 billion U.S. yogurt market involves dedicated fermentation tanks and cooling systems.

The substantial investment required for brand building and distribution networks also acts as a powerful deterrent to exiting. Companies that have poured millions into establishing brand recognition and securing shelf space in major retailers are reluctant to abandon these assets. This reluctance means firms might persist in competing even when facing low or negative profitability, as the cost of leaving the market altogether is simply too high.

- Specialized Assets: Significant capital tied up in culturing equipment and processing lines for products like Greek yogurt or cultured butter.

- Brand Equity: Extensive marketing spend and years of effort to build consumer trust and preference for cultured dairy brands.

- Distribution Networks: Established relationships and logistical infrastructure for perishable goods, costly to dismantle or abandon.

- Contractual Obligations: Long-term supply agreements or leases that can incur penalties if terminated early.

Market Share and Aggressiveness of Competitors

Lifeway Foods has demonstrated robust performance, with reported net sales increasing by 8.5% to $159.1 million for the fiscal year ended December 31, 2023. This growth highlights Lifeway's ability to maintain a strong market presence amidst intense competition.

However, the competitive landscape is characterized by significant aggression from major players. Giants like Danone, a global leader in dairy, are continuously investing in product innovation and market expansion within the probiotic dairy sector. For instance, Danone's Activia brand remains a prominent competitor, consistently vying for consumer attention through marketing and new product introductions.

Yakult, another key international competitor, also maintains a strong foothold, particularly in global markets, with its science-backed probiotic beverages. Their focused approach on the health benefits of probiotics fuels aggressive marketing and distribution strategies. This intense rivalry means Lifeway must remain agile and innovative to defend and grow its market share.

- Lifeway Foods' 2023 net sales reached $159.1 million, an 8.5% increase.

- Major competitors like Danone and Yakult are actively innovating in the probiotic dairy market.

- Aggressive marketing and distribution by competitors pose a challenge to Lifeway's market share.

The competitive rivalry within Lifeway Foods' market is intense, fueled by a broad range of players from global conglomerates to specialized health brands. This crowded space means Lifeway competes not only with other kefir producers but also with a vast array of yogurt and functional beverage companies, all vying for consumer dollars. The global probiotic market, valued around $60 billion in 2024, underscores the significant competition for capturing consumer interest through product innovation and health claims.

| Competitor | Product Focus | Key Competitive Strategy |

|---|---|---|

| Danone | Yogurt, Probiotic Dairy | Product innovation, extensive marketing (e.g., Activia) |

| Nestlé | Broad Beverage Portfolio, Health Foods | Global reach, diverse product offerings |

| Yakult | Probiotic Beverages | Science-backed health claims, strong international presence |

| Niche Health Brands | Kefir, Fermented Foods | Specialty ingredients, organic/non-dairy options |

SSubstitutes Threaten

The threat of substitutes for Lifeway Foods' kefir products is significant, primarily stemming from a wide array of other products offering similar gut health benefits. Traditional yogurts, particularly Greek yogurt, remain a strong competitor, with the U.S. yogurt market valued at approximately $9.2 billion in 2023. Other fermented foods like kombucha, kimchi, and sauerkraut also attract health-conscious consumers, with the global kombucha market alone projected to reach $7.7 billion by 2027.

Furthermore, the burgeoning market for probiotic supplements presents a direct substitute. These supplements offer concentrated doses of beneficial bacteria, often in convenient pill or powder form, appealing to consumers seeking targeted gut health solutions. The global probiotic market was estimated to be worth over $60 billion in 2024, indicating a substantial competitive landscape.

For consumers looking for alternatives to traditional dairy kefir, plant-based options like almond, coconut, and oat milk kefirs present a significant threat. These non-dairy kefirs, often fortified with probiotics, cater to individuals with lactose intolerance or those following vegan diets. Lifeway Foods, recognizing this trend, has expanded its own product line to include non-dairy kefir varieties, directly competing with these substitutes.

The broader health beverage market, encompassing fortified juices, smoothies, and functional waters, presents a substantial threat of substitution for Lifeway Foods. Consumers seeking general wellness benefits, rather than specifically probiotics, have an extensive range of alternative options available.

In 2024, the global functional beverage market was valued at over $160 billion, with projections indicating continued growth, highlighting the broad appeal of health-focused drinks beyond probiotics. This vast and expanding market offers consumers numerous alternatives that can fulfill similar health objectives, thereby diluting the unique selling proposition of kefir.

Price-Performance Trade-off of Substitutes

The attractiveness of substitutes for Lifeway Foods is heavily influenced by the price-performance trade-off consumers perceive. If alternative products, such as other fermented dairy or plant-based beverages, offer similar health benefits, like probiotic content or nutritional value, at a lower cost or with greater convenience, consumers are likely to switch.

For instance, by mid-2024, the average price for a 32-ounce Kefir product from Lifeway hovered around $4.50. In contrast, many almond or oat milk brands, while not always offering the same probiotic profile, were available in similar sizes for under $3.50, presenting a clear price advantage for consumers prioritizing cost over specific health attributes.

- Price Sensitivity: Consumers are increasingly price-conscious, making lower-priced substitutes a significant threat.

- Health Benefit Equivalence: Substitutes that can match or closely approximate Lifeway's probiotic and nutritional benefits at a competitive price will gain market share.

- Convenience Factor: Products that are more readily available or easier to consume on-the-go can also draw consumers away from traditional kefir.

Consumer Awareness and Shifting Health Trends

Lifeway Foods, a prominent player in the kefir market, faces a significant threat from substitutes driven by evolving consumer awareness and health trends. As consumers become more educated about the benefits of gut health and the appeal of functional foods, this trend broadly favors probiotic-rich products like kefir. However, it also acts as a catalyst for the expansion of all products containing probiotics, intensifying competition.

Dietary shifts, such as the growing adoption of plant-based lifestyles or a heightened focus on specific superfoods, can rapidly alter consumer preferences. This dynamic can lead consumers to explore alternative sources of probiotics or beneficial nutrients, potentially diverting demand away from traditional kefir products. For instance, the burgeoning popularity of kombucha, another fermented beverage rich in probiotics, presents a direct substitute that has seen substantial market growth.

- Growing Probiotic Market: The global probiotic market was valued at approximately $50 billion in 2023 and is projected to grow, indicating increased consumer interest in gut health products.

- Kombucha's Rise: Kombucha sales have surged, with the market expected to reach over $10 billion by 2027, demonstrating its strong appeal as a kefir alternative.

- Plant-Based Alternatives: The plant-based food market is booming, with projections suggesting it could reach hundreds of billions of dollars in the coming years, potentially drawing consumers seeking dairy-free or novel functional ingredients.

The threat of substitutes for Lifeway Foods' kefir is substantial, fueled by a diverse range of products offering similar health benefits, particularly for gut health. Traditional yogurts, especially Greek yogurt, remain a formidable competitor, with the US yogurt market valued at around $9.2 billion in 2023. Other fermented foods like kombucha and kimchi are also gaining traction among health-conscious consumers, with the global kombucha market projected to hit $7.7 billion by 2027.

Probiotic supplements represent another direct substitute, offering concentrated doses of beneficial bacteria in convenient forms. The global probiotic market was valued at over $60 billion in 2024, underscoring the competitive intensity. Furthermore, plant-based kefirs made from almond, coconut, or oat milk cater to consumers with lactose intolerance or those following vegan diets, creating a direct challenge Lifeway is addressing with its own non-dairy offerings.

The broader health beverage market, including fortified juices and smoothies, also poses a threat. In 2024, this market was valued at over $160 billion, providing consumers with numerous alternatives for general wellness. Price sensitivity is a key factor, with substitutes often offering similar benefits at a lower cost; for example, Lifeway's 32-ounce kefir averaged around $4.50 in mid-2024, while comparable plant-based milks were often under $3.50.

| Substitute Category | Estimated Market Size (2023/2024) | Key Competitive Factors |

| Yogurt (especially Greek) | US Market: ~$9.2 billion (2023) | Familiarity, wide availability, price |

| Kombucha | Global Market: ~$7.7 billion (projected 2027) | Trendy, perceived health benefits, flavor variety |

| Probiotic Supplements | Global Market: >$60 billion (2024) | Concentrated dosage, convenience, targeted effects |

| Plant-Based Alternatives (Kefir/Yogurt) | Growing rapidly, part of multi-billion dollar plant-based market | Dietary restrictions (lactose intolerance, vegan), novel flavors |

| General Health Beverages | Global Market: >$160 billion (2024) | Broad wellness appeal, convenience, diverse options |

Entrants Threaten

Entering the cultured dairy market, particularly to challenge established brands like Lifeway, demands substantial upfront capital. This includes building or acquiring modern processing facilities, investing in specialized fermentation equipment, and establishing a robust cold chain distribution network. For instance, setting up a dairy processing plant can easily cost tens of millions of dollars, with specialized equipment for probiotic cultivation adding further expense.

Lifeway Foods has cultivated a significant level of brand loyalty over its many years of operation. This loyalty is a substantial barrier for any potential new entrant looking to gain a foothold in the competitive beverage market.

Furthermore, Lifeway benefits from established and extensive distribution channels that reach a wide array of major U.S. retailers. Replicating this network, which includes securing prime shelf space often occupied by established brands, presents a formidable challenge for newcomers.

In 2023, Lifeway Foods reported net sales of $140.9 million, demonstrating the scale and reach of its established market presence. This financial performance underscores the difficulty new entrants would face in competing for consumer attention and shelf availability.

New entrants into the functional foods market, particularly those focusing on probiotic-rich products like Lifeway Foods, face significant hurdles in securing essential inputs. Access to a consistent supply of high-quality raw milk is fundamental, and establishing reliable relationships with dairy farmers can take considerable time and investment. For instance, in 2024, the U.S. dairy industry continued to grapple with fluctuating milk prices, influenced by factors like feed costs and global demand, making consistent sourcing a strategic challenge.

Furthermore, proprietary probiotic cultures are a critical differentiator for companies like Lifeway. Developing and maintaining exclusive access to specific, effective probiotic strains requires substantial research and development, creating a powerful barrier to entry. Newcomers may find it difficult to replicate the specialized cultures that contribute to product efficacy and brand reputation, especially when established players have long-standing partnerships with research institutions or have invested heavily in their own microbial libraries.

Regulatory Hurdles and Food Safety Standards

The food and beverage sector, especially dairy, faces rigorous health, safety, and labeling regulations. New companies entering this market must meticulously comply with these complex rules, a process that demands considerable time and financial investment. For instance, in 2024, the U.S. Food and Drug Administration (FDA) continued to enforce strict Good Manufacturing Practices (GMPs) and HACCP principles across food production facilities, adding layers of operational complexity for any new entrant aiming to distribute their products nationwide.

These regulatory requirements act as a substantial barrier to entry, significantly deterring potential new competitors. Navigating the labyrinth of permits, inspections, and compliance certifications can be a daunting and expensive undertaking. The cost associated with meeting these standards, from facility upgrades to specialized testing, can easily run into hundreds of thousands, if not millions, of dollars, making it a challenging hurdle for smaller or less capitalized businesses.

- Stringent Health and Safety Regulations: Dairy products, in particular, are subject to strict oversight regarding pasteurization, bacterial counts, and allergen control.

- Complex Labeling Requirements: Accurate ingredient lists, nutritional information, and origin claims must be meticulously adhered to, with penalties for non-compliance.

- Cost of Compliance: Meeting these standards often necessitates significant capital expenditure on equipment, quality control systems, and legal/consulting fees.

- Time Investment: The approval processes and ongoing audits can consume valuable time, delaying market entry and product launch for new businesses.

Experience and Learning Curve

The manufacturing of cultured dairy products, such as kefir, demands specialized knowledge in fermentation, stringent quality control, and nuanced product development. Newcomers would encounter a significant learning curve to replicate the consistent quality and distinct taste profiles that consumers associate with established Lifeway brands. For example, achieving the precise microbial balance for optimal fermentation and shelf-life requires years of accumulated know-how.

This experience gap translates into higher initial operational costs and a longer time-to-market for potential entrants. Lifeway Foods, Inc., a prominent player, has refined its processes over decades, building a reputation for reliability. In 2023, Lifeway reported net sales of $146.2 million, demonstrating the market's preference for established, trusted brands.

- Expertise in Fermentation: Cultured dairy requires deep understanding of microbial cultures and their interaction with dairy substrates.

- Quality Control Rigor: Maintaining consistent taste, texture, and safety standards is paramount and takes time to perfect.

- Product Development Innovation: Developing new flavors and product variations within the cultured dairy space requires market insight and R&D investment.

- Brand Reputation: Established brands benefit from consumer trust built over years of consistent product delivery.

The threat of new entrants for Lifeway Foods is moderate, primarily due to high capital requirements for dairy processing, specialized equipment, and establishing a cold chain. Additionally, significant investment is needed to replicate Lifeway's established distribution networks and secure prime retail shelf space.

Lifeway's strong brand loyalty and proprietary probiotic cultures also act as substantial barriers. New companies must overcome the challenge of building consumer trust and differentiating their products in a crowded market. In 2023, Lifeway Foods reported net sales of $140.9 million, reflecting its significant market penetration.

Navigating stringent health, safety, and labeling regulations adds further complexity and cost for potential entrants. Compliance with FDA standards, for example, demands considerable time and financial investment in 2024. Furthermore, acquiring the specialized knowledge in fermentation and quality control that Lifeway possesses through decades of operation presents a steep learning curve.

| Barrier Type | Description | Impact on New Entrants | Example Data (2023/2024) |

|---|---|---|---|

| Capital Requirements | Building processing facilities, acquiring specialized equipment, cold chain logistics. | High | Dairy plant setup can exceed tens of millions of dollars. |

| Brand Loyalty & Reputation | Established consumer trust and preference for Lifeway's products. | High | Lifeway Foods' net sales reached $140.9 million in 2023. |

| Distribution Channels | Access to major retailers and established supply chains. | High | Securing shelf space against established brands is difficult. |

| Proprietary Technology | Exclusive access to effective probiotic strains and fermentation know-how. | High | R&D investment in microbial libraries creates differentiation. |

| Regulatory Compliance | Adherence to FDA health, safety, and labeling standards. | Moderate to High | Strict GMPs and HACCP enforcement in 2024. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis leverages data from industry-specific market research reports, company financial statements, and trade association publications to provide a comprehensive view of competitive dynamics.