Landsea Homes Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Landsea Homes Bundle

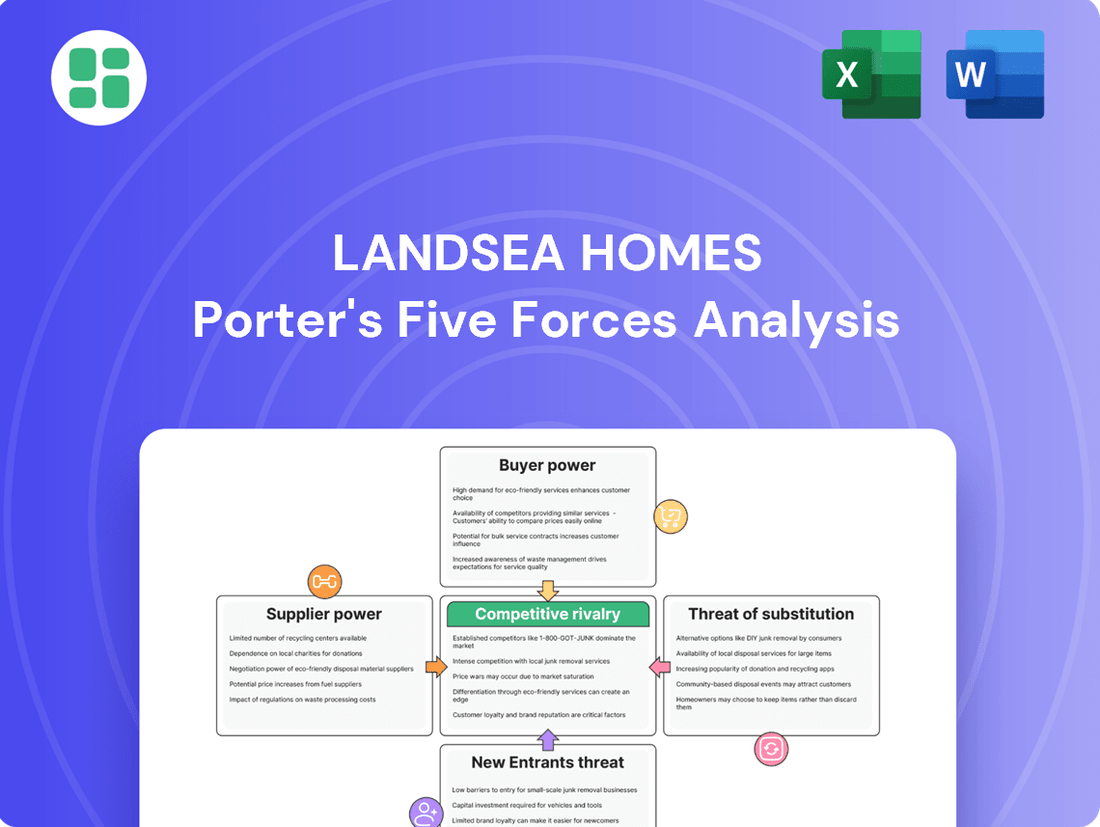

Understanding Landsea Homes's competitive landscape requires a deep dive into the five forces shaping its industry. From the bargaining power of buyers to the threat of new entrants, each element plays a crucial role in defining market dynamics. This brief overview only scratches the surface of the intricate pressures Landsea Homes navigates daily.

The complete report reveals the real forces shaping Landsea Homes’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

The construction industry's ongoing labor shortage, projected to require hundreds of thousands more workers through 2025, significantly bolsters supplier power. This scarcity of skilled tradespeople, such as electricians and heavy equipment operators, means these specialized suppliers can command higher prices and dictate terms more effectively.

Building material costs, though stabilizing, are still higher than before the pandemic. For instance, lumber prices, which saw extreme volatility, remained significantly elevated in early 2024 compared to 2019 averages, impacting Landsea Homes' construction expenses.

Tariffs on key materials like steel and aluminum, coupled with ongoing supply chain issues, continue to put upward pressure on prices. This means Landsea Homes faces persistent cost challenges from its suppliers.

Landsea Homes' effectiveness in managing these elevated material costs through smart purchasing and exploring alternative materials is a critical factor in its profitability and competitive positioning.

The cost and availability of developed lots are major hurdles for homebuilders, with a significant majority citing this as a serious challenge throughout 2024, a trend anticipated to continue into 2025. This scarcity directly impacts Landsea Homes' ability to secure essential raw materials for its operations.

Landsea Homes' asset-light approach, where it controls 55% of its lots without outright ownership, provides some maneuverability. However, this strategy still leaves the company exposed to the volatility of land market prices, highlighting the persistent bargaining power of land developers and sellers.

Supplier Power 4

Supplier power for Landsea Homes is influenced by fluctuating material costs. In early 2024, key items like concrete block and fiberglass insulation experienced significant price hikes, with fiberglass insulation costs up more than 20% compared to the previous year.

While lumber prices have recently stabilized near three-year lows, projections indicate a moderate upward trend in overall material expenses through 2025. This dynamic environment necessitates that Landsea Homes remain agile in managing supplier relationships and cost pressures across its diverse material needs.

- Concrete block and fiberglass insulation prices surged in early 2024.

- Fiberglass insulation costs increased by over 20% year-over-year.

- Lumber prices are near three-year lows but expected to see moderate increases.

- Landsea Homes must navigate varying supplier pressures across different material categories.

Supplier Power 5

Suppliers of specialized components and sustainable materials, crucial for Landsea Homes' modern designs and eco-friendly ethos, likely hold significant bargaining power. As the demand for green building materials continues to climb, the potentially higher costs associated with these inputs could exert pressure on Landsea Homes' gross margins. Effective management through strategic sourcing and thoughtful design decisions becomes paramount to mitigate this impact.

For instance, in 2024, the demand for certified sustainable lumber saw a notable increase, with prices for some varieties rising by as much as 15-20% compared to the previous year. This trend directly affects homebuilders like Landsea Homes that prioritize such materials.

- Increased demand for sustainable materials: Suppliers of eco-friendly products, such as recycled steel or low-VOC paints, are in a stronger position due to growing consumer and regulatory preference.

- Specialized component reliance: Landsea Homes' focus on modern designs may necessitate unique, custom-made components from a limited number of suppliers, enhancing their leverage.

- Cost pass-through potential: Suppliers of these specialized and sustainable materials may have the ability to pass on rising input costs, impacting Landsea Homes' profitability if not managed proactively.

- Strategic sourcing importance: The ability of Landsea Homes to secure favorable terms and reliable supply chains for these critical materials will be a key determinant in managing supplier power.

The bargaining power of suppliers for Landsea Homes is substantial, driven by labor shortages and material cost volatility. Skilled labor scarcity means specialized trades can demand higher prices, while elevated costs for materials like concrete block and fiberglass insulation, up over 20% year-over-year in early 2024, directly impact Landsea's expenses.

| Material Category | Early 2024 Price Change (YoY) | Key Driver | Impact on Landsea Homes |

|---|---|---|---|

| Skilled Labor | Significant increase | Industry-wide shortage | Higher project costs, potential delays |

| Fiberglass Insulation | >20% increase | Supply chain, demand | Increased building material expense |

| Lumber | Stabilized near 3-year lows, projected moderate increase | Market fluctuations, demand | Cost management essential for profitability |

| Sustainable Materials | 15-20% increase for some varieties | Growing demand, certifications | Potential margin pressure on eco-friendly designs |

What is included in the product

This analysis examines the competitive intensity, buyer and supplier power, threat of new entrants, and substitutes impacting Landsea Homes' market position.

Instantly visualize competitive pressures with a dynamic, interactive Porter's Five Forces chart, making complex market dynamics easily digestible for strategic planning.

Customers Bargaining Power

High mortgage rates, hovering around 7% in 2024, significantly curb customer affordability for new homes. This elevated financing cost makes buyers more price-sensitive, giving them greater leverage to negotiate better terms or delay purchases until rates ease. The reduced purchasing power translates directly into increased bargaining power for potential Landsea Homes customers.

Buyer power significantly influences the homebuilding sector, particularly for companies like Landsea Homes. Customer expectations that prices or interest rates might fall if they delay their purchase can lead to increased buyer hesitancy. This psychological dynamic gives potential buyers more leverage in negotiations, as they feel they can wait for better terms.

This expectation was a significant concern for many homebuilders throughout 2024, with reports indicating a notable portion of builders citing buyer sentiment regarding future price or rate drops as a key challenge. This trend is anticipated to persist into 2025, continuing to shape buyer behavior and negotiation dynamics.

While the increase in existing home inventory in certain markets, like the 16.6% rise in active listings seen in May 2024 compared to the previous year, offers buyers more choices, it hasn't fully offset the persistent supply-demand imbalance. This means buyers still face a market where their bargaining power is somewhat constrained, especially as new construction continues to grapple with rising costs and labor shortages, impacting overall housing availability.

Buyer Power 4

Landsea Homes' strategic shift towards markets like Texas and Florida, characterized by lower average selling prices, directly impacts buyer power. This move suggests that in these regions, customers may possess greater leverage to negotiate pricing and demand incentives, reflecting a more price-sensitive market segment.

The company's geographic diversification, including its expansion into these more affordable areas, implies a recognition of varying customer affordability and purchasing power across different markets. This can translate into increased negotiation strength for buyers in those specific locales.

- Geographic Shift Impact: Landsea Homes' increased focus on Texas and Florida, areas with lower median home prices compared to some coastal markets, amplifies buyer negotiation leverage.

- Affordability Sensitivity: In markets where affordability is a primary concern, buyers are more likely to exert pressure for better pricing and additional concessions.

- Market Responsiveness: The company's adaptation to these markets indicates an awareness of customer price sensitivity, which inherently strengthens the bargaining power of these buyers.

Buyer Power 5

The housing market's cooling trend, evident throughout 2024 and projected to continue into 2025, suggests a shift in buyer power. Slower home sales and extended selling periods in various regions grant consumers more negotiation leverage. This dynamic environment encourages builders like Landsea Homes to offer increased incentives to sustain sales velocity.

For instance, in early 2024, the National Association of Realtors reported a median existing-home sales price increase of 5.7% year-over-year, yet also noted a rise in inventory levels in many markets. This suggests that while prices may still be rising, the pace of sales is moderating, giving buyers more time to consider options and negotiate terms. Landsea Homes, like its competitors, may need to adapt by offering more attractive financing options or price adjustments to attract buyers in this environment.

- Buyer Leverage: A cooling housing market in 2024 and 2025 grants buyers more negotiation power due to slower sales and longer listing times.

- Builder Incentives: To maintain sales momentum, homebuilders are likely to increase incentives, such as price reductions or financing assistance.

- Market Conditions: Reports from early 2024 indicated rising inventory levels in many areas, supporting the notion of a buyer's market.

- Strategic Response: Landsea Homes may need to implement strategies like offering favorable financing or adjusting pricing to remain competitive.

Elevated mortgage rates, consistently above 7% in 2024, significantly diminish buyer purchasing power, leading to increased price sensitivity and greater negotiation leverage for Landsea Homes' potential customers. This affordability challenge means buyers are more inclined to seek concessions or delay purchases, directly strengthening their bargaining position.

The company's strategic pivot to markets like Texas and Florida, featuring lower average selling prices, further amplifies buyer power. In these more price-conscious regions, customers are better positioned to negotiate favorable terms and demand incentives, reflecting a heightened sensitivity to cost.

| Factor | Impact on Buyer Bargaining Power | Landsea Homes Relevance |

| Mortgage Rates (2024 avg. ~7%) | Reduced affordability, increased price sensitivity | Buyers more likely to negotiate |

| Geographic Focus (Texas, Florida) | Lower average selling prices, higher affordability | Increased buyer leverage in these markets |

| Housing Market Cooling (2024-2025) | Slower sales, longer listing times | Buyers have more time to negotiate |

Preview Before You Purchase

Landsea Homes Porter's Five Forces Analysis

This comprehensive Landsea Homes Porter's Five Forces Analysis is the exact document you will receive immediately after purchase, offering a detailed examination of competitive forces within the homebuilding industry. You are previewing the final version, precisely the same document that will be available to you instantly after buying, providing actionable insights into industry attractiveness and strategic positioning. No mockups, no samples; the document you see here is exactly what you’ll be able to download after payment, ensuring you get a professionally formatted and ready-to-use analysis.

Rivalry Among Competitors

The U.S. homebuilding sector is highly fragmented and intensely competitive, with many players vying for market share in regions where Landsea Homes operates, such as Arizona, California, Florida, and Texas. This crowded landscape means Landsea Homes faces constant pressure from both large, established builders and smaller, local developers.

Evidence of this fierce competition can be seen in Landsea Homes' financial performance. For the first quarter of 2025, the company reported a net loss, even as its home deliveries increased. This suggests that to move inventory and maintain sales volume in a competitive environment, Landsea Homes may have been forced to absorb higher costs or offer significant incentives, impacting its profitability.

Competitive rivalry within the homebuilding sector, including companies like Landsea Homes, is expected to intensify as the industry navigates a projected slowdown in overall construction growth for 2025. This muted demand, particularly in residential markets, stems from weakened investor confidence and persistently high interest rates, forcing companies to vie more aggressively for a reduced number of buyers.

Landsea Homes differentiates itself through its focus on master-planned communities, modern aesthetics, and sustainable building practices. This strategy aims to attract buyers seeking a specific lifestyle and value proposition in a crowded housing market. For instance, in 2023, Landsea Homes reported a 10.3% increase in revenue to $1.3 billion, showcasing the market's reception to its offerings.

However, the homebuilding industry is inherently competitive, with many builders employing similar differentiation tactics. This means Landsea Homes must constantly innovate in design, technology, and sustainability to stay ahead. The U.S. Census Bureau reported that in 2023, housing starts increased by 12.1% compared to 2022, indicating robust activity but also intensified competition among builders.

Competitive Rivalry 4

Landsea Homes' focus on an asset-light approach, where it manages rather than owns most of its lots, aligns with a broader industry trend toward operational efficiency. This strategy, however, intensifies competition for prime land parcels, a critical resource for homebuilders.

The demand for desirable locations means that builders are constantly in a race to secure land, driving up acquisition costs and making it a fiercely contested aspect of the market. This competition directly impacts profitability and growth potential.

- Land Acquisition Competition: Builders actively compete for limited desirable land, increasing acquisition costs.

- Asset-Light Strategy Impact: While efficient, this strategy shifts the competitive battleground to land control and access.

- Industry Trend: The prevalence of asset-light models means more players are focused on securing land, heightening rivalry.

Competitive Rivalry 5

Competitive rivalry for Landsea Homes is intensified by regional differences in housing demand and construction. High-growth states such as Texas, Florida, and Arizona are experiencing significant population influx, which naturally attracts more homebuilders.

This increased builder presence in desirable areas often leads to more aggressive pricing strategies and promotional offers as companies vie for market share. For instance, in 2024, states like Florida saw a substantial increase in new housing starts, with builders actively competing for buyers through various incentives.

- Regional Demand Shifts: Areas like Texas and Florida continue to attract significant migration, boosting housing demand and construction activity.

- Builder Concentration: In these high-growth regions, a higher number of builders compete for a limited pool of available land and skilled labor.

- Price Competition: Increased competition can result in builders offering incentives like reduced prices, upgrades, or closing cost assistance to attract buyers.

- Market Saturation: In certain submarkets within these states, the sheer volume of new construction can lead to oversupply, further intensifying rivalry.

The homebuilding industry, where Landsea Homes operates, is characterized by intense rivalry. This is driven by a fragmented market with numerous players, from large national builders to smaller local developers, all competing for customers. Landsea Homes faces this pressure particularly in growth states like Florida and Texas, where increased builder presence leads to aggressive pricing and incentives to capture market share.

For example, in 2024, Florida experienced a notable rise in housing starts, indicating a heightened competitive environment as builders actively sought buyers. This competition can force companies like Landsea Homes to make strategic decisions that impact profitability, such as offering concessions to move inventory, as suggested by their first quarter 2025 net loss despite increased deliveries.

| Metric | Landsea Homes (Q1 2025) | Industry Trend (2024) | Impact on Rivalry |

|---|---|---|---|

| Net Income | Net Loss | Mixed, but competitive pressures noted | Companies may resort to price cuts or incentives. |

| Home Deliveries | Increased | Varies by region, but overall activity remains competitive | Higher volume may require aggressive sales tactics. |

| Land Acquisition | Asset-light strategy | Intensified competition for desirable lots | Drives up land costs and favors builders with strong land pipelines. |

SSubstitutes Threaten

The primary substitute for a new Landsea Home is purchasing an existing, previously owned property. While the supply of existing homes has seen an uptick, it has not yet returned to pre-pandemic levels. This persistent undersupply, exacerbated by several years of limited inventory, has significantly inflated prices for resale homes, making new construction a more appealing option for a segment of buyers in 2024.

Renting remains a significant substitute for Landsea Homes, especially as mortgage rates and home prices continue to present barriers to entry for many potential buyers. In early 2024, the median existing-home price hovered around $389,400, making the down payment and monthly mortgage a substantial commitment. This economic reality pushes more consumers towards rental markets, where monthly costs, while rising, may still be perceived as more manageable than outright ownership.

However, the dynamic between renting and buying is constantly shifting. As of the first quarter of 2024, national average rents for a three-bedroom home saw an increase of approximately 3.5% year-over-year. If this upward trend in rental costs persists and the gap between monthly rent payments and mortgage payments narrows, some renters may find homeownership becoming a more attractive financial proposition, potentially easing the threat of substitution.

Home remodeling and renovation projects present a significant threat of substitution for Landsea Homes. Many homeowners, particularly those with substantial equity, may choose to upgrade their existing properties instead of purchasing a new home. This trend is expected to grow as the housing stock ages, potentially drawing demand away from new construction.

Threat of Substitution 4

The threat of substitutes for Landsea Homes primarily comes from alternative housing solutions that cater to different buyer needs and price points. These include manufactured homes, modular homes, and tiny homes.

While these substitutes may not directly compete within Landsea Homes' established market of master-planned communities, they represent an indirect threat, especially to price-sensitive segments of the housing market or individuals prioritizing flexibility over traditional homeownership models.

For instance, the manufactured housing sector, a significant substitute, saw shipments of 92,000 new homes in 2023, indicating a substantial market for more affordable housing alternatives. This segment offers lower entry costs and faster construction times, appealing to buyers who might otherwise consider entry-level options from traditional builders.

- Alternative Housing Solutions: Manufactured homes, modular homes, and tiny homes offer lower price points and quicker occupancy, appealing to budget-conscious buyers.

- Indirect Threat: While not directly targeting Landsea's master-planned communities, these substitutes capture a segment of the overall housing demand.

- Market Data: The manufactured housing industry shipped approximately 92,000 new homes in 2023, highlighting its significant market presence as a substitute.

- Buyer Preferences: These alternatives cater to buyers seeking greater affordability and flexibility in their living arrangements.

Threat of Substitution 5

Economic headwinds, such as elevated interest rates and consumer expectations of future price decreases, can act as significant substitutes for purchasing a new home from Landsea Homes. For instance, the Federal Reserve's benchmark interest rate, which influences mortgage rates, remained at a target range of 5.25%-5.50% through much of 2024, a substantial increase from previous years. This makes financing a new home considerably more expensive.

Consequently, potential buyers might opt to delay their purchase, effectively substituting immediate homeownership with extended periods of saving or renting. This shift directly impacts builder sales volumes. In 2024, the U.S. median existing-home price saw a year-over-year increase, according to the National Association of Realtors, further pressuring affordability and encouraging a wait-and-see approach from many consumers.

- Economic Factors: High interest rates and buyer expectations of future price declines are key substitutes.

- Consumer Behavior: Buyers may delay purchases, substituting immediate ownership with renting or saving.

- Impact on Builders: This substitution trend can lead to reduced sales volumes for companies like Landsea Homes.

- Market Data: Federal Reserve interest rates remained high in 2024, and median home prices continued to rise, exacerbating affordability issues.

The threat of substitutes for Landsea Homes is multifaceted, encompassing existing homes, renting, home renovations, and alternative housing types. While the supply of existing homes has increased, it remains below pre-pandemic levels, making new construction more attractive for some buyers in 2024, especially given median existing-home prices around $389,400 in early 2024. Renting continues to be a strong substitute, with three-bedroom rents rising about 3.5% year-over-year in Q1 2024, which could narrow the affordability gap with homeownership if the trend continues.

| Substitute Type | Key Characteristics | 2024 Market Context |

|---|---|---|

| Existing Homes | Previously owned properties | Supply still recovering; prices inflated, making new builds competitive. |

| Renting | Monthly occupancy without ownership | Rising rents (3.5% YoY for 3-bed in Q1 2024) may eventually favor buying. |

| Home Renovation | Upgrading existing properties | Growing trend driven by homeowner equity and aging housing stock. |

| Alternative Housing | Manufactured, modular, tiny homes | Lower price points and faster construction appeal to budget buyers; 92,000 manufactured homes shipped in 2023. |

Entrants Threaten

The threat of new entrants in the homebuilding industry, particularly for companies like Landsea Homes, is significantly mitigated by high capital requirements. Acquiring land, funding development, and covering construction costs demand substantial upfront investment, creating a formidable barrier for aspiring builders. For instance, in 2024, the average cost of undeveloped land suitable for residential development in many key U.S. markets continued to climb, often running into millions of dollars per parcel, making it difficult for smaller or newer companies to compete.

Even with an asset-light strategy, which focuses on managing rather than owning all assets, Landsea Homes still requires considerable capital for land acquisition and development partnerships. This financial commitment, coupled with the need for robust supply chain management and skilled labor, deters many potential new players. The regulatory landscape, including zoning laws and permitting processes, also adds complexity and cost, further solidifying the position of established firms.

The threat of new entrants in the homebuilding industry, particularly for companies like Landsea Homes, is significantly mitigated by extensive regulatory hurdles. Navigating complex zoning laws, lengthy permitting processes, and stringent environmental regulations demands substantial expertise and time, creating a considerable barrier for newcomers seeking to quickly establish operations.

These regulatory complexities, which can add months or even years to project timelines, require specialized knowledge and significant upfront investment to overcome. For instance, in 2024, the average time to obtain building permits in major metropolitan areas often exceeded six months, a substantial delay that new entrants must absorb before generating revenue.

Established relationships with suppliers, subcontractors, and local authorities represent a significant barrier for new homebuilders entering the market. Landsea Homes, like other incumbents, benefits from these existing networks, which streamline operations and secure favorable terms. For instance, in 2024, the U.S. housing market continued to grapple with persistent material shortages and labor constraints, making it even more challenging for new players to forge reliable partnerships.

Building these crucial relationships from scratch is both time-consuming and capital-intensive. New entrants would need to invest heavily in business development and potentially pay premiums for materials and labor, eroding their initial profitability. This was particularly evident in 2024, where the cost of lumber, a key building material, saw fluctuations impacting overall construction expenses.

Threat of New Entrants 4

The homebuilding sector, especially for brands like Landsea Homes that focus on quality and sustainability, relies heavily on brand recognition and customer trust. New companies entering this space must overcome the significant hurdle of establishing a reputation and earning consumer confidence against well-established competitors.

Building this trust takes time and considerable investment. For instance, in 2024, the average time for a new homebuilder to achieve significant market share can be years, often requiring substantial marketing budgets and a proven track record of successful projects. Landsea Homes, having cultivated a strong brand identity around its High Performance Homes, benefits from existing customer loyalty that new entrants would struggle to replicate quickly.

- Brand Loyalty: Established builders like Landsea Homes benefit from repeat customers and strong word-of-mouth referrals.

- Capital Requirements: Significant upfront capital is needed for land acquisition, construction, and marketing, creating a barrier for newcomers.

- Regulatory Hurdles: Navigating zoning laws, building permits, and environmental regulations can be complex and time-consuming for new entrants.

- Economies of Scale: Larger, established builders often achieve lower costs per unit due to bulk purchasing of materials and efficient operational processes, which new firms cannot immediately match.

Threat of New Entrants 5

The threat of new entrants into the homebuilding sector, particularly for companies like Landsea Homes, is currently moderate to high, but with significant deterrents emerging in 2024 and projected into early 2025. The cyclical nature of the housing market, coupled with economic headwinds, makes entry particularly risky. Elevated interest rates, which have impacted buyer affordability and builder financing throughout 2024, alongside fluctuating material costs, create an environment where new companies could face substantial challenges from the outset.

Furthermore, the prospect of thin margins and potential losses can act as a significant deterrent. For instance, Landsea Homes reported a net loss in Q1 2025, underscoring the financial pressures within the industry. This financial vulnerability, amplified by the current economic climate, suggests that new entrants would need substantial capital and a very robust business plan to navigate these choppy waters successfully.

- Housing Market Volatility: 2024 saw continued interest rate sensitivity, impacting demand and builder margins.

- Cost Pressures: Fluctuating material costs and labor shortages remain persistent challenges for new entrants.

- Financial Performance: Companies like Landsea Homes experiencing losses, as seen in Q1 2025, signal a difficult entry environment.

- Capital Intensity: Homebuilding requires significant upfront investment, a barrier for less capitalized new firms.

The threat of new entrants for Landsea Homes remains considerable, though several factors temper its immediate impact. High capital requirements for land acquisition and development, coupled with stringent regulatory processes, create significant upfront barriers. For example, in 2024, the average cost of land in prime U.S. housing markets continued its upward trend, often necessitating millions in initial investment.

Established relationships with suppliers and subcontractors are crucial for operational efficiency, a network that new entrants must painstakingly build. In 2024, persistent material shortages and labor constraints further complicated these partnership efforts. Brand loyalty and customer trust, cultivated over years by companies like Landsea Homes, also present a substantial hurdle for newcomers seeking to gain market traction.

| Barrier to Entry | Impact on New Entrants (2024/2025 Outlook) | Example Data/Trend |

|---|---|---|

| Capital Requirements | High | Land acquisition costs in key markets exceeding millions of dollars. |

| Regulatory Hurdles | Significant | Permitting processes often taking over six months in major metropolitan areas. |

| Supplier/Subcontractor Relationships | Challenging to Establish | Ongoing material shortages and labor scarcity impacting partnership formation. |

| Brand Recognition & Trust | Difficult to Replicate | New entrants require years and substantial marketing investment to build comparable reputation. |

Porter's Five Forces Analysis Data Sources

Our Landsea Homes Porter's Five Forces analysis is built upon a foundation of credible data, including publicly available financial statements, industry-specific market research reports, and insights from reputable real estate analytics firms.