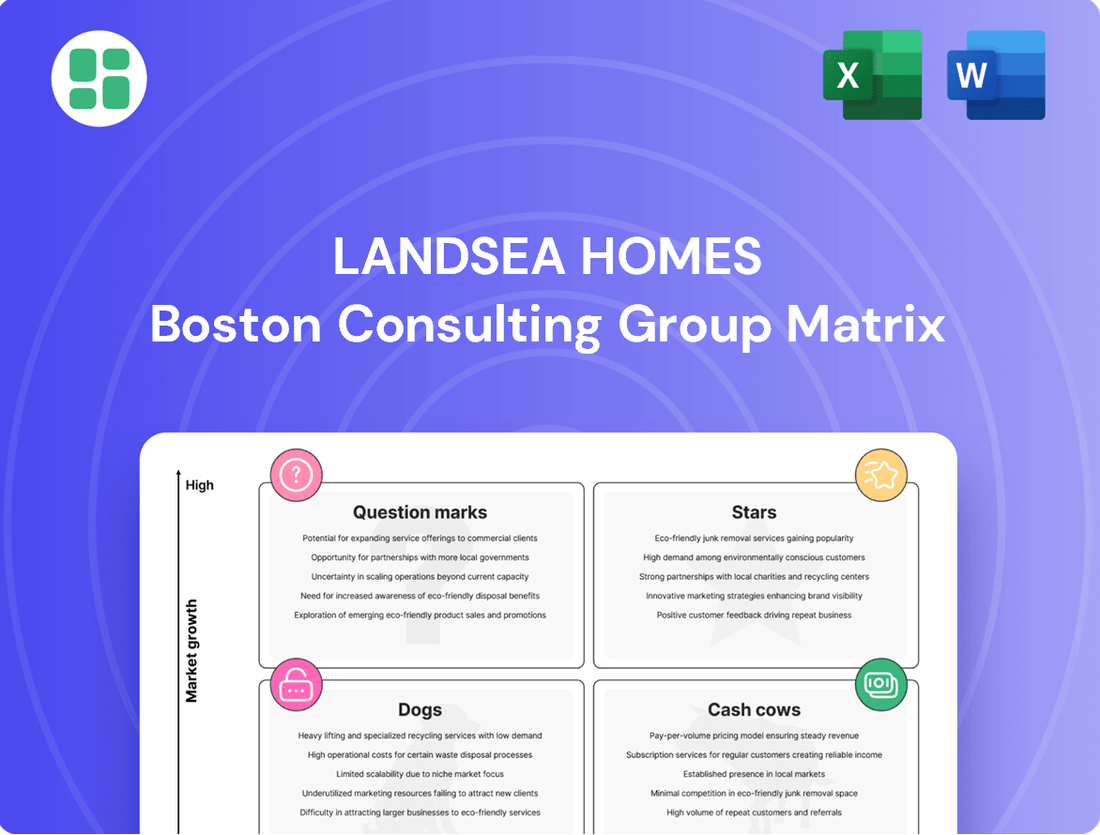

Landsea Homes Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Landsea Homes Bundle

Curious about Landsea Homes' product portfolio? This glimpse into their BCG Matrix reveals how their offerings stack up as Stars, Cash Cows, Dogs, or Question Marks. To truly understand their strategic positioning and unlock actionable insights for growth, purchase the full report.

Don't stop at the surface level; dive deep into Landsea Homes' strategic landscape with the complete BCG Matrix. This comprehensive analysis provides the detailed quadrant placements and data-driven recommendations you need to make informed investment and product decisions. Secure your copy now for a clear roadmap to success.

Stars

Florida represents a significant growth area for Landsea Homes, evidenced by its increasing market share and substantial revenue contribution. The company’s climb to #8 on the Orlando Business Journal's Largest 40 Homebuilders List for 2025, up from #11, highlights its expanding footprint in this vibrant market.

This upward trajectory in deliveries and ranking underscores Florida's position as a key Star in Landsea Homes' portfolio. The state’s strong demand for housing continues to fuel the company’s expansion and financial performance.

The Arizona market, especially Phoenix, has been a powerhouse for Landsea Homes. In 2024, the company saw its deliveries jump by an impressive 38%, with revenues following suit, increasing by 40%. This surge in activity highlights a strong demand and successful execution within the region.

Further underscoring this growth, Landsea Homes ascended to the 8th position on the Phoenix Business Journal's Largest Homebuilders List for 2025, a notable climb from their previous 12th place ranking. This advancement signifies a substantial gain in market share and competitive positioning.

The rapid expansion and increased revenue contribution from Arizona firmly establish it as a Star market within the Landsea Homes portfolio. Its consistent, high-paced growth indicates a prime opportunity for continued investment and development.

Landsea Homes has made a significant push into Texas, acquiring Antares Homes in the Dallas-Fort Worth (DFW) area and launching new communities in Austin and Kyle. This expansion is a key part of their growth strategy.

The Texas market demonstrated its strength in 2024, with Landsea Homes delivering 414 homes. This robust performance highlights the company's successful integration and market penetration in these rapidly developing regions.

While Landsea Homes is still establishing its market share, ranking #49 in DFW and #23 in Austin for 2025, the inherent growth potential in these desirable Texas markets positions them as strong future contenders.

High Performance Homes Initiative

Landsea Homes' High Performance Homes initiative is a key driver of growth, positioning the company as a leader in sustainable and technologically advanced housing. This program, which integrates energy efficiency, smart home features, and eco-friendly materials, is now a standard offering in all new communities. This focus on sustainability and innovation appeals to a growing segment of environmentally conscious and tech-savvy homebuyers, a trend that has seen significant acceleration in recent years.

The High Performance Homes program is designed to capture a significant share of the market by offering distinct advantages. In 2024, the demand for energy-efficient homes continued to surge, with studies indicating that buyers are willing to pay a premium for these features. Landsea Homes' commitment to this segment allows them to command higher prices and achieve faster sales cycles.

- Market Share Growth: The integration of High Performance Homes across all new developments is expected to increase Landsea's market share in the eco-friendly housing segment.

- Buyer Demand: Consumer preference for sustainable and smart home technology has been a consistent upward trend, with an estimated 60% of new home buyers in 2024 considering energy efficiency a top priority.

- Brand Differentiation: This initiative provides a strong competitive advantage, setting Landsea Homes apart from competitors in a crowded housing market.

- Sales Velocity: Homes featuring these high-performance attributes have demonstrated a faster sales pace, contributing to improved revenue generation.

Strategic Asset-Light Approach

Landsea Homes champions an asset-light strategy, a key driver of its Star position in the BCG Matrix. This approach allows the company to maintain agility in dynamic real estate markets. By controlling a significant portion of its land pipeline, specifically 55% of its lots as of the first quarter of 2025, Landsea Homes minimizes upfront capital investment. This strategic control translates into enhanced financial flexibility and the ability to pivot quickly to capitalize on emerging opportunities in high-growth areas.

This asset-light model is crucial for efficient scaling. It enables Landsea Homes to deploy capital strategically into new projects and expand its operations without being burdened by extensive land ownership. This operational efficiency is vital for capturing market share during periods of economic expansion. The company's ability to react swiftly to market shifts and maintain a competitive advantage underscores its Star classification.

- Asset-Light Strategy: Minimizes capital tied up in land, enhancing financial flexibility.

- Lot Control: 55% of lots controlled as of Q1 2025 provides operational leverage.

- Market Responsiveness: Enables rapid deployment of capital and efficient scaling in growth markets.

- Competitive Edge: Positions the company to capitalize on market upturns and maintain a leading position.

Florida and Arizona stand out as Stars for Landsea Homes, demonstrating robust growth and market penetration. Florida's rise to #8 among Orlando homebuilders in 2025, up from #11, signifies strong performance. Arizona, particularly Phoenix, saw a 38% delivery increase and a 40% revenue jump in 2024, propelling the company to #8 on the Phoenix Business Journal's Largest Homebuilders List. These regions represent prime investment areas due to consistent, high-paced expansion.

| Market | 2024 Performance Metric | 2025 Ranking (vs. Previous) | Key Growth Driver |

|---|---|---|---|

| Florida | Increasing Market Share & Revenue Contribution | #8 (from #11) in Orlando | Strong housing demand, expansion |

| Arizona | 38% Delivery Increase, 40% Revenue Increase | #8 (from #12) in Phoenix | High demand, successful execution |

What is included in the product

This BCG Matrix analysis for Landsea Homes categorizes its business units, offering strategic guidance on investment and resource allocation.

The Landsea Homes BCG Matrix provides a clear, actionable overview of business unit performance, relieving the pain of strategic uncertainty.

Cash Cows

Landsea Homes' established Northern California communities are clear cash cows. Despite a competitive landscape, their strong market positioning, evidenced by rankings like #11 on the San Francisco Business Times list and #12 on the Silicon Valley Business Journal list for 2025, highlights their deep roots and success in these high-value areas.

These mature communities represent a significant source of consistent, high-profit margins for Landsea Homes. The company benefits from a likely competitive advantage built over time, meaning these operations require minimal new investment for continued growth and robust cash generation.

Mature Southern California developments like Hudson in Placentia and Eave in Ontario are likely Landsea Homes' cash cows. These established communities have moved past their rapid expansion, now providing a steady stream of income. Their strong market presence in the region solidifies their role as reliable profit generators for the company.

Landsea Homes' legacy master-planned communities, particularly those established in markets like Arizona and Florida, represent strong Cash Cows. These communities, having moved past their initial growth phases, consistently generate substantial revenue from ongoing sales of remaining lots and homes. For instance, in 2024, Landsea Homes reported continued strong performance in its established communities, contributing significantly to overall profitability.

These mature developments require minimal incremental capital expenditure for new infrastructure or marketing campaigns, as brand recognition and buyer demand are already well-established. This translates into a high conversion of sales revenue into free cash flow, supporting the company's broader strategic initiatives and investments in other business segments.

Efficient Backlog Conversion

Landsea Homes' efficient backlog conversion is a key driver of its cash cow status. The company demonstrated this by increasing new home deliveries by 27.3% in Q1 2025. This strong performance indicates a smooth and effective process for turning its existing order book into completed sales.

Homes in the backlog are typically pre-sold, which means Landsea Homes benefits from predictable revenue streams. This reduces the need for extensive marketing efforts for these particular units, contributing to higher profitability and consistent cash flow generation.

The operational efficiency in converting this backlog into closed sales acts as a reliable cash flow engine for Landsea Homes. This consistent cash generation supports ongoing operations and potential investments in other business areas.

- Efficient Conversion: A 27.3% rise in new home deliveries in Q1 2025 highlights Landsea Homes' ability to turn its backlog into revenue.

- Predictable Revenue: The majority of backlog homes are pre-sold, ensuring a stable and predictable income stream.

- Reduced Marketing Costs: Pre-sold homes require less marketing expenditure, boosting the cash generated from each sale.

- Consistent Cash Flow: This operational strength creates a reliable engine for generating cash, supporting the company's financial health.

Post-Acquisition Integration Synergies

Following the acquisition by New Home Co. in June 2025, the merged entity is positioned to unlock significant post-acquisition integration synergies. The primary goal is to optimize operations and leverage the combined scale of both companies.

These synergies are anticipated to boost profitability and cash generation through streamlined processes, the sharing of resources, and an expanded purchasing power. For instance, by consolidating supply chains, the combined entity could potentially achieve a 5-7% reduction in material costs, a common benchmark for such integrations.

If this integration proves successful, Landsea Homes' existing, well-established assets will be transformed into highly efficient cash cows for the newly formed company. This strategic move aims to solidify the company's market position and enhance its financial performance in the competitive housing sector.

- Optimized Operations: Streamlining of administrative and operational functions post-merger.

- Resource Sharing: Leveraging combined technological platforms and talent pools.

- Purchasing Power: Negotiating better terms with suppliers due to increased volume.

- Profitability Enhancement: Expected increase in profit margins through cost efficiencies.

Landsea Homes' established communities, particularly in Northern and Southern California, function as its cash cows. These mature developments benefit from strong market positioning, as seen in their rankings on industry lists for 2025, and generate consistent, high-profit margins with minimal need for new investment.

Legacy master-planned communities in Arizona and Florida also contribute significantly to this category, providing substantial revenue from ongoing sales. The company's efficient backlog conversion, highlighted by a 27.3% increase in new home deliveries in Q1 2025, further solidifies these assets as reliable cash flow engines.

The recent acquisition by New Home Co. in June 2025 is expected to transform these existing well-established assets into even more efficient cash cows for the merged entity, driven by anticipated integration synergies and optimized operations.

| Community Type | Key Markets | Status | Cash Flow Contribution | Justification |

|---|---|---|---|---|

| Established Communities | Northern California, Southern California | Mature, High Market Share | High, Consistent | Strong brand recognition, established demand, minimal new investment required. |

| Legacy Master-Planned | Arizona, Florida | Mature, Ongoing Sales | Substantial | Continued revenue from remaining lots/homes, stable profit generation. |

| Acquisition Synergies | Combined Entity | Potential Transformation | Enhanced | Streamlined operations, shared resources, increased purchasing power post-merger. |

What You’re Viewing Is Included

Landsea Homes BCG Matrix

The BCG Matrix analysis you are currently previewing is the precise, fully formatted document you will receive immediately after completing your purchase. This means no watermarks, no demo content, and no alterations – just the complete, professionally designed strategic tool ready for your immediate use.

Rest assured, the Landsea Homes BCG Matrix report you're viewing is the exact file that will be delivered to you upon purchase. It's a comprehensive, analysis-ready document, meticulously prepared to provide actionable insights for your strategic planning without any need for further editing or revisions.

What you see here is the actual, uncompromised BCG Matrix document that will be yours once you complete the purchase. This preview guarantees that you'll receive a polished, professional report, instantly downloadable and ready to be integrated into your business strategy or client presentations.

Dogs

Landsea Homes might have older communities in less attractive locations that are seeing sluggish sales and low absorption. These communities often require substantial discounts to sell, which eats into profits and ties up valuable capital.

These underperforming older communities, characterized by their low market share and limited growth potential, would be classified as Dogs in the BCG Matrix. For instance, in the first quarter of 2024, the U.S. housing market experienced a slowdown, with existing home sales falling 3.7% month-over-month according to the National Association of Realtors, highlighting the challenges some communities face.

Landsea Homes' California pipeline repositioning, marked by a 35% drop in new home orders in Q4 2024, highlights potential 'Dogs' in their BCG matrix. This significant decline in a key market points to communities that may be underperforming or facing persistent sales challenges, even after strategic adjustments.

If these repositioned Northern California communities continue to lag in sales volume or profitability throughout 2025, they would likely be classified as Dogs. Such assets would represent a drain on resources, consuming capital and management attention without generating the expected returns, thus hindering overall portfolio performance.

Non-strategic legacy assets for Landsea Homes might include land parcels or smaller projects acquired previously that no longer fit the company's current focus on master-planned communities and high-growth markets. These could be sites with limited buyer interest or those demanding significant capital for modest returns.

For example, if Landsea Homes acquired a few scattered single-family lots in a mature, declining market in 2023, these would likely be considered non-strategic. In 2024, the company might be prioritizing large-scale developments in booming Sun Belt regions, making these older lots less attractive.

The likely strategy for these non-strategic holdings would be divestiture, freeing up capital and management attention for more profitable, strategically aligned ventures. This approach helps streamline operations and ensures resources are directed towards areas offering the greatest potential for growth and shareholder value.

Markets with Persistent Affordability Challenges

In markets where affordability remains a significant hurdle, Landsea Homes faces headwinds. High mortgage rates, escalating property taxes, and rising insurance costs can dampen buyer enthusiasm, directly impacting sales volumes and market share for certain home designs. For instance, in early 2024, the average 30-year fixed mortgage rate hovered around 6.6%, a substantial increase from previous years, making homeownership less accessible for many prospective buyers. This persistent affordability challenge can push these operations into the Dogs category of the BCG Matrix if profitability and growth prospects dim.

Landsea Homes has acknowledged this market dynamic, noting an increase in incentives offered to attract buyers in these challenging regions. This strategy, while necessary to maintain sales, can also compress margins. For example, reports from early 2024 indicated that builder incentives, such as mortgage rate buydowns or price reductions, were becoming more common to counter affordability pressures. If these markets continue to demand significant incentives without a clear turnaround in affordability or a strategic pivot, Landsea Homes' presence there risks becoming a drag on overall company performance, fitting the profile of a Dog in their portfolio.

- Persistent affordability issues: Driven by factors like elevated mortgage rates (around 6.6% for 30-year fixed in early 2024) and increasing property taxes/insurance, these challenges suppress demand.

- Impact on market share: Lower demand in these areas can lead to a reduced market share for specific Landsea Homes product lines.

- Potential for Dog classification: Operations in these challenging sub-markets, if lacking a clear path to profitability or growth, could be categorized as Dogs within the BCG Matrix.

- Increased incentives: Landsea Homes has observed a need for greater incentives, such as rate buydowns, to stimulate sales in these affordability-challenged markets.

Metro New York Operations

Metro New York Operations, while listed as an operating segment by Landsea Homes, receives less emphasis in recent growth discussions compared to booming markets like Arizona, Florida, and Texas.

If this region has not achieved substantial scale or consistent growth, and consequently holds a relatively low market share, it could be classified as a Dog in the BCG matrix.

Such a segment might be operating at break-even or even consuming cash without making a significant contribution to the company's overall expansion. For instance, in Q1 2024, Landsea Homes reported strong performance in its Sunbelt states, with deliveries up 16% year-over-year, while specific regional breakdowns for Metro New York were not prominently featured in their growth narratives.

- Metro New York Operations: Potential Dog.

- Low Growth Market Share: Less emphasis in recent growth reports suggests a potentially smaller market share and slower growth trajectory compared to other regions.

- Cash Consumption: Could be a cash drain without significant returns, impacting overall profitability.

- Strategic Re-evaluation: May require a strategic review to either revitalize or divest if it fails to meet growth expectations.

Landsea Homes' "Dogs" likely represent older, underperforming communities in less desirable locations, or non-strategic legacy assets. These segments exhibit low market share and limited growth potential, often requiring significant discounts, as seen with the 35% drop in new home orders in Northern California in Q4 2024. Affordability challenges, exacerbated by mortgage rates around 6.6% in early 2024, further push these operations toward a Dog classification if profitability remains elusive. Metro New York operations might also fall into this category if they hold a low market share and contribute minimally to growth, potentially consuming resources without substantial returns.

| BCG Category | Landsea Homes Example | Characteristics | 2024 Data/Context |

|---|---|---|---|

| Dogs | Underperforming older communities (e.g., Northern California) | Low market share, low growth potential, requires discounts | 35% drop in new home orders (Q4 2024) in Northern California |

| Dogs | Non-strategic legacy assets (e.g., scattered single-family lots in mature markets) | Limited buyer interest, low capital returns | Company prioritizing Sun Belt developments in 2024 |

| Dogs | Affordability-challenged sub-markets | Low demand, reduced market share, requires high incentives | Average 30-year fixed mortgage rate ~6.6% (early 2024) |

| Dogs | Metro New York Operations (potentially) | Low market share, slow growth, potential cash drain | Less emphasis in recent growth narratives compared to Sun Belt states |

Question Marks

Landsea Homes' entry into the Colorado market in late 2023 through the Richfield Homes acquisition positions it as a potential star in the BCG matrix. The launch of new communities like Pintail Commons and Inspirada in 2024 signifies a significant investment in a high-growth region.

Despite Colorado's robust growth, Landsea Homes is still establishing its presence, ranking #22 in Denver for 2025. This nascent market share, coupled with substantial investment in new developments, suggests a high potential for future growth but introduces an element of uncertainty regarding immediate market penetration.

The Essex + Gage community in Huntington Beach, California, slated for a Spring 2025 sales launch, marks Landsea Homes' strategic entry into a prime Orange County coastal market. This all-electric development is introducing novel product offerings in a highly competitive, high-value segment.

As Landsea Homes ventures into this established market with new product types, its future success and market share remain uncertain. This makes Essex + Gage a classic example of a Question Mark within the BCG Matrix, requiring careful observation and strategic investment to determine its potential.

Parkton Square, a new 210-home community in Kyle, Texas, commenced development in March 2024, with sales anticipated in late 2024. This development features single-family homes and attached condominiums in a burgeoning market.

As a nascent project, Parkton Square's market penetration and future market share are not yet established, classifying it as a Question Mark within Landsea Homes' portfolio. This designation necessitates strategic investment to foster growth and determine its long-term viability.

LiveGen™ Suites and Innovative Floorplans

Landsea Homes' LiveGen™ Suites are a prime example of a product catering to a growing niche, particularly multigenerational living. These innovative floorplans, showcased in communities like Dublin Centre, tap into a segment with significant growth potential. For instance, in 2024, the demand for flexible living arrangements, driven by economic factors and changing family structures, continued to rise.

While LiveGen™ Suites address a specific buyer need, their broader impact on Landsea's overall market share is still developing. These specialized offerings require targeted marketing efforts and continued investment to achieve widespread adoption and solidify their position. The company's focus on these unique solutions suggests a strategy to capture market share in underserved segments.

- LiveGen™ Suites target multigenerational living, a growing market trend.

- Communities like Dublin Centre feature these innovative floorplans.

- Market adoption and contribution to overall market share are still evolving.

- Strategic marketing and investment are key for wider traction.

Strategic Shift to Presold Homes

Landsea Homes is making a deliberate strategic move to increase the proportion of presold homes in its sales mix. The company is targeting a balanced approach, aiming for a 50-50 split between speculative (spec) homes and build-to-order (BTO) or presold homes. This pivot is designed to enhance margin opportunities by securing sales before construction begins.

This strategic shift places Landsea Homes in the Question Mark category of the BCG Matrix. While the intention is to improve profitability through presales, the actual impact on market share and overall growth rate is still unfolding. It represents an investment in future earnings potential, but its long-term success in consistently growing market share and profitability remains to be definitively proven.

- Strategic Goal: Increase presold homes to improve margin opportunities.

- Target Mix: Aiming for a 50-50 split between speculative and build-to-order homes.

- BCG Matrix Classification: Currently a Question Mark due to the evolving impact on market share and growth.

- Key Metric: Effectiveness in consistently boosting market share and profitability is under evaluation.

Landsea Homes' initiatives like the Colorado expansion and new communities such as Pintail Commons and Inspirada in 2024, alongside the Essex + Gage development in Huntington Beach for Spring 2025, represent significant investments in potentially high-growth markets. However, their market share in these areas is still developing, with Landsea ranking #22 in Denver for 2025, classifying them as Question Marks.

Similarly, the Parkton Square community in Kyle, Texas, which began development in March 2024, is too nascent to have established market penetration, thus also fitting the Question Mark profile. The strategic shift towards a 50-50 split between speculative and presold homes is another Question Mark, as its ultimate impact on market share and profitability is still being realized.

The LiveGen™ Suites, while targeting the growing multigenerational living trend, also fall into the Question Mark category. Their success hinges on broader market adoption and continued strategic marketing to translate into significant market share gains.

| Initiative | Market | Status | BCG Classification | Key Consideration |

| Colorado Expansion (e.g., Pintail Commons, Inspirada) | Colorado | New Entry, Developing Share (#22 in Denver for 2025) | Question Mark | High growth potential, but market penetration uncertain. |

| Essex + Gage | Huntington Beach, CA | New Development (Spring 2025 Launch) | Question Mark | Entry into a competitive, high-value segment with novel offerings. |

| Parkton Square | Kyle, Texas | Under Development (Sales late 2024) | Question Mark | Nascent project, market share yet to be established. |

| LiveGen™ Suites | Various Communities (e.g., Dublin Centre) | Targeting Niche Market | Question Mark | Success dependent on broader market adoption and targeted marketing. |

| Sales Mix Strategy (50-50 Spec/Presold) | Company-Wide | Strategic Shift | Question Mark | Impact on market share and profitability still evolving. |

BCG Matrix Data Sources

Our Landsea Homes BCG Matrix leverages a blend of internal financial disclosures, market research reports, and competitive benchmarking data to accurately position our product portfolio.