Karooooo SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Karooooo Bundle

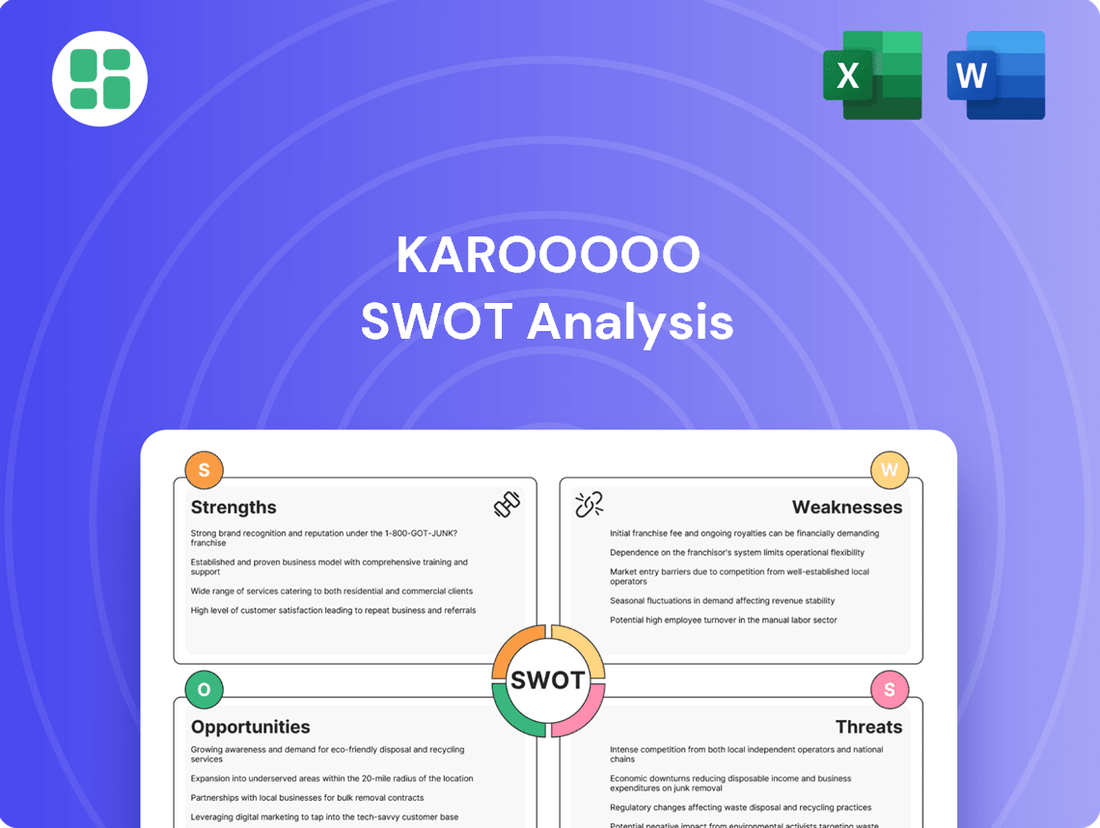

Karooooo's innovative fleet management solutions position it strongly in a growing market, but understanding the nuances of its competitive landscape and potential regulatory shifts is crucial for strategic advantage. Our full SWOT analysis delves into these critical areas, revealing actionable insights into their unique market position and future growth drivers.

Want the full story behind Karooooo’s strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Karooooo's proprietary technology platform is a significant strength, offering real-time data analytics that differentiate its connected vehicle and asset solutions. This advanced infrastructure underpins its competitive advantage in the market.

The platform's core capability lies in simplifying complex decision-making processes by providing actionable, differentiated insights. This empowers businesses to achieve greater operational efficiency and optimization.

Karooooo's diverse service offerings are a significant strength, encompassing fleet management, insurance telematics, and consumer solutions. This broad portfolio allows them to serve a wide array of clients across transportation, logistics, and insurance sectors. For instance, their fleet management solutions are crucial for optimizing operations in industries that saw significant growth in 2024, with the global fleet management market projected to reach over $35 billion by 2025.

This strategic diversification across multiple segments acts as a buffer against market volatility in any single industry. By not being overly dependent on one area, Karooooo can maintain more stable revenue streams. Their expansion into new areas, such as Karooooo Logistics offering delivery-as-a-service (DaaS), further broadens their market reach and creates additional revenue opportunities, tapping into the burgeoning e-commerce delivery market.

Karooooo's financial health is a significant strength, marked by robust growth and profitability. For instance, in the first quarter of fiscal year 2026, the company saw its Cartrack subscription revenue surge by an impressive 19% year-over-year. This consistent top-line expansion, coupled with a 19% increase in earnings per share (EPS) during the same period, highlights the company's ability to translate sales into shareholder value.

The underlying success is driven by a proven Software-as-a-Service (SaaS) business model that generates recurring revenue. This model, combined with Karooooo's disciplined approach to managing its capital and its strong capacity for generating cash, provides a solid foundation for its financial stability and future growth initiatives.

High Customer Retention and Subscriber Growth

Karooooo demonstrates exceptional customer loyalty, reflected in its high retention rates. This suggests that customers find significant value in Karooooo's offerings, leading to sustained engagement with its services.

The company's subscriber base is on a consistent upward trajectory. For instance, Cartrack subscribers grew by 17% in Q1 FY2026, reaching a total of 2.4 million. This robust growth underscores Karooooo's effectiveness in attracting new customers and highlights the strength of its recurring revenue model.

- High Customer Retention: Indicates strong customer satisfaction and loyalty.

- Consistent Subscriber Growth: Cartrack subscribers reached 2.4 million in Q1 FY2026, a 17% increase.

- Recurring Revenue Model: Sustained growth in subscribers reinforces a stable income stream.

Extensive Global Footprint and Market Penetration

Karooooo's extensive global footprint is a significant strength, with operations spanning over 20 countries. This broad reach allows the company to tap into diverse market opportunities and build a substantial customer base. By the end of fiscal year 2024, Karooooo was servicing more than 125,000 commercial customers and boasted 2.4 million active subscribers, showcasing its deep market penetration.

This wide geographical presence and large customer base enable Karooooo to benefit from economies of scale, which can lead to cost efficiencies and increased profitability. The company's strategic emphasis on expanding its distribution networks and growing its customer numbers in existing markets, notably in Southeast Asia, is a key driver for continued organic growth. This focus positions Karooooo to capitalize on emerging market trends and solidify its competitive advantage.

- Global Operations: Active in over 20 countries.

- Customer Base: Servicing more than 125,000 commercial clients.

- Subscriber Numbers: Reached 2.4 million active subscribers by FY2024.

- Growth Strategy: Focused expansion in markets like Southeast Asia.

Karooooo's proprietary technology platform is a significant strength, offering real-time data analytics that differentiate its connected vehicle and asset solutions. This advanced infrastructure underpins its competitive advantage in the market.

The platform's core capability lies in simplifying complex decision-making processes by providing actionable, differentiated insights. This empowers businesses to achieve greater operational efficiency and optimization.

Karooooo's financial health is a significant strength, marked by robust growth and profitability. For instance, in the first quarter of fiscal year 2026, the company saw its Cartrack subscription revenue surge by an impressive 19% year-over-year. This consistent top-line expansion, coupled with a 19% increase in earnings per share (EPS) during the same period, highlights the company's ability to translate sales into shareholder value.

The underlying success is driven by a proven Software-as-a-Service (SaaS) business model that generates recurring revenue. This model, combined with Karooooo's disciplined approach to managing its capital and its strong capacity for generating cash, provides a solid foundation for its financial stability and future growth initiatives.

| Key Metric | Q1 FY2026 | Year-over-Year Growth |

| Cartrack Subscription Revenue | N/A | 19% |

| Earnings Per Share (EPS) | N/A | 19% |

| Cartrack Subscribers | 2.4 million | 17% |

What is included in the product

Delivers a strategic overview of Karooooo’s internal and external business factors, highlighting its market strengths, operational gaps, and potential risks.

Offers a clear, actionable SWOT framework to identify and address operational inefficiencies.

Weaknesses

Karooooo's reliance on specific geographic markets, particularly South Africa, presents a notable weakness. This concentration exposes the company to the risks of regional economic downturns and intense competition within those areas. For example, the South African fleet management market is characterized by established competitors, potentially limiting Karooooo's market share expansion and pricing power.

This geographic concentration also poses a threat to scalability. If Karooooo continues to derive a substantial portion of its revenue from a limited number of regions, it may struggle to achieve broader international growth. For instance, while Karooooo reports significant customer numbers, a detailed breakdown by region in their 2024 filings would highlight the extent of this dependency and its potential impact on future revenue diversification.

The telematics sector is a crowded arena, featuring both large, established companies and niche providers delivering comparable services. Karooooo contends with formidable rivals such as Geotab Inc., Verizon Telematics, and MiX Telematics, whose market presence can exert downward pressure on pricing or demand substantial, ongoing investment in research and development to stay ahead.

This highly competitive environment necessitates a relentless focus on innovation and unique value propositions to secure and grow market share. For instance, while specific market share data for 2024-2025 is still emerging, the global telematics market was projected to reach over $40 billion by 2025, indicating the scale of competition Karooooo navigates.

Karooooo's growth is intrinsically linked to how quickly businesses and individuals embrace connected vehicle and telematics technology. If adoption rates lag, or if there's significant hesitation in integrating these digital tools, it could directly impact Karooooo's ability to attract new subscribers and boost its earnings. For instance, while the global telematics market was valued at approximately USD 25.6 billion in 2023 and projected to reach USD 67.9 billion by 2030, any slowdown in this growth trajectory presents a direct risk to Karooooo's expansion plans.

Potential Data Privacy and Security Concerns

Karooooo's reliance on real-time vehicle and asset data exposes it to significant data privacy and cybersecurity risks. A data breach could not only tarnish its reputation but also result in substantial regulatory fines and a critical loss of customer confidence, impacting its market position.

Maintaining cutting-edge cybersecurity defenses and ensuring compliance with increasingly stringent data protection laws, such as GDPR and similar regulations globally, represents an ongoing and significant operational expense for Karooooo. For instance, the global cybersecurity market was projected to reach over $300 billion in 2024, highlighting the scale of investment required.

- Reputational Damage: A single security incident can erode years of trust built with clients.

- Regulatory Fines: Non-compliance with data privacy laws can lead to penalties, as seen with companies facing millions in fines under GDPR.

- Customer Attrition: Loss of faith in data security can drive customers to competitors.

- Increased Operational Costs: Continuous investment in advanced security infrastructure and personnel is essential.

Integration Challenges with New Technologies

Karooooo faces integration challenges as it adopts new technologies like AI and machine learning. The fast-evolving landscape of mobility and data analytics means keeping its platform current with cutting-edge advancements, such as AI-powered predictive analytics, demands significant and continuous investment in both capital and specialized talent. For instance, integrating new IoT device capabilities requires careful planning and execution to ensure compatibility and optimal performance.

Failure to seamlessly incorporate these emerging technologies could undermine Karooooo's competitive edge. Staying ahead means not just adopting new tech, but ensuring it works harmoniously with existing systems. This requires ongoing research and development, potentially impacting the company's financial resources. For example, in 2024, the global AI market was projected to reach over $200 billion, highlighting the scale of investment required to remain competitive in this space.

- Technological Obsolescence Risk: Rapid advancements in AI and IoT can quickly make existing systems outdated, necessitating frequent upgrades.

- High Integration Costs: Implementing new technologies requires substantial financial outlay for software, hardware, and skilled personnel.

- Expertise Gap: Finding and retaining employees with the necessary skills to manage and integrate advanced technologies can be difficult.

- Platform Compatibility Issues: Ensuring new technologies work seamlessly with Karooooo's existing platform is a complex technical hurdle.

Karooooo's significant reliance on the South African market presents a key weakness, exposing it to regional economic volatility and concentrated competitive pressures. This geographic concentration also limits the company's potential for broad international growth and revenue diversification. For instance, while Karooooo reported a substantial customer base, detailed regional breakdowns in their 2024 reports would better illustrate the extent of this dependency.

The telematics industry is highly competitive, with numerous players like Geotab and Verizon Telematics. This necessitates continuous investment in R&D to maintain a competitive edge, especially as the global telematics market was projected to exceed $40 billion by 2025, indicating intense market dynamics.

Karooooo's growth is directly tied to the adoption rate of connected vehicle technology. Slower adoption or hesitancy in integrating digital tools could impede subscriber growth and earnings. For example, while the global telematics market was valued at approximately USD 25.6 billion in 2023, any slowdown in its projected growth to USD 67.9 billion by 2030 poses a direct risk.

The company faces substantial data privacy and cybersecurity risks due to its reliance on real-time vehicle data. A breach could severely damage its reputation and lead to significant regulatory fines, as seen with GDPR penalties. The global cybersecurity market's projected growth to over $300 billion in 2024 underscores the significant investment required for robust defenses.

Integrating emerging technologies like AI and machine learning presents integration challenges and high costs for Karooooo. The rapid pace of technological advancement requires continuous capital investment and specialized talent. For instance, the global AI market's projected growth to over $200 billion in 2024 highlights the competitive landscape and investment demands.

Full Version Awaits

Karooooo SWOT Analysis

This preview reflects the real document you'll receive—professional, structured, and ready to use. You're seeing the actual Karooooo SWOT analysis, detailing its Strengths, Weaknesses, Opportunities, and Threats. The full, comprehensive report is unlocked immediately after purchase.

Opportunities

The global telematics market is booming, with projections indicating it will reach USD 234.96 billion by 2029. This growth is fueled by a strong desire for connected vehicles and more efficient fleet operations.

This expansive market offers Karooooo a prime opportunity to broaden its customer base and boost its earnings. The widespread adoption of telematics in logistics and transportation worldwide is a key driver for this expansion.

Karooooo sees significant potential in expanding its reach into emerging markets, particularly in Southeast Asia, which is already demonstrating impressive growth. In Q1 FY2026, this region saw subscription revenue jump by 30%, highlighting its strategic importance.

The company is also looking beyond its existing footprint to new geographic territories and untapped industry sectors. These underserved verticals can leverage Karooooo's advanced mobility technology, presenting a clear avenue for diversification and increased market penetration.

To capitalize on these opportunities, Karooooo is planning strategic investments in sales and marketing efforts within these target regions. This focused approach is expected to drive substantial new customer acquisition and solidify its presence in these promising growth areas.

The telematics sector is seeing a significant rise in AI and machine learning for predictive analytics, presenting a prime opportunity for Karooooo to elevate its offerings. By integrating these advanced technologies, Karooooo can unlock more powerful insights for its clients.

Developing AI-driven features like predictive maintenance, smarter route optimization, and enhanced driver behavior analysis will directly boost Karooooo's value proposition. For instance, in 2024, the global AI in fleet management market was valued at approximately $2.5 billion, with projections indicating substantial growth, underscoring the demand for such advanced capabilities.

Strategic Partnerships and Acquisitions

Karooooo can significantly boost its market reach and technological prowess through strategic alliances. Collaborating with automotive original equipment manufacturers (OEMs), insurance providers, and logistics firms offers a pathway to new distribution channels and deeper integration within the automotive value chain. For instance, a partnership with a major OEM could see Karooooo's telematics solutions pre-installed in new vehicles, dramatically expanding its customer base. In 2024, the global automotive telematics market was valued at approximately USD 30 billion, with projections indicating substantial growth, presenting a fertile ground for such collaborations.

Furthermore, strategic acquisitions of smaller, innovative technology companies can rapidly enhance Karooooo's capabilities and market position. Acquiring a company specializing in advanced AI-driven fleet management analytics, for example, could allow Karooooo to offer more sophisticated services to its clients. This approach not only diversifies its product portfolio but also accelerates entry into new market segments. The company's financial flexibility, evidenced by its strong cash flow generation, positions it well to pursue such accretive acquisitions in the evolving tech landscape.

- Expand Distribution: Partnering with automotive OEMs to integrate telematics into new vehicles.

- Enhance Technology: Acquiring startups with advanced AI or data analytics capabilities.

- Market Penetration: Accelerating growth through co-marketing agreements with insurance or logistics companies.

- Product Diversification: Broadening service offerings by integrating complementary technologies via partnerships.

Increased Demand for Usage-Based Insurance (UBI)

The global shift towards usage-based insurance (UBI) models is a substantial opportunity for Karooooo. As insurers worldwide increasingly leverage real-time driving data to refine risk assessments and tailor premiums, Karooooo's telematics solutions are well-positioned to meet this growing demand. This trend directly complements Karooooo's existing strengths in data collection and analysis, making its platform a valuable asset for insurance providers seeking to implement UBI effectively.

Key aspects of this opportunity include:

- Growing UBI Market Share: The UBI market is projected to reach over $150 billion globally by 2027, indicating a strong and expanding customer base for telematics providers like Karooooo.

- Data-Driven Underwriting: Insurers are actively seeking reliable data to improve underwriting accuracy, a core function that Karooooo's telematics technology directly supports.

- Personalized Premiums: UBI allows for fairer pricing based on actual driving behavior, creating a win-win scenario for both insurers and policyholders, which Karooooo's platform facilitates.

- Enhanced Risk Management: By providing granular insights into driving patterns, Karooooo's solutions enable insurers to better manage and mitigate risks associated with vehicle usage.

Karooooo can capitalize on the expanding telematics market, with global projections reaching USD 234.96 billion by 2029, by increasing its customer base and earnings through wider adoption in logistics and transportation.

The company is well-positioned to leverage the growing demand for AI and machine learning in fleet management, a market valued at approximately $2.5 billion in 2024, by integrating predictive analytics to enhance its service offerings.

Strategic partnerships with automotive OEMs and insurance providers present a significant avenue for Karooooo to expand its distribution channels, mirroring the growth in the USD 30 billion automotive telematics market in 2024.

Furthermore, the increasing adoption of usage-based insurance (UBI) models, with a projected global market exceeding $150 billion by 2027, offers Karooooo a strong opportunity to provide essential data for risk assessment and personalized premiums.

Threats

The telematics sector is seeing significant consolidation, with major global companies actively competing. This intense rivalry puts pressure on pricing, potentially squeezing Karooooo's profit margins. For instance, in 2024, the global telematics market was valued at approximately $30 billion and is projected to grow, meaning more players will vie for market share.

Competitors are increasingly offering comparable or even superior features at more attractive price points. This could lead to a gradual erosion of Karooooo's customer base and overall profitability. Companies that can innovate and clearly distinguish their offerings will be better positioned to navigate this challenging landscape.

The rapid evolution of IoT and AI technologies presents a significant threat to Karooooo. If the company doesn't consistently update its platform, it risks becoming outdated quickly, especially with new disruptive technologies emerging from competitors. This means Karooooo must commit to ongoing, substantial investment in research and development to stay ahead.

Economic downturns, particularly those impacting the transportation and logistics sectors, pose a significant threat to Karooooo. Reduced client spending on fleet management and telematics solutions can directly curb subscriber additions and revenue growth. For instance, if a major recession hits in 2024-2025, businesses might cut back on non-essential services, impacting Karooooo's recurring revenue model.

Financial instability in key operating markets, such as South Africa or other African nations where Karooooo has a strong presence, could also lead to slower adoption rates or increased churn. The company must maintain prudent financial provisioning to navigate these potential economic headwinds effectively.

Cybersecurity Risks and Data Breaches

Karooooo's reliance on real-time data analytics for connected vehicles positions it as a significant target for cybersecurity threats. The evolving landscape of software-defined vehicles and increasing interconnectedness inherently broadens the potential avenues for cyberattacks, creating a substantial risk. A major security breach could severely damage Karooooo's reputation, erode customer confidence, and result in considerable financial penalties.

The potential financial impact of a data breach is substantial. For instance, the average cost of a data breach in 2024 reached $4.73 million globally, according to IBM's Cost of a Data Breach Report. For a company like Karooooo, which handles sensitive operational and customer data, a breach could lead to:

- Regulatory Fines: Non-compliance with data protection regulations like GDPR or CCPA can incur significant fines, potentially millions of dollars.

- Reputational Damage: Loss of trust from fleet operators and end-users can lead to customer attrition and difficulty in acquiring new business.

- Operational Disruption: System downtime and recovery efforts can halt services, impacting revenue and client satisfaction.

Regulatory Changes and Data Localization Laws

Karooooo faces significant threats from evolving government regulations. For instance, the General Data Protection Regulation (GDPR) in Europe, which came into full effect in 2018, has set a precedent for stringent data privacy rules globally, impacting how Karooooo collects and processes user data. Many countries are now implementing similar legislation, creating a complex compliance landscape.

Data localization laws are another major concern. Countries like China and India have increasingly mandated that data generated within their borders must be stored locally. This could force Karooooo to invest in new data centers or partnerships, potentially increasing operational costs and slowing down expansion plans. For example, India's Personal Data Protection Bill, expected to be fully enacted by 2025, will likely include robust data localization requirements for digital services.

- Regulatory Uncertainty: Karooooo must navigate a patchwork of evolving data privacy, vehicle safety, and telematics regulations across its operating regions, requiring continuous legal and technical adaptation.

- Data Localization Costs: Strict data localization mandates in key markets could necessitate significant capital expenditure for new infrastructure or operational model changes, impacting scalability and potentially reducing profit margins.

- Compliance Burden: Maintaining compliance with diverse and frequently updated regulatory frameworks across different jurisdictions presents an ongoing operational challenge and potential for penalties if not managed effectively.

Intense competition and rapidly advancing technologies like AI and IoT pose significant threats, potentially eroding Karooooo's market share and profitability if it fails to innovate. Economic downturns and financial instability in key markets could also hamper growth by reducing client spending on telematics solutions. Furthermore, the increasing risk of cybersecurity breaches, with global average data breach costs reaching $4.73 million in 2024, could lead to substantial financial penalties and reputational damage.

| Threat Category | Specific Threat | Potential Impact | 2024/2025 Data/Context |

|---|---|---|---|

| Competition | Market Consolidation & Aggressive Pricing | Margin pressure, loss of market share | Global telematics market valued at ~$30 billion in 2024, with increasing competition. |

| Technological Obsolescence | Failure to adopt new IoT/AI advancements | Outdated platform, reduced competitiveness | Continuous R&D investment is crucial to keep pace with disruptive technologies. |

| Economic Factors | Recessions impacting transportation/logistics spending | Slower subscriber growth, reduced revenue | Businesses may cut back on non-essential services during economic slowdowns. |

| Cybersecurity | Data breaches and cyberattacks | Reputational damage, financial penalties, operational disruption | Average cost of data breach globally in 2024 was $4.73 million (IBM). |

| Regulatory Landscape | Evolving data privacy and localization laws | Increased compliance costs, operational complexity, potential fines | GDPR precedent, with India's data protection bill by 2025 likely including localization. |

SWOT Analysis Data Sources

This Karooooo SWOT analysis is built upon a foundation of reliable information, drawing from the company's official financial reports, comprehensive market research, and expert industry analysis to provide a robust strategic overview.