Karooooo Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Karooooo Bundle

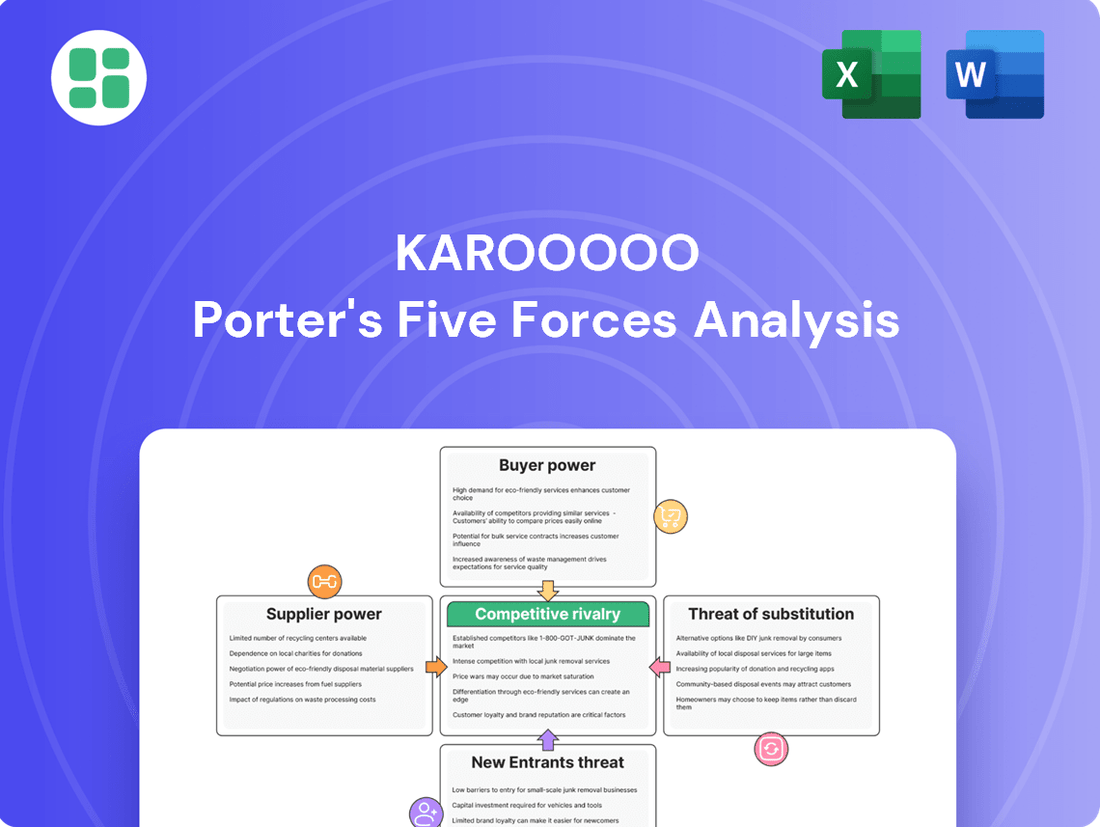

Karooooo's competitive landscape is shaped by several key forces, including the bargaining power of buyers and the threat of new entrants. Understanding these dynamics is crucial for grasping the company's strategic positioning.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Karooooo’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

Supplier concentration for critical components like IoT hardware, sensors, and connectivity modules significantly influences their bargaining power over Karooooo. If specialized telematics devices or advanced AI components are sourced from a limited number of dominant suppliers, Karooooo faces increased leverage from these providers, potentially driving up costs.

For instance, the global market for IoT connectivity modules, a key component for Karooooo's telematics solutions, is characterized by a few major players. In 2024, companies like Quectel and Sierra Wireless hold substantial market share, meaning Karooooo's ability to negotiate favorable pricing on these essential parts is constrained by the limited alternatives available.

The bargaining power of suppliers for Karooooo is significantly influenced by the switching costs associated with its technology infrastructure. If Karooooo's fleet management and vehicle tracking solutions are deeply embedded with proprietary hardware or software from a specific supplier, transitioning to an alternative vendor would likely involve considerable expense and operational disruption. This difficulty in switching directly empowers those suppliers.

For instance, if Karooooo relies on specialized telematics hardware that requires extensive integration and testing with its existing software platform, the cost of re-tooling or re-certifying for a new hardware supplier could be substantial. This creates a dependency, as the effort and financial outlay to change suppliers can be prohibitive, thereby strengthening the supplier's negotiating position.

Suppliers offering highly specialized or proprietary technology, such as advanced AI/ML algorithms for data analytics or unique secure communication protocols, possess greater bargaining power. Karooooo relies on real-time data analytics, and if certain insights or functionalities are only available from a limited set of suppliers, their influence grows.

Threat of Forward Integration by Suppliers

The threat of forward integration by Karooooo's suppliers is a key consideration. If these suppliers possess the capability and a strong incentive to move into offering complete telematics or fleet management solutions, they could directly challenge Karooooo's market position. This would mean Karooooo might need their components less, or worse, find their suppliers becoming direct competitors, thereby significantly boosting supplier leverage.

For instance, a supplier of GPS tracking hardware could develop its own software platform, bypassing Karooooo's service offering. This is particularly relevant in the rapidly evolving IoT and fleet management sectors, where technology integration is paramount. Such a move would allow suppliers to capture a larger share of the value chain.

- Supplier Capability: Assess if key suppliers have the technical expertise and financial resources to develop and market end-to-end telematics solutions.

- Market Incentive: Evaluate if suppliers see a significant profit opportunity or strategic advantage in directly competing with Karooooo.

- Competitive Landscape: Consider if existing or potential new suppliers are already demonstrating a trend towards offering more integrated services.

Importance of Karooooo to Suppliers

The significance of Karooooo's business to its suppliers is a key factor in their bargaining power. If Karooooo accounts for a substantial portion of a supplier's revenue, that supplier might be more inclined to offer favorable pricing or terms to maintain the relationship. This is because losing Karooooo as a major client could significantly impact their own financial stability.

Conversely, if Karooooo is a relatively small client for a large, diversified supplier, the supplier's dependence on Karooooo is minimal. In such scenarios, the supplier holds more leverage, as Karooooo's business is not critical to their overall success. This dynamic can lead to less favorable terms for Karooooo.

- Supplier Dependence: Karooooo's revenue contribution to its suppliers is a critical determinant of their bargaining power.

- Diversified Suppliers: For suppliers with a broad customer base, Karooooo's individual business volume may have a limited impact on their overall revenue, thus reducing their incentive to offer concessions.

- Karooooo's Purchasing Power: The scale of Karooooo's operations and its purchasing volume can influence the terms it negotiates with suppliers.

The bargaining power of suppliers for Karooooo is shaped by the concentration of key component providers and the switching costs associated with its technology. Limited suppliers for specialized hardware like IoT modules, such as Quectel and Sierra Wireless in 2024, grant them significant leverage, potentially increasing Karooooo's operational expenses due to fewer alternatives.

Furthermore, suppliers offering unique technologies, like advanced AI analytics or proprietary communication protocols, gain considerable influence. The threat of suppliers integrating forward into offering complete telematics solutions also elevates their bargaining power, as they could become direct competitors, diminishing Karooooo's reliance on them.

Karooooo's impact on a supplier's revenue is a crucial factor; if Karooooo represents a large portion of a supplier's business, the supplier may offer better terms. Conversely, if Karooooo is a minor client for a diversified supplier, the supplier holds more negotiating strength.

| Factor | Impact on Karooooo | Example (2024) |

|---|---|---|

| Supplier Concentration | Increases supplier leverage | Limited providers for IoT connectivity modules |

| Switching Costs | Strengthens supplier position | High costs for re-integrating new telematics hardware |

| Proprietary Technology | Enhances supplier bargaining power | Unique AI/ML algorithms for data analytics |

| Forward Integration Threat | Potential for direct competition | Hardware suppliers developing their own software platforms |

| Karooooo's Customer Significance | Reduces supplier leverage if Karooooo is a major client | Supplier dependence on Karooooo's order volume |

What is included in the product

Karooooo's Porter's Five Forces analysis reveals the intense competition from existing players and the threat of new entrants, while also highlighting the company's strong customer loyalty and the moderate bargaining power of its suppliers.

Karooooo's Porter's Five Forces Analysis provides a visual, interactive dashboard that simplifies complex competitive pressures, enabling swift identification of strategic vulnerabilities and opportunities.

Customers Bargaining Power

Karooooo's customer base is quite varied, encompassing everything from massive corporations to smaller businesses in sectors like transportation, logistics, and insurance. This diversity is a key strength.

While very large clients, due to their significant order volumes and strategic value, naturally possess considerable bargaining power, Karooooo's wide reach across many customers helps to balance this out. This broad customer distribution prevents the company from becoming overly dependent on any single large client, thereby reducing the overall risk associated with customer concentration.

The effort, time, and financial investment required for a customer to transition from Karooooo's fleet management and telematics solutions to a competitor's offering are significant. These switching costs directly impact the bargaining power of customers, as higher costs to switch generally mean less leverage.

Karooooo's platform often features deep integration with a customer's operational workflows, particularly with its real-time data analytics capabilities. This tight integration means that moving to another provider would necessitate not only changing software but also potentially retraining staff and reconfiguring business processes, adding to the switching burden.

Furthermore, Karooooo's use of proprietary hardware, such as its telematics devices, can also elevate switching costs. Replacing this hardware across an entire fleet represents a substantial capital expenditure and logistical challenge for customers, further cementing their commitment to the current provider and diminishing their bargaining power.

In the competitive fleet management software and telematics sector, customer price sensitivity is a significant factor. As of 2024, many businesses are scrutinizing operational costs, making them more inclined to seek the most cost-effective solutions. This heightened price sensitivity means providers must clearly articulate the value proposition beyond just the sticker price.

Karooooo addresses this by focusing on demonstrating tangible return on investment (ROI) for its clients. By highlighting how its telematics solutions lead to reduced fuel consumption, optimized routing, and fewer accidents, Karooooo helps customers see the long-term financial benefits that outweigh the initial software and hardware costs. For instance, a 2023 study indicated that effective fleet management can reduce operational expenses by up to 15%, a figure Karooooo aims to help its clients achieve or surpass.

Availability of Substitute Solutions

The bargaining power of customers is significantly influenced by the availability of substitute solutions. Customers can easily switch to alternative telematics providers or even opt for in-house fleet management systems if Karooooo's pricing or features are not competitive. This is particularly true as the market for fleet management technology continues to grow and innovate.

The increasing sophistication of competing solutions, many of which now integrate advanced features like AI-driven analytics and IoT capabilities, further strengthens customer leverage. For instance, by mid-2024, a notable portion of fleet operators were exploring or implementing solutions that offered predictive maintenance or enhanced driver behavior monitoring, putting pressure on existing providers to continually improve their offerings.

- Broad Market Options: Customers have a wide array of telematics and fleet management solutions to choose from, impacting Karooooo's pricing power.

- Technological Advancements: The rise of AI and IoT in competing systems provides customers with advanced alternatives, increasing their ability to negotiate.

- Switching Costs: While some switching costs exist, the availability of user-friendly and feature-rich alternatives can mitigate these for customers.

- Customer Expectations: As technology evolves, customer expectations for telematics solutions also rise, pushing providers like Karooooo to remain competitive or risk losing business to substitutes.

Customer Information and Transparency

The internet has dramatically increased customer information and transparency, directly impacting their bargaining power. Consumers can now effortlessly compare Karooooo's pricing, features, and service quality against numerous competitors. This easy access to market data empowers customers to negotiate better terms, as they are well-informed about alternatives and industry standards.

For instance, in the fleet management sector, online reviews and comparison platforms allow potential clients to scrutinize provider offerings. A customer seeking telematics solutions can, within minutes, identify providers offering similar GPS tracking and driver behavior monitoring at different price points. This level of readily available data means Karooooo must continually demonstrate its value proposition to retain and attract clients, as switching costs, while potentially present, are often outweighed by perceived savings or superior features identified through online research.

- Increased Online Information: The proliferation of online resources provides customers with unprecedented access to data on fleet management solutions.

- Price and Feature Comparison: Customers can easily compare Karooooo's pricing structures and feature sets against those of competitors like MiX Telematics or Geotab.

- Enhanced Negotiation Leverage: This transparency allows customers to demand more competitive pricing and customized service agreements.

- Informed Decision-Making: Buyers are better equipped to make informed choices, directly influencing Karooooo's ability to command premium pricing without clear differentiation.

Karooooo faces moderate customer bargaining power, largely due to the increasing availability of substitute solutions and heightened price sensitivity in the fleet management market. While Karooooo's deep integration and proprietary hardware create some switching costs, customers can readily compare offerings online, empowering them to negotiate better terms. The company must continuously demonstrate its ROI to justify its pricing against competitors.

| Factor | Impact on Karooooo | 2024 Market Context |

|---|---|---|

| Availability of Substitutes | Moderate to High | Numerous telematics providers offer comparable GPS tracking and driver behavior monitoring. |

| Price Sensitivity | Moderate to High | Businesses are scrutinizing operational costs, seeking cost-effective solutions. |

| Switching Costs | Moderate | Integration and proprietary hardware create some stickiness, but are often outweighed by perceived savings. |

| Information Transparency | High | Online reviews and comparison platforms allow easy price and feature evaluation. |

Same Document Delivered

Karooooo Porter's Five Forces Analysis

This preview showcases the complete Karooooo Porter's Five Forces Analysis, offering a detailed examination of competitive forces within the fleet management technology sector. You're viewing the exact, professionally formatted document that will be instantly delivered upon purchase, ensuring no discrepancies or missing information. This comprehensive analysis equips you with actionable insights into industry attractiveness and strategic positioning.

Rivalry Among Competitors

The telematics and fleet management software market is quite crowded, with a wide array of companies vying for market share. This includes big global players like Verizon Connect and Samsara, alongside many smaller, regional specialists and newer tech companies. Karooooo faces competition from businesses that might focus solely on software, others on hardware, and some that cater to very specific industry needs.

The fleet management software market is on a significant growth trajectory, with projections indicating a compound annual growth rate (CAGR) of over 16-17% between 2024 and 2029. This robust expansion offers a favorable environment for all industry participants.

Such rapid growth can temper competitive rivalry. As the overall market expands, companies have the opportunity to increase their revenue and customer base without necessarily needing to steal market share directly from existing competitors, fostering a less aggressive competitive dynamic.

Karooooo stands out by offering real-time data analytics, advanced AI video features, and an operations cloud platform that supports digital transformation. This focus on unique, value-added services helps reduce the intensity of direct competition based solely on price.

The company's commitment to ongoing innovation, particularly in predictive maintenance, artificial intelligence and machine learning integration, and leveraging 5G connectivity, is key to maintaining its competitive edge. For instance, Karooooo's investment in AI for video telematics aims to provide deeper insights beyond traditional tracking, differentiating its offering in a crowded market.

Exit Barriers

High fixed costs in developing and maintaining a global IoT SaaS platform, coupled with significant investments in hardware and customer acquisition, create substantial exit barriers for companies like Karooooo. These barriers mean that even when market conditions are tough, businesses are compelled to remain operational and continue competing, thereby intensifying the overall rivalry within the sector. For instance, the substantial capital expenditure required for ongoing research and development, alongside the infrastructure needed to support a vast network of connected devices, locks companies into the market.

These high exit barriers contribute to a more persistent competitive landscape. Companies are less likely to divest or withdraw due to the sunk costs involved. This can lead to prolonged price competition or aggressive market share battles as players strive to recover their investments. In 2024, the telematics industry, where Karooooo operates, continued to see significant investment in technology upgrades and service expansion, reinforcing the commitment of existing players and deterring new entrants from easily exiting if faced with initial challenges.

- High Capital Investment: The cost of building and maintaining a global IoT SaaS platform, including software development, data centers, and cybersecurity, represents a significant sunk cost.

- Hardware Investment: Karooooo's business model involves deploying hardware devices, which incurs upfront manufacturing and inventory costs that are difficult to recoup upon exit.

- Customer Acquisition Costs: Building a substantial customer base in the fleet management and telematics sector requires considerable sales and marketing expenditure, creating a barrier to leaving the market without recovering these costs.

- Brand and Reputation: Established brands and customer relationships are valuable assets that are hard to transfer or sell, making outright exit less attractive than continued operation.

Switching Costs for Customers

High switching costs for customers can significantly impact competitive rivalry by creating a barrier to entry and customer acquisition. When clients are deeply integrated into a competitor's system, it becomes more challenging and expensive for Karooooo to attract them, intensifying the competition for new business.

For instance, if a competitor offers specialized hardware or software that requires substantial investment to replace, customers face financial and operational hurdles in switching. This lock-in effect means Karooooo must offer compelling value propositions and potentially absorb higher customer acquisition costs to win over these entrenched clients.

- Customer Lock-in: High switching costs, such as integration with existing systems or proprietary technology, can trap customers with competitors.

- Acquisition Challenges: This lock-in makes it harder and more expensive for Karooooo to acquire new customers who are already committed elsewhere.

- Increased Competition: The effort to overcome these barriers intensifies the fight for market share among all players.

- Strategic Importance: Understanding and potentially mitigating these switching costs is crucial for Karooooo's growth strategy.

The telematics market is highly competitive, with numerous global and regional players, including giants like Verizon Connect and Samsara, plus specialized niche providers. This intense rivalry is somewhat tempered by strong market growth, projected at over 16-17% CAGR through 2029, allowing companies to expand without solely relying on market share grabs. Karooooo differentiates itself through advanced AI video, real-time analytics, and a comprehensive operations cloud, moving beyond basic feature competition.

High exit barriers, stemming from substantial capital investments in IoT platforms, hardware deployment, and customer acquisition, mean companies remain in the market, contributing to sustained competitive pressure. For instance, the ongoing need for technological upgrades and service expansion in 2024 underscores this persistent competition. Customer lock-in due to integrated systems and proprietary technology further intensifies the battle for new clients, making acquisition more costly and strategic.

| Competitor Type | Key Offerings | Karooooo's Differentiation |

|---|---|---|

| Global Players (e.g., Verizon Connect, Samsara) | Broad telematics solutions, fleet management software | AI video, real-time analytics, operations cloud |

| Regional Specialists | Targeted solutions for specific local markets | Scalable, advanced technology platform |

| Software-Focused Companies | Fleet management software only | Integrated hardware and software solutions |

| Hardware-Focused Companies | Telematics devices | Comprehensive data analytics and AI insights |

SSubstitutes Threaten

Before telematics became prevalent, businesses relied on manual logs, spreadsheets, and basic GPS units for fleet oversight. These older methods, while less sophisticated, still exist as a viable alternative for smaller operations or those prioritizing cost savings, offering a fundamental, albeit less data-rich, approach to fleet management.

Large enterprises with substantial IT budgets may choose to develop proprietary fleet management and telematics systems. These custom-built solutions, though requiring significant upfront investment and ongoing maintenance, offer a high degree of specialization. This can directly challenge Karooooo's market position by providing an alternative that is meticulously aligned with a company's unique operational requirements.

The broader Internet of Things (IoT) market presents a threat of substitutes for Karooooo. General-purpose IoT platforms can collect and analyze data from a wide range of connected assets, not exclusively vehicles. While these platforms may not possess the same specialized mobility features as Karooooo's offerings, they can be adapted to perform some telematics functions, thereby presenting a competitive alternative.

Smartphone-Based Telematics

The threat of substitutes for Karooooo's telematics solutions is growing, primarily from smartphone-based applications. As smartphones become more powerful, they can replicate some core telematics functions, such as GPS tracking and basic driver behavior analysis, without requiring specialized hardware. This presents a viable, often lower-cost alternative for certain market segments.

For instance, many consumer-focused applications and smaller fleet operators might find smartphone telematics a more budget-friendly entry point. This is particularly true for use cases where advanced, integrated hardware features are not critical. The accessibility and widespread adoption of smartphones mean that these substitutes can reach a broad audience.

Consider the market trends: By the end of 2023, smartphone penetration in many developed markets exceeded 85%, with a significant portion of those devices equipped with advanced GPS and sensor capabilities. This vast installed base of potential telematics platforms via smartphones directly challenges dedicated telematics providers. For example, in 2024, we see a rise in app-based mileage trackers and driver safety apps that offer rudimentary telematics features at a fraction of the cost of dedicated hardware solutions.

Here's a breakdown of the substitute threat:

- Functionality Replication: Modern smartphones can perform GPS tracking, speed monitoring, and even rudimentary accident detection, mimicking basic telematics services.

- Cost Advantage: Smartphone-based solutions leverage existing hardware, significantly reducing the upfront cost compared to dedicated telematics devices.

- Market Penetration: The ubiquity of smartphones means a readily available platform for substitute telematics services, especially in consumer and small business segments.

- Ease of Adoption: Users can often download and start using smartphone telematics apps immediately, bypassing the installation process required for hardware-based systems.

Alternative Data Collection Methods

Beyond Karooooo's integrated telematics, businesses can turn to alternative data collection. This includes using vehicle diagnostic ports, commonly known as OBD-II readers. While these offer basic connectivity and data, they are generally less comprehensive than dedicated telematics solutions.

Manufacturer-embedded telematics systems also present a substitute. These are built into vehicles by the manufacturer and can provide some data, fulfilling certain operational needs without requiring third-party hardware. However, their data scope and analytical capabilities may be limited compared to specialized platforms.

For instance, in 2024, the automotive industry saw continued development in in-car connectivity. While specific market share data for embedded telematics versus aftermarket solutions like Karooooo's can fluctuate, the trend indicates a growing availability of vehicle data, even if its depth varies significantly.

These alternatives pose a threat by offering lower-cost or readily available data points, potentially reducing the perceived necessity for Karooooo's more advanced, integrated telematics services for certain customer segments.

The threat of substitutes for Karooooo's telematics solutions is significant, primarily driven by the increasing capabilities and accessibility of smartphones. These devices can replicate core telematics functions like GPS tracking and driver behavior analysis, often at a lower cost, making them attractive alternatives, especially for smaller fleets or cost-conscious segments.

Furthermore, businesses can opt for proprietary, custom-built systems or leverage general-purpose IoT platforms, which, while requiring investment, offer tailored functionality. Even manufacturer-embedded telematics and basic OBD-II readers provide alternative data sources, potentially reducing the perceived need for specialized third-party solutions.

By the end of 2023, smartphone penetration in many developed nations surpassed 85%, with these devices increasingly equipped with advanced GPS and sensors. This widespread adoption creates a vast potential platform for substitute telematics services, as seen in 2024 with the rise of app-based mileage trackers and driver safety apps that offer basic telematics features at a fraction of the cost of dedicated hardware.

| Substitute Type | Key Features | Cost Implication | Market Segment Impact |

| Smartphone Apps | GPS tracking, basic driver behavior analysis | Low (leverages existing hardware) | Small to medium businesses, cost-sensitive users |

| Proprietary Systems | Highly customized functionality | High (significant upfront and ongoing investment) | Large enterprises with specific IT needs |

| General IoT Platforms | Broad data collection from connected assets | Moderate to High (depending on customization) | Diversified industries, data-intensive operations |

| Manufacturer-Embedded Telematics | Basic vehicle data, integrated connectivity | Included in vehicle cost (potential for limited scope) | New vehicle buyers, basic fleet monitoring needs |

| OBD-II Readers | Basic diagnostic data retrieval | Low to Moderate (requires hardware purchase) | DIY diagnostics, simple data logging |

Entrants Threaten

Building a global mobility technology platform, similar to Karooooo's operations, demands substantial initial capital. This includes heavy investment in research and development for sophisticated software, securing or manufacturing reliable hardware, establishing robust network infrastructure, and creating a worldwide sales and customer support system. For instance, in 2024, companies in the telematics and fleet management sector often report R&D expenditures ranging from 10% to 20% of their revenue, highlighting the ongoing need for significant financial backing.

These considerable capital needs create a formidable barrier for potential new competitors looking to enter the market. The sheer scale of investment required to match existing players' technological capabilities and market reach makes it exceedingly difficult for smaller or less-funded entities to compete effectively, thus protecting Karooooo from immediate new threats.

The development of sophisticated real-time data analytics, AI/ML capabilities, and robust cloud infrastructure for connected vehicles, as demonstrated by Karooooo's operations, requires highly specialized technical expertise and a significant history of innovation. Potential new entrants face a substantial hurdle in rapidly acquiring or developing this complex technological know-how, which is a critical barrier.

Karooooo's strong customer retention, reported at over 90% in recent years, highlights a significant level of brand loyalty. This loyalty makes it challenging for new entrants to lure away existing customers, as they would need to offer substantially better value or unique features to overcome the inertia and satisfaction of current users.

Furthermore, Karooooo benefits from network effects, particularly within its fleet management and telematics solutions. As more vehicles and businesses utilize the Karooooo platform, the data insights and operational efficiencies become more valuable for all participants, creating a virtuous cycle that strengthens the incumbent's position and deters new entrants who struggle to achieve critical mass.

Regulatory Hurdles and Compliance

The telematics sector, especially for insurance and commercial fleets, faces significant regulatory challenges. New companies must contend with intricate rules on data privacy, vehicle safety standards, and driver hour limitations, increasing the cost and complexity of market entry.

Navigating these regulatory frameworks requires substantial investment in legal counsel and compliance infrastructure. For instance, in 2024, the General Data Protection Regulation (GDPR) in Europe continues to set a high bar for data handling, impacting how telematics data is collected and used.

- Data Privacy Compliance: Adhering to regulations like GDPR and CCPA is paramount, requiring robust data protection measures.

- Vehicle Safety Standards: Meeting evolving safety certifications for telematics devices installed in vehicles adds R&D and manufacturing costs.

- Industry-Specific Regulations: Compliance with rules governing commercial transport, such as those for driver hours and payload management, is essential for fleet telematics providers.

Access to Distribution Channels

Karooooo's established sales and distribution network, spanning over 20 countries, presents a significant barrier for new entrants. Building a comparable reach and efficiency in diverse and competitive markets would require substantial investment and time. For instance, in 2024, Karooooo continued to expand its footprint, leveraging existing partnerships and local sales teams to penetrate new regions effectively.

New competitors would struggle to replicate Karooooo's established relationships with fleet operators and dealerships, which are crucial for product adoption and ongoing service. These deep-rooted connections are not easily forged and represent a considerable hurdle to overcome. The company’s ability to offer integrated solutions, from hardware to software and support, further solidifies its channel advantage.

- Extensive Global Reach: Karooooo operates in over 20 countries, a scale difficult for newcomers to match quickly.

- Established Partnerships: Strong relationships with fleet operators and dealerships create loyalty and market penetration.

- Integrated Solutions: Offering a complete package of hardware, software, and support strengthens the value proposition through existing channels.

- Brand Recognition: Years of operation have built brand trust and awareness, making customers more receptive to Karooooo's offerings.

The threat of new entrants for Karooooo is generally low due to significant capital requirements for platform development, robust R&D, and global infrastructure. For example, in 2024, the telematics industry saw companies dedicating 10-20% of revenue to R&D, a substantial barrier for startups. Furthermore, intricate regulatory landscapes concerning data privacy, like GDPR, and vehicle safety standards add considerable complexity and cost, demanding specialized legal and compliance investments.

| Barrier Type | Description | Impact on New Entrants | Example Data (2024) |

|---|---|---|---|

| Capital Requirements | High investment in R&D, hardware, software, and global infrastructure. | Deters smaller, underfunded competitors. | Telematics R&D spending often 10-20% of revenue. |

| Technical Expertise | Need for advanced data analytics, AI/ML, and cloud infrastructure. | Requires specialized skills and innovation history. | Development of sophisticated AI for fleet optimization is costly. |

| Regulatory Hurdles | Compliance with data privacy (GDPR) and vehicle safety standards. | Increases costs and time-to-market. | GDPR compliance requires significant legal and technical investment. |

| Distribution & Partnerships | Established global sales network and strong customer relationships. | Difficult to replicate Karooooo's market penetration. | Karooooo's presence in over 20 countries showcases scale. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Karooooo is built upon a foundation of robust data, including Karooooo's official investor relations materials, financial filings, and publicly available annual reports. We supplement this with insights from reputable industry research firms and market intelligence platforms covering the fleet management and telematics sectors.