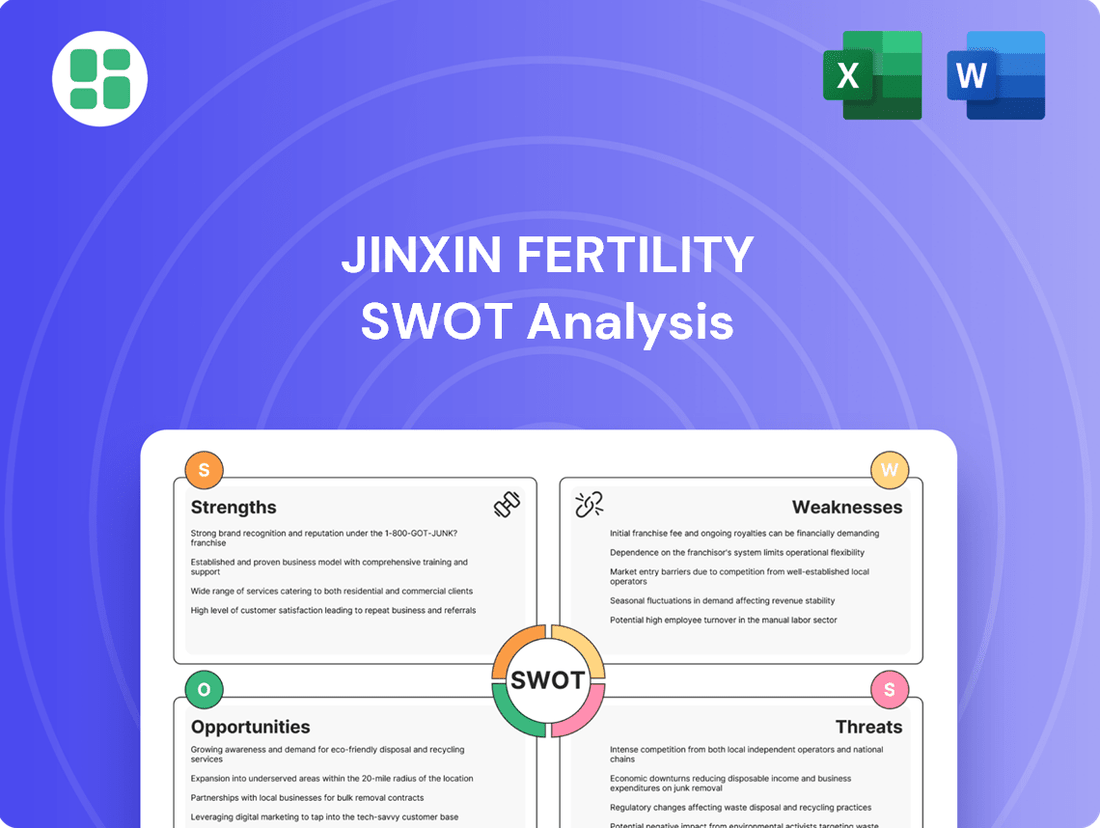

Jinxin Fertility SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Jinxin Fertility Bundle

Jinxin Fertility's market position is shaped by its strong brand recognition and growing demand for fertility services, but it also faces intense competition and evolving regulatory landscapes. Understanding these dynamics is crucial for strategic planning.

Want the full story behind Jinxin Fertility's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Jinxin Fertility Group holds a commanding position as a premier provider of assisted reproductive services (ARS) in both China and the United States. This dual-market leadership is a substantial competitive edge, enabling the company to capitalize on its established brand and operational know-how in two of the globe's most significant fertility markets.

The company's robust market standing is bolstered by its extensive network of high-quality hospitals and clinics strategically located in key areas such as Sichuan, the Greater Bay Area, Yunnan, and the Western United States. For instance, as of its 2023 annual report, Jinxin Fertility operated 16 ARS centers across China and 5 in the US, serving a substantial patient base.

Jinxin Fertility provides a complete spectrum of assisted reproductive technology (ART) services, encompassing IVF, IUI, egg retrieval, embryo transfer, and genetic screening. This all-encompassing approach allows Jinxin to address a wide array of patient requirements across the entire fertility process, from initial preparation to post-natal support.

Jinxin Fertility has cultivated a significant competitive edge through its robust brand recognition, cutting-edge technology, and highly skilled medical professionals. This strong foundation is bolstered by the company's dedication to delivering high-quality, all-encompassing fertility treatments and a personalized patient experience, which significantly enhances its brand appeal.

The company's technological leadership is further cemented by its consistent integration of advanced innovations. For instance, Jinxin Fertility actively employs state-of-the-art genetic screening techniques and sophisticated IVF protocols, ensuring it remains at the forefront of the industry.

Strategic Expansion and Partnerships

Jinxin Fertility is strategically expanding its global presence and forging key partnerships to drive growth. This includes the establishment of HRC Medical's satellite center in Beverly Hills and a new business development hub in San Francisco, both launched in 2024, underscoring a commitment to enhancing accessibility and market penetration in key regions.

The company's foray into the Southeast Asian IVF market, marked by a strategic partnership with PT Morula Indonesia in July 2024, highlights its proactive approach to regional diversification. This move leverages local expertise and aims to capture emerging market opportunities, further solidifying its international footprint.

These strategic initiatives are designed to broaden Jinxin Fertility's service offerings and reach, capitalizing on the growing demand for fertility treatments worldwide. The company's expansion strategy is a testament to its ambition to become a leading global player in the assisted reproductive technology sector.

- Strategic Expansion: Opened HRC Medical satellite center in Beverly Hills and a new business development hub in San Francisco in 2024.

- Market Entry: Entered Southeast Asia IVF market via partnership with PT Morula Indonesia in July 2024.

- Regional Diversification: Demonstrates intent to expand geographically and leverage new market expertise.

Experienced Medical Team and Management

Jinxin Fertility's strength lies in its highly experienced medical team and seasoned management. This is crucial in the specialized and regulated fertility sector, ensuring high standards of patient care and operational efficiency. Their hospitals are consistently ranked among the best in their regions, a testament to their commitment to quality.

The company actively recruits top medical talent and fosters collaborations for specialist training, including a notable partnership with the Keck School of Medicine of the University of Southern California. This strategic approach to talent development directly translates into superior clinical outcomes and reinforces Jinxin's reputation for excellence in fertility services.

- Experienced Medical Team: Jinxin boasts a team of seasoned fertility specialists and medical professionals with extensive experience.

- Robust Management: The company benefits from strong leadership with deep understanding of the healthcare and fertility industry.

- Top-Tier Hospitals: Jinxin's facilities are recognized as leading fertility centers within their operating regions.

- Strategic Training Collaborations: Partnerships, such as the one with the Keck School of Medicine, ensure continuous skill enhancement and access to cutting-edge medical knowledge.

Jinxin Fertility's strengths are deeply rooted in its dual-market leadership across China and the United States, supported by a substantial network of 16 ARS centers in China and 5 in the US as of 2023. The company offers a comprehensive suite of ART services, from IVF to genetic screening, catering to diverse patient needs. Its commitment to advanced technology and a highly skilled medical team, including collaborations with institutions like the Keck School of Medicine, ensures superior clinical outcomes and a strong brand reputation.

What is included in the product

Analyzes Jinxin Fertility’s competitive position through key internal and external factors, detailing its strengths, weaknesses, opportunities, and threats.

Provides a clear, actionable SWOT analysis for Jinxin Fertility, highlighting key areas for improvement and growth to alleviate strategic uncertainty.

Weaknesses

Jinxin Fertility Group experienced a notable dip in profitability during 2024, even as revenues saw a modest uptick. Specifically, net profit fell by 21.2% for the year ending December 31, 2024, suggesting that rising costs or pricing pressures are eating into earnings.

This profitability squeeze is further underscored by the board's decision to forgo a final dividend for 2024, a move that often signals financial caution or a need to retain capital to address operational challenges.

While Jinxin Fertility has expanded into the United States, its core revenue streams remain heavily anchored in China, creating significant geographic concentration. This reliance on specific regions within China makes the company particularly vulnerable to localized regulatory changes and policy shifts impacting the healthcare and fertility sectors. For instance, the Chinese government's evolving stance on assisted reproductive technologies, as seen in recent policy adjustments, directly influences Jinxin's operational environment and revenue potential.

Jinxin Fertility faces significant challenges due to its high operational costs and capital intensity. Providing advanced Assisted Reproductive Technology (ART) services, which require cutting-edge equipment and highly skilled medical professionals, naturally incurs substantial ongoing expenses. This is further underscored by the company's Return on Capital Employed (ROCE) of 3.4% as of December 2024, a figure that falls below the broader healthcare industry's average.

This underperformance suggests that the substantial capital Jinxin Fertility has invested is not yet generating returns as efficiently as it could. The business model itself is inherently capital-intensive, meaning it requires significant upfront and ongoing investment in facilities and technology. This situation points to potential areas for improving operational efficiency and ensuring that capital deployment leads to more robust profitability in the future.

Intense Market Competition

The fertility services sector is experiencing a significant surge in competition, particularly in key markets like China and the United States. This intense rivalry comes from both established public institutions and a growing number of private entities vying for market share. Jinxin, despite its leading position, faces the challenge of potential price erosion and market share dilution as new players enter and existing ones expand their operations.

To navigate this increasingly crowded landscape, Jinxin must prioritize continuous innovation and robust service differentiation. For instance, while specific market share data for 2024 is still emerging, the global fertility services market was valued at approximately USD 25.5 billion in 2023 and is projected to grow significantly. This growth attracts new entrants, intensifying the need for Jinxin to stand out.

- Intensifying Competition: Both public and private entities are actively expanding in high-demand fertility markets like China and the US.

- Pricing and Market Share Pressure: New entrants and aggressive expansion by existing competitors could lead to downward pressure on pricing and Jinxin's market share.

- Innovation Imperative: Continuous investment in new technologies and unique service offerings is critical for Jinxin to maintain its competitive advantage.

Societal and Ethical Sensitivities

Societal and ethical considerations surrounding fertility treatments, especially advanced ART, present a significant weakness for Jinxin Fertility. Public perception and evolving ethical debates about reproductive rights can influence demand and attract regulatory attention. For instance, varying legal stances on procedures like egg freezing for single women, as seen in some regions, can create market access challenges.

Navigating these sensitivities is crucial, as missteps can lead to reputational damage and impact market penetration. The company must remain attuned to public discourse and regulatory shifts in its operating markets, which can be dynamic.

- Ethical Debates: Ongoing discussions regarding the ethics of assisted reproductive technologies (ART) can shape public opinion and regulatory frameworks.

- Legal Restrictions: Varying legal restrictions on fertility services, such as limitations on single individuals accessing egg freezing in certain jurisdictions, can constrain market opportunities.

- Reputational Risk: Failure to adequately address societal concerns can result in negative publicity, impacting brand image and customer trust.

- Evolving Norms: Societal acceptance of fertility treatments is not uniform and can change, requiring continuous adaptation and communication strategies.

Jinxin Fertility's profitability faced a substantial decline in 2024, with net profit dropping 21.2% despite revenue growth, indicating cost pressures or pricing challenges. The company's high capital intensity, evidenced by a 3.4% Return on Capital Employed in December 2024, suggests inefficient capital utilization compared to industry averages.

Intense competition from both public and private entities in key markets like China and the US poses a threat to Jinxin's market share and could lead to price erosion. Furthermore, the company's reliance on China for its core revenue streams makes it vulnerable to localized regulatory shifts and policy changes impacting the fertility sector.

| Weakness | Description | Impact |

| Profitability Squeeze | Net profit down 21.2% in 2024; forgoing final dividend. | Signals financial caution, potential need for capital retention. |

| Geographic Concentration | Heavy reliance on China for revenue. | Vulnerability to localized regulatory changes and policy shifts. |

| High Capital Intensity | Low ROCE of 3.4% as of Dec 2024. | Inefficient capital utilization, potential for improved operational efficiency. |

| Intensifying Competition | New entrants and expansion by existing players in China and US. | Risk of price erosion and market share dilution. |

What You See Is What You Get

Jinxin Fertility SWOT Analysis

This preview reflects the real Jinxin Fertility SWOT analysis document you'll receive. You're seeing the actual content, not a sample, ensuring transparency and quality.

The detailed analysis of Jinxin Fertility's Strengths, Weaknesses, Opportunities, and Threats is presented here in its entirety. Upon purchase, you will download this exact, comprehensive document.

Rest assured, the preview you see is precisely what you will get after purchasing the Jinxin Fertility SWOT analysis. No hidden sections or missing information, just the complete professional report.

Opportunities

The global and regional markets for Assisted Reproductive Technology (ART) are seeing robust expansion. This growth is fueled by increasing infertility diagnoses, people opting for parenthood later in life, and greater public understanding of these treatments.

The United States ART market is anticipated to hit US$14.98 billion by 2032. Similarly, China's in vitro fertilization (IVF) market is projected to reach US$11.26 billion by 2033, indicating substantial opportunities for companies like Jinxin Fertility.

This expanding market landscape offers a significant growth runway for Jinxin Fertility, presenting a clear opportunity to capture a larger market share and increase revenue streams through its ART services.

China's government is actively pushing pronatalist policies to combat declining birth rates. This includes expanding medical insurance to cover Assisted Reproductive Technology (ART) services and offering subsidies for childbirth, making fertility treatments more affordable and accessible. This directly benefits companies like Jinxin Fertility.

A key development is the inclusion of ART services under public medical insurance in 27 Chinese provinces as of early 2024. This policy shift significantly reduces out-of-pocket expenses for patients, thereby increasing demand for fertility services and creating a more favorable market environment for Jinxin Fertility's operations.

The field of assisted reproductive technology (ART) is experiencing incredibly fast progress. Innovations like AI-driven embryo selection, which has shown accuracy rates between 70% and 97%, non-invasive genetic screening (niPGT), and advanced cryopreservation methods are significantly boosting success rates and making treatments more efficient.

Jinxin Fertility's commitment to technology and genetic screening is a major advantage here. By embracing these cutting-edge advancements, the company can improve patient results and draw in a larger client base, solidifying its position in a rapidly evolving market.

Expansion into New Geographies and Service Lines

Jinxin Fertility has a significant opportunity to broaden its reach by entering new geographical markets and developing additional service lines. This strategic move could tap into previously unaddressed patient populations and enhance its overall market position.

The company's recent collaboration in Southeast Asia with PT Morula Indonesia exemplifies this expansionist approach, targeting regions demonstrating robust growth potential in fertility services. This partnership, established in 2024, is expected to contribute to Jinxin's international revenue diversification.

Further penetration into underserved domestic regions or the exploration of complementary healthcare services, such as genetic testing or post-natal care, could create new avenues for revenue generation and solidify Jinxin's competitive advantage. The global fertility market, valued at approximately USD 25 billion in 2024, presents ample room for such strategic diversification.

- Geographic Expansion: Targeting high-growth markets in Southeast Asia and other emerging economies.

- Service Diversification: Introducing adjacent services like genetic counseling and advanced reproductive technologies.

- Partnerships: Leveraging strategic alliances to accelerate market entry and service adoption, as seen with the PT Morula Indonesia venture.

Consolidation and Acquisition

The global fertility market remains quite fragmented, offering Jinxin Fertility a significant runway for expansion through strategic mergers and acquisitions. This consolidation strategy allows the company to quickly gain market share and operational efficiencies.

Jinxin has already successfully executed this approach, notably with its acquisitions in Sichuan and Southwest China. These moves demonstrate a clear capability to integrate new entities and expand its geographical footprint.

Further bolstering this opportunity, Jinxin's collaboration with Warburg Pincus provides both capital and strategic guidance, facilitating the identification and pursuit of attractive acquisition targets. This partnership is key to unlocking further growth avenues.

- Market Fragmentation: The global fertility sector is characterized by numerous smaller players, creating fertile ground for consolidation.

- Acquisition Success: Jinxin's prior acquisitions in Sichuan and Southwest China highlight its proven ability to integrate and leverage acquired assets.

- Strategic Partnerships: The backing of Warburg Pincus enhances Jinxin's capacity to identify and execute strategic M&A deals, potentially increasing market share and service offerings.

The expanding global ART market, projected to reach significant figures like US$14.98 billion in the US by 2032 and China's IVF market hitting US$11.26 billion by 2033, offers substantial growth avenues for Jinxin Fertility.

Government initiatives in China, including the inclusion of ART services under public medical insurance in 27 provinces by early 2024 and pronatalist policies, are making treatments more accessible and affordable, directly boosting demand.

Technological advancements in ART, such as AI-driven embryo selection and niPGT, are improving success rates, presenting an opportunity for Jinxin to enhance its service offerings and attract more patients.

The fragmented nature of the global fertility market, valued at approximately USD 25 billion in 2024, allows Jinxin to pursue strategic mergers and acquisitions to quickly expand its market share and operational efficiencies, further supported by its partnership with Warburg Pincus.

Threats

The fertility market is experiencing a surge in competition, with established providers expanding their reach and new clinics frequently entering the landscape. This heightened rivalry, particularly evident with numerous clinics operating in both the US and China, is likely to create significant pricing pressure for companies like Jinxin Fertility.

While the overall fertility market shows robust growth, this intense competition poses a direct threat to profit margins. If Jinxin Fertility cannot successfully defend its premium market positioning or implement substantial cost-saving measures, its profitability could be negatively impacted by aggressive pricing strategies from competitors.

Changes in healthcare regulations, particularly in China and the US, could significantly impact Jinxin Fertility's operations. While current policies in China are generally supportive of the fertility industry, future shifts, especially concerning ethical considerations, licensing requirements, or reimbursement models, could pose challenges. For example, ongoing discussions regarding reproductive rights for single women in China might lead to policy adjustments that affect Jinxin's service offerings or market access.

Economic downturns pose a significant threat to Jinxin Fertility, as fertility treatments are often viewed as discretionary medical expenses. During recessions or periods of economic contraction, consumers tend to cut back on non-essential spending, which can directly impact demand for Jinxin's services.

This reduced demand means patients might postpone or entirely skip fertility treatments due to financial constraints. For Jinxin Fertility, this translates into a direct hit on revenue streams. The company's reported decline in net profit in 2024, even with revenue growth, highlights its susceptibility to these economic headwinds and the pressure on its profitability.

High Cost of Treatment and Affordability Concerns

The significant expense associated with assisted reproductive technology (ART) services continues to present a substantial hurdle for many prospective patients, even with the introduction of some governmental financial assistance. If a considerable segment of the population must bear the brunt of treatment costs directly, it could impede market expansion and adoption, especially within more price-conscious demographics. This financial pressure might also encourage individuals to explore less expensive alternatives, including seeking treatment abroad.

For instance, in 2023, the average cost of a single IVF cycle in China could range from approximately ¥30,000 to ¥50,000 (around $4,100 to $6,900 USD), a substantial sum for many families. While some regions have implemented pilot programs offering subsidies for fertility treatments, these often have caps or specific eligibility criteria, leaving a significant portion of the cost unfunded. This affordability gap is a critical factor that could limit Jinxin Fertility's reach, particularly in lower-tier cities or among lower-income groups.

- High Out-of-Pocket Expenses: The majority of ART costs remain a direct burden on patients, limiting accessibility.

- Market Penetration Barrier: High prices can restrict Jinxin Fertility's ability to capture a larger share of the potential market.

- Competitive Pressure from Overseas: Patients facing high domestic costs may opt for more affordable fertility tourism.

Talent Retention and Shortage of Skilled Professionals

The highly specialized nature of assisted reproductive technology (ART) means Jinxin Fertility relies on a core group of skilled embryologists, reproductive endocrinologists, and other medical staff. A scarcity of these professionals, or aggressive competition for them, could significantly increase labor expenses and potentially hinder service quality or the company's ability to grow.

For instance, the global demand for fertility specialists is projected to rise, with some reports indicating a shortage in key markets. In 2024, the average salary for an embryologist in a major metropolitan area could range from $80,000 to $120,000 annually, a figure likely to escalate with increased demand.

- Talent Specialization: ART requires niche expertise, making it difficult to find qualified personnel quickly.

- Rising Labor Costs: Competition for top talent can drive up salaries and benefits, impacting profitability.

- Impact on Expansion: A lack of skilled staff can slow down the opening of new clinics or the adoption of new technologies.

Intensifying competition within the fertility sector, particularly in the US and China, presents a significant threat of price wars, potentially eroding Jinxin Fertility's profit margins. Regulatory shifts in key markets like China, concerning ethical considerations or licensing, could also disrupt operations and market access, impacting Jinxin's strategic flexibility.

Economic downturns pose a direct risk, as fertility treatments are discretionary, leading to reduced demand and revenue. The substantial out-of-pocket costs for ART, even with some subsidies, remain a barrier to market penetration, potentially driving patients to seek more affordable options abroad.

A shortage of specialized medical professionals, such as embryologists and reproductive endocrinologists, could escalate labor costs and constrain Jinxin Fertility's ability to expand or maintain service quality. For instance, the average embryologist salary in major US metros was projected to be between $80,000-$120,000 annually in 2024, a figure likely to rise amid demand.

| Threat Category | Specific Threat | Potential Impact on Jinxin Fertility | 2024/2025 Data Point |

|---|---|---|---|

| Competition | Increased number of clinics | Price erosion, reduced market share | High competition noted in US & China markets |

| Regulation | Policy changes in China/US | Operational disruption, market access issues | Potential policy shifts on reproductive rights for single women in China |

| Economic Factors | Economic downturns | Decreased demand for discretionary services | Consumer spending cutbacks on non-essential medical expenses |

| Affordability | High out-of-pocket costs for ART | Limited market penetration, patient cost-burden | Average IVF cycle cost in China: ¥30,000-¥50,000 (approx. $4,100-$6,900 USD) in 2023 |

| Talent Acquisition | Shortage of specialized medical staff | Increased labor costs, service quality risk | Projected rise in global demand for fertility specialists |

SWOT Analysis Data Sources

This Jinxin Fertility SWOT analysis is built upon a foundation of verified financial statements, comprehensive market research, and expert industry commentary. These diverse and reliable data sources ensure a robust and accurate assessment of the company's strategic position.