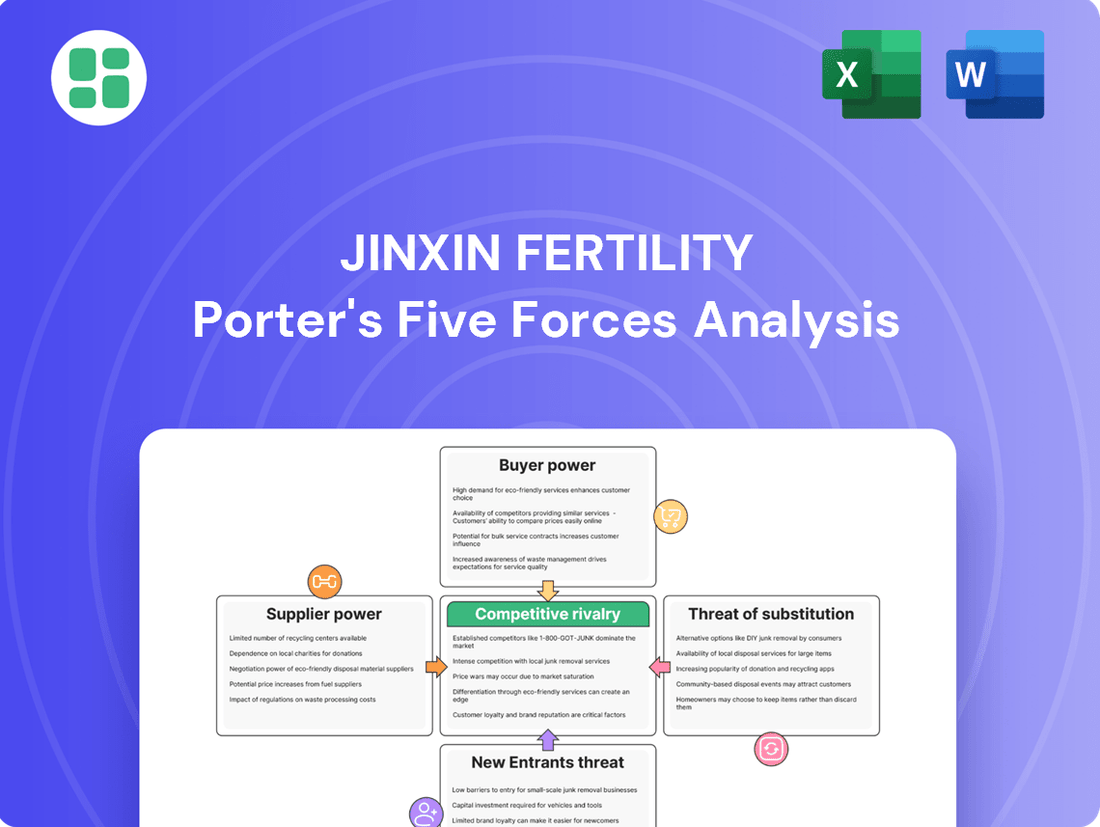

Jinxin Fertility Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Jinxin Fertility Bundle

Jinxin Fertility operates in a dynamic market shaped by intense competition and evolving patient needs. Understanding the interplay of buyer power, supplier leverage, and the threat of new entrants is crucial for navigating this landscape.

The complete report reveals the real forces shaping Jinxin Fertility’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Suppliers of specialized medical equipment and laboratory consumables for assisted reproductive technologies (ART) wield considerable bargaining power. For instance, manufacturers of advanced incubators and micro-manipulators, critical for IVF procedures, often possess proprietary technology. This specialization means Jinxin Fertility has limited alternative suppliers, allowing these vendors to influence pricing and contract terms. The global ART equipment market was valued at approximately USD 2.5 billion in 2023 and is projected to grow, indicating the importance of these specialized suppliers.

The availability of highly skilled medical professionals, such as embryologists and reproductive endocrinologists, is fundamental to Jinxin Fertility's success. These specialists possess unique expertise, which translates into considerable leverage when negotiating compensation, benefits, and work environments. Jinxin's active physician recruitment in 2024 underscores the persistent demand for such talent.

Suppliers of proprietary pharmaceuticals and hormones, such as those crucial for Assisted Reproductive Technology (ART) cycles, wield significant bargaining power. Companies like Jinxin Fertility depend on these specialized drugs, including hormones like human chorionic gonadotropin (hCG), which are often protected by patents. This exclusivity means limited competition among suppliers, allowing them to dictate pricing, which directly affects Jinxin's operational costs and profit margins.

Technology and Software Providers

Technology and software providers, especially those offering advanced patient management systems, sophisticated embryo tracking tools like AI-driven selection, and genetic screening platforms, hold significant bargaining power. As fertility treatments increasingly rely on cutting-edge technology, clinics become more dependent on specialized software and AI solutions, thereby strengthening the suppliers' position.

The growing importance of AI in areas such as embryo grading, where algorithms can potentially identify the most viable embryos with greater accuracy, further concentrates power in the hands of these tech innovators. For instance, advancements in machine learning for predicting IVF success rates are a key area where specialized software developers can command premium pricing and favorable terms.

- AI in Embryo Selection: Technologies that use artificial intelligence to assess embryo viability are becoming a critical differentiator in IVF success rates, increasing the leverage of their developers.

- Data Management Systems: Specialized software for managing patient data, treatment protocols, and lab operations is essential for fertility clinics, making providers of these robust systems influential.

- Genetic Screening Platforms: The demand for preimplantation genetic testing (PGT) means that providers of the associated diagnostic and analytical software have considerable market sway.

Real Estate and Facility Development

The bargaining power of suppliers in real estate and facility development for Jinxin Fertility is significant. Given their need for specialized facilities like cleanrooms for labs and prime locations in China and the US, suppliers of high-quality construction and fit-out services hold considerable sway. Jinxin's expansion, including the Shenzhen Zhongshan Hospital project slated for 2025, underscores their reliance on these suppliers for critical infrastructure development.

- Real Estate Scarcity: Prime urban locations in key markets are often in high demand, giving property owners and developers leverage in lease or purchase negotiations.

- Specialized Construction Needs: The unique requirements for fertility centers, such as advanced HVAC systems and sterile environments, mean that construction firms with proven expertise in this niche can command higher prices.

- Supply Chain Dependencies: Delays or cost overruns from real estate and construction suppliers can directly impact Jinxin's expansion timelines and capital expenditure budgets.

Suppliers of essential pharmaceuticals and hormones for ART cycles, often protected by patents, exert significant bargaining power over Jinxin Fertility. The reliance on specific, patented drugs like gonadotropins means Jinxin has few alternatives, allowing these suppliers to influence pricing. This directly impacts Jinxin's operational costs, as seen in the global fertility drug market, which is projected to reach USD 5.4 billion by 2027.

The bargaining power of suppliers for specialized medical equipment and consumables is substantial due to proprietary technology and limited alternatives. Companies providing advanced incubators and micro-manipulators, critical for IVF, can dictate terms. The global ART equipment market, valued at USD 2.5 billion in 2023, highlights the dependence on these key vendors.

Providers of advanced technology, including AI-driven embryo selection tools and sophisticated patient management systems, hold considerable leverage. As fertility treatments become more technologically reliant, clinics like Jinxin are increasingly dependent on these specialized software and AI solutions, strengthening the suppliers' negotiating position.

| Supplier Category | Key Products/Services | Impact on Jinxin Fertility | Market Data/Trends |

|---|---|---|---|

| Pharmaceuticals & Hormones | Gonadotropins, Progesterone | High dependence, price sensitivity | Global fertility drug market projected to reach USD 5.4 billion by 2027. |

| Medical Equipment | Incubators, Micro-manipulators | Limited alternatives, proprietary tech | Global ART equipment market valued at USD 2.5 billion in 2023. |

| Technology & Software | AI embryo selection, Patient data systems | Increasing reliance, specialized solutions | Growth in AI applications for IVF success prediction. |

What is included in the product

This analysis of Jinxin Fertility's competitive landscape reveals the intensity of rivalry, the bargaining power of patients and suppliers, and the threat of new entrants or substitutes in the fertility services market.

Quickly identify and address competitive threats with a pre-built Porter's Five Forces model, simplifying complex market dynamics for strategic action.

Customers Bargaining Power

Patients investing in fertility treatments face significant emotional and financial commitments. This deep investment means they are highly attuned to factors like success rates, the caliber of medical care, and the overall cost. For instance, a study in 2024 indicated that the average cost of a single IVF cycle can range from $12,000 to $17,000 in the US, a substantial sum that naturally amplifies patient scrutiny.

This heightened sensitivity grants customers a degree of bargaining power, as they will actively seek providers offering the best value and outcomes. However, the highly personal and time-sensitive nature of fertility treatments can temper this power. Once a patient is mid-treatment, the practicalities of switching clinics become very difficult, reducing their ability to leverage their bargaining position effectively.

Customers today have unprecedented access to information, allowing them to thoroughly research clinic success rates, read patient reviews, and compare services offered by fertility providers. This transparency, amplified by online platforms and data sharing, directly empowers patients. For instance, by mid-2024, numerous patient advocacy groups actively publish aggregated success rate data, often showing variations of 5-15% between clinics for specific age groups, forcing providers to be more open about their outcomes.

This increased data accessibility significantly bolsters the bargaining power of potential Jinxin Fertility patients. They can now make more informed decisions, choosing clinics that demonstrate superior success rates and positive patient experiences. Consequently, fertility clinics, including Jinxin Fertility, are compelled to maintain high standards and deliver competitive outcomes to attract and retain patients in this transparent market.

Government policies in China are actively shaping the landscape for assisted reproductive technology (ART) services, directly influencing the bargaining power of customers. For instance, initiatives to include ART services under public medical insurance in provinces like Jiangsu and Zhejiang, along with regional subsidies, are making these treatments more accessible. This policy shift lowers the out-of-pocket expenses for patients, making them more price-sensitive and potentially increasing their leverage when selecting providers. In 2024, such governmental support is expected to further empower consumers by offering more choices and encouraging competition among fertility clinics based on affordability and insurance compatibility.

Limited Geographic Options (for specialized care)

Patients requiring highly specialized or advanced assisted reproductive technology (ART) services, particularly those residing outside major metropolitan areas, often face a restricted selection of providers. This scarcity of options can significantly diminish their bargaining power when dealing with established and reputable fertility clinics, such as Jinxin Fertility, especially if the company commands a dominant position within a specific geographic region.

For instance, in 2024, while the global fertility market continued to expand, the availability of niche ART procedures like advanced genetic screening or specific donor egg programs remained concentrated in fewer centers. This geographical limitation means patients in these areas may have to travel or accept the services of the few available providers, thereby strengthening the provider's position.

- Limited Provider Choice: Patients in less urbanized areas or those needing rare specialized treatments may only have one or two viable fertility clinic options.

- Reduced Price Sensitivity: With fewer alternatives, patients are less able to negotiate prices or demand specific service inclusions.

- Regional Market Dominance: Jinxin Fertility, if it holds a strong market share in a particular region, benefits from this limited geographic choice, enhancing its bargaining power over customers.

Brand Reputation and Trust

Jinxin Fertility has cultivated a strong brand reputation and trust over its years of operation, particularly in China and the United States. This established presence signifies a perceived quality of care that directly impacts customer bargaining power.

In the sensitive field of fertility treatments, patients often place a high premium on reliability and a history of successful outcomes. This inherent need for trust makes them less inclined to switch to providers with less established reputations or lower price points, thereby limiting their ability to negotiate terms.

- Brand Recognition: Jinxin Fertility's name is associated with specialized fertility services, a key factor for patients seeking expert care.

- Patient Testimonials and Success Rates: Positive patient experiences and documented success rates further solidify trust, diminishing price sensitivity.

- Long-Term Relationships: The nature of fertility treatment often involves ongoing care, fostering loyalty and reducing the likelihood of customers seeking out alternative providers solely based on cost.

The bargaining power of customers in the fertility sector, including Jinxin Fertility, is influenced by information accessibility and cost. With readily available online reviews and success rate data, patients can compare providers more effectively, driving competition. For example, by mid-2024, patient advocacy groups were actively publishing comparative success rate data, highlighting variations of 5-15% between clinics, which compels providers to be more transparent and competitive.

However, the emotional and financial commitment to fertility treatments can temper this power. Once a patient is invested in a treatment plan, switching clinics becomes logistically challenging, reducing their leverage. The average cost of an IVF cycle, estimated between $12,000 to $17,000 in the US in 2024, also makes patients more discerning about value and outcomes.

Government initiatives, such as provincial insurance coverage for ART services in China in 2024, are increasing price sensitivity and empowering consumers by expanding choices and encouraging competition based on affordability.

Geographic limitations and the scarcity of specialized ART procedures can also reduce customer bargaining power, particularly in less urbanized areas where Jinxin Fertility might hold a stronger regional position.

| Factor | Impact on Customer Bargaining Power | Jinxin Fertility Relevance |

|---|---|---|

| Information Access | Increases power through comparison | Patients research success rates and reviews |

| Treatment Commitment | Decreases power due to switching difficulty | Mid-treatment patients have less leverage |

| Cost of Services | Increases price sensitivity | High treatment costs ($12k-$17k per IVF cycle in US, 2024) amplify scrutiny |

| Government Policy | Increases power via affordability and choice | Subsidies and insurance coverage in China enhance patient options |

| Provider Specialization & Location | Decreases power with limited options | Niche procedures concentrated in fewer centers |

Full Version Awaits

Jinxin Fertility Porter's Five Forces Analysis

This preview showcases the complete Jinxin Fertility Porter's Five Forces Analysis, offering a detailed examination of competitive forces within the fertility industry. The document you see here is the exact, professionally formatted analysis you will receive immediately after purchase, ensuring no discrepancies or missing information.

Rivalry Among Competitors

The fertility market, especially in China, presents a landscape with numerous public and private clinics, creating a fragmented environment. However, this fragmentation is increasingly giving way to consolidation, as larger players seek to gain scale and efficiency. This trend suggests a dynamic market where competitive pressures are evolving.

Jinxin Fertility is a prime example of a company actively navigating this consolidating market. They are strategically pursuing acquisitions and forming partnerships to bolster their position. For instance, their investment in Morula in Indonesia demonstrates a clear intent to expand their reach beyond domestic borders and capture new market share in growing regions.

Jinxin Fertility operates in a highly competitive landscape, facing significant pressure from both established domestic rivals in China, such as Amcare, Bosheng Medical, and Angel's Maternity Hospital, and prominent international clinics. This rivalry extends to its operations in the United States, intensifying the need for strategic differentiation.

Competitors actively engage in a battle for market share by investing heavily in brand recognition, adopting cutting-edge medical technologies, and aggressively recruiting top-tier physicians. For instance, the global Assisted Reproductive Technology (ART) market, which Jinxin Fertility is a part of, was valued at approximately USD 28.8 billion in 2023 and is projected to grow significantly, indicating ample room for competition and innovation.

Competitive rivalry in the fertility sector is intensely driven by clinics' demonstrated success rates and their embrace of cutting-edge assisted reproductive technology (ART). This includes innovations like AI-powered embryo selection and non-invasive preimplantation genetic testing (PGT), alongside the caliber of medical professionals. Jinxin Fertility actively strengthens its position by prioritizing the recruitment of top-tier physicians and expanding its technological infrastructure, aiming to stay ahead in this dynamic landscape.

Pricing Pressures and Affordability Initiatives

Government initiatives in China, such as expanding medical insurance coverage for assisted reproductive technologies (ART), are creating significant pricing pressures for fertility clinics. This push for affordability means providers like Jinxin Fertility must carefully manage costs to remain competitive while still delivering high-quality patient care.

The inclusion of ART services in national medical insurance schemes, a trend gaining momentum through 2024, directly impacts clinic revenue models. For instance, the inclusion of some ART treatments in China's basic medical insurance in 2023 aimed to reduce out-of-pocket expenses for patients, forcing clinics to adjust their pricing strategies to align with these new reimbursement frameworks.

- Increased Competition: As ART becomes more accessible, more domestic and international players are entering the Chinese market, intensifying rivalry and driving down prices.

- Government Mandates: Policy changes favoring affordability and insurance coverage directly influence the pricing power of fertility service providers.

- Patient Sensitivity: Consumers are becoming more price-sensitive, especially with the availability of insurance subsidies, demanding value for money in their fertility treatments.

Geographic Expansion and Capacity Building

Competitive rivalry in the fertility sector is intensified by strategic geographic expansion and capacity building. Jinxin Fertility's proactive approach includes opening new centers and expanding existing facilities, such as the planned Shenzhen Zhongshan Hospital in 2025. This expansion directly addresses growing market demand and the need to stay ahead of competitors.

Furthermore, HRC Medical's establishment of satellite centers in the US demonstrates a commitment to increasing accessibility and service capacity. These moves are crucial for capturing market share and offering more convenient options to a wider patient base.

- Geographic Expansion: Jinxin Fertility's planned Shenzhen Zhongshan Hospital opening in 2025 signifies its strategic push into new markets.

- Capacity Building: HRC Medical's satellite center development in the US increases treatment capacity and patient reach.

- Market Responsiveness: These expansions are direct reactions to escalating demand and the competitive landscape, aiming to solidify market position.

Competitive rivalry in the fertility market is fierce, driven by a race for market share through technological advancement and physician recruitment. Jinxin Fertility faces strong competition from both domestic players like Amcare and international clinics, necessitating continuous investment in innovation and talent. The global ART market, valued at approximately USD 28.8 billion in 2023, reflects this intense competition and ongoing growth.

| Competitor | Key Strategies | Market Focus |

|---|---|---|

| Jinxin Fertility | Acquisitions, Partnerships, Geographic Expansion (e.g., Morula in Indonesia, Shenzhen Zhongshan Hospital planned for 2025) | China, United States, Southeast Asia |

| Amcare | Brand Recognition, Advanced Technology, Physician Recruitment | China |

| HRC Medical | Satellite Center Development, Increased Accessibility | United States |

SSubstitutes Threaten

Natural conception through lifestyle changes remains a significant substitute for assisted reproductive technologies (ART). Many individuals explore dietary improvements, exercise, and stress management techniques as initial steps. For instance, studies often highlight the positive impact of maintaining a healthy weight and reducing alcohol intake on fertility, representing a low-cost, accessible alternative.

Less invasive fertility treatments like Intrauterine Insemination (IUI) and ovulation induction present a viable substitute for more complex Assisted Reproductive Technology (ART) procedures such as In Vitro Fertilization (IVF). These simpler methods are often favored by individuals with less severe infertility, offering a less costly and less physically demanding alternative. For instance, IUI success rates can range from 10-20% per cycle, making it an attractive initial option for many couples.

For couples facing infertility, adoption and surrogacy present significant alternatives to assisted reproductive technologies (ART) like those offered by Jinxin Fertility. While surrogacy is heavily regulated and largely unavailable within China, affluent individuals may pursue cross-border surrogacy, a distinct family-building solution that bypasses domestic fertility clinic services.

The global surrogacy market is substantial, with estimates suggesting the U.S. market alone could reach $1.5 billion by 2025. This highlights a critical substitute, especially for those with the financial means to explore international options, potentially impacting demand for Jinxin's core ART services if these alternatives become more accessible or appealing.

Emerging Technologies and Therapies

Emerging technologies like In Vitro Gametogenesis (IVG) and stem cell therapies for ovarian rejuvenation or sperm production represent a significant long-term threat to existing assisted reproductive technologies (ART). These advancements, though still in their nascent stages, could fundamentally alter how fertility is achieved, potentially offering alternatives that bypass conventional methods like IVF.

Uterine tissue regeneration is another area of innovation that could provide substitute pathways to pregnancy. While these technologies are not yet widely available or proven for widespread clinical use, their potential to offer novel solutions for infertility is considerable. For instance, research into IVG, which aims to create eggs and sperm from stem cells, is progressing, with early successes demonstrated in mice, suggesting a future where infertility could be addressed through entirely new biological processes.

- In Vitro Gametogenesis (IVG): Aims to create eggs and sperm from stem cells, potentially bypassing traditional ART.

- Stem Cell Therapies: Focus on ovarian rejuvenation or enhancing sperm production, offering new avenues for fertility.

- Uterine Tissue Regeneration: Explores methods to repair or regenerate uterine tissue, potentially aiding implantation and pregnancy.

- Long-Term Impact: These technologies, if successful, could offer entirely new, possibly more natural, ways to achieve pregnancy, posing a significant substitution threat to current ART providers.

Preventative Care and Early Diagnostics

Improved preventative care and earlier diagnosis of fertility issues present a significant threat of substitution for advanced Assisted Reproductive Technology (ART) services. As these methods become more sophisticated, they can address underlying causes of infertility more effectively. For instance, advancements in reproductive health monitoring, such as highly accurate ovulation tracking and non-invasive diagnostic tests, allow for more targeted interventions, potentially reducing the reliance on complex ART procedures.

The market for fertility diagnostics and preventative solutions is growing. By 2024, the global fertility testing market was valued at approximately USD 2.5 billion and is projected to expand further. This growth indicates a rising consumer interest in understanding and managing their reproductive health proactively, which could divert demand from more intensive treatments.

- Early Detection: Non-invasive tests can identify potential fertility issues at earlier stages.

- Targeted Treatments: Advanced monitoring allows for more precise and less intrusive interventions.

- Reduced ART Reliance: Success in preventative care can decrease the overall need for ART services.

The threat of substitutes for Jinxin Fertility's services is multifaceted, encompassing natural conception, less invasive treatments, alternative family-building options, and emerging scientific advancements. Natural conception through lifestyle changes remains a primary substitute, with many individuals prioritizing diet, exercise, and stress management. Less invasive treatments like Intrauterine Insemination (IUI) are also significant substitutes, often pursued before more complex ART. Adoption and surrogacy offer distinct family-building paths, particularly for those with financial means to explore international options, though surrogacy is heavily regulated in China.

Emerging technologies such as In Vitro Gametogenesis (IVG) and stem cell therapies represent a substantial long-term threat. These innovations aim to create eggs and sperm from stem cells or rejuvenate reproductive organs, potentially offering entirely new ways to address infertility. For instance, advancements in uterine tissue regeneration could also provide alternative pathways to pregnancy, bypassing traditional ART methods. The global fertility testing market's growth, valued at approximately USD 2.5 billion by 2024, underscores a rising interest in proactive reproductive health management, potentially diverting demand from intensive treatments.

| Substitute Category | Examples | Key Characteristics | Potential Impact on Jinxin Fertility |

|---|---|---|---|

| Natural Conception | Lifestyle changes (diet, exercise, stress) | Low cost, accessible, perceived as natural | Reduces initial demand for ART |

| Less Invasive ART | IUI, Ovulation Induction | Lower cost, less physically demanding, suitable for less severe infertility | Acts as an initial step before IVF, potentially delaying or reducing IVF demand |

| Alternative Family Building | Adoption, Surrogacy (international) | Different family formation path, can be costly and complex | Offers a complete alternative to biological reproduction via ART |

| Emerging Technologies | IVG, Stem Cell Therapies, Tissue Regeneration | Novel scientific approaches, currently in development, potential for future disruption | Could fundamentally alter the ART landscape, posing a long-term substitution threat |

Entrants Threaten

Establishing a high-quality fertility center demands significant capital for advanced equipment, specialized labs, and patient care facilities, creating a formidable barrier. For instance, a state-of-the-art IVF laboratory alone can cost upwards of $1 million to set up and maintain.

This substantial financial outlay, encompassing everything from embryology equipment to sterile environments, deters many potential new entrants from entering the market. The sheer scale of investment needed to compete effectively means only well-funded organizations can realistically consider launching new fertility services.

The fertility industry, especially Assisted Reproductive Technology (ART), faces a stringent regulatory environment in key markets like China and the US. New entrants must obtain specific licenses and certifications, adhering to rigorous medical and ethical standards. This complex web of regulations acts as a substantial barrier, with China, for instance, planning to expand its licensed IVF facilities to over 600 by 2025, highlighting the controlled growth of the sector.

The threat of new entrants into the fertility services market is significantly constrained by the critical need for highly specialized medical talent. Attracting and retaining experienced reproductive endocrinologists, embryologists, and other essential medical professionals is a considerable hurdle, given their scarcity and intense demand across the industry.

New companies would face immense difficulty assembling a team possessing the requisite expertise and established reputation, making it challenging to directly compete with established entities like Jinxin Fertility. For instance, the global shortage of embryologists, a key role, means that building a competent team can take years and substantial investment, deterring many potential new market participants.

Brand Reputation and Patient Trust

Building a strong brand reputation and earning patient trust in a sensitive medical field like fertility requires significant time and consistent quality care. New entrants often struggle to replicate the years of accumulated goodwill and positive patient experiences that established players, such as Jinxin Fertility, have developed.

These established providers benefit from strong word-of-mouth referrals, a critical factor in healthcare where personal recommendations carry substantial weight. For instance, in 2023, Jinxin Fertility reported a significant portion of its new patient inquiries originating from referrals, underscoring the power of its existing patient network.

- Established Trust: Years of successful treatments and patient satisfaction create a formidable barrier.

- Referral Networks: Positive patient experiences translate into organic marketing and reduced customer acquisition costs.

- Brand Loyalty: Patients often return to or recommend providers they trust, making it difficult for newcomers to gain traction.

- Reputational Risk: New entrants face a higher risk of negative publicity if early patient outcomes are not optimal, further solidifying the advantage of established brands.

Technological Advancements and R&D Costs

The threat of new entrants in the Assisted Reproductive Technology (ART) sector, particularly concerning technological advancements and research and development (R&D) costs, is moderate but presents significant barriers for newcomers. The rapid evolution of ART, including innovations like artificial intelligence in embryo selection and advanced genetic screening techniques, demands substantial and ongoing investment. For instance, companies investing heavily in AI for ART could see their operational efficiency increase significantly, making it harder for less capitalized new entrants to compete on technological sophistication.

Established players in the ART market often possess the financial muscle to sustain high R&D expenditures, which can run into millions of dollars annually for cutting-edge research. This creates a considerable hurdle for new companies aiming to enter the market with comparable technological capabilities. A new entrant would need to secure substantial funding to match the R&D budgets of leading firms like CooperCompanies, which reported over $250 million in R&D spending in 2023, or Thermo Fisher Scientific, a major player in fertility diagnostics and consumables.

- High R&D Investment: New entrants must commit significant capital to research and development to remain competitive with advanced ART technologies.

- Technological Gap: Established firms with proven track records and ongoing innovation in areas like CRISPR gene editing or advanced AI-driven diagnostics create a substantial technological gap.

- Capital Requirements: Acquiring and implementing state-of-the-art equipment and attracting top-tier scientific talent requires substantial upfront investment, often exceeding $10 million for a fully equipped fertility clinic.

- Regulatory Hurdles: Navigating complex regulatory approvals for new technologies and treatments adds to the cost and time-to-market, further deterring new entrants.

The threat of new entrants in the fertility market is significantly low due to the immense capital required for establishing high-quality centers, with IVF labs alone costing over $1 million. Stringent regulations and licensing add further complexity, as seen in China's plan to expand licensed IVF facilities to over 600 by 2025. The scarcity of specialized medical talent, such as embryologists, also presents a major hurdle, as building a competent team can take years and substantial investment.

| Barrier Type | Description | Example/Data Point |

| Capital Requirements | High upfront investment for advanced equipment and facilities. | IVF laboratory setup cost: $1 million+ |

| Regulatory Hurdles | Complex licensing and adherence to strict medical/ethical standards. | China's goal of 600+ licensed IVF facilities by 2025. |

| Talent Scarcity | Difficulty in attracting and retaining specialized medical professionals. | Global shortage of embryologists necessitates years for team building. |

| Brand Reputation & Trust | Established players benefit from years of patient satisfaction and referrals. | Jinxin Fertility's significant new patient inquiries from referrals in 2023. |

| R&D Investment | Ongoing costs for technological advancements in ART. | CooperCompanies R&D spending: over $250 million in 2023. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Jinxin Fertility leverages data from publicly available financial statements, industry-specific market research reports, and regulatory filings to provide a comprehensive view of the competitive landscape.