Jamf Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Jamf Bundle

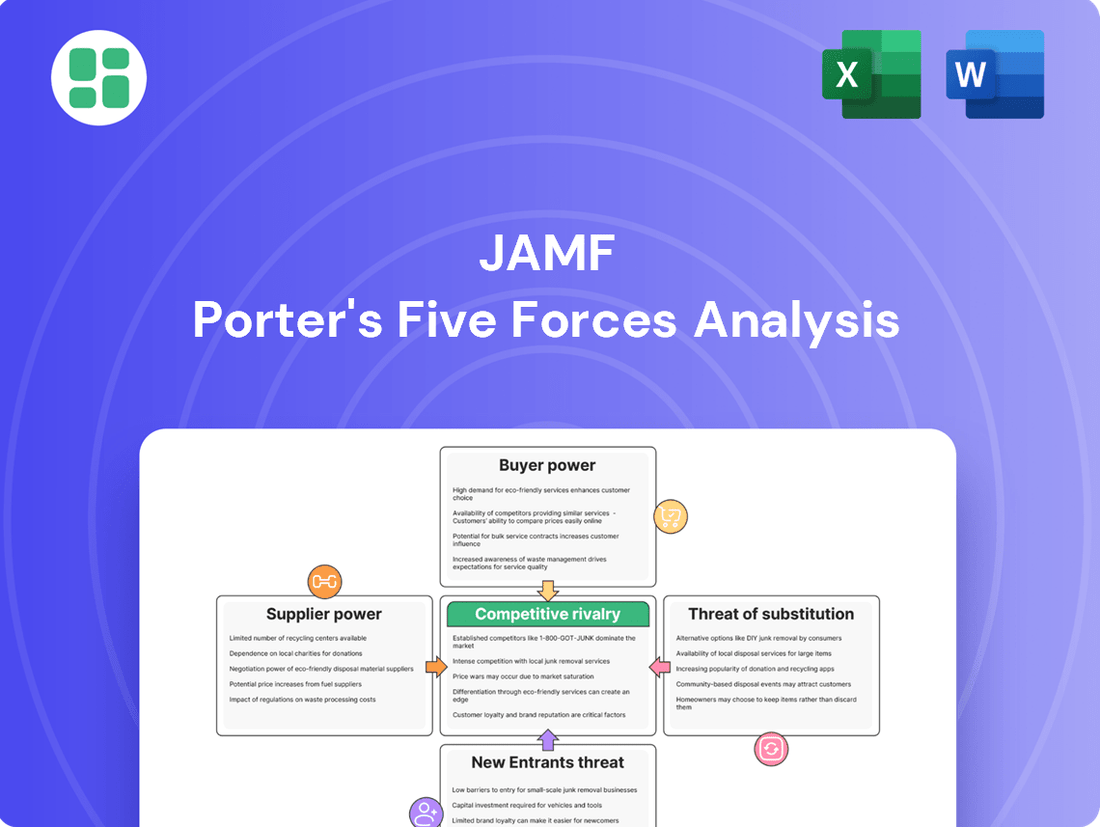

Jamf's position in the Apple device management market is shaped by distinct competitive forces. Understanding the bargaining power of buyers, the threat of new entrants, and the intensity of rivalry is crucial for any stakeholder. This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Jamf’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

Jamf's reliance on Apple's ecosystem positions Apple as a powerful supplier. Apple dictates the APIs and operating system updates for iOS and macOS, which are the very foundation of Jamf's device management solutions. This means Jamf must constantly adapt to Apple's roadmap, giving Apple considerable leverage over Jamf's product development and strategic direction.

Jamf's reliance on major cloud infrastructure providers such as Amazon Web Services (AWS), Microsoft Azure, or Google Cloud Platform (GCP) significantly influences its bargaining power with these suppliers. While Jamf, as a cloud-based software platform, needs robust and scalable infrastructure to serve its global customer base, the process of migrating such a large-scale operation to a different provider is inherently complex and expensive. This switching cost grants cloud providers considerable leverage, particularly in negotiating pricing and service level agreements.

Jamf's reliance on specialized software components, such as those for identity management (like Okta or Microsoft Entra ID) and SIEM systems (e.g., Google Chronicle), can grant these suppliers a degree of bargaining power. The unique or proprietary nature of these integrated solutions means Jamf may have limited alternatives if a supplier decides to alter terms or pricing. This is a key consideration in Jamf's operational strategy.

Talent and Expertise in Apple Ecosystem

The bargaining power of suppliers, particularly concerning specialized talent within the Apple ecosystem, presents a significant factor for companies like Jamf. The demand for IT professionals adept at managing Apple devices, including their security features and enterprise integration, often outstrips supply. This scarcity directly impacts recruitment costs and the ability to scale operations efficiently.

The specialized nature of managing Apple devices in an enterprise setting necessitates a workforce with specific expertise. Professionals skilled in macOS, iOS, and Jamf's own management software are in high demand. This specialized skill set means that these individuals can command higher salaries and better benefits, increasing operational expenses for companies relying on them.

- High Demand for Apple-Specific IT Skills: As of early 2024, job postings requiring Apple device management expertise, particularly within enterprise environments, continue to see robust growth, reflecting a persistent talent gap.

- Increased Recruitment and Retention Costs: Companies often face higher recruitment fees and offer more competitive compensation packages to attract and retain skilled Apple ecosystem IT professionals, impacting overall labor costs.

- Impact on Innovation Capacity: A limited pool of specialized talent can constrain a company's ability to innovate and implement advanced security protocols or new device management strategies, as they may lack the necessary in-house expertise.

Dependency on Hardware Manufacturers for New Device Support

Jamf's reliance on Apple for timely support of new devices and operating systems highlights a significant aspect of supplier bargaining power. While Jamf doesn't purchase hardware directly, its business model hinges on immediate compatibility with the latest Apple products and software releases. This interdependence means Apple effectively acts as a crucial supplier, dictating the pace of technological evolution that Jamf must match to uphold its value proposition of same-day support.

- Dependency on Apple: Jamf's core offering requires seamless integration with new Apple hardware and macOS, iOS, and iPadOS updates.

- Same-Day Support Obligation: Failure to support new releases promptly can erode customer trust and Jamf's competitive advantage.

- Implicit Supplier Relationship: Apple's control over product roadmaps and release schedules grants it considerable leverage.

Jamf's dependence on Apple's ecosystem is a primary driver of supplier bargaining power. Apple's control over APIs, operating system updates, and product roadmaps directly dictates Jamf's development and strategic direction, giving Apple significant leverage. This relationship is further amplified by Jamf's commitment to same-day support for new Apple devices and software releases, making timely compatibility a critical, non-negotiable aspect of Jamf's value proposition.

The scarcity of specialized IT talent proficient in managing Apple devices within enterprise environments, a trend evident in early 2024, also empowers suppliers of this expertise. Companies like Jamf face increased recruitment and retention costs due to high demand for these skills, potentially impacting innovation capacity if the talent pool remains limited.

| Supplier | Nature of Dependence | Impact on Jamf |

|---|---|---|

| Apple Inc. | Operating system, APIs, device releases | Dictates product development, requires same-day support |

| Cloud Infrastructure Providers (AWS, Azure, GCP) | Scalable hosting for SaaS platform | High switching costs grant leverage in pricing/SLAs |

| Specialized Software Component Providers (e.g., Okta, Microsoft Entra ID) | Identity management, security integrations | Limited alternatives can lead to unfavorable terms |

| IT Talent with Apple Ecosystem Expertise | Skilled workforce for device management | Increased recruitment/retention costs, potential innovation constraints |

What is included in the product

This analysis dissects the competitive landscape for Jamf, examining the power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within the Apple device management market.

Jamf's Porter's Five Forces Analysis provides a structured framework to identify and mitigate competitive threats, offering clarity on market dynamics to reduce strategic uncertainty.

Customers Bargaining Power

Jamf's extensive reach, serving over 75,900 customers worldwide, significantly dilutes the bargaining power of individual clients. This diverse clientele spans major enterprises, educational bodies, and governmental organizations, preventing any single customer from holding substantial sway over Jamf's pricing or terms.

The sheer breadth of Jamf's customer base means that no single entity contributes a disproportionately large share of the company's revenue. Consequently, individual customers possess limited leverage to negotiate favorable terms, as their business represents a small fraction of Jamf's overall operations.

For enterprise clients, the cost and complexity of switching Mobile Device Management (MDM) providers are substantial. Imagine the effort involved in migrating vast amounts of device data, retraining IT teams on a new system, and the potential for operational hiccups during the transition. These factors create a significant hurdle for large organizations considering a change.

Jamf's strength lies in its deep integration with existing IT environments and its specialized features tailored for Apple devices. This robust ecosystem and specialized functionality act as powerful deterrents to switching, effectively locking in customers by making the move to a competitor a more arduous and costly undertaking.

The increasing adoption of Apple devices in businesses, driven by employee demand and a perception of enhanced security, makes robust management solutions like Jamf indispensable. This criticality means businesses are less likely to switch for minor cost savings, bolstering Jamf's position.

In 2024, the enterprise mobility management (EMM) market, which Jamf operates within, continued its strong growth, with Apple devices holding a significant share. Companies are investing heavily in solutions that ensure data protection and operational efficiency, directly increasing the bargaining power of customers who demand high-quality, reliable management tools.

Customer Demand for Unified Solutions

Customers are increasingly looking for one-stop shops for their technology needs. This means they want solutions that manage devices, keep them secure, and handle user identities all in one place. This trend boosts the appeal of platforms like Jamf, which can deliver this kind of integrated experience.

Jamf's strength lies in its capacity to bundle various functionalities into a single, cohesive platform. This integration makes it harder for customers to demand unbundled, cheaper alternatives, as the convenience and efficiency of a unified solution often outweigh the desire for separate, lower-cost components. For instance, Jamf's comprehensive management capabilities across Apple devices streamline IT operations, reducing the need for customers to juggle multiple vendors and solutions.

- Unified Solution Demand: A 2024 survey indicated that over 70% of IT decision-makers prioritize integrated endpoint management solutions that combine device management, security, and application deployment.

- Jamf's Value Proposition: Jamf's platform offers a single pane of glass for managing Apple devices, which can significantly reduce IT overhead compared to managing separate security and management tools.

- Reduced Pressure for Fragmentation: By providing a comprehensive suite, Jamf lessens customer pressure to seek out and integrate disparate, potentially less secure or efficient, individual tools.

Price Sensitivity and Budget Constraints

Even with the significant value Jamf provides, customers, particularly during economic downturns, can exhibit price sensitivity and face budget limitations. This can translate into extended sales cycles or demands for more adaptable pricing structures, potentially affecting Jamf's revenue expansion. For instance, in 2024, many IT departments reported tighter budgets, leading to increased scrutiny on software expenditures.

This price sensitivity can manifest in several ways:

- Negotiation Tactics: Customers might push for volume discounts or longer-term contracts with upfront price commitments to manage their budgets more effectively.

- Feature Prioritization: Organizations may opt for essential Jamf features initially, delaying adoption of premium services to spread costs over time.

- Competitive Benchmarking: Buyers will likely compare Jamf's pricing against alternative solutions, even if those alternatives offer less comprehensive functionality.

Despite these pressures, Jamf has historically benefited from robust demand, indicating that the perceived value often outweighs immediate cost concerns for many organizations committed to Apple device management.

Jamf's extensive customer base, exceeding 75,900 clients globally, naturally limits the bargaining power of any single customer. This broad reach ensures that no individual client holds significant leverage over Jamf's pricing or terms, as their business represents a small fraction of the company's overall revenue.

The high switching costs associated with migrating MDM solutions, including data transfer and retraining, create a substantial barrier for enterprise clients. Jamf's deep integration and specialized Apple device features further solidify customer retention, making the move to competitors a complex and costly endeavor.

While customers may exhibit price sensitivity, particularly with tighter IT budgets observed in 2024, Jamf's value proposition often offsets these concerns. Organizations increasingly seek integrated solutions for device management and security, a demand Jamf effectively meets with its comprehensive platform.

| Factor | Impact on Jamf's Customer Bargaining Power | Supporting Data/Observation (2024) |

| Customer Concentration | Low | 75,900+ customers worldwide; no single customer dominates revenue share. |

| Switching Costs | High | Significant effort for data migration, retraining, and potential operational disruption. |

| Product Differentiation | High | Deep integration with Apple ecosystem; specialized features deter switching. |

| Price Sensitivity | Moderate | Budget constraints in 2024 led to increased scrutiny on software spend. |

| Demand for Unified Solutions | Lowers Customer Power | Over 70% of IT decision-makers in 2024 prioritized integrated endpoint management. |

Preview the Actual Deliverable

Jamf Porter's Five Forces Analysis

This preview showcases the complete Jamf Porter's Five Forces Analysis, offering a detailed examination of competitive forces within the Apple device management market. The document you see here is precisely the same professionally formatted and insightful analysis you'll receive instantly upon purchase, ensuring no discrepancies or missing information. You can confidently proceed knowing that the comprehensive strategic overview of Jamf's competitive landscape is what you will download and utilize immediately after completing your transaction.

Rivalry Among Competitors

Jamf contends with formidable rivals like Kandji and Mosyle, both of which are also exclusively focused on managing Apple devices. These companies offer comparable functionalities, creating a highly competitive landscape for organizations prioritizing Apple hardware.

The market for Apple device management is characterized by this direct competition, with firms like Kandji and Mosyle actively seeking to capture market share. This rivalry means Jamf must continually innovate and differentiate its offerings to retain its customer base, especially among businesses heavily invested in the Apple ecosystem.

Larger, diversified unified endpoint management (UEM) vendors are increasingly supporting Apple devices, intensifying competitive rivalry. For instance, Microsoft's Intune, a significant player in the UEM space, reported over 400 million active users in early 2024, demonstrating its broad reach across various operating systems.

These cross-platform UEM providers, including IBM with its MaaS360 and VMware's Workspace ONE, offer comprehensive solutions for mixed-OS environments. This capability can attract organizations seeking a single vendor to manage all their endpoints, potentially drawing customers away from specialists like Jamf who focus solely on Apple ecosystems.

The competitive rivalry within the Apple device management sector is intense, driven by the constant need for innovation. Companies must continually enhance features such as zero-touch deployment, advanced security protocols, and AI-driven automation to stay ahead. Jamf differentiates itself through its commitment to same-day support for new Apple operating system releases and its integrated security capabilities, a critical factor in a market where security breaches are a significant concern.

However, this differentiation is challenged as competitors are also rapidly advancing their platforms. For instance, Microsoft Intune, a major competitor, has been actively expanding its feature set, including enhanced security management and broader device support, aiming to capture a larger share of the enterprise market. The pace of innovation means that even strong differentiators can quickly become table stakes.

Market Growth and Attractiveness

The enterprise mobility management (EMM) market, particularly for Apple device management, is booming. Projections indicate it will hit USD 69.12 billion by 2030, growing at a robust 24.1% compound annual growth rate. This rapid expansion naturally draws in more competitors and capital, fueling intense rivalry.

As the market expands, more companies are entering the fray, eager to capture market share. This influx of new players, alongside existing ones, intensifies competition. Companies are vying for dominance by offering innovative solutions and aggressive pricing strategies to attract and retain customers.

- Market Growth: The EMM market, including Apple device management, is projected to reach USD 69.12 billion by 2030.

- CAGR: This market is expected to grow at a CAGR of 24.1%.

- Competitive Impact: Such significant growth attracts new entrants and investment, thereby increasing competitive rivalry.

- Strategic Focus: Companies are compelled to differentiate through features, service, and pricing to stand out in this dynamic environment.

Pricing Strategies and Customer Retention

Competitive rivalry in the endpoint management space is intense. Competitors frequently employ aggressive pricing tactics and bundle services to win and keep customers. For instance, Microsoft's Intune, a significant competitor, is often bundled with Microsoft 365 subscriptions, presenting a cost-effective alternative for organizations already invested in the Microsoft ecosystem.

Jamf counters this by emphasizing its strong return on investment (ROI), particularly through the consolidation of various management and security tools into a single platform. This simplification and enhanced security posture are key selling points for retaining Jamf's existing customer base and maintaining a healthy net retention rate, even as rivals offer competitive pricing.

In 2024, the market continued to see players leveraging ecosystem advantages. For companies deeply integrated with Apple devices, Jamf's specialized focus and deep integration capabilities offer a distinct value proposition that can outweigh purely price-driven decisions. This specialization is critical for Jamf to defend against broader, more generalized endpoint management solutions.

- Aggressive Pricing: Competitors may undercut Jamf on price or offer discounts, especially when bundling with other software suites.

- Bundled Services: The inclusion of endpoint management as part of larger enterprise agreements by competitors like Microsoft can create a perception of lower cost.

- ROI Demonstration: Jamf's strategy relies on proving that its platform's efficiency gains and security enhancements deliver a superior overall ROI, justifying its pricing.

- Net Retention Focus: Maintaining a high net retention rate is paramount, requiring Jamf to continuously deliver value and address evolving customer needs in a dynamic market.

Competitive rivalry in the Apple device management sector is fierce, with both specialized competitors like Kandji and Mosyle, and broader unified endpoint management (UEM) providers such as Microsoft Intune. Intune, with over 400 million active users in early 2024, represents a significant challenge due to its cross-platform capabilities and ecosystem integration.

These larger UEM vendors, alongside others like IBM MaaS360 and VMware Workspace ONE, offer comprehensive solutions for mixed-OS environments, potentially drawing customers seeking a single management platform. This intensifies the pressure on Jamf to continually innovate and highlight its specialized value proposition for Apple-centric organizations.

The expanding enterprise mobility management (EMM) market, projected to reach USD 69.12 billion by 2030 with a 24.1% CAGR, attracts new entrants and fuels aggressive competition. Companies are compelled to differentiate through advanced features, superior service, and strategic pricing, with competitors often bundling services to gain market share.

| Competitor | Focus | Key Differentiator/Strategy |

| Kandji | Apple Device Management | Specialized feature set, user experience |

| Mosyle | Apple Device Management | Cost-effectiveness, broad Apple ecosystem support |

| Microsoft Intune | Unified Endpoint Management (UEM) | Ecosystem integration (Microsoft 365), broad OS support, large user base |

| IBM MaaS360 | UEM | Comprehensive cross-platform management |

| VMware Workspace ONE | UEM | Digital workspace solutions, cross-platform management |

SSubstitutes Threaten

Apple's native device management tools, such as Apple Business Manager (ABM) and Apple School Manager (ASM), present a viable substitute for third-party solutions, particularly for organizations with straightforward management requirements. These built-in platforms offer essential device enrollment and basic configuration capabilities, directly integrated with Apple's ecosystem. For smaller businesses or educational institutions with limited IT resources or a primary focus on Apple devices, these native tools can effectively meet their needs without the added cost of specialized software. This substitution is particularly relevant as Apple continues to enhance the functionality of its native management offerings, aiming to capture a larger share of the device management market directly.

While not purpose-built for Apple ecosystems, some general IT management platforms offer basic support for macOS and iOS devices. These solutions, often catering to mixed-platform environments, could be viewed as substitutes for organizations prioritizing a unified console over highly specialized Apple management capabilities. For instance, a company managing a predominantly Windows fleet might opt for a broader endpoint management tool that includes rudimentary Apple device integration rather than investing in a dedicated Apple solution.

For very small businesses or those with just a handful of Apple devices, manual management can seem like a viable alternative to dedicated Mobile Device Management (MDM) solutions. This often involves basic IT support or even individual user responsibility for updates and security configurations. However, this approach quickly becomes untenable as device numbers grow, offering limited scalability and robust security features.

The threat of manual device management as a substitute for solutions like Jamf is significant for micro-businesses. For instance, a startup with fewer than 10 employees might find it cost-effective to manage their few iPhones and Macs manually. Yet, this method lacks the centralized control, automated deployment, and advanced security policies that MDM platforms provide, making it a poor substitute for any organization aiming for growth and data protection.

Cloud-based Productivity Suites with Basic MDM

Cloud-based productivity suites like Microsoft 365 and Google Workspace are increasingly bundling basic Mobile Device Management (MDM) features. These integrated solutions can satisfy some fundamental device management requirements, especially for companies already committed to these platforms. For instance, Microsoft 365 Business Premium includes Intune, offering core MDM functionalities.

This poses a threat to specialized MDM providers like Jamf, as organizations might opt for the bundled solution to reduce costs and complexity. While these offerings may not match the depth of features found in dedicated MDM platforms, they serve as a viable alternative for many businesses. In 2024, the adoption of cloud productivity suites continues to grow, making their integrated MDM capabilities a more significant competitive factor.

- Integrated Functionality: Cloud suites offer a single point of management for productivity tools and basic device controls.

- Cost-Effectiveness: Bundled MDM features can be perceived as a more economical choice compared to standalone MDM solutions.

- Ecosystem Lock-in: Deep integration within existing cloud ecosystems encourages users to leverage their bundled MDM capabilities.

- Growing Market Share: The widespread adoption of platforms like Microsoft 365 and Google Workspace means their MDM features reach a vast user base.

Bring Your Own Device (BYOD) Policies with Limited Control

Organizations that implement Bring Your Own Device (BYOD) policies with limited control over personal devices may reduce their reliance on comprehensive Mobile Device Management (MDM) solutions. Instead, they might opt for simpler security measures or focus on managing specific applications rather than the entire device. This trend, while not a direct replacement for Jamf's advanced device management, can diminish the overall market demand for such specialized services.

In 2024, a significant portion of businesses continued to explore BYOD, with some reports indicating that over 70% of organizations had some form of BYOD policy in place. However, the level of control varied widely. Those with looser policies often found that basic endpoint security software, which is less expensive and easier to deploy than full MDM, met their minimal security needs. This creates a competitive pressure by offering a less integrated, but still functional, alternative for managing employee-owned devices.

- Reduced Demand for Full MDM: Less stringent BYOD policies can lead companies to forgo comprehensive device management, opting for simpler security solutions.

- Focus on Application-Level Security: Some organizations prioritize securing specific business applications on personal devices rather than managing the entire device ecosystem.

- Cost-Conscious Alternatives: Basic security software or native device features are often seen as more cost-effective substitutes for advanced MDM platforms.

- Market Segmentation: This creates a segment of the market where demand is met by less feature-rich, and therefore less expensive, security and management tools.

Apple's native management tools, such as Apple Business Manager, offer a direct substitute for organizations with simpler needs. These built-in platforms provide essential device enrollment and basic configuration, especially for businesses focused solely on Apple devices. Cloud productivity suites like Microsoft 365 and Google Workspace are increasingly bundling basic MDM features, presenting a cost-effective alternative for companies already invested in these ecosystems. In 2024, the trend of integrated cloud solutions offering MDM capabilities continued to grow, impacting the demand for specialized MDM providers.

| Substitute Type | Description | Key Advantage | Potential Impact on Jamf |

|---|---|---|---|

| Apple Native Management | Apple Business Manager (ABM), Apple School Manager (ASM) | Direct integration, cost-effective for Apple-only environments | Reduces need for third-party solutions for basic management |

| Bundled Cloud MDM | Microsoft Intune (with Microsoft 365), Google Workspace MDM | Cost savings, unified management within existing productivity suites | Captures market share from organizations seeking integrated solutions |

| Manual Management | Individual device configuration and updates | No additional software cost, suitable for very small device counts | Limited scalability and security, not a viable substitute for growing businesses |

Entrants Threaten

Developing a sophisticated Apple device management solution demands substantial technical acumen and significant investment in research and development. This includes mastering Apple's intricate ecosystem and continuously adapting to its evolving APIs, a complex undertaking for newcomers.

The high cost and specialized knowledge required to build a comparable platform act as a formidable barrier. For instance, companies like Jamf have invested decades and hundreds of millions in R&D to refine their offerings, making it exceptionally difficult for new players to compete on the same level.

Jamf's nearly two decades of leadership in Apple device management have cultivated a robust brand reputation and deep customer trust, particularly within large enterprises and educational sectors. This established goodwill makes it difficult for newcomers to quickly gain market recognition and loyalty. For instance, Jamf's extensive experience translates into a proven track record of reliability and support, which is a significant barrier to entry for any new player attempting to replicate that level of confidence.

Jamf benefits significantly from economies of scale, evident in its robust development, sales, and support infrastructure that caters to over 75,900 customers. This scale allows for more efficient operations and lower per-unit costs, a hurdle for nascent competitors.

Furthermore, strong network effects are generated by Jamf Nation, its expansive user community, and a broad partner ecosystem. As more organizations and IT professionals engage with Jamf, the platform's value and utility increase, creating a formidable barrier to entry for newcomers attempting to replicate this interconnectedness.

Regulatory and Compliance Requirements

The growing emphasis on data security, privacy, and compliance, such as GDPR and HIPAA, significantly elevates the entry barrier for new companies in the enterprise mobility management sector. Building solutions that adhere to these rigorous regulatory standards demands substantial investment in advanced security functionalities and obtaining necessary certifications, creating a considerable challenge for potential competitors.

For instance, in 2024, the global cybersecurity market reached an estimated $230 billion, highlighting the immense resources required to develop and maintain compliant solutions. New entrants must navigate complex legal frameworks and invest heavily in secure infrastructure and ongoing audits, making it difficult to compete with established players who have already met these requirements.

- Increased Investment Needs: New entrants must allocate significant capital to develop robust security features and achieve compliance certifications like ISO 27001, which can cost tens of thousands of dollars and take months to obtain.

- Expertise and Talent Acquisition: Companies need specialized personnel with expertise in cybersecurity law and compliance, a talent pool that is both scarce and expensive to recruit, especially in 2024 where demand for such skills is at an all-time high.

- Ongoing Compliance Costs: Beyond initial setup, continuous monitoring, regular audits, and updates to meet evolving regulations represent ongoing operational expenses that new entrants must factor into their business model.

Strategic Acquisitions and Consolidation

The enterprise mobility management (EMM) sector is experiencing significant consolidation, with strategic acquisitions becoming a key feature. For instance, Jamf's acquisition of Identity Automation in 2023 bolstered its identity and access management capabilities, demonstrating how established players are expanding their offerings. This trend creates formidable barriers to entry for smaller, nascent companies. Larger, well-capitalized firms leverage these acquisitions to broaden their service portfolios and increase their market penetration, making it increasingly challenging for new entrants to gain a foothold.

These strategic moves by industry leaders directly impact the threat of new entrants. By integrating complementary technologies and customer bases, acquiring companies effectively enlarge their competitive moat. This consolidation means that any new player entering the EMM market would face not only established competitors but also a landscape increasingly dominated by a few larger entities with expanded resources and market reach. For example, the EMM market, valued at approximately $10.5 billion in 2023, is projected to grow, but this growth is increasingly shaped by M&A activity rather than organic new market entrants.

The threat of new entrants into the Apple device management sector, particularly for solutions like Jamf, is significantly constrained by high capital requirements and the need for specialized expertise. Developing and maintaining a competitive platform demands substantial investment in research and development, as well as ongoing adaptation to Apple's evolving technologies. Furthermore, stringent data security and privacy regulations, such as GDPR and HIPAA, necessitate considerable investment in compliance and advanced security features, creating a steep climb for newcomers.

Established players like Jamf have built strong brand loyalty and benefit from network effects through active user communities and partner ecosystems, making it difficult for new companies to gain traction. The industry's trend toward consolidation, marked by strategic acquisitions, further solidifies the position of incumbents, raising the barrier for emerging businesses. For instance, the global cybersecurity market, a critical component of EMM, reached an estimated $230 billion in 2024, underscoring the immense financial commitment required.

| Barrier Type | Description | Example Impact |

| Capital Requirements | High R&D investment, infrastructure, and compliance costs. | Jamf's decades of R&D represent hundreds of millions in investment. |

| Technical Expertise | Mastery of Apple's ecosystem and evolving APIs. | New entrants need specialized talent for complex development. |

| Brand Loyalty & Network Effects | Established trust and value from user communities. | Jamf Nation's community fosters strong customer loyalty. |

| Regulatory Compliance | Adherence to data security and privacy laws. | Meeting GDPR/HIPAA requires significant investment in security features. |

| Industry Consolidation | Strategic acquisitions by established players. | Jamf's acquisition of Identity Automation in 2023 expanded its capabilities. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Jamf leverages data from Jamf's annual reports and investor relations materials, alongside industry-specific market research reports and IT management software vendor financial disclosures. This blend provides a comprehensive view of competitive pressures.