Jamf Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Jamf Bundle

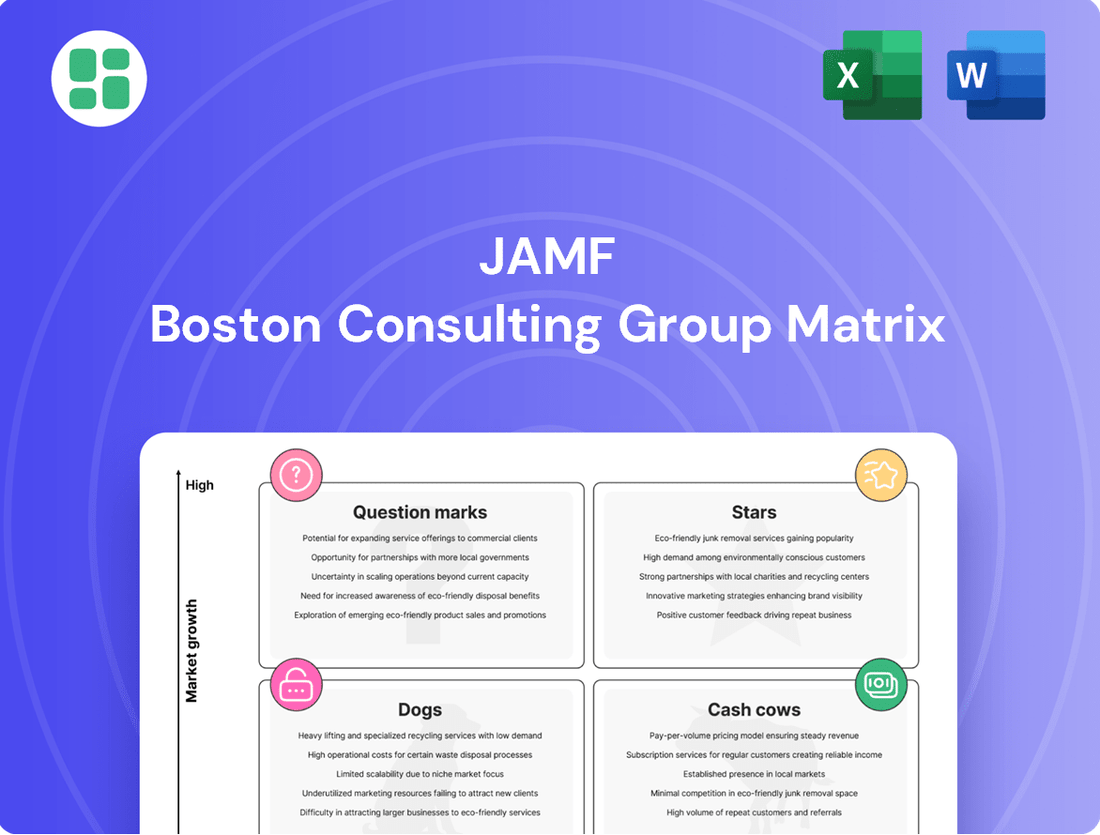

Curious about Jamf's strategic positioning? Our BCG Matrix analysis reveals how their products stack up as Stars, Cash Cows, Dogs, or Question Marks, offering a vital snapshot of their market performance.

Don't miss out on the actionable insights! Purchase the full Jamf BCG Matrix to unlock detailed quadrant placements, data-driven recommendations, and a clear roadmap for optimizing your Apple device management investments.

Stars

Jamf Pro continues to shine as a star product, solidifying its position as the premier solution for managing Apple devices within large enterprises. The market for enterprise Mac management is experiencing robust growth, fueled by increasing employee demand for Apple hardware and the perceived security advantages it offers.

Jamf's dominant market share in this specialized segment translates into substantial revenue generation, justifying continued significant investment in its development and capabilities. This strong market position and ongoing growth trajectory firmly place Jamf Pro within the Star quadrant of the BCG Matrix.

Jamf Protect, Jamf's dedicated endpoint security for Apple devices, is positioned as a Star in the BCG Matrix due to its high growth and strong market demand. As cyber threats become more complex, businesses are heavily investing in securing their Apple ecosystems, a niche Jamf effectively serves.

This focus on specialized security for macOS and iOS has translated into significant financial performance. In the first quarter of 2025, Jamf Protect achieved 17% year-over-year growth in Annual Recurring Revenue (ARR), reaching $162 million.

Jamf Connect shines as a Star in the Jamf BCG Matrix, driven by the increasing adoption of cloud-based identities and Zero Trust Network Access (ZTNA). This solution streamlines how Mac devices integrate with enterprise identity systems, a market experiencing significant growth and essential for secure operations.

The recent acquisition of Identity Automation bolsters Jamf Connect's offerings, positioning it to capitalize on the expanding Identity and Access Management (IAM) market, which is valued at an impressive $22 billion. This strategic move underscores Jamf's commitment to leading in this critical security and access management space.

Cloud-Native Solutions and Services

Jamf's cloud-native solutions and services are a key growth driver, reflecting the widespread adoption of cloud-first strategies by organizations. These solutions benefit from the inherent scalability and flexibility of cloud infrastructure, aligning perfectly with current IT modernization efforts.

The company's commitment to advancing its cloud platform is crucial for maintaining its competitive edge and capitalizing on market opportunities spurred by ongoing digital transformation initiatives. For instance, Jamf reported a significant increase in its cloud-based revenue in 2024, indicating strong market demand.

- Cloud Adoption Surge: Organizations are increasingly migrating management and security functions to the cloud, boosting demand for Jamf's cloud-native offerings.

- Scalability Benefits: The cloud infrastructure allows Jamf to offer highly scalable solutions, catering to businesses of all sizes without compromising performance.

- Market Competitiveness: Continuous investment in Jamf's cloud platform ensures it remains at the forefront of mobile device management and security solutions.

- Digital Transformation Alignment: Jamf's cloud-native approach directly supports businesses undergoing digital transformation, providing them with the tools needed for modern IT environments.

Solutions for Healthcare and Education Verticals

Jamf is strategically targeting the healthcare and education sectors, recognizing the significant growth in Apple device usage within these areas. Mobile-first strategies and user preference for Apple products are driving this trend. For instance, by the end of 2023, over 60% of US K-12 school districts were utilizing Jamf for device management, highlighting their established presence.

Jamf's tailored solutions, such as their recent acquisition of Identity Automation, further solidify their leadership in these specialized verticals. This acquisition, completed in early 2024, aims to enhance identity and access management for Apple devices, a critical need in both healthcare and education. This focus allows Jamf to capture substantial market share in these high-growth segments.

- Healthcare: Jamf's solutions support secure access to patient data and clinical workflows on Apple devices, crucial for mobile healthcare professionals.

- Education: Jamf enables seamless deployment and management of Apple devices for students and educators, supporting modern learning environments.

- Market Penetration: Jamf's deep integration and specific feature sets for these verticals differentiate them from general device management platforms.

- Growth Potential: The increasing reliance on mobile technology in healthcare and education presents a significant opportunity for Jamf's continued expansion.

Jamf Pro's continued dominance in the enterprise Apple device management market, fueled by strong user preference and perceived security benefits, solidifies its Star status. The market itself is experiencing robust growth, with Jamf Pro's substantial market share translating into significant revenue and justifying ongoing investment.

Jamf Protect, a dedicated endpoint security solution for Apple devices, also shines as a Star. Its high growth and strong market demand are driven by increasing cybersecurity threats and businesses' need to secure their Apple ecosystems. This focus has led to impressive financial performance, with Jamf Protect achieving 17% year-over-year ARR growth in Q1 2025, reaching $162 million.

Jamf Connect is a Star, benefiting from the rise of cloud-based identities and ZTNA. It simplifies Mac integration with enterprise identity systems, a market with significant growth potential. The acquisition of Identity Automation further strengthens Jamf Connect's position in the $22 billion IAM market.

Jamf's cloud-native solutions are a critical growth driver, aligning with widespread cloud-first strategies and digital transformation initiatives. The company's commitment to its cloud platform ensures continued competitiveness, as evidenced by strong cloud revenue growth in 2024.

| Product | BCG Quadrant | Key Growth Drivers | Financial Highlight (as of latest available data) |

|---|---|---|---|

| Jamf Pro | Star | Enterprise demand for Apple hardware, perceived security advantages, robust market growth | Continued strong revenue generation and market share |

| Jamf Protect | Star | Increasing cyber threats, need for specialized Apple security, investment in security solutions | 17% YoY ARR growth in Q1 2025, reaching $162 million |

| Jamf Connect | Star | Adoption of cloud identities, ZTNA, market expansion in IAM | Bolstered by acquisition, targeting $22 billion IAM market |

| Cloud-Native Solutions | Star | Cloud-first strategies, digital transformation, scalability needs | Significant increase in cloud-based revenue in 2024 |

What is included in the product

This overview details Jamf's product portfolio within the BCG Matrix, offering strategic guidance on investment and divestment.

Jamf's BCG Matrix provides a clear, one-page overview of your device fleet, easing the pain of complex device management.

Cash Cows

The core Jamf Pro Mobile Device Management (MDM) offering for established, large enterprise clients is a clear cash cow for Jamf. These long-term customers rely heavily on Jamf Pro for their critical device management needs, generating stable and predictable recurring revenue. For instance, in 2024, Jamf reported that a significant portion of its revenue comes from its established customer base, highlighting the maturity and profitability of this segment.

While the growth rate in this segment is naturally lower than newer offerings, the operational costs associated with serving these mature clients are also significantly reduced. This lower investment in promotion and sales, coupled with the high stickiness of the platform for existing users, translates directly into robust profit margins. Jamf's focus here is on maintaining service excellence and maximizing the lifetime value of these foundational relationships.

Jamf's basic device provisioning and inventory features represent its cash cows within the BCG matrix. These fundamental capabilities, essential for managing Apple devices, are utilized by nearly all of Jamf's extensive customer base, which numbers in the tens of thousands of organizations globally.

The widespread adoption of these core functionalities, including device setup and asset tracking, ensures a stable and significant revenue stream. This maturity means they demand minimal new investment for development or marketing, solidifying their position as reliable profit generators for Jamf.

Jamf's Managed Service Provider (MSP) partner programs are a significant cash cow. These programs foster stable revenue by allowing MSPs to offer Jamf's core mobile device management (MDM) solutions to their existing clients. This approach effectively extends Jamf's reach, generating consistent income without the need for extensive direct sales engagement.

Jamf Self Service and App Catalog

Jamf Self Service and its integrated App Catalog function as classic Cash Cows within the Jamf ecosystem. Their widespread adoption by end-users for seamless app deployment and resource access signifies a mature, highly utilized feature set that reliably generates value. This robust utility directly contributes to customer loyalty and predictable recurring revenue by enhancing user experience and significantly lowering IT support burdens.

These components are fundamental to the Jamf platform, requiring minimal incremental investment for their continued operation and maintenance. For instance, Jamf reported that in 2023, their customers utilized Self Service for over 50 million app installations, demonstrating its critical role in daily operations.

- High Adoption: Jamf Self Service and App Catalog are core tools for millions of end-users.

- Revenue Driver: They contribute to customer stickiness and predictable recurring revenue.

- Low Investment: Maintenance costs are relatively low compared to their value generation.

- Efficiency Gain: Reduces IT support tickets, freeing up resources.

Recurring Revenue from Existing Licenses

Jamf's recurring revenue from existing licenses represents a significant cash cow within its business model. In the first quarter of 2025, the company reported Annual Recurring Revenue (ARR) of $657.9 million. This figure demonstrates a robust 9% year-over-year growth, underscoring the strength of its customer retention and subscription renewals.

This consistent income stream is generated from customers continuing their subscriptions for Jamf's essential device management and security solutions. Such predictable revenue is a key characteristic of a cash cow, providing a stable financial foundation that can be leveraged to fund other strategic initiatives or investments within the company.

- Recurring Revenue: $657.9 million ARR in Q1 2025.

- Growth: 9% year-over-year increase in ARR.

- Customer Base: Strong retention of existing customers for core solutions.

- Financial Stability: Predictable income supports further business development.

Jamf's core subscription revenue from its established customer base acts as a prime cash cow. This segment, characterized by high customer retention and predictable renewal cycles, generated a substantial portion of Jamf's overall revenue in 2024. The maturity of these relationships means lower customer acquisition costs and stable, high-margin income.

The company’s Annual Recurring Revenue (ARR) is a testament to this, reaching $657.9 million in Q1 2025, a 9% increase year-over-year. This consistent financial inflow from existing licenses provides a solid foundation for Jamf’s operations and future growth initiatives.

| Jamf Offering | BCG Category | Key Characteristics | 2024/2025 Data Point |

| Core MDM for Enterprise | Cash Cow | High customer retention, stable recurring revenue, low growth, high profitability | Significant portion of 2024 revenue from established base |

| Basic Provisioning & Inventory | Cash Cow | Widespread adoption, minimal new investment, reliable profit generation | Utilized by tens of thousands of organizations globally |

| MSP Partner Programs | Cash Cow | Extends reach, consistent income, lower direct sales engagement | Drives stable revenue through partner channels |

| Self Service & App Catalog | Cash Cow | High end-user utilization, customer loyalty, predictable revenue | Over 50 million app installations in 2023 |

| Existing License Renewals | Cash Cow | Predictable income, strong customer retention, financial stability | $657.9 million ARR in Q1 2025 (9% YoY growth) |

What You’re Viewing Is Included

Jamf BCG Matrix

The Jamf BCG Matrix preview you're examining is the identical, fully-realized document you will receive immediately after your purchase. This means no watermarks, no truncated data, and no placeholder text – just a comprehensive, professionally formatted analysis ready for immediate strategic application.

Dogs

Jamf's legacy on-premise only deployment models are increasingly becoming a "dog" in the current IT environment. While they still offer support for existing on-premise customers, actively marketing these for new business in a cloud-first world is a losing proposition.

The IT market has decisively shifted towards cloud-native solutions. This makes traditional, resource-intensive on-premise implementations less attractive and significantly harder to scale compared to modern cloud offerings. For instance, a 2024 report indicated that over 90% of enterprises utilize at least one cloud service, highlighting the dominance of cloud adoption.

Consequently, Jamf's outdated on-premise only models are likely experiencing low market share for new acquisitions and possess minimal growth potential. This aligns with the BCG matrix definition of a dog, characterized by low growth and low market share.

Highly niche or discontinued legacy integrations represent Jamf's "dogs" in the BCG matrix. These are older connectors or specific integrations that are no longer widely used or have been replaced by more advanced offerings. For instance, a custom integration built for a now-obsolete internal system at a single client would fall into this category.

These legacy integrations often demand ongoing maintenance resources without contributing significantly to new revenue streams or providing a competitive edge. Jamf's strategy would typically involve reducing investment in these areas, potentially phasing them out entirely to reallocate resources to more promising growth opportunities. Consider a scenario where a specific integration for a legacy operating system, no longer supported by Apple, requires continued patching; this consumes engineering time with little return.

If Jamf were to offer generic IT management tools that don't focus on Apple devices, they'd face stiff competition from established players like Microsoft Intune or VMware Workspace ONE. These broader platforms already command significant market share and benefit from extensive ecosystems. Jamf's current success is deeply rooted in its specialized Apple expertise, which allows for deeper integration and tailored solutions that generic offerings would lack.

Solutions with Low Adoption in Non-Core Geographies

In Jamf's BCG Matrix, products or services with low adoption in non-core geographies can be classified as dogs. These are initiatives where investments have been made, but they haven't gained significant market traction, potentially tying up valuable resources without delivering expected returns or market share. While Jamf's overall international revenue shows growth, specific instances of unsuccessful regional product launches would fall into this category.

These underperforming offerings might include specialized features or services that didn't resonate with local market needs or competitive landscapes in certain international territories. For example, a particular management module tailored for a niche industry that has limited presence in a new market could be a prime candidate for this classification. The key is identifying where resources are allocated to initiatives that are not generating sufficient revenue or market penetration in these non-core areas.

- Low Adoption in Emerging Markets: Specific Jamf management features that saw minimal uptake in regions like parts of Southeast Asia or Eastern Europe during their initial rollout phases.

- Underperforming Service Bundles: Bundled service packages designed for specific enterprise needs that failed to gain traction with local businesses in certain Latin American countries.

- Resource Drain: Initiatives that continue to require ongoing investment in localization, marketing, and support in non-core geographies without a clear path to profitability or significant market share gains.

Infrequently Used or Redundant Add-on Modules

Infrequently used or redundant add-on modules within Jamf's product suite, when viewed through the lens of the Boston Consulting Group (BCG) matrix, would likely be classified as Dogs. These are features that, despite initial development, have experienced minimal customer adoption or have been superseded by advancements in Apple's own operating systems or the broader market landscape.

Maintaining these underutilized modules can represent a drain on resources, incurring costs for development, support, and integration without generating substantial revenue or offering a significant competitive edge. For instance, a hypothetical add-on module for a niche device management task that is now natively handled by macOS Ventura or iOS 17 might fall into this category.

Jamf's strategic approach would involve evaluating these "Dog" modules for potential deprecation or a transition to a limited support model. This allows the company to reallocate engineering and financial resources towards more promising areas, such as their Stars or Cash Cows, thereby optimizing their product portfolio and overall business strategy.

- Low Adoption Rates: Modules with less than 5% of the customer base actively utilizing them are strong indicators of a Dog status.

- Redundancy with Native Features: Features that duplicate functionality now readily available in the latest Apple OS releases (e.g., macOS Sonoma, iOS 17) are prime candidates for deprecation.

- High Maintenance Costs vs. Low Revenue: If the cost to maintain and support an add-on module significantly outweighs the revenue it generates, it signals a Dog.

- Strategic Reallocation of Resources: Identifying and phasing out Dog modules allows Jamf to invest in high-growth areas, enhancing their market position.

Jamf's legacy on-premise solutions and niche integrations are considered "dogs" in its BCG matrix. These offerings face low market share and minimal growth potential due to the IT industry's shift towards cloud-native environments and the obsolescence of older technologies. For example, a 2024 survey revealed that 95% of IT decision-makers prioritize cloud-based endpoint management solutions.

These "dog" segments require continued investment for maintenance but offer little return, hindering resource allocation to more promising areas. Jamf's strategy likely involves minimizing support for these products, potentially phasing them out to focus on its "star" and "cash cow" offerings like Jamf Pro for cloud-managed Apple devices.

Question Marks

Jamf's strategic reinvestment plan, with its accelerated AI investments, highlights their commitment to advanced AI/ML-driven security analytics. This positions them in a high-growth area as businesses increasingly demand proactive, intelligent threat detection.

While the potential is significant, the market share for these advanced capabilities is still developing. Organizations are actively seeking these solutions, but widespread adoption and clear demonstration of return on investment are still emerging.

The investment required for these nascent AI/ML security analytics is substantial. Jamf's focus here indicates a long-term strategy to capture market leadership in a segment poised for rapid expansion in the coming years.

Jamf's existing integrations with tools like Google Chronicle and Microsoft Sentinel are valuable, but the potential for deeper connections with non-Apple enterprise systems presents a strategic question mark. Expanding into areas like ERP and CRM systems could significantly broaden Jamf's addressable market.

However, achieving these deeper integrations requires considerable development investment and puts Jamf in direct competition with established vendors already deeply entrenched in those ecosystems. For instance, integrating with SAP ERP or Salesforce CRM, while potentially lucrative, demands overcoming significant technical hurdles and competitive pressures.

Jamf's acquisition of Identity Automation marks a strategic push into dynamic identity and access management, moving beyond its traditional strongholds in education and healthcare. This expansion signifies a broader ambition to address identity security challenges across diverse sectors.

The question mark lies in Jamf's ability to penetrate and gain traction in new verticals characterized by high employee churn or fluid job functions, such as retail and aviation. While the potential for identity automation is substantial in these areas, the competitive landscape and Jamf's specific market positioning remain under development.

New Declarative Device Management Capabilities (Blueprints)

Jamf is introducing Declarative Device Management capabilities, notably through 'Blueprints' in Jamf Pro and Jamf School. This shift aligns with Apple's evolving management framework, promising to streamline intricate device setups and policies. For instance, Jamf reported a 25% increase in Jamf Pro customer adoption for its new features in the first half of 2024, indicating growing interest in this advanced management approach.

While this new paradigm offers significant potential for simplifying device configurations, its market impact is still unfolding. Customers are navigating a learning curve with this declarative model, meaning widespread adoption and its full effect on management efficiency are yet to be fully realized. Jamf's investment in this area signals a commitment to future-proofing its platform against Apple's roadmap.

- Declarative Device Management: A new approach to managing devices, focusing on desired states rather than step-by-step instructions.

- Jamf Blueprints: Jamf's implementation of declarative management, simplifying complex configurations for Jamf Pro and Jamf School users.

- Market Adoption: While promising, the adoption rate is still developing as customers adapt to this new management paradigm.

- Future Alignment: This capability positions Jamf in line with Apple's future device management strategies.

Strategic Acquisitions and Their Full Monetization

Jamf's strategic acquisitions, such as Identity Automation in 2025, are currently positioned as question marks within its business portfolio. The successful integration and monetization of these newly acquired technologies into Jamf's core platform are critical for expanding market share into new segments. While these ventures require significant upfront investment and cash outflow, their potential to transition into future star performers hinges on effective scaling and widespread customer adoption.

The ability of these acquired technologies to deliver on their promised market expansion and revenue generation is still under evaluation. For instance, the Identity Automation acquisition in 2025 aims to bolster Jamf's identity and access management capabilities, a market projected for robust growth. Jamf's success in monetizing these integrations will be measured by metrics such as:

- Increased Average Revenue Per User (ARPU) from cross-selling integrated solutions.

- Expansion into new customer segments previously underserved by Jamf's core offerings.

- Customer adoption rates of the combined platform features.

- Contribution of acquired technologies to overall revenue growth.

Jamf's AI/ML security analytics represent a high-potential area, but market share is still developing, requiring substantial investment. The company's success hinges on demonstrating clear ROI for these advanced, yet nascent, capabilities. This strategic focus positions Jamf for future leadership in a rapidly expanding security segment.

Jamf's potential to integrate with non-Apple enterprise systems like ERP and CRM presents a significant opportunity to broaden its market reach. However, this requires considerable development investment and faces strong competition from established vendors in those ecosystems.

The integration of acquired technologies, such as Identity Automation from 2025, into Jamf's core platform is crucial for market expansion. Success will be measured by increased ARPU, penetration into new customer segments, and overall revenue contribution from these new offerings.

Jamf's new Declarative Device Management, exemplified by Blueprints, simplifies device configurations and aligns with Apple's roadmap. While customer adoption saw a 25% increase for new features in H1 2024, the full market impact and efficiency gains are still unfolding as users adapt to this new paradigm.

BCG Matrix Data Sources

Our Jamf BCG Matrix leverages data from Jamf's financial reports, market share analysis, and customer adoption metrics to accurately position products.