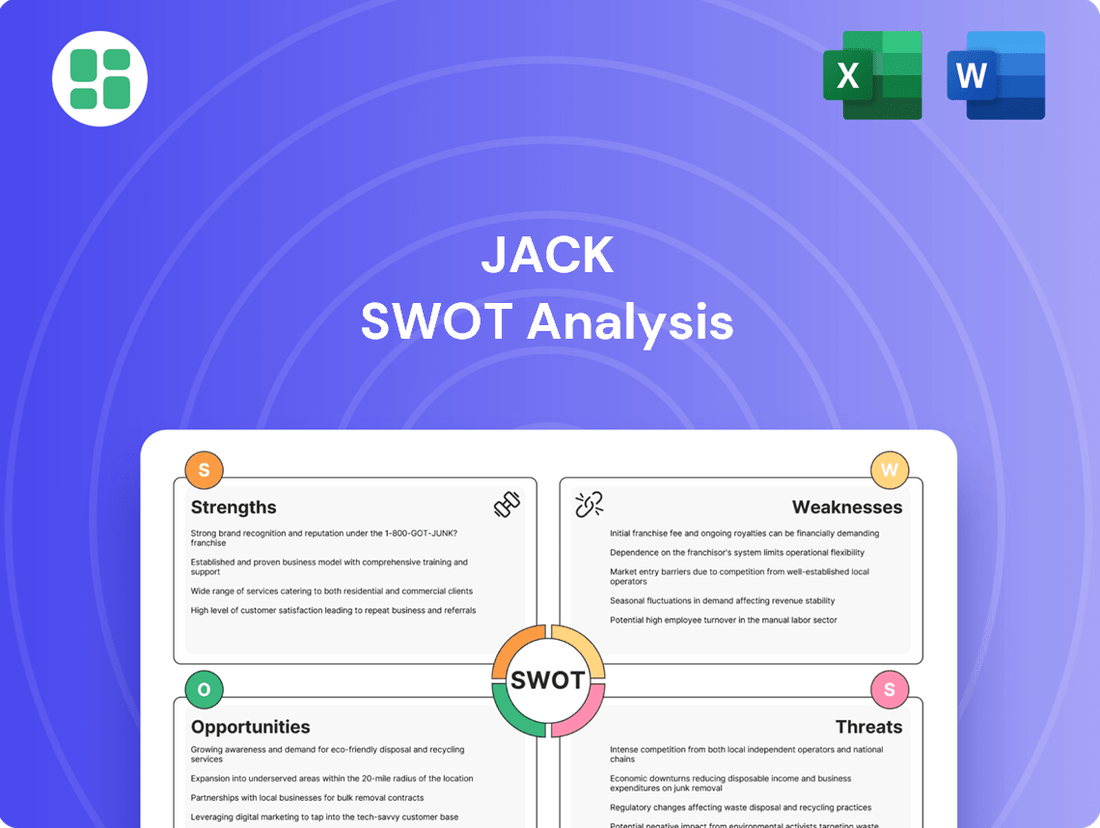

Jack SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Jack Bundle

Curious about Jack's competitive edge and potential pitfalls? Our comprehensive SWOT analysis dives deep into its core strengths, identifies emerging threats, and maps out promising opportunities for growth. Don't miss out on the crucial details that can shape your strategy.

Unlock the full strategic roadmap for Jack. Beyond this snapshot, our complete SWOT analysis provides actionable insights, expert commentary, and an editable format to empower your decision-making. Invest in clarity and gain a competitive advantage.

Strengths

Jack in the Box boasts a diverse menu, a significant strength that appeals to a broad customer base. Their offerings span burgers, chicken, tacos, and breakfast items, available around the clock. This wide variety sets them apart from more niche competitors.

Menu innovation is a key driver, with the successful introduction of the Smashed Jack burger in 2024. Further variations, such as the Sourdough Smashed Jack and Big Smashed Jack, launched in late 2024 and early 2025, demonstrate a commitment to keeping the menu fresh and exciting for consumers.

Jack in the Box's robust drive-thru infrastructure remains a key strength, catering to convenience-seeking consumers. This focus is particularly relevant as drive-thru traffic continues to be a significant revenue driver for quick-service restaurants.

The company is aggressively pursuing digital transformation, investing in mobile ordering, self-order kiosks, and loyalty programs. This digital push aims to improve customer experience and operational efficiency, with a target of achieving 20% of sales through digital channels by 2027, a notable increase from 12% in 2024.

Jack in the Box boasts significant brand recognition, especially in the Western and Southern US, its core operating regions. This strong presence, with around 2,190 restaurants across 23 states as of July 2025, translates to an impressive 80% brand awareness among consumers.

Strategic Franchise Model

Jack in the Box benefits significantly from its strategic franchise model, which is a core strength. As of October 2022, a substantial 93% of its 2,181 restaurants operated under franchise agreements. This asset-light approach is crucial, as it generates stable revenue streams from franchise fees and royalties.

This structure also effectively minimizes the company's direct exposure to operational risks and the capital demands associated with opening new locations. The focus on expanding through franchising is designed to achieve consistent positive net unit growth, reinforcing the brand's reach and market presence without heavy corporate investment.

- Franchise Dominance: 93% of Jack in the Box's 2,181 locations were franchised by October 2022.

- Revenue Stability: Franchise fees and royalties provide a consistent income stream.

- Reduced Risk: The asset-light model limits direct operational and capital expenditure burdens.

- Growth Strategy: Aims for steady net unit growth via its franchise program.

Commitment to Value and Innovation

Jack in the Box’s commitment to value is a significant strength, evident in its marketing and menu. The 'Munchies Under $4' initiative, for example, directly targets budget-conscious consumers, a key demographic. This focus on affordability, coupled with ongoing product innovation like the Smashed Jack line, helps maintain customer interest and attract new patrons. In 2024, such value-driven strategies are crucial for market share in a competitive fast-food landscape.

This dedication to both price and new offerings is a core differentiator. By consistently introducing appealing items and maintaining accessible price points, Jack in the Box can effectively compete against rivals. The company’s ability to balance these two elements allows it to cater to a broad customer base, ensuring sustained relevance and appeal in the quick-service restaurant sector.

- Value Proposition: Initiatives like 'Munchies Under $4' offer accessible price points, attracting a wide customer base.

- Menu Innovation: The introduction of popular items such as the Smashed Jack burger line keeps the menu fresh and engaging.

- Competitive Pricing: Jack in the Box strategically prices its offerings to appeal to price-sensitive consumers, a critical factor in the QSR market.

Jack in the Box's extensive menu diversity is a significant strength, offering everything from burgers and tacos to breakfast items, catering to a wide array of customer preferences. Their commitment to menu innovation, highlighted by the successful launch of the Smashed Jack burger in 2024 and its subsequent variations in late 2024 and early 2025, keeps their offerings fresh and appealing. This broad appeal, combined with a strong drive-thru infrastructure, positions them well in the convenience-focused quick-service restaurant market.

The company's aggressive digital transformation strategy is another key strength. Investments in mobile ordering, self-order kiosks, and loyalty programs are designed to enhance customer experience and streamline operations, with a goal of 20% of sales coming from digital channels by 2027, up from 12% in 2024. This forward-looking approach, coupled with significant brand recognition across its core operating regions, where it boasts around 80% brand awareness among consumers, reinforces its market position.

| Metric | Value | Year/Period | Significance |

|---|---|---|---|

| Menu Variety | Burgers, Chicken, Tacos, Breakfast | Ongoing | Broad customer appeal |

| New Product Launch | Smashed Jack Burger Line | 2024-2025 | Menu innovation and customer engagement |

| Digital Sales Target | 20% | 2027 | Customer convenience and operational efficiency |

| Brand Awareness | 80% | As of July 2025 | Strong market presence in core regions |

What is included in the product

Analyzes Jack’s competitive position through key internal and external factors, identifying strengths, weaknesses, opportunities, and threats.

Provides a clear, actionable framework for identifying and addressing strategic challenges.

Weaknesses

Jack in the Box's operational footprint is notably concentrated, with a strong presence in only 23 states, primarily across the Western and Southern United States. This geographic limitation restricts its national market penetration and exposes the company to a higher degree of risk from regional economic fluctuations or changes in local consumer tastes.

Compared to competitors with a more extensive national presence, Jack in the Box's limited reach means it misses out on broader market opportunities and diversification benefits. While the company has expressed plans for expansion, its current geographic concentration remains a significant weakness.

Jack in the Box has been grappling with a noticeable downturn in its performance, particularly evident in its same-store sales and customer traffic. These metrics are crucial as they reflect the company's ability to draw and keep customers coming back to its restaurants. The persistent struggles here suggest that the current economic climate, marked by consumer caution and broader macroeconomic pressures, is significantly impacting the company's ability to attract and retain its customer base.

The data underscores this challenge, with Jack in the Box reporting a 4.4% decrease in same-store sales during the second quarter of 2025. This decline is a clear indicator of the headwinds the company is facing, as fewer customers are choosing to dine at their locations or make purchases. Such a trend points to a need for strategic adjustments to better resonate with consumer spending habits and preferences in the current economic landscape.

Jack in the Box faces formidable competition in the quick-service restaurant (QSR) sector, contending with established giants such as McDonald's, Burger King, and Wendy's. This crowded market necessitates constant innovation and strategic pricing to maintain customer loyalty and market share. For instance, in the first quarter of 2024, Jack in the Box reported a 5.6% increase in same-store sales, a positive sign but one that must be viewed against the backdrop of aggressive marketing and expansion by its larger rivals.

Recent Restaurant Closures and Divestiture Plans

Jack in the Box's 'JACK on Track' initiative includes a significant restaurant closure plan, with 150-200 underperforming locations slated to shut down. A substantial portion of these, between 80 and 120, are expected to be closed by the end of 2025. This aggressive streamlining aims to improve overall operational efficiency and profitability by shedding less successful outlets.

Further complicating its portfolio, Jack in the Box is actively considering strategic alternatives for its Del Taco brand, including a potential divestiture. While this move aligns with a strategy to simplify the business model, it also represents a potential reduction in revenue diversification. The company is balancing the benefits of a more focused operation against the loss of a distinct revenue stream.

- Restaurant Closures: 150-200 total, with 80-120 by end of 2025.

- Del Taco Divestiture: Strategic alternatives being explored, including a potential sale.

- Impact: Simplification of business model versus reduced revenue diversification.

Vulnerability to Economic Pressures on Consumers

Jack's performance is susceptible to economic headwinds impacting consumer spending. A noticeable shift towards caution, especially among lower-income demographics, has directly translated into decreased discretionary spending on fast food offerings. This trend was particularly evident in late 2024, with reports indicating a 5% year-over-year decline in casual dining traffic for this segment.

Furthermore, persistent inflationary pressures and escalating labor costs are creating a double squeeze on Jack's profit margins. These rising operational expenses can necessitate price adjustments, a move that risks alienating price-sensitive customers who are already feeling the pinch of a challenging economic climate. For instance, a recent industry survey found that over 60% of consumers are actively seeking value-oriented meal options.

- Reduced Discretionary Spending: Lower-income consumers are cutting back on non-essential purchases like fast food due to economic pressures.

- Margin Squeeze: Inflation and high labor costs are increasing operational expenses, impacting profitability.

- Pricing Challenges: The need to potentially raise prices could deter budget-conscious customers, further impacting sales volume.

Jack's limited geographic footprint, concentrated in just 23 states, hinders national market penetration and exposes it to regional economic vulnerabilities. This concentration means missing out on broader market opportunities and diversification benefits that competitors with wider reach enjoy.

The company's same-store sales have faced a downturn, with a 4.4% decrease reported in Q2 2025, indicating challenges in attracting and retaining customers amidst economic pressures. This decline suggests a need for strategic adjustments to better align with current consumer spending habits.

Jack in the Box is undergoing significant restructuring, planning to close 150-200 underperforming restaurants, with 80-120 expected by the end of 2025. Additionally, the potential divestiture of its Del Taco brand, while simplifying the business, also means a reduction in revenue diversification.

The company faces intense competition from major players like McDonald's, Burger King, and Wendy's, requiring constant innovation and strategic pricing to maintain market share. Despite a positive 5.6% same-store sales increase in Q1 2024, this must be viewed against the aggressive strategies of its rivals.

Full Version Awaits

Jack SWOT Analysis

The preview you see is the same document the customer will receive after purchasing. This ensures transparency and that you know exactly what you're getting.

You're viewing a live preview of the actual SWOT analysis file. The complete version becomes available after checkout, providing you with the full, comprehensive report.

Opportunities

Jack in the Box is strategically positioned for significant geographic expansion, aiming to broaden its reach beyond established Western and Southern U.S. markets.

The company is making a notable return to Chicago with eight company-operated restaurants slated to open in 2025, signaling a deliberate push into new, high-potential urban centers.

Further growth is planned across several new U.S. states including Utah, Kentucky, Arkansas, Montana, Wyoming, Michigan, Florida, and Georgia, alongside international ambitions in Mexico, indicating a multi-faceted expansion strategy.

Investing further in digital tools like AI-powered kiosks and mobile ordering apps is a key opportunity. These technologies can streamline the customer journey and boost efficiency. For instance, Jack in the Box is actively testing freestanding kiosks to improve sales and manage labor costs more effectively, aiming to increase their digital sales channel.

There's a clear path for Jack to keep shaking things up with its menu. Think new, exciting items like healthier choices, more plant-based options, and those tempting limited-time offers that get people talking. This is all about staying on top of what customers want, which is constantly changing.

The Smashed Jack platform really showed us how well new products can do. It’s a prime example of how launching fresh ideas can directly lead to bigger sales and a stronger position in the market. For instance, in Q1 2024, Jack's limited-time offers, like the Spicy Chicken Smasher, contributed significantly to a 4% increase in same-store sales year-over-year.

Strategic Real Estate Optimization and Franchise Growth

The JACK on Track initiative is strategically divesting certain real estate assets to embrace an asset-light operational model. This move is anticipated to boost cash flow and facilitate debt reduction, thereby strengthening the company's financial foundation. For example, as of the first quarter of 2024, Jack in the Box reported a 7.5% increase in total revenue year-over-year, partly driven by the early stages of this strategic realignment.

This focus on an asset-light approach, coupled with a robust pipeline of new franchise development agreements, sets the stage for sustained net unit expansion. The company's franchising program is a key driver for this growth, allowing for capital-efficient scaling and improved overall profitability. In 2023, Jack in the Box signed 65 new franchise development agreements, indicating strong interest from potential franchisees.

- Asset-Light Model: Selling select real estate to improve cash flow and reduce debt.

- Franchise Growth: Strong pipeline of development agreements driving net unit expansion.

- Profitability Improvement: Franchising program enhances margins and returns.

- 2023 Performance: Signed 65 new franchise development agreements, signaling market confidence.

Responding to Evolving Consumer Preferences

The fast-food landscape is rapidly changing, with consumers increasingly seeking healthier choices, plant-based meals, and environmentally friendly packaging. Jack in the Box has a significant opportunity to tap into these evolving preferences.

By expanding its menu to include more low-calorie options, fresh ingredients, and sustainable packaging, Jack in the Box can attract a wider and more health-conscious customer base. This aligns with broader industry shifts, where brands that prioritize these elements often see increased customer loyalty and sales.

- Menu Diversification: Introducing a wider array of salads, grilled options, and plant-based alternatives can directly address consumer demand for healthier fast-food.

- Sustainable Practices: Investing in eco-friendly packaging solutions, such as compostable or recyclable materials, resonates with environmentally aware consumers.

- Market Trends: The plant-based food market alone was projected to reach $74.2 billion globally by 2030, indicating a substantial growth area.

- Consumer Demand: A 2024 survey indicated that over 60% of consumers are more likely to choose restaurants that offer sustainable packaging options.

Jack in the Box is poised for significant growth through strategic menu innovation and digital enhancements. The company's focus on introducing new, appealing items, including healthier and plant-based options, directly addresses evolving consumer preferences. Furthermore, investments in digital tools like AI-powered kiosks and mobile ordering are expected to improve customer experience and operational efficiency.

The company's "Smashed Jack" platform, for example, demonstrated the sales potential of new product launches, with limited-time offers contributing to a 4% year-over-year increase in same-store sales in Q1 2024. This indicates a strong opportunity to leverage culinary creativity to drive traffic and revenue.

Jack in the Box's strategic shift towards an asset-light model, divesting real estate to boost cash flow and reduce debt, is a key financial opportunity. This, combined with a robust franchise development pipeline, is projected to fuel sustained net unit expansion. The company signed 65 new franchise development agreements in 2023, highlighting strong franchisee confidence and market demand.

Expanding its menu to cater to health-conscious consumers and adopting sustainable practices presents another significant opportunity. With the plant-based food market projected for substantial growth and consumer preference leaning towards eco-friendly packaging, Jack in the Box can capture a wider customer base.

| Opportunity Area | Key Actions | Potential Impact (2024-2025 Data) |

|---|---|---|

| Menu Innovation | Introduce healthier options, plant-based meals, and limited-time offers. | Drive same-store sales growth; capitalize on evolving consumer tastes. |

| Digital Transformation | Implement AI kiosks and enhance mobile ordering. | Improve customer experience, increase operational efficiency, boost digital sales. |

| Geographic Expansion | Enter new U.S. markets and international territories. | Increase brand visibility and market share; drive unit growth. |

| Sustainability Initiatives | Adopt eco-friendly packaging and promote healthier menu items. | Attract environmentally conscious consumers; enhance brand reputation. |

Threats

The quick-service restaurant industry is a battlefield, with titans like McDonald's and Starbucks, alongside nimble newcomers, constantly fighting for customer attention. This intense rivalry means Jack in the Box faces pressure from all sides through aggressive pricing, eye-catching marketing campaigns, and a steady stream of new menu items.

Jack in the Box's recent performance, with same-store sales showing a persistent underperformance, highlights its struggle to keep pace. For instance, in the first quarter of fiscal year 2024, Jack in the Box reported a 2.3% decrease in same-store sales for company-operated restaurants, indicating a tangible loss of ground against competitors.

A significant threat to Jack in the Box is the accelerating consumer demand for healthier options and environmentally friendly practices. Many consumers are actively seeking out plant-based meals and products with a reduced environmental footprint. For instance, a 2024 report indicated that 60% of consumers are more likely to choose restaurants that offer sustainable options, a trend that could bypass brands perceived as less health-conscious.

Ongoing macroeconomic challenges, including persistent inflation and rising commodity costs, are a significant threat to Jack's profitability. For instance, the U.S. Consumer Price Index (CPI) saw a 3.3% increase year-over-year in May 2024, impacting input costs. These pressures force difficult pricing strategy decisions, potentially alienating price-sensitive customers.

Furthermore, elevated labor expenses, driven by a tight job market, add another layer of cost burden. This can squeeze profit margins if not effectively passed on to consumers. The Federal Reserve’s continued vigilance on inflation could also lead to sustained higher interest rates, increasing borrowing costs for the company.

Reduced consumer discretionary spending, particularly among lower-income demographics, directly threatens Jack's sales volume and foot traffic. As inflation erodes purchasing power, consumers are likely to cut back on non-essential purchases, which could disproportionately affect businesses like Jack.

Supply Chain Disruptions and Food Safety Concerns

The fast-food sector, including major players like McDonald's, faces significant risks from supply chain disruptions. In 2024, continued geopolitical instability and adverse weather events have already impacted agricultural yields and transportation, leading to price volatility for key ingredients like beef and poultry. For instance, the cost of beef, a staple for many burger chains, saw a notable increase in early 2024, affecting profit margins.

Food safety concerns represent another critical threat. A single widely publicized incident of contamination or a recall can erode consumer confidence instantaneously. In 2023, several restaurant chains experienced temporary closures or significant sales drops following reports of E. coli or salmonella outbreaks. The reputational damage from such events can be long-lasting, requiring extensive marketing efforts to rebuild trust.

- Increased Ingredient Costs: Global supply chain issues in 2024 have pushed up the price of commodities like cooking oil and grains, impacting profitability.

- Product Shortages: Disruptions in logistics and labor availability can lead to temporary unavailability of popular menu items, frustrating customers.

- Reputational Damage: Foodborne illness outbreaks, such as the one affecting a major US chicken chain in late 2023, can lead to immediate sales declines and long-term brand erosion.

- Operational Inefficiencies: Unreliable supply chains force restaurants to maintain higher inventory levels or seek alternative, potentially more expensive, suppliers, increasing operational complexity.

Labor Costs and Availability

Rising labor costs are a significant concern for fast-food businesses like Jack in the Box. In 2024, many states and cities continued to implement higher minimum wage mandates, directly increasing payroll expenses. For instance, California's minimum wage reached $16.00 per hour for all employers in 2024, impacting chains operating within the state.

Beyond wage increases, attracting and keeping enough qualified staff presents ongoing challenges. High employee turnover rates, common in the quick-service restaurant sector, lead to increased recruitment and training costs. This can erode restaurant-level profit margins, forcing companies to consider strategies like boosting automation or raising menu prices to offset these pressures.

- Increased Minimum Wage: Many regions saw minimum wage hikes in 2024, directly impacting payroll.

- Recruitment & Retention Challenges: High turnover necessitates continuous spending on hiring and training.

- Impact on Margins: Higher labor costs can squeeze profitability at the individual restaurant level.

- Strategic Responses: Companies may need to invest in automation or adjust pricing to manage these threats.

Jack in the Box faces intense competition from established giants and emerging brands, forcing it to constantly innovate with pricing and marketing. Its recent underperformance, with a 2.3% drop in same-store sales for company-operated restaurants in Q1 FY2024, underscores this challenge.

Shifting consumer preferences towards healthier and sustainable options pose a significant threat, as 60% of consumers in 2024 favored restaurants with eco-friendly practices. Macroeconomic headwinds, including 3.3% year-over-year CPI increases in May 2024 and rising commodity costs, squeeze margins and complicate pricing strategies.

Labor expenses are escalating, with minimum wages reaching $16.00/hour in California in 2024, alongside difficulties in staff retention that increase training costs. Supply chain disruptions, evident in early 2024 with increased beef costs, and food safety concerns, highlighted by past outbreaks leading to sales declines, also present substantial risks.

| Threat | Impact | 2024 Data Point |

| Intense Competition | Loss of market share, pressure on pricing | 2.3% decrease in same-store sales (Q1 FY24) |

| Changing Consumer Preferences | Reduced demand for current offerings | 60% of consumers prefer sustainable options (2024) |

| Macroeconomic Headwinds | Increased operating costs, reduced consumer spending | 3.3% CPI increase (May 2024) |

| Rising Labor Costs | Erosion of profit margins, need for automation/price increases | California minimum wage at $16.00/hour (2024) |

| Supply Chain Disruptions & Food Safety | Ingredient cost volatility, potential reputational damage, product shortages | Increased beef costs (early 2024) |

SWOT Analysis Data Sources

This SWOT analysis is built upon a robust foundation of data, incorporating official financial reports, comprehensive market research, and expert industry insights to provide a well-informed strategic overview.