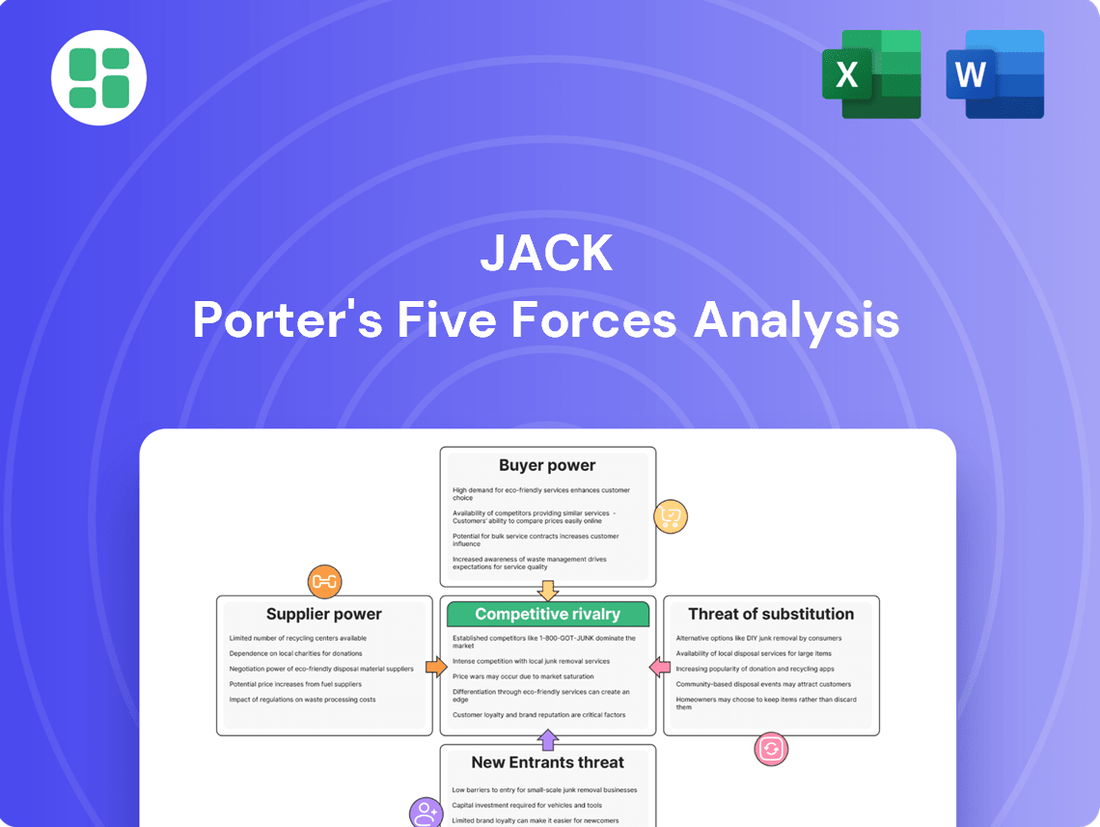

Jack Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Jack Bundle

Jack's Five Forces Analysis reveals the intricate web of competitive pressures shaping his market, from the bargaining power of buyers to the ever-present threat of new entrants. Understanding these forces is crucial for any business seeking to thrive.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Jack’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

The bargaining power of suppliers within the fast-food industry, including for companies like Jack in the Box, is typically quite low. This is largely because many key ingredients, such as beef, chicken, and various produce items, are considered commodities. This means they are widely available from numerous sources, preventing any single supplier from wielding significant influence.

Large chains like Jack in the Box benefit from this by sourcing their ingredients from a diverse pool of suppliers. This broad sourcing strategy naturally reduces the company's reliance on any one supplier, giving them considerable leverage in negotiations. For instance, in 2023, the average cost of ground beef saw fluctuations, but the ability to source from multiple suppliers allowed major chains to mitigate the impact of price increases from any single provider.

This ability to switch suppliers easily if terms become unfavorable further diminishes individual supplier power. It ensures that Jack in the Box can secure competitive pricing and favorable contract terms, effectively limiting the extent to which suppliers can dictate prices or conditions.

While Jack in the Box's core ingredients like buns and ground beef are largely commoditized, meaning many suppliers can provide them, the situation shifts slightly for specialized items. Think proprietary sauces or unique bakery components. For these, there might be fewer suppliers, giving those select few a bit more leverage. However, the sheer volume Jack in the Box purchases still significantly tips the scales in their favor.

The company's substantial purchasing power is a key factor in mitigating supplier influence. In 2023, Jack in the Box reported total revenue of approximately $1.03 billion. This massive scale allows them to negotiate favorable terms and pricing through bulk purchasing, effectively reducing the bargaining power of individual suppliers.

The bargaining power of suppliers in the fast-food industry is generally moderate, largely due to the sheer volume of purchases made by major chains. For instance, McDonald's alone purchased approximately 1.2 billion pounds of beef in 2023, giving it considerable leverage over its meat suppliers. This immense buying power allows these chains to negotiate favorable pricing and terms, thereby limiting the suppliers' ability to dictate conditions.

While direct backward integration by these large chains is uncommon, the mere possibility serves as a significant check on supplier power. Suppliers understand that if they push for excessively high prices or unfavorable terms, a major fast-food company could, in theory, invest in its own production facilities to create those inputs. This theoretical threat is enough to keep many suppliers cooperative and their demands reasonable.

Supplier Power 4

Inflationary pressures on commodities and wages, particularly evident in early 2025, can directly impact supplier costs. These rising expenses may be passed on to Jack in the Box, potentially squeezing profit margins.

However, Jack in the Box possesses a degree of resilience. Its ability to strategically adjust menu prices, coupled with strong franchise-level margins, provides a buffer against these escalating supplier costs. For instance, in Q1 2024, the company reported a 3.1% increase in same-store sales, indicating some capacity to absorb cost pressures through pricing adjustments.

- Supplier Cost Increases: Anticipated rise in commodity prices and labor wages in 2024-2025 impacting input costs for Jack in the Box.

- Pricing Power: Jack in the Box's capacity to implement menu price adjustments to offset increased supplier expenses.

- Franchise Margins: Healthy franchise-level profitability offers a cushion against inflationary pressures on the supply chain.

- Sales Performance: Continued same-store sales growth, such as the 3.1% seen in Q1 2024, supports the company's ability to manage cost pass-throughs.

Supplier Power 5

The bargaining power of suppliers for a company like Jack in the Box is generally low. This is largely due to the fragmented nature of the agricultural and food processing industries. Many suppliers are smaller entities compared to major fast-food corporations.

This size and market share disparity means individual suppliers have limited leverage when negotiating prices or terms with large buyers like Jack in the Box. For instance, while specific data for Jack in the Box's supplier relationships isn't publicly detailed, the broader industry trend shows that large restaurant chains can often secure favorable pricing due to their significant purchasing volume.

- Fragmented Supplier Base: The agricultural sector, a primary supplier for fast food, consists of numerous independent farms and smaller processing companies.

- Economies of Scale for Buyers: Large chains like Jack in the Box benefit from bulk purchasing, giving them considerable negotiation strength.

- Limited Supplier Concentration: Unlike industries with a few dominant suppliers, food sourcing typically involves a wide array of options, reducing reliance on any single supplier.

- Industry Standards and Competition: Competition among suppliers for contracts with major fast-food chains tends to drive down prices and limit individual supplier power.

The bargaining power of suppliers for large fast-food chains like Jack in the Box is generally low, primarily due to the commoditized nature of many ingredients and the significant purchasing volume of these corporations. This allows them to negotiate favorable terms and prices, limiting individual supplier influence.

For example, in 2023, Jack in the Box reported revenues of approximately $1.03 billion, underscoring its substantial buying power. This scale enables the company to source from a wide array of suppliers, reducing dependence on any single entity and strengthening its negotiating position.

While specialized ingredients might offer some suppliers more leverage, the overall ability of chains like Jack in the Box to switch suppliers or even consider backward integration acts as a potent check on supplier demands, ensuring costs remain manageable.

| Factor | Impact on Jack in the Box | Data Point (2023/2024) |

|---|---|---|

| Supplier Concentration | Low for most commodities | Fragmented agricultural sector |

| Purchasing Volume | High, leading to strong negotiation power | $1.03 billion in revenue |

| Ingredient Commoditization | Reduces reliance on specific suppliers | Beef, chicken, produce widely available |

| Potential for Backward Integration | Theoretical threat limiting supplier pricing | Industry-wide consideration |

| Impact of Inflation | Potential for increased input costs | Anticipated rise in commodity and labor prices (2024-2025) |

What is included in the product

Leverages Porter's Five Forces to dissect Jack's competitive environment, revealing industry attractiveness and strategic positioning.

Effortlessly identify and mitigate competitive threats with a visual representation of each force, allowing for targeted strategic adjustments.

Customers Bargaining Power

Customers in the fast-food sector wield significant bargaining power. This strength stems from the sheer volume of available options and the minimal expense or effort involved in switching between brands. For instance, in 2024, the quick-service restaurant market in the U.S. featured over 200,000 establishments, offering consumers a vast array of choices for their meals.

Jack in the Box, like its peers, contends with this reality in a crowded marketplace. Competitors frequently offer comparable menu items, allowing consumers to easily shift their patronage based on factors like promotional pricing, proximity, or even a simple craving for something different. This ease of switching means customers can effectively pressure companies on price and product innovation.

The bargaining power of customers in the restaurant industry is significantly amplified by the widespread adoption of digital platforms. In 2024, mobile ordering and delivery apps are ubiquitous, allowing consumers to effortlessly compare prices and offerings from numerous establishments. This ease of access empowers customers to seek out the best value or most convenient option, putting pressure on restaurants to remain competitive.

Customers hold considerable sway when they demand more for less, a trend amplified in uncertain economic times. This pressure often sparks intense price competition, or 'value wars,' among companies, forcing them to constantly re-evaluate their pricing. For instance, in 2024, the fast-food industry saw significant promotional activity as chains battled for market share by offering value-driven deals to attract budget-conscious consumers.

Buyer Power 4

Buyer power is significantly influenced by shifting consumer preferences, particularly the growing demand for healthier, plant-based, and customizable food options. This trend empowers customers as they actively seek out businesses that align with their evolving values and dietary needs.

Fast-food businesses are under pressure to innovate their menus to cater to these changing tastes. Failure to adapt means risking market share erosion to more agile competitors or even alternative food providers. For instance, by mid-2024, the global plant-based food market was projected to reach over $70 billion, demonstrating a clear consumer shift.

- Consumer Demand: A rising interest in plant-based diets and personalized meal options directly increases customer leverage.

- Market Adaptation: Companies must respond to these preferences or face competitive disadvantages.

- Market Growth: The plant-based food sector's continued expansion highlights the impact of these changing consumer demands.

Buyer Power 5

Customers wield significant power when they can easily switch to competitors or when their purchasing volume is high. For instance, negative publicity or food safety concerns can quickly damage a brand's reputation, forcing companies to be highly responsive. Jack in the Box, having faced such challenges, understands how swiftly customer trust can erode, impacting sales and market share.

The bargaining power of customers can be amplified by several factors:

- Price Sensitivity: When customers are highly sensitive to price, they can exert pressure for lower costs.

- Availability of Substitutes: A wide array of alternative products or services increases customer options and their leverage.

- Low Switching Costs: If it's easy and inexpensive for customers to switch to another provider, their power increases.

- Information Availability: Well-informed customers can compare offerings more effectively, demanding better value.

Customers in the fast-food sector possess considerable bargaining power due to the abundance of choices and low switching costs. This leverage is further amplified by digital platforms, enabling easy price comparisons and a constant demand for value. In 2024, the U.S. quick-service restaurant market, with over 200,000 establishments, exemplifies this intense competition.

| Factor Amplifying Customer Bargaining Power | 2024 Relevance | Impact on Restaurants |

|---|---|---|

| Availability of Substitutes | Over 200,000 U.S. QSR establishments | Pressure on pricing and product differentiation |

| Low Switching Costs | Ease of switching between brands | Customers can easily shift patronage |

| Information Availability | Ubiquitous mobile ordering and delivery apps | Customers compare prices and offerings readily |

| Price Sensitivity | Increased promotional activity and value wars | Forces constant re-evaluation of pricing strategies |

Same Document Delivered

Jack Porter's Five Forces Analysis

This preview showcases the complete, professionally crafted Jack Porter's Five Forces Analysis you will receive immediately upon purchase. You're viewing the exact document, ready for download and immediate application to your strategic planning needs. Rest assured, there are no placeholders or missing sections; what you see is precisely what you get.

Rivalry Among Competitors

Competitive rivalry in the fast-food sector, particularly for Jack in the Box, is fierce. This intensity stems from a crowded marketplace with many established brands and relatively slow growth in certain segments, making market share gains a constant battle. Low customer switching costs mean patrons can easily opt for a competitor based on price, convenience, or a new offering.

Jack in the Box faces a broad spectrum of competitors. This includes major national burger chains like McDonald's and Burger King, but also a wide array of other quick-service restaurants (QSRs) offering various cuisines. For instance, in 2024, the QSR market continues to see significant competition from brands like Chick-fil-A, Wendy's, and Taco Bell, all vying for consumer attention and dollars.

Jack in the Box faces intense competition from major players like McDonald's, Burger King, and Wendy's, as well as fast-casual giants such as Chick-fil-A and Taco Bell, alongside numerous regional quick-service restaurants. This crowded market necessitates constant vigilance and strategic maneuvering to maintain and grow market share.

Rivals frequently engage in aggressive price wars, offering value menus and promotions to attract budget-conscious consumers. For instance, McDonald's Dollar Menu and Burger King's $5 Your Way Meal are direct challenges to Jack in the Box's value proposition. In 2023, the quick-service restaurant industry continued to see heavy promotional activity as brands fought for consumer dollars.

Marketing battles are fierce, with significant advertising spend dedicated to brand building and product launches. Menu innovation is another critical battleground; competitors are continually introducing new items, from plant-based options to limited-time offers, to capture consumer interest and adapt to evolving tastes. This dynamic environment means Jack in the Box must consistently innovate and differentiate itself to stand out.

Competitive rivalry at Jack in the Box is intense, with product differentiation, though present in unique menu items like their breakfast and diverse burger selections, often proving easily imitable. This means competitors can quickly replicate successful offerings, forcing Jack in the Box to constantly innovate. For instance, in 2023, the fast-food industry saw significant menu innovation, with many chains introducing limited-time offers to capture market share, directly impacting Jack in the Box's ability to maintain a unique selling proposition.

Competitive Rivalry 4

Competitive rivalry in the quick-service restaurant (QSR) sector is exceptionally fierce, particularly as overall traffic saw a notable decline in Q1 2025. This downturn forces each player to fight harder for every customer, intensifying the competition for market share.

Companies are actively investing in digital transformation and enhancing customer loyalty programs. For instance, many major QSR chains reported significant growth in digital orders, often exceeding 30% of total sales by early 2025, signaling a critical shift in consumer behavior and competitive strategy.

Drive-thru efficiency has also become a paramount differentiator. Innovations in order-taking technology and streamlined kitchen operations are being deployed to reduce wait times, a key factor for customer retention in this fast-paced industry.

- Declining QSR Traffic: Overall QSR traffic experienced a downturn in Q1 2025, escalating the fight for each customer.

- Digital Investment: Companies are prioritizing digital capabilities, with digital orders representing over 30% of sales for many major chains by early 2025.

- Loyalty Programs: Enhanced loyalty programs are a key strategy to retain customers in a saturated market.

- Drive-Thru Efficiency: Streamlining drive-thru operations through technology is crucial for gaining a competitive edge and improving customer experience.

Competitive Rivalry 5

Competitive rivalry within the fast-food industry remains intense, pushing companies like Jack in the Box to constantly adapt. Strategic initiatives are key to staying ahead. For instance, Jack in the Box's 'JACK on Track' plan is a prime example of this, focusing on optimizing its restaurant portfolio.

This plan involves closing underperforming locations and strategically entering new markets. A notable move is the planned expansion into Chicago and Florida in 2025. These actions are designed to streamline operations, improve financial performance, and boost unit economics, directly addressing the competitive pressures.

- Strategic Restructuring: Jack in the Box's 'JACK on Track' initiative includes closing approximately 20 underperforming restaurants in 2024.

- Market Expansion: The company plans to enter new markets such as Chicago and Florida in 2025, indicating a proactive approach to growth and market share.

- Focus on Unit Economics: These strategic moves are aimed at improving the profitability and efficiency of individual restaurant locations.

- Competitive Imperative: Such actions are necessary responses to the highly competitive landscape, where differentiation and operational excellence are crucial for survival and success.

Competitive rivalry in the quick-service restaurant (QSR) sector is exceptionally fierce, particularly as overall traffic saw a notable decline in Q1 2025, escalating the fight for each customer. Companies are actively investing in digital transformation and enhancing customer loyalty programs, with digital orders representing over 30% of sales for many major chains by early 2025. Drive-thru efficiency has also become a paramount differentiator, with innovations in order-taking technology and streamlined kitchen operations being deployed to reduce wait times.

Jack in the Box's 'JACK on Track' initiative, which includes closing approximately 20 underperforming restaurants in 2024 and expanding into new markets like Chicago and Florida in 2025, is a direct response to these competitive pressures. These actions aim to streamline operations, improve financial performance, and boost unit economics, crucial for survival and success in this dynamic industry.

| Competitor | Market Share (Est. 2024) | Key Competitive Strategy |

|---|---|---|

| McDonald's | ~15-20% | Value offerings, digital innovation, global presence |

| Starbucks | ~10-15% | Premium coffee, loyalty program, convenient store locations |

| Chick-fil-A | ~8-10% | Customer service, consistent quality, limited menu focus |

| Burger King | ~5-7% | Promotional pricing, menu variety, brand nostalgia |

| Wendy's | ~4-6% | Fresh ingredients, value menu, social media engagement |

SSubstitutes Threaten

The threat of substitutes for traditional fast food remains significant. Consumers increasingly opt for alternatives like fast-casual chains, which often emphasize fresher ingredients and perceived healthier options. For instance, Chipotle and Panera Bread continue to draw customers seeking a different dining experience.

Beyond fast-casual, full-service restaurants and even convenient grocery store prepared meals present viable substitutes. In 2024, the market for ready-to-eat meals from supermarkets saw continued growth, reflecting a consumer desire for quick yet potentially more wholesome options than traditional fast food. This broadens the competitive landscape considerably.

Home cooking and the burgeoning meal kit delivery sector pose a substantial threat of substitution for fast-food establishments. Consumers increasingly prioritize healthier options and cost-effectiveness, making these alternatives more appealing. For instance, in 2024, the global meal kit delivery market was valued at approximately $15 billion, demonstrating significant consumer adoption.

The growing trend of preparing meals at home, fueled by wellness initiatives and a desire for budget control, directly siphons demand away from fast food. This shift is particularly pronounced among younger demographics and those actively managing their household expenses. Data from 2024 indicated that over 60% of consumers reported cooking at home more frequently than in previous years, a direct challenge to quick-service restaurants.

Emerging alternatives like virtual kitchens and ghost kitchens present a significant threat by offering diverse cuisines with considerably lower overheads than traditional fast-food models. These operations can rapidly pivot to meet evolving consumer tastes and dietary trends, providing a flexible and cost-effective substitute.

4

The increasing prevalence of healthier food choices, readily available in supermarkets and fast-casual dining, directly challenges Jack in the Box. Consumers are actively seeking out fresh, low-calorie, and plant-based meals, forcing the company to constantly innovate its menu offerings. This trend puts pressure on Jack in the Box to adapt or risk losing market share to these evolving consumer preferences.

The threat of substitutes is particularly potent in the fast-food industry. For instance, by the end of 2023, the plant-based food market in the U.S. was valued at approximately $8 billion, demonstrating a significant consumer shift. This indicates that alternatives to traditional fast food, like Jack in the Box's core offerings, are not only available but are also gaining substantial traction.

- Growing Demand for Healthier Options: Consumers are increasingly prioritizing nutritious choices, impacting traditional fast-food demand.

- Plant-Based Market Expansion: The U.S. plant-based food market reached around $8 billion by the end of 2023, signaling a strong substitute trend.

- Supermarket and Fast-Casual Competition: These channels offer convenient and often healthier alternatives, directly competing with Jack in the Box's convenience factor.

- Menu Adaptation Necessity: Jack in the Box must continually update its menu to align with evolving consumer preferences for fresh, low-calorie, and plant-based items to remain competitive.

5

The threat of substitutes is a significant consideration, particularly for businesses in the food service industry. Convenience stores and gas stations are increasingly offering prepared meals, providing a low-cost, quick alternative for consumers needing immediate sustenance. While these outlets may not match the variety or quality of dedicated restaurants, they effectively address the basic need for fast and accessible food, diverting potential customers.

For instance, in 2024, the convenience store sector saw continued growth in its prepared food segments. Data from the National Association of Convenience Stores (NACS) indicated that in-store foodservice, including prepared foods, represented a substantial portion of sales for many operators. This trend highlights how these businesses are evolving to capture a broader customer base, including those who might otherwise patronize more traditional dining establishments.

- Convenience stores and gas stations are expanding their prepared food offerings.

- These outlets provide a low-cost, quick substitute for consumers on the go.

- They fulfill the immediate need for quick and easy food, even without extensive menu depth.

- This trend impacts traditional food service providers by offering an accessible alternative.

The threat of substitutes for traditional fast food is substantial, encompassing a wide array of alternatives that cater to evolving consumer preferences. These substitutes range from fast-casual dining and full-service restaurants to home-cooked meals and meal kit deliveries, all vying for consumer spending on food. The increasing consumer focus on health, value, and convenience means that businesses like Jack in the Box must continually assess and adapt to these competitive pressures.

In 2024, the market demonstrated a clear shift towards healthier and more diverse food options. For instance, the plant-based food market in the U.S. continued its upward trajectory, with projections indicating continued growth beyond its approximate $8 billion valuation at the end of 2023. This expansion directly challenges traditional fast-food offerings by providing viable, often perceived as healthier, alternatives.

The rise of meal kit delivery services and the increased emphasis on home cooking further amplify the threat of substitutes. With the global meal kit delivery market valued at around $15 billion in 2024, consumers are actively seeking convenient ways to prepare meals at home, often at a lower cost and with greater control over ingredients. This trend directly diverts demand from quick-service restaurants.

Furthermore, convenience stores and gas stations are enhancing their prepared food selections, presenting a low-cost, readily accessible substitute for immediate consumption. This expansion into prepared foods by non-traditional food providers means consumers have more options than ever for quick meals, directly impacting the market share of established fast-food chains.

| Substitute Category | Key Characteristics | 2024 Market Relevance | Impact on Fast Food |

|---|---|---|---|

| Fast-Casual Chains | Fresher ingredients, perceived healthier options | Continued growth and consumer preference | Direct competition for lunch and dinner |

| Full-Service Restaurants | Dine-in experience, broader menu variety | Stable demand, caters to different occasions | Offers an alternative for sit-down meals |

| Grocery Store Prepared Meals | Convenience, often perceived as healthier | Growing market segment | Competes for quick meal occasions |

| Meal Kit Delivery | Home cooking convenience, ingredient control | Valued at approx. $15 billion globally | Reduces reliance on external food providers |

| Home Cooking | Cost-effectiveness, health control | Over 60% of consumers cooking more in 2024 | Siphons demand from all external food options |

| Convenience Stores/Gas Stations | Low-cost, immediate availability | Expanding prepared food offerings | Provides a basic, quick food alternative |

Entrants Threaten

The threat of new entrants in the fast-food sector is generally considered moderate to low. While it might seem easy to open a burger joint, significant hurdles exist. For instance, establishing a new fast-food chain in 2024 requires substantial upfront capital, often running into millions of dollars, for prime real estate acquisition or leasing, specialized kitchen equipment, and initial marketing campaigns.

These high capital requirements act as a major deterrent. Consider that securing a good location in a busy area can cost hundreds of thousands, if not millions, in rent or purchase price. Add to that the cost of equipping a commercial kitchen, which can easily exceed $100,000, plus initial inventory and staffing costs, and the barrier to entry becomes quite formidable for aspiring entrepreneurs.

The threat of new entrants for Jack in the Box is generally considered moderate. Established brands like Jack in the Box benefit from strong brand recognition, customer loyalty, and extensive marketing budgets that new players struggle to match. Building a recognizable brand and customer base takes substantial time and investment, creating a barrier for newcomers.

For instance, in 2023, Jack in the Box invested significantly in marketing campaigns, aiming to reinforce its brand presence and attract new customers. This level of expenditure, coupled with existing market saturation in the quick-service restaurant sector, makes it challenging for a new competitor to gain significant traction quickly.

The threat of new entrants is moderate. Existing dominant players, like McDonald's and Starbucks, benefit from prime real estate access and robust, established supply chains. For instance, securing a high-traffic corner in a major city can cost millions, a significant barrier for newcomers.

Newcomers struggle to replicate these advantages, facing higher initial costs for site acquisition and the complex task of building efficient, cost-effective supply networks that can compete on price and delivery speed. This often means starting in less desirable locations or with less optimized logistics.

While the capital investment for a single coffee shop might be relatively low, scaling to compete with national chains requires substantial funding for multiple locations, marketing, and supply chain development. For example, the average cost to open a new Starbucks location in 2024 can range from $200,000 to over $1 million, depending on the site and build-out.

4

The threat of new entrants is significantly influenced by regulatory hurdles. Compliance with health, safety, and environmental standards, for instance, adds considerable complexity and cost, disproportionately affecting smaller or less experienced businesses. In 2024, many sectors saw increased scrutiny on sustainability reporting, with new regulations like the EU's Corporate Sustainability Reporting Directive (CSRD) impacting market entry costs for companies globally.

These regulatory burdens can act as substantial barriers, making it more challenging for newcomers to compete effectively. For example, the pharmaceutical industry requires extensive clinical trials and FDA approvals, a process that can cost hundreds of millions of dollars and take over a decade, effectively deterring many potential entrants.

- Regulatory Compliance Costs: New entrants face significant upfront investment in meeting existing and evolving regulations.

- Industry-Specific Hurdles: Sectors like finance, healthcare, and energy have particularly stringent and costly entry requirements.

- Impact on Small Businesses: Smaller companies often lack the resources to navigate complex regulatory landscapes, limiting their ability to enter.

- Evolving Standards: Continuous updates to regulations, such as those related to data privacy (e.g., GDPR, CCPA) or environmental impact, necessitate ongoing adaptation and investment.

5

The threat of new entrants in the retail sector, particularly for large established chains, is significantly mitigated by their ability to leverage substantial economies of scale. This advantage allows them to negotiate better prices for inventory, invest more heavily in widespread marketing campaigns, and streamline operations across numerous locations. For instance, in 2024, major retailers continued to benefit from bulk purchasing power, which often translates to lower per-unit costs compared to smaller, emerging businesses. This cost advantage is a formidable barrier, making it challenging for new players to match the competitive pricing and extensive product variety offered by incumbents.

This cost advantage allows existing large chains to maintain competitive pricing and absorb cost pressures more effectively. For example, a large supermarket chain might secure a 5% discount on produce due to its volume, a margin a new independent grocer simply cannot achieve.

- Economies of Scale: Large chains benefit from lower per-unit costs in purchasing, marketing, and operations.

- Competitive Pricing: This cost advantage enables incumbents to offer more attractive prices to consumers.

- Barrier to Entry: The difficulty for new, smaller players to match these cost efficiencies acts as a significant deterrent.

- Market Resilience: Established players can better withstand market fluctuations and cost increases due to their operational efficiencies.

The threat of new entrants for Jack in the Box is moderate, primarily due to the substantial capital required to establish a competitive presence in the fast-food industry. Newcomers face significant barriers related to brand building, securing prime real estate, and matching the marketing prowess of established players.

For instance, the cost of opening a new restaurant location in a desirable area can easily run into hundreds of thousands or even millions of dollars in 2024, encompassing leasehold improvements, kitchen equipment, and initial inventory. Furthermore, building brand recognition and customer loyalty takes considerable time and financial investment, resources that emerging businesses often lack compared to incumbents like Jack in the Box.

The threat of new entrants is also influenced by economies of scale enjoyed by larger chains. These established players benefit from bulk purchasing power, leading to lower per-unit costs for ingredients and supplies, a significant advantage that new entrants struggle to replicate. This cost disparity makes it difficult for newcomers to compete on price, further solidifying the moderate threat level.

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis is built upon a robust foundation of data, including publicly available company filings, industry-specific market research reports, and economic indicators. This comprehensive approach ensures a thorough understanding of competitive dynamics.