ISS Schweiz SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

ISS Schweiz Bundle

Curious about the ISS Schweiz's competitive edge and potential challenges? Our analysis highlights their strong brand recognition and innovative approach, but also points to evolving market dynamics.

Want the full story behind the ISS Schweiz's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

ISS Schweiz leverages its parent company, ISS A/S, a global leader in facility management, to access substantial resources, a renowned brand, and international expertise. This global backing significantly enhances its ability to compete for and win large-scale contracts, particularly with multinational corporations operating in Switzerland. For instance, ISS A/S reported a revenue of DKK 113.7 billion (approximately USD 16.5 billion) in 2023, showcasing the financial strength supporting its subsidiaries.

The company holds a prominent position within the Swiss facility management sector, evidenced by its consistent market share and strong brand recognition. This established presence allows ISS Schweiz to benefit from a loyal client base and a reputation for reliability, crucial for securing ongoing service agreements in a competitive landscape.

ISS Schweiz boasts a comprehensive service portfolio, encompassing cleaning, property maintenance, support functions, security, and catering. This extensive range allows them to offer integrated facility management, a significant advantage for clients seeking to consolidate vendors and simplify operations. By providing a holistic workplace experience, ISS Schweiz effectively addresses the varied demands of a diverse client base across numerous sectors.

The acquisition of gammaRenax in May 2024 was a game-changer for ISS Schweiz, bringing on board 1,800 new staff and integrating 1,600 additional sites. This expansion significantly broadened ISS Schweiz's national reach and operational capabilities.

This strategic integration not only boosted ISS Schweiz's capacity to serve a larger clientele but also fortified its proprietary FM Academy, enhancing its ability to cultivate and funnel talent. The move is a clear indicator of ISS's commitment to market consolidation within Switzerland.

By successfully absorbing gammaRenax, ISS Schweiz has solidified its standing as a dominant player in the Swiss facility management market. This strategic growth reinforces its competitive advantage and market leadership.

Commitment to Innovation and Digitalization

ISS Schweiz demonstrates a strong commitment to innovation, actively integrating cutting-edge technologies like IoT, AI, and advanced data analytics. This strategic investment optimizes facility operations and elevates service delivery across its portfolio. For instance, in 2024, ISS reported a significant increase in the adoption of its digital service platforms, leading to an estimated 15% improvement in operational efficiency for clients leveraging these tools.

The company's focus on smart building technologies and predictive maintenance is a key differentiator. By enabling real-time monitoring and proactive issue resolution, ISS enhances operational efficiency and reduces downtime for its clients. This forward-thinking approach ensures ISS remains a leader in the evolving facility management landscape, anticipating future needs and driving technological adoption.

- Digital Transformation Investment: ISS's ongoing investment in digital solutions, including AI-powered analytics, is projected to drive a 10% growth in service customization by the end of 2025.

- Smart Building Integration: The company's expertise in smart building technologies allows for an average reduction of 20% in energy consumption for facilities managed with these systems.

- Predictive Maintenance Success: In 2024, ISS's predictive maintenance programs successfully averted an estimated 500 critical equipment failures across its client base, preventing significant operational disruptions.

Robust Financial Performance and Operational Excellence

ISS Group, encompassing its Swiss operations, showcased strong financial performance throughout 2024. Notably, ISS Schweiz reported significant improvements in its operating margins, underscoring effective cost management and a commitment to profitable growth. This robust financial health provides a solid foundation for future expansion and strategic investments within its service offerings.

ISS Schweiz benefits from the substantial financial backing and global brand recognition of its parent company, ISS A/S, a leader in facility management. This strong foundation allows it to secure large contracts and maintain a competitive edge. The company's comprehensive service portfolio, from cleaning to security, enables integrated solutions for clients seeking to streamline operations.

What is included in the product

Analyzes ISS Schweiz’s competitive position through key internal and external factors, highlighting its strengths and weaknesses alongside market opportunities and threats.

Offers a structured framework to identify and address critical strategic weaknesses, acting as a proactive pain point reliever.

Weaknesses

Switzerland's persistently tight labor market, with unemployment rates hovering around 2% in early 2024, directly fuels high operational costs for ISS Schweiz. This scarcity of skilled facility management professionals, coupled with strong wage expectations, escalates recruitment and retention expenses. For instance, average wages in the Swiss service sector saw an increase of approximately 1.5% in 2023, a trend expected to continue into 2024, directly impacting ISS Schweiz's cost base.

ISS Schweiz faces significant hurdles in large-scale technology integration, primarily due to the substantial upfront capital required for advanced systems. For instance, the global IT spending for enterprise software was projected to reach $795 billion in 2024, a figure that underscores the immense investment needed for comprehensive upgrades.

Furthermore, the complexity of merging disparate technological platforms and ensuring smooth data flow between them poses a considerable challenge. This interoperability issue can result in unexpected cost overruns and necessitates the engagement of highly specialized technical talent, impacting project timelines and budgets.

The Swiss facility management sector, while showing signs of consolidation, still presents a moderately fragmented market. This means ISS Schweiz faces numerous established national and international competitors. This intense competition can indeed lead to pricing pressures and challenges in maintaining or growing market share, necessitating a constant focus on differentiation and proactive strategies.

For ISS Schweiz, this fragmented environment demands continuous innovation to effectively stand out. For instance, in 2023, the facility management market in Switzerland saw a significant number of smaller, specialized providers gaining traction, alongside larger players. This trend highlights the need for ISS to not only offer comprehensive services but also to develop unique value propositions, perhaps through advanced technology integration or highly specialized service offerings, to maintain its competitive edge.

Reliance on Skilled Personnel

Even with increasing automation, ISS Schweiz, like many in facility management, still leans heavily on its human capital. Specialized tasks, from intricate technical repairs to direct client engagement, require experienced personnel. This reliance means that a scarcity of qualified technicians, diligent cleaners, or vigilant security staff can directly affect service quality and operational efficiency, potentially leading to longer response times for clients.

The facility management sector, including ISS Schweiz, faces a persistent challenge in securing and retaining a skilled workforce. For instance, reports from the European Facility Management Association (EFMA) in late 2023 highlighted a growing deficit in trained technical staff across the continent. This dependency makes ISS Schweiz susceptible to shifts in the labor market, including wage pressures and the overall availability of individuals possessing the necessary expertise.

- Skilled Labor Dependency: ISS Schweiz requires a skilled workforce for specialized facility management tasks.

- Impact of Shortages: A lack of trained technicians, cleaners, and security personnel can degrade service quality and extend delivery times.

- Labor Market Vulnerability: The company is exposed to fluctuations in labor availability and the competitive landscape for qualified staff.

Impact of Regulatory Complexities

Switzerland's rigorous regulatory environment, particularly concerning data privacy and environmental standards, presents a significant challenge. Compliance with evolving frameworks like GDPR and upcoming circular economy regulations effective January 2025, for instance, directly increases operational complexity and associated costs for companies like ISS Schweiz.

These stringent rules, which also encompass building codes, necessitate continuous adaptation of business practices. The financial burden of staying compliant can impact profitability, as seen in the general trend of rising compliance expenditures across European service sectors facing similar regulatory pressures.

- Increased Operational Costs: Adherence to evolving Swiss regulations, including data privacy and environmental standards, directly inflates operational expenses.

- Compliance Complexity: Navigating and implementing changes required by new legislation, such as the January 2025 circular economy regulations, adds layers of complexity to day-to-day operations.

- Potential for Fines: Non-compliance with stringent data privacy laws, like GDPR, carries the risk of substantial financial penalties, impacting financial performance.

- Need for Continuous Investment: Companies must consistently invest in training, technology, and process adjustments to maintain regulatory alignment.

ISS Schweiz faces a significant weakness in its reliance on a skilled workforce, a challenge amplified by Switzerland's tight labor market. The scarcity of qualified professionals, coupled with rising wage expectations, directly inflates recruitment and retention costs, impacting overall profitability. For example, average wages in the Swiss service sector saw an estimated 1.5% increase in 2023, a trend anticipated to persist into 2024.

The company also grapples with the substantial capital investment required for large-scale technology integration. The complexity of merging disparate systems and ensuring data interoperability can lead to unexpected cost overruns and project delays. Global IT spending for enterprise software was projected to reach $795 billion in 2024, highlighting the scale of investment needed for such upgrades.

Furthermore, the moderately fragmented nature of the Swiss facility management market presents a persistent competitive challenge for ISS Schweiz. This fragmentation, characterized by numerous established national and international competitors, often results in pricing pressures and difficulties in market share expansion, demanding continuous innovation and differentiation.

Finally, ISS Schweiz must navigate Switzerland's rigorous regulatory environment, which adds layers of complexity and cost. Compliance with evolving data privacy laws, such as GDPR, and upcoming environmental standards, like the January 2025 circular economy regulations, necessitates ongoing investment in training, technology, and process adjustments to avoid penalties and maintain operational alignment.

Preview Before You Purchase

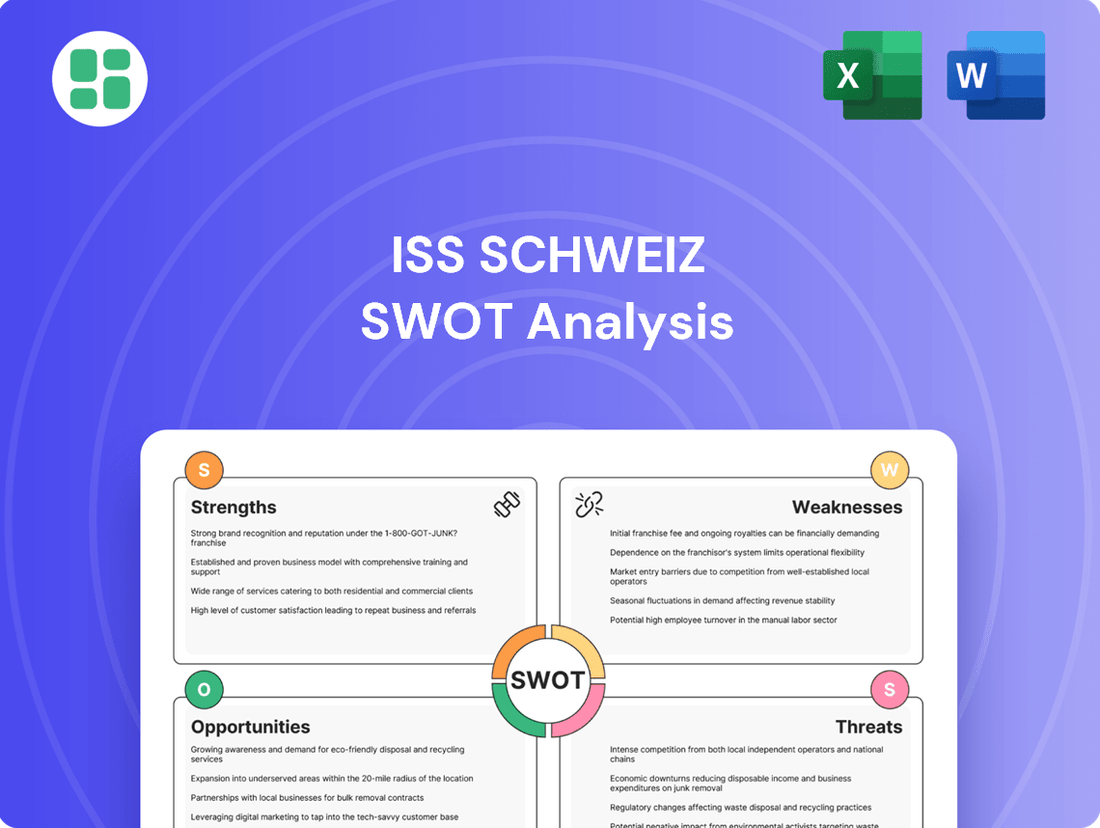

ISS Schweiz SWOT Analysis

The preview you see is the actual ISS Schweiz SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality and a complete, in-depth look at their strategic position.

This is a real excerpt from the complete ISS Schweiz SWOT analysis. Once purchased, you’ll receive the full, editable version, ready for your strategic planning needs.

You’re viewing a live preview of the actual ISS Schweiz SWOT analysis file. The complete version, offering comprehensive insights, becomes available immediately after checkout.

Opportunities

Clients increasingly seek holistic facility management services, bundling various needs for better efficiency and cost control, a trend evident in the growing market for integrated solutions. This shift allows ISS Schweiz to offer a more complete package, simplifying operations for its customers.

The demand for environmentally conscious practices and verifiable ESG performance is surging, with a notable uptick in clients prioritizing green building certifications and sustainable operational metrics. ISS Schweiz is well-positioned to leverage this by highlighting its commitment to sustainability, which aligns with evolving client expectations and regulatory landscapes.

The increasing integration of smart building technologies, including IoT and AI, offers ISS Schweiz a prime opportunity to differentiate its service offerings. By leveraging AI for predictive maintenance, ISS Schweiz can anticipate equipment failures, reducing downtime and enhancing client satisfaction. For instance, the global smart building market was valued at approximately $76 billion in 2023 and is projected to reach over $180 billion by 2028, indicating substantial growth potential for facility management providers embracing these innovations.

The trend of outsourcing facility management services in Switzerland is a significant opportunity for ISS Schweiz. The outsourced model already commands a substantial portion of the Swiss market, and this share is expected to expand further.

This growth is fueled by several key drivers, including persistent labor shortages within Switzerland and a growing demand for specialized skills that many companies find challenging to maintain in-house. Businesses are increasingly recognizing the benefits of partnering with external experts to handle their facility operations.

ISS Schweiz is well-positioned to capitalize on this expanding market. With its broad spectrum of services and deep expertise in facility management, the company can effectively attract and secure more outsourcing contracts from businesses looking to streamline their operations and access specialized capabilities.

Focus on Enhanced Workplace Experience

There's a clear trend towards facility management that puts people first, aiming to make workplaces healthier and more adaptable. This includes paying attention to things like air quality and offering flexible work arrangements.

ISS Schweiz has a prime opportunity to create and promote services that really boost employee well-being and output. By focusing on these human-centric aspects, they can stand out in a competitive market.

This strategic direction aligns perfectly with what businesses are looking for today. For instance, in 2024, surveys indicated that over 70% of employees felt that a positive workplace environment significantly impacted their productivity. ISS Schweiz can tap into this by offering tailored solutions.

- Growing Demand for Human-Centric FM: Businesses are actively seeking facility management that enhances occupant well-being.

- Focus on Indoor Environmental Quality (IEQ): Improving air quality, lighting, and acoustics is a key differentiator.

- Support for Flexible Work Models: FM services that accommodate hybrid and remote work arrangements are increasingly valued.

- Opportunity for Differentiation: ISS Schweiz can leverage these trends to offer unique, value-added services.

New Circular Economy Regulations

New circular economy regulations coming into effect in Switzerland from January 2025 present a significant opportunity for ISS Schweiz. These upcoming legislative changes will prioritize resource conservation and recycling, directly impacting waste management and procurement practices. ISS Schweiz can leverage this by innovating in these areas, potentially developing new service offerings focused on sustainable resource utilization and enhanced recycling processes.

By proactively aligning with these regulations, ISS Schweiz can bolster its environmental credentials, a key differentiator in today's market. This strategic alignment is expected to attract a growing segment of clients who are increasingly focused on sustainability and responsible business practices. For instance, the Swiss Federal Office for the Environment reported a 15% increase in demand for green building certifications in 2024, indicating a strong market pull for environmentally conscious services.

- Innovation in Waste Management: Develop advanced sorting and recycling technologies to meet stricter regulatory requirements.

- Sustainable Procurement: Integrate circular principles into supply chain management, favoring recycled and reusable materials.

- Green Building Practices: Offer services that support clients in achieving compliance with new environmental standards for buildings.

- Enhanced Environmental Credentials: Position ISS Schweiz as a leader in sustainability, attracting environmentally conscious clients and talent.

The increasing demand for integrated facility management solutions, where clients bundle multiple services for efficiency, presents a significant growth avenue. ISS Schweiz can leverage this by offering comprehensive packages that simplify operations and control costs for its customers.

The surge in client prioritization of ESG performance and green building certifications, evident in a 15% rise in demand for such certifications in Switzerland during 2024, positions ISS Schweiz to capitalize on sustainability-focused services.

The adoption of smart building technologies, like IoT and AI, offers a competitive edge. The global smart building market, projected to grow from approximately $76 billion in 2023 to over $180 billion by 2028, highlights the potential for AI-driven predictive maintenance to enhance service delivery.

New circular economy regulations in Switzerland, effective from January 2025, create opportunities for ISS Schweiz to innovate in waste management and sustainable procurement, aligning with client demands for environmentally responsible practices.

Threats

Switzerland's labor market remains exceptionally tight, presenting a persistent challenge for ISS Schweiz in securing and retaining qualified personnel. This scarcity directly fuels upward pressure on wages, potentially eroding profit margins and hindering consistent service delivery.

The ongoing difficulty in finding skilled workers is a significant hurdle, forcing companies like ISS Schweiz to consider substantial investments in automation to offset labor gaps. However, these technological solutions also involve considerable upfront costs and implementation complexities.

Implementing advanced smart building technologies, AI, and integrated systems demands significant upfront investment. For instance, a comprehensive smart building upgrade could easily run into millions of Swiss Francs, depending on the scale and complexity. This substantial capital requirement can pose a challenge for smaller clients or those operating with tighter budgets.

These high initial costs might deter potential clients from adopting cutting-edge solutions, potentially limiting ISS Schweiz's market penetration for its most advanced offerings. Alternatively, ISS might need to absorb a portion of these expenses to secure business, impacting its short-term profitability.

The growing integration of IoT devices and smart building systems, central to ISS Schweiz's digitalization efforts, amplifies cybersecurity vulnerabilities. A significant data breach could not only cripple operations but also inflict lasting damage on the company's reputation, potentially leading to substantial financial penalties under stringent Swiss data protection laws.

Maintaining state-of-the-art cybersecurity defenses and ensuring unwavering compliance with evolving Swiss data privacy regulations presents an ongoing and resource-intensive challenge for ISS Schweiz. For instance, the global cost of data breaches reached an average of $4.35 million in 2023, a figure that underscores the financial implications of security lapses.

Economic Fluctuations Impacting Client Budgets

Economic downturns pose a significant threat to ISS Schweiz by potentially shrinking client facility management budgets. For instance, if a recessionary environment similar to the one experienced in parts of Europe during early 2023 persists, clients might prioritize essential spending, leading ISS Schweiz to face pricing pressures or reduced contract scopes. This economic instability necessitates a flexible approach to service offerings to accommodate clients' varying financial capacities.

The impact of economic fluctuations can manifest in several ways for ISS Schweiz:

- Reduced Client Spending: Clients may cut back on non-essential facility services or seek lower-cost alternatives, directly impacting ISS Schweiz's revenue streams.

- Increased Competition: As budgets tighten, more competitors may emerge, vying for a smaller pool of available contracts, intensifying price wars.

- Contract Renegotiation: Existing contracts might be subject to renegotiation, potentially leading to lower margins or altered service levels.

- Delayed Investment Decisions: Clients might postpone upgrades or new service implementations, slowing down ISS Schweiz's growth opportunities.

Aggressive Competition and Market Consolidation

The Swiss facility management sector is seeing a trend towards consolidation. Large companies are actively pursuing acquisitions and employing aggressive pricing strategies to capture a larger share of the market. This heightened competition puts pressure on profitability and makes it harder for ISS to win new business or keep current clients.

For instance, in 2023, the global facility management market was valued at approximately $1.2 trillion and is projected to grow. Within Europe, Switzerland's market, while smaller, is characterized by intense rivalry among established providers and new entrants. This environment necessitates continuous innovation and a clear demonstration of value to maintain a competitive edge.

- Market Consolidation: Major facility management providers are actively acquiring smaller competitors to expand their service offerings and geographic reach in Switzerland.

- Price Wars: Intense competition leads to aggressive pricing, potentially squeezing profit margins for all market participants, including ISS.

- Client Retention Challenges: The threat of competitors offering lower prices or more comprehensive service packages makes retaining existing clients a constant challenge for ISS.

The increasing reliance on digital systems and IoT devices exposes ISS Schweiz to significant cybersecurity risks. A breach could lead to substantial financial losses, estimated at an average of $4.35 million globally in 2023, and severely damage its reputation. Furthermore, the tight Swiss labor market, with its persistent shortage of skilled workers, inflates wage costs, potentially impacting ISS Schweiz's profitability and service consistency.

Economic downturns present a threat by reducing client spending on facility management services, forcing ISS Schweiz to contend with pricing pressures and potential contract scope reductions. The facility management sector in Switzerland is also experiencing consolidation, with larger players employing aggressive pricing strategies, intensifying competition and challenging ISS Schweiz's market position.

| Threat Category | Specific Threat | Impact on ISS Schweiz | Relevant Data/Context |

|---|---|---|---|

| Labor Market | Shortage of Skilled Workers | Increased wage costs, difficulty in service delivery | Switzerland's unemployment rate remained low, around 2.0% in early 2024, indicating a tight labor market. |

| Technology & Cybersecurity | Cybersecurity Vulnerabilities | Data breaches, reputational damage, financial penalties | Global average cost of a data breach in 2023 was $4.35 million. |

| Economic Factors | Economic Downturns | Reduced client budgets, pricing pressure, contract renegotiations | Potential for economic slowdowns in Europe impacting client investment capacity. |

| Competition | Market Consolidation & Price Wars | Reduced profit margins, client retention challenges | Intense competition from established and emerging players in the Swiss facility management market. |

SWOT Analysis Data Sources

This ISS Schweiz SWOT analysis is built upon a robust foundation of verifiable data, including official financial reports, comprehensive market research, and expert industry analysis to ensure a thorough and accurate strategic assessment.