ISS Schweiz Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

ISS Schweiz Bundle

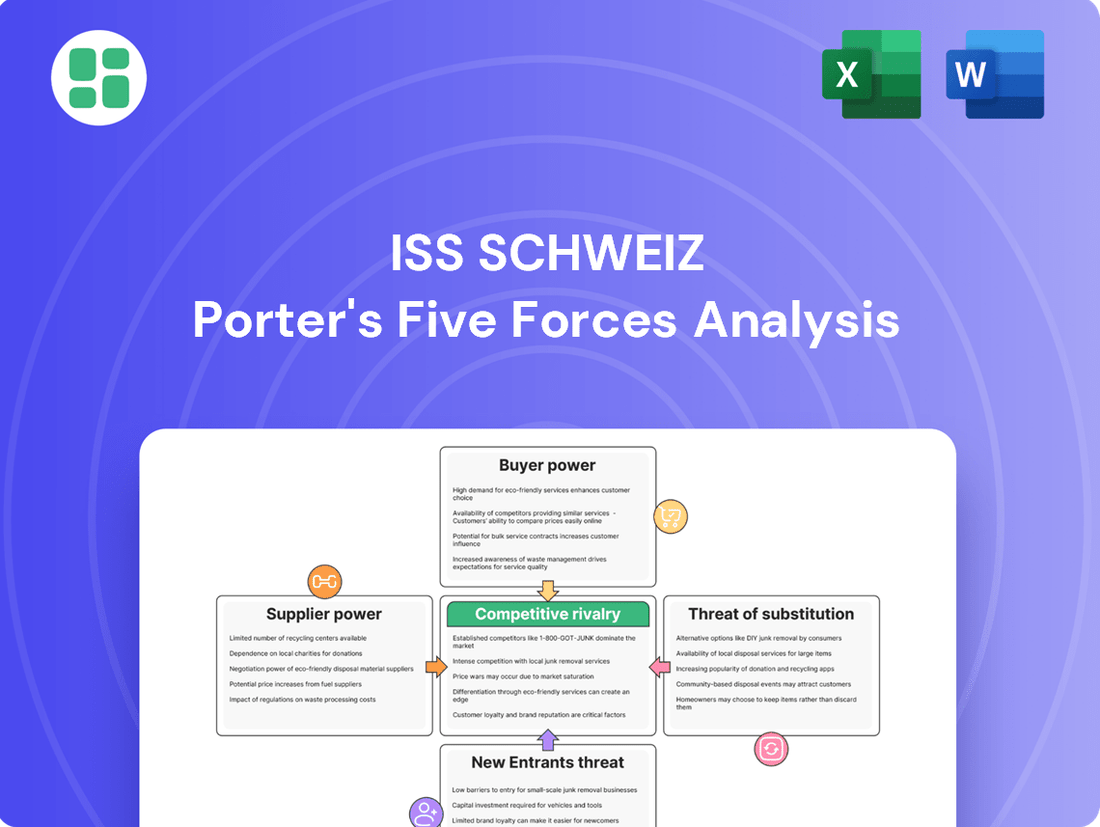

Understanding the competitive landscape for ISS Schweiz through Porter's Five Forces reveals critical insights into industry attractiveness and potential profitability. Factors like the bargaining power of buyers and the intensity of rivalry significantly shape their operational environment.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore ISS Schweiz’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

The bargaining power of suppliers for ISS Schweiz is significantly shaped by how concentrated the supplier market is for essential resources. For specialized cleaning chemicals, security technology, catering ingredients, and sophisticated building management systems, if there are only a handful of companies providing these, they gain considerable leverage. This is particularly true if the inputs are unique or difficult to substitute.

For instance, in 2024, the global market for advanced building management systems saw significant consolidation, with the top three providers accounting for over 60% of market share. This concentration means ISS Schweiz might face higher prices for these critical technologies if alternatives are scarce or require extensive integration efforts. Conversely, for more common supplies like standard office stationery or basic cleaning agents, ISS Schweiz benefits from a wider array of suppliers, allowing them to negotiate more favorable terms and prices.

The costs associated with switching suppliers for ISS Schweiz can significantly bolster supplier power. If transitioning to a new provider for critical equipment or specialized software necessitates substantial staff retraining, retooling of existing infrastructure, or complex integration processes, ISS Schweiz may find itself effectively locked into current supplier relationships.

These high switching costs directly diminish ISS Schweiz's leverage to negotiate more favorable terms or explore alternative sourcing options, thereby concentrating power in the hands of its existing suppliers.

Suppliers might gain leverage if they can credibly threaten to move into the facility management space themselves, essentially becoming competitors to ISS Schweiz. This forward integration would directly challenge ISS's market position.

While large-scale forward integration by general suppliers is uncommon, providers of specialized technology or advanced equipment could potentially offer their own installation, maintenance, or integrated service packages. For instance, a major HVAC system provider might offer comprehensive building management services, bypassing traditional facility management companies.

The mere possibility of such a move can empower suppliers during price or contract negotiations. Knowing that a supplier could potentially disrupt the market by offering end-to-end solutions gives them a stronger hand in discussions with ISS Schweiz.

Importance of ISS Schweiz to Suppliers

The bargaining power of suppliers to ISS Schweiz is significantly influenced by ISS Schweiz's importance as a customer. If ISS Schweiz accounts for a large percentage of a supplier's total sales, that supplier will likely be more accommodating with pricing and terms to secure continued business. For instance, if a key cleaning supply provider derives 20% of its annual revenue from ISS Schweiz, they have a strong incentive to maintain a positive relationship.

Conversely, if ISS Schweiz represents only a small fraction of a supplier's revenue, perhaps less than 1%, the supplier has less motivation to negotiate favorable terms. In such scenarios, the supplier can more easily absorb the loss of ISS Schweiz as a client, thereby increasing their leverage in negotiations. This dynamic is crucial for understanding the supplier-customer relationship within the facility services industry.

- Customer Dependence: Suppliers who rely heavily on ISS Schweiz for revenue are more likely to offer competitive pricing and favorable contract terms.

- Revenue Concentration: If ISS Schweiz constitutes a significant portion of a supplier's sales, the supplier's bargaining power is diminished.

- Alternative Markets: Suppliers with diverse customer bases have less pressure to concede to ISS Schweiz's demands.

- Supplier Power Assessment: Analyzing the percentage of revenue ISS Schweiz represents for its suppliers is key to assessing supplier bargaining power.

Availability of Substitute Inputs

The availability of substitute inputs significantly curtails the bargaining power of suppliers for ISS Schweiz. If the company can readily source alternative materials or adopt different technologies that perform a similar function, suppliers lose their leverage to dictate terms and prices. For instance, in the realm of standard cleaning supplies, where numerous vendors offer comparable products, ISS Schweiz can easily switch suppliers, thereby diminishing any single supplier's ability to command higher prices.

In 2024, the global market for cleaning and hygiene products, a key input category for ISS Schweiz, demonstrated robust competition. Reports indicate that the market saw a steady influx of new entrants, particularly from Asia, offering cost-effective alternatives to established brands. This increased competition among suppliers of janitorial supplies, chemicals, and equipment directly translates to a reduced bargaining power for any individual supplier, as ISS Schweiz can leverage multiple competitive bids.

- Reduced Supplier Leverage: The presence of readily available substitute inputs weakens the negotiating position of existing suppliers.

- Cost Savings Potential: ISS Schweiz can capitalize on competition among suppliers of similar products to secure more favorable pricing.

- Technological Adaptability: The ability to adopt alternative technologies further dilutes supplier power, allowing for flexibility in sourcing and operations.

- Market Dynamics in 2024: Increased competition within the cleaning supplies sector, driven by new market entrants, has amplified the availability of substitutes.

The bargaining power of suppliers for ISS Schweiz is influenced by the concentration of suppliers for critical inputs. For specialized items like advanced security systems or unique catering ingredients, a concentrated supplier market, such as the over 60% market share held by the top three building management system providers in 2024, grants suppliers significant leverage.

High switching costs for ISS Schweiz, involving retraining or infrastructure changes, lock the company into existing supplier relationships, thereby increasing supplier power. Furthermore, suppliers who can credibly threaten to integrate forward into facility management services, like an HVAC provider offering end-to-end solutions, gain an advantage in negotiations.

ISS Schweiz's importance as a customer also plays a role; if ISS Schweiz represents a substantial portion of a supplier's revenue, the supplier's power is diminished. Conversely, the availability of substitutes, as seen with the influx of cost-effective cleaning product suppliers in 2024, reduces supplier leverage.

| Factor | Impact on Supplier Power | 2024 Data Example |

| Supplier Concentration | Increases Power | Top 3 Building Management Systems: >60% market share |

| Switching Costs | Increases Power | High for specialized software/equipment integration |

| Forward Integration Threat | Increases Power | Specialized tech providers offering integrated services |

| Customer Dependence | Decreases Power | If ISS Schweiz is a small % of supplier revenue |

| Availability of Substitutes | Decreases Power | New entrants in cleaning supplies market |

What is included in the product

Tailored exclusively for ISS Schweiz, this analysis dissects the five forces shaping its competitive environment, from supplier power to the threat of new entrants.

Effortlessly visualize competitive pressures with an intuitive spider chart, providing instant clarity on strategic positioning.

Quickly assess and adapt to market shifts by easily swapping in new data, ensuring your Porter's Five Forces analysis remains relevant and actionable.

Customers Bargaining Power

The bargaining power of ISS Schweiz's customers is heavily shaped by how concentrated their client base is and the sheer volume of services purchased. Major clients, such as large corporations or government bodies, often wield considerable influence because they account for a significant chunk of ISS Schweiz's income. Losing such a client would have a substantial financial impact, giving them more leverage in negotiations.

In contrast, a broad and diverse customer base, composed of many smaller clients, dilutes the bargaining power of any single customer. This fragmentation means that individual clients have less ability to dictate terms, as their business, in isolation, represents a smaller portion of ISS Schweiz's overall revenue. For instance, if the top 10 clients represent over 60% of ISS's revenue, their collective bargaining power would be substantial.

The ease with which customers can switch from ISS Schweiz to a competitor significantly influences their bargaining power. If switching is simple and inexpensive, customers can more easily demand better pricing or service. For instance, a client moving from one IT managed services provider to another might face minimal costs if data migration is straightforward and existing hardware is compatible.

Conversely, high switching costs empower ISS Schweiz by reducing customer leverage. These costs can include the expense of integrating new systems, potential operational disruptions during the transition, or the need for staff retraining. ISS Schweiz actively works to increase these barriers by offering comprehensive, integrated facility management solutions and fostering long-term, collaborative partnerships.

In 2024, the facility management sector saw continued emphasis on technology integration, with many clients investing in smart building solutions. This trend inherently raises switching costs, as a new provider would need to replicate or integrate with these complex systems, making it harder for customers to move. ISS Schweiz's investment in digital platforms and customized service models further solidifies customer loyalty by embedding their operations deeply within ISS's framework.

Customer price sensitivity significantly impacts the bargaining power of buyers in the facility management sector. When services are viewed as interchangeable, and price becomes the main driver, customers can push prices down considerably. For instance, in 2024, many B2B service contracts saw increased scrutiny on cost optimization, with some clients renegotiating terms for savings of 5-10%.

ISS Schweiz addresses this by highlighting the comprehensive value of its integrated service offerings, focusing on operational improvements and quality enhancements rather than solely competing on price. This strategy aims to differentiate ISS beyond mere cost, thereby reducing the perception of its services as a commodity and lessening direct price-based bargaining.

Clients primarily driven by cost reduction initiatives will naturally wield greater bargaining power. This is evident in the growing trend of competitive bidding processes where multiple providers are evaluated, often leading to price concessions from incumbents or new entrants seeking market share.

Customer Information and Transparency

Customers armed with detailed market intelligence, like competitor pricing and service specifics, naturally gain more leverage. This heightened transparency in the facility management sector empowers clients to scrutinize bids more thoroughly and negotiate for better terms. For instance, in 2024, a significant portion of large corporate clients actively solicited multiple bids, with over 70% reporting that price comparison was a primary driver in their selection process.

ISS Schweiz needs to clearly articulate its unique value proposition, moving beyond standard service delivery to highlight distinct advantages. This involves showcasing innovation, sustainability initiatives, or specialized expertise that competitors may not offer. The ability for customers to easily compare service providers means ISS must continuously demonstrate superior quality and cost-effectiveness to maintain its competitive edge.

- Informed Decision-Making: Customers in 2024 increasingly utilize online platforms and industry reports to benchmark service providers, leading to more informed purchasing decisions.

- Price Sensitivity: Facility management contracts, especially for large enterprises, often involve substantial budgets, making price a critical factor in customer negotiations.

- Demand for Value-Added Services: Beyond core services, clients are seeking providers who offer integrated solutions, such as smart building technology or ESG reporting, to enhance their own operational efficiency and sustainability goals.

- Supplier Consolidation: While some customers seek specialized providers, many large organizations are consolidating their facility management needs with fewer, more capable partners, increasing the stakes for each contract.

Threat of Backward Integration by Customers

The threat of customers integrating backward into facility management services poses a significant challenge for ISS Schweiz. Large corporations, with substantial resources and in-house capabilities, might consider bringing facility management in-house if they perceive it as more cost-effective or strategically advantageous. This is especially relevant as the global facility management market is projected to reach over $1.5 trillion by 2027, indicating significant potential for in-house operations.

For ISS Schweiz, the key to mitigating this threat lies in consistently demonstrating superior value. This means showcasing how their outsourced solutions deliver greater efficiency, specialized expertise, and ultimately, cost savings that outweigh the perceived benefits of backward integration. For instance, ISS Schweiz's ability to leverage economies of scale and advanced technology in areas like energy management or specialized cleaning can be a strong differentiator. In 2023, ISS reported a revenue of €12.4 billion, highlighting their scale and operational capacity.

- Customer Bargaining Power: The potential for customers to perform facility management in-house is a direct lever of bargaining power.

- Large Organization Advantage: Very large clients are more likely to possess the financial and operational capacity for backward integration.

- ISS Schweiz's Value Proposition: ISS must highlight superior efficiency, cost-effectiveness, and specialized expertise compared to in-house alternatives.

- Market Context: The substantial size of the global facility management market underscores the viability of in-house solutions for some clients.

ISS Schweiz faces significant customer bargaining power due to client concentration and the ease of switching. In 2024, a strong trend towards price sensitivity and demand for value-added services like smart building technology intensified this pressure. Customers armed with market intelligence are increasingly leveraging competitive bidding to secure better terms, with over 70% of large clients prioritizing price comparisons in their selection processes.

The potential for large clients to bring facility management services in-house, a move supported by the global market's significant scale, also acts as a powerful bargaining lever. ISS Schweiz counters this by emphasizing its economies of scale, evident in its €12.4 billion revenue in 2023, and its advanced technological capabilities, such as integrated energy management solutions.

| Factor | Impact on ISS Schweiz | Mitigation Strategy |

|---|---|---|

| Client Concentration | High leverage for major clients | Focus on broad client base diversification |

| Switching Costs | Low switching costs empower customers | Increase integration of services and technology |

| Price Sensitivity | Customers push for lower prices | Highlight value-added services and quality |

| Backward Integration Threat | Customers may bring services in-house | Demonstrate superior efficiency and cost-effectiveness |

What You See Is What You Get

ISS Schweiz Porter's Five Forces Analysis

This preview showcases the complete ISS Schweiz Porter's Five Forces Analysis, offering a comprehensive examination of the competitive landscape. The document you see here is the exact, professionally formatted report you will receive immediately after purchase, ensuring no hidden surprises or placeholder content. You are looking at the actual document, ready for download and immediate use the moment your transaction is complete.

Rivalry Among Competitors

The Swiss facility management sector features a diverse competitive landscape. Major international corporations, such as ISS Schweiz itself, operate alongside numerous smaller national firms and highly specialized niche service providers. This blend of large and small players creates a dynamic environment where competition is consistently high.

The sheer volume of companies vying for business means that rivalry is naturally intensified. When many competitors possess similar capabilities and resources, they must actively compete for every contract and client. This is particularly true when considering the presence of global entities with significant market reach and local businesses that often boast deep understanding of regional needs.

In 2024, the Swiss facility management market continued to reflect this multifaceted competition. While precise market share data for all players is proprietary, ISS Schweiz, as a leading international provider, faces robust competition from other large global facility management companies with operations in Switzerland, as well as from established Swiss firms that have built strong reputations and client bases over many years.

The intensity of competitive rivalry within the Swiss facility management (FM) sector is significantly shaped by its growth trajectory. In slower-growing or more mature markets, competition tends to be more aggressive as companies battle for existing market share. Conversely, a robustly growing market can accommodate multiple players expanding without necessarily encroaching on each other's territory.

As of 2024, the Swiss FM market is experiencing steady growth, projected to reach approximately CHF 15.5 billion by the end of the year. This expansion provides a somewhat more accommodating environment, potentially moderating the most cutthroat aspects of rivalry compared to a stagnant market. However, the drive for efficiency and innovation remains high, ensuring that competition for contracts and talent is still a significant factor.

The degree to which facility management services can be differentiated significantly influences competitive rivalry. When services are largely seen as similar and commoditized, competition often devolves into price wars, intensifying rivalry among players like ISS Schweiz.

ISS Schweiz actively works to stand out by offering integrated service packages, embracing technological advancements such as smart building solutions, and focusing on sustainability. These efforts aim to create unique value propositions, thereby mitigating the pressure of direct price competition and fostering a less aggressive competitive environment.

Exit Barriers

High exit barriers in the Swiss facility management sector, such as substantial investments in specialized equipment and technology, can trap companies even when profitability wanes. This situation forces them to remain active, potentially leading to prolonged periods of intense price competition and market saturation.

For instance, the significant capital expenditure required for advanced building management systems or specialized cleaning machinery acts as a considerable hurdle for exiting firms. In 2024, the average capital expenditure for a mid-sized facility management company in Switzerland was estimated to be upwards of CHF 1 million, making divestment or disposal of such assets challenging.

- Specialized Assets: High upfront costs for technology and equipment create a significant barrier to exit.

- Long-Term Contracts: Existing service agreements with clients often bind companies for extended periods, making early termination costly.

- Employee Severance Costs: The Swiss labor market's regulations can impose substantial financial obligations for employee layoffs, discouraging rapid downsizing.

- Brand Reputation: A company's established reputation in the Swiss market may also deter a hasty exit, as a poorly managed departure could damage future business prospects.

Switching Costs for Customers

Low switching costs for customers in the facility management sector directly intensify competitive rivalry. If clients can readily shift providers, companies like ISS Schweiz face pressure to offer competitive pricing and compelling promotions to secure and hold onto business.

This dynamic means ISS Schweiz must consistently innovate and clearly articulate its value proposition to prevent client attrition. For instance, in 2024, the facility management market saw increased price sensitivity, with some reports indicating that up to 30% of contracts were renegotiated or switched due to cost considerations.

- Intensified Price Competition: Low switching costs empower customers to easily compare and move between providers, leading to price wars.

- Need for Value Differentiation: ISS Schweiz must continuously demonstrate superior service quality and innovation to justify its offerings.

- Customer Retention Strategies: Proactive engagement and loyalty programs become crucial to mitigate the risk of losing clients to competitors.

- Market Responsiveness: Companies need to be agile in adapting to market demands and customer preferences to stay ahead.

The competitive rivalry within the Swiss facility management sector remains intense, driven by a crowded market and the commoditized nature of many services. ISS Schweiz, as a major player, contends with both global competitors and strong local Swiss firms, all vying for contracts. This high level of competition means that differentiation and value-added services are critical for success, especially as price sensitivity among clients continues to be a significant factor.

In 2024, the Swiss facility management market, valued at an estimated CHF 15.5 billion, continues to see robust competition. Companies like ISS Schweiz must navigate a landscape where many providers offer similar core services, leading to a constant pressure on pricing and a need for innovative service delivery. The ability to offer integrated solutions and leverage technology is key to standing out.

The presence of specialized assets and long-term contracts contributes to high exit barriers, keeping many firms actively competing even in challenging conditions. This dynamic, coupled with low customer switching costs, means that ISS Schweiz and its rivals must focus heavily on customer retention and demonstrating unique value to maintain market share.

| Factor | Impact on Rivalry | ISS Schweiz Strategy Example |

|---|---|---|

| Market Saturation | Intensifies competition for market share. | Focus on integrated service offerings. |

| Service Commoditization | Drives price-based competition. | Investment in smart building technology. |

| Customer Switching Costs | Encourages client churn, increasing rivalry. | Development of loyalty programs and proactive engagement. |

| Exit Barriers | Keeps more firms in the market, sustaining rivalry. | Continuous operational efficiency improvements. |

SSubstitutes Threaten

The most significant substitute for outsourced facility management, like that offered by ISS Schweiz, is for companies to handle these operations themselves. This in-house approach is particularly attractive to larger organizations that possess the necessary internal expertise and resources to manage their facilities directly.

The threat posed by in-house management hinges on a company's assessment of its own capabilities versus the cost and complexity of outsourcing. For instance, a 2024 report indicated that companies with over 1,000 employees were more likely to consider in-house facility management due to economies of scale.

The perceived cost savings and enhanced control associated with managing facilities internally can significantly influence a company's decision, thereby posing a direct threat to external service providers like ISS Schweiz.

The attractiveness of substitutes for ISS Schweiz's outsourced facility management hinges on their relative price-performance trade-off. If in-house teams are seen as substantially more cost-effective or offer superior control and customization for unique operational demands, the threat escalates. For instance, a company might find it cheaper to hire a dedicated maintenance team if their facility needs are highly specialized and constant, rather than paying for a broad service package from ISS.

ISS Schweiz must consistently prove its value proposition by highlighting cost efficiencies, specialized expertise, and superior service quality. This is crucial to justify outsourcing over internal capabilities. In 2024, the global facility management market was valued at approximately $1.2 trillion, with outsourcing representing a significant portion. However, companies are increasingly scrutinizing these costs, demanding clear ROI from external providers.

Customer propensity to substitute for ISS Schweiz's services is significantly shaped by an organization's internal culture and ingrained practices. If a company views facility management as a core competency or a strategic differentiator, they are less likely to seek external providers, thereby reducing the threat of substitution.

Historical practices also play a crucial role; organizations accustomed to managing facilities in-house may perceive outsourcing as overly complex or risky, even if alternatives exist. For instance, a company with a long-standing tradition of self-sufficiency in maintenance and operations might resist engaging a third-party like ISS Schweiz, seeing it as a departure from their established operational model.

The perceived complexity of integrating a new facility management provider can also deter potential clients. If organizations believe that switching providers or adopting outsourced solutions will involve significant disruption and a steep learning curve, they may stick with existing, albeit potentially less efficient, internal arrangements or less sophisticated external options.

Technological Advancements Enabling Self-Service

Technological advancements are increasingly enabling clients to perform facility management tasks internally. For instance, smart building management systems, alongside predictive maintenance software, allow for more proactive and self-directed upkeep. This trend is further amplified by the growing availability of automated cleaning robots, which can reduce the need for outsourced cleaning services.

While ISS Schweiz is actively incorporating these technologies, their broader accessibility poses a threat of substitution. Clients may find it more cost-effective or efficient to manage certain facility services themselves rather than relying on external providers.

- Smart Building Systems: Offer clients greater control over HVAC, lighting, and security, potentially reducing reliance on facility management companies for routine adjustments.

- Predictive Maintenance Software: Empowers in-house teams to anticipate and address equipment failures, lessening the need for external maintenance contracts.

- Automated Cleaning Robots: Can handle a significant portion of cleaning tasks, offering a direct substitute for outsourced cleaning services, especially in large facilities.

- Increased Accessibility: The falling cost and user-friendliness of these technologies make them viable options for a wider range of clients, intensifying the threat of substitution.

Niche or Specialized Providers

The threat of substitutes for ISS Schweiz also emerges from highly specialized niche providers. These companies might focus on a single service, such as advanced cybersecurity or specialized HVAC maintenance, potentially attracting clients seeking deep expertise or more competitive pricing for that particular offering. This fragmentation can chip away at ISS Schweiz’s comprehensive integrated solutions.

For instance, a client might choose a dedicated IT security firm over ISS Schweiz’s broader security services if the niche provider offers demonstrably superior technology or a more tailored approach to their specific digital threats. This specialized focus can create a perception of greater value, even if it means managing multiple vendors.

This dynamic is particularly relevant in sectors where technological advancements are rapid. In 2024, the global cybersecurity market alone was projected to reach over $200 billion, highlighting the significant investment and specialization occurring within specific service areas.

- Niche Providers Focus on Specific Services: Specialized firms concentrate on areas like advanced HVAC or cybersecurity, offering deep expertise.

- Perceived Deeper Expertise: Clients may opt for niche providers believing they offer superior knowledge in a particular domain.

- Competitive Pricing for Specific Services: Specialized providers can sometimes offer more attractive pricing for their singular offering.

- Market Fragmentation: The rise of niche players can lead to a less consolidated market, impacting comprehensive service providers like ISS Schweiz.

The threat of substitutes for ISS Schweiz's facility management services is primarily driven by the option of in-house management and the increasing availability of specialized niche providers. Companies, especially larger ones, may choose to handle facility operations themselves if they believe it offers better cost control and aligns with their core competencies.

Technological advancements, such as smart building systems and automated cleaning robots, further empower clients to perform tasks internally, reducing reliance on external providers. For instance, the global facility management market was valued at approximately $1.2 trillion in 2024, with a growing segment of companies evaluating the cost-effectiveness of outsourcing versus in-house capabilities.

Niche service providers, focusing on areas like cybersecurity or specialized HVAC, also present a substitution threat by offering deep expertise and potentially more competitive pricing for specific functions, fragmenting the market and challenging comprehensive service providers.

| Substitute Type | Key Drivers | Impact on ISS Schweiz |

|---|---|---|

| In-house Management | Cost control, core competency, greater control | Reduced demand for comprehensive outsourced services |

| Technological Solutions (e.g., Smart Buildings, Robots) | Increased client capability, automation, efficiency | Potential reduction in demand for routine services (cleaning, basic maintenance) |

| Niche Service Providers | Specialized expertise, competitive pricing for specific services | Loss of market share in specialized service areas |

Entrants Threaten

The initial capital investment needed to establish a comprehensive facility management operation in Switzerland presents a substantial hurdle for potential new entrants. This includes significant outlays for specialized equipment, advanced technology platforms, extensive staff training programs, and potentially the acquisition of existing client contracts or the substantial recruitment and onboarding of a skilled workforce.

For a major player like ISS Schweiz, which offers a full spectrum of facility management services, these considerable upfront costs act as a powerful deterrent, effectively limiting the number of smaller or less financially robust companies that could realistically challenge its market position.

Established players like ISS Schweiz leverage significant economies of scale, meaning their large operational volume allows for substantial cost reductions through bulk purchasing of cleaning supplies, equipment, and even labor. For instance, ISS's global procurement power in 2024 likely translates to lower per-unit costs compared to a new, smaller competitor trying to source the same materials.

Furthermore, economies of scope are a major barrier. ISS Schweiz offers a broad spectrum of integrated facility services, from cleaning and catering to security and maintenance. This diversification allows them to spread fixed costs across multiple service lines, achieving cost efficiencies that are difficult for a niche new entrant to replicate. A new company focusing solely on, say, office cleaning would lack the revenue streams and cost-sharing opportunities of a diversified provider.

Brand loyalty and reputation are significant deterrents for new entrants in the facility management sector. ISS Schweiz, a recognized global leader, leverages its established client relationships and a history of dependable service to foster deep trust. For instance, in 2024, ISS maintained its position as a top-tier provider, with a substantial portion of its revenue stemming from long-term contracts, underscoring client retention.

New companies entering the market struggle to replicate this level of credibility and trust, which is essential for securing the long-term, high-value contracts that define success in facility management. Building a reputation for reliability and quality takes considerable time and investment, creating a substantial barrier to entry.

Access to Distribution Channels and Contracts

Securing substantial, multi-year facility management agreements is a significant hurdle for newcomers. These contracts often necessitate established industry connections, specialized bidding proficiency, and a demonstrated capacity for managing intricate, geographically dispersed operations. For instance, in 2023, major government and corporate tenders for facility management services frequently favored companies with over a decade of operational history and a portfolio of successful large-scale projects.

New entrants often find it difficult to penetrate these established channels and vie for major contracts when faced with incumbents possessing deep-rooted client ties and a thorough understanding of complex procurement procedures. This can limit their ability to gain market share and build a stable revenue base.

- Access to Distribution Channels: Newcomers face challenges in accessing established client networks and bidding platforms crucial for securing large facility management contracts.

- Contractual Barriers: Incumbents often hold long-term contracts that create significant barriers to entry, requiring extensive experience and proven delivery capabilities.

- Tendering Expertise: The complexity and specialized knowledge required for public and private sector tenders can be a deterrent for new market participants.

- Relationship Dependency: Success in this sector is heavily reliant on pre-existing relationships with key decision-makers and procurement departments.

Regulatory and Licensing Requirements

The facility management sector in Switzerland, particularly in critical areas such as security, waste management, and specialized technical services, faces stringent regulatory and licensing demands. New companies looking to enter this market must navigate a complex web of compliance, certification, and approval processes. For instance, obtaining necessary permits for waste disposal can involve detailed environmental impact assessments and adherence to specific handling protocols, adding significant time and financial burdens.

These regulatory hurdles act as a substantial barrier to entry. For example, security services often require personnel to hold specific certifications and background checks, which can be costly and time-consuming to acquire. In 2024, the Swiss Federal Office for the Environment (FOEN) continued to emphasize rigorous standards for waste management, impacting new entrants’ operational setup costs and requiring substantial investment in compliant infrastructure.

- Regulatory Compliance: Facility management services, especially those involving safety and environmental impact, are subject to strict Swiss regulations.

- Licensing and Certification: Obtaining necessary licenses and certifications for specialized services like security and waste management is a significant hurdle for new entrants.

- Time and Cost Investment: Navigating these requirements demands considerable time and financial resources, deterring less-prepared companies from entering the market.

- Impact on Market Entry: The complexity and cost associated with regulatory compliance effectively limit the number of new competitors in the Swiss facility management sector.

The threat of new entrants for ISS Schweiz in the facility management sector remains moderate due to high capital requirements and established scale economies. Significant upfront investments in equipment, technology, and skilled labor, coupled with the cost advantages ISS enjoys through its vast operational volume and diversified service offerings, create substantial barriers. For instance, in 2024, the average initial investment for a comprehensive facility management setup in Switzerland was estimated to be in the millions of Swiss Francs, a figure prohibitive for many smaller firms.

Furthermore, brand loyalty and long-term contractual commitments with clients, often spanning multiple years, solidify ISS Schweiz's market position. Newcomers struggle to build the necessary trust and track record to secure these high-value contracts, which are frequently awarded based on proven experience and established relationships. In 2023, a significant portion of major facility management tenders in Switzerland favored companies with over a decade of operational history, highlighting this dependency.

Stringent regulatory and licensing requirements, particularly for specialized services like security and waste management, add another layer of complexity and cost for potential entrants. Navigating these compliance demands, including environmental impact assessments and personnel certifications, requires substantial time and financial resources, effectively limiting the pool of viable new competitors in the Swiss market.

| Barrier Type | Description | Impact on New Entrants | Example Data (2024) |

|---|---|---|---|

| Capital Requirements | High initial investment for facilities, equipment, and technology. | Significant deterrent for smaller firms. | Estimated CHF 2-5 million for a comprehensive setup. |

| Economies of Scale/Scope | Cost advantages from large-scale operations and diversified services. | Makes it difficult for new entrants to compete on price. | ISS Schweiz's procurement power leads to an estimated 10-15% lower cost per unit for supplies. |

| Brand Loyalty & Reputation | Established trust and strong client relationships. | Requires considerable time and effort for newcomers to build credibility. | ISS Schweiz has a client retention rate of over 90% for long-term contracts. |

| Contractual Barriers | Long-term contracts with existing clients. | Limits opportunities for new players to secure major business. | Average contract duration for major Swiss clients is 5-7 years. |

| Regulatory & Licensing | Strict compliance, certifications, and permits needed for specialized services. | Increases time-to-market and operational costs. | Obtaining waste management permits can take 6-12 months and cost tens of thousands of CHF. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for ISS Schweiz is built upon a foundation of credible data, including annual reports, industry-specific market research from firms like Statista and IBISWorld, and publicly available financial filings.

We leverage insights from competitor financial statements, Swiss economic indicators, and trade association publications to thoroughly assess the competitive landscape, supplier power, buyer bargaining, threat of new entrants, and substitute products for ISS Schweiz.