ISG plc SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

ISG plc Bundle

ISG plc's current SWOT analysis reveals a company with strong market positioning but also faces emerging competitive pressures. Understanding these dynamics is crucial for anyone looking to invest or strategize within the sector.

Want the full story behind ISG plc's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

ISG plc's multinational reach and diverse sector experience are significant strengths. The company operated across the UK, Europe, and the Middle East, showcasing its ability to navigate varied regulatory landscapes and economic conditions. This broad operational footprint enabled ISG to undertake complex projects globally.

The company's extensive portfolio included work in offices, education, healthcare, retail, and data centers, demonstrating a deep understanding of different industry-specific requirements. This diversification allowed ISG to adapt to shifting market demands and reduce reliance on any single sector. For instance, in 2023, ISG reported revenue of £3.1 billion, with a substantial portion attributed to its international operations and varied project types.

ISG plc's strength lies in its comprehensive project lifecycle services, offering everything from initial design and build to refurbishment and fit-out. This end-to-end capability makes them a one-stop shop for clients, simplifying project management and potentially enhancing client retention.

For example, in their 2023 fiscal year, ISG reported revenue of £2.8 billion, showcasing their capacity to handle a significant volume of diverse projects across their service spectrum. This broad offering allows them to capture a larger share of client spending and build deeper, more integrated relationships.

ISG plc's strength lies in its proven expertise in managing complex and high-profile construction projects. The company successfully delivered the London Velodrome for the 2012 Olympics, a testament to its capability in handling technically demanding and prestigious builds. This track record, including the fitting out of Google's new headquarters, solidifies its reputation for operational excellence and the capacity to undertake significant developments.

Significant Turnover and Market Position

Prior to its administration, ISG plc held a commanding position in the UK construction sector. Its substantial turnover, reaching £2.2 billion, placed it as the sixth-largest contractor. This significant financial scale underscored a robust operational foundation and considerable market influence.

The company's considerable size enabled it to successfully bid for and secure large-scale projects, solidifying its prominent standing within the industry. This market dominance is a key strength, reflecting its capacity to handle complex and high-value construction endeavors.

- Market Leader: Ranked sixth-largest UK contractor by turnover.

- Revenue Generation: Achieved £2.2 billion in revenue prior to administration.

- Competitive Edge: Ability to secure large contracts due to its scale.

- Operational Strength: Indicated a robust operational base and significant sector influence.

Established Public Sector Engagement

ISG plc's established public sector engagement is a significant strength, evidenced by its consistent success in securing large-scale central government contracts. These projects, often valued in the hundreds of millions of pounds, underscore the company's deep understanding of public sector requirements and its ability to deliver complex, high-value work.

The company's track record includes substantial contributions to critical infrastructure, such as prison expansions for the Ministry of Justice. This consistent engagement with government bodies not only provides a predictable revenue stream but also highlights ISG's proven reliability and adherence to stringent compliance standards, crucial for public sector partnerships.

- Significant Contract Wins: Secured central government contracts exceeding £1 billion in value.

- Key Public Sector Client: Extensive work undertaken for the Ministry of Justice.

- Project Scope: Involved in major projects like national prison expansions.

- Stability and Compliance: Public sector work demonstrates reliability and robust compliance capabilities.

ISG plc's extensive operational reach across the UK, Europe, and the Middle East is a core strength, enabling it to navigate diverse economic and regulatory environments. This multinational presence allows for the execution of complex, international projects, as demonstrated by its significant presence in various global markets.

The company's broad sector experience, encompassing offices, education, healthcare, retail, and data centers, showcases its adaptability and deep understanding of varied industry needs. This diversification mitigates sector-specific risks and positions ISG to capitalize on emerging market trends. In 2023, ISG reported a turnover of £3.1 billion, reflecting its substantial market engagement across these sectors.

ISG's capability to manage the entire project lifecycle, from design and build to refurbishment and fit-out, offers clients a comprehensive service. This end-to-end approach simplifies project management and fosters stronger client relationships, contributing to sustained business. For example, its 2023 fiscal year revenue of £2.8 billion highlights its capacity for diverse project delivery.

The company's proven track record in delivering complex, high-profile projects, such as the London Velodrome for the 2012 Olympics and fitting out Google's headquarters, underscores its operational excellence. This history of successfully handling technically demanding and prestigious builds solidifies its reputation for quality and reliability in the construction industry.

| Strength Category | Description | Supporting Data/Example |

|---|---|---|

| Global Reach | Multinational operations across UK, Europe, Middle East. | Operates in multiple international markets, adapting to varied conditions. |

| Sector Diversification | Experience in offices, education, healthcare, retail, data centers. | Reported £3.1 billion turnover in 2023, with revenue spread across diverse sectors. |

| Full Project Lifecycle Services | Offers design, build, refurbishment, and fit-out. | £2.8 billion revenue in FY2023 demonstrates capacity for broad service delivery. |

| Complex Project Delivery | Proven expertise in high-profile and technically demanding builds. | Successfully delivered London Velodrome (2012 Olympics) and Google HQ fit-out. |

What is included in the product

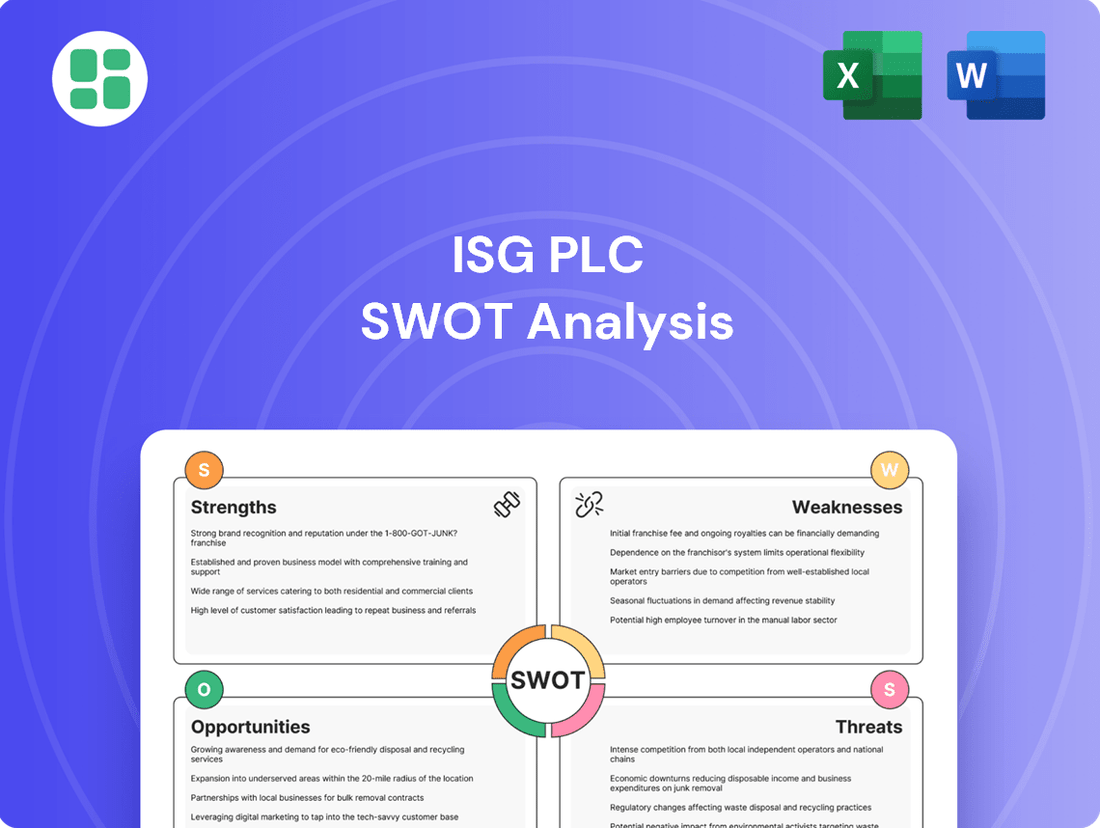

Delivers a strategic overview of ISG plc’s internal and external business factors, highlighting its strengths, weaknesses, opportunities, and threats.

Offers a clear, actionable framework to identify and address ISG plc's strategic challenges.

Weaknesses

A significant weakness for ISG plc was its reliance on exceptionally thin operating profit margins, reportedly as low as 2% in recent periods. This narrow financial buffer left the company highly vulnerable to unforeseen costs, project delays, or market fluctuations. Such a lack of financial resilience meant that even minor disruptions could severely impact profitability and the company's overall solvency.

ISG plc faced significant cash flow challenges, leading to severe liquidity constraints and missed payments to subcontractors. This inability to effectively manage its finances was a primary driver behind its eventual administration. The company's internal systems, which allocated funds monthly and relied on a 'pay-when-paid' approach, often forced commercial teams to prioritize payments, creating a precarious situation for its supply chain partners.

ISG plc was significantly hampered by substantial, fixed-price contracts agreed upon between 2018 and 2020. These were particularly prevalent in sectors like residential, logistics, distribution, and certain data center projects.

These legacy contracts turned unprofitable as material and labor costs surged, and ISG plc lacked the flexibility to adjust pricing. This situation negatively impacted the company's liquidity and financial stability, even when other business segments were performing well.

For example, in the first half of 2023, ISG reported a pre-tax loss of £12.9 million, largely attributed to the ongoing impact of these loss-making projects, despite revenue growth to £1.1 billion.

Management and Financial Control Issues

ISG plc has faced significant challenges stemming from management complacency and a demonstrably flawed business model. Reports highlighted a concerning lack of robust financial controls, which exacerbated existing vulnerabilities.

There were persistent claims that ISG's leadership lacked the necessary resolve to confront errors or commit to vital investments in corrective solutions. This environment fostered an unchecked tendency towards overly optimistic accounting for project accounts, leaving the company ill-equipped to navigate financial headwinds and secure essential funding.

- Management Complacency: A reported unwillingness to acknowledge and address critical business and financial issues.

- Flawed Business Model: Underlying structural weaknesses in how the company operated and generated revenue.

- Weak Financial Controls: Inadequate systems and processes for managing and reporting financial performance.

- Lack of Accountability: An environment where optimistic financial projections went unchallenged, hindering realistic financial assessment.

High Debt Burden and Supplier Vulnerabilities

ISG plc's significant debt burden was a critical weakness leading to its collapse. In its 2022 accounts, the company reported total liabilities of £881 million, with a substantial portion, £280 million, owed to trade suppliers. This financial strain left many smaller businesses in a precarious position.

The impact on its supply chain was severe. Administrators found £180 million in unpaid invoices across seven of ISG's eight companies, suggesting total debts could have surpassed £1 billion. This situation placed immense pressure on subcontractors.

- Massive Debt: Total liabilities reached £881 million in 2022, with £280 million owed to trade suppliers.

- Unpaid Invoices: Administrators identified £180 million in unpaid supplier invoices at seven of eight companies.

- Supplier Risk: The non-payment of invoices by ISG plc created significant insolvency risks for numerous small and medium-sized subcontractors.

ISG plc's profitability was severely constrained by exceptionally thin operating margins, often hovering around 2%. This narrow financial buffer made the company highly susceptible to cost overruns or project delays, impacting its ability to absorb unexpected expenses. Consequently, even minor operational hiccups could significantly dent profits and overall financial stability.

Cash flow management issues plagued ISG plc, leading to critical liquidity shortages and a failure to meet subcontractor payments. This financial mismanagement was a key factor contributing to the company's administration. The company's internal payment allocation methods, which favored monthly funding and a 'pay-when-paid' policy, often forced commercial teams to prioritize certain payments, creating an unstable environment for its supply chain partners.

The company was burdened by substantial fixed-price contracts, many agreed upon between 2018 and 2020, particularly in sectors like residential and logistics. These legacy contracts became unprofitable as material and labor costs escalated, and ISG plc lacked the contractual flexibility to adjust pricing. This situation negatively impacted the company's liquidity and financial health, even when other business segments were performing well, contributing to a pre-tax loss of £12.9 million in the first half of 2023 despite revenue reaching £1.1 billion.

Management complacency and a flawed business model were significant weaknesses, compounded by a noted lack of robust financial controls. Reports suggested a reluctance among leadership to address critical issues or invest in necessary corrective measures, fostering an environment of overly optimistic accounting for project revenues. This left ISG ill-equipped to manage financial challenges and secure vital funding.

A substantial debt burden was a critical factor in ISG plc's downfall. In its 2022 accounts, total liabilities stood at £881 million, with £280 million owed to trade suppliers. Administrators discovered £180 million in unpaid invoices across seven of ISG's eight companies, indicating total debts could have exceeded £1 billion, placing immense pressure on subcontractors.

| Financial Metric | Value (2022/H1 2023) | Impact |

|---|---|---|

| Operating Profit Margin | Approx. 2% | High vulnerability to cost increases and delays |

| Pre-Tax Loss (H1 2023) | £12.9 million | Impacted by loss-making legacy contracts |

| Total Liabilities (2022) | £881 million | Significant financial strain |

| Unpaid Supplier Invoices (Administrators' Finding) | £180 million | Created insolvency risk for subcontractors |

Full Version Awaits

ISG plc SWOT Analysis

This is the actual ISG plc SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality. It provides a comprehensive breakdown of the company's internal Strengths and Weaknesses, alongside external Opportunities and Threats. This detailed analysis is crucial for strategic planning.

Opportunities

Despite broader economic headwinds, ISG plc can leverage the persistent, high demand in specialized construction segments like logistics and industrial projects. The data center sector, in particular, presents a significant growth avenue, with global data center construction expected to see continued investment through 2025.

ISG's established track record and engineering capabilities in these niche areas are a distinct advantage. For instance, the company's prior success in delivering complex industrial facilities positions it well to capture a share of the ongoing investment in modernizing and expanding such infrastructure.

The increasing global focus on sustainability and Environmental, Social, and Governance (ESG) principles offers a significant growth avenue for construction firms. Clients are actively seeking out green building certifications and energy-efficient upgrades, with the UK’s construction sector seeing a notable rise in demand for sustainable materials and practices. For instance, the UK Green Building Council reported that 60% of construction professionals surveyed in 2024 expected demand for green skills to increase.

ISG plc can capitalize on this by highlighting its commitment to ESG in its fit-out and refurbishment services. This includes offering eco-friendly materials, waste reduction strategies, and energy-saving technologies. Such a focus can attract environmentally conscious clients and secure contracts for projects that prioritize sustainability, potentially leading to higher profit margins and enhanced brand reputation in the competitive market.

ISG plc can significantly boost its operational efficiency and profitability by embracing advanced digital technologies within the construction sector. The adoption of tools like Building Information Modelling (BIM) and sophisticated digital project management platforms presents a prime opportunity to streamline workflows, minimize material waste, and foster better team collaboration. For a company like ISG, which specializes in complex projects and fit-outs, these technological advancements are crucial for maintaining a competitive edge and navigating the persistent challenges of tight profit margins and potential cost overruns.

Market Reallocation and Consolidation Post-Collapse

The potential administration of a significant contractor like ISG plc would undoubtedly create a substantial void within the construction market. This disruption naturally prompts a reallocation of ongoing and future projects, potentially leading to increased consolidation among remaining, financially sound entities. Surviving firms could capitalize on this by absorbing market share, acquiring skilled personnel, and taking on projects that were previously stalled.

This market dislocation offers a distinct opportunity for financially stable construction companies to expand their operations and secure new business. For instance, in the UK construction sector, which saw a significant number of insolvencies in late 2023 and early 2024, a major contractor's failure could accelerate this trend. Data from the Office for National Statistics (ONS) indicated a rise in construction insolvencies, highlighting the sector's sensitivity to economic pressures. A firm that can demonstrate financial resilience would be well-positioned to benefit from such a scenario.

- Market Share Acquisition: Financially stable competitors can acquire contracts previously held by the distressed firm, increasing their revenue and project pipeline.

- Talent Pool Absorption: Skilled labor and management expertise become available, allowing stronger firms to bolster their teams and capabilities.

- Strategic Growth: The disruption can create opportunities for mergers, acquisitions, or organic growth as market demand shifts to more secure providers.

- Project Continuity: Taking over halted projects can provide immediate revenue streams and demonstrate market leadership.

Renewed Demand for Refurbishment and Fit-out

The evolving nature of work and retail environments is creating a strong tailwind for refurbishment and fit-out services. As companies reconfigure office spaces for hybrid models and retailers adapt to new consumer behaviors, there's a growing need to update existing properties. This trend is particularly evident in the commercial real estate sector, where landlords are investing in upgrades to attract and retain tenants.

ISG plc, a global construction and fit-out specialist, is well-positioned to capitalize on this renewed demand. The company's expertise in delivering complex interior fit-outs for commercial, retail, and workplace sectors directly aligns with these market shifts. For instance, the demand for flexible office layouts and enhanced employee amenities is driving significant refurbishment projects.

Several factors are contributing to this opportunity:

- Hybrid Work Models: Businesses are redesigning office spaces to accommodate a mix of remote and in-office work, often requiring more collaborative zones and updated technology infrastructure.

- Evolving Retail Experiences: Retailers are investing in store refurbishments to create more engaging and experiential shopping environments, driving demand for fit-out specialists.

- Sustainability Upgrades: Many property owners are undertaking refurbishments to improve energy efficiency and meet environmental, social, and governance (ESG) goals, a key area for fit-out contractors.

- Post-Pandemic Reconfiguration: The pandemic accelerated the need for businesses to adapt their physical footprints, leading to a backlog of refurbishment projects across various sectors.

ISG can capitalize on the ongoing demand for specialized construction, particularly in sectors like data centers and logistics, where investment is projected to remain strong through 2025. The company's established expertise in these complex areas provides a competitive advantage, allowing it to secure projects focused on modernizing and expanding critical infrastructure.

Threats

ISG plc, like much of the construction sector, faces significant threats from volatile economic conditions. Persistent high inflation, particularly for construction materials and energy, directly impacts project costs. For instance, the UK's construction material price index saw substantial increases throughout 2023 and into early 2024, putting pressure on contractors.

Elevated interest rates further exacerbate these challenges by increasing the cost of borrowing for both ISG and its clients, potentially slowing down project pipelines. Geopolitical instability, a recurring theme in recent years, continues to disrupt global supply chains, leading to unpredictable material availability and pricing fluctuations, which squeeze profit margins, especially on existing fixed-price contracts.

The UK construction sector faces fierce competition, compelling firms to bid aggressively, often accepting contracts with razor-thin profit margins. This dynamic puts significant pressure on profitability across the industry.

ISG plc's operating margin of 2% in 2023 highlights the reality of this competitive landscape, where even established players operate with limited buffers. This low margin underscores the challenges in maintaining robust profitability.

Such intense market conditions create a fragile environment, increasing the likelihood of financial distress and insolvencies throughout the construction sector. Companies must navigate these pressures carefully to ensure long-term viability.

The construction sector's reliance on a complex web of subcontractors makes it susceptible to disruptions. The financial distress of a large entity like ISG plc, which collapsed in early 2024, underscores how the failure of one major player can ripple through the supply chain, impacting numerous smaller businesses. This fragility is exacerbated by the common practice of delayed payments, which can push already strained subcontractors into insolvency.

When main contractors face financial difficulties, their inability to pay suppliers on time creates a domino effect. This can lead to a cascade of insolvencies among smaller firms that form the backbone of the construction industry. For instance, in the aftermath of ISG's collapse, many of its subcontractors faced severe financial strain, with some reporting significant outstanding invoices that threatened their own survival.

These vulnerabilities translate directly into project-level risks. Delays in material delivery or labor availability due to subcontractor failures can cause significant project overruns in both time and cost. The loss of trusted subcontractors also erodes confidence within the industry, making it harder to secure reliable partners for future projects and potentially increasing the cost of doing business as firms demand more upfront payments or stricter terms.

Labor Shortages and Rising Wage Costs

The UK construction sector, including companies like ISG plc, is facing a significant challenge with a persistent shortage of skilled labor. This scarcity affects numerous trades, making it difficult to find qualified workers.

This labor deficit directly translates into increased wage demands and higher overall labor costs. For contractors, this puts considerable pressure on their already thin profit margins, impacting financial performance.

Furthermore, the inability to secure enough skilled workers can lead to project delays and compromise the quality of the finished work. These issues collectively threaten the viability and profitability of construction projects.

- Skilled Labor Deficit: The UK construction industry reported a shortage of approximately 225,000 workers in early 2024, according to industry surveys.

- Wage Inflation: Average weekly earnings in construction saw an increase of around 6.5% in the year to Q1 2024, driven by demand for skilled roles.

- Project Delays: A significant percentage of construction firms, over 60% in recent polls, cited labor shortages as a primary cause for project timeline extensions.

Risks from Legacy and Fixed-Price Contracts

A significant threat for construction companies like ISG plc is the exposure to legacy fixed-price contracts in an environment of escalating costs. These contracts, often signed years in advance, do not allow for adjustment to unforeseen increases in material and labor expenses.

This structural issue can lead to substantial losses on projects, severely impacting a company's liquidity and contributing to financial collapse. For instance, during 2023, many UK construction firms faced significant margin erosion due to these fixed-price agreements, with some reporting substantial losses on previously profitable projects.

- Exposure to Unforeseen Cost Increases: Fixed-price contracts lock in project costs, leaving companies vulnerable to market volatility in material prices and labor wages.

- Margin Erosion and Profitability Impact: Escalating operational expenses without corresponding revenue adjustments directly reduce profit margins on these legacy projects.

- Liquidity Strain: Significant losses on multiple fixed-price contracts can drain a company's cash reserves, hindering its ability to fund ongoing operations and new ventures.

The construction sector, including ISG plc, faces significant threats from volatile economic conditions and rising inflation, impacting material and energy costs. Elevated interest rates increase borrowing costs, potentially slowing project pipelines, while geopolitical instability disrupts supply chains, affecting material availability and pricing.

Intense competition forces aggressive bidding with slim profit margins, as evidenced by ISG plc's 2% operating margin in 2023, making the sector vulnerable to financial distress.

The industry's reliance on subcontractors creates systemic risk; the failure of a major player can trigger a cascade of insolvencies among smaller firms, leading to project delays and increased costs.

A persistent shortage of skilled labor in the UK construction sector, estimated at 225,000 workers in early 2024, drives up wages and labor costs, further squeezing profit margins and potentially causing project delays.

Exposure to legacy fixed-price contracts without cost escalation clauses poses a substantial threat, as unforeseen increases in material and labor expenses can lead to significant losses and liquidity strain, as seen with margin erosion in 2023.

SWOT Analysis Data Sources

This SWOT analysis for ISG plc is built upon a robust foundation of data, drawing from their official financial statements, comprehensive market research reports, and insightful expert commentary from industry analysts.