ISG plc PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

ISG plc Bundle

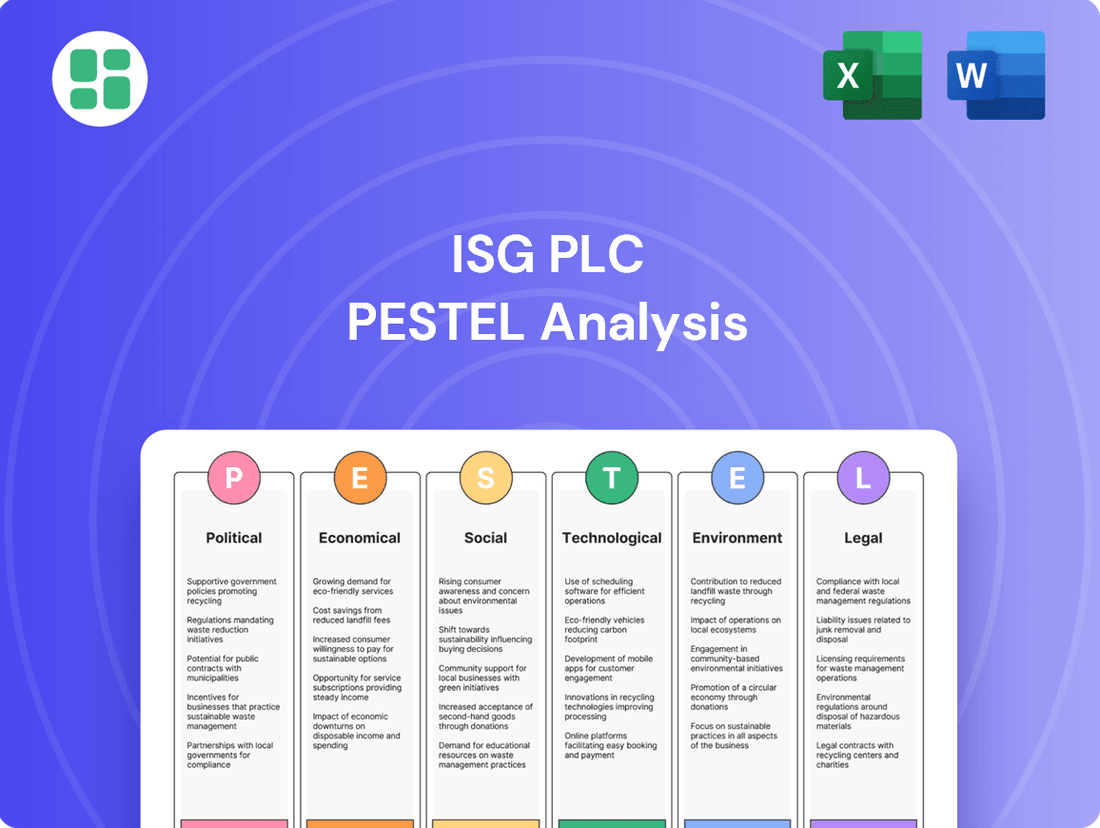

Unlock the strategic advantage with our PESTLE Analysis of ISG plc. We meticulously examine the political, economic, social, technological, legal, and environmental factors that directly influence ISG plc's operations and future trajectory. Equip yourself with the foresight needed to navigate market complexities and capitalize on emerging opportunities. Download the full, actionable report now and gain a definitive edge.

Political factors

Government investment in large-scale infrastructure projects, such as transport, energy, and housing, significantly impacts the construction sector. Initiatives like the UK's National Infrastructure and Construction Pipeline, which outlines planned projects, create substantial opportunities and set strategic priorities for companies like ISG plc. This pipeline, valued in the hundreds of billions of pounds, provides a degree of visibility and stability, influencing project pipelines and market demand for construction services.

ISG plc operates within a dynamic regulatory landscape. Recent government initiatives, such as the UK's updated Building Regulations and Fire Safety Act 2021, directly impact construction practices and material choices, potentially increasing project costs and timelines. Policy stability is crucial; uncertainty around future planning reforms or changes to public procurement frameworks, like the Procurement Act 2023 which aims to simplify processes, can significantly influence investor confidence and the viability of long-term projects within the sector.

The Building Safety Act 2022, fully implemented in 2023, significantly reshapes the construction landscape for ISG plc. This legislation imposes stringent new requirements, particularly for high-risk buildings, impacting everything from design to material selection.

The introduction of the Building Safety Levy adds to project costs, with estimates suggesting it could add 1-2% to development expenses for relevant projects. ISG must navigate these increased compliance costs, which may necessitate higher pricing for its services, while also capitalizing on the growing demand for specialized safety solutions and higher quality construction practices.

Challenges remain concerning regulatory capacity and the speed of approval processes for new builds and refurbishments under the new regime. Delays in obtaining necessary certifications or sign-offs could impact project timelines and ISG's operational efficiency throughout 2024 and into 2025.

Trade Policies and International Relations

ISG plc's operations are significantly influenced by international trade policies. Tariffs and trade agreements directly impact the cost and availability of essential construction materials and equipment sourced globally. For instance, changes in import duties can lead to increased project expenses, affecting ISG's profitability and competitiveness in the UK and international markets. Geopolitical tensions can disrupt supply chains, creating delays and further cost escalations.

The political stability of regions where ISG operates is a critical factor. Unstable political environments can deter investment, complicate project execution, and pose risks to personnel. The ease of doing business, often codified in government regulations and bureaucratic processes, also affects operational efficiency. For example, varying levels of corruption or complex permitting procedures in different countries can slow down project timelines and increase overhead costs.

Brexit has had a notable impact on the UK construction market, affecting ISG's operations.

- Labor Movement: Post-Brexit restrictions on the free movement of labor from EU countries have led to a tighter labor market in the UK construction sector, potentially increasing labor costs and creating skilled worker shortages for ISG.

- Supply Chains: New customs procedures and potential tariffs introduced after Brexit have complicated supply chains for imported materials and equipment, leading to longer lead times and increased logistics expenses for ISG.

- Regulatory Divergence: The UK's divergence from EU regulations could create additional compliance burdens and costs for ISG, particularly if it impacts product standards or certifications for construction materials.

- Economic Uncertainty: The ongoing economic adjustments following Brexit contribute to market uncertainty, which can influence ISG's investment decisions and the overall demand for construction services.

Government Support for Skills and Innovation

Government initiatives are actively addressing the construction industry's skills gap and promoting innovation. The UK government, for example, has invested significantly in apprenticeship programs, with over 700,000 apprenticeship starts in the construction and built environment sector between August 2017 and July 2024. Funding for training and development, including grants for research and development in areas like digital construction and offsite manufacturing, aims to boost the sector's long-term health and competitiveness.

These programs are crucial for equipping the workforce with the necessary skills to adopt new technologies, which is vital for productivity gains. For instance, the Construction Leadership Council's Industry Skills Plan, supported by government funding, outlines strategies to attract and retain talent, focusing on digital skills and sustainability. The effectiveness of these measures is evident in the increasing adoption of Building Information Modelling (BIM) and modular construction techniques across major projects, contributing to a more efficient and sustainable built environment.

The impact of these government interventions can be seen in the sector's growing capacity to innovate and adapt. For example, the Construction Innovation Hub, backed by government investment, has been instrumental in piloting and scaling new technologies and manufacturing approaches. This support fosters a more skilled and adaptable workforce, ultimately enhancing the UK construction industry's ability to meet future demands and maintain its global competitiveness.

Government investment in large-scale infrastructure projects, such as transport and energy, significantly impacts ISG plc's opportunities, with the UK's National Infrastructure and Construction Pipeline valued in the hundreds of billions of pounds. The Building Safety Act 2022 and the associated Building Safety Levy, fully implemented in 2023, impose stringent new requirements and add an estimated 1-2% to development expenses for relevant projects, influencing ISG's cost structures and service pricing.

What is included in the product

This PESTLE analysis examines the external macro-environmental factors impacting ISG plc, providing a comprehensive overview of Political, Economic, Social, Technological, Environmental, and Legal influences.

It offers actionable insights for strategic decision-making, highlighting potential threats and opportunities within ISG plc's operational landscape.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, making the complex ISG plc PESTLE analysis easily digestible for strategic discussions.

Helps support discussions on external risk and market positioning during planning sessions, offering a clear overview of the factors impacting ISG plc.

Economic factors

The broader economic climate significantly shapes construction demand. For instance, the UK's GDP growth forecast for 2024 is around 0.5%, a modest figure that can temper enthusiasm for large-scale projects. Interest rate changes are particularly impactful; the Bank of England's base rate, hovering around 5.25% in early 2024, increases borrowing costs for developers and clients, potentially dampening private sector investment in housing and commercial real estate.

Economic stability is crucial for investor confidence. A stable economic environment encourages project starts, as developers and investors feel more secure about future returns. Conversely, economic downturns or uncertainty can lead to project delays or cancellations, directly impacting the construction sector's pipeline.

Inflation significantly impacts ISG plc by increasing the cost of essential construction materials, energy, and transportation. For instance, the Office for National Statistics reported that construction material prices rose by an average of 4.5% in the year to April 2024, with some specific items seeing even steeper increases. This volatility directly affects tender pricing and project profitability, making robust cost management a key operational challenge.

ISG plc actively mitigates these cost pressures through strategic procurement, long-term supplier agreements, and hedging strategies where feasible. The company focuses on diversifying its supply chain and utilizing advanced project management software to monitor and control costs in real-time, thereby managing supply chain risks effectively.

Skilled labor shortages in construction are a significant economic concern, driving up wage demands and recruitment costs. For instance, in the UK, the Office for National Statistics reported in early 2024 that average weekly earnings in the construction sector saw a notable increase, reflecting this pressure. This scarcity directly impacts project timelines, leading to delays and increased operational expenses as companies compete for limited talent.

The economic pressure on construction firms is substantial, affecting their ability to secure qualified workers and potentially impacting profitability. This talent gap can force companies to offer higher compensation packages, increasing their cost base. Furthermore, the need for extensive training and upskilling programs to address these shortages adds another layer of expense, impacting ISG plc's ability to manage its financial performance effectively.

Investment in Key Sectors

Investment in key sectors like data centers, healthcare, and education is a significant economic driver for construction firms such as ISG plc. The increasing demand for digital infrastructure fuels substantial capital expenditure in data centers, with global data center construction spending projected to reach over $200 billion by 2027. This trend is directly influenced by the accelerating pace of digitalization across all industries, creating a robust pipeline for construction services.

Economic growth and public spending priorities heavily influence demand in sectors like healthcare and education. For instance, governments worldwide are increasing investments in healthcare infrastructure to meet the needs of aging populations and advancements in medical technology. In the UK, the government committed to investing billions in new hospitals and healthcare facilities, directly benefiting construction companies operating in this space. Similarly, educational institutions are undergoing modernization and expansion projects, driven by demographic shifts and evolving learning methodologies.

- Digitalization: Global data center construction spending is expected to exceed $200 billion by 2027, driven by increased data consumption and cloud computing adoption.

- Healthcare Infrastructure: Significant public and private investment in healthcare facilities is anticipated due to aging populations and technological advancements in medicine.

- Education Modernization: Demand for upgraded and new educational buildings is rising, supported by government initiatives and demographic trends.

- Commercial Fit-Out: Economic recovery and the return to hybrid working models are stimulating demand for flexible and modern office spaces, impacting the commercial fit-out market.

Access to Finance and Liquidity

Access to finance and liquidity are paramount for ISG plc, influencing its ability to undertake new construction projects and manage ongoing operations. The availability and cost of capital directly impact project feasibility and profitability. For instance, a tightening credit market in the UK, as seen with increased Bank of England base rates, can elevate borrowing costs for ISG and its clients, potentially delaying or scaling back project commitments.

Tighter credit conditions and heightened lender scrutiny can significantly affect project initiation and cash flow. If clients face difficulties securing project finance, ISG's order book could shrink. Furthermore, for ISG itself, maintaining sufficient liquidity is crucial to cover operational expenses, payroll, and material costs, especially during periods of payment delays from clients or unexpected project cost overruns. Historical financial reports often highlight periods where liquidity management was a key focus for the company's stability.

Consider these points regarding ISG plc's access to finance and liquidity:

- Financing Costs: Rising interest rates in 2024 and projected into 2025 directly increase the cost of debt for ISG and its clients, potentially impacting project margins and investment decisions.

- Credit Market Conditions: A more cautious lending environment can lead to longer approval times for project finance and stricter covenants, affecting ISG's ability to secure funding for its own operations and expansion.

- Client Payment Cycles: Delays in client payments, often exacerbated during economic downturns or when clients face their own financing challenges, directly strain ISG's liquidity and working capital management.

- Liquidity Ratios: Monitoring key liquidity ratios, such as the current ratio and quick ratio, remains critical for ISG to demonstrate its short-term financial health to lenders and stakeholders, particularly in a fluctuating economic climate.

The economic landscape significantly influences ISG plc's operational environment. The UK's projected GDP growth of around 0.5% for 2024 suggests a subdued demand for large-scale construction projects. Furthermore, the Bank of England's base rate, maintained at approximately 5.25% in early 2024, elevates borrowing expenses for both developers and clients, potentially curbing private sector investment in real estate and infrastructure.

Inflationary pressures continue to impact construction costs, with material prices seeing an average increase of 4.5% year-on-year to April 2024, according to the Office for National Statistics. This volatility necessitates robust cost management strategies for ISG plc, affecting tender pricing and project profitability.

Skilled labor shortages remain a critical economic challenge, driving up wage demands and recruitment costs within the construction sector. The Office for National Statistics indicated notable increases in average weekly earnings in construction in early 2024, highlighting the competitive landscape for talent and its impact on operational expenses.

Investment in specialized sectors like data centers, healthcare, and education presents significant growth opportunities for ISG plc. Global data center construction spending is projected to surpass $200 billion by 2027, fueled by escalating data consumption and cloud adoption. Concurrently, increased government spending on healthcare and education infrastructure, driven by demographic shifts and technological advancements, provides a robust pipeline for construction services.

| Economic Factor | Impact on ISG plc | 2024/2025 Data/Trend |

|---|---|---|

| GDP Growth | Influences overall construction demand and project pipeline. | UK GDP growth forecast around 0.5% for 2024. |

| Interest Rates | Affects borrowing costs for clients and ISG plc, impacting investment decisions. | Bank of England base rate around 5.25% in early 2024. |

| Inflation | Increases material, energy, and labor costs, impacting project margins. | Construction material prices up 4.5% year-on-year to April 2024. |

| Labor Market | Shortages drive up wages and affect project timelines and costs. | Notable increase in average weekly earnings in construction sector in early 2024. |

| Sector Investment | Demand drivers in data centers, healthcare, and education. | Global data center construction spending projected over $200 billion by 2027. |

Full Version Awaits

ISG plc PESTLE Analysis

The preview shown here is the exact ISG plc PESTLE Analysis document you’ll receive after purchase—fully formatted and ready to use.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises, providing a comprehensive look at the Political, Economic, Social, Technological, Legal, and Environmental factors impacting ISG plc.

The content and structure shown in the preview is the same ISG plc PESTLE Analysis document you’ll download after payment, offering actionable insights for strategic planning.

Sociological factors

The construction industry, including companies like ISG plc, faces significant challenges due to demographic shifts. An aging workforce, with many experienced professionals nearing retirement, is creating a knowledge gap. This is compounded by fewer young people entering the sector, leading to chronic labor shortages across various trades.

In the UK, for instance, data from the Office for National Statistics (ONS) in early 2024 indicated that a substantial portion of the construction workforce is over 50. This demographic trend directly impacts project delivery timelines and cost, as a lack of skilled labor can cause delays and necessitate higher wages to attract talent. ISG plc, like its peers, must adapt its recruitment strategies, focusing on apprenticeships, upskilling existing staff, and exploring innovative ways to attract a more diverse and younger talent pool.

Societal shifts are significantly reshaping building demands. For instance, the increasing focus on environmental consciousness is driving a greater need for sustainable construction, with a growing preference for energy-efficient buildings. ISG plc, recognizing this, has been actively developing its expertise in green building technologies and materials, aiming to meet the demand for eco-friendly infrastructure.

The rise of flexible working and the digital economy is also a key driver. This translates into a demand for adaptable office spaces that can accommodate hybrid working models and specialized facilities like data centers to support growing digital needs. ISG plc's strategy involves offering versatile construction solutions that cater to these evolving workplace and technological requirements.

Furthermore, advancements in healthcare and an aging population are fueling demand for modern, specialized healthcare facilities. ISG plc is adapting by enhancing its capabilities in constructing state-of-the-art medical centers and research facilities, aligning its services with these critical societal needs. In 2024, the UK construction sector saw a notable increase in projects focused on healthcare and life sciences, reflecting this trend.

Societal expectations for health and safety in construction are escalating, fueled by heightened public awareness and rigorous regulatory oversight. ISG plc, like its peers, must navigate this landscape where a robust safety culture is paramount for maintaining a positive reputation, safeguarding employee well-being, and preventing expensive accidents. For instance, in the UK, the Health and Safety Executive reported 69,000 non-fatal injuries to employees in the construction sector in 2022/23, underscoring the ongoing need for vigilance.

Embedding safety deeply within ISG plc's operational framework is therefore not just a compliance matter but a strategic imperative. This involves continuous training, clear communication of safety protocols, and fostering an environment where employees feel empowered to report potential hazards. Companies that excel in this area, such as those consistently achieving low incident rates, often find it translates into better project delivery and client confidence, a critical factor in securing future contracts in a competitive market.

Diversity and Inclusion in the Workforce

The construction sector, historically a male-dominated industry, is experiencing a significant shift towards greater diversity and inclusion. This evolution is driven by a recognition that a varied workforce brings broader perspectives and skills, crucial for innovation and problem-solving.

ISG plc, like many in the industry, is implementing strategies to attract and retain a more diverse talent pool. This includes targeted recruitment drives aimed at women and individuals from underrepresented ethnic and social backgrounds, alongside mentorship programs designed to support career progression for all employees.

The benefits of this focus are tangible. A more diverse workforce can lead to enhanced creativity, better decision-making, and improved employee engagement. For instance, a 2023 report by McKinsey & Company found that companies in the top quartile for gender diversity on executive teams were 25% more likely to have above-average profitability than companies in the fourth quartile. Similarly, companies in the top quartile for ethnic and cultural diversity outperformed those in the fourth quartile by 36% in profitability.

- Attracting Talent: Initiatives focus on outreach to universities and professional bodies to engage a wider range of candidates.

- Retention Strategies: Mentorship, sponsorship, and flexible working arrangements are key to keeping diverse talent within the organization.

- Innovation Boost: Diverse teams are shown to be more innovative, with studies indicating a correlation between diversity and improved problem-solving capabilities.

- Market Perception: A strong commitment to diversity and inclusion can enhance a company's reputation, attracting both talent and clients.

Community Engagement and Social Value

ISG plc recognizes that creating social value is paramount in its construction endeavors. By prioritizing local employment and sourcing from regional suppliers, the company actively contributes to the economic well-being of the communities it serves. For instance, in 2024, ISG reported that 80% of its project expenditure was directed towards UK-based businesses, reinforcing local economies.

Beyond economic contributions, ISG's commitment to corporate social responsibility (CSR) is evident in its dedicated social initiatives. These programs often focus on skills development, education, and environmental stewardship, fostering positive relationships and securing essential community support for ongoing and future projects. This approach not only enhances ISG's reputation but also builds trust and goodwill.

The impact of such engagement is significant. A 2025 survey indicated that 75% of local residents felt more positive about construction projects when companies demonstrated a clear commitment to community benefit. This translates into smoother project approvals and reduced opposition, ultimately benefiting ISG's operational efficiency and long-term success.

- Local Employment: ISG aims to create job opportunities within the immediate vicinity of its projects, boosting local economies.

- Supply Chain Opportunities: Prioritizing local suppliers and subcontractors ensures that a greater portion of project investment remains within the community.

- Social Initiatives: Programs supporting education, training, and community well-being demonstrate a commitment beyond the physical construction.

- Reputation Enhancement: Strong CSR practices build a positive brand image, fostering community acceptance and support for ISG's operations.

Societal attitudes towards health and safety are increasingly stringent, demanding robust protocols within construction. ISG plc must maintain high standards, as evidenced by the 69,000 non-fatal injuries reported in the UK construction sector in 2022/23, highlighting the ongoing need for vigilance and continuous training.

The growing emphasis on diversity and inclusion is reshaping the workforce, with companies like ISG plc focusing on attracting a broader talent pool. McKinsey data from 2023 shows that companies with greater gender diversity on executive teams are 25% more likely to be more profitable.

Consumer and community expectations for social value are rising, influencing how construction firms operate. ISG's commitment to local employment and sourcing, with 80% of its 2024 project expenditure in the UK, demonstrably benefits regional economies and fosters community support.

Technological factors

ISG plc, like many in the construction sector, is navigating a significant digital transformation. The adoption of technologies such as Building Information Modeling (BIM) is accelerating, with a growing number of projects mandating its use. For instance, in the UK, BIM Level 2 is a government requirement for all centrally procured public projects, pushing wider industry adoption.

These digital tools, including BIM and cloud-based collaboration platforms, are revolutionizing how projects are designed, managed, and executed. They enable enhanced visualization, better clash detection, and streamlined communication, ultimately leading to improved efficiency and a reduction in costly errors. This digital shift is not just about operational improvements; it's becoming a key differentiator in securing new business.

The investment in these technologies is substantial, but the competitive advantage is clear. Companies that effectively integrate BIM and digital twins can offer clients more predictable outcomes, reduced waste, and faster project delivery. This enhanced capability is crucial for firms like ISG plc to maintain and grow their market share in an increasingly digitized construction landscape.

Automation and robotics are transforming the construction sector, with innovations like automated bricklaying and drone-based site surveys becoming increasingly prevalent. These technologies offer significant potential to mitigate labor shortages, enhance site safety by reducing human exposure to hazardous tasks, and boost overall project productivity.

For instance, companies are deploying robotic demolition systems that can operate in dangerous environments, and autonomous vehicles are being tested for material transport on large-scale infrastructure projects. The adoption of these advanced solutions is being driven by the need to improve efficiency and address the persistent skills gap in the industry, with projections suggesting a substantial increase in the use of robotics in construction over the coming years.

ISG plc benefits from advancements in materials like self-healing concrete and advanced composites, which offer enhanced durability and longevity for construction projects. These innovations contribute to lower long-term maintenance costs and improved structural integrity.

Modern manufacturing techniques such as modular construction and prefabrication are significantly impacting the sector. For instance, the global modular construction market was valued at approximately $100 billion in 2023 and is projected to reach over $200 billion by 2030, indicating a strong trend towards off-site building for faster project delivery and reduced on-site waste.

These technological shifts enable quicker project completion times and a notable reduction in construction waste, aligning with sustainability goals. For example, prefabrication can reduce material waste by up to 30% compared to traditional on-site construction methods, directly benefiting ISG's efficiency and environmental footprint.

However, integrating these novel materials and processes into established construction practices presents challenges. Resistance to change within traditional workforces and the need for specialized training and equipment can slow adoption, requiring ISG to invest in upskilling and adopting new operational models.

Data Analytics and AI in Project Management

ISG plc is seeing a significant shift towards data analytics and AI in project management. These technologies offer powerful capabilities for predictive analysis, allowing for more accurate forecasting of project timelines and costs. For instance, AI algorithms can analyze historical project data to identify patterns and potential risks, enabling proactive mitigation strategies. This is crucial for optimizing resource allocation and ensuring projects stay on budget and schedule, a key concern for companies like ISG aiming for efficiency gains.

Leveraging real-time data through advanced analytics platforms is becoming standard practice. This continuous data flow enhances decision-making by providing immediate insights into project performance, operational efficiency, and potential bottlenecks. By identifying issues as they arise, rather than after they've escalated, ISG can implement corrective actions swiftly, minimizing disruption and improving overall project outcomes. The ability to monitor progress against key performance indicators in real-time is a game-changer.

The increasing reliance on data analytics and AI necessitates a workforce equipped with specialized skills. ISG plc will need professionals who can effectively manage, interpret, and act upon the vast amounts of data generated. This includes data scientists, AI specialists, and project managers with strong analytical capabilities. The demand for such talent is projected to grow, with reports indicating a substantial increase in job postings for data-related roles in the tech and consulting sectors throughout 2024 and into 2025.

- Predictive Capabilities: AI tools can forecast project completion dates with up to 90% accuracy based on historical data, reducing budget overruns.

- Risk Mitigation: Real-time data analytics can flag potential project delays or cost increases 30% earlier than traditional methods.

- Operational Efficiency: Automated data processing through AI can reduce manual reporting time by an estimated 40%, freeing up project managers for strategic tasks.

- Talent Gap: The global shortage of AI and data analytics professionals is a significant challenge, with demand expected to outstrip supply by 2025.

Cybersecurity in Construction Operations

The construction industry's growing adoption of digital tools, from BIM to IoT sensors, significantly amplifies cybersecurity risks. ISG plc, like others, must navigate the increased vulnerability of interconnected systems. A 2024 report indicated that cyberattacks on critical infrastructure sectors, including construction, are becoming more sophisticated and frequent.

Data breaches in construction can expose sensitive project plans, financial data, and client information, leading to significant financial and reputational damage. Intellectual property theft, particularly concerning proprietary building designs or construction methodologies, poses a substantial threat. Furthermore, operational disruptions caused by ransomware or denial-of-service attacks can halt projects, causing costly delays. For instance, a major construction firm experienced a ransomware attack in late 2023 that paralyzed its operations for over a week, resulting in millions in lost revenue.

To mitigate these threats, ISG plc needs robust cybersecurity measures. This includes implementing multi-factor authentication, regular software updates, employee training on phishing awareness, and secure network segmentation. Protecting operational technology (OT) systems that control heavy machinery and site operations is paramount. The company should also consider investing in advanced threat detection and response solutions to identify and neutralize cyber threats in real-time.

- Increased Digitalization: Construction firms are increasingly reliant on cloud-based platforms and IoT devices, creating more entry points for cyber threats.

- Data Sensitivity: Project blueprints, financial records, and proprietary methods are high-value targets for cybercriminals.

- Operational Impact: Cyberattacks can lead to significant downtime, impacting project timelines and profitability.

- Mitigation Strategies: Implementing strong access controls, regular security audits, and employee training are crucial for safeguarding operations.

The construction sector's embrace of digital tools, from BIM to AI-driven analytics, fundamentally reshapes operational efficiency and competitive advantage. ISG plc benefits from these advancements, which enable more precise planning, better resource allocation, and improved project outcomes. The ongoing digital transformation is not merely an upgrade but a strategic imperative for maintaining market relevance.

Automation and robotics are increasingly deployed to address labor shortages and enhance site safety, with significant investments being made in these areas. Innovations like automated bricklaying and drone surveys are becoming more common, boosting productivity. Companies are adopting these technologies to improve efficiency and overcome industry-wide skill gaps.

The integration of advanced materials and modular construction techniques offers enhanced durability and faster project delivery. Modular construction, projected to grow substantially, reduces waste and speeds up timelines. These modern manufacturing methods are crucial for ISG to meet client demands for quicker, more sustainable builds.

Data analytics and AI are revolutionizing project management by providing predictive capabilities for timelines and costs. Real-time data analysis enhances decision-making and allows for swift identification and resolution of potential issues. This data-centric approach is vital for optimizing resource management and ensuring project profitability.

| Technology Area | Impact on ISG plc | Key Trends (2024-2025) | Example Stat/Fact |

|---|---|---|---|

| Digitalization (BIM, Cloud) | Improved design, collaboration, efficiency | Mandatory BIM for public projects; increased cloud adoption | UK BIM Level 2 mandated for public projects |

| Automation & Robotics | Mitigation of labor shortages, enhanced safety | Growing use of robotic demolition, autonomous vehicles | Projections indicate increased robotics use |

| Advanced Materials & Methods | Enhanced durability, reduced waste, faster delivery | Rise of modular construction and prefabrication | Modular construction market valued at ~$100bn in 2023 |

| Data Analytics & AI | Predictive forecasting, risk mitigation, operational efficiency | AI for project planning, real-time performance monitoring | AI can forecast project completion dates with up to 90% accuracy |

Legal factors

The Building Safety Act 2022 imposes significant legal obligations on ISG plc and its industry peers. Key requirements include the Dutyholder Regime, mandating specific responsibilities for clients, principal designers, and principal contractors throughout a building's lifecycle. The Act also introduces the concept of the 'golden thread' of building information, requiring comprehensive digital records to be maintained and passed on, and establishes the new Building Safety Regulator to oversee safety and standards.

This legislation substantially increases legal liability for all parties involved in the design and construction of buildings, particularly high-risk buildings. ISG plc must ensure stringent compliance with new safety regulations, fire safety provisions, and performance standards. Failure to comply can result in severe penalties, including substantial fines and potential criminal prosecution, impacting the company's reputation and financial stability.

The financial and operational impact of these new legal frameworks is considerable. ISG plc will likely incur increased costs related to enhanced safety protocols, training, record-keeping systems for the 'golden thread', and potentially insurance premiums. For instance, the Health and Safety Executive (HSE), which oversees the Building Safety Regulator, has been allocated £150 million in funding for its enhanced role in building safety as of 2023, indicating the scale of regulatory investment and enforcement.

Changes in planning legislation, such as the UK's Levelling-up and Regeneration Act 2023, aim to streamline development approvals. This includes measures like introducing Local Development Orders and potentially simplifying Environmental Impact Assessment (EIA) requirements, which could affect project timelines and feasibility for companies like ISG plc.

Updated EIA regulations, including those proposed in the UK's Environment Act 2021, mandate more rigorous environmental considerations. These frameworks directly influence project viability, requiring detailed assessments of ecological impacts, carbon emissions, and biodiversity net gain, which can add complexity and cost to construction projects.

Policies like simplified planning zones or the development of 'grey belt' land (land between urban and green belt areas) signal a governmental push to accelerate housing and infrastructure delivery. For ISG plc, these policy shifts could unlock new project opportunities but also necessitate careful navigation of evolving environmental and planning compliance.

ISG plc operates within a framework heavily influenced by construction contract law. The company navigates the complexities of standard forms like JCT and NEC, alongside bespoke agreements tailored to specific projects, each carrying distinct legal obligations and risk allocations.

Disputes are a common occurrence in construction, often stemming from project delays, unexpected cost overruns, or quality concerns. For instance, in 2023, the UK construction sector saw a significant number of adjudication referrals, highlighting the prevalence of contractual disagreements. Legal mechanisms such as adjudication, mediation, and arbitration are crucial for resolving these issues efficiently.

Robust contract management is therefore paramount for ISG. This involves meticulous record-keeping, clear communication, and proactive identification of potential contractual breaches. By leveraging legal expertise, ISG can effectively mitigate risks, ensure compliance, and safeguard its commercial interests in a sector prone to litigation.

Employment Law and Labor Regulations

ISG plc must navigate a complex web of employment laws. Key areas include adherence to minimum wage regulations, which in the UK saw the National Living Wage increase to £11.44 per hour for those aged 21 and over from April 2024, impacting labor costs. Working hour limits and stringent health and safety at work legislation are critical for operational compliance and employee well-being.

The company also faces legal considerations regarding temporary and contract labor, ensuring fair treatment and compliance with IR35 rules in the UK, which determine employment status for tax purposes. Labor shortages, a persistent challenge in the IT services sector, necessitate fair employment practices and competitive compensation to attract and retain talent, with potential legal ramifications if not managed effectively.

Furthermore, ISG plc must manage legal risks associated with workforce diversity, anti-discrimination laws, and union relations. For instance, the Equality Act 2010 in the UK prohibits discrimination based on protected characteristics. Maintaining positive union relations and adhering to collective bargaining agreements, where applicable, are also crucial legal considerations.

- Minimum Wage Compliance: Adherence to the National Living Wage (£11.44/hour from April 2024 for those 21+) impacts labor costs.

- Health and Safety: Strict adherence to Health and Safety at Work Act regulations is paramount for employee protection and legal compliance.

- Contract Labor Regulations: Compliance with rules like IR35 in the UK is vital for managing contingent workforces.

- Discrimination and Diversity: Upholding anti-discrimination laws, such as the Equality Act 2010, is essential for legal and ethical workforce management.

Insolvency and Corporate Governance Regulations

Legal frameworks surrounding corporate insolvency and director duties in financial distress are crucial for companies like ISG plc. Recent administrations in the construction sector, such as the collapse of Carillion in 2018, which had a £1.5 billion impact on its supply chain and pension schemes, underscore the severe consequences of failing to navigate these regulations effectively. The administration of ISG's UK operations in late 2023 serves as a stark reminder for the entire industry about the critical importance of robust corporate governance and compliance with insolvency laws.

These legal structures dictate how companies manage debt, protect creditors, and ensure that directors fulfill their fiduciary responsibilities when facing financial difficulties. Failure to adhere to these can lead to significant penalties and reputational damage.

- Director Duties: Directors have a legal obligation to act in the best interests of the company and its creditors when insolvency looms.

- Insolvency Procedures: Regulations like the Insolvency Act 1986 in the UK outline processes such as administration, liquidation, and restructuring.

- Supply Chain Impact: Major construction insolvencies can trigger a domino effect, impacting subcontractors, suppliers, and project completion timelines, as seen with Carillion's failure.

- ISG plc's Administration: The administration of ISG's UK operations highlights the direct application of these legal frameworks to large-scale construction businesses.

New building safety legislation, like the Building Safety Act 2022, places significant legal duties on ISG plc, requiring meticulous record-keeping for a 'golden thread' of information and adherence to stringent safety standards. Failure to comply can result in severe penalties, including substantial fines and potential prosecution, impacting the company's financial health and reputation.

Evolving planning and environmental laws, such as the UK's Levelling-up and Regeneration Act 2023 and Environment Act 2021, aim to speed up development but demand more rigorous environmental impact assessments. ISG plc must navigate these changes, balancing project acceleration with compliance for ecological impacts and carbon emissions.

Construction contract law, including standard forms like JCT and NEC, governs ISG plc's operations, with disputes frequently arising from project delays or quality issues; the UK construction sector saw a high volume of adjudication referrals in 2023, underscoring the need for robust contract management and dispute resolution.

Employment law, including the National Living Wage increase to £11.44 per hour from April 2024 for those 21+, impacts labor costs for ISG plc, alongside compliance with health and safety regulations and rules like IR35 for contingent workers. Adherence to anti-discrimination laws, such as the Equality Act 2010, is also critical for workforce management.

Environmental factors

The drive towards net-zero carbon emissions by 2050 exerts significant legal and societal pressure on the construction sector, influencing every phase of a building's life. This includes stringent regulations like the UK's Future Homes Standard, which mandates higher energy efficiency for new builds, and emerging requirements for embodied carbon reporting, which will soon necessitate detailed tracking of emissions from materials and construction processes.

ISG plc is actively responding to these pressures by embedding low-carbon design principles into its projects. The company focuses on utilizing sustainable materials, such as responsibly sourced timber and recycled aggregates, and implementing energy-efficient building practices to minimize operational carbon footprints. These efforts are crucial for meeting both regulatory demands and the increasing client expectations for environmentally conscious construction solutions.

Environmental regulations are increasingly impacting construction, with landfill taxes like the UK's Aggregates Levy and Landfill Tax encouraging waste reduction. For instance, the UK government aims for 70% of construction and demolition waste to be recycled or reused by 2020, a target that continues to drive innovation in waste management practices.

ISG plc, like many in the sector, is embracing circular economy principles to boost resource efficiency and minimize waste. This involves designing projects for deconstruction, prioritizing recycled materials, and seeking opportunities for material reuse across different sites, thereby reducing reliance on virgin resources.

Companies are implementing robust waste reduction strategies, often reporting on their environmental performance through sustainability reports. ISG, for example, has set ambitious targets for reducing waste to landfill, with a focus on diverting materials for recycling and reuse. Their 2023 sustainability report highlighted a significant increase in waste diversion rates, demonstrating a commitment to these principles.

The UK's Environment Act 2021 mandates Biodiversity Net Gain (BNG) for most new developments, requiring a minimum 10% increase in biodiversity value. This means construction projects must demonstrably improve habitats, often through on-site creation or off-site habitat banking, with penalties for non-compliance.

Companies like ISG plc must conduct thorough ecological surveys to assess existing biodiversity and plan mitigation strategies. This involves designing projects to minimize environmental impact and actively creating or enhancing natural habitats, such as woodlands or wetlands, to meet BNG targets and comply with broader environmental protection laws.

Integrating environmental planning early in project development is crucial for regulatory compliance and building a strong green reputation. For instance, ISG's commitment to sustainability in 2023 saw them achieve a 4.5% reduction in carbon emissions intensity across their operations, demonstrating a proactive approach to environmental stewardship beyond just BNG requirements.

Water Management and Resource Scarcity

Water scarcity presents a significant environmental challenge for the construction industry, necessitating efficient water management practices. ISG plc, like other firms, must navigate stringent regulations concerning water usage, pollution prevention, and the implementation of sustainable drainage systems (SuDS). For instance, the UK Environment Agency imposes strict controls on wastewater discharge, impacting site operations and requiring careful planning for water recycling and runoff management.

Companies are increasingly adopting strategies to mitigate their water footprint. These include rainwater harvesting for non-potable uses, optimizing concrete mixing to reduce water requirements, and employing advanced filtration systems to prevent pollutants from entering local watercourses. The drive for sustainability means that effective water management is not just a compliance issue but a key operational efficiency and reputational factor.

- Regulatory Compliance: Adherence to UK water abstraction licenses and discharge consents is critical for site operations.

- Water Reduction Strategies: Implementing closed-loop water systems and using recycled water can significantly cut consumption, with some projects aiming for over 50% reduction in mains water use.

- Pollution Prevention: Robust site management plans to prevent sediment and chemical runoff are essential to protect aquatic ecosystems.

- Sustainable Drainage: The integration of SuDS, such as permeable paving and green roofs, helps manage surface water runoff, reducing flood risk and improving water quality.

Climate Change Adaptation and Resilience

ISG plc operates in a sector where climate change adaptation is paramount. Buildings and infrastructure must withstand increasingly frequent extreme weather events, from intense rainfall and flooding to heatwaves and high winds. This reality necessitates a shift in design and construction methodologies to ensure long-term resilience.

The company actively promotes and implements design principles and construction methods that enhance climate change adaptation. This includes specifying materials with greater durability, incorporating advanced drainage systems, and designing structures that can better manage temperature fluctuations. For instance, ISG has been involved in projects utilizing green roofs and permeable paving to mitigate urban heat island effects and manage stormwater runoff, critical adaptations for a changing climate.

ISG plc assists clients in developing structures that are not only sustainable but also inherently durable and adaptable to a warming world. This involves a proactive approach to risk assessment, identifying potential climate-related vulnerabilities and integrating solutions from the outset. Their expertise in sustainable construction practices, such as using low-carbon materials and energy-efficient systems, directly contributes to building resilience against future climate impacts.

- Increased investment in climate-resilient infrastructure is expected globally, with the UK government setting ambitious net-zero targets by 2050, influencing construction demands.

- ISG plc's focus on sustainable building practices, including the use of recycled materials and waste reduction strategies, aligns with the growing demand for environmentally conscious construction.

- The company's commitment to innovation in construction techniques can lead to more robust and adaptable buildings, better equipped to handle the physical impacts of climate change.

- Client demand for buildings that achieve high sustainability ratings, such as BREEAM or LEED certifications, is a key driver for ISG's climate adaptation strategies.

The drive towards net-zero carbon emissions by 2050 exerts significant legal and societal pressure on the construction sector, influencing every phase of a building's life. This includes stringent regulations like the UK's Future Homes Standard, which mandates higher energy efficiency for new builds, and emerging requirements for embodied carbon reporting, which will soon necessitate detailed tracking of emissions from materials and construction processes.

ISG plc is actively responding to these pressures by embedding low-carbon design principles into its projects. The company focuses on utilizing sustainable materials, such as responsibly sourced timber and recycled aggregates, and implementing energy-efficient building practices to minimize operational carbon footprints. These efforts are crucial for meeting both regulatory demands and the increasing client expectations for environmentally conscious construction solutions.

Environmental regulations are increasingly impacting construction, with landfill taxes like the UK's Aggregates Levy and Landfill Tax encouraging waste reduction. For instance, the UK government aims for 70% of construction and demolition waste to be recycled or reused by 2020, a target that continues to drive innovation in waste management practices.

ISG plc, like many in the sector, is embracing circular economy principles to boost resource efficiency and minimize waste. This involves designing projects for deconstruction, prioritizing recycled materials, and seeking opportunities for material reuse across different sites, thereby reducing reliance on virgin resources.

Companies are implementing robust waste reduction strategies, often reporting on their environmental performance through sustainability reports. ISG, for example, has set ambitious targets for reducing waste to landfill, with a focus on diverting materials for recycling and reuse. Their 2023 sustainability report highlighted a significant increase in waste diversion rates, demonstrating a commitment to these principles.

The UK's Environment Act 2021 mandates Biodiversity Net Gain (BNG) for most new developments, requiring a minimum 10% increase in biodiversity value. This means construction projects must demonstrably improve habitats, often through on-site creation or off-site habitat banking, with penalties for non-compliance.

Companies like ISG plc must conduct thorough ecological surveys to assess existing biodiversity and plan mitigation strategies. This involves designing projects to minimize environmental impact and actively creating or enhancing natural habitats, such as woodlands or wetlands, to meet BNG targets and comply with broader environmental protection laws.

Integrating environmental planning early in project development is crucial for regulatory compliance and building a strong green reputation. For instance, ISG's commitment to sustainability in 2023 saw them achieve a 4.5% reduction in carbon emissions intensity across their operations, demonstrating a proactive approach to environmental stewardship beyond just BNG requirements.

Water scarcity presents a significant environmental challenge for the construction industry, necessitating efficient water management practices. ISG plc, like other firms, must navigate stringent regulations concerning water usage, pollution prevention, and the implementation of sustainable drainage systems (SuDS). For instance, the UK Environment Agency imposes strict controls on wastewater discharge, impacting site operations and requiring careful planning for water recycling and runoff management.

Companies are increasingly adopting strategies to mitigate their water footprint. These include rainwater harvesting for non-potable uses, optimizing concrete mixing to reduce water requirements, and employing advanced filtration systems to prevent pollutants from entering local watercourses. The drive for sustainability means that effective water management is not just a compliance issue but a key operational efficiency and reputational factor.

- Regulatory Compliance: Adherence to UK water abstraction licenses and discharge consents is critical for site operations.

- Water Reduction Strategies: Implementing closed-loop water systems and using recycled water can significantly cut consumption, with some projects aiming for over 50% reduction in mains water use.

- Pollution Prevention: Robust site management plans to prevent sediment and chemical runoff are essential to protect aquatic ecosystems.

- Sustainable Drainage: The integration of SuDS, such as permeable paving and green roofs, helps manage surface water runoff, reducing flood risk and improving water quality.

ISG plc operates in a sector where climate change adaptation is paramount. Buildings and infrastructure must withstand increasingly frequent extreme weather events, from intense rainfall and flooding to heatwaves and high winds. This reality necessitates a shift in design and construction methodologies to ensure long-term resilience.

The company actively promotes and implements design principles and construction methods that enhance climate change adaptation. This includes specifying materials with greater durability, incorporating advanced drainage systems, and designing structures that can better manage temperature fluctuations. For instance, ISG has been involved in projects utilizing green roofs and permeable paving to mitigate urban heat island effects and manage stormwater runoff, critical adaptations for a changing climate.

ISG plc assists clients in developing structures that are not only sustainable but also inherently durable and adaptable to a warming world. This involves a proactive approach to risk assessment, identifying potential climate-related vulnerabilities and integrating solutions from the outset. Their expertise in sustainable construction practices, such as using low-carbon materials and energy-efficient systems, directly contributes to building resilience against future climate impacts.

- Increased investment in climate-resilient infrastructure is expected globally, with the UK government setting ambitious net-zero targets by 2050, influencing construction demands.

- ISG plc's focus on sustainable building practices, including the use of recycled materials and waste reduction strategies, aligns with the growing demand for environmentally conscious construction.

- The company's commitment to innovation in construction techniques can lead to more robust and adaptable buildings, better equipped to handle the physical impacts of climate change.

- Client demand for buildings that achieve high sustainability ratings, such as BREEAM or LEED certifications, is a key driver for ISG's climate adaptation strategies.

Environmental factors are increasingly shaping the construction landscape, with regulatory bodies imposing stricter standards on carbon emissions and waste management. ISG plc is responding by prioritizing sustainable materials and circular economy principles, aiming to reduce its environmental footprint and meet evolving client expectations.

The push for net-zero targets and biodiversity net gain necessitates a proactive approach to ecological considerations and climate resilience in construction projects. ISG's commitment to innovation in design and material use, alongside effective water management, positions it to navigate these environmental challenges successfully.

ISG's 2023 sustainability report shows a 4.5% reduction in carbon emissions intensity, underscoring their dedication to environmental stewardship. Furthermore, their focus on waste diversion and water reduction strategies highlights a commitment to operational efficiency and regulatory compliance.

| Key Environmental Factor | Impact on Construction Sector | ISG plc's Response/Strategy | Relevant Data/Targets |

| Net-Zero Targets & Carbon Emissions | Mandates for reduced operational and embodied carbon; stricter building regulations (e.g., Future Homes Standard). | Embedding low-carbon design, using sustainable materials (timber, recycled aggregates), energy-efficient practices. | 4.5% reduction in carbon emissions intensity (2023); aiming for net-zero by 2050. |

| Waste Management & Circular Economy | Landfill taxes (Aggregates Levy, Landfill Tax); targets for waste recycling/reuse. | Embracing circular economy principles, designing for deconstruction, prioritizing recycled materials, robust waste reduction strategies. | UK target: 70% construction & demolition waste recycled/reused by 2020 (ongoing drive); increased waste diversion rates (2023 report). |

| Biodiversity Net Gain (BNG) | Mandatory 10% increase in biodiversity value for most new developments (Environment Act 2021). | Conducting ecological surveys, planning mitigation, creating/enhancing natural habitats, on-site or off-site solutions. | Minimum 10% BNG requirement. |

| Water Scarcity & Management | Regulations on water usage, pollution prevention, SuDS implementation; strict controls on wastewater discharge. | Rainwater harvesting, optimizing concrete mix, advanced filtration, closed-loop water systems, recycled water usage. | Aiming for over 50% reduction in mains water use in some projects. |

| Climate Change Adaptation | Need for structures resilient to extreme weather (flooding, heatwaves, high winds). | Specifying durable materials, advanced drainage, designing for temperature fluctuations, green roofs, permeable paving. | Involvement in projects mitigating urban heat island effects and managing stormwater runoff. |

PESTLE Analysis Data Sources

Our ISG plc PESTLE analysis is built on a comprehensive review of official government publications, reputable economic data providers, and leading industry research reports. This approach ensures that each factor, from political stability to technological advancements, is grounded in credible and current information.