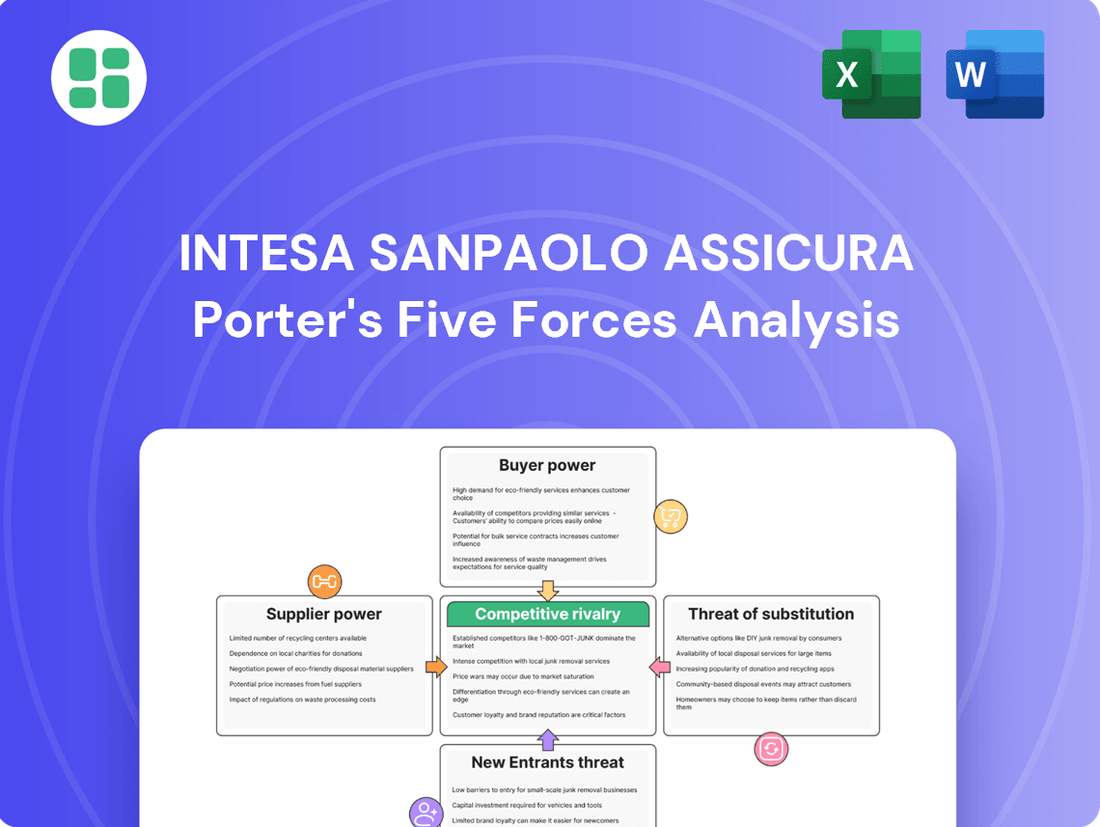

Intesa Sanpaolo Assicura Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Intesa Sanpaolo Assicura Bundle

Intesa Sanpaolo Assicura navigates a dynamic insurance landscape, where buyer bargaining power can significantly influence pricing and product offerings. The threat of new entrants, while present, is often mitigated by high capital requirements and regulatory hurdles within the Italian insurance market. Understanding these forces is crucial for any stakeholder looking to grasp Intesa Sanpaolo Assicura's strategic positioning.

The complete report reveals the real forces shaping Intesa Sanpaolo Assicura’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

The bargaining power of reinsurance providers for Intesa Sanpaolo Assicura is substantial, particularly for specialized risks. The global reinsurance market's concentration means a few key players can dictate terms, especially when Intesa Sanpaolo Assicura needs coverage for unique or high-exposure events.

Intesa Sanpaolo Assicura's need to transfer risk to reinsurers directly translates into supplier power for these entities. Their pricing and contract conditions are significantly shaped by the reinsurers' financial strength and willingness to take on risk.

Global catastrophe trends and capital market shifts directly influence reinsurance pricing. For instance, in 2023, the property catastrophe reinsurance market saw significant rate increases following major global insured losses, directly impacting the cost of risk transfer for insurers like Intesa Sanpaolo Assicura.

Technology and software vendors hold considerable bargaining power over Intesa Sanpaolo Assicura. The insurance industry's reliance on sophisticated IT systems, data analytics, and AI for underwriting, claims processing, and customer interaction is substantial. In 2024, Italian insurers continued to invest heavily in digital transformation, with spending on technology solutions expected to rise significantly, creating a strong demand for specialized software.

Suppliers of proprietary or highly specialized insurance software and data analytics platforms can leverage this demand. High switching costs associated with integrating new systems and the critical nature of these services for operational efficiency allow these vendors to negotiate favorable terms, including higher prices. This dependence means Intesa Sanpaolo Assicura faces a challenge in reducing its reliance on these key technology providers.

External providers for claims adjustment, legal services, and repair networks possess some bargaining power, especially if they offer specialized skills or cater to specific market segments. The quality and efficiency of these services are critical for customer satisfaction and retention, allowing reputable or specialized providers to negotiate better terms.

Investment Management Firms

Investment management firms hold significant bargaining power over Intesa Sanpaolo Assicura, particularly for specialized investment mandates within life insurance products. Their ability to generate strong, consistent returns is a key leverage point. For instance, in 2024, top-performing active equity funds in Europe often exceeded benchmark indices by over 5%, demonstrating the value specialized managers can bring.

The reputation and unique strategies of these external investment managers can command higher fees, especially if they manage a substantial portion of Intesa Sanpaolo Assicura's life insurance premiums. This is amplified when these firms possess proprietary investment methodologies or access to exclusive market opportunities not readily available to the insurer internally.

- Performance-driven leverage: Investment firms with a proven track record of outperforming benchmarks, potentially by 3-7% annually in certain asset classes, can negotiate more favorable terms.

- Specialization advantage: Managers specializing in niche markets or alternative investments, where Intesa Sanpaolo Assicura may lack in-house expertise, possess greater bargaining power.

- Scale of assets managed: The larger the pool of premiums entrusted to an external investment manager, the more influence they wield in fee negotiations.

- Reputational capital: Well-regarded firms with strong brand recognition can often dictate terms due to the perceived lower risk and higher potential upside they offer.

Data and Information Providers

Data and information providers wield considerable influence over Intesa Sanpaolo Assicura. Access to precise and current data, encompassing actuarial figures, market insights, and customer behavior patterns, is fundamental for accurate risk evaluation and the creation of effective insurance products. In 2023, the global data analytics market was valued at approximately $271.8 billion, highlighting the immense economic importance of this sector.

Suppliers offering specialized, extensive, or frequently updated data sets, particularly those concerning evolving demographics or climate-related risks, possess significant bargaining power. For instance, providers of real-time catastrophe modeling data or detailed consumer credit histories are invaluable. Insurers like Intesa Sanpaolo Assicura depend on such data to ensure competitive pricing strategies and to craft personalized insurance solutions in a constantly shifting marketplace.

- Data Accuracy and Timeliness: Insurers rely on data providers for the precision and speed of information delivery, impacting underwriting and pricing.

- Data Uniqueness and Comprehensiveness: Providers with proprietary or exceptionally detailed datasets, especially on emerging risks, command higher power.

- Market Intelligence: Insights into competitor strategies and customer preferences, sourced from data providers, are critical for product development.

- Regulatory Compliance Data: Access to up-to-date data that ensures adherence to financial regulations is non-negotiable for insurers.

The bargaining power of suppliers for Intesa Sanpaolo Assicura is notably influenced by the specialized nature of services and data required in the insurance sector. Key suppliers, including reinsurers and technology vendors, often hold significant leverage due to the critical and often proprietary nature of their offerings. This power is further amplified by the concentration within certain supply markets and the high switching costs associated with integrating new systems or data sources.

In 2024, the demand for advanced IT solutions and data analytics continued to drive up costs for specialized software providers, as insurers like Intesa Sanpaolo Assicura invested heavily in digital transformation. Similarly, the reinsurance market, particularly for catastrophe coverage, saw continued firming of rates due to global loss events, giving reinsurers considerable pricing power. Investment management firms with proven alpha generation capabilities also command higher fees, impacting the cost of managing insurance assets.

| Supplier Type | Bargaining Power Factors | Impact on Intesa Sanpaolo Assicura |

|---|---|---|

| Reinsurers | Market concentration, need for risk transfer, global loss events | Higher reinsurance premiums, limited capacity for specialized risks |

| Technology Vendors | Reliance on specialized software, high switching costs, digital transformation investment | Increased IT spending, potential for vendor lock-in |

| Investment Managers | Performance track record, specialization, scale of assets, reputation | Higher management fees, dependence on external expertise for asset growth |

| Data Providers | Data accuracy, uniqueness, comprehensiveness, regulatory compliance needs | Increased costs for critical data, reliance on external sources for market insights |

What is included in the product

This analysis delves into the competitive landscape for Intesa Sanpaolo Assicura, examining the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within the insurance sector.

Effortlessly identify and mitigate competitive threats by visualizing the intensity of each of Porter's Five Forces on Intesa Sanpaolo Assicura's market landscape.

Customers Bargaining Power

For standardized insurance products, customer bargaining power is significant. In 2024, the rise of digital comparison platforms made it easier than ever for consumers to shop around for the best deals on auto and home insurance, often revealing price differences of 15-20% for similar coverage. This transparency forces Intesa Sanpaolo Assicura to remain highly competitive on pricing and ensure policy terms are easily understood to avoid losing customers to rivals.

While some insurance transitions require administrative steps, the overall cost for customers to switch providers, particularly for non-life policies, remains quite low. This ease of switching means Intesa Sanpaolo Assicura faces constant pressure to maintain competitive pricing, excellent service, and appealing product innovations to keep its customers.

In 2024, the Italian insurance market, where Intesa Sanpaolo Assicura operates, saw a significant number of policyholders actively comparing options. For instance, data from Associazione Nazionale fra le Imprese Assicuratrici (ANIA) indicated a notable increase in online quote requests across various insurance categories, highlighting customer price sensitivity and a willingness to explore alternatives.

The rise of digital platforms and direct sales channels has significantly boosted customer bargaining power. Customers can now easily research, compare, and purchase insurance policies online, bypassing traditional intermediaries. This shift means Intesa Sanpaolo Assicura needs a robust digital strategy to cater to these informed and empowered consumers who expect convenience and competitive pricing.

Customer Segmentation and Needs

Intesa Sanpaolo Assicura's customer base is diverse, encompassing both individual consumers and corporate entities, each exhibiting different levels of bargaining influence. For instance, in 2024, while individual policyholders might be more price-sensitive, large institutional clients or high-net-worth individuals often possess greater leverage due to the scale of their business or investments and their capacity to negotiate bespoke policy terms and pricing.

This disparity in customer power necessitates a strategic approach to segmentation and product development. The insurer must be adept at tailoring its insurance solutions and service models to meet the specific, often complex, requirements of these varied customer groups, ensuring competitive offerings that address distinct risk profiles and service expectations.

- Individual Customers: Typically have lower individual bargaining power, but collective action or price comparison websites can increase their influence.

- Corporate Clients: Possess higher bargaining power due to the volume of business, potential for bundled services, and the ability to seek customized insurance packages.

- Sophisticated Investors: Often have complex financial needs and the knowledge to negotiate terms, potentially seeking specialized coverage or alternative risk transfer mechanisms.

- Market Concentration: The degree of competition in specific insurance segments also impacts customer bargaining power; a more competitive market generally empowers customers more.

Regulatory Protections

Regulatory protections in Italy significantly bolster the bargaining power of customers. Consumer protection laws, enforced by bodies like IVASS (Istituto per la Vigilanza sulle Assicurazioni), ensure transparency in policy terms and conditions, fair claims handling, and accessible dispute resolution mechanisms. This legal framework empowers customers to demand better service and product clarity from insurers like Intesa Sanpaolo Assicura.

These regulations directly influence Intesa Sanpaolo Assicura's operations by dictating how products are marketed and how claims are processed. For instance, stringent disclosure requirements mean customers are better informed, allowing them to compare offerings more effectively and negotiate terms. The presence of supervisory bodies also means that customers have recourse if they feel unfairly treated, increasing their leverage.

Recent regulatory shifts, such as the potential for mandatory catastrophic insurance coverage, further shape customer demand and expectations. This type of regulation can create a baseline level of awareness and demand for specific insurance products, giving customers more power in selecting providers that meet these new mandated standards. For example, in 2024, the Italian government continued to explore measures to enhance consumer protection in financial services, including insurance.

- Consumer Protection Laws: Italian regulations mandate clear communication, fair pricing, and robust complaint handling procedures for insurance providers.

- Supervisory Bodies: IVASS oversees the insurance market, ensuring compliance with consumer rights and market conduct rules.

- Dispute Resolution: Customers have access to arbitration and mediation services, providing alternative avenues to resolve disputes with insurers.

- Impact on Intesa Sanpaolo Assicura: Regulations necessitate transparent product design and responsive claims management, enhancing customer leverage.

The bargaining power of customers for Intesa Sanpaolo Assicura is substantial, amplified by digital comparison tools and low switching costs. In 2024, Italian consumers actively used online platforms to compare insurance policies, with price differences often exceeding 15% for comparable coverage, forcing insurers to remain competitive. This ease of comparison and switching empowers customers, making price sensitivity a key factor in their purchasing decisions.

| Customer Segment | Bargaining Power Indicator | 2024 Market Trend Impact |

|---|---|---|

| Individual Policyholders | Moderate to High (due to price comparison sites) | Increased price sensitivity and demand for transparent offerings. |

| Corporate Clients | High (due to volume and negotiation capacity) | Continued demand for customized policies and bundled services. |

| Digital Savvy Consumers | High (due to information access and direct purchasing) | Expectation of seamless online experience and competitive pricing. |

What You See Is What You Get

Intesa Sanpaolo Assicura Porter's Five Forces Analysis

This preview showcases the complete Intesa Sanpaolo Assicura Porter's Five Forces Analysis, offering a detailed examination of industry competition. The document you see here is precisely the same professionally written and formatted analysis you will receive immediately after purchase, ensuring no surprises. You'll gain immediate access to this comprehensive report, ready for your strategic planning and decision-making needs.

Rivalry Among Competitors

The Italian insurance market is quite crowded, with many companies vying for customers. This includes big domestic names, international insurers, and even newer tech-focused companies. Intesa Sanpaolo Assicura, while a major player due to its banking group affiliation, contends with numerous established competitors, making the competitive landscape quite intense.

The Italian insurance market is expected to see steady growth, with both life and non-life insurance premiums on the rise. However, the sector is quite mature, meaning this growth isn't explosive. For instance, in 2023, the Italian insurance market generated approximately €139 billion in gross written premiums, a slight increase from the previous year.

This moderate growth environment naturally fuels competitive rivalry. Companies are keenly focused on gaining market share from competitors, as there's less opportunity to simply capitalize on a rapidly expanding overall market. This dynamic forces insurers to innovate and differentiate their offerings to attract and retain customers.

Competitive rivalry in the insurance sector, particularly for Intesa Sanpaolo Assicura, is intense. Many insurance products are inherently similar, making it difficult to stand out based on features alone. This means companies often compete on factors beyond the core product itself.

Intesa Sanpaolo Assicura leverages its robust brand recognition, a significant advantage in building customer trust. Furthermore, its expansive network of bank branches provides a unique distribution channel, allowing for integrated offerings that combine banking and insurance services. This synergy is a key differentiator, as seen in their efforts to cross-sell insurance products to existing banking clients, a strategy that has historically driven significant revenue. For instance, in 2023, Intesa Sanpaolo Group reported a net profit of €7.1 billion, with its insurance division contributing substantially to this performance through such integrated strategies.

However, rivals are not standing still. Competitors are actively investing in enhancing customer service quality, adopting digital technologies to streamline processes and improve user experience, and employing aggressive pricing strategies. This continuous effort by competitors to innovate and offer value means Intesa Sanpaolo Assicura must consistently refine its approach to product differentiation and customer engagement to maintain its competitive edge in the market.

Exit Barriers

Intesa Sanpaolo Assicura, like many in the insurance sector, faces substantial exit barriers. These are primarily driven by the immense fixed costs tied to maintaining sophisticated IT infrastructure essential for policy management and claims processing. Furthermore, stringent regulatory compliance demands continuous investment in systems and expertise, making a swift exit financially prohibitive.

The long-term nature of insurance policy obligations, such as life insurance contracts, also acts as a significant exit barrier. Companies are legally and financially committed to fulfilling these promises over many years, even if market conditions become unfavorable. This commitment locks in capital and resources, discouraging firms from simply ceasing operations.

These high exit barriers mean that even when profitability is challenged, companies like Intesa Sanpaolo Assicura are compelled to remain in the market and continue competing. This persistence, despite potential strains, fuels sustained competitive rivalry among existing players.

- High Fixed Costs: Significant investments in IT and regulatory compliance create substantial sunk costs.

- Long-Term Obligations: Commitments to policyholders, especially in life insurance, extend for decades.

- Regulatory Hurdles: Strict capital requirements and solvency ratios make winding down operations complex and costly.

- Market Persistence: These barriers force companies to remain competitive even in less profitable periods, intensifying rivalry.

Strategic Alliances and M&A

Strategic alliances and mergers and acquisitions (M&A) significantly influence competitive rivalry in the insurance sector. Intesa Sanpaolo Assicura itself has been involved in integrating its insurance operations, a common move to achieve scale and efficiency. For instance, in 2023, the European insurance M&A market saw continued activity, with deal volumes reflecting a strategic push for consolidation. These transactions can reshape market shares and create formidable competitors.

These consolidations can lead to:

- Market Consolidation: Larger entities emerge, potentially increasing pricing power and reducing the number of independent players.

- Shifted Market Shares: Acquisitions directly transfer customer bases and market presence, altering the competitive balance.

- Enhanced Capabilities: Companies gain access to new technologies, distribution channels, or specialized product lines, intensifying competition through differentiation.

The Italian insurance market is highly competitive, with numerous domestic and international players vying for market share. Intesa Sanpaolo Assicura faces rivals that are actively investing in technology and customer service, alongside aggressive pricing. This intense rivalry is further fueled by high exit barriers, such as significant fixed costs and long-term policy obligations, which compel companies to remain in the market even during challenging periods.

Strategic consolidations through mergers and acquisitions also intensify competition, leading to larger entities with enhanced capabilities and shifted market shares. For instance, the European insurance M&A market saw continued activity in 2023, impacting the competitive landscape. This dynamic environment requires Intesa Sanpaolo Assicura to constantly innovate and differentiate its offerings to maintain its position.

| Metric | 2023 Value (Approx.) | Trend |

| Italian Insurance Market Gross Written Premiums | €139 Billion | Slight Increase |

| Intesa Sanpaolo Group Net Profit | €7.1 Billion | Strong Performance |

SSubstitutes Threaten

Large corporations increasingly explore self-insurance and captive insurers as alternatives to traditional insurance. For instance, in 2024, the global captive insurance market was valued at approximately $90 billion and is projected to grow, indicating a significant shift. This strategy allows companies to retain risk, potentially lowering costs for predictable or high-frequency losses.

By managing their own insurance functions, these entities reduce their dependence on external providers like Intesa Sanpaolo Assicura. The viability of self-insurance hinges on a company's robust financial health, its willingness to absorb potential losses, and a thorough cost-benefit analysis comparing in-house management against purchasing coverage from traditional insurers.

Government-provided social security and welfare programs can significantly act as a substitute for private insurance offerings. These state-backed systems, covering areas like healthcare, pensions, and unemployment benefits, can lessen the perceived necessity for individuals to purchase private insurance, especially for basic needs.

In Italy, for instance, a well-established social safety net might dampen demand for specific life and health insurance products. For example, the Italian public healthcare system, Servizio Sanitario Nazionale (SSN), provides universal coverage, potentially reducing the uptake of private health insurance policies among a broad segment of the population. Similarly, the national pension system influences how much individuals rely on private pension plans.

Alternative Risk Transfer (ART) mechanisms present a growing threat to traditional insurance providers like Intesa Sanpaolo Assicura. For significant or catastrophic risks, companies are increasingly turning to instruments like catastrophe bonds and industry loss warranties. These financial derivatives allow for risk to be transferred outside the conventional insurance and reinsurance channels, offering a potential substitute for standard commercial insurance policies.

Risk Prevention and Mitigation Technologies

The threat of substitutes for Intesa Sanpaolo Assicura is amplified by advancements in risk prevention and mitigation technologies. Technologies like IoT devices and AI-powered analytics allow individuals and businesses to proactively manage and reduce risks, potentially lessening their reliance on traditional insurance products.

For instance, smart home systems can detect and alert to issues like water leaks or fires, reducing property damage. Similarly, telematics in vehicles monitor driving behavior, promoting safer habits and potentially lowering accident rates. These technological solutions offer alternative ways to achieve risk reduction that were previously only available through insurance.

- IoT Devices: Smart home sensors and security systems offer a direct substitute for certain property insurance coverages by preventing or minimizing damage.

- AI-Powered Analytics: Predictive analytics can identify and mitigate risks in areas like health or finance, potentially reducing the need for specific insurance policies.

- Cybersecurity Solutions: Robust cybersecurity measures can substitute for cyber insurance by preventing data breaches and their associated financial losses.

- Behavioral Monitoring: Telematics in cars and wearables for health encourage safer behaviors, directly impacting the frequency and severity of claims, thus acting as a substitute for comprehensive coverage.

Peer-to-Peer (P2P) Insurance Models

Peer-to-peer (P2P) insurance models are emerging as a noteworthy threat of substitutes for traditional insurers like Intesa Sanpaolo Assicura. These platforms enable groups to pool risks and manage claims collectively, often with significantly lower operational costs. For instance, platforms like Lemonade, a prominent P2P insurer, reported a gross loss ratio of 72% in Q1 2024, demonstrating efficiency.

These P2P models can be particularly appealing for niche markets or community-specific insurance needs. By fostering direct participation and trust among policyholders, they offer an alternative that bypasses some of the traditional insurer's overheads. This direct engagement can translate into more competitive pricing for consumers.

The growth trajectory of P2P insurance, though still in its early stages, indicates a potential shift in consumer preference towards more transparent and community-driven insurance solutions. As these platforms mature, they could capture a segment of the market seeking alternatives to conventional insurance products.

- Emerging P2P platforms offer risk pooling and collective claim payouts.

- Lower overheads compared to traditional insurers are a key differentiator.

- Niche and community-based insurance needs are particularly vulnerable to P2P substitution.

- Trust and direct policyholder participation are core tenets of P2P models.

The threat of substitutes for Intesa Sanpaolo Assicura is multifaceted, encompassing self-insurance, government programs, alternative risk transfer mechanisms, technological advancements, and peer-to-peer insurance models.

Large corporations increasingly utilize self-insurance and captive insurers, with the global captive insurance market valued at approximately $90 billion in 2024, indicating a significant trend towards retaining risk internally.

Government social security and welfare programs, like Italy's Servizio Sanitario Nazionale, provide a safety net that can reduce individual demand for private health and pension insurance.

Alternative Risk Transfer (ART) instruments such as catastrophe bonds and industry loss warranties offer ways to transfer risk outside traditional insurance channels, directly competing for large-scale risk coverage.

Technological advancements, including IoT devices and AI analytics, enable proactive risk reduction, potentially diminishing the need for certain insurance policies by preventing losses. For example, telematics in vehicles promote safer driving, impacting accident frequency.

Peer-to-peer (P2P) insurance models, exemplified by platforms like Lemonade which reported a 72% gross loss ratio in Q1 2024, present a lower-overhead, community-driven alternative that can offer more competitive pricing.

| Substitute Type | Description | Market Indicator/Example | Impact on Intesa Sanpaolo Assicura |

|---|---|---|---|

| Self-Insurance/Captives | Corporations retaining risk internally. | Global captive insurance market valued at ~$90 billion (2024). | Reduces demand for traditional commercial insurance. |

| Government Programs | State-provided social security and welfare. | Italy's Servizio Sanitario Nazionale (universal healthcare). | Lowers perceived need for private health/pension insurance. |

| Alternative Risk Transfer (ART) | Financial instruments like catastrophe bonds. | Growth in ART market for managing large-scale risks. | Offers alternatives for catastrophic risk coverage. |

| Risk Prevention Tech | IoT, AI, telematics for proactive risk management. | Smart home systems, vehicle telematics. | Decreases frequency/severity of insurable events. |

| Peer-to-Peer (P2P) Insurance | Community-based risk pooling and claim management. | Lemonade's 72% gross loss ratio (Q1 2024). | Provides lower-cost, transparent alternatives. |

Entrants Threaten

The insurance sector is heavily regulated, demanding substantial capital reserves, with Solvency II ratios being a key metric. For instance, in 2023, the average Solvency II ratio for EU insurance companies remained robust, signaling the high capital demands. Navigating intricate licensing and compliance procedures further complicates market entry.

In the insurance industry, trust is the bedrock of customer loyalty, and established players like Intesa Sanpaolo Assicura have cultivated this over many years. Newcomers struggle to replicate this deep-seated confidence, which is often a direct result of decades of dependable service and a strong, recognizable brand.

Intesa Sanpaolo Assicura's inherent advantage stems from its affiliation with the broader Intesa Sanpaolo banking group, a connection that instantly lends credibility and a sense of security. For instance, by the end of 2023, Intesa Sanpaolo Group reported a net profit of €4.3 billion, underscoring the financial strength and stability that its insurance arm can leverage to build customer trust, a significant barrier for new entrants.

Access to established distribution networks presents a significant hurdle for new entrants in the insurance sector. Intesa Sanpaolo Assicura effectively utilizes the vast branch network of its parent company, Intesa Sanpaolo, providing a ready-made channel to millions of customers. This inherited advantage makes it challenging for newcomers to compete on reach.

Pure-play insurtechs, for instance, must invest heavily in building their own distribution capabilities or forging costly partnerships to gain market access. In 2024, the cost of customer acquisition for digital-first insurance providers often exceeded 150 euros per policy, highlighting the expense involved in bypassing traditional channels.

Data and Technology Infrastructure

The threat of new entrants into the insurance sector, particularly for a company like Intesa Sanpaolo Assicura, is significantly influenced by the immense requirements for data and technology infrastructure. Developing the sophisticated IT systems, advanced data analytics capabilities, and complex actuarial models essential for effective underwriting, accurate pricing, and streamlined claims management demands considerable financial investment and specialized expertise.

New players entering the market face the daunting task of either building these critical capabilities from the ground up or acquiring them, presenting a substantial barrier to entry. For instance, in 2024, the global insurtech market saw substantial funding, with companies raising billions, yet many still grapple with scaling their technology to compete with established players who have decades of data and system refinement.

- High Capital Outlay: Significant upfront investment is needed for robust IT platforms, data warehousing, and cybersecurity measures.

- Data Acquisition and Management: Accessing and effectively managing vast datasets for risk assessment and product development is a complex and costly undertaking.

- Talent Acquisition: Securing skilled data scientists, actuaries, and IT professionals is crucial but challenging, given the high demand.

- Regulatory Compliance: Ensuring all technological systems meet stringent industry regulations adds another layer of complexity and cost for new entrants.

Customer Acquisition Costs

Customer acquisition costs in the insurance sector, particularly for established players like Intesa Sanpaolo Assicura, are substantial. In a mature market, attracting new policyholders typically involves significant investment in marketing campaigns, sales force commissions, and the administrative overhead of onboarding. For instance, in 2024, the average customer acquisition cost for non-life insurance in Europe was estimated to be between 30% and 50% of the first-year premium, a figure that can be even higher for specialized products or in highly competitive regions.

New entrants face an uphill battle due to these high customer acquisition costs. To gain traction, they often must undercut existing players on price or introduce novel features, both of which can strain initial profitability. This makes it challenging for new companies to achieve break-even quickly. Intesa Sanpaolo Assicura, however, benefits from its established brand recognition and the extensive existing customer base within the broader Intesa Sanpaolo Group, facilitating cross-selling opportunities that significantly reduce its own acquisition costs.

- High Marketing Spend: Acquiring new customers in the insurance industry requires substantial investment in advertising, digital marketing, and promotional activities.

- Sales Channel Costs: Commissions paid to agents and brokers, along with the operational costs of maintaining a sales network, add to acquisition expenses.

- Onboarding and Underwriting: The process of evaluating risk, issuing policies, and setting up new accounts involves administrative and actuarial resources.

- Competitive Pricing Pressure: New entrants often need to offer attractive introductory rates or discounts, which can lead to lower initial profit margins.

The threat of new entrants for Intesa Sanpaolo Assicura is considerably low due to significant barriers like high capital requirements, stringent regulatory hurdles, and the need for established trust. For instance, the average Solvency II ratio for EU insurers remained robust in 2023, highlighting the substantial capital reserves new entrants must possess. Furthermore, replicating the deep-seated customer confidence built over decades by incumbents like Intesa Sanpaolo Assicura is a formidable challenge for newcomers.

Intesa Sanpaolo Assicura benefits from its parent company's strong financial standing, evidenced by Intesa Sanpaolo Group's €4.3 billion net profit in 2023, which bolsters its credibility. Access to extensive distribution networks, such as the parent bank's branch system, provides a significant advantage, making it difficult for new players to achieve comparable market reach. The cost of customer acquisition for digital-first insurers in 2024 often exceeded 150 euros per policy, underscoring the expense new entrants face in bypassing traditional channels.

The technological and data infrastructure demands for insurance operations are immense, requiring substantial investment in IT systems, data analytics, and actuarial models. New entrants must either build these capabilities or acquire them, a costly endeavor, despite billions raised in the insurtech market in 2024. High customer acquisition costs, often 30-50% of the first-year premium for non-life insurance in Europe in 2024, further deter new market participants.

| Barrier to Entry | Description | Impact on New Entrants | Example Data (2023-2024) |

|---|---|---|---|

| Capital Requirements | Need for substantial capital reserves and robust IT infrastructure. | High initial investment, limiting the number of potential entrants. | Average Solvency II ratio for EU insurers remained high in 2023. |

| Brand Reputation & Trust | Established players have built long-term customer loyalty and trust. | New entrants struggle to gain customer confidence and market share. | Decades of dependable service are difficult to replicate quickly. |

| Distribution Networks | Access to established sales channels and customer bases. | New entrants face challenges in reaching a broad customer base. | Intesa Sanpaolo Assicura leverages Intesa Sanpaolo's branch network. |

| Customer Acquisition Costs | High expenses associated with marketing, sales, and onboarding. | New entrants may need to offer lower prices, impacting initial profitability. | Digital-first insurer acquisition costs often exceeded €150 per policy in 2024. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Intesa Sanpaolo Assicura is built upon a foundation of comprehensive data, including the company's official annual reports, investor relations materials, and filings with regulatory bodies. We also incorporate insights from reputable industry research firms and financial news outlets to capture current market dynamics and competitive landscapes.