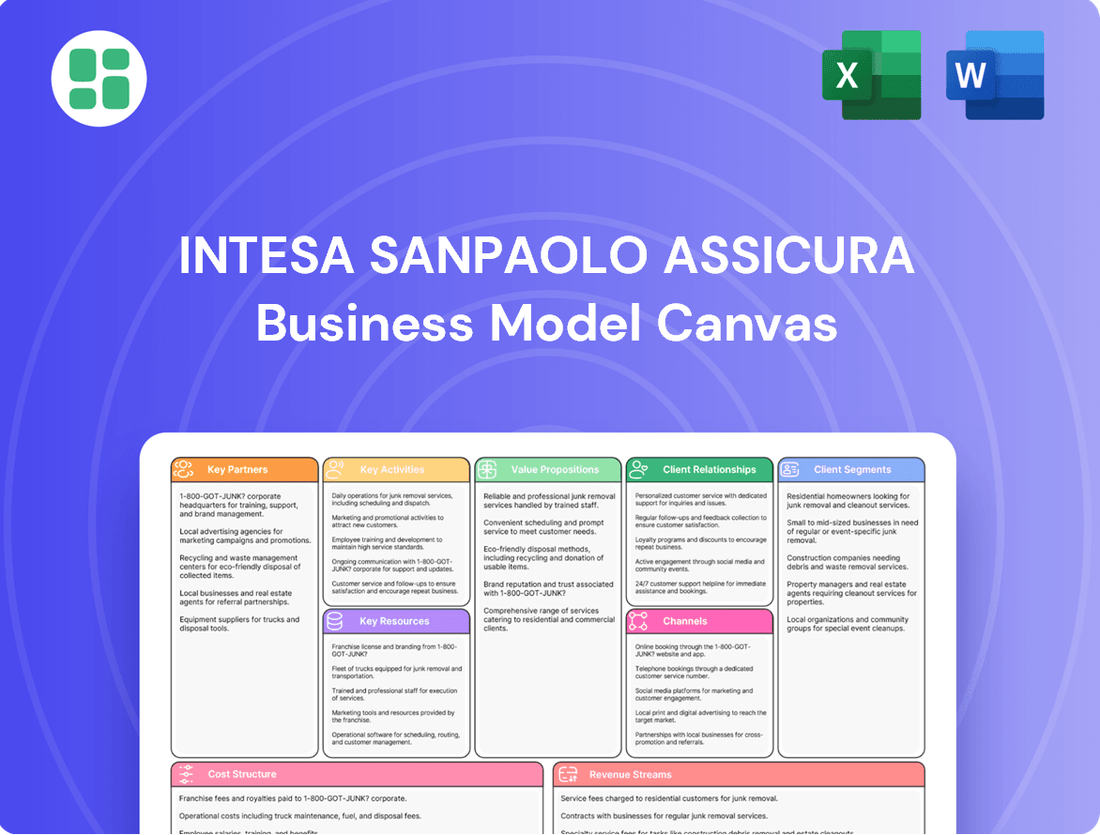

Intesa Sanpaolo Assicura Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Intesa Sanpaolo Assicura Bundle

Discover the strategic framework behind Intesa Sanpaolo Assicura's success with our comprehensive Business Model Canvas. This detailed analysis uncovers their customer relationships, key resources, and revenue streams, offering a clear roadmap to their market dominance. Ready to gain a competitive edge? Download the full Business Model Canvas to unlock actionable insights for your own ventures.

Partnerships

Intesa Sanpaolo's extensive bank network is absolutely crucial for Intesa Sanpaolo Assicura, serving as its primary distribution channel. This partnership allows the insurance arm to tap into the parent bank's vast customer base, with over 11.2 million customers in Italy as of the end of 2023, providing direct access for sales and cross-selling initiatives.

The bank's physical presence, with its more than 4,000 branches across Italy, ensures broad customer reach and facilitates face-to-face interactions, which are vital for building trust in insurance products. This deep integration means that insurance offerings are seamlessly presented within the familiar banking relationship, streamlining the customer journey and enhancing convenience.

Intesa Sanpaolo Assicura's collaboration with reinsurance companies is fundamental for its risk management strategy. These partnerships allow the company to offload a portion of its underwriting risk, particularly for substantial or intricate insurance policies. This risk transfer is vital for maintaining financial stability and ensuring sufficient capacity to offer diverse coverage options.

By engaging with reinsurers, Intesa Sanpaolo Assicura can underwrite policies that might otherwise exceed its internal risk tolerance. This access to external capacity is critical for growth and market competitiveness. For instance, in 2024, the global reinsurance market continued to be a significant factor in the insurance industry's ability to manage catastrophic events and large-scale risks.

Beyond financial capacity, reinsurers often bring specialized expertise in risk assessment, actuarial analysis, and emerging market trends. This knowledge sharing helps Intesa Sanpaolo Assicura refine its underwriting practices and product development, ultimately enhancing its overall resilience and market positioning.

Intesa Sanpaolo Assicura's strategic alliances with technology and software providers are fundamental to its operational excellence. These partnerships are crucial for building and sustaining a resilient IT infrastructure, advanced digital platforms, and sophisticated data analytics capabilities. For instance, in 2024, the insurance sector saw significant investment in digital transformation, with companies like Intesa Sanpaolo Assicura leveraging these collaborations to streamline policy administration and claims processing.

These collaborations directly enhance key business functions such as customer relationship management and the creation of cutting-edge digital insurance products. By partnering with specialized tech vendors, Intesa Sanpaolo Assicura can ensure its systems are efficient and that it remains competitive in the fast-paced digital insurance market. This focus on external tech expertise is a common strategy, with industry reports from 2024 indicating that insurers heavily rely on tech partnerships to drive innovation and improve customer experience.

External Claims Adjusters/Assessors

Intesa Sanpaolo Assicura collaborates with specialized external claims adjusters and assessors to streamline its claims management process. This partnership is crucial for handling complex or geographically dispersed claims efficiently and objectively, ensuring fair and accurate settlements by providing independent evaluations of damages and losses.

These external experts allow Intesa Sanpaolo Assicura to concentrate on its core insurance operations, confident that claims are being handled professionally. In 2024, the insurance industry saw a significant reliance on third-party administrators for claims processing, with estimates suggesting that over 60% of insurers utilize external adjusters for at least a portion of their claims volume, particularly for specialized lines of business.

- Efficiency Gains: Outsourcing claims adjustments reduces internal processing times, especially for high-volume or specialized claims.

- Objectivity and Fairness: Independent adjusters provide unbiased assessments, bolstering customer trust and reducing disputes.

- Cost Management: Engaging external adjusters can be more cost-effective than maintaining a large, in-house claims department, particularly during fluctuating claim volumes.

- Focus on Core Business: Allows Intesa Sanpaolo Assicura to dedicate resources to product development, underwriting, and customer service.

Financial Advisors and Wealth Managers

Intesa Sanpaolo Assicura collaborates with independent financial advisors and wealth management firms to broaden its market reach, especially to high-net-worth individuals and specialized business clients. These partnerships allow for the seamless integration of insurance products into comprehensive financial planning strategies, offering clients a more holistic approach to their financial well-being. This strategy is crucial for expanding market penetration and effectively addressing a wider array of client financial planning needs.

For instance, in 2024, the Italian wealth management sector saw continued growth, with assets under management in advisory services reaching significant figures, underscoring the importance of these distribution channels for insurance providers. These collaborations enable Intesa Sanpaolo Assicura to tap into established client bases and leverage the expertise of advisors who understand specific client segments.

- Extended Reach: Accessing client segments not directly served by the bank's internal network.

- Holistic Planning: Integrating insurance into broader financial advice for comprehensive client solutions.

- Market Penetration: Deepening presence in diverse financial planning markets.

- Expertise Leverage: Utilizing the specialized knowledge of independent advisors.

Intesa Sanpaolo Assicura's key partnerships are vital for its operational success and market reach. The extensive bank network of its parent company, Intesa Sanpaolo, acts as the primary distribution channel, providing access to over 11.2 million customers in Italy as of late 2023. This integration allows for seamless cross-selling within the familiar banking environment.

Strategic alliances with technology providers are crucial for digital transformation, enhancing IT infrastructure and data analytics capabilities, as seen with significant sector investments in 2024. Furthermore, collaborations with reinsurance companies are fundamental for risk management, enabling the company to underwrite larger policies and access specialized expertise. Partnerships with independent financial advisors and wealth management firms in 2024 also extended market reach, particularly to high-net-worth individuals.

| Partnership Type | Key Role | Benefit to Intesa Sanpaolo Assicura | 2024 Relevance/Data |

|---|---|---|---|

| Intesa Sanpaolo Bank Network | Primary Distribution Channel | Access to 11.2M+ customers (end 2023), direct sales, cross-selling | Leveraging 4,000+ Italian branches for customer interaction |

| Reinsurance Companies | Risk Management, Capacity | Offload underwriting risk, enhance capacity for diverse policies | Crucial for managing catastrophic events and large-scale risks globally |

| Technology & Software Providers | Digital Transformation, IT Infrastructure | Streamline operations, enhance digital platforms, data analytics | Industry saw significant tech investment in 2024; essential for competitive digital offerings |

| Independent Financial Advisors | Market Reach Expansion | Access to specialized client segments, integrate insurance into financial planning | Italian wealth management sector growth in 2024, access to established client bases |

What is included in the product

This Business Model Canvas provides a detailed blueprint of Intesa Sanpaolo Assicura's strategy, outlining its customer segments, value propositions, and key resources.

It offers a clear, actionable framework for understanding the insurer's operations and its approach to delivering value in the insurance market.

Intesa Sanpaolo Assicura's Business Model Canvas offers a clear, actionable framework to address the complexities of insurance product development and distribution, streamlining operations and reducing time-to-market.

Activities

Intesa Sanpaolo Assicura's key activity of insurance product development involves a deep dive into market needs, leading to the creation of innovative life and non-life insurance solutions. This includes continuously updating existing products to align with shifting customer expectations and regulatory landscapes, ensuring relevance and competitiveness.

This crucial process relies heavily on rigorous actuarial analysis and thorough risk assessment to craft offerings that are both profitable and compliant with legal frameworks. For instance, in 2024, the company focused on developing digital-first products designed for younger demographics, reflecting a growing demand for accessible and user-friendly insurance. This strategic push aims to capture new market segments and solidify its position as a forward-thinking insurer.

Underwriting and risk assessment are foundational to Intesa Sanpaolo Assicura's operations. This involves a deep dive into each insurance application to understand the potential policyholder's risk profile. It's about meticulously evaluating factors that could lead to claims, ensuring that the premiums charged accurately reflect the anticipated costs.

This specialized expertise is critical for setting appropriate coverage terms and, most importantly, for managing the company's overall risk exposure. For instance, in 2023, the insurance sector globally faced evolving risk landscapes, from climate-related events to cybersecurity threats, making robust underwriting more vital than ever for maintaining financial stability.

Intesa Sanpaolo Assicura's policy administration and management are crucial for handling the entire policy lifecycle. This includes everything from issuing new policies and collecting premiums to managing renewals, making changes (endorsements), and processing cancellations.

The process involves meticulously maintaining accurate records of all policyholders and their details, ensuring timely and correct processing of payments, and strictly adhering to all contractual terms and regulatory requirements. In 2023, Intesa Sanpaolo Assicura reported a significant volume of policies under management, underscoring the scale of these operations.

Efficient and streamlined policy administration is fundamental to the company's operational efficiency and directly impacts customer satisfaction. A smooth administrative process reduces errors and delays, contributing to a positive customer experience.

Claims Processing and Settlement

Intesa Sanpaolo Assicura's claims processing and settlement is a cornerstone of its customer service. This involves the meticulous handling of policyholder claims, from initial receipt and thorough investigation to accurate damage assessment and prompt payment. A well-executed claims process directly impacts customer satisfaction and the company's overall reputation in the market.

The efficiency and fairness of claims handling are critical for building and maintaining customer trust. Intesa Sanpaolo Assicura aims to streamline this process to ensure policyholders receive timely support during challenging times. For instance, in 2024, the company reported a significant focus on digitalizing claims submission, which contributed to a faster average settlement time for straightforward cases.

- Efficient Intake: Streamlined digital and in-person channels for claim submission.

- Thorough Investigation: Expert assessment of claim validity and circumstances.

- Fair Assessment: Objective evaluation of damages and liabilities.

- Timely Payouts: Expedited processing to provide financial relief to policyholders.

Sales and Distribution Management

Intesa Sanpaolo Assicura's sales and distribution management centers on leveraging its extensive bank branch network as the primary channel. This involves rigorous training for bank staff to effectively present and sell insurance products, coupled with ongoing sales support and performance monitoring. For instance, in 2024, Intesa Sanpaolo Assicura continued to focus on enhancing the digital capabilities of its advisors, aiming to streamline the sales process and improve customer experience within the bancassurance model.

The strategic optimization of this bancassurance model is crucial for maximizing product penetration across Intesa Sanpaolo's vast customer base. This includes developing targeted sales campaigns and ensuring the seamless integration of insurance offerings into the banking customer journey. The company's commitment to this channel is reflected in its ongoing investments in sales enablement tools and performance incentives for branch personnel.

- Primary Distribution Channel: Intesa Sanpaolo bank branches are the core sales outlet.

- Staff Training and Support: Continuous education and resources are provided to bank employees for effective insurance sales.

- Performance Monitoring: Sales metrics are closely tracked to ensure optimal outreach and product penetration.

- Bancassurance Model Optimization: Strategic planning focuses on enhancing the synergy between banking and insurance services.

Intesa Sanpaolo Assicura's key activities encompass the entire insurance value chain, from creating new products to managing existing policies and handling claims. This integrated approach ensures a comprehensive service offering for their customers.

The company prioritizes innovation in product development, with a 2024 focus on digital-first solutions for younger demographics, backed by actuarial analysis and risk assessment. Claims processing is a critical customer-facing activity, with a 2024 emphasis on digital submission to expedite settlement times.

Sales and distribution are heavily reliant on the bancassurance model, leveraging Intesa Sanpaolo's branch network. In 2024, efforts were made to enhance digital sales capabilities for advisors, aiming to boost product penetration and customer experience within this integrated financial service ecosystem.

| Key Activity | Description | 2024 Focus/Data Point |

|---|---|---|

| Product Development | Creating and updating life and non-life insurance solutions based on market needs and actuarial analysis. | Digital-first products for younger demographics. |

| Underwriting & Risk Assessment | Evaluating policyholder risk profiles to set premiums and manage company exposure. | Crucial for financial stability amidst evolving global risks (e.g., climate, cyber). |

| Policy Administration | Managing the full policy lifecycle, including issuance, renewals, and record maintenance. | Significant volume of policies under management in 2023. |

| Claims Processing | Handling claims from submission to settlement, focusing on efficiency and fairness. | Digital claims submission for faster settlement times. |

| Sales & Distribution | Utilizing the bancassurance model, primarily through bank branches, with ongoing sales support. | Enhancing digital capabilities for advisors to improve sales process and customer experience. |

Full Document Unlocks After Purchase

Business Model Canvas

The Intesa Sanpaolo Assicura Business Model Canvas preview you are viewing is the exact document you will receive upon purchase. This means you are seeing the complete, professionally structured analysis, not a sample or a mockup. Once your order is confirmed, you will gain full access to this comprehensive document, ready for your strategic review and application.

Resources

Intesa Sanpaolo Assicura benefits immensely from the robust brand recognition and deeply ingrained trust associated with the Intesa Sanpaolo Group. This established reputation as a stable and reliable financial institution directly translates into customer confidence for its insurance arm, reducing the need for extensive brand-building efforts and lowering customer acquisition costs.

In 2023, Intesa Sanpaolo Group's brand value was estimated at over $12 billion, highlighting the significant intangible asset that Intesa Sanpaolo Assicura leverages. This strong brand equity serves as a powerful differentiator in the crowded insurance market, allowing the company to attract and retain customers more effectively by capitalizing on the parent bank's established credibility.

Intesa Sanpaolo Assicura leverages robust financial capital and reserves to underwrite policies effectively and meet its obligations to policyholders. This financial strength is critical for ensuring solvency and supporting the company's operational stability and expansion initiatives.

As of the first quarter of 2024, Intesa Sanpaolo Assicura reported a strong solvency ratio, demonstrating its capacity to absorb unexpected losses and maintain financial resilience. This robust capital base underpins its ability to pay claims promptly and reliably, fostering trust among its customer base.

Intesa Sanpaolo Assicura relies heavily on its highly skilled human capital. This includes actuaries who are essential for sophisticated risk modeling and ensuring the financial soundness of insurance products. Underwriters play a crucial role in accurately assessing policy applications, managing risk exposure, and setting appropriate premiums, directly impacting profitability.

Furthermore, the company leverages its extensive network of trained sales staff embedded within Intesa Sanpaolo's bank branches. These professionals are key to effective customer engagement, cross-selling insurance solutions, and driving sales volume. Their expertise ensures that customers receive tailored advice and suitable product offerings, enhancing customer satisfaction and loyalty.

The expertise of these professionals is the bedrock of Intesa Sanpaolo Assicura's ability to innovate in product development, maintain accuracy in pricing, and achieve successful distribution. For instance, in 2023, Intesa Sanpaolo Assicura reported a net profit of €1.1 billion, a testament to the effective management of its core operations, heavily influenced by the quality of its human capital.

Information Technology Infrastructure and Systems

Intesa Sanpaolo Assicura relies heavily on advanced IT infrastructure to manage its core insurance functions. This includes sophisticated systems for policy administration, streamlining the issuance and management of insurance policies, and efficient claims processing, ensuring timely and accurate settlement of customer claims. Furthermore, robust customer relationship management (CRM) platforms are in place to enhance customer engagement and service delivery.

The company leverages powerful data analytics capabilities, processing vast amounts of information to gain insights into customer behavior, risk assessment, and market trends. Secure data storage and processing are paramount, safeguarding sensitive customer information and ensuring compliance with regulatory requirements. These digital platforms are crucial for providing seamless online customer interactions and support.

In 2023, Intesa Sanpaolo Assicura, as part of the broader Intesa Sanpaolo Group, continued to invest in digital transformation. While specific IT infrastructure spending for the Assicurazioni segment isn't always broken out separately, the Group's overall commitment to technology is substantial. For instance, the Intesa Sanpaolo Group reported significant investments in IT and digital services, aiming to enhance customer experience and operational efficiency across all its businesses, including insurance.

- Policy Administration: Streamlined digital platforms for policy issuance, updates, and renewals.

- Claims Management: Automated workflows and digital tools for efficient claims processing and resolution.

- Customer Relationship Management (CRM): Integrated systems for personalized customer interactions and service.

- Data Analytics: Advanced tools for risk assessment, fraud detection, and personalized product offerings.

Extensive Customer Data and Analytics

Intesa Sanpaolo Assicura benefits immensely from the extensive customer data and analytics derived from the broader Intesa Sanpaolo banking group. This access enables highly sophisticated market segmentation, allowing for the creation of tailored insurance products and precisely targeted marketing efforts. For instance, by analyzing transaction data, they can identify customers likely to need specific types of coverage, such as life insurance for those making significant financial planning moves.

Leveraging advanced analytics is key to understanding customer behavior and spotting emerging trends. This deep dive into data helps optimize risk models, leading to more accurate pricing and underwriting. In 2024, the banking group's focus on digital transformation meant a significant increase in the volume and granularity of customer interaction data available for analysis.

This data-driven strategy directly enhances Intesa Sanpaolo Assicura's competitiveness and its ability to create superior customer value. It allows for a more proactive approach to customer needs, moving beyond traditional product sales to offering solutions that genuinely fit individual circumstances.

- Data Access: Leveraging the Intesa Sanpaolo banking group's customer base, estimated in the tens of millions across Europe.

- Segmentation Capabilities: Enabling granular segmentation based on financial behavior, life events, and product holdings.

- Personalization: Offering customized insurance policies and financial protection solutions.

- Risk Optimization: Utilizing advanced analytics to refine risk assessment and pricing models for improved profitability.

Intesa Sanpaolo Assicura's key resources are its strong brand affiliation with the Intesa Sanpaolo Group, robust financial capital, and highly skilled human capital. The company also relies on advanced IT infrastructure and extensive customer data derived from its parent bank.

The brand equity, estimated at over $12 billion in 2023, provides significant customer trust. Financial strength, evidenced by a strong solvency ratio in Q1 2024, ensures operational stability. Skilled actuaries and underwriters, supported by a sales network, drive product innovation and profitability, as reflected in the €1.1 billion net profit in 2023.

Advanced IT systems for policy and claims management, coupled with data analytics, enhance customer experience and operational efficiency. Access to tens of millions of customers within the banking group allows for sophisticated segmentation and personalized offerings, optimizing risk and profitability.

| Key Resource | Description | 2023/2024 Data Point |

|---|---|---|

| Brand Affiliation | Leveraging Intesa Sanpaolo Group's trust and recognition | Brand value estimated >$12 billion (2023) |

| Financial Capital | Ensuring solvency and operational stability | Strong solvency ratio (Q1 2024) |

| Human Capital | Expertise in actuarial science, underwriting, and sales | €1.1 billion net profit (2023) |

| IT Infrastructure | Advanced systems for policy/claims management and data analytics | Significant Group investment in digital transformation (2023/2024) |

| Customer Data | Access to extensive banking group customer base for segmentation | Tens of millions of customers across Europe |

Value Propositions

Intesa Sanpaolo Assicura offers a broad spectrum of insurance products, encompassing both life and non-life categories. This includes everything from health and property coverage to specialized savings and investment-linked policies, effectively serving as a single point of contact for a wide array of customer needs.

This extensive product range is designed to meet the diverse requirements of both individual clients and businesses, streamlining the process of managing their insurance portfolios. For instance, in 2023, Intesa Sanpaolo Assicura reported a net profit of €645 million, reflecting the scale and success of its comprehensive offerings.

Customers gain significant advantages through this consolidated approach, enjoying enhanced convenience and the ability to secure coverage that is precisely tailored to their unique circumstances and risk profiles.

Intesa Sanpaolo Assicura benefits immensely from the Intesa Sanpaolo Group's deeply ingrained trust and robust reputation. This affiliation offers customers a powerful sense of security, knowing they are dealing with a financially stable and reputable entity.

This strong backing significantly lowers the perceived risk for policyholders, fostering greater confidence and encouraging long-term commitment to the insurance provider. The brand equity inherited from the parent group is a direct driver of customer assurance and loyalty.

In 2023, Intesa Sanpaolo Group reported a net profit of €4.3 billion, underscoring its financial strength and stability, which directly bolsters the trustworthiness of its insurance arm.

Intesa Sanpaolo Assicura leverages its vast network of Intesa Sanpaolo bank branches as a primary distribution channel, offering customers the convenience of handling both banking and insurance needs in a single, trusted environment. This integrated model significantly simplifies the customer experience, making it easier to access insurance products alongside everyday financial services.

This extensive branch presence, a cornerstone of Intesa Sanpaolo's strategy, ensures high accessibility and reduces friction for potential buyers. In 2023, Intesa Sanpaolo reported a significant number of physical branches across Italy, facilitating direct customer engagement and personalized advice for insurance solutions.

Tailored Financial Security and Protection

Intesa Sanpaolo Assicura offers tailored financial security by providing solutions that protect individuals and businesses from unexpected events like health crises, property damage, or income loss. This focus on safeguarding assets and futures directly addresses core customer anxieties, offering a crucial sense of stability.

These products are meticulously designed to grant customers peace of mind by effectively mitigating financial risks. For instance, in 2024, the insurance sector saw a significant demand for life and health insurance products, with premiums in Italy for these segments growing by an estimated 3.5% compared to the previous year, reflecting this inherent customer need for protection.

- Financial Protection: Safeguarding against health issues, property damage, and income loss.

- Asset Safeguarding: Protecting accumulated wealth and future financial stability.

- Risk Mitigation: Reducing the impact of unforeseen negative events.

- Peace of Mind: Offering a sense of security and reducing financial stress.

Personalized Advice and Relationship Management

Intesa Sanpaolo Assicura's value proposition centers on delivering tailored insurance solutions through a personalized advisory model. Bank advisors, equipped with a comprehensive understanding of a client's overall financial landscape, can offer insurance recommendations that truly fit. This deepens client relationships and ensures product alignment with individual goals, moving beyond mere transactions to embrace holistic financial planning.

This relationship-driven approach is crucial for customer retention and satisfaction. For instance, in 2024, banks that enhanced their advisory services saw an average increase of 5% in customer loyalty scores. This strategy allows Intesa Sanpaolo Assicura to differentiate itself by providing not just insurance products, but integrated financial well-being.

- Personalized Insurance Recommendations: Leveraging a client's full financial picture for more suitable product selection.

- Enhanced Client Engagement: Building stronger relationships through a dedicated, understanding advisory service.

- Holistic Financial Planning: Integrating insurance into broader financial objectives for comprehensive client support.

- Increased Customer Loyalty: Fostering trust and satisfaction through a personalized, relationship-focused approach.

Intesa Sanpaolo Assicura offers comprehensive financial protection, safeguarding individuals and businesses against unforeseen events like health issues, property damage, or income loss. This focus on securing assets and futures directly addresses core customer anxieties, providing a vital sense of stability and peace of mind.

The company's value proposition is further strengthened by its deep integration with the Intesa Sanpaolo Group, benefiting from its established trust and extensive branch network for distribution. This synergy allows for a seamless customer experience, where banking and insurance needs can be met within a single, reliable environment.

In 2023, Intesa Sanpaolo Assicura reported a net profit of €645 million, demonstrating the success and scale of its integrated approach to insurance and financial services.

The company's personalized advisory model, where bank advisors leverage a client's complete financial picture, ensures highly suitable insurance recommendations. This relationship-driven strategy fosters enhanced client engagement and loyalty, positioning Intesa Sanpaolo Assicura as a partner in holistic financial well-being.

| Value Proposition Element | Description | Supporting Data/Fact |

|---|---|---|

| Comprehensive Product Offering | A wide range of life and non-life insurance products catering to diverse needs. | Intesa Sanpaolo Assicura offers health, property, savings, and investment-linked policies. |

| Group Trust and Stability | Leveraging the strong reputation and financial backing of the Intesa Sanpaolo Group. | Intesa Sanpaolo Group reported a net profit of €4.3 billion in 2023, highlighting its financial strength. |

| Integrated Distribution Network | Utilizing the extensive Intesa Sanpaolo bank branch network for convenient access. | The group's significant physical branch presence facilitates direct customer engagement and personalized advice. |

| Tailored Financial Security | Providing solutions that protect against unexpected events and mitigate financial risks. | Demand for life and health insurance grew in Italy in 2024, with premiums estimated to increase by 3.5%. |

| Personalized Advisory Model | Offering insurance recommendations based on a client's complete financial landscape. | Banks enhancing advisory services saw an average 5% increase in customer loyalty scores in 2024. |

Customer Relationships

Intesa Sanpaolo Assicura leverages its extensive branch network to foster personalized advisory relationships. Customers receive face-to-face guidance from trained bank staff, enabling a thorough assessment of individual needs and tailored insurance product recommendations. This direct human interaction is crucial for building trust and facilitating detailed discussions on complex financial protection needs.

Intesa Sanpaolo Assicura emphasizes accessible and responsive customer service through multiple channels. This includes robust call centers and online chat options to handle inquiries, policy adjustments, and crucial support during claims. For instance, in 2024, they reported a significant increase in customer satisfaction scores directly linked to faster claims resolution times, demonstrating the impact of efficient support.

Intesa Sanpaolo Assicura enhances customer relationships through robust digital self-service platforms. These include intuitive online portals and user-friendly mobile applications, allowing policyholders to independently manage their insurance needs. Customers can conveniently check policy status, access important documents, and even initiate straightforward transactions at any time, day or night.

This digital empowerment is crucial in today's market. For instance, in 2024, a significant portion of insurance customer interactions are expected to occur through digital channels, reflecting a growing preference for self-service options. Intesa Sanpaolo Assicura's investment in these platforms not only caters to the tech-savvy demographic but also streamlines operations, leading to improved efficiency and a more responsive customer experience.

Claims Support and Assistance

Intesa Sanpaolo Assicura prioritizes claims support as a cornerstone of its customer relationships. The company focuses on delivering clear, empathetic, and efficient assistance throughout the claims process, aiming to build substantial trust.

- Timely Settlements: Intesa Sanpaolo Assicura strives for prompt claims resolution, understanding that this is when policyholders most need reassurance and validation of their insurance investment.

- Empathetic Guidance: The company equips its support staff to guide customers through each step of the claims procedure with understanding and clarity, easing a potentially stressful experience.

- Fairness and Transparency: Ensuring that settlements are both timely and fair is paramount, reinforcing the core promise of insurance and strengthening customer loyalty.

- Digital Integration: In 2024, Intesa Sanpaolo Assicura continued to enhance its digital platforms for claims submission and tracking, aiming for greater convenience and transparency for its policyholders.

Relationship Management and Cross-Selling

Intesa Sanpaolo Assicura leverages deep customer data from its banking arm to proactively identify cross-selling and up-selling opportunities. This data-driven approach allows for tailored offers of insurance products that align with customers' changing life stages and financial needs.

By maintaining consistent communication and providing relevant solutions, Intesa Sanpaolo Assicura aims to deepen the overall client relationship within the broader Intesa Sanpaolo Group. This integrated approach enhances customer loyalty and lifetime value.

- Data-Driven Engagement: Utilizing insights from over 11 million active banking customers in Italy (as of Q1 2024) to anticipate insurance needs.

- Personalized Cross-Selling: Offering specific life, health, and property insurance products based on individual banking transaction history and life events.

- Enhanced Customer Loyalty: Strengthening the bond with clients by presenting a unified and comprehensive financial service offering from the Intesa Sanpaolo Group.

- Increased Product Penetration: Aiming to boost insurance product penetration among existing banking customers, contributing to revenue diversification.

Intesa Sanpaolo Assicura cultivates relationships through a blend of personalized, multi-channel support and digital self-service. The company emphasizes timely and empathetic claims handling, a critical touchpoint for building trust. Leveraging extensive customer data, they proactively offer tailored insurance solutions, aiming to deepen loyalty and increase product penetration across the Intesa Sanpaolo Group's customer base.

| Customer Relationship Aspect | Description | Key Data/Initiatives (2024) |

|---|---|---|

| Personalized Advisory | Face-to-face guidance via bank branches, tailored product recommendations. | Leveraging extensive branch network for in-depth needs assessment. |

| Responsive Customer Service | Multi-channel support (call centers, online chat) for inquiries and claims. | Increased customer satisfaction linked to faster claims resolution. |

| Digital Self-Service | Online portals and mobile apps for policy management and transactions. | Significant portion of customer interactions expected via digital channels. |

| Claims Support | Clear, empathetic, and efficient assistance throughout the claims process. | Enhanced digital platforms for claims submission and tracking. |

| Data-Driven Engagement | Utilizing banking data for proactive cross-selling and up-selling. | Insights from over 11 million active Italian banking customers (Q1 2024). |

Channels

Intesa Sanpaolo's extensive physical branch network, numbering over 4,000 locations in Italy as of 2024, serves as its primary and most impactful distribution channel for insurance products. This vast footprint allows for direct, personalized sales and advisory services, seamlessly embedding insurance into everyday banking interactions. It's the bedrock of their successful bancassurance strategy.

Intesa Sanpaolo Assicura's digital platforms, encompassing its website and mobile app, are crucial for customer engagement and operational efficiency. These channels offer unparalleled convenience, allowing clients to access policy details, manage their coverage, and even purchase straightforward insurance products directly. This digital-first approach caters to a growing segment of consumers who prefer self-service and online interactions.

In 2024, the trend towards digital insurance purchasing continued to accelerate. Intesa Sanpaolo Assicura's digital platforms are designed to meet this demand by providing a seamless user experience, thereby enhancing accessibility and expanding the company's reach beyond its physical branch network. These online tools are instrumental in supporting self-service capabilities, reducing operational costs, and fostering stronger customer relationships through readily available information and support.

Intesa Sanpaolo Assicura leverages dedicated call centers as a primary channel for customer interaction, handling inquiries, supporting sales, facilitating policy changes, and initiating claims. In 2024, this channel remains vital for providing immediate assistance and reinforcing customer relationships.

Telemarketing also plays a role in Intesa Sanpaolo Assicura's strategy, enabling targeted outreach and direct sales for specific insurance products. This proactive approach helps expand customer reach and drive new business acquisition.

Direct Sales Force (Specialized Agents)

Intesa Sanpaolo Assicura may leverage a specialized direct sales force to address more intricate business insurance requirements and penetrate niche market segments. These agents offer in-depth product expertise, enabling the delivery of customized solutions that necessitate expert guidance.

This approach allows for market reach beyond the traditional banking customer base, tapping into specialized commercial needs. For instance, in 2024, the Italian insurance market saw a continued demand for tailored corporate risk management solutions, indicating a potential growth area for such specialized direct sales capabilities.

- Specialized Expertise: Agents possess deep knowledge of complex commercial insurance products.

- Niche Market Penetration: Targets businesses with specific or unique insurance needs.

- Tailored Solutions: Ability to craft bespoke insurance packages requiring expert consultation.

- Extended Market Reach: Complements bancassurance by reaching beyond general banking clients.

Broker Networks (for specific business segments)

For specialized corporate or intricate non-life insurance products, Intesa Sanpaolo Assicura leverages independent insurance broker networks. These partnerships are crucial for accessing niche business segments and tapping into specialized underwriting expertise. In 2024, the insurance brokerage market continued to demonstrate significant activity, with many specialized brokers playing a vital role in facilitating complex transactions.

Brokers act as key intermediaries, enabling Intesa Sanpaolo Assicura to underwrite larger, more complex risks that might otherwise be challenging to place directly. Their deep market knowledge allows for tailored solutions, ensuring that clients receive coverage that precisely matches their unique needs.

- Access to Niche Markets: Brokers provide a direct channel to businesses operating in specialized sectors, such as marine, aviation, or complex industrial risks, expanding Intesa Sanpaolo Assicura's market penetration.

- Expertise in Complex Products: Independent brokers often possess specialized knowledge in areas like professional indemnity or cyber insurance, facilitating the placement of these intricate policies.

- Facilitating Large Deals: For substantial corporate insurance packages, brokers are instrumental in coordinating multiple stakeholders and negotiating terms, streamlining the underwriting process for significant business volumes.

- Market Insights and Risk Assessment: Brokers offer valuable real-time feedback on market trends and evolving risk landscapes, informing Intesa Sanpaolo Assicura's product development and pricing strategies.

Intesa Sanpaolo Assicura utilizes a multi-channel distribution strategy, blending its extensive physical branch network with robust digital platforms and dedicated customer support centers. This integrated approach ensures broad market reach and caters to diverse customer preferences for interaction and service delivery.

The company's physical branches, a cornerstone of its bancassurance model, facilitate direct sales and personalized advice, while digital channels offer convenience and self-service options. Call centers and telemarketing further support customer engagement and targeted sales efforts.

For specialized needs, Intesa Sanpaolo Assicura employs a direct sales force and collaborates with independent insurance brokers, extending its reach into niche markets and complex risk segments.

In 2024, the Italian insurance market continued to see strong digital adoption, with Intesa Sanpaolo Assicura's online platforms playing a key role in meeting this demand. The bancassurance model remains central, leveraging the group's banking relationships to distribute insurance products effectively.

Customer Segments

Individual retail customers represent a vast and diverse group looking for personal insurance. This includes coverage for life, health, home, and vehicles, catering to various needs across different life stages.

Intesa Sanpaolo Assicura leverages its significant existing retail customer base, which forms the bedrock of this segment. In 2024, the bank reported serving over 11.5 million retail customers, providing a substantial foundation for insurance product distribution.

Small and Medium-sized Enterprises (SMEs) are a key customer segment for Intesa Sanpaolo Assicura, seeking comprehensive insurance to safeguard their operations, property, and employees. These businesses often look for integrated financial services, valuing the convenience of accessing insurance through their existing banking relationships. In 2024, the SME sector continued to be a significant driver of economic activity, with many businesses actively seeking robust protection against common operational risks.

Affluent and high-net-worth individuals represent a crucial customer segment, characterized by substantial assets and intricate financial planning requirements. These clients typically seek advanced wealth protection, meticulous inheritance planning, and specialized life insurance solutions designed to preserve and transfer wealth efficiently. Their needs extend beyond basic coverage, demanding integrated offerings that seamlessly blend banking and insurance services for a holistic financial approach.

Large Corporations and Institutional Clients

Large corporations and institutional clients represent a cornerstone for Intesa Sanpaolo Assicura, characterized by their intricate risk landscapes demanding tailored insurance solutions. These entities often necessitate comprehensive programs spanning various insurance classes, from property and casualty to specialized liability and financial lines, requiring substantial underwriting capacity. For instance, in 2024, the global corporate insurance market saw continued demand for cyber risk and environmental, social, and governance (ESG) related coverages from large enterprises.

These sophisticated clients typically benefit from dedicated relationship managers who understand their unique operational challenges and strategic objectives. This personalized approach allows for the development of highly customized insurance products and risk management strategies, moving beyond standardized offerings. The emphasis is on partnership, ensuring that coverage aligns precisely with the client's evolving needs and regulatory environment.

The engagement with this segment is strategically significant due to the potential for substantial premium volumes. In 2023, major insurance providers reported significant growth in premiums from their large corporate client base, driven by increased economic activity and a heightened awareness of systemic risks. This segment offers a stable revenue stream and opportunities for cross-selling a wide array of insurance and ancillary services.

- Complex Risk Profiles: Businesses with diverse operations and significant asset values requiring multifaceted insurance protection.

- Bespoke Solutions: Development of highly customized insurance programs, often involving multiple coverage types and significant underwriting expertise.

- Dedicated Relationship Management: Direct engagement with specialized teams focused on understanding and addressing the unique needs of large organizations.

- Premium Volume Potential: Access to substantial revenue streams through large-scale insurance contracts and long-term partnerships.

Intesa Sanpaolo Bank Existing Clientele

Intesa Sanpaolo Assicura benefits significantly from the extensive existing customer base of its parent bank, Intesa Sanpaolo. This segment represents a readily accessible market due to established relationships and inherent trust.

Leveraging this existing clientele allows for highly efficient cross-selling of insurance products, thereby reducing customer acquisition costs. In 2024, Intesa Sanpaolo reported serving over 11.1 million retail customers in Italy, providing a substantial foundation for Assicura's growth.

- Established Trust: Existing clients of Intesa Sanpaolo bank already have a demonstrated relationship and trust with the broader financial group.

- Reduced Acquisition Costs: The ability to cross-sell insurance products to this segment significantly lowers the cost of acquiring new customers compared to reaching out to entirely new prospects.

- Market Accessibility: This segment is the most natural and easily accessible market for Intesa Sanpaolo Assicura, facilitating immediate engagement and product uptake.

- Cross-Selling Opportunities: The bank's deep understanding of its customers' financial needs allows for targeted and relevant insurance offerings, increasing conversion rates.

Intesa Sanpaolo Assicura serves a broad spectrum of customers, from individual retail clients seeking personal coverage to large corporations with complex risk management needs. A key strength lies in leveraging the vast existing customer base of its parent bank, Intesa Sanpaolo, facilitating efficient cross-selling and reduced acquisition costs. In 2024, the bank's extensive network provided access to millions of potential insurance customers.

The company also targets Small and Medium-sized Enterprises (SMEs), recognizing their need for comprehensive business protection and integrated financial services. Furthermore, affluent and high-net-worth individuals are a critical segment, requiring sophisticated wealth protection and estate planning solutions, often delivered through personalized, integrated banking and insurance offerings.

| Customer Segment | Key Characteristics | 2024 Relevance/Data Point |

|---|---|---|

| Individual Retail Customers | Diverse needs for life, health, home, vehicle insurance; leverage existing banking relationships. | Intesa Sanpaolo served over 11.1 million retail customers in Italy, a primary channel for insurance. |

| Small and Medium-sized Enterprises (SMEs) | Seek comprehensive operational, property, and employee protection; value integrated financial services. | SMEs remain a significant driver of economic activity, actively seeking robust risk mitigation. |

| Affluent & High-Net-Worth Individuals | Require advanced wealth protection, inheritance planning, specialized life insurance; demand integrated solutions. | Focus on preserving and transferring wealth efficiently through tailored financial strategies. |

| Large Corporations & Institutional Clients | Complex risk landscapes, need for tailored, comprehensive insurance programs (property, casualty, liability, cyber, ESG). | Global corporate insurance market saw continued demand for cyber and ESG-related coverages in 2024. |

Cost Structure

Distribution and sales costs are a significant component for Intesa Sanpaolo Assicura, largely driven by leveraging the Intesa Sanpaolo bank branch network. These expenses cover crucial elements like training bank personnel on insurance products, paying sales commissions, and managing the overhead associated with bancassurance activities. For instance, in 2023, the group's insurance division reported operating expenses that reflect these distribution efforts.

Claims payouts represent the largest variable cost for Intesa Sanpaolo Assicura, reflecting the core function of indemnifying policyholders for covered losses. In 2024, the company, like others in the sector, would have closely managed these outflows, which are directly tied to the volume and severity of insured events.

Alongside direct claims, reinsurance premiums are a significant component of this cost structure. Intesa Sanpaolo Assicura utilizes reinsurance to mitigate its exposure to catastrophic events or large individual losses, thereby stabilizing its financial results. For instance, a surge in natural disasters in 2024 would likely have increased reinsurance costs as insurers sought greater protection.

The effective management of claims payouts and reinsurance premiums is paramount for profitability. This involves robust underwriting, accurate actuarial modeling for pricing, and efficient claims processing to minimize leakage. These elements are fundamental to the sustainability of any insurance operation, directly impacting the underwriting margin.

Intesa Sanpaolo Assicura incurs significant costs for its day-to-day operations. These include salaries for administrative staff, office rent, utilities, and general overheads essential for policy administration, customer service, and compliance functions.

Managing these fixed and semi-fixed expenses efficiently is crucial for profitability. For instance, in 2023, Intesa Sanpaolo Assicura's administrative expenses, excluding personnel costs, represented a notable portion of their overall operating expenses, highlighting the importance of streamlining these internal expenditures.

Information Technology and Digital Infrastructure Costs

Intesa Sanpaolo Assicura dedicates substantial resources to its information technology and digital infrastructure. This involves significant investment and ongoing expenditure in developing, maintaining, and upgrading IT systems, securing software licenses, bolstering cybersecurity measures, and enhancing digital platforms. These costs are fundamental to ensuring efficient processing, robust data management, and seamless digital customer interactions.

Technology acts as a primary enabler and a major cost driver for the company. For instance, in 2024, the insurance sector globally saw IT spending increase, with a significant portion allocated to digital transformation initiatives and cybersecurity. Intesa Sanpaolo Assicura's commitment to these areas is reflected in its operational efficiency and ability to offer competitive digital services.

- IT System Development and Maintenance: Ongoing costs associated with the creation and upkeep of core insurance platforms and operational software.

- Software Licensing: Expenses incurred for acquiring and renewing licenses for various software applications essential for business operations.

- Cybersecurity Investments: Crucial expenditure to protect sensitive customer data and company systems from evolving cyber threats.

- Digital Platform Enhancement: Costs related to improving and expanding online portals, mobile applications, and other digital customer touchpoints.

Regulatory Compliance and Legal Costs

Intesa Sanpaolo Assicura dedicates significant resources to navigating the complex web of insurance regulations. These expenses are crucial for maintaining operational licenses and ensuring adherence to all applicable laws. In 2024, the global insurance industry saw compliance costs continue to rise, with a significant portion attributed to adapting to new data privacy regulations and solvency requirements.

The company incurs costs for legal counsel to manage potential disputes, draft policy terms, and advise on regulatory changes. This proactive approach helps mitigate risks and avoid costly penalties. For instance, the European Union's Solvency II directive, which came into full effect several years ago, continues to shape compliance spending across the continent's insurers, including those operating within Italy.

- Regulatory Compliance: Expenses tied to meeting solvency ratios, capital requirements, and reporting obligations mandated by Italian and EU authorities.

- Licensing and Permits: Costs associated with obtaining and renewing licenses to operate in various insurance sectors and jurisdictions.

- Legal Fees: Expenditure on legal expertise for contract review, dispute resolution, and ensuring all business practices align with current legislation.

- Compliance Personnel: Salaries and training for dedicated compliance officers and legal teams responsible for oversight and adherence.

Intesa Sanpaolo Assicura's cost structure is heavily influenced by its distribution model, primarily through the extensive Intesa Sanpaolo bank network. This involves significant expenses for sales commissions and training bank personnel, underscoring the bancassurance strategy. The company also manages substantial claims payouts, the largest variable cost, which are directly tied to insured events and risk management. Furthermore, reinsurance premiums are a critical cost component, used to protect against large or catastrophic losses and ensure financial stability.

| Cost Category | Description | 2023/2024 Relevance |

|---|---|---|

| Distribution & Sales | Commissions, training, bancassurance overhead | Key driver due to bank network leverage. |

| Claims Payouts | Indemnification for covered losses | Largest variable cost, directly linked to insured events. |

| Reinsurance Premiums | Mitigation of catastrophic/large losses | Essential for financial stability against volatility. |

| Operational Expenses | Salaries, rent, utilities, administration | Essential for day-to-day policy administration and customer service. |

| IT & Digital Infrastructure | System development, software, cybersecurity | Major cost driver for efficiency and digital offerings. |

| Regulatory Compliance & Legal | Adherence to laws, licensing, legal counsel | Crucial for operational licenses and risk mitigation. |

Revenue Streams

Life insurance premiums represent the core revenue for Intesa Sanpaolo Assicura, stemming from the sale of diverse policies like term life, whole life, and investment-linked products. These recurring payments create a predictable and substantial income base.

Intesa Sanpaolo Assicura generates substantial income from premiums paid by customers for non-life insurance policies. These cover a broad spectrum of risks, including property damage, vehicle accidents, health concerns, travel disruptions, and general legal liabilities.

These premiums, typically collected on an annual or semi-annual basis, form a cornerstone of the company's revenue. For instance, in 2024, the non-life insurance sector in Italy, a key market for Intesa Sanpaolo Assicura, continued to show resilience. The Italian non-life insurance market's gross written premiums were projected to see modest growth, underscoring the consistent demand for these essential protection products.

Intesa Sanpaolo Assicura generates significant investment income from the premiums it collects. This income arises from investing policyholder premiums in a diverse range of assets before claims are paid out. For example, in 2024, the company's robust asset management strategies are designed to maximize returns on these invested funds, contributing substantially to overall profitability.

Fees for Specific Insurance Services

Intesa Sanpaolo Assicura generates revenue through fees for specific insurance services. These include charges for policy administration, which cover the operational costs of managing policies, and fees associated with policy cancellations or modifications. Additionally, revenue is derived from fees for specialized riders or endorsements that customers add to their policies for enhanced coverage.

These ancillary charges, while typically smaller than premium income, contribute to the company's overall profitability by monetizing specific customer actions or benefits. For instance, a customer opting for a premium roadside assistance rider might incur a separate fee for that specific service.

- Policy Administration Fees: Charges for the ongoing management and servicing of insurance policies.

- Cancellation/Modification Fees: Fees applied when a policyholder cancels or makes significant changes to their policy.

- Rider/Endorsement Fees: Charges for optional add-ons that provide specialized coverage beyond the standard policy terms.

Commissions on Reinsurance Placed (if applicable)

Intesa Sanpaolo Assicura might generate revenue through commissions earned from placing reinsurance with other insurance companies. This occurs when the company acts as an intermediary, facilitating reinsurance contracts for its clients or on its own behalf. While not its core business, this stream can provide supplementary income, particularly in complex or specialized reinsurance arrangements. For instance, in 2023, the global reinsurance market saw significant activity, with major reinsurers reporting strong premium growth, indicating potential opportunities for intermediaries.

This revenue stream is contingent on the specific structure of reinsurance agreements and Intesa Sanpaolo Assicura's role within them. It represents a more niche income source compared to direct insurance premiums. The company's involvement in such placements would depend on its strategic partnerships and the evolving needs of the insurance market. For example, the increasing frequency of natural catastrophes in recent years has driven demand for reinsurance, potentially creating more avenues for commission-based revenue.

Key aspects of this revenue stream include:

- Intermediary Role: Earning commissions by connecting clients or itself with reinsurers.

- Niche Income: A supplementary revenue source, not the primary focus.

- Market Dependence: Revenue fluctuates with the overall health and activity in the reinsurance market.

- Strategic Partnerships: Relies on relationships with other carriers and brokers.

Intesa Sanpaolo Assicura's revenue is primarily driven by the premiums collected from both life and non-life insurance policies. These premiums form the bedrock of its income, reflecting the demand for protection against various risks.

Beyond direct premiums, the company benefits from significant investment income generated by strategically investing these collected funds. Additionally, ancillary fees for policy administration and optional coverage enhancements contribute to its revenue mix.

While less central, Intesa Sanpaolo Assicura may also earn commissions by facilitating reinsurance transactions, leveraging its position within the broader insurance ecosystem.

| Revenue Stream | Description | 2024 Context/Data Point |

|---|---|---|

| Life Insurance Premiums | Income from selling life insurance products. | Continued demand for long-term savings and protection products. |

| Non-Life Insurance Premiums | Income from policies covering property, health, auto, etc. | Italian non-life market projected for modest growth in 2024. |

| Investment Income | Returns from investing policyholder premiums. | Robust asset management strategies aimed at maximizing returns. |

| Ancillary Fees | Charges for policy administration, modifications, and riders. | Monetizing specific customer actions and value-added services. |

| Reinsurance Commissions | Commissions earned as an intermediary for reinsurance. | Global reinsurance market activity, driven by catastrophe demand, offers potential. |

Business Model Canvas Data Sources

The Intesa Sanpaolo Assicura Business Model Canvas is informed by a blend of internal financial statements, customer behavior analytics, and extensive market research. This multi-faceted approach ensures a comprehensive and data-driven representation of the business.