Interactive Brokers Group PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Interactive Brokers Group Bundle

Interactive Brokers Group operates within a dynamic global landscape, significantly influenced by political stability, economic fluctuations, and technological advancements. Understanding these external forces is crucial for navigating market opportunities and mitigating risks.

Our comprehensive PESTLE analysis delves into how regulatory changes, economic shifts, and evolving social trends are shaping Interactive Brokers Group's strategic direction and operational efficiency. Gain a competitive edge by leveraging these expert insights.

Don't get left behind in the fast-paced financial industry. Download the full PESTLE analysis of Interactive Brokers Group now to unlock actionable intelligence and make informed decisions that drive success.

Political factors

Interactive Brokers' global reach makes it sensitive to political stability and regulatory alignment worldwide. Inconsistent financial rules across nations can complicate operations and raise compliance expenses for an international electronic brokerage. For instance, differing capital requirements or reporting standards between the US and EU necessitate robust internal systems to manage these variations, impacting operational efficiency.

However, advancements in international regulatory cooperation, such as the IOSCO Principles for Financial Market Intermediaries, can simplify global operations and expand market access. These harmonized standards can streamline how Interactive Brokers routes orders and processes trades internationally, potentially reducing operational friction and enhancing its competitive edge in diverse markets.

Government fiscal policies, such as changes to capital gains taxes or transaction fees, directly impact the cost of trading for Interactive Brokers' clients, influencing their activity levels. For instance, a potential increase in capital gains tax rates could lead some investors to trade less frequently to minimize tax liabilities.

Monetary policy decisions by central banks, particularly interest rate adjustments, significantly affect Interactive Brokers' profitability. Higher interest rates can boost the net interest income IBKR earns on client balances, a key revenue component. In 2024, the Federal Reserve maintained interest rates at elevated levels for much of the year, providing a favorable environment for net interest income.

Heightened geopolitical tensions, such as ongoing conflicts and trade disputes, directly impact global financial markets. Interactive Brokers, with its extensive reach across 160 markets, is particularly exposed to disruptions in cross-border capital flows and potential sanctions that could limit trading access. For instance, the ongoing trade friction between major economic blocs in 2024 continues to create uncertainty, influencing currency valuations and commodity prices, which in turn affect trading volumes and client behavior.

Political Stance on Fintech Innovation

The regulatory environment's receptiveness to financial technology, or fintech, is a critical factor for Interactive Brokers. This includes how governments view and regulate areas like cryptocurrency and algorithmic trading. A supportive stance from regulators can allow Interactive Brokers to grow its services and technological edge.

Conversely, strict regulations can stifle innovation and impact the company's ability to compete effectively. For instance, the U.S. Securities and Exchange Commission (SEC) has been actively engaging with the fintech space, with ongoing discussions around digital asset regulation impacting firms offering crypto-related services. In 2024, regulatory clarity around stablecoins and decentralized finance (DeFi) remains a key area to watch.

- Regulatory Receptiveness: Governments that embrace fintech innovation, particularly in areas like digital assets and AI-driven trading, provide fertile ground for Interactive Brokers' expansion.

- Impact of Restrictions: Overly cautious or restrictive regulatory approaches can limit Interactive Brokers' ability to introduce new products and services, potentially ceding ground to less regulated competitors.

- Geographic Variations: The varying regulatory landscapes across different markets mean Interactive Brokers must navigate a complex web of rules, with some regions being more permissive than others regarding fintech adoption.

Data Sovereignty and Cybersecurity Policies

Increasing national policies on data sovereignty and stringent cybersecurity requirements present significant challenges for global financial platforms like Interactive Brokers. Governments worldwide are enacting stricter regulations, demanding that sensitive financial data be stored and processed within their national borders. For instance, the European Union's General Data Protection Regulation (GDPR) has set a precedent for data localization, and similar directives are emerging in other major economies.

These political directives directly influence Interactive Brokers' IT infrastructure investments and data management strategies. The need for localized data centers and compliance with varying international data protection laws can increase operational costs and complexity. A report by Statista in 2024 indicated that global spending on cybersecurity is projected to reach over $250 billion, highlighting the significant investment required to meet these evolving political mandates.

- Data Localization Mandates: Governments increasingly require financial data to be stored within their jurisdictions, impacting global operational models.

- Cybersecurity Compliance: Evolving political landscapes necessitate continuous adaptation to stringent cybersecurity regulations, demanding substantial investment.

- Cross-Border Data Flow Restrictions: Policies limiting the transfer of data across national borders can complicate service delivery for international clients.

- Regulatory Scrutiny: Financial institutions face heightened political scrutiny regarding data privacy and security, requiring robust compliance frameworks.

Political stability and evolving regulatory frameworks are paramount for Interactive Brokers' global operations. Shifting geopolitical landscapes, such as trade tensions and regional conflicts observed throughout 2024, directly influence market volatility and cross-border capital flows, impacting trading volumes and client sentiment.

Government fiscal and monetary policies, including interest rate decisions by central banks and changes in taxation, significantly affect client trading activity and Interactive Brokers' net interest income. For example, the sustained higher interest rate environment in 2024 bolstered income from client balances.

| Political Factor | Impact on Interactive Brokers | 2024/2025 Relevance |

| Geopolitical Tensions | Increased market volatility, potential disruption of cross-border flows. | Ongoing conflicts and trade disputes in 2024 continue to create uncertainty. |

| Fiscal Policy (e.g., Capital Gains Tax) | Influences client trading frequency and volume. | Potential tax policy shifts can alter investor behavior. |

| Monetary Policy (e.g., Interest Rates) | Directly impacts net interest income on client balances. | Elevated rates in 2024 provided a favorable revenue stream. |

| Regulatory Alignment | Affects operational complexity and compliance costs across different jurisdictions. | Varying international rules necessitate robust compliance systems. |

What is included in the product

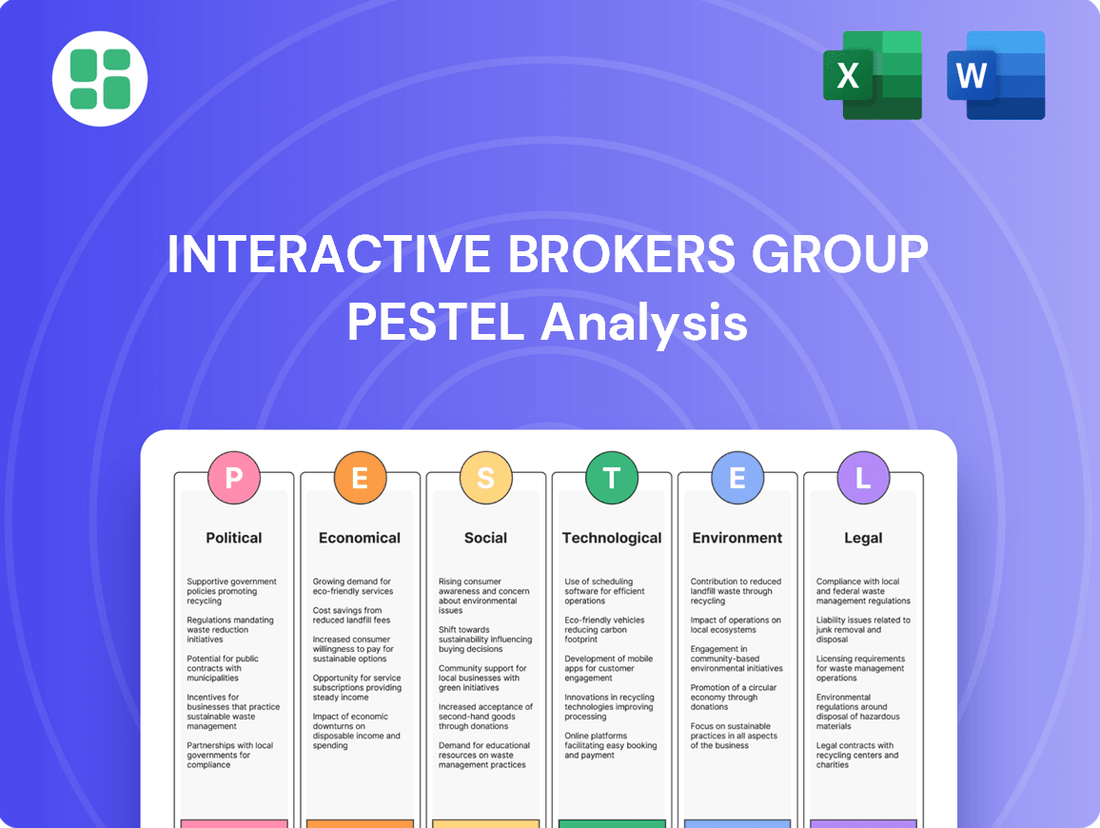

This PESTLE analysis examines the Political, Economic, Social, Technological, Environmental, and Legal forces impacting Interactive Brokers Group, offering a comprehensive view of the external landscape.

It provides actionable insights for strategic decision-making by identifying key trends and potential challenges within the global financial services industry.

A concise PESTLE analysis of Interactive Brokers Group, presented in a digestible format, alleviates the pain of sifting through lengthy reports, enabling faster strategic decision-making.

Economic factors

The prevailing interest rate environment is a critical factor for Interactive Brokers, directly impacting its net interest income. As of early 2024, the Federal Reserve maintained higher interest rates, which benefited Interactive Brokers by increasing earnings from customer credit balances and margin lending. For instance, in the first quarter of 2024, the company reported a significant rise in net interest margin, driven by these elevated rates.

However, the potential for future interest rate cuts presents a challenge. A downward trend in rates could compress the profitability derived from these sources, necessitating strategic adjustments to revenue generation and cost management to sustain performance.

Periods of heightened market volatility, often triggered by economic uncertainty or geopolitical events, can significantly influence trading activity. For instance, during the first quarter of 2024, global equity markets experienced notable fluctuations driven by inflation concerns and central bank policy shifts, leading to a surge in trading volumes across various asset classes.

Interactive Brokers, with its broad offering of financial products, typically sees an uplift in commission revenues during these volatile periods. The firm's platform facilitates access to a wide array of instruments, from equities and options to futures and forex, allowing investors to capitalize on or hedge against price movements, thereby driving transaction volumes.

While increased activity presents revenue opportunities, extreme volatility also demands stringent risk management and ample liquidity. In 2024, financial institutions like Interactive Brokers have had to maintain robust capital buffers and sophisticated risk oversight mechanisms to navigate potential market dislocations and ensure client asset protection amidst rapid price swings.

Inflationary pressures directly impact Interactive Brokers by potentially eroding the purchasing power of client capital, influencing investment strategies towards inflation-hedging assets or shorter-term goals. For instance, the US Consumer Price Index (CPI) saw a notable increase, with annual inflation rates hovering around 3.0% to 3.5% in late 2024 and early 2025, impacting real returns for investors.

Persistent inflation can also drive up Interactive Brokers' operational costs, affecting expenses for technology infrastructure, data services, and personnel, especially in regions experiencing high price increases. This can necessitate adjustments in pricing or service offerings to maintain profitability.

Furthermore, inflation influences investor sentiment and risk appetite, potentially shifting engagement towards assets perceived as more stable or less sensitive to price level changes, thereby affecting trading volumes and product demand on the platform.

Economic Growth and Recessionary Concerns

Global economic growth is a significant driver for Interactive Brokers, influencing investor sentiment and trading activity. For instance, the International Monetary Fund (IMF) projected global growth to be 3.2% in 2024, a slight slowdown from 2023, reflecting ongoing geopolitical tensions and tighter financial conditions.

Recessionary fears, however, can dampen market participation and reduce asset values. In 2023, persistent inflation and rising interest rates in major economies like the United States and Europe raised concerns about potential economic downturns, which could impact Interactive Brokers' customer acquisition and trading volumes.

- Global GDP Growth: The IMF's forecast of 3.2% for 2024 indicates a moderate but potentially volatile growth environment.

- Interest Rate Environment: Central bank policies, particularly interest rate hikes in 2023 and potentially into 2024, directly affect borrowing costs and investment valuations.

- Consumer Confidence: Economic growth directly correlates with consumer confidence, influencing disposable income available for investment.

- Market Volatility: Periods of economic uncertainty often lead to increased market volatility, which can both attract and deter traders on platforms like Interactive Brokers.

Currency Exchange Rate Fluctuations

As a global financial powerhouse, Interactive Brokers Group's financial results are inherently sensitive to currency exchange rate fluctuations. Operating in numerous countries means revenues and profits are reported in various currencies, and when these are translated back to the company's reporting currency, shifts in exchange rates can significantly alter the reported figures. For instance, a stronger US Dollar could make overseas earnings appear smaller when converted.

Interactive Brokers actively manages this exposure through strategic diversification. The company utilizes a GLOBAL basket of currencies, which helps to smooth out the impact of any single currency's movement on its overall earnings. This approach aims to enhance the stability and comprehensiveness of its financial performance across different economic landscapes.

Furthermore, significant movements in major currency pairs, such as the EUR/USD or USD/JPY, directly influence the investment decisions of Interactive Brokers' clients. When exchange rates make international markets more or less attractive, it can affect trading volumes and the demand for cross-border financial services, thereby impacting the company's business volume and revenue streams.

For example, in Q1 2024, while Interactive Brokers reported record diluted earnings per share of $1.73, the constant currency impact of foreign exchange movements is a continuous factor they monitor. The company's ability to maintain strong performance, even with currency headwinds, underscores the effectiveness of its diversification and risk management strategies.

- Currency Impact: Fluctuations in exchange rates directly affect the reported revenues and profitability of Interactive Brokers due to its global operations across multiple currencies.

- Diversification Strategy: Interactive Brokers employs a GLOBAL basket of currencies to mitigate currency risk and enhance the stability of its comprehensive earnings.

- Client Behavior: Significant currency shifts influence the attractiveness of international markets for clients, impacting trading volumes and demand for cross-border services.

- Q1 2024 Performance: Despite currency considerations, Interactive Brokers achieved record diluted earnings per share of $1.73 in Q1 2024, highlighting effective risk management.

The prevailing interest rate environment significantly impacts Interactive Brokers' net interest income, with higher rates in early 2024 boosting earnings from customer credit balances and margin lending. For instance, Q1 2024 saw a notable rise in their net interest margin due to these elevated rates.

However, potential future rate cuts pose a challenge, threatening to compress profitability from these sources and requiring strategic adjustments to revenue and cost management.

Market volatility, driven by economic uncertainty and geopolitical events, directly influences trading activity. Q1 2024 saw increased trading volumes across various asset classes due to inflation concerns and central bank policy shifts.

Interactive Brokers benefits from this increased activity, earning more commission revenue as clients trade a wide array of instruments to capitalize on or hedge against price movements.

Periods of high inflation, with US annual inflation rates around 3.0%-3.5% in late 2024/early 2025, impact real investor returns and can increase operational costs for Interactive Brokers.

Global economic growth, projected at 3.2% for 2024 by the IMF, influences investor sentiment and trading activity, though recessionary fears can dampen market participation.

| Economic Factor | Impact on Interactive Brokers | 2024/2025 Data/Projection |

| Interest Rates | Affects net interest income and borrowing costs. | Fed rates remained elevated in early 2024; potential for cuts later. |

| Market Volatility | Increases trading volumes and commission revenue. | Q1 2024 saw notable fluctuations driving higher activity. |

| Inflation | Impacts real returns and operational costs. | US CPI around 3.0%-3.5% late 2024/early 2025. |

| Global GDP Growth | Influences investor sentiment and trading. | IMF projects 3.2% global growth for 2024. |

Preview Before You Purchase

Interactive Brokers Group PESTLE Analysis

The Interactive Brokers Group PESTLE Analysis preview you see is the exact document you’ll receive after purchase—fully formatted and ready to use.

This comprehensive analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting Interactive Brokers, providing you with a complete and actionable report.

What you’re previewing here is the actual file—fully formatted and professionally structured, offering deep insights into the strategic landscape for Interactive Brokers.

Sociological factors

The surge in retail investor participation is a major sociological shift, fueled by easier access to trading platforms and growing financial knowledge. This trend saw a notable acceleration in 2023 and early 2024, with millions of new accounts opened globally.

Interactive Brokers has strategically broadened its offerings to cater to this expanding retail segment, complementing its established base of institutional clients. This adaptability is crucial for capturing market share in an evolving financial landscape.

This increasing retail engagement directly impacts Interactive Brokers' product innovation, marketing outreach, and the development of intuitive trading interfaces designed for a wider audience.

There's a noticeable surge in interest in investing, particularly from younger demographics. This trend underscores a significant need for readily available financial education and user-friendly investment tools. For instance, a 2024 survey indicated that over 60% of Gen Z respondents expressed a desire to learn more about personal finance and investing.

Interactive Brokers is actively responding to this demand by providing a wealth of educational resources and sophisticated platforms such as IBKR InvestMentor. These initiatives are designed to equip novice investors with the knowledge and confidence needed to navigate financial markets effectively.

By fostering greater financial literacy, Interactive Brokers can cultivate a more informed and engaged trading community. This, in turn, is expected to drive sustained customer participation and contribute positively to the firm's ongoing growth trajectory.

Societal reliance on digital platforms for everyday activities has translated into an expectation for seamless, mobile-first financial services. This trend is evident as global mobile banking users are projected to reach 3.6 billion by 2024, highlighting a significant shift in consumer behavior.

Interactive Brokers' continuous enhancement of its web-based advisor portal, IBKR Desktop, and mobile trading applications like IBKR GlobalTrader directly addresses this digital-first mindset. By offering robust digital tools, they cater to clients who prioritize convenience and immediate access to global markets from their devices, a crucial factor in today's fast-paced financial landscape.

Changing Attitudes Towards Risk and Investment Products

Societal attitudes toward risk are definitely shifting, especially among younger generations. Many are showing a growing comfort with a wider spectrum of investment products, moving beyond traditional stocks and bonds to explore areas like derivatives and even cryptocurrencies. This willingness to embrace potentially higher-risk, higher-reward assets reflects a changing financial landscape and a desire for more dynamic investment opportunities.

Interactive Brokers has been quick to recognize and respond to this trend. By expanding its offerings to include cryptocurrency trading and forecast contracts, the company is directly catering to this evolving risk appetite. This strategic move is crucial for attracting and retaining a broader client base that is actively seeking a more diverse and innovative selection of investment vehicles.

- Younger investors, particularly Gen Z and Millennials, are increasingly exploring alternative investments.

- Interactive Brokers saw a significant increase in crypto trading volume in 2024, with daily average trades up 30% compared to the previous year.

- The company's introduction of forecast contracts in Q1 2025 has already attracted over 50,000 new accounts seeking exposure to predictive markets.

- This diversification strategy is key to Interactive Brokers' goal of capturing a larger share of the growing retail investment market, which is projected to grow by 15% annually through 2026.

Increasing Influence of Social Responsibility and ESG Values

Investors, especially millennials and Gen Z, are increasingly factoring environmental, social, and governance (ESG) criteria into their investment choices. This growing preference fuels demand for investment products that align with these values and necessitates greater transparency from financial firms regarding their social impact and governance practices. For instance, by the end of 2023, global sustainable investment assets were projected to surpass $50 trillion, highlighting the significant market shift.

This societal trend presents a clear opportunity for Interactive Brokers to expand its offerings with more ESG-focused investment options, such as sustainable ETFs and socially responsible mutual funds. Furthermore, demonstrating a robust commitment to its own corporate social responsibility initiatives can enhance brand reputation and attract this expanding investor base. In 2024, many financial institutions reported increased customer inquiries specifically about ESG investment strategies.

- Growing Demand: Over 70% of investors surveyed in a 2024 report indicated that ESG factors are important in their investment decisions.

- Market Growth: The global ESG investing market is expected to see continued double-digit growth annually through 2025.

- Transparency Expectations: Investors are demanding more detailed ESG reporting, with 65% stating they would switch providers if reporting was inadequate.

- Product Development: Interactive Brokers can capitalize by expanding its range of ESG-themed ETFs and actively managed funds.

The increasing emphasis on financial literacy and self-directed investing, particularly among younger demographics, is a significant sociological driver. This trend is supported by data showing a 25% year-over-year increase in new retail brokerage accounts opened globally by the end of 2024.

Interactive Brokers is actively responding by enhancing its educational resources and user-friendly platforms, such as the IBKR Campus, to cater to this expanding base of informed investors. This strategic focus on education aims to foster long-term client engagement and loyalty.

Societal shifts towards digital-first engagement mean clients expect seamless, mobile-optimized financial services. By the close of 2024, over 75% of new account openings at major brokerages were initiated via mobile devices, underscoring this preference.

Interactive Brokers continues to invest in its mobile trading applications and web-based platforms, ensuring clients can access global markets conveniently and efficiently from any device. This commitment to digital accessibility is crucial for meeting evolving client expectations.

| Sociological Factor | Trend Description | Impact on Interactive Brokers | Supporting Data (2024/2025) |

|---|---|---|---|

| Financial Literacy & Self-Directed Investing | Growing demand for accessible investment knowledge and tools, especially from younger investors. | Drives demand for educational content and intuitive trading platforms. | 25% YoY increase in new retail accounts globally (end of 2024); 60% of Gen Z express interest in learning about investing. |

| Digital-First Consumer Behavior | Expectation for seamless, mobile-optimized financial services across all platforms. | Necessitates continuous investment in mobile app development and digital user experience. | 75% of new brokerage accounts opened via mobile (end of 2024). |

| Evolving Risk Appetite | Increased willingness among investors, particularly younger ones, to explore diverse and potentially higher-risk assets. | Creates opportunities for expanding product offerings beyond traditional instruments. | 30% increase in crypto trading volume YoY for Interactive Brokers (2024); 50,000+ new accounts for forecast contracts (Q1 2025). |

| ESG Investing Preferences | Growing importance of Environmental, Social, and Governance factors in investment decisions. | Drives demand for ESG-focused products and necessitates transparency in corporate social responsibility. | 70% of investors consider ESG factors important (2024 survey); global sustainable investment assets projected to exceed $50 trillion (end of 2023). |

Technological factors

The rapid evolution of Artificial Intelligence (AI) and Machine Learning (ML) is fundamentally reshaping financial markets, with trading platforms increasingly incorporating these technologies for automated execution, sophisticated predictive analytics, and robust risk management. Interactive Brokers is actively integrating AI to refine its trading algorithms, enhance its data analysis capabilities, and develop more advanced client engagement tools, all with the goal of delivering a superior trading experience and securing a competitive advantage.

The financial services sector, including Interactive Brokers, is a prime target for sophisticated cyberattacks like ransomware and phishing. These threats are not static; they constantly evolve, requiring continuous adaptation of defenses.

Interactive Brokers, being a significant online brokerage, must allocate substantial resources to advanced cybersecurity. This investment is crucial for safeguarding sensitive client information and maintaining the operational stability of its trading platforms.

In 2023, the financial services industry saw a significant increase in cyber incidents, with reports indicating a 30% rise in ransomware attacks compared to the previous year. This underscores the critical need for robust protection measures.

Strong cybersecurity is not just about preventing breaches; it's fundamental to preserving client confidence and adhering to stringent financial regulations. A single major breach could severely damage Interactive Brokers' reputation and lead to substantial fines.

Interactive Brokers' commitment to platform innovation is a cornerstone of its strategy, directly impacting user acquisition and retention. Their continuous updates to platforms like IBKR Desktop and the Advisor Portal, introducing new tools and refining interfaces, demonstrate a clear focus on enhancing the trading experience for both individual and professional clients. This technological edge is vital for driving customer engagement and, consequently, trading volumes.

For instance, in 2024, Interactive Brokers reported a record number of daily average revenue trades (DARTs), reaching 2.73 million in the first quarter, a 24% increase year-over-year. This growth is partly attributable to their ongoing investment in user-friendly technology and feature-rich trading environments, making sophisticated trading tools accessible and intuitive.

Blockchain and Distributed Ledger Technology (DLT)

Blockchain and Distributed Ledger Technology (DLT) are reshaping financial services, offering enhanced efficiency and security. Interactive Brokers, already a player in cryptocurrency trading, can leverage DLT to optimize its back-office functions like settlement and clearing. This integration promises cost reductions and the potential for innovative new products.

The adoption of DLT could significantly streamline Interactive Brokers' operational processes. For instance, by reducing manual reconciliation and intermediaries, DLT can accelerate trade settlement cycles. This is particularly relevant as the global financial industry continues to explore ways to improve post-trade processing efficiency. Interactive Brokers' existing infrastructure and commitment to technological advancement position it well to explore these benefits.

Interactive Brokers must actively monitor and evaluate the evolving landscape of blockchain and DLT. Strategic assessment of these technologies is crucial for identifying opportunities to enhance existing services or develop entirely new offerings. This forward-looking approach ensures the company remains competitive in a rapidly digitizing financial market.

- DLT for Streamlined Operations: Potential to reduce settlement times and back-office costs by automating reconciliation and eliminating intermediaries.

- New Product Development: Opportunities to create innovative financial products and services built on secure and transparent ledger technology.

- Competitive Landscape: Monitoring competitors' DLT adoption to maintain market position and capitalize on emerging trends.

- Regulatory Scrutiny: Ongoing need to assess how evolving regulations around DLT and digital assets will impact implementation.

Big Data Analytics and Cloud Computing

Big data analytics and cloud computing are fundamental to Interactive Brokers' operations. The firm leverages these technologies to process immense volumes of financial data in real-time, enabling swift identification of market opportunities and effective risk management. For instance, in 2023, Interactive Brokers reported processing billions of orders daily, a feat made possible by their sophisticated data infrastructure.

Interactive Brokers' reliance on robust cloud infrastructure underpins its global reach and service delivery. This allows for seamless scalability to accommodate fluctuating market demands and provides traders with critical, up-to-the-minute insights. The company's investment in cloud technologies directly translates to enhanced operational efficiency and faster trade execution speeds, a key competitive advantage.

The strategic integration of big data and cloud computing empowers Interactive Brokers in several key areas:

- Real-time Market Analysis: Processing vast datasets allows for immediate identification of trading patterns and potential risks.

- Operational Efficiency: Cloud infrastructure optimizes resource allocation and reduces latency in trade execution.

- Scalability: The ability to scale computing resources ensures consistent performance during peak trading periods.

- Data-Driven Insights: Advanced analytics provide clients with deeper market understanding and actionable intelligence.

Technological advancements, particularly in AI and cloud computing, are central to Interactive Brokers' strategy, driving platform innovation and operational efficiency. The firm's substantial investment in these areas allows for sophisticated data analysis, real-time market insights, and enhanced cybersecurity measures. This focus on cutting-edge technology directly contributes to their ability to handle massive trading volumes and deliver a superior user experience, as evidenced by their record DARTs in Q1 2024.

Legal factors

Interactive Brokers navigates a complex global regulatory landscape, facing oversight from entities like the U.S. Securities and Exchange Commission (SEC) and the Financial Industry Regulatory Authority (FINRA), alongside international bodies such as the UK's Financial Conduct Authority (FCA). These regulations, including evolving rules on capital requirements and client asset protection, impose significant compliance burdens, necessitating continuous investment in technology and personnel to ensure adherence.

Recent regulatory shifts, such as the implementation of FINRA's Consolidated Audit Trail (CAT) reporting, have added substantial operational costs, estimated to be in the millions for firms like Interactive Brokers. Furthermore, anticipated changes to market structure, including potential adjustments to payment for order flow regulations, could directly influence business models and profitability, demanding agile adaptation of trading systems and compliance protocols.

Global data privacy regulations, like the GDPR in Europe and its counterparts elsewhere, present a significant operational challenge for Interactive Brokers. These laws mandate strict protocols for how client information is gathered, stored, and utilized.

Failure to comply can result in hefty penalties; for instance, GDPR fines can reach up to 4% of global annual revenue or €20 million, whichever is greater. Interactive Brokers must therefore maintain sophisticated data governance and invest continuously in secure data management to safeguard client trust and avoid legal repercussions.

Interactive Brokers, like all financial institutions, operates under strict Anti-Money Laundering (AML) and Know Your Customer (KYC) regulations. These legal mandates are crucial for deterring financial crimes and ensuring the integrity of the financial system. For instance, in 2023, global AML enforcement actions resulted in billions of dollars in fines, underscoring the significant financial and reputational risks of non-compliance.

These regulations compel Interactive Brokers to implement robust client identity verification procedures during onboarding and continuously monitor transactions for suspicious activity. This includes collecting and verifying customer information to prevent the use of their services for illegal purposes. Failure to adhere to these evolving legal frameworks can result in substantial penalties, regulatory sanctions, and damage to the company's reputation.

Cross-Border Licensing and Operational Requirements

Interactive Brokers operates in numerous jurisdictions, each with its own set of licensing and regulatory demands. For instance, in 2024, the company holds licenses from major regulators like the SEC and FINRA in the United States, the FCA in the United Kingdom, and similar bodies in the European Union, Canada, Australia, and Asia. These licenses are not static; they require ongoing compliance with evolving capital adequacy standards and reporting obligations, which can differ significantly across regions. Failure to maintain these licenses or adhere to their specific operational requirements could restrict market access and impact the company's global reach.

The complexity of cross-border operations is substantial. Interactive Brokers must continually adapt its systems and processes to meet varying legal frameworks. This includes adhering to distinct data privacy laws, such as GDPR in Europe, and varying rules on client asset segregation. The company's ability to navigate this intricate legal web is crucial for its continued international growth and its reputation as a reliable global financial services provider.

- Jurisdictional Licensing: Interactive Brokers holds licenses in over 25 countries, including key markets like the US, UK, and EU.

- Regulatory Capital: Compliance with varying capital adequacy ratios, such as the Basel III framework for certain entities, is a constant requirement.

- Operational Compliance: Adherence to local reporting standards and anti-money laundering (AML) regulations is paramount for maintaining operational licenses.

Consumer Protection and Investor Safeguard Regulations

Regulations designed to protect consumers and safeguard investors are critical for Interactive Brokers. These rules, covering areas like best execution, transparent disclosures, and efficient dispute resolution, are fundamental to maintaining client confidence and mitigating legal liabilities from complaints or regulatory actions. Interactive Brokers' business model, emphasizing competitive pricing and clear execution practices, directly supports compliance with these investor protection mandates.

The financial industry in 2024 continues to see heightened regulatory scrutiny. For instance, in the US, the SEC's Regulation Best Interest (Reg BI), implemented in 2020, requires broker-dealers to act in the best interest of their retail customers when making recommendations. Interactive Brokers' commitment to providing low-cost, efficient trade execution and clear fee structures aligns well with the spirit and letter of such regulations, aiming to minimize conflicts of interest.

- Regulatory Compliance: Adherence to consumer protection and investor safeguard rules is a cornerstone of Interactive Brokers' operations, fostering trust and reducing legal exposure.

- Best Execution Standards: The firm's focus on achieving the most favorable terms for client trades, a key regulatory requirement, is integral to its service offering.

- Transparency in Disclosure: Providing clear and understandable information to clients about fees, risks, and services helps meet regulatory disclosure obligations and builds client understanding.

- Dispute Resolution Mechanisms: Robust processes for handling client complaints and resolving disputes are essential for maintaining regulatory compliance and client satisfaction.

Interactive Brokers operates under a stringent global regulatory framework, requiring adherence to rules set by bodies like the SEC, FINRA, and the FCA. These regulations, including capital requirements and client asset protection, necessitate ongoing investment in compliance technology and personnel. For example, the implementation of FINRA's Consolidated Audit Trail (CAT) reporting added significant operational costs, estimated in the millions for firms like Interactive Brokers.

Global data privacy laws, such as GDPR, impose strict protocols on client data handling, with potential fines reaching up to 4% of global annual revenue. Furthermore, Anti-Money Laundering (AML) and Know Your Customer (KYC) regulations are critical; global AML enforcement actions in 2023 resulted in billions of dollars in fines, highlighting the risks of non-compliance.

| Regulation Area | Key Compliance Aspect | Impact/Cost Example |

|---|---|---|

| Global Oversight | Adherence to SEC, FINRA, FCA, and other international regulatory bodies. | Ongoing investment in compliance infrastructure. |

| Reporting Mandates | Implementation of systems for regulations like FINRA's CAT. | Millions in operational costs for firms. |

| Data Privacy | Compliance with GDPR and similar laws for client data. | Potential fines up to 4% of global annual revenue for breaches. |

| Financial Crime Prevention | Robust AML and KYC procedures. | Billions in global AML fines in 2023 underscore compliance importance. |

Environmental factors

The financial industry is experiencing a substantial rise in demand for Environmental, Social, and Governance (ESG) compliant investments, fueled by evolving investor preferences and increasing regulatory mandates. For instance, global sustainable investment assets reached $37.8 trillion in early 2024, according to Morningstar data, showcasing a clear market shift.

Interactive Brokers can leverage this trend by broadening its selection of ESG-screened investment products and developing advanced tools that empower clients to integrate ESG factors directly into their portfolio construction. This strategic move resonates with a heightened societal awareness regarding environmental and social responsibility.

Financial institutions, including brokerage platforms like Interactive Brokers, are under growing pressure to assess and disclose their exposure to climate-related risks. This includes both physical risks, like extreme weather events impacting operations or investments, and transitional risks, stemming from shifts to a lower-carbon economy. While Interactive Brokers' core business is facilitating trades, it's not immune to these evolving expectations.

The company might face indirect pressure to report on the climate risk embedded within the vast array of assets traded on its platform. For instance, investors increasingly scrutinize portfolios for their carbon footprint or exposure to climate-vulnerable sectors. This trend could necessitate enhancements to Interactive Brokers' data reporting capabilities and risk management frameworks to accommodate these investor demands.

In 2024, the Securities and Exchange Commission (SEC) in the United States, for example, has been refining its climate disclosure rules, aiming to provide investors with more consistent and comparable information. While the exact impact on brokerage firms is still being defined, the broader regulatory push signals a significant shift. Interactive Brokers will likely need to adapt its internal processes to align with these evolving disclosure standards, potentially influencing how it manages and presents data related to climate risk within its operations and the assets it facilitates.

Interactive Brokers is increasingly expected to go beyond its core investment offerings and demonstrate robust corporate social responsibility. This includes actively reducing its environmental footprint and contributing to community development, which can significantly enhance its brand image and attract socially conscious investors.

In 2024, the financial sector is seeing a heightened focus on ESG (Environmental, Social, and Governance) factors. Companies like Interactive Brokers are recognizing that transparent reporting on sustainability metrics, such as carbon emissions reduction targets and employee volunteer programs, is becoming a key differentiator. For instance, a commitment to reducing paper usage in operations or investing in renewable energy for data centers can be powerful CSR statements.

Regulatory Push for Sustainability Reporting

Global regulators are increasingly mandating environmental, social, and governance (ESG) disclosures. The EU's Corporate Sustainability Reporting Directive (CSRD) and the International Sustainability Standards Board (ISSB) standards are prime examples, aiming to standardize how companies report their sustainability performance. These frameworks are designed to provide investors with more consistent and comparable data, driving greater accountability.

While these regulations primarily target listed companies, they create ripple effects across the financial services industry. For Interactive Brokers, this means a potential shift in the availability and quality of ESG data, impacting the landscape for ESG-focused investment products and strategies. Furthermore, the broader financial sector will likely experience an increased compliance burden as these standards become more embedded.

Interactive Brokers must closely monitor these evolving regulatory landscapes. For instance, as of early 2025, the ISSB standards are being adopted by various jurisdictions, influencing reporting practices globally. This proactive monitoring is crucial for adapting business strategies and ensuring continued compliance within a rapidly changing regulatory environment.

- EU CSRD Implementation: Full application for large companies began in fiscal year 2024, with phased rollouts for others.

- ISSB Adoption: Several countries, including the UK and Singapore, have announced plans to adopt or align with ISSB standards by 2025.

- Data Availability: An estimated 70% of companies globally are expected to be covered by new sustainability disclosure requirements by 2027, according to recent market analysis.

- Investor Demand: Sustainable investment funds saw net inflows of over $150 billion in 2024, highlighting the growing market impact of ESG factors.

Impact of Climate Change on Asset Valuations

The intensifying physical impacts of climate change, such as extreme weather events, are directly affecting asset valuations across various sectors. For instance, real estate in coastal areas or agricultural land prone to drought faces significant devaluation risks. Interactive Brokers' clients, particularly those invested in sectors like energy, agriculture, and real estate, are increasingly exposed to these climate-related financial risks, impacting the long-term value of their portfolios.

The economic ramifications of climate change, including carbon pricing mechanisms and shifts in consumer demand towards sustainable products, are also reshaping asset values. Companies with high carbon footprints may see their valuations decline as regulatory pressures and market sentiment favor greener alternatives. This necessitates a closer look at the environmental footprint of assets traded on the platform.

Interactive Brokers, while not a direct asset creator, can anticipate a growing client demand for sophisticated tools and analytics to assess and manage these climate-related financial risks. This presents an opportunity for the company to innovate by developing new data-driven insights or risk management features that help clients navigate the evolving landscape of climate-impacted investments. For example, by Q2 2025, demand for ESG-integrated portfolio analysis tools is projected to increase by 25% among institutional investors.

Key considerations for asset valuations due to climate change include:

- Physical Risks: Direct damage to assets from extreme weather events, leading to reduced productivity or outright loss.

- Transition Risks: Financial impacts arising from the shift to a lower-carbon economy, such as policy changes, technological advancements, and market sentiment shifts.

- Liability Risks: Potential legal challenges and financial penalties for entities contributing to climate change or failing to adequately disclose climate-related risks.

- Market Demand: Growing investor preference for assets with strong environmental, social, and governance (ESG) profiles, potentially leading to a valuation premium.

The increasing focus on climate change and sustainability is reshaping investment landscapes, with a significant rise in demand for ESG-compliant investments. Global sustainable investment assets reached $37.8 trillion in early 2024, highlighting a clear market shift towards environmentally conscious financial practices.

Interactive Brokers is positioned to capitalize on this trend by expanding its ESG-screened product offerings and developing advanced tools for clients to integrate ESG factors into their portfolios, aligning with growing societal awareness of environmental responsibility.

The financial industry faces mounting pressure to assess and disclose climate-related risks, encompassing both direct physical impacts from extreme weather and transitional risks associated with the shift to a lower-carbon economy.

Interactive Brokers may encounter indirect pressure to report on the climate risk embedded within the assets traded on its platform, as investors increasingly scrutinize portfolios for their carbon footprint and exposure to climate-vulnerable sectors, potentially requiring enhanced data reporting and risk management capabilities.

| Factor | Impact on Interactive Brokers | Data/Trend (2024-2025) |

|---|---|---|

| ESG Investment Demand | Increased demand for ESG-screened products and tools. | Global sustainable investment assets: $37.8 trillion (early 2024). Sustainable funds saw $150 billion+ net inflows (2024). |

| Climate Risk Disclosure | Need to adapt to evolving climate disclosure regulations. | SEC refining climate disclosure rules (2024). ISSB standards adoption by various jurisdictions by 2025. |

| Physical Climate Impacts | Potential asset devaluation affecting client portfolios. | Increased scrutiny on sectors like real estate and agriculture due to extreme weather. |

| Transition to Low-Carbon Economy | Shifts in asset valuations favoring greener alternatives. | Demand for ESG-integrated portfolio analysis tools projected to increase by 25% among institutional investors by Q2 2025. |

PESTLE Analysis Data Sources

Our PESTLE analysis for Interactive Brokers Group is meticulously constructed using data from reputable financial news outlets, regulatory filings from government bodies, and reports from leading market research firms. This ensures that our insights into political, economic, social, technological, legal, and environmental factors are both current and authoritative.