Interactive Brokers Group Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Interactive Brokers Group Bundle

Discover the strategic engine behind Interactive Brokers Group's dominance with our comprehensive Business Model Canvas. This detailed breakdown reveals their innovative approach to customer relationships, revenue streams, and key resources that fuel their growth. Perfect for anyone looking to understand how a leading fintech firm operates and thrives.

Want to dissect the success of Interactive Brokers Group? Our full Business Model Canvas offers a clear, section-by-section analysis of their value proposition, cost structure, and competitive advantages. Download it now to gain actionable insights for your own business strategy.

Partnerships

Interactive Brokers cultivates vital relationships with a vast network of global exchanges and liquidity providers. This ensures clients benefit from efficient trade execution and competitive pricing across a wide array of assets, from equities to forex. For instance, their access to major exchanges like the NYSE and Nasdaq, alongside numerous ECNs, is fundamental to their low-cost execution model.

These strategic alliances are the backbone of Interactive Brokers' ability to offer direct market access, a key differentiator for active traders. By connecting with deep liquidity pools, they can consistently provide tight bid-ask spreads, which is especially important for institutional clients and high-frequency traders who rely on minimal slippage. In 2024, Interactive Brokers reported an average daily volume of 10.5 million trades, underscoring the scale and importance of these partnerships.

Interactive Brokers' reliance on technology and data providers is critical for its operational excellence. In 2024, the company continued to invest heavily in these areas, ensuring its platforms offer real-time market data feeds and sophisticated trading tools. These partnerships are fundamental to providing clients with the competitive edge needed in fast-paced financial markets.

Interactive Brokers actively engages with a global network of regulatory bodies, such as the SEC in the United States and the FCA in the United Kingdom, to ensure adherence to evolving financial regulations. This commitment to compliance, evidenced by their consistent regulatory filings and audits, is crucial for maintaining operational integrity and client trust across diverse markets.

Crucial to its operations, Interactive Brokers partners with major clearing houses like the Depository Trust & Clearing Corporation (DTCC) for efficient and secure trade settlement. In 2023, the DTCC processed trillions of dollars in securities transactions daily, highlighting the scale and importance of these partnerships for the smooth functioning of global financial markets and Interactive Brokers' ability to offer seamless trading services.

Introducing Brokers and Financial Advisors

Interactive Brokers actively collaborates with introducing brokers (IBs) and financial advisors, offering them a robust technological platform to manage their client accounts. This partnership model allows these professionals to access Interactive Brokers' extensive global market reach and sophisticated trading tools, effectively extending their service capabilities.

By leveraging Interactive Brokers' infrastructure, IBs and advisors can focus on client relationships and investment strategies rather than building and maintaining their own trading systems. This symbiotic relationship significantly expands Interactive Brokers' market presence. For instance, as of early 2024, Interactive Brokers serves millions of accounts, a substantial portion of which are facilitated through its partner network.

- Leveraged Technology: Partners gain access to Interactive Brokers' advanced trading platforms, order routing, and risk management systems.

- Global Market Access: The platform provides seamless access to over 150 markets across multiple currencies, enabling partners to offer diverse investment opportunities.

- Scalability: This model allows partners to scale their businesses efficiently without significant upfront investment in technology or infrastructure.

- Cost Efficiency: Interactive Brokers handles the heavy lifting of technology development and regulatory compliance, reducing operational costs for partners.

Cryptocurrency Platforms

Interactive Brokers' strategic alliances with cryptocurrency platforms are crucial for expanding its digital asset offerings. By partnering with entities such as Paxos and investing in Zero Hash, the company is actively integrating crypto trading capabilities into its existing brokerage services.

These collaborations are designed to meet increasing client demand for exposure to the burgeoning cryptocurrency market. This allows Interactive Brokers to provide a more comprehensive suite of investment options, catering to a diverse client base looking to diversify their portfolios into digital assets.

The company's investment in Zero Hash, a digital asset infrastructure provider, underscores its commitment to building robust crypto trading infrastructure. This move is particularly significant as the digital asset landscape continues to evolve rapidly, with market capitalization for cryptocurrencies reaching trillions of dollars at various points in recent years.

- Paxos: A regulated blockchain company providing infrastructure for the tokenization of real-world assets and the issuance of stablecoins, facilitating compliant crypto trading for Interactive Brokers' clients.

- Zero Hash: An investment in this digital asset settlement and custody platform allows Interactive Brokers to offer regulated crypto trading and custody solutions, enhancing its digital asset services.

- Market Expansion: These partnerships enable Interactive Brokers to tap into the growing demand for cryptocurrency investments, positioning the firm to capture market share in this innovative financial sector.

Interactive Brokers' network of key partnerships is foundational to its expansive service offering. These collaborations with global exchanges and liquidity providers are essential for delivering competitive pricing and efficient trade execution across a vast range of financial instruments. Their integration with major exchanges and electronic communication networks (ECNs) underpins their low-cost execution model, a critical advantage for their diverse client base.

The company's relationships with technology and data providers are equally vital, ensuring its platforms remain at the forefront of trading innovation. These partnerships enable the delivery of real-time market data and sophisticated analytical tools, empowering clients with the insights needed to navigate complex markets. In 2024, Interactive Brokers continued its significant investment in these technological alliances, reinforcing its commitment to providing a superior trading experience.

Furthermore, Interactive Brokers' strategic alliances with introducing brokers and financial advisors allow these professionals to leverage its advanced infrastructure. This enables them to offer their clients access to global markets and sophisticated trading tools without the burden of building their own technology. This mutually beneficial arrangement significantly broadens Interactive Brokers' reach, with millions of accounts facilitated through this partner network as of early 2024.

| Partner Type | Role/Benefit | Example/Impact |

|---|---|---|

| Exchanges & Liquidity Providers | Ensures efficient execution and competitive pricing | Access to NYSE, Nasdaq, ECNs; supports low-cost model |

| Technology & Data Providers | Delivers real-time data and trading tools | Enables advanced analytics and platform functionality |

| Introducing Brokers & Financial Advisors | Extends market reach and client service capabilities | Facilitates millions of accounts; allows partners to scale |

What is included in the product

Interactive Brokers Group's Business Model Canvas focuses on providing a global, technology-driven platform for sophisticated traders and institutions, offering a wide range of products and low costs.

It details their diverse customer segments, efficient distribution channels, and a compelling value proposition centered on advanced trading tools and competitive pricing.

Interactive Brokers' Business Model Canvas acts as a pain point reliever by offering a clear, one-page snapshot of their complex trading and brokerage operations, simplifying understanding for diverse stakeholders.

It addresses the pain of information overload by condensing their strategy into a digestible format, making it easy to identify core components and facilitate quick review.

Activities

Interactive Brokers' primary function is the automated, global electronic execution and clearing of trades for a vast range of financial instruments. This involves sophisticated order routing to ensure the best possible prices and efficient, timely processing of all transactions, including the crucial settlement phase.

The company leverages its cutting-edge, proprietary technology to achieve this, a significant factor in its ability to offer competitive pricing and reliable service. For instance, in 2023, Interactive Brokers reported executing an average of 2.2 million trades per day, highlighting the sheer volume and efficiency of their execution systems.

Interactive Brokers Group's core strength lies in its continuous investment in and development of its proprietary trading technology. This includes enhancing platforms like Trader Workstation (TWS) and IBKR Desktop, focusing on smart order routing, robust risk management, and user-friendly client interfaces. This commitment to innovation is vital for maintaining their competitive edge and ensuring scalability in a rapidly evolving market.

Interactive Brokers Group actively manages financial risks, encompassing credit, market, and operational exposures. This is a core function crucial for stability.

Adherence to stringent regulatory requirements across numerous global jurisdictions is a constant and vital activity. For instance, in 2023, the company reported total revenue of $27.5 billion, a figure influenced by its ability to navigate complex regulatory landscapes.

Continuous monitoring, detailed reporting, and proactive adaptation to evolving financial regulations are paramount. This ensures operational integrity and robust client protection, underpinning the trust placed in the firm.

Customer Account Management and Support

Interactive Brokers' key activity involves robust customer account management and support. This encompasses everything from the initial onboarding of new clients to providing continuous technical and trading assistance. The firm actively manages client equity, margin loans, and credit balances, ensuring a smooth operational experience for its diverse user base.

Efficient and responsive customer service is paramount for client satisfaction and retention, especially for their sophisticated trading clientele. In 2023, Interactive Brokers reported a significant increase in client accounts, reaching over 2.7 million, underscoring the scale of their account management operations. Their commitment to support is a cornerstone of their business model.

- Onboarding: Streamlined processes for new client account setup.

- Ongoing Support: Providing technical and trading assistance to active users.

- Financial Management: Managing customer equity, margin loans, and credit balances.

- Client Retention: Fostering satisfaction through effective customer service, crucial for sophisticated traders.

Global Market Expansion and Product Innovation

Interactive Brokers actively pursues global market expansion by entering new regions and continuously innovating its product suite. This involves introducing new financial instruments and enhancing platforms with advanced features, such as AI-powered tools, to cater to a growing international client base. Expanding access to a wider array of international exchanges is a core component of this strategy, aiming to drive client acquisition and broaden overall market reach.

In 2024, Interactive Brokers continued to solidify its global presence, with a significant portion of its revenue generated from international operations. The company's commitment to product innovation is evident in its ongoing platform development, which includes the integration of sophisticated analytical tools and a broader selection of tradable assets. This focus on innovation and expansion is crucial for maintaining its competitive edge and attracting a diverse clientele.

- Global Footprint: Interactive Brokers operates across numerous countries, offering access to a vast network of global exchanges.

- Product Diversification: The company consistently adds new financial instruments, including equities, options, futures, forex, bonds, and funds, from around the world.

- Platform Enhancement: Continuous investment in technology leads to the introduction of advanced trading tools, AI-driven insights, and improved user interfaces.

- Market Access: Expanding access to emerging markets and new asset classes is a key driver for attracting and retaining clients globally.

Interactive Brokers Group's key activities revolve around providing a comprehensive electronic trading platform and associated services to a global client base. This includes the execution and clearing of trades across a wide array of financial instruments, leveraging proprietary technology for efficiency and competitive pricing. The company also focuses on robust risk management, regulatory compliance, and customer account management.

A significant ongoing activity is the continuous development and enhancement of their trading platforms and technology infrastructure. This ensures they remain at the forefront of electronic trading innovation, offering advanced tools and a broad range of tradable products to their diverse clientele. Expansion into new markets and the addition of new asset classes are also central to their strategy for growth.

| Key Activity | Description | Supporting Data/Examples (2023/2024) |

| Electronic Trade Execution & Clearing | Automated, global execution and clearing of trades for diverse financial instruments. | Average daily volume of 2.2 million trades executed in 2023. |

| Technology Development & Innovation | Continuous investment in proprietary trading technology and platform enhancements. | Ongoing development of Trader Workstation (TWS) and IBKR Desktop, integration of AI-powered tools. |

| Risk Management & Regulatory Compliance | Proactive management of financial risks and adherence to global regulatory standards. | Total revenue of $27.5 billion in 2023, reflecting scale and operational integrity. |

| Global Market Expansion & Product Diversification | Entering new regions and adding new financial instruments to the platform. | Expansion into new markets and addition of emerging market access; over 2.7 million client accounts in 2023. |

Preview Before You Purchase

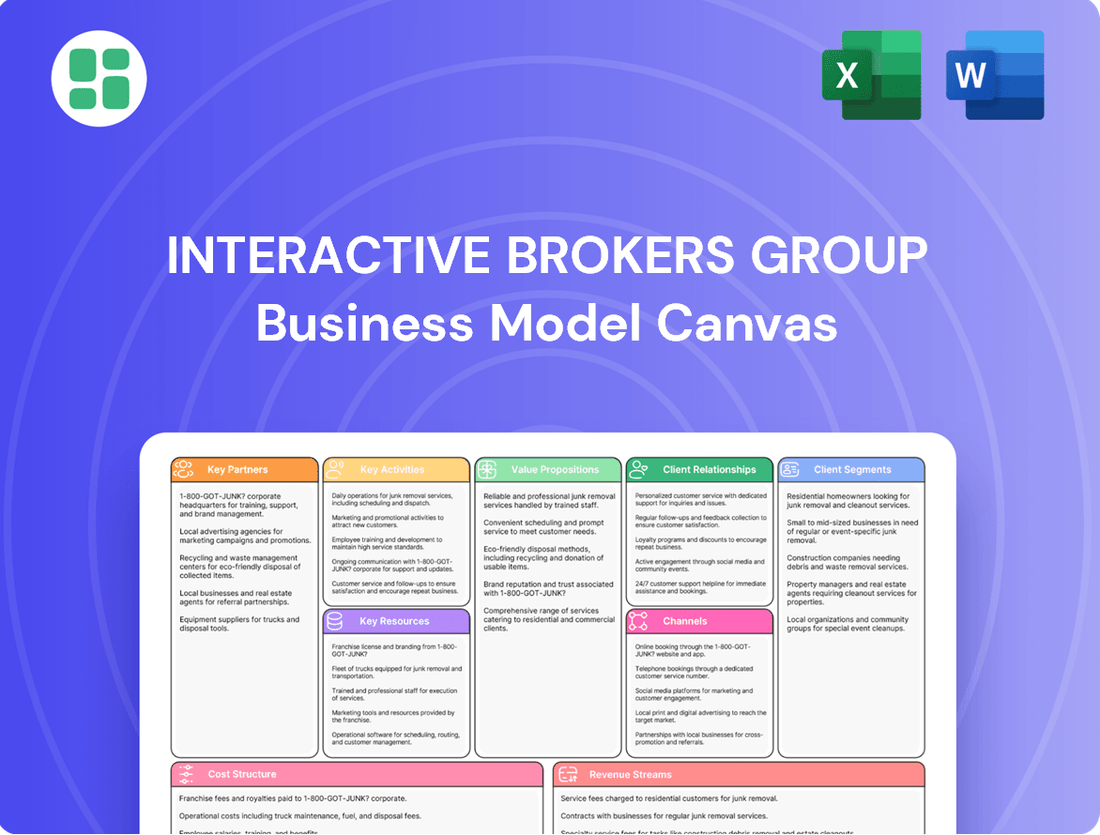

Business Model Canvas

This preview offers an authentic glimpse into the Interactive Brokers Group Business Model Canvas, showcasing the precise structure and content you will receive. Upon completing your purchase, you will gain full access to this exact, professionally prepared document, ready for immediate use and customization.

Resources

Interactive Brokers' core strength lies in its advanced proprietary trading technology. This includes its robust trading platforms like Trader Workstation (TWS), IBKR Desktop, and IBKR Mobile, all designed for high-speed, efficient global market access. This technological backbone is crucial for their low-cost execution model.

The company's smart order router is a key component, intelligently finding the best prices across various exchanges. This sophisticated system, coupled with their powerful backend infrastructure, ensures seamless and cost-effective trade execution for millions of users worldwide. Continuous investment in this technology is a significant driver of their competitive edge.

Interactive Brokers' significant financial capital, including substantial firm equity and client cash balances, is a cornerstone of its operations. As of the first quarter of 2024, the company reported total equity of $14.1 billion, highlighting its robust financial foundation.

This strong capital base is essential for supporting its extensive clearing operations and providing the liquidity necessary for its global brokerage activities. It allows Interactive Brokers to offer margin lending services and maintain competitive rates for its clients.

Interactive Brokers Group's extensive network of regulatory licenses, spanning over 20 jurisdictions including major financial hubs like the US, UK, and EU, is a cornerstone of its business. This global licensing framework, coupled with a robust compliance infrastructure, allows the company to legally offer its services to clients worldwide, fostering trust and market access.

In 2024, maintaining this broad regulatory footprint is critical. For instance, the firm's US operations are regulated by FINRA and the SEC, while its European entities adhere to MiFID II. This deep expertise in navigating complex, evolving compliance landscapes ensures lawful and ethical operations, a key differentiator in the financial services industry.

Skilled Human Capital

Interactive Brokers' success hinges on its highly skilled human capital. This includes top-tier talent in software development, crucial for building and refining their advanced trading platforms. Financial engineers and risk management professionals are also paramount, ensuring the integrity and efficiency of their operations.

Despite a strong emphasis on automation, human expertise remains indispensable. This is evident in managing relationships with sophisticated institutional clients and navigating the complex, ever-changing landscape of global financial regulations and market dynamics. For instance, as of early 2024, Interactive Brokers employs thousands of individuals worldwide, with a significant portion dedicated to these specialized roles.

- Software Development: Essential for platform innovation and maintenance.

- Financial Engineering: Drives product development and trading strategies.

- Risk Management: Safeguards the firm and its clients.

- Global Compliance: Ensures adherence to diverse regulatory frameworks.

Brand Reputation and Trust

Interactive Brokers' (IBKR) brand reputation is built on a foundation of low costs, cutting-edge technology, and extensive global market access. This long-standing reputation acts as a powerful intangible asset, drawing in and keeping sophisticated individual and institutional clients who value reliability and performance.

The company's consistent track record and numerous industry accolades, including being recognized for its trading platforms and customer service, further bolster this trust. For instance, in 2024, IBKR continued to be a top-rated broker across various financial publications, underscoring its market leadership.

- Low Costs: IBKR is consistently cited for its competitive pricing, a key differentiator for active traders.

- Advanced Technology: Their sophisticated trading platforms, like Trader Workstation (TWS), are a major draw for professionals.

- Global Market Access: Offering access to over 150 markets worldwide is a significant advantage for diversified portfolios.

- Reliability: A history of stable operations and robust infrastructure builds essential client confidence.

Interactive Brokers' key resources include its proprietary trading technology, substantial financial capital, extensive regulatory licenses, and highly skilled human capital.

Their advanced trading platforms and smart order router are central to their low-cost execution model. As of Q1 2024, the firm reported total equity of $14.1 billion, underpinning its global brokerage operations and margin lending capabilities.

A broad network of over 20 global regulatory licenses, including those in the US and EU, ensures lawful operations. This is supported by a workforce with deep expertise in software development, financial engineering, risk management, and global compliance, essential for navigating complex financial markets and regulations.

Value Propositions

Interactive Brokers (IBKR) stands out by offering exceptionally low commissions and highly competitive margin rates across a vast array of financial instruments, including stocks, options, and forex. This aggressive pricing strategy directly benefits active traders and institutional clients who prioritize minimizing transaction costs to enhance their net returns.

For instance, in 2024, IBKR continued to offer commission-free trading for U.S. stocks and ETFs, a significant draw for high-volume traders. Their margin rates, often cited as among the lowest in the industry, can be as low as 3.1% for larger balances, a stark contrast to the higher rates offered by many competitors, making it a cost-effective choice for leveraged trading strategies.

Interactive Brokers offers clients unparalleled direct access to over 160 global markets, spanning numerous countries and currencies, all from a single, unified platform. This expansive reach empowers investors to navigate diverse international investment landscapes with ease.

Clients can trade an exceptionally broad spectrum of financial products, including stocks, options, futures, forex, bonds, mutual funds, and even cryptocurrencies. This vast selection caters to a wide array of investment strategies and risk appetites, making it a comprehensive solution for global portfolio management.

As of early 2024, Interactive Brokers reported serving millions of accounts, a testament to its ability to attract and retain a diverse global client base seeking broad market access and product variety.

Interactive Brokers provides sophisticated trading platforms packed with advanced tools for executing trades, managing risk, analyzing portfolios, and conducting research. These platforms are designed for professional and institutional traders who demand robust functionality.

Key features include powerful charting capabilities, algorithmic trading options, and access to real-time market data. For instance, as of Q1 2024, Interactive Brokers reported an average of 2.7 million daily average revenue trades (DARTs), highlighting the extensive use of their advanced trading technology.

The company consistently invests in enhancing these tools, ensuring they remain at the forefront of trading technology. This commitment to innovation supports traders in making informed decisions and executing strategies efficiently in dynamic markets.

Superior Execution Quality

Interactive Brokers prioritizes superior execution quality by employing advanced smart order routing technology. This system actively seeks the best available prices across multiple exchanges, aiming to fill client orders at the most advantageous rates. For instance, in 2024, the company continued to refine its routing algorithms, contributing to its reputation among active traders.

This dedication to best-price execution is a significant value proposition, particularly for high-volume traders who can see substantial savings and improved outcomes through efficient order fulfillment. It directly impacts client profitability and trading success.

- Smart Order Routing: Technology that finds the best prices across exchanges.

- Best-Price Execution: Aiming to fill orders at the most favorable available rates.

- High-Volume Trader Appeal: A key draw for clients who trade frequently.

- Improved Trading Outcomes: Direct impact on client profitability and efficiency.

High Interest on Uninvested Cash Balances

Interactive Brokers offers a compelling value proposition by providing competitive interest rates on uninvested cash balances within client accounts. This is particularly attractive in the current economic climate, where interest rates have risen significantly. For instance, as of early 2024, Interactive Brokers was offering tiered interest rates on USD cash balances, with rates as high as 4.83% for balances exceeding $1 million.

This feature allows clients to generate income on their idle funds without the hassle of transferring them to separate savings accounts. It streamlines the investment process and ensures that capital is always working for the client. This benefit is a key differentiator, especially for active traders or those managing substantial cash reserves.

The advantages are clear:

- Earn Income on Idle Funds: Clients can accrue interest on cash not actively deployed in investments.

- Competitive Rates: Interactive Brokers consistently offers rates that are competitive within the market.

- Convenience: No need to move cash to separate accounts to earn interest.

- Maximizing Returns: This feature enhances overall portfolio yield, especially during periods of elevated interest rates.

Interactive Brokers provides a comprehensive trading environment by offering access to a vast array of global markets and financial instruments, coupled with exceptionally low costs. This broad market access and cost-efficiency are central to its appeal for a diverse client base, from retail traders to institutional investors.

The company's commitment to advanced technology ensures clients have access to sophisticated trading platforms and tools. These platforms facilitate efficient trade execution, risk management, and in-depth market analysis, supporting informed decision-making.

Interactive Brokers' value proposition is further enhanced by its focus on superior order execution quality and competitive interest rates on uninvested cash. These elements directly contribute to client profitability and overall satisfaction.

| Value Proposition Aspect | Description | Key Benefit | 2024 Data/Example |

|---|---|---|---|

| Low Commissions & Margin Rates | Aggressively priced trading costs. | Maximizes net returns for active traders. | Commission-free U.S. stocks/ETFs; margin rates as low as 3.1%. |

| Global Market Access | Access to over 160 markets worldwide. | Diversified investment opportunities. | Unified platform for trading across numerous countries. |

| Broad Product Offering | Wide range of instruments including stocks, options, futures, forex, bonds, crypto. | Caters to diverse investment strategies. | Millions of accounts served by early 2024. |

| Advanced Trading Platforms | Sophisticated tools for trading, risk management, research. | Enables efficient and informed trading. | 2.7 million DARTs reported in Q1 2024. |

| Superior Execution Quality | Smart order routing for best-price execution. | Optimizes trade fills and reduces slippage. | Refined routing algorithms in 2024. |

| Interest on Uninvested Cash | Competitive rates on idle cash balances. | Generates income on un-deployed capital. | Rates up to 4.83% on USD cash in early 2024. |

Customer Relationships

Interactive Brokers excels in customer relationships through its robust automated self-service digital platforms. Clients can independently manage their accounts, execute trades, and access a wealth of market data and research tools. This digital-first approach is a cornerstone of their business, reflecting a commitment to efficiency and client empowerment.

This strategy directly supports Interactive Brokers' low-cost structure, enabling them to offer competitive pricing while providing sophisticated tools to a global client base. For instance, in Q1 2024, Interactive Brokers reported an average of 2.9 million daily average revenue-generating customers, a testament to the scalability and appeal of their automated services.

Interactive Brokers Group offers a robust suite of online resources, including comprehensive educational materials, live webinars, and advanced research tools. This empowers clients, from seasoned traders to beginners, to conduct their own in-depth analysis and make informed investment decisions.

This self-directed approach is particularly appealing to sophisticated investors who value autonomy in their research. For instance, in 2024, Interactive Brokers continued to expand its library of educational content, covering topics from fundamental analysis to complex options strategies, supporting a diverse client base.

Interactive Brokers acknowledges that while self-service is key, institutional and professional clients like financial advisors and hedge funds require a higher level of engagement. For these crucial segments, they provide specialized support, including dedicated trading desks and personalized account managers. This ensures that the complex trading and operational needs of these high-value clients are met with tailored solutions.

Community and Forum Engagement

Interactive Brokers cultivates a vibrant client community through its Trader Workstation (TWS) platform forums. These spaces allow traders to connect, share trading ideas, and discuss market strategies, fostering a collaborative environment. This peer-to-peer interaction serves as a valuable supplement to the company's direct customer support.

- Community Hub: Interactive Brokers provides dedicated forums where clients can engage with each other, sharing insights and troubleshooting common trading issues.

- Knowledge Sharing: These platforms facilitate the exchange of trading strategies and market analysis, enhancing the collective knowledge of the user base.

- Enhanced Support: The community aspect offers an additional layer of support, enabling users to learn from experienced traders and find solutions quickly.

Proactive Communication on Platform Enhancements and Market News

Interactive Brokers Group actively informs its clients about platform enhancements and market developments. This proactive communication strategy, often delivered via in-platform notifications and emails, ensures clients are aware of new features and how to utilize the evolving Interactive Brokers ecosystem. For example, in 2024, Interactive Brokers rolled out several significant platform updates, including enhanced AI-powered research tools and expanded cryptocurrency trading options, which were communicated through these channels.

This approach fosters client engagement and helps them maximize their use of the platform's capabilities. By staying informed about product expansions and relevant market news, clients can adapt their strategies effectively. Interactive Brokers reported a record number of daily average revenue trades (DARTs) in the first quarter of 2024, reaching 2.76 million, indicating strong client activity potentially bolstered by timely information.

- Platform Updates: Regular announcements on new features, such as advanced charting tools and improved order execution algorithms.

- Product Expansion: Information on the addition of new asset classes or trading instruments, like the expanded offerings in fixed income securities throughout 2024.

- Market News: Timely dissemination of crucial market insights and economic data that could impact trading decisions.

- Client Engagement: Utilizing in-platform alerts and email campaigns to ensure clients are consistently informed and can leverage new capabilities.

Interactive Brokers prioritizes a self-service model, empowering clients with advanced digital platforms for account management and trading. This automated approach, complemented by extensive online resources and community forums, fosters client autonomy and knowledge sharing.

Channels

Interactive Brokers' proprietary trading platforms, including Trader Workstation (TWS), IBKR Desktop, and IBKR Mobile, serve as the primary channels for client engagement and service delivery. These platforms are the direct conduits through which customers access global markets, execute trades, and manage their portfolios.

TWS is engineered for sophisticated traders and institutional clients, offering advanced order types, real-time analytics, and extensive market data. IBKR Desktop provides a more integrated and user-friendly experience for a broad range of investors, while IBKR Mobile caters to the needs of active traders requiring flexibility and accessibility from anywhere.

As of the first quarter of 2024, Interactive Brokers reported a significant increase in client accounts, reaching over 2.7 million. This growth underscores the widespread adoption and effectiveness of their proprietary platforms in attracting and retaining a diverse client base.

Interactive Brokers' web-based client portal offers a straightforward, browser-accessible platform for managing accounts, viewing reports, and executing basic trades. This channel is designed for clients who value simplicity and immediate access without software installation.

This portal is a key touchpoint for clients seeking efficient account oversight and transactional capabilities. It complements their more advanced trading platforms by providing a universally accessible interface.

Interactive Brokers offers sophisticated Application Programming Interfaces (APIs) designed for institutional clients, proprietary trading firms, and advanced individual traders. These APIs facilitate direct integration with clients' custom trading systems, empowering automated and algorithmic trading strategies. In 2024, Interactive Brokers continued to enhance its API offerings, supporting the complex needs of high-frequency and quantitative trading operations.

Direct Sales and Institutional Relationship Teams

Interactive Brokers leverages direct sales and institutional relationship teams to cultivate high-value client partnerships, particularly with hedge funds, large institutions, and financial advisors. These dedicated teams provide personalized onboarding and ongoing support, ensuring tailored solutions and direct consultation. In 2024, Interactive Brokers reported a significant increase in institutional client assets under custody, underscoring the effectiveness of these relationship-driven channels in driving substantial business growth.

This direct engagement is vital for understanding the complex needs of institutional clients and offering bespoke trading solutions and access to Interactive Brokers' extensive product suite. The relationship managers act as a primary point of contact, facilitating seamless integration and providing continuous support. This personal touch is critical for retaining and expanding business with these key segments.

Key aspects of these channels include:

- Dedicated Relationship Managers: Assigned to key institutional accounts for personalized service and support.

- Tailored Solutions: Development of customized trading platforms and services to meet specific client requirements.

- Direct Consultation: Offering expert advice and support on trading strategies, market access, and regulatory compliance.

- Onboarding and Integration: Streamlining the process for new institutional clients to access Interactive Brokers' ecosystem.

Global Marketing and Online Presence

Interactive Brokers Group cultivates a robust global marketing strategy centered on its extensive online presence. This includes a sophisticated website, targeted digital advertising campaigns, and partnerships with financial news outlets to reach a worldwide audience of investors and traders.

The company effectively communicates its competitive edge, diverse product suite, and international capabilities through these digital channels. In 2024, Interactive Brokers continued to invest significantly in advertising and marketing, with marketing expenses playing a crucial role in client acquisition and brand awareness.

- Website: Interactive Brokers' primary digital hub, offering extensive research, trading platforms, and account management tools.

- Digital Advertising: Paid search, social media marketing, and display advertising target specific investor demographics globally.

- Financial News & Content: Partnerships and sponsored content with reputable financial publications extend reach and credibility.

- Global Reach: Marketing efforts highlight the platform's availability in numerous countries and support for multiple currencies.

Interactive Brokers' channels are multifaceted, encompassing proprietary trading platforms like Trader Workstation (TWS), IBKR Desktop, and IBKR Mobile, alongside a web-based client portal and robust Application Programming Interfaces (APIs). These digital avenues are complemented by direct sales and institutional relationship teams, and supported by a strong global online marketing presence.

| Channel Type | Description | 2024 Highlight |

| Proprietary Platforms | TWS, IBKR Desktop, IBKR Mobile for trading and portfolio management. | Client accounts surpassed 2.7 million in Q1 2024. |

| Web Portal | Browser-based access for account management and basic trades. | Provides universal access and complements advanced platforms. |

| APIs | Facilitates direct integration for algorithmic and automated trading. | Enhanced offerings support complex quantitative trading. |

| Direct Sales/Relationships | Personalized service for institutional clients like hedge funds. | Increase in institutional client assets under custody. |

| Online Marketing | Website, digital ads, and financial news partnerships. | Significant investment in marketing for client acquisition and brand awareness. |

Customer Segments

Institutional traders and professional firms, including hedge funds and mutual funds, represent a crucial customer segment for Interactive Brokers. These entities demand robust trading infrastructure, seeking high-speed execution and access to deep liquidity across a wide array of global markets. Interactive Brokers caters to these needs with advanced platforms and competitive pricing, particularly its low margin rates, which are a significant draw for sophisticated trading operations.

Interactive Brokers is a crucial partner for financial advisors and introducing brokers, providing them with the sophisticated tools needed to manage client assets effectively. These professionals rely on the platform for its comprehensive portfolio management capabilities, including advanced rebalancing tools and consolidated client reporting.

In 2024, Interactive Brokers continued to enhance its offerings for this segment, with a particular focus on streamlining workflows and providing superior client communication features. The platform’s ability to execute trades across a vast array of global markets with low commissions remains a significant draw for advisors seeking to optimize their clients' investment strategies.

Introducing brokers, in particular, benefit from Interactive Brokers’ white-label solutions and robust back-office support, allowing them to build and grow their own client base under their brand while leveraging the firm’s extensive infrastructure and regulatory compliance. This partnership model enables smaller firms to compete effectively in the financial services landscape.

Active and sophisticated individual investors are a core customer segment. These individuals actively trade across various asset classes, from equities and options to futures and forex. They demand robust platforms offering real-time data, sophisticated charting tools, and direct market access to execute complex strategies efficiently.

Interactive Brokers appeals to this group through its competitive pricing, with commission rates often cited as among the lowest in the industry, especially for high-volume traders. For instance, in 2023, many active traders benefited from Interactive Brokers' tiered commission structures that decrease with trading volume, making it cost-effective for frequent transactions.

This segment values the broad global market access provided, allowing them to trade on exchanges worldwide without needing multiple brokerage accounts. Their sophisticated approach often involves utilizing leverage and maintaining significant cash balances, which Interactive Brokers facilitates with competitive margin rates and interest on idle cash.

International Investors

International investors represent a substantial and growing segment for Interactive Brokers. Many are drawn to the platform's ability to provide low-cost access to a wide array of global markets, with a particular emphasis on U.S. equities. This accessibility, coupled with competitive foreign exchange rates, makes it an attractive proposition for those looking to diversify their portfolios beyond their domestic markets.

Interactive Brokers actively cultivates this international client base through strategic global expansion. This focus allows them to cater to the specific needs of diverse foreign investors, offering a comprehensive trading experience that bridges geographical barriers. The firm’s commitment to serving these clients is a key driver of its business model.

As of the first quarter of 2024, Interactive Brokers reported a significant portion of its client base hails from outside the United States, underscoring the importance of this segment. For instance, the company consistently highlights its international growth in earnings calls, noting that a substantial percentage of its new accounts originate from regions like Europe and Asia.

- Global Market Access: Offers trading in over 150 markets across various asset classes, appealing to international investors seeking diversification.

- Competitive FX Fees: Provides some of the lowest foreign exchange conversion fees in the industry, a major draw for those trading across currencies.

- Regulatory Compliance: Navigates complex international regulations to offer services in numerous jurisdictions, facilitating easier access for global clients.

- Technology Platform: A robust and reliable trading platform accessible worldwide, supporting the needs of active international traders.

Emerging Retail Investors (IBKR Lite)

Interactive Brokers is actively broadening its appeal to emerging retail investors through services like IBKR Lite. This initiative acknowledges a growing segment of the market that may be new to investing or simply prefers a straightforward, commission-free approach for trading U.S. stocks and ETFs.

This customer group prioritizes user-friendliness and access to a wide array of investment products. By offering a simplified, cost-effective trading experience, Interactive Brokers aims to capture a larger share of this expanding demographic.

- Targeting Novice Traders: IBKR Lite caters to individuals with less trading experience, offering a simplified platform.

- Commission-Free Trading: This model provides commission-free trades on U.S.-listed stocks and ETFs, a key draw for cost-conscious retail investors.

- Growing Market Segment: Emerging retail investors represent a significant and expanding portion of the overall investment community.

- Product Accessibility: Despite the simplified model, this segment still expects access to a diverse range of investment options beyond just U.S. stocks and ETFs.

Interactive Brokers serves a diverse clientele, from large institutions to individual investors. In 2024, the firm continued to attract sophisticated traders and professional firms by offering deep liquidity and advanced trading technology. Financial advisors and introducing brokers also rely on Interactive Brokers for robust portfolio management tools and white-label solutions.

Active individual investors are a core segment, drawn to competitive pricing and extensive global market access. International investors, in particular, find value in the low-cost access to diverse markets and favorable FX rates, with a significant portion of Interactive Brokers' client base now residing outside the U.S.

Furthermore, Interactive Brokers is actively expanding its reach to emerging retail investors through offerings like IBKR Lite, which provides commission-free trading on U.S. stocks and ETFs. This strategic move targets a growing demographic seeking user-friendly and cost-effective investment solutions.

| Customer Segment | Key Needs/Attractions | 2024 Focus/Data Points |

| Institutional Traders & Professional Firms | High-speed execution, deep liquidity, low margin rates | Continued enhancement of trading infrastructure |

| Financial Advisors & Introducing Brokers | Portfolio management, client reporting, white-label solutions | Streamlining workflows, superior client communication |

| Active & Sophisticated Individual Investors | Real-time data, charting tools, global market access, low commissions | Competitive tiered commissions, interest on idle cash |

| International Investors | Low-cost global market access, competitive FX fees | Significant international client base growth (Q1 2024 data) |

| Emerging Retail Investors | User-friendliness, commission-free trading (U.S. stocks/ETFs) | Expansion via IBKR Lite |

Cost Structure

Interactive Brokers invests heavily in its proprietary trading technology, a core component of its business model. This includes substantial expenditures on software development, server infrastructure, and network capabilities to ensure robust performance and scalability for its global client base. For instance, in 2023, the company reported technology and development expenses of $1.1 billion, highlighting the significant commitment to maintaining and advancing its sophisticated trading platforms.

Interactive Brokers incurs significant costs for executing trades, clearing transactions, and adhering to regulatory mandates. These expenses are directly influenced by the sheer volume of trades processed and the complex web of rules governing financial markets worldwide.

In 2024, for instance, a substantial portion of Interactive Brokers' operating expenses is allocated to these essential functions. For example, exchange and ECN fees, which are part of execution costs, can vary significantly. Regulatory fees, such as those from FINRA or the SEC, also add to this cost base, ensuring compliance across all operations.

Interactive Brokers Group's employee compensation and benefits represent a substantial cost, even with extensive automation. In 2023, the company reported total compensation and benefits expenses of $1.4 billion, reflecting significant investment in its global team. This expenditure covers essential personnel across technology development, stringent compliance and risk management, customer support, and executive leadership.

Data and Market Information Costs

Interactive Brokers Group invests heavily in acquiring real-time market data, news feeds, and research from a multitude of global providers. These essential services are the bedrock upon which clients make their trading decisions, demanding significant financial outlay to maintain accuracy and breadth.

For instance, in 2023, the company reported expenses related to data processing and clearance services, which are intrinsically linked to these data acquisition costs. While specific figures for data alone aren't always itemized separately, the overall operational expenses reflect this critical investment.

- Data Acquisition: Subscribing to real-time feeds from exchanges worldwide, including NASDAQ, NYSE, LSE, and many others, is a primary cost driver.

- News and Research: Licensing content from financial news agencies like Reuters, Bloomberg, and specialized research firms adds to the expense.

- Technology Infrastructure: Maintaining the systems to process, store, and distribute this vast amount of data efficiently requires ongoing investment in hardware and software.

- Regulatory Compliance: Ensuring data handling meets global regulatory standards also contributes to the overall cost structure.

General and Administrative Expenses (including Advertising)

Interactive Brokers Group's cost structure is significantly influenced by its general and administrative (G&A) expenses. These operational overheads encompass a broad range of costs essential for running a global financial services firm, including office space, utilities, and the salaries of administrative and support staff. Legal and compliance costs are also substantial, reflecting the highly regulated nature of the financial industry.

The company also allocates considerable resources to advertising and marketing. This investment is crucial for customer acquisition and retention, particularly as Interactive Brokers pursues global expansion and aims to attract a diverse client base. These marketing efforts are designed to highlight the firm's competitive pricing, advanced trading platforms, and extensive product offerings. For the first quarter of 2024, Interactive Brokers reported total expenses of $741 million, a figure that includes these G&A and marketing components.

- Operational Overheads: Includes office expenses, IT infrastructure, and personnel costs supporting daily operations.

- Legal and Compliance: Significant expenses related to regulatory adherence and legal counsel in various jurisdictions.

- Advertising and Marketing: Costs associated with customer acquisition, brand building, and global market penetration.

- First Quarter 2024 Expenses: Total expenses reported were $741 million, reflecting the scale of these G&A and marketing investments.

Interactive Brokers' cost structure is dominated by technology investments, operational expenses for trade execution and data acquisition, and personnel costs. In 2023, technology and development expenses reached $1.1 billion, while compensation and benefits totaled $1.4 billion, underscoring the significant resources dedicated to its sophisticated platforms and global workforce. These investments are critical for maintaining a competitive edge in the fast-paced financial markets.

| Cost Category | 2023 Expense (USD billions) | Key Components |

| Technology & Development | 1.1 | Software, servers, network infrastructure |

| Compensation & Benefits | 1.4 | Salaries for tech, compliance, support staff |

| Execution, Clearing & Data | N/A (Integrated into operational expenses) | Exchange fees, regulatory fees, market data subscriptions |

| General & Administrative | N/A (Part of total Q1 2024 expenses) | Office space, legal, marketing, compliance |

Revenue Streams

Interactive Brokers earns a significant portion of its income from commissions on client trades. These commissions are applied across a wide array of financial instruments, such as stocks, options, futures, and foreign exchange.

In late 2024 and continuing into early 2025, the company saw a notable uptick in commission revenue. This growth was directly linked to a surge in client trading activity, indicating a more engaged and active user base.

Interactive Brokers Group's net interest income is a significant revenue driver, primarily generated from interest earned on customer margin loans and the company's management of uninvested client cash balances. This stream is particularly sensitive to interest rate environments. For instance, in the first quarter of 2024, Interactive Brokers reported net interest income of $1.4 billion, a substantial increase driven by higher prevailing interest rates.

The company profits from the spread between the interest it pays on client credit balances and the higher rates it earns on margin lending and its own investment of these funds. As interest rates rose through 2023 and into early 2024, this net interest margin widened, directly boosting profitability. This strategy allows them to capitalize on market conditions by effectively leveraging client assets.

Interactive Brokers generates revenue from a variety of other fees beyond commissions and interest. These include charges for market data subscriptions, which provide clients with real-time price feeds and analytical tools. For the first quarter of 2024, market data revenue was a notable contributor, reflecting the platform's extensive global data offerings.

The company also collects risk exposure fees, particularly for clients who engage in highly leveraged trading or hold complex derivative positions. These fees help to offset the increased risk the firm assumes. Furthermore, Interactive Brokers participates in exchange-mandated programs that involve payments for order flow, a common practice in the brokerage industry.

Securities Lending Income

Interactive Brokers generates revenue through its Securities Lending program, where it lends fully paid securities from client accounts to entities like short sellers. Clients can participate in this program, known as the Stock Yield Enhancement Program, and earn a portion of the generated income. In 2023, Interactive Brokers reported $1.3 billion in revenue from stock lending, a significant increase from $760 million in 2022, reflecting strong demand in the lending market.

This revenue stream is particularly robust when market volatility increases, driving demand for borrowing securities. The program allows Interactive Brokers to monetize assets held within client accounts, providing an additional income source beyond traditional trading commissions and interest on cash balances.

- Securities Lending Income: Revenue generated by lending client-owned securities.

- Stock Yield Enhancement Program: Client opt-in program for earning a share of lending income.

- 2023 Performance: $1.3 billion in revenue from stock lending.

- Market Influence: Increased market volatility typically boosts this revenue stream.

Software Licensing and Technology Solutions

Interactive Brokers likely leverages its sophisticated trading technology and infrastructure by offering software licensing and technology solutions to other financial entities. This B2B revenue stream capitalizes on their advanced platforms, potentially including order management systems, risk management tools, and execution capabilities. While not always a publicly highlighted segment, such offerings can provide a significant, albeit less visible, income source by monetizing their technological prowess beyond their retail and institutional brokerage client base.

For instance, a firm like Interactive Brokers, known for its robust technological backbone, could license its proprietary trading software or offer white-label solutions. This allows other financial institutions to access cutting-edge trading technology without the immense cost of developing it in-house. This strategy diversifies revenue and reinforces their position as a technology leader in the financial services industry.

- Technology Licensing: Interactive Brokers may license its proprietary trading platforms, algorithms, or risk management software to other financial institutions.

- Back-Office Solutions: The company could offer its back-office processing, clearing, and settlement technology as a service to smaller broker-dealers or fintech firms.

- White-Labeling: Interactive Brokers might provide white-label trading solutions, allowing other companies to offer brokerage services under their own brand, powered by IBKR's technology.

Interactive Brokers' revenue streams are diverse, encompassing commissions from a vast array of financial instruments, including stocks, options, and futures. They also generate substantial income from net interest, earned on client margin loans and uninvested cash balances, which saw a significant boost in early 2024 due to rising interest rates. Additional fees for market data, risk exposure, and participation in payment for order flow programs further diversify their income.

The company's Securities Lending program is a notable contributor, generating $1.3 billion in 2023 by lending client-owned securities. This revenue stream is particularly sensitive to market volatility, as increased demand for borrowing securities directly translates to higher earnings. Interactive Brokers also likely monetizes its technological expertise through software licensing and technology solutions offered to other financial entities, providing a less visible but potentially significant income source.

| Revenue Stream | Description | 2023/Early 2024 Data Point |

|---|---|---|

| Commissions | Fees on client trades across various instruments. | Surge in trading activity in late 2024/early 2025 boosted this. |

| Net Interest Income | Interest on margin loans and client cash. | $1.4 billion in Q1 2024, driven by higher rates. |

| Securities Lending | Income from lending client securities. | $1.3 billion in 2023. |

| Other Fees | Market data, risk exposure, payment for order flow. | Market data a notable contributor in Q1 2024. |

| Technology Licensing | Licensing trading platforms and solutions. | Potential diversification through B2B offerings. |

Business Model Canvas Data Sources

The Interactive Brokers Group Business Model Canvas is informed by a blend of proprietary financial data, extensive market research reports, and internal strategic planning documents. These sources provide a comprehensive view of the company's operations and market positioning.