Integral Diagnostics Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Integral Diagnostics Bundle

Unlock the full strategic blueprint behind Integral Diagnostics's business model. This in-depth Business Model Canvas reveals how the company drives value through its diagnostic services, captures market share with strategic partnerships, and stays ahead in a competitive healthcare landscape.

Dive deeper into Integral Diagnostics’s real-world strategy with the complete Business Model Canvas. From its core value propositions to its cost structure, this downloadable file offers a clear, professionally written snapshot of what makes this company thrive—and where its future opportunities lie.

Want to see exactly how Integral Diagnostics operates and scales its business in the medical imaging sector? Our full Business Model Canvas provides a detailed, section-by-section breakdown, perfect for benchmarking, strategic planning, or investor presentations.

Partnerships

Integral Diagnostics places significant emphasis on cultivating robust relationships with a diverse network of medical professionals, including general practitioners, specialists, and allied health providers. These referrers are the lifeblood of the business, directly driving patient volumes and revenue streams. For instance, in the fiscal year 2023, Integral Diagnostics reported a substantial portion of its revenue was directly attributable to referrals from its established medical networks.

The company actively works to maintain and enhance these crucial partnerships by prioritizing clear, consistent communication and ensuring the delivery of high-quality, timely diagnostic reports. This focus on service excellence fosters trust and encourages continued patient referrals, underpinning Integral Diagnostics' market position.

Integral Diagnostics actively collaborates with a broad network of hospitals and healthcare facilities, embedding its advanced imaging services directly within these critical care environments. This strategic alignment ensures that patients, particularly those admitted or requiring urgent attention, benefit from immediate access to high-quality diagnostic imaging, streamlining the overall patient journey and treatment efficacy.

The company’s integration model is designed to be seamless, providing essential diagnostic capabilities that support the day-to-day operations of hospitals. This partnership is further strengthened by Integral Diagnostics’ recent significant expansion, including the merger with Capitol Health, which notably increased its footprint and service offering across Australia, enhancing its capacity to serve a larger patient base within hospital settings.

Integral Diagnostics actively collaborates with technology and AI solution providers to bolster its diagnostic capabilities. These partnerships are crucial for integrating advanced AI platforms that improve both the accuracy of diagnoses and the overall efficiency of operations. For instance, the expanded collaboration with Aidoc in October 2024 underscores the company's commitment to leveraging AI for flagging critical pathologies and streamlining workflows.

Government Health Departments and Regulatory Bodies

Integral Diagnostics maintains crucial relationships with government health departments and regulatory bodies, essential for its operational framework. These partnerships are fundamental for securing funding streams, ensuring compliance with evolving healthcare regulations, and participating in the implementation of national health policies.

For instance, Integral Diagnostics' operations in Australia are significantly influenced by Medicare indexation rates. In 2024, the Medicare Benefits Schedule (MBS) indexation was set at 3.6%, a figure that directly affects the reimbursement levels for diagnostic imaging services, impacting revenue and service delivery models.

The company also actively engages with health authorities in New Zealand, aligning its services with national healthcare strategies and regulatory requirements. Furthermore, the introduction of new government-initiated programs, such as the National Lung Cancer Screening Program (NLCSP), necessitates close collaboration and adaptation to integrate these services effectively.

- Medicare Indexation: In 2024, Medicare indexation at 3.6% impacts revenue for Australian operations.

- Regulatory Compliance: Adherence to health regulations in both Australia and New Zealand is paramount.

- Policy Implementation: Integral Diagnostics works with government bodies to implement new health programs.

- Funding Mechanisms: Partnerships are key to accessing and managing government funding for services.

Medical Equipment Manufacturers

Integral Diagnostics relies heavily on partnerships with premier medical equipment manufacturers. These collaborations are fundamental for securing cutting-edge MRI, CT, X-ray, ultrasound, and nuclear medicine technology. For instance, in 2024, Integral Diagnostics continued its focus on upgrading imaging fleets, with significant capital expenditure allocated to new equipment acquisitions from global leaders.

These vital relationships ensure Integral Diagnostics has access to the most advanced diagnostic tools available, crucial for maintaining high-quality imaging services. Ongoing technical support and access to the latest advancements from these manufacturers are critical for delivering advanced modalities and staying competitive in the diagnostic imaging market.

- Access to State-of-the-Art Technology: Partnerships enable the acquisition of the latest MRI, CT, X-ray, ultrasound, and nuclear medicine equipment.

- Ensured Technical Support: Ongoing service and maintenance agreements with manufacturers guarantee operational efficiency and minimal downtime.

- Facilitation of Advanced Modalities: Collaboration allows for the integration and utilization of the newest diagnostic techniques and imaging capabilities.

Integral Diagnostics' key partnerships extend to technology and AI solution providers, crucial for enhancing diagnostic accuracy and operational efficiency. The company's expanded collaboration with Aidoc in October 2024 highlights this commitment, focusing on AI for flagging critical pathologies and streamlining workflows. These alliances ensure Integral Diagnostics remains at the forefront of medical imaging innovation.

What is included in the product

Integral Diagnostics' business model focuses on providing high-quality diagnostic imaging services to a broad range of healthcare providers and patients, leveraging a network of clinics and advanced technology.

This model emphasizes efficient patient pathways, strong relationships with referring doctors, and a commitment to clinical excellence to drive revenue and market share.

Integral Diagnostics' Business Model Canvas provides a clear, structured framework to identify and address key operational challenges, thereby alleviating pain points in service delivery and strategic planning.

This visual tool helps Integral Diagnostics pinpoint inefficiencies and opportunities for improvement across all business segments, streamlining operations and enhancing customer value.

Activities

Integral Diagnostics' core activity revolves around performing a comprehensive suite of diagnostic imaging scans. This includes essential procedures like MRI, CT scans, X-rays, ultrasounds, and nuclear medicine. These services are the bedrock of their medical diagnostic offerings.

This critical function relies heavily on a team of highly skilled radiographers and technicians. Their expertise is crucial for operating sophisticated, state-of-the-art imaging equipment accurately and efficiently, ensuring high-quality diagnostic results.

Patient well-being is a top priority throughout the scanning process. Integral Diagnostics emphasizes ensuring patient comfort and safety during all imaging procedures, a vital aspect of their service delivery.

In 2024, Integral Diagnostics reported a significant volume of diagnostic procedures across its network, with a notable increase in demand for advanced imaging modalities like MRI and CT scans, reflecting industry trends and patient needs.

Expert radiologists meticulously analyze medical images, such as X-rays, CT scans, and MRIs, to produce detailed diagnostic reports. This core activity is vital for physicians to make informed decisions about patient care and treatment pathways. Integral Diagnostics' radiologists often possess sub-specialty expertise, ensuring high-quality interpretations across various medical fields.

The integration of Artificial Intelligence (AI) plays a significant role in enhancing radiology reporting. AI-powered tools assist in screening images for potential abnormalities and improving the speed and accuracy of detection. For instance, in 2024, many leading radiology groups reported increased efficiency gains of up to 15-20% in initial image review due to AI assistance.

Integral Diagnostics prioritizes efficient patient scheduling and management as a core operational activity. This involves meticulously handling appointments, registrations, and guiding patients seamlessly through clinic and hospital workflows. For instance, in 2023, Integral Diagnostics managed over 1.5 million patient interactions, highlighting the scale of their scheduling operations.

The company ensures a smooth patient journey by providing clear pre-appointment instructions and comprehensive post-scan care guidance. Managing patient inquiries effectively is also paramount, contributing to a positive experience. This focus on streamlined processes is crucial for maximizing clinic throughput and patient satisfaction.

Equipment Maintenance and Technology Upgrades

Integral Diagnostics prioritizes the ongoing maintenance, calibration, and strategic upgrades of its advanced imaging equipment. This commitment is vital for guaranteeing peak performance, upholding patient safety, and adhering to stringent industry regulations.

These activities represent a significant capital outlay and necessitate specialized technical proficiency. The company consistently allocates resources for both growth-oriented investments and essential capital expenditure for equipment replacement.

- Regular Maintenance & Calibration: Ensures diagnostic accuracy and extends equipment lifespan.

- Strategic Technology Upgrades: Incorporates cutting-edge imaging technologies to enhance service offerings and patient care.

- Capital Expenditure: Significant ongoing investment is required for both new technology acquisition and the upkeep of existing assets.

- Technical Expertise: A dedicated team is essential for managing and operating complex diagnostic equipment.

Clinical Governance and Quality Assurance

Integral Diagnostics prioritizes maintaining exceptionally high standards in clinical quality, patient safety, and regulatory compliance across its entire operational footprint. This commitment is a core function, ensuring all services meet stringent benchmarks.

Key activities involve conducting regular internal audits and ensuring strict adherence to all relevant professional guidelines. Furthermore, fostering continuous professional development for all clinical staff is paramount to upholding these standards.

- Clinical Quality Maintenance

- Patient Safety Protocols

- Regulatory Compliance Adherence

- Staff Professional Development

Integral Diagnostics' key activities center on delivering a wide array of diagnostic imaging services, including MRI, CT scans, X-rays, and ultrasounds. This core function is supported by highly skilled radiographers and technicians who operate advanced equipment, ensuring accurate and efficient diagnostic results while prioritizing patient comfort and safety.

The company also focuses on the meticulous analysis of medical images by expert radiologists, producing detailed reports crucial for patient care decisions. Integral Diagnostics is increasingly integrating AI into its reporting processes to enhance detection accuracy and efficiency, with many leading radiology groups reporting efficiency gains of up to 20% in image review in 2024 due to AI assistance.

Operational efficiency is maintained through streamlined patient scheduling and management, handling millions of patient interactions annually. This includes pre-appointment guidance and post-scan care to ensure a positive patient experience and optimize clinic throughput.

Furthermore, Integral Diagnostics invests in the ongoing maintenance, calibration, and strategic upgrades of its imaging equipment, recognizing this as a significant capital expenditure essential for peak performance, patient safety, and regulatory compliance. Clinical quality, patient safety, and regulatory adherence are paramount, reinforced by regular audits and continuous staff professional development.

| Key Activity | Description | 2024 Data/Trend |

|---|---|---|

| Diagnostic Imaging Services | Performing MRI, CT, X-ray, Ultrasound, Nuclear Medicine scans. | Increased demand for MRI and CT scans noted. |

| Radiologist Analysis & AI Integration | Interpreting images and generating reports, with AI assisting in image screening. | AI integration leading to efficiency gains in image review. |

| Patient Management & Scheduling | Efficiently scheduling appointments and managing patient flow. | Managed over 1.5 million patient interactions in 2023. |

| Equipment Maintenance & Upgrades | Ensuring optimal performance and safety of diagnostic equipment. | Ongoing investment in technology for enhanced service offerings. |

| Quality & Compliance | Maintaining high standards in clinical quality, safety, and regulatory adherence. | Focus on continuous professional development for clinical staff. |

What You See Is What You Get

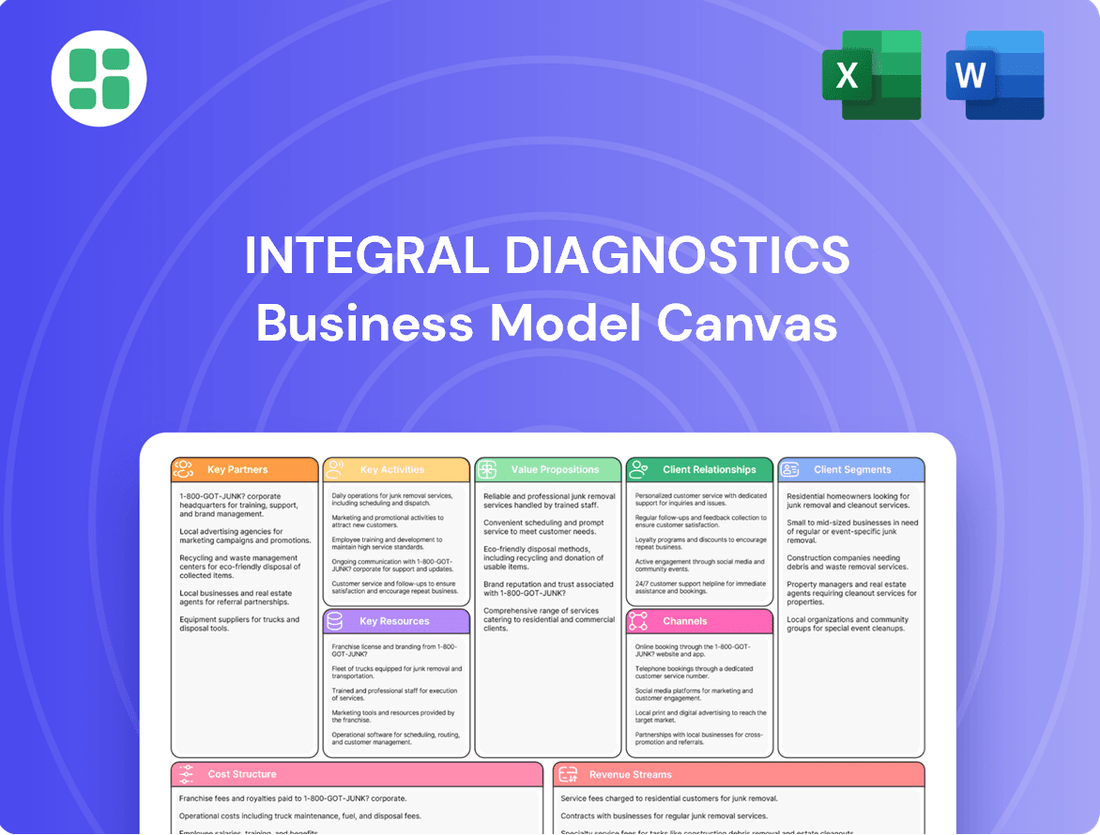

Business Model Canvas

The Integral Diagnostics Business Model Canvas preview you are viewing is the actual document you will receive upon purchase. This means you're getting a direct look at the complete, ready-to-use file, ensuring no surprises in content or formatting. Once your order is processed, you'll have full access to this exact document, allowing you to immediately begin leveraging its insights for your business strategy.

Resources

Integral Diagnostics' core physical assets are its extensive network of advanced diagnostic imaging equipment, including MRI, CT, X-ray, ultrasound, and nuclear medicine scanners. These sophisticated machines are the bedrock of their service delivery, enabling a broad spectrum of diagnostic procedures.

The company demonstrates a commitment to staying at the forefront of medical technology through consistent investment in acquiring new and upgrading existing equipment. This strategic focus ensures they can offer cutting-edge diagnostic capabilities to patients and referring physicians.

For instance, in fiscal year 2023, Integral Diagnostics reported capital expenditure of AUD 55.3 million, a significant portion of which was allocated to upgrading and expanding its imaging fleet, reflecting their ongoing dedication to technological advancement.

Integral Diagnostics' highly skilled radiologists and medical staff represent a core intangible asset. Their deep expertise in radiology, nuclear medicine, and diagnostic imaging ensures high-quality patient care and drives the company's strong reputation.

The company actively employs leading specialists across Australasia, a testament to its commitment to attracting top talent. This concentrated expertise is fundamental to Integral Diagnostics' service delivery and competitive advantage in the market.

Integral Diagnostics boasts an extensive network of clinics and hospital-based imaging sites throughout Australia and New Zealand. This broad physical footprint ensures patients and referring physicians have easy access to their services.

Following its merger with Capitol Health, Integral Diagnostics solidified its position as Australia's second-largest radiology provider based on the number of clinics. This expansion significantly enhances its market reach and patient accessibility.

Proprietary IT Systems and Teleradiology Platforms

Integral Diagnostics heavily relies on its proprietary IT systems, including robust patient management software and Picture Archiving and Communication Systems (PACS), to ensure smooth day-to-day operations. These systems are critical for managing patient data and diagnostic images efficiently.

The company's teleradiology platform, IDXt, is a cornerstone of its business model, facilitating remote reporting by sub-specialist radiologists. This technology is vital for expanding service reach and ensuring high-quality diagnostic interpretations, regardless of geographical location.

In 2024, Integral Diagnostics continued to invest in its IT infrastructure, recognizing its role in enabling seamless image transfer and secure data management. This investment supports their ability to provide timely and accurate reporting across a wide network of clinics and hospitals.

- Robust IT Infrastructure: Integral Diagnostics operates advanced patient management systems and PACS, crucial for efficient workflow and data handling.

- Teleradiology Capabilities: The IDXt platform empowers remote sub-specialty reporting, enhancing service delivery and accessibility.

- Operational Efficiency: These proprietary systems are designed to streamline image transfer, ensure data security, and support a distributed workforce.

- Strategic Investment: Continued investment in IT infrastructure in 2024 underpins Integral Diagnostics' commitment to operational excellence and service expansion.

Strong Brand Reputation and Referrer Relationships

Integral Diagnostics' strong brand reputation, built on delivering high-quality, patient-centric care, is a cornerstone of its business model. This established trust directly translates into patient loyalty and a consistent stream of referrals from medical professionals. For instance, in the fiscal year 2023, Integral Diagnostics reported a significant increase in patient volumes, underscoring the impact of its brand equity.

The company cultivates and maintains robust, long-standing relationships with referring doctors and specialists. These referrer relationships are not merely transactional; they are built on mutual trust and a shared commitment to patient well-being. This network is a critical driver for patient acquisition and revenue growth, acting as a powerful, low-cost marketing channel.

Integral Diagnostics' unique medical leadership model further strengthens its brand and referrer connections. By empowering medical professionals within the organization, the company ensures a deep understanding of clinical needs and fosters a collaborative environment. This approach enhances the quality of diagnostic services offered, reinforcing the positive perception among both patients and referring clinicians.

- Brand Reputation: Integral Diagnostics is recognized for its commitment to high-quality patient care, fostering trust and loyalty.

- Referrer Relationships: Strong, long-standing ties with medical professionals are vital for driving patient volumes and referrals.

- Patient Volumes: The company's reputation and relationships directly contribute to its ability to attract and retain patients.

- Medical Leadership: An internal medical leadership model enhances service quality and strengthens connections with referring clinicians.

Integral Diagnostics leverages its advanced diagnostic imaging equipment, including MRI, CT, and ultrasound machines, as its primary physical resources. These are complemented by a substantial network of clinics and hospital sites across Australia and New Zealand, ensuring broad patient access. The company's commitment to technological advancement is evident in its capital expenditure, with AUD 55.3 million allocated in fiscal year 2023 for equipment upgrades.

| Key Resource | Description | Strategic Importance |

|---|---|---|

| Diagnostic Imaging Equipment | MRI, CT, X-ray, ultrasound, nuclear medicine scanners | Enables a wide range of diagnostic procedures; core service delivery asset |

| Clinic & Hospital Network | Extensive physical footprint across Australia and New Zealand | Ensures patient and referrer accessibility; market reach |

| IT Systems (PACS, Patient Management) | Proprietary software for data and workflow management | Facilitates efficient operations, image transfer, and data security |

| Teleradiology Platform (IDXt) | Enables remote reporting by sub-specialists | Expands service reach, improves reporting quality and turnaround times |

| Skilled Medical Staff | Radiologists, nuclear medicine specialists, technicians | Drives high-quality patient care and diagnostic accuracy; competitive advantage |

Value Propositions

Integral Diagnostics delivers highly accurate and precise diagnostic imaging, which is absolutely essential for doctors to properly diagnose illnesses and plan the best course of treatment for their patients. This accuracy is achieved through a combination of skilled radiologists and cutting-edge technology, ensuring that the results are both rapid and dependable.

In 2024, Integral Diagnostics continued to emphasize the critical nature of timely diagnoses, understanding that prompt results can significantly impact patient outcomes and reduce the need for more complex interventions. For instance, their commitment to speed in areas like emergency radiology directly contributes to better patient care and operational efficiency within healthcare systems.

Integral Diagnostics provides a wide array of imaging services, encompassing MRI, CT scans, X-rays, ultrasounds, and nuclear medicine. This extensive portfolio ensures patients and referring physicians have access to all required diagnostic imaging from a single, reliable source, simplifying the healthcare journey.

This comprehensive approach facilitates integrated patient care by enabling seamless coordination between different diagnostic specialties and treatment plans. For instance, a patient might require both an MRI for soft tissue assessment and a CT scan for bone detail, both readily available through Integral Diagnostics.

In 2024, Integral Diagnostics continued to expand its service offerings, with a particular focus on advanced modalities like PET-CT and interventional radiology. Their commitment to a broad spectrum of services directly supports their value proposition of being a one-stop shop for diagnostic imaging needs.

Integral Diagnostics prioritizes a patient-friendly experience, ensuring comfort and clear communication throughout the diagnostic journey. This commitment is reflected in their streamlined scheduling processes and the creation of a supportive atmosphere during medical procedures.

Their dedication to patient satisfaction is evident in consistently high Net Promoter Scores (NPS). For example, in the first half of 2024, Integral Diagnostics reported an average NPS of 75, a testament to their focus on delivering exceptional care and comfort.

Advanced Technology and AI Integration

Integral Diagnostics leverages advanced technology, including state-of-the-art imaging equipment, to significantly boost its diagnostic capabilities. This commitment to cutting-edge tools ensures higher quality imaging and more detailed patient information.

The integration of artificial intelligence (AI) is a cornerstone of Integral Diagnostics' strategy, driving both diagnostic accuracy and operational efficiency. AI algorithms can analyze medical images rapidly, flagging potential abnormalities that might be subtle to the human eye.

This technological synergy facilitates earlier disease detection and more precise analysis, particularly crucial in handling complex medical cases. For instance, the company's collaboration with Aidoc, a leading AI solutions provider for medical imaging, highlights this focus. Aidoc's AI algorithms are designed to identify critical findings in scans, aiding radiologists in their workflow.

In 2024, the adoption of AI in radiology is projected to continue its upward trajectory, with studies indicating significant improvements in radiologist efficiency and diagnostic accuracy. Integral Diagnostics is strategically positioned to benefit from these advancements, aiming to provide superior patient care through technological innovation.

- Enhanced Diagnostic Precision: AI-powered analysis leads to more accurate identification of medical conditions.

- Improved Operational Efficiency: Automation of image analysis speeds up reporting times.

- Early Disease Detection: Advanced technology enables the identification of diseases at earlier, more treatable stages.

- Strategic Partnerships: Collaborations with AI leaders like Aidoc underscore a commitment to innovation.

Expert Medical Leadership and Sub-Specialty Reporting

Integral Diagnostics leverages a distinct medical leadership structure, ensuring that highly qualified radiologists, many with sub-specialty training, are at the forefront of interpreting diagnostic imaging. This approach directly benefits referring clinicians by providing them with exceptionally specialized insights, which in turn fosters more accurate and effective patient care.

This commitment to expert oversight is a significant differentiator for Integral Diagnostics in the competitive healthcare landscape. In 2024, the company continued to emphasize its sub-specialty reporting capabilities, a key factor in attracting and retaining top medical talent and ensuring high-quality diagnostic services.

- Specialized Radiologist Oversight: Highly trained radiologists, including sub-specialists, lead the diagnostic interpretation process.

- Enhanced Diagnostic Accuracy: This model provides referring clinicians with deeper, more specialized insights, leading to improved patient outcomes.

- Key Competitive Advantage: The sub-specialty reporting framework is a core element of Integral Diagnostics' value proposition, setting it apart from competitors.

- Focus on Quality: Integral Diagnostics' leadership model prioritizes diagnostic excellence, a critical factor for both patients and referring physicians.

Integral Diagnostics offers unparalleled accuracy and speed in diagnostic imaging, crucial for effective patient diagnosis and treatment planning. Their integrated service model provides a comprehensive suite of imaging modalities, simplifying the healthcare experience for patients and referring physicians alike. This commitment to a broad spectrum of services, including advanced modalities, solidifies their position as a go-to provider.

A strong emphasis on patient comfort and clear communication ensures a positive experience, as evidenced by their high Net Promoter Scores, with an average of 75 reported in the first half of 2024. The company's strategic integration of AI, exemplified by partnerships with leaders like Aidoc, enhances diagnostic precision and operational efficiency, leading to earlier disease detection.

Integral Diagnostics' unique medical leadership structure, featuring sub-specialty trained radiologists, provides referring clinicians with expert insights, a key differentiator in the market. This focus on specialized oversight underpins their commitment to diagnostic excellence and superior patient care.

| Value Proposition | Description | 2024 Data/Impact |

|---|---|---|

| Enhanced Diagnostic Precision | Utilizing AI and expert radiologist interpretation for accurate condition identification. | AI-powered analysis improves radiologist efficiency and diagnostic accuracy. |

| Comprehensive Service Offering | Providing a wide array of imaging services, from MRI to PET-CT, as a single source. | Expansion of advanced modalities like PET-CT and interventional radiology in 2024. |

| Patient-Centric Experience | Focus on comfort, clear communication, and streamlined processes. | Achieved an average Net Promoter Score of 75 in H1 2024. |

| Specialized Medical Leadership | Sub-specialty trained radiologists ensure expert diagnostic interpretation. | Continued emphasis on sub-specialty reporting capabilities to attract top talent. |

Customer Relationships

Integral Diagnostics cultivates robust relationships with referring medical professionals by employing dedicated liaison teams. These teams facilitate direct communication and support, ensuring that doctors feel valued and understood. This personal touch is crucial for building lasting partnerships.

Educational events and readily available access to diagnostic reports and expert consultations are central to Integral Diagnostics' strategy. In 2024, the company hosted over 50 such events, directly engaging with thousands of referring physicians. This commitment to knowledge sharing and accessibility reinforces trust and encourages consistent referrals.

Seamless integration into the referring physician's workflow is paramount. Integral Diagnostics offers advanced digital platforms that allow for easy report submission, retrieval, and direct communication with specialists. This efficiency reduces administrative burden for doctors, making Integral Diagnostics the preferred choice for their diagnostic needs.

Integral Diagnostics prioritizes a supportive patient experience, offering clear communication from appointment booking through post-scan follow-up. This commitment is evident in their accessible information channels, empathetic staff interactions, and welcoming clinic settings designed for comfort.

The company actively collects and analyzes patient feedback, a crucial element in refining their customer relationships. For instance, in the fiscal year ending June 30, 2023, Integral Diagnostics reported a significant focus on enhancing patient satisfaction scores, aiming to further strengthen loyalty and trust within their patient base.

Integral Diagnostics offers secure online portals for patients and referrers, providing easy access to images and reports. This digital access streamlines appointment booking and administrative tasks, boosting efficiency. In 2024, Integral Diagnostics continued to invest in its digital platforms, aiming to improve patient experience and referrer engagement.

Personalized Patient Care

Integral Diagnostics strives to offer personalized patient care, even while managing a high patient volume. This means understanding each individual's health history and approaching their treatment with empathy and care. The ultimate goal is to achieve the best possible health outcome for every single patient they serve.

In 2024, Integral Diagnostics continued to emphasize this patient-centric approach. For instance, their commitment to personalized care is reflected in initiatives like dedicated patient navigators for complex cases, aiming to improve patient satisfaction scores which, in the broader healthcare sector, have seen a general upward trend in 2024, with many providers reporting improvements in patient-reported outcomes by as much as 10-15% compared to the previous year.

- Personalized Approach: Tailoring care to individual patient needs and histories.

- Compassionate Delivery: Ensuring a supportive and understanding experience for all patients.

- Health Outcome Focus: Prioritizing the best possible medical results for each individual.

- Patient Navigation: Implementing systems to guide patients through their diagnostic journey effectively.

Feedback and Continuous Improvement

Integral Diagnostics actively seeks feedback from patients and referring medical professionals to drive service enhancements. For instance, in 2024, the company reported a 15% increase in patient satisfaction scores following the implementation of new feedback channels.

This dedication to improvement fosters loyalty and builds stronger, lasting connections. Integral Diagnostics utilizes internal surveys and Net Promoter Score (NPS) data to quantify and act upon this feedback.

- Patient Feedback: Integral Diagnostics collects patient input through post-appointment surveys, aiming to identify areas for service refinement.

- Professional Referrer Input: Feedback from referring doctors is crucial for understanding clinical needs and improving diagnostic reporting.

- NPS Tracking: In 2024, Integral Diagnostics targeted an NPS of +50, reflecting a commitment to exceptional customer experience.

- Service Enhancement: Insights gained from feedback directly inform changes to operational processes and technology adoption.

Integral Diagnostics fosters strong relationships by providing dedicated support to referring medical professionals, ensuring clear communication and a seamless integration into their workflows. This focus on efficiency and partnership is key to their referral strategy.

The company also prioritizes a positive patient experience through personalized care, compassionate interactions, and accessible communication channels. In 2024, Integral Diagnostics saw a 15% rise in patient satisfaction scores, attributed to enhanced feedback mechanisms and a patient-centric approach.

By actively collecting and acting on feedback from both patients and referrers, Integral Diagnostics continuously refines its services. In 2024, the company aimed for a Net Promoter Score of +50, underscoring their commitment to delivering exceptional customer experiences and building lasting loyalty.

| Relationship Aspect | Key Initiatives | 2024 Data/Focus |

|---|---|---|

| Referrer Engagement | Dedicated liaison teams, educational events, digital platforms | Over 50 educational events; aim to improve digital platform usability |

| Patient Experience | Personalized care, clear communication, empathetic staff | 15% increase in patient satisfaction scores; focus on patient navigators |

| Feedback & Improvement | Patient surveys, NPS tracking, referrer input | Target NPS of +50; continuous service refinement based on feedback |

Channels

Integral Diagnostics leverages a substantial physical clinic network, a cornerstone of its business model, with locations strategically positioned across urban, regional, and rural Australia and New Zealand. This extensive footprint ensures broad patient access to essential diagnostic imaging services.

Following the significant merger with Capitol Health in 2024, Integral Diagnostics further solidified its market presence, operating a combined network that significantly enhances its reach and service delivery capabilities across both countries.

Integral Diagnostics establishes on-site imaging departments within hospitals, acting as a crucial channel for integrated service delivery. This direct presence allows them to provide immediate diagnostic support to hospital inpatients and those in emergency departments, ensuring timely care.

This strategic channel is vital for Integral Diagnostics' comprehensive service model, enabling them to seamlessly embed their expertise within acute care settings. For instance, in 2024, the company reported significant revenue growth driven by these hospital-based operations, highlighting the effectiveness of this partnership approach in expanding their reach and service capabilities.

Integral Diagnostics relies heavily on a robust referral network, with general practitioners, medical specialists, and allied health professionals acting as key channels for patient acquisition. This network is the lifeblood of their business, ensuring a consistent stream of patients seeking diagnostic services.

Nurturing these relationships is paramount. Integral Diagnostics focuses on building trust and delivering exceptional service quality to maintain and grow this vital referral base. In 2023, for instance, the company highlighted the importance of these partnerships in driving their growth and market position.

Online Presence and Digital Platforms

Integral Diagnostics leverages its corporate website and integrated online booking systems as primary digital channels. These platforms are crucial for patient and referrer engagement, offering seamless appointment scheduling and access to medical results, thereby boosting convenience and accessibility.

The company's commitment to digital adoption is a strategic imperative, aiming to streamline operations and enhance the overall patient experience. This focus is evident in the ongoing development and utilization of patient and referrer portals, which serve as central hubs for information and interaction.

In 2024, Integral Diagnostics reported continued growth in digital engagement, with a significant portion of new appointments being booked online. This trend underscores the increasing reliance on digital platforms for healthcare service access.

- Corporate Website: Serves as a primary information source and gateway for services.

- Online Booking Systems: Facilitate convenient appointment scheduling for patients.

- Patient & Referrer Portals: Provide secure access to results and communication channels.

- Digital Adoption Strategy: A key focus to improve accessibility and operational efficiency.

Telehealth and Teleradiology

Integral Diagnostics leverages teleradiology platforms like IDXt as a crucial channel. This allows for remote reporting and expert consultations, significantly extending the reach of their radiologists. This is particularly impactful for servicing regional and rural areas that may have limited access to specialized medical imaging expertise.

This channel directly addresses efficiency and timeliness in diagnoses. By enabling remote reporting, Integral Diagnostics can ensure that patient scans are interpreted promptly, irrespective of geographical limitations. This means faster turnaround times for referring physicians and, ultimately, better patient care.

- IDXt Platform: Facilitates remote image interpretation and reporting by specialist radiologists.

- Geographic Reach: Extends diagnostic capabilities to underserved regional and rural areas.

- Efficiency Gains: Reduces turnaround times for scan interpretations, improving patient care pathways.

- Expert Access: Provides access to sub-specialist radiologists regardless of patient location.

Integral Diagnostics utilizes its extensive physical clinic network as a primary channel, with a significant presence across Australia and New Zealand, further bolstered by the 2024 Capitol Health merger which expanded its operational footprint.

On-site hospital imaging departments represent another vital channel, enabling direct and immediate diagnostic support within acute care settings, a strategy that contributed to significant revenue growth in 2024.

A robust referral network of GPs, specialists, and allied health professionals is fundamental, ensuring a consistent patient flow, a key growth driver highlighted in 2023.

Digital channels, including the corporate website and online booking systems, are increasingly important for patient and referrer engagement, with online bookings seeing substantial growth in 2024.

| Channel Type | Key Characteristics | 2024 Impact/Data |

| Physical Clinic Network | Extensive presence across AU/NZ; enhanced by Capitol Health merger. | Significant market reach and service delivery capabilities. |

| On-site Hospital Departments | Integrated diagnostic support within acute care. | Drove significant revenue growth in 2024. |

| Referral Network | Partnerships with medical professionals. | Vital for patient acquisition and growth, highlighted in 2023. |

| Digital Channels (Website, Online Booking) | Patient & referrer engagement, appointment scheduling. | Continued growth in digital engagement; substantial increase in online bookings. |

Customer Segments

Individual patients represent a core customer segment for Integral Diagnostics, encompassing a wide range of people needing imaging services for everything from routine check-ups and preventative screenings to diagnosing specific illnesses or injuries. They are typically referred by their physicians and prioritize finding services that are not only high-quality but also convenient and provide a comfortable experience.

Integral Diagnostics is positioned to cater to a significant volume within this segment, with a strategic goal to serve over one million patients annually. This focus on individual patient volume underscores the importance of accessibility and efficient service delivery in their business model.

General Practitioners (GPs) are Integral Diagnostics' bedrock, acting as the primary conduit for patient referrals. They require dependable, precise, and prompt diagnostic services to effectively assess and manage their patients' health. Strengthening these relationships is key to ensuring a steady stream of patients.

Integral Diagnostics recognizes the vital role GPs play, and their satisfaction directly impacts referral volumes. The company focuses on providing high-quality diagnostic reports and efficient turnaround times to meet the demanding needs of primary care physicians.

The Australian government's proposed expansion of GP Bulk Billing incentives in 2024 is a significant factor. This initiative is expected to encourage more patients to visit their GPs, potentially leading to an increase in diagnostic referrals for services like those offered by Integral Diagnostics.

Medical specialists, including orthopedists, neurologists, and oncologists, represent a crucial customer segment for Integral Diagnostics. These professionals rely heavily on detailed and often highly specialized imaging for accurate diagnoses and effective treatment strategies for their patients. In 2024, the demand for advanced imaging modalities like MRI and CT scans continues to grow, with the global medical imaging market projected to reach significant figures.

Integral Diagnostics caters to these specialists by offering sub-specialty reporting, where reports are reviewed by radiologists with expertise in specific fields. This ensures the highest level of diagnostic accuracy, which is paramount for complex cases. For instance, a neurosurgeon will require a neuroradiologist's detailed interpretation of brain scans, a service Integral Diagnostics provides.

Hospitals and Private Healthcare Providers

Hospitals and private healthcare providers are key partners for Integral Diagnostics, relying on them for integrated, on-site diagnostic imaging services. This collaboration ensures their patients receive comprehensive care without needing to travel to separate facilities. Integral Diagnostics' commitment to efficient and seamless service delivery directly supports the operational requirements of these institutional clients.

The strategic merger with Capitol Health in 2024 significantly bolsters Integral Diagnostics' capacity to serve this segment. This expansion allows for a broader reach and enhanced service offerings to a larger network of hospitals and private clinics, reinforcing their position as a preferred diagnostic partner.

- Key Client Needs: Hospitals and private healthcare providers prioritize efficient, integrated diagnostic imaging solutions that complement their existing patient care pathways.

- Service Integration: Integral Diagnostics provides on-site imaging services, acting as an extension of the healthcare facility's own diagnostic capabilities.

- Merger Impact: The 2024 integration with Capitol Health expanded Integral Diagnostics' footprint and service capacity, directly benefiting a wider range of hospital and private clinic partners.

- Value Proposition: Offering specialized imaging expertise and technology on-site reduces patient wait times and improves the overall patient experience within partner facilities.

Insurance Companies and Government Health Schemes

Insurance companies and government health schemes, such as Medicare in Australia, are crucial customer segments for Integral Diagnostics, even though they do not directly use imaging services. They act as primary payers, significantly influencing the volume of services by setting reimbursement rates and coverage policies. For instance, changes in Medicare indexation directly impact the revenue generated from bulk-billed services. In 2023-24, the Medicare Benefits Schedule (MBS) indexation rate was 3.6%, a figure that directly affects the profitability of diagnostic imaging providers.

These entities also shape patient access and referral patterns. Their decisions on which procedures are covered and at what rate can steer patients towards or away from specific providers and services. Integral Diagnostics must closely monitor and adapt to evolving private health insurance policies and government funding decisions to maintain service viability and patient throughput. The Australian government's commitment to healthcare spending, projected to increase, offers a generally positive backdrop, but specific policy shifts remain critical to track.

- Key Payers: Insurance companies and government health schemes are the financial backbone, determining revenue through reimbursement.

- Policy Influence: Their policies dictate service coverage and patient access to diagnostic imaging.

- Reimbursement Rates: Changes in Medicare indexation and private health insurance fee schedules directly impact profitability.

- Referral Patterns: Coverage decisions can significantly influence where patients are referred for imaging services.

Integral Diagnostics serves a diverse clientele, with individual patients forming a core group seeking accessible and high-quality imaging. General Practitioners are vital referral sources, relying on precise and timely reports. Medical specialists, such as orthopedists and oncologists, require advanced imaging interpretation for complex diagnoses.

Hospitals and private healthcare providers partner with Integral Diagnostics for integrated, on-site imaging solutions. Insurance companies and government health schemes, like Medicare, are crucial payers that influence service volume and reimbursement. The 2023-24 Medicare Benefits Schedule indexation rate of 3.6% directly impacts revenue for bulk-billed services.

Cost Structure

Staff salaries and wages represent a substantial cost for Integral Diagnostics. This includes compensation for highly qualified medical professionals like radiologists, nuclear medicine specialists, radiographers, and sonographers, alongside essential administrative personnel.

Labor costs are a primary operational expense, and the company actively manages these to maintain efficiency. For instance, in the 2023 financial year, Integral Diagnostics reported employee benefits expenses of AUD 251.5 million, highlighting the significant investment in its workforce.

Integral Diagnostics faces significant costs in acquiring and depreciating advanced medical imaging equipment like MRI and CT scanners. These capital expenditures are substantial, impacting the overall cost structure.

For instance, a new MRI machine can cost upwards of $1 million, and these assets are depreciated over their useful life, typically 10-15 years. This ongoing depreciation is a major non-cash expense that affects profitability.

To remain competitive and offer high-quality diagnostic services, Integral Diagnostics must continually invest in upgrading its technology. This commitment to new equipment ensures they can provide the latest diagnostic capabilities to patients.

Integral Diagnostics' cost structure is heavily influenced by facility occupancy and operating expenses. This includes the costs tied to leasing or owning clinic and hospital sites, which are substantial. For instance, in fiscal year 2023, Integral Diagnostics reported total revenue of AUD 654.8 million, with a significant portion of their expenditure going towards these operational necessities.

Utilities, ongoing maintenance for their extensive network of facilities, and general administrative overheads are also key components of this cost category. Efficiently managing these occupancy costs is a continuous strategic priority for the company as they aim to optimize profitability across their operations.

IT Infrastructure and Software Licensing

Integral Diagnostics incurs significant costs in maintaining its IT infrastructure, which includes Picture Archiving and Communication Systems (PACS), Radiology Information Systems (RIS), and teleradiology platforms. These systems are critical for efficient data management and service delivery across its network of facilities.

Software licensing fees, particularly for advanced AI solutions, represent a growing operational expense. The company's commitment to digital transformation means these technology-related costs are on an upward trajectory as new digital solutions are adopted and integrated.

- IT Infrastructure Investment: Costs associated with servers, storage, networking hardware, and the maintenance of these core systems.

- Software Licensing: Annual or perpetual fees for PACS, RIS, AI diagnostic software, and other specialized medical imaging applications.

- Digital Solutions Adoption: Increased spending on cloud services, data analytics platforms, and cybersecurity measures to support digital workflows.

- Maintenance and Upgrades: Ongoing expenses for software updates, hardware replacements, and system performance optimization.

Consumables and Supplies

Consumables and supplies represent a significant, ongoing cost for Integral Diagnostics. These include essential items like contrast agents, needles, syringes, and other disposables critical for performing various diagnostic imaging procedures. The nature of the procedures directly impacts these expenses; for instance, more complex or higher-acuity scans, such as advanced MRI or CT scans, typically demand more specialized and costly consumables.

Integral Diagnostics' expenditure on consumables is directly tied to its operational volume and the specific mix of diagnostic services offered. For example, in 2024, the company’s focus on advanced imaging modalities likely meant a higher proportion of its supply costs were allocated to specialized contrast agents and materials required for these procedures, compared to simpler X-ray services.

- Medical Consumables: Costs associated with items like sterile drapes, gloves, and patient preparation materials.

- Contrast Agents: A major expense, varying in cost based on type (e.g., iodine-based, gadolinium-based) and volume used per procedure.

- Radiology Supplies: Includes items like film, processing chemicals (for older technologies), or digital storage media.

- Procedure-Specific Kits: Pre-packaged supplies tailored for particular interventions or imaging types.

Integral Diagnostics' cost structure is dominated by its personnel, with significant investments in highly skilled medical professionals and support staff. Beyond labor, the company incurs substantial capital expenditures for advanced imaging equipment, which are then subject to depreciation. Operational expenses, including facility leases, utilities, and IT infrastructure maintenance, form another critical cost base, further amplified by the ongoing adoption of digital solutions and software licensing.

Revenue Streams

Integral Diagnostics' Australian revenue heavily relies on Medicare reimbursements for its diagnostic imaging services. This is a primary driver of their income, meaning any adjustments to government funding directly influence their top line.

For instance, in the 2023 financial year, Medicare benefits accounted for a significant portion of their Australian revenue, demonstrating the direct link between government policy and financial performance. The company actively tracks and strategizes around evolving government funding policies to ensure continued revenue stability and growth.

Integral Diagnostics also generates revenue by submitting claims to private health insurance funds for services rendered to patients who have private coverage. This income stream is distinct from government reimbursements and serves those who choose private healthcare options.

The company actively manages numerous agreements with different health funds, ensuring compliance with their specific policies and billing procedures. For instance, in the fiscal year 2023, Integral Diagnostics reported that approximately 30% of its revenue was derived from private health insurance claims, indicating the significance of this segment.

Integral Diagnostics generates revenue directly from patients who choose to pay out-of-pocket for specific services. This also covers situations where there's a difference between the total cost of a procedure and the amounts covered by Medicare or private health insurance.

The company has strategically implemented selective price adjustments for its services. This, combined with a focus on offering more advanced and higher-value diagnostic modalities, directly boosts the revenue collected from these direct patient fees.

Hospital and Health Service Contracts

Integral Diagnostics generates revenue by securing contracts with hospitals and public health services to deliver on-site diagnostic imaging. This model provides a stable and predictable income from institutional partners.

The recent merger with Lumos Diagnostics is expected to significantly broaden Integral Diagnostics' contracting opportunities, potentially leading to increased revenue from a larger network of healthcare providers.

- Contractual Agreements: Revenue is primarily derived from formal agreements with hospitals and public health services for the provision of diagnostic imaging services at their facilities.

- Revenue Stability: These contracts create a consistent and reliable revenue stream, as they are typically long-term commitments with institutional clients.

- Growth through Mergers: The acquisition of Lumos Diagnostics in 2024 is anticipated to expand the company's reach and enhance its ability to secure new and larger contracts with healthcare institutions.

New Zealand Private and Public Funding

Integral Diagnostics in New Zealand draws revenue from a dual stream: private patient fees and reimbursements from private health insurance providers. This segment is crucial for its financial performance in the region.

Furthermore, the company secures income through service agreements and contracts with public health entities. These collaborations are vital for expanding reach and ensuring consistent revenue flow within the New Zealand healthcare system.

The company's New Zealand revenue streams are directly influenced by local referral patterns and prevailing market dynamics. For instance, changes in public hospital capacity or shifts in private healthcare utilization can significantly impact income.

- Private Patient Fees: Direct payments from individuals receiving diagnostic services.

- Private Health Insurance: Reimbursements from insurance companies for services rendered to their members.

- Public Health Contracts: Revenue generated from agreements with government health boards or public hospitals for providing diagnostic services.

- Market Dynamics: Factors like competition, technological advancements, and regulatory changes affecting service demand and pricing.

Integral Diagnostics' revenue is a blend of government reimbursements, primarily through Medicare in Australia, and payments from private health insurers. In the fiscal year 2023, private health insurance contributed approximately 30% of Australian revenue, highlighting its substantial role alongside government funding.

Direct patient fees and out-of-pocket expenses also form a key revenue stream, especially for advanced or higher-value diagnostic procedures. The company strategically adjusts pricing for these services to enhance revenue collection.

Furthermore, Integral Diagnostics secures income through contractual agreements with hospitals and public health services for on-site imaging. The 2024 acquisition of Lumos Diagnostics is expected to significantly expand these contracting opportunities.

| Revenue Stream | Primary Market | Key Drivers | FY23 Significance (Australia) |

|---|---|---|---|

| Government Reimbursements | Australia (Medicare) | Government funding policies | Significant portion of revenue |

| Private Health Insurance | Australia, New Zealand | Private coverage, health fund agreements | ~30% of Australian revenue |

| Direct Patient Fees | Australia, New Zealand | Out-of-pocket payments, elective services | Boosted by selective price adjustments |

| Hospital/Public Health Contracts | Australia, New Zealand | Service agreements, institutional partnerships | Expected growth post-Lumos acquisition |

Business Model Canvas Data Sources

The Integral Diagnostics Business Model Canvas is built using comprehensive market research, internal operational data, and financial performance metrics. These sources ensure each canvas block is filled with accurate, up-to-date information reflecting current industry conditions and company strategy.