Integral Diagnostics Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Integral Diagnostics Bundle

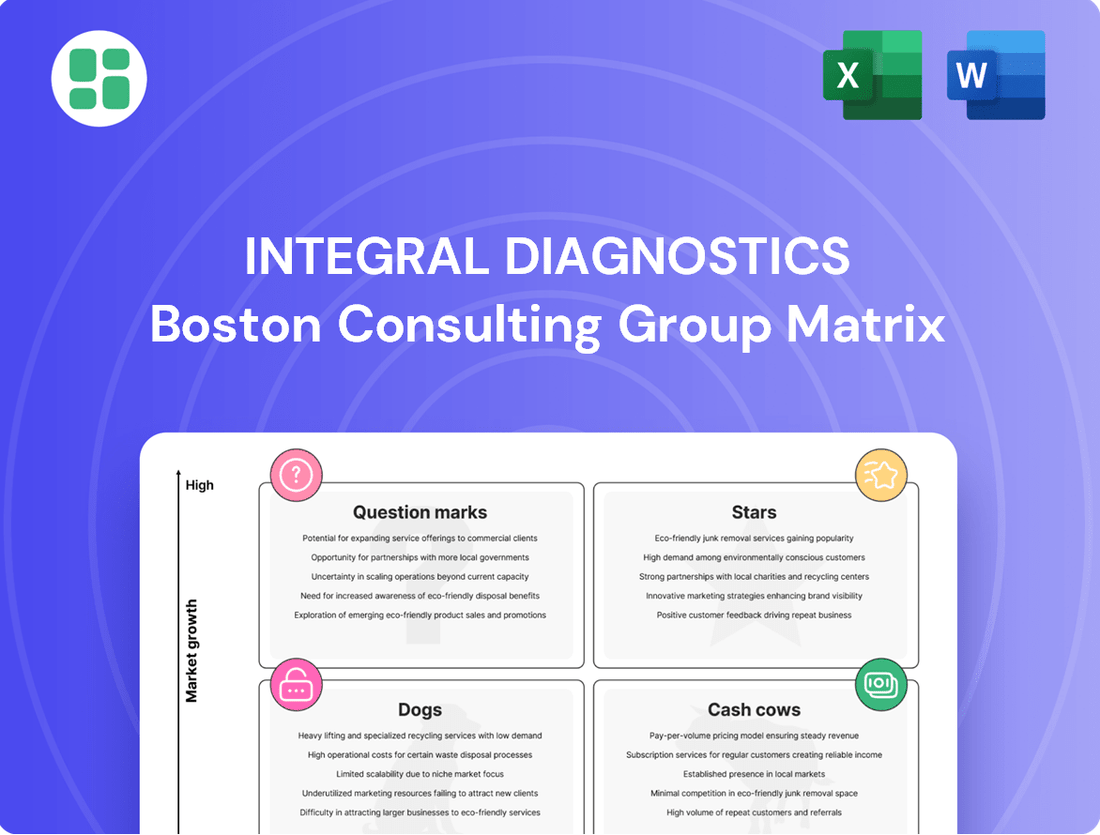

Curious about how Integral Diagnostics' product portfolio stacks up? Our BCG Matrix preview offers a glimpse into their market position, highlighting potential Stars, Cash Cows, Dogs, and Question Marks. To truly unlock strategic advantage and make informed decisions about resource allocation, dive into the full report.

Gain a comprehensive understanding of Integral Diagnostics' strategic positioning by purchasing the complete BCG Matrix. This detailed analysis provides the granular insights needed to identify high-growth opportunities and manage underperforming assets effectively, empowering you to drive future success.

Don't let your competitors outmaneuver you; get the full Integral Diagnostics BCG Matrix today. It's your essential guide to understanding market dynamics and making confident, data-driven investment choices for sustainable growth.

Stars

Integral Diagnostics' advanced MRI services are poised for substantial growth, particularly in Australia, following the deregulation of MRI services slated for July 2025. This pivotal regulatory shift will elevate partial MRI licenses to full Medicare eligibility, a move expected to significantly boost demand for these high-value diagnostic imaging procedures.

The company is well-positioned to capitalize on this burgeoning market, leveraging its established infrastructure and expanding network to meet the anticipated surge in MRI service utilization. Integral Diagnostics' strategic emphasis on higher-end modalities, with MRI at the forefront, directly aligns with this high-growth segment of the diagnostic imaging landscape.

Integral Diagnostics (IDX) is solidifying its position in the AI-driven medical imaging sector, particularly in Australia and New Zealand, through a significant expansion of its partnership with Aidoc. This collaboration centers on the Aidoc aiOS platform, a sophisticated system designed to automatically identify and flag critical pathologies. This capability offers IDX a distinct competitive edge in a market segment that is both rapidly advancing and experiencing substantial growth.

The strategic integration of Aidoc's AI technology represents a forward-thinking investment by IDX, placing the company at the vanguard of diagnostic innovation. By leveraging AI to enhance the accuracy and efficiency of medical imaging analysis, IDX is poised to deliver superior patient care and operational advantages. This move is particularly relevant as the global AI in healthcare market is projected to reach significant valuations, with some estimates suggesting it could surpass $100 billion by 2028, underscoring the high-growth potential of this technology segment.

Integral Diagnostics (IDX) is making significant strides in PET-CT and nuclear medicine, positioning itself for growth. The company is actively expanding its PET-CT facilities, highlighting its commitment to high-acuity work in this specialized sector. This expansion suggests a strategic focus on a high-demand area of diagnostic imaging.

Nuclear medicine services are also experiencing a boost, with a recent Medicare indexation increase underscoring their increasing recognition and value. IDX further strengthens its position by employing dual-trained radiologists in this high-growth field, ensuring specialized expertise.

Teleradiology Services (IDXt)

Integral Diagnostics' teleradiology arm, IDXt, is a star performer within the company's BCG Matrix. This segment has seen impressive organic growth, now representing a significant 15% of IDX's total Australian revenue.

IDXt's success is fueled by a robust demand for flexible and efficient medical imaging reporting. Its strong internal market share highlights its competitive advantage in this rapidly evolving sector.

- IDXt's contribution to Australian revenue: 15%

- Growth driver: Increasing demand for efficient and flexible reporting solutions.

- Strategic focus: Continued investment in digital and AI technologies.

- Outlook: Expected acceleration in expansion.

National Lung Cancer Screening Program Services

Integral Diagnostics (IDX) is poised to capitalize on the Australian government's National Lung Cancer Screening Program (NLCSP), set to be funded from July 2025. This initiative represents a substantial high-growth opportunity for diagnostic services.

IDX is actively preparing by trialling advanced AI algorithms within its Aidoc platform. These algorithms are specifically designed for enhanced lung nodule detection, a critical component of effective lung cancer screening.

- Government Funding: The NLCSP, backed by Australian government funding from July 2025, creates a stable and expanding market for lung cancer screening services.

- AI Integration: IDX's strategic trials of AI algorithms on the Aidoc platform demonstrate a commitment to leveraging cutting-edge technology for improved diagnostic accuracy in lung nodule detection.

- Market Position: Proactive engagement in this government-supported program positions IDX to become a key provider of essential diagnostic services, anticipating significant demand as the program rolls out.

Integral Diagnostics' teleradiology arm, IDXt, is a clear star performer, contributing a significant 15% to the company's Australian revenue. This segment thrives on the increasing demand for efficient and flexible medical imaging reporting solutions.

IDXt's strong internal market share underscores its competitive advantage, and the company continues to invest in digital and AI technologies to further accelerate its expansion in this high-growth area.

The National Lung Cancer Screening Program, funded from July 2025, presents another star opportunity for IDX. By integrating advanced AI for lung nodule detection, IDX is positioning itself as a key provider for this government-backed initiative.

The company's strategic focus on high-acuity services like MRI and PET-CT, coupled with its AI partnerships, solidifies its star status in the diagnostic imaging market.

| Business Segment | Market Growth | IDX Position | Key Strengths | Outlook |

|---|---|---|---|---|

| Teleradiology (IDXt) | High | Star | 15% of AU Revenue, Demand for flexible reporting | Accelerating expansion, AI investment |

| Lung Cancer Screening (NLCSP) | High | Star | Government funded (July 2025), AI for nodule detection | Key provider role, significant demand |

| Advanced MRI | High | Star | Deregulation (July 2025), infrastructure | Capitalizing on increased demand |

| PET-CT & Nuclear Medicine | High | Star | Facility expansion, dual-trained radiologists | Focus on high-demand, specialized sectors |

What is included in the product

The Integral Diagnostics BCG Matrix analyzes business units by market share and growth rate, guiding investment decisions.

Visualizes business unit performance, simplifying strategic decisions and alleviating the pain of resource allocation uncertainty.

Cash Cows

Established General X-ray and Routine Ultrasound services are integral to Integral Diagnostics' portfolio, functioning as its Cash Cows. These services are characterized by high volume and stable demand across Australia and New Zealand, consistently generating reliable cash flow for the company.

In 2024, Integral Diagnostics reported that its diagnostic imaging segment, which heavily relies on these established services, continued to be a significant contributor to revenue. The mature nature of these offerings means they require minimal investment in marketing and development, allowing them to efficiently convert revenue into profit.

These foundational imaging modalities are the bedrock of Integral Diagnostics' daily operations, providing a predictable revenue stream that supports investment in other areas of the business. Their consistent performance underscores their role as dependable cash generators within the company's strategic framework.

Integral Diagnostics' core CT services in established clinics are its cash cows. Despite a 2.0% reduction in Medicare benefits in 2024, these services maintain high volume and a strong market share, especially in higher-end CT scans. Their consistent utilization and well-defined patient pathways ensure they remain significant revenue generators.

Integral Diagnostics' comprehensive clinics in mature Australian regions like the Gold Coast and Western Victoria are prime examples of cash cows. These facilities benefit from consistent, high patient volumes and a reliable referrer network, translating into predictable and substantial profit margins.

In 2024, Integral Diagnostics reported strong performance from its established diagnostic imaging services, with these mature clinics forming the backbone of its revenue. Their long-standing market presence allows for operational efficiencies and a deep understanding of local patient needs, solidifying their position as reliable profit generators.

Loyal Patient and Referrer Base

Integral Diagnostics' dedication to patient-centric care and medical leadership has cultivated a deeply loyal patient and referrer base across its extensive network. This enduring trust ensures a steady stream of referrals and repeat business, generating predictable cash flow without requiring substantial investment in new customer acquisition.

This established loyalty is a critical advantage in the competitive healthcare landscape, particularly in mature markets where building new relationships can be challenging and costly. For instance, in the fiscal year 2023, Integral Diagnostics reported a strong performance, with revenue growth reflecting the stability provided by this loyal customer segment.

- Consistent Referral Volumes: The established relationships with referring physicians and satisfied patients guarantee a reliable inflow of new cases.

- Reduced Marketing Costs: Minimal need for aggressive acquisition strategies due to inherent patient and referrer loyalty.

- Predictable Cash Flow: The stable demand from this base provides a predictable and dependable revenue stream.

- Market Stability: Loyalty acts as a buffer against market fluctuations and competitive pressures in established segments.

Standard Diagnostic Imaging in Less Competitive Areas

Integral Diagnostics' standard diagnostic imaging services in less competitive Australian and New Zealand markets are likely positioned as cash cows. These established operations benefit from stable demand and a reduced need for significant capital expenditure, enabling them to consistently generate profits.

These segments act as reliable income generators, providing the financial flexibility to fund investments in more dynamic areas of the business. For instance, in fiscal year 2023, Integral Diagnostics reported a significant portion of its revenue stemming from its mature imaging services, underscoring their cash-generating capacity.

- Dominant Market Position: Likely holds a leading share in specific, less contested regional markets.

- Steady Profit Generation: These services consistently produce reliable earnings with minimal reinvestment needs.

- Cash Flow Contribution: Funds generated can be strategically deployed to support high-growth business units or acquisitions.

- Low Growth, High Share: Characteristic of a mature market where the company has a strong, defensible position.

Integral Diagnostics' established general X-ray and routine ultrasound services, alongside its core CT services in mature clinics, are its primary cash cows. These operations benefit from high patient volumes and stable demand, particularly in established Australian regions. Despite a 2.0% reduction in Medicare benefits in 2024, these services continue to generate reliable cash flow with minimal need for reinvestment, supporting the company's overall financial health.

| Service Segment | Market Position | Cash Flow Generation | Investment Needs |

|---|---|---|---|

| General X-ray & Routine Ultrasound | High Volume, Stable Demand | Consistent & Reliable | Minimal |

| Core CT Services (Mature Clinics) | Strong Market Share, High Utilization | Significant Revenue Generator | Low |

| Comprehensive Clinics (Mature Regions) | Consistent High Patient Volumes | Predictable & Substantial Profits | Low |

What You’re Viewing Is Included

Integral Diagnostics BCG Matrix

The Integral Diagnostics BCG Matrix preview you are viewing is precisely the document you will receive upon purchase, ensuring complete transparency and no hidden surprises. This means you'll get the fully formatted, analysis-ready report without any watermarks or demo content, ready for immediate strategic application. Once you complete your purchase, this exact BCG Matrix file will be instantly downloadable, allowing you to seamlessly integrate it into your business planning and decision-making processes. You can confidently use this preview as a true representation of the high-quality, professionally designed strategic tool you'll acquire.

Dogs

Integral Diagnostics’ New Zealand operations are currently positioned as a Dog in the BCG Matrix. This is evidenced by a substantial impairment loss of $71.5 million recognized in the first half of fiscal year 2024, stemming from lowered growth forecasts for the region.

The company faces significant headwinds in Auckland due to competition from referrer-owned radiology practices, which has eroded market share and profitability in key areas. This situation highlights a low-growth, low-market share dynamic for this segment of the business.

Integral Diagnostics is actively pursuing strategies to mitigate these challenges, including efforts to broaden its referrer base to reduce reliance on existing, underperforming relationships.

Integral Diagnostics likely classifies older, less efficient imaging equipment as Dogs within its BCG Matrix. This category would include legacy systems that are costly to maintain, offer lower resolution, or are simply outpaced by modern technological advancements. For instance, while specific figures for Integral Diagnostics’ older equipment aren't publicly itemized, the broader medical imaging industry saw capital expenditures on new equipment rise significantly. In 2024, for example, many healthcare providers were investing heavily in AI-integrated imaging solutions, making older, non-integrated machines less competitive.

Integral Diagnostics' Dogs category encompasses niche diagnostic imaging services with declining demand. These are typically low-volume procedures where market need is shrinking or has become highly commoditized, making them unprofitable. Integral Diagnostics holds a negligible market share in these specific service areas.

Services falling into this quadrant often no longer align with Integral Diagnostics' strategic emphasis on high-acuity and advanced imaging modalities. For instance, older, less sophisticated imaging techniques for common ailments might be relegated to this category as newer, more advanced technologies gain traction and patient preference. In 2024, the company's focus has been on expanding its capabilities in areas like AI-driven radiology and advanced MRI, further de-emphasizing these legacy services.

Specific Clinics in Highly Saturated Local Markets

Specific clinics situated in highly saturated local markets represent Integral Diagnostics' Dogs in the BCG Matrix. These are typically urban locations with a dense concentration of diagnostic service providers, leading to intense competition. For instance, in 2024, major metropolitan areas like Sydney and Melbourne continued to see a high density of imaging centers, making it challenging for any single player to capture significant market share.

These underperforming locations often exhibit minimal year-over-year revenue growth and struggle to achieve profitability. Despite being part of Integral Diagnostics' broader network, their contribution to overall revenue is marginal. Data from 2023 indicated that certain smaller, independent clinics acquired by Integral Diagnostics in densely populated areas were operating at a loss or with very slim profit margins, failing to meet internal benchmarks for growth and return on investment.

- Low Market Share: Clinics in these areas often hold less than 5% of the local market share due to the sheer number of competitors.

- Minimal Growth Prospects: The mature nature of these markets offers limited opportunities for significant expansion or increased patient volume.

- Profitability Challenges: High operating costs and price competition can erode profit margins, making these locations financially burdensome.

- Strategic Review: Integral Diagnostics may consider divesting or restructuring these underperforming assets to reallocate resources to more promising ventures.

Low-Margin, High-Volume CT Services Post-Funding Reduction

The recent 2.0% reduction in Medicare benefits for all CT services, effective November 2024, presents a significant challenge for Integral Diagnostics, particularly impacting its lower-margin, high-volume CT procedures. This policy change directly squeezes the profitability of services that rely on scale to generate revenue. For instance, a standard head CT, which might have a lower profit margin per scan, will now yield even less after the benefit reduction.

If Integral Diagnostics cannot effectively pivot its service mix towards higher-margin, specialized CT scans or achieve substantial operational efficiencies, these high-volume, low-margin CT services risk becoming cash traps. These segments, characterized by low market growth and potentially declining market share due to the reduced profitability, could drain resources without offering commensurate returns.

- Impact on Low-Margin CT: The 2.0% Medicare benefit reduction in November 2024 directly targets the profitability of high-volume, low-margin CT services.

- Risk of Cash Traps: Without a shift to higher-value CT services or improved efficiency, these segments could become unprofitable drains on resources.

- Strategic Imperative: Integral Diagnostics must focus on increasing the proportion of specialized, higher-reimbursement CT procedures in its service offering.

- Operational Efficiency: Simultaneously, maintaining and enhancing operational efficiencies across all CT services is crucial to mitigate the impact of reduced reimbursements.

Integral Diagnostics' New Zealand operations are a clear example of a Dog in the BCG Matrix, facing a low-growth, low-market share scenario. This is underscored by a significant $71.5 million impairment loss in the first half of fiscal year 2024, driven by reduced regional growth forecasts and intense competition from referrer-owned radiology practices in Auckland, which has eroded market share and profitability.

Integral Diagnostics' Dogs also encompass older, less efficient imaging equipment, such as legacy MRI or CT scanners that are costly to maintain and technologically surpassed by newer, AI-integrated solutions. The company is actively working to broaden its referrer base and reduce reliance on underperforming relationships to navigate these challenges.

Niche diagnostic imaging services with declining demand, often low-volume and commoditized, also fall into this category. These services no longer align with Integral Diagnostics' strategic focus on high-acuity and advanced imaging modalities, such as AI-driven radiology, which saw increased investment across the healthcare sector in 2024.

Specific clinics in highly saturated urban markets, like those in Sydney and Melbourne in 2024, represent Integral Diagnostics' Dogs due to intense competition. These locations often exhibit minimal revenue growth and struggle with profitability, with some acquired independent clinics operating at a loss or with slim margins, failing to meet investment return benchmarks.

The 2.0% reduction in Medicare benefits for CT services, effective November 2024, further pressures Integral Diagnostics' low-margin CT procedures. Without a strategic pivot to higher-margin specialized CT scans or significant operational efficiencies, these high-volume, low-margin services risk becoming cash traps, draining resources without adequate returns.

Question Marks

Integral Diagnostics' newer AI algorithms, such as those recently trialled for the National Lung Cancer Screening Program (NLSCP), are positioned as Stars within its BCG Matrix. These advanced applications hold significant promise for high growth in emerging diagnostic sub-segments.

While these cutting-edge AI tools show immense potential, Integral Diagnostics is still in the process of establishing its market share and proving their full clinical and financial impact. For instance, early trials for the NLSCP in 2024 demonstrated a notable improvement in nodule detection rates compared to traditional methods, suggesting strong future revenue streams.

Integral Diagnostics' strategic investments in new greenfield sites, like the PET-CT facility in Noosa and the expansion at Ocean Grove, exemplify its approach to Stars or Question Marks within the BCG matrix. These initiatives target emerging geographic markets or specialized service areas with significant future potential.

These new ventures, while promising, are in their nascent stages. They necessitate substantial capital outlay to establish infrastructure, build patient volumes, and capture market share. For instance, the Noosa PET-CT site, opened in late 2023, is still developing its patient base and operational efficiency, reflecting its Question Mark status as it seeks to become a market leader.

Integral Diagnostics' acquisition of 65 Capitol Health clinics places them squarely in the Question Mark category of the BCG Matrix. This expansion, while promising significant synergies, necessitates careful evaluation of each new clinic's market share and growth potential. For instance, if a newly acquired clinic operates in a rapidly growing diagnostic imaging market but currently holds a small market share, it represents a prime candidate for increased investment to become a Star.

The challenge lies in optimizing these newly integrated facilities. Integral Diagnostics must strategically allocate resources to boost the performance of clinics with high growth potential, ensuring they capture a larger market share. Conversely, underperforming clinics within the acquired network might require divestment or significant restructuring to prevent them from becoming Dogs, draining valuable capital.

Advanced and Niche Imaging Modalities in Early Adoption

Exploring advanced and niche imaging modalities, like AI-powered diagnostic tools or novel molecular tracers, positions Integral Diagnostics for high-growth potential in specialized medical fields. These cutting-edge technologies, while currently having low market penetration, offer significant opportunities for differentiation and market leadership.

The investment required for these advanced modalities is substantial, encompassing not only the acquisition of sophisticated equipment but also the development of specialized expertise and clinical validation. For instance, the global market for AI in medical imaging was projected to reach approximately $2.5 billion in 2023 and is expected to grow significantly, indicating a strong future demand for such innovations.

- High Growth Potential: Emerging modalities tap into unmet needs and offer superior diagnostic capabilities, driving future revenue streams.

- Substantial Investment: Significant capital expenditure is necessary for advanced technology and specialized personnel.

- Low Initial Penetration: Early adoption means a smaller existing customer base, requiring market education and development.

- Expertise Requirement: Building and maintaining a team skilled in these niche areas is critical for success.

Diversification Strategy for New Zealand Referrer Base

Integral Diagnostics is strategically expanding its reach within New Zealand by focusing on attracting more General Practitioners (GPs) to its referral network. This initiative is a direct response to the growing trend of referrer-owned practices, which can limit organic growth opportunities.

The company's efforts to diversify its referrer base are crucial for unlocking new growth avenues in a competitive New Zealand market. While the strategy is in motion, its effectiveness in substantially boosting Integral Diagnostics' market share remains a key question, positioning this initiative as a Question Mark within the BCG Matrix.

- Diversification Focus: Integral Diagnostics is prioritizing engagement with General Practitioners (GPs) in New Zealand.

- Market Challenge: This strategy aims to mitigate the impact of referrer-owned practices.

- Growth Potential: The initiative seeks to open new growth avenues in a challenging market.

- Uncertain Outcome: Significant increases in market share due to this strategy are not yet guaranteed.

Integral Diagnostics' investment in new facilities and niche technologies, such as AI-driven diagnostics and advanced imaging modalities, currently places them in the Question Mark category. These ventures require significant capital but offer high growth potential in emerging markets.

The company's strategic acquisition of clinics, like the 65 Capitol Health locations, also represents Question Marks. Success hinges on integrating these effectively and increasing their market share in potentially high-growth areas.

Integral Diagnostics' efforts to expand its GP referral network in New Zealand also fall into the Question Mark quadrant. This strategy aims to overcome market limitations, but its ability to significantly boost market share is still to be determined.

The key challenge for these Question Marks is to convert their high growth potential into market leadership through strategic investment and effective execution, transforming them into Stars.

BCG Matrix Data Sources

Our BCG Matrix leverages comprehensive market data, including financial performance reports, industry growth rates, and competitor analysis, to accurately position each business unit.