Instacart Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Instacart Bundle

Instacart navigates a complex competitive landscape, with significant pressure from rivals and the constant threat of new entrants disrupting the grocery delivery market. Understanding the bargaining power of both buyers and suppliers is crucial to grasping Instacart's strategic positioning.

The complete report reveals the real forces shaping Instacart’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Instacart's reliance on its extensive retail partner network for product inventory means these grocers hold considerable sway. Major retail chains, in particular, can exert significant bargaining power; their continued participation is crucial, and Instacart's business could be threatened if key partners pursue their own delivery services or strike exclusive agreements with rivals.

Despite these pressures, Instacart has demonstrated an ability to expand its retail footprint. The company onboarded over 40 net-new retailer sites in the first half of 2025, a notable increase compared to the approximately 30 launched throughout the entirety of 2024, suggesting a growing diversification of its partnerships.

Instacart's reliance on a flexible workforce means the availability and contentment of its independent shoppers are paramount to its operations. The gig economy's expansion is a significant factor; projections indicate gig workers could comprise close to 50% of the U.S. labor force by 2025.

This growing segment of the workforce, however, faces increasing competition from other delivery services. This competition can amplify the collective bargaining power of these shoppers, potentially leading to demands for improved compensation, benefits, or working conditions.

Such demands could directly impact Instacart by raising operational expenses or potentially compromising the consistency and quality of its services if shopper satisfaction declines.

Instacart's reliance on specialized technology and platform infrastructure providers presents a moderate bargaining power dynamic. While many core services are commoditized, dependence on unique software or proprietary systems can empower certain suppliers. For instance, the integration of AI is a key strategic focus, with over 80% of Instacart's Q2 2025 code being AI-assisted, suggesting a drive to internalize capabilities and potentially mitigate reliance on external tech vendors.

Brand Equity and Exclusivity Deals of Retailers

Grocery retailers with strong brand equity, like Kroger or Whole Foods, can exert significant bargaining power over Instacart. Their established customer loyalty allows them to negotiate better commission rates or even demand exclusivity, potentially limiting Instacart's access to popular brands. This leverage is amplified when retailers can credibly threaten to partner with competing delivery platforms.

Instacart's strategy involves strengthening these retailer relationships through technological integration. For example, their work with Publix to embed Instacart's Storefront technology directly into the retailer's own app aims to create a more seamless experience for consumers and secure Instacart's position. This deepens the partnership, making it harder for retailers to switch to rivals.

- Brand Strength: Retailers with high brand recognition and customer loyalty can command more favorable terms from Instacart.

- Exclusive Partnerships: The possibility of retailers striking exclusive deals with Instacart's competitors increases their bargaining leverage.

- Technological Integration: Instacart's efforts to integrate its technology into retailer platforms, such as with Publix, aim to solidify partnerships and reduce the bargaining power of individual retailers.

- Market Access: Retailers' ability to grant or deny Instacart access to their desirable brands is a key factor in the negotiation dynamic.

Input Costs for Shopper Operations

Input costs for Instacart shoppers, such as fuel, vehicle maintenance, and insurance, directly impact their profitability. For instance, if average gas prices, which fluctuated significantly in 2024, rise sharply, shoppers' take-home pay decreases. This squeeze on earnings can diminish their willingness to work for Instacart, thereby increasing their bargaining power to demand higher compensation or incentives to maintain service quality.

The broader gig economy landscape is also shifting. By 2025, there's a growing emphasis on providing gig workers with better protections. This includes addressing concerns about fair pay, access to benefits, and improved working conditions. Such developments could embolden Instacart shoppers to collectively push for more favorable terms, further amplifying their supplier power.

- Fuel Costs: Fluctuations in gasoline prices directly affect shopper earnings.

- Vehicle Maintenance: Regular upkeep and potential repairs represent a significant operational expense.

- Insurance Premiums: Vehicle insurance costs are a non-negotiable expense for shoppers.

- Gig Worker Protections: Increasing focus on worker rights and fair compensation in 2025 could empower shoppers.

The bargaining power of suppliers for Instacart is multifaceted, primarily stemming from its reliance on grocery retailers and its shopper workforce. Major grocery chains, with their established brands and customer bases, can negotiate terms that favor them, potentially impacting Instacart's margins. For example, retailers with strong brand equity can leverage their market access to secure better commission rates or even demand exclusivity, as seen in the ongoing strategic integrations like Instacart's work with Publix.

Instacart's shopper base also wields significant power, especially with the growing gig economy. Rising input costs for shoppers, such as fuel and vehicle maintenance, directly impact their profitability. As of early 2025, average gas prices, which saw considerable volatility in 2024, continue to influence shopper earnings. Furthermore, the increasing focus on worker protections in the gig economy by 2025 could embolden shoppers to demand better compensation and conditions, directly affecting Instacart's operational costs and service consistency.

| Supplier Type | Key Bargaining Factors | Impact on Instacart |

|---|---|---|

| Grocery Retailers | Brand strength, customer loyalty, market access to popular brands, ability to partner with competitors. | Negotiation of commission rates, potential for exclusivity agreements, risk of losing key partners. |

| Independent Shoppers | Input costs (fuel, maintenance), availability of alternative gig work, increasing focus on worker protections. | Potential for wage demands, impact on service availability and quality if satisfaction declines, increased operational expenses. |

What is included in the product

Instacart's Porter's Five Forces analysis reveals the intense rivalry from grocery retailers and other delivery services, the significant bargaining power of both shoppers and customers, and the low barriers to entry for new platform competitors.

Instantly gauge competitive intensity and identify strategic vulnerabilities with a dynamic Porter's Five Forces analysis, eliminating the guesswork in market positioning.

Customers Bargaining Power

Customers can easily switch between Instacart and other grocery delivery services or even shop directly with retailers. This flexibility means consumers can readily compare prices and services, forcing Instacart to stay competitive. For instance, in 2024, the average customer spent around $100 per Instacart order, a figure that could easily be shifted to a competitor offering a better deal.

Customers are acutely aware of the total cost of grocery delivery, making them highly sensitive to delivery fees, service charges, and any product markups Instacart applies. This sensitivity directly fuels their bargaining power, as they can easily switch to competitors or alternative shopping methods if they perceive better value elsewhere.

In 2024, Instacart's strategy to combat this includes offerings like Instacart+ membership, which waives delivery fees on orders over a certain threshold, and a lowered basket minimum of $10 for these members. This move aims to retain price-conscious customers by reducing perceived costs, but it also highlights the ongoing pressure from consumers to keep overall expenses down.

The sheer volume of grocery options available to consumers significantly amplifies their bargaining power. Major retailers like Walmart and Kroger offer their own direct-to-door delivery services, bypassing third-party platforms altogether. This creates a competitive landscape where customers can easily switch providers based on price, convenience, or selection, forcing Instacart to remain highly competitive.

Access to Product Information and Comparisons

Customers armed with digital tools can effortlessly compare prices, product availability, and promotions across numerous grocery retailers. This heightened transparency allows them to make value-driven purchasing decisions, compelling Instacart to maintain competitive and appealing services. For instance, in 2023, the average Instacart shopper spent approximately $100 per order, highlighting the importance of perceived value.

Instacart is actively enhancing how brands connect with consumers, focusing on clear price visibility and targeted promotions. This strategic shift acknowledges the customer's power to seek out the best deals, directly influencing Instacart's operational and pricing strategies to retain market share.

- Price Transparency: Online platforms provide easy access to price comparisons, pushing Instacart to optimize its pricing models.

- Information Accessibility: Customers can readily find product details and reviews, demanding quality and consistency from Instacart's service.

- Promotional Awareness: Shoppers are aware of discounts and offers across different retailers, requiring Instacart to manage its promotional strategies effectively.

Customer Reviews and Social Media Influence

Customer reviews and social media chatter significantly impact Instacart's brand image and ability to attract new users. Negative feedback, amplified online, gives customers a potent, informal bargaining tool, pressuring Instacart to quickly address service issues and prioritize customer satisfaction.

Instacart is actively working to enhance customer loyalty, particularly with individuals who joined in 2025. This focus on retention acknowledges the power of satisfied customers who can become brand advocates, while dissatisfied ones can deter potential users.

- Customer Voice Amplification: Online platforms allow individual customer complaints to reach a wide audience, influencing purchasing decisions for many others.

- Reputational Risk: A single viral negative review can damage Instacart's reputation more than a hundred positive ones, creating a strong incentive for service improvement.

- Retention Focus: By 2025, Instacart's efforts to retain customers, especially newer ones, signal an understanding that repeat business is more cost-effective than constant acquisition, driven partly by the fear of negative word-of-mouth.

The bargaining power of customers remains a significant force for Instacart, driven by the ease of switching and a keen awareness of costs. In 2024, with average order values around $100, consumers can readily shift their spending to competitors or direct retailer services if pricing or convenience falters. This constant threat compels Instacart to refine its pricing, promotions, and membership benefits, like Instacart+, to retain its user base and manage the inherent price sensitivity.

| Factor | Impact on Instacart | Customer Action |

|---|---|---|

| Switching Ease | Lowers customer loyalty | Move to competitors or direct retail delivery |

| Price Sensitivity | Pressures margins | Seek lower fees and markups |

| Information Access | Demands transparency | Compare prices and services easily |

| Brand Reputation | Influences acquisition/retention | Share positive/negative feedback online |

What You See Is What You Get

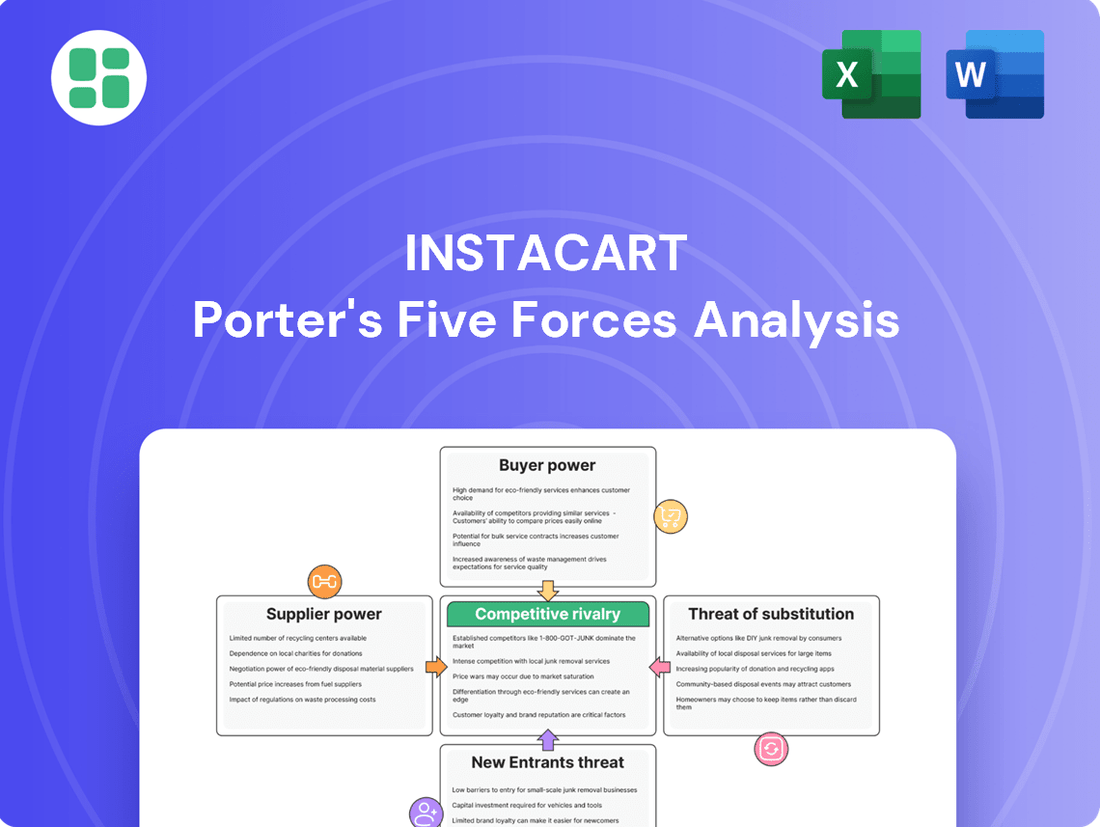

Instacart Porter's Five Forces Analysis

This preview showcases the complete Instacart Porter's Five Forces Analysis, offering a detailed examination of competitive rivalry, the bargaining power of buyers and suppliers, the threat of new entrants, and the threat of substitute products. The document you see here is precisely the same professionally formatted and ready-to-use analysis you will receive immediately after purchase, ensuring full transparency and immediate value.

Rivalry Among Competitors

Instacart operates in a fiercely competitive landscape, facing off against well-funded giants like DoorDash, Uber Eats, Amazon Fresh, and Walmart. These established players boast substantial financial backing and robust existing logistics infrastructure, allowing them to aggressively pursue market share in the online grocery and food delivery space.

These rivals are actively broadening their grocery delivery offerings and deploying diverse strategies to capture more customers, intensifying the competitive pressure on Instacart. For instance, in 2023, DoorDash reported a gross order volume of $67.4 billion, highlighting its scale and reach in the broader delivery market, which directly impacts grocery delivery competition.

Competitors in the grocery delivery space, including giants like DoorDash and Uber Eats, as well as direct grocery store delivery services, frequently resort to aggressive pricing and promotional tactics. This often manifests as price wars, where discounts and free delivery offers become commonplace, aimed squarely at capturing market share. For instance, in 2024, many platforms continued to offer new user incentives and loyalty programs, putting direct pressure on Instacart's customer acquisition costs and retention efforts.

These intense promotional activities directly impact Instacart's profitability by squeezing its already thin margins. To counter this, Instacart must continuously innovate its own pricing structures and loyalty programs, such as its Instacart+ membership, to retain its customer base. The ongoing battle for consumer attention through discounts and perks means Instacart cannot afford to be complacent, requiring constant strategic adjustments to maintain its competitive edge.

Instacart faces intense competition, with rivals continuously pouring resources into cutting-edge technologies like AI for smarter operations and robust logistics networks to ensure speedy, reliable deliveries. This relentless drive for innovation means Instacart must also commit significant capital to its own technological advancements and operational efficiencies to stay ahead.

For instance, Instacart's investment in Caper Cart technology, which aims to automate checkout, and its use of AI for code deployment highlight this necessity. In 2023, Instacart reported $1.2 billion in revenue, underscoring the scale of operations and the financial commitment required to maintain service quality and competitive standing in a rapidly evolving market.

Expansion of Traditional Grocers' Direct-to-Consumer Models

Many major grocery chains are significantly bolstering their own online ordering, delivery, and curbside pickup services. This strategic shift diminishes their dependence on third-party delivery platforms, including Instacart, by fostering direct customer relationships.

This move creates a more intense competitive landscape as these grocers can leverage their existing infrastructure and customer base to offer potentially more competitive pricing and a more seamless customer experience by avoiding third-party fees.

- Increased In-House Fulfillment: Major retailers like Walmart and Kroger have heavily invested in their own online grocery platforms, aiming to capture a larger share of the digital grocery market.

- Reduced Platform Dependency: By strengthening their proprietary delivery and pickup options, grocers can reduce the commission fees paid to third-party services, potentially improving profit margins.

- Enhanced Customer Experience: Direct control over the fulfillment process allows grocers to better manage inventory, delivery times, and customer service, offering a more integrated and potentially superior experience.

Competition for Shopper Workforce

The competition for shoppers is fierce, as Instacart and its rivals vie for a limited pool of independent gig workers. This intense rivalry can significantly impact operational costs. For instance, in 2024, Instacart has continued to adjust its shopper compensation models, often introducing bonuses and promotions to attract and retain workers during peak demand periods. This directly influences the company's ability to maintain consistent service quality.

This competition for the shopper workforce can lead to increased expenses for Instacart. To secure a reliable base of shoppers, companies may need to offer higher pay rates or more appealing incentive structures. For example, a 2023 survey indicated that a significant percentage of gig workers prioritize flexibility and earning potential, suggesting that competitive compensation is a key differentiator in attracting and keeping these workers engaged with platforms like Instacart.

- Intense Rivalry: Instacart faces stiff competition from other grocery delivery platforms and gig economy services for the same pool of independent shoppers.

- Impact on Costs: This competition can drive up shopper wages and incentive payouts, directly affecting Instacart's operational expenses.

- Service Level Management: Maintaining high service levels is challenged when shopper availability fluctuates due to competitive pressures.

- Shopper Retention: Offering attractive compensation and benefits is crucial for Instacart to retain its shopper base against competing offers.

Instacart's competitive rivalry is characterized by aggressive market strategies from major players like DoorDash and Uber Eats, who are expanding their grocery delivery services. These competitors, backed by substantial financial resources, frequently engage in price wars and promotional offers, such as discounts and free delivery, to attract and retain customers. For instance, in 2024, many platforms continued to offer strong new user incentives and loyalty programs, directly impacting Instacart's customer acquisition costs and retention efforts.

Major grocery retailers are also strengthening their in-house delivery and pickup options, reducing their reliance on third-party platforms like Instacart. This trend allows grocers to foster direct customer relationships and potentially offer more competitive pricing by avoiding third-party fees. Instacart must therefore continually invest in technology and operational efficiency, as demonstrated by its $1.2 billion in revenue in 2023, to maintain its competitive edge.

The competition for shoppers is also intense, driving up operational costs for Instacart as it competes for gig workers. In 2024, Instacart has adjusted its shopper compensation, often using bonuses and promotions to ensure shopper availability during peak times. This competition for the shopper workforce can lead to higher wages and incentive payouts, directly affecting Instacart's expenses and its ability to manage service levels.

| Competitor | 2023 Gross Order Volume (Billions) | Key Grocery Strategy |

|---|---|---|

| DoorDash | $67.4 | Expanding grocery offerings, aggressive promotions |

| Uber Eats | N/A (Part of Uber's broader mobility/delivery) | Leveraging existing network for grocery expansion |

| Walmart | N/A (Integrated retail) | Strong in-house delivery and pickup services |

| Amazon Fresh | N/A (Integrated retail) | Utilizing Amazon's logistics and Prime membership |

SSubstitutes Threaten

Traditional in-store grocery shopping remains the most significant substitute for Instacart's service. Consumers can personally select their produce, avoid delivery fees, and often find lower prices by shopping in person. In 2024, despite the growth of online grocery, a substantial portion of consumers still prioritize the cost savings and immediate availability of in-store options over the convenience of delivery.

Major grocery chains like Walmart and Kroger have significantly expanded their own direct-to-consumer delivery and curbside pickup services. Walmart, for instance, reported a substantial increase in online grocery sales, with millions of customers utilizing these options in 2024. This direct offering bypasses the need for a third-party shopper and can provide a more seamless customer experience, directly competing with Instacart's value proposition.

Meal kit subscriptions like HelloFresh and prepared food delivery services such as DoorDash offer consumers convenient alternatives to traditional grocery shopping, acting as significant substitutes for Instacart. These services cater to a similar need for convenient meal solutions, directly competing for a share of the consumer's food expenditure. In 2024, the meal kit market alone was projected to reach over $20 billion globally, indicating a substantial and growing alternative for consumers.

Specialty Food Delivery Services

Niche food delivery services, concentrating on specific areas like organic produce or gourmet items, present a distinct threat to Instacart. These specialized providers can capture market share by catering to consumers with particular tastes or demands for unique products. For instance, services focusing solely on farm-to-table delivery might attract customers seeking freshness and local sourcing that Instacart’s broader model may not always prioritize.

These specialized platforms can siphon off business from Instacart, particularly when they offer a highly curated selection or a superior shopping experience for their niche market. Consumers looking for artisanal cheeses or specific ethnic ingredients might find these dedicated services more appealing. The growth in the specialty food sector, with consumers increasingly valuing unique and high-quality ingredients, amplifies this threat.

- Targeted Consumer Base: Specialty services appeal to consumers with specific dietary needs or preferences, such as vegan, gluten-free, or organic shoppers, who may find Instacart's vast selection overwhelming or lacking in depth for their requirements.

- Unique Product Offerings: Many niche players partner directly with local farms or small producers, offering items not readily available through traditional grocery store partnerships that form the backbone of Instacart's supply.

- Curated Experience: Beyond product variety, these services often provide a more personalized and educational shopping experience, highlighting the origin of goods and offering recipe suggestions tailored to their specialty items, fostering stronger customer loyalty.

- Market Growth: The global online grocery market, which includes specialty segments, saw significant expansion. For example, the market was valued at over $1 trillion in 2023 and is projected to continue its upward trajectory, indicating ample room for specialized players to gain traction.

Small Local Stores and Farmers Markets

For consumers who value community connection, unique artisan goods, or a more personal shopping journey, small local stores and farmers' markets present a compelling alternative to Instacart. These venues offer a distinctly different experience, emphasizing locally sourced produce and direct engagement with vendors, which appeals to a segment of the market seeking authenticity and a break from large-scale online platforms.

The appeal of these substitutes is often rooted in freshness and traceability. For instance, in 2024, the demand for locally sourced food continued to grow, with many consumers willing to pay a premium for products with a known origin. Farmers' markets, in particular, saw consistent foot traffic, with many reporting sales increases over the previous year, reflecting a sustained consumer interest in direct-from-farm purchasing.

- Local Sourcing Appeal: Consumers increasingly seek transparency in their food supply chain, making local stores and farmers' markets attractive substitutes.

- Personalized Experience: The direct interaction and unique product offerings at these venues provide a distinct advantage over the standardized online grocery model.

- Community Engagement: For many, supporting local businesses and connecting with their community through these purchasing channels is a significant motivator.

- Freshness and Quality Perception: Products from farmers' markets and small local stores are often perceived as fresher and of higher quality due to shorter supply chains.

The threat of substitutes for Instacart is significant, encompassing traditional in-store shopping, direct grocery chain services, meal kit subscriptions, and niche food delivery platforms. Consumers often weigh the cost savings and immediate availability of in-person shopping against the convenience of delivery. For example, in 2024, a substantial portion of shoppers still favored the lower prices and ability to personally select items at physical stores.

Major retailers like Walmart have bolstered their own delivery and pickup options, offering a seamless alternative that bypasses third-party services. Walmart’s online grocery sales saw considerable growth in 2024, with millions of customers utilizing these direct channels. Similarly, meal kit services such as HelloFresh, which generated over $20 billion globally in 2024, cater to the demand for convenient meal solutions, directly competing with Instacart for consumer spending.

Niche food delivery services specializing in organic produce or gourmet items also pose a threat by catering to specific consumer preferences. These platforms can attract customers seeking unique products or a more curated shopping experience. The global online grocery market, valued at over $1 trillion in 2023, continues to expand, providing fertile ground for these specialized players to gain market share.

Local stores and farmers' markets offer a distinct substitute, appealing to consumers who value community connection, artisan goods, and a personal shopping journey. The demand for locally sourced food, with consumers often willing to pay a premium for traceability, remained strong in 2024. Farmers' markets, in particular, reported consistent foot traffic and sales increases, underscoring a sustained consumer interest in direct-from-farm purchasing.

| Substitute Type | Key Advantages | 2024 Market Relevance |

|---|---|---|

| In-Store Grocery Shopping | Cost savings, personal selection, immediate availability | Substantial consumer preference for cost and control |

| Direct Retailer Delivery/Pickup | Seamless experience, often lower fees, direct brand relationship | Significant growth in adoption by major chains like Walmart |

| Meal Kit Subscriptions | Convenience, pre-portioned ingredients, recipe guidance | Global market projected over $20 billion |

| Niche Food Delivery | Specialized product selection, curated experience, unique sourcing | Growing consumer demand for specific dietary or quality needs |

| Local Stores/Farmers' Markets | Freshness, traceability, community connection, unique artisan goods | Continued strong consumer interest in local sourcing and freshness |

Entrants Threaten

The online grocery delivery sector, exemplified by Instacart, presents a significant barrier to new entrants due to its high capital investment needs. Launching a competitive service requires substantial funding for technology development, building a widespread logistics network, and aggressive marketing to gain traction. For instance, in 2024, companies entering this space often need hundreds of millions of dollars to establish operations and compete effectively, a sum that deters many potential disruptors.

Instacart's established network effects with both retailers and shoppers present a significant barrier to new entrants. The company has built a robust ecosystem, securing partnerships with a vast majority of major grocery chains and attracting a large, active base of independent shoppers.

For any new competitor to gain traction, they must simultaneously convince numerous retailers to join their platform while also building a reliable pool of shoppers. This dual-sided challenge is incredibly capital-intensive and time-consuming, as demonstrated by the years Instacart took to reach its current scale.

As of early 2024, Instacart serves over 1,400 national and local retail banners across North America, a testament to its deep integration. Replicating this breadth of partnerships and shopper density would require substantial investment and a proven value proposition to lure away established players.

Instacart has cultivated substantial brand recognition and customer trust through years of dedicated service. Newcomers face the daunting task of investing heavily in marketing and customer acquisition to erode this established loyalty and convince consumers to abandon familiar, dependable services.

Complex Logistics and Operational Expertise

Operating an online grocery delivery service like Instacart demands intricate logistics, coordinating a vast network of shoppers, handling temperature-sensitive goods, and ensuring efficient delivery across varied regions. This operational complexity is a major barrier.

Newcomers face significant challenges in building the necessary infrastructure and expertise to compete effectively. For instance, Instacart's model relies on a flexible workforce, which requires sophisticated management systems to maintain service quality and shopper satisfaction.

- Logistical Complexity: Managing thousands of shoppers and ensuring timely deliveries across diverse geographic areas requires advanced technology and operational planning.

- Perishable Inventory: Handling groceries, especially frozen and refrigerated items, necessitates a robust cold chain and efficient inventory management to minimize spoilage.

- Scale and Reach: New entrants must quickly achieve a significant scale to offer competitive pricing and a wide selection of stores and products, which is capital-intensive.

- Operational Expertise: Developing the know-how to manage shopper networks, customer service, and delivery efficiency is a steep learning curve.

Regulatory and Labor Landscape Challenges

New entrants face significant hurdles in navigating the complex and ever-changing regulatory landscape, especially concerning gig economy labor laws and worker classification. For instance, in 2024, several states continued to debate and implement new legislation impacting independent contractor status, potentially increasing labor costs for companies like Instacart.

Compliance with a patchwork of state and local regulations, which can vary widely, adds another layer of difficulty. The ongoing risk of legal challenges related to worker status, as seen in past lawsuits, can deter new players and necessitate substantial legal and operational adjustments to mitigate these threats.

- Worker Classification Scrutiny: Ongoing legal battles and legislative efforts in 2024 continued to scrutinize the classification of gig workers, potentially forcing new entrants to classify drivers as employees, thereby increasing payroll taxes and benefits costs.

- State-Specific Regulations: New entrants must contend with diverse state-level regulations, such as California's AB5 and its subsequent amendments, which significantly impact how gig economy businesses operate and manage their workforce.

- Potential for Fines and Penalties: Non-compliance with labor laws and worker classification can result in substantial fines and penalties, creating a significant financial barrier for businesses looking to enter the market.

The threat of new entrants in Instacart's market remains moderate to low due to substantial barriers. High capital requirements for technology and logistics, coupled with established network effects from retailers and shoppers, make market entry challenging. For example, as of early 2024, Instacart's extensive network of over 1,400 retail banners and a vast shopper base create significant hurdles for newcomers aiming to replicate this scale and density.

The operational complexity of managing a large, flexible workforce and ensuring efficient delivery of perishable goods also deters new entrants. Furthermore, navigating evolving labor laws and worker classification regulations, a key concern in 2024, adds another layer of risk and cost. Companies like Instacart have invested heavily in sophisticated management systems, a cost that new players must also bear.

| Barrier | Description | Impact on New Entrants |

|---|---|---|

| Capital Investment | High costs for technology, logistics, and marketing. | Deters new entrants needing hundreds of millions in 2024. |

| Network Effects | Established relationships with retailers and shoppers. | Requires simultaneous acquisition of both sides of the marketplace. |

| Operational Complexity | Managing logistics, perishables, and a flexible workforce. | Demands significant expertise and infrastructure investment. |

| Brand Recognition | Instacart's established customer trust and loyalty. | Requires substantial marketing spend to gain market share. |

| Regulatory Landscape | Complex labor laws and worker classification issues. | Increases compliance costs and legal risks for new players. |

Porter's Five Forces Analysis Data Sources

Our Instacart Porter's Five Forces analysis is built upon a robust foundation of data, including Instacart's own investor relations materials, earnings call transcripts, and publicly available financial statements. We supplement this with insights from industry research reports, news articles, and competitor analysis to capture the full competitive landscape.