Instacart Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Instacart Bundle

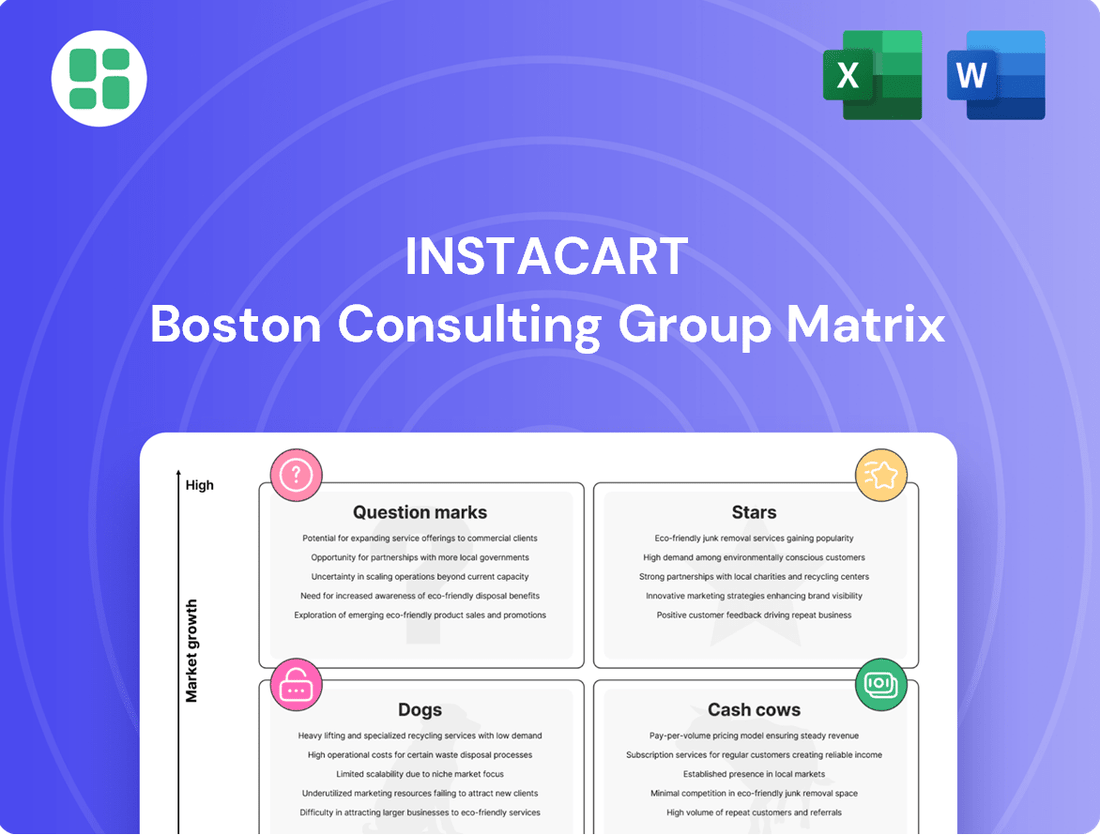

Instacart's diverse service offerings can be strategically analyzed through the lens of the BCG Matrix. Understanding where each service falls—whether a high-growth Star, a stable Cash Cow, a struggling Dog, or a promising Question Mark—is crucial for optimizing resource allocation and future growth.

This preview offers a glimpse into Instacart's strategic positioning, but the full BCG Matrix report unlocks a comprehensive understanding of each service's market share and growth potential. Purchase the complete report for detailed quadrant placements and actionable insights to drive Instacart's success.

Stars

Instacart's core grocery delivery service in established markets like North America is a clear Star. The company boasts an impressive reach, serving 98% of U.S. and Canadian households.

This strong market penetration, coupled with the ongoing expansion of the online grocery sector, fuels continued high growth for Instacart's primary offering. It's a solid position in a thriving segment.

Instacart's advertising platform is a shining star in its business portfolio, experiencing rapid growth. For 2024, its advertising revenue is anticipated to hit $1.18 billion, with projections climbing to $1.45 billion by 2025, showcasing its significant market presence in the burgeoning retail media sector.

This platform acts as a crucial bridge, linking consumer packaged goods (CPG) brands directly to Instacart's vast shopper base. Its high market share within the expanding retail media landscape solidifies its position as a star performer, driven by a strategic effort to broaden its advertising partner base to include emerging brands.

Instacart+ is a significant growth engine for Instacart, driving a 20% increase in order frequency among its members. This subscription service is crucial for cultivating user loyalty and generating predictable recurring revenue in the expanding convenience market.

The program's value proposition is further amplified by its extension to cover free delivery on restaurant orders via the Uber Eats collaboration, attracting and retaining a highly engaged customer base.

Connected Stores Technology (e.g., Caper Carts, Storefront Pro)

Instacart's Connected Stores Technology, like Caper Carts and Storefront Pro, represents a significant push into enterprise solutions for brick-and-mortar retailers. These AI-powered tools aim to modernize physical stores and create seamless online-to-offline shopping journeys.

These initiatives are demonstrating strong growth potential. Pilot programs for Caper Carts, for instance, have reported double-digit increases in average basket size, indicating a tangible benefit for participating retailers. This success is driving adoption, with dozens of retailers now integrating these technologies.

- Caper Carts: AI-powered smart shopping carts designed to enhance the in-store experience and increase basket size.

- Storefront Pro: A platform that helps retailers build and manage their online presence, bridging the gap between physical and digital retail.

- Growth Metrics: Pilot programs have shown double-digit increases in basket size, a key indicator of customer engagement and spending.

- Retailer Adoption: The technologies are being adopted by dozens of retailers, signaling market validation and expansion beyond traditional delivery services.

AI-Powered Personalization and Shopping Tools

Instacart's investment in AI-powered personalization, such as Smart Shop and Health Tags, is a key driver for its growth potential. These tools offer tailored product suggestions and dietary filtering, enhancing the customer journey. For instance, Health Tags allow users to easily identify products meeting specific nutritional needs, a feature increasingly valued by consumers.

Inspiration Pages further leverage AI to curate product collections and recipes, aiming to boost order values and user engagement. This focus on personalized discovery is crucial for Instacart to stand out in the crowded online grocery market. By analyzing vast amounts of consumer data, Instacart can offer increasingly relevant shopping experiences.

- Smart Shop: Offers personalized product recommendations based on past purchases and browsing behavior.

- Health Tags: Enables users to filter products by specific dietary needs like gluten-free, vegan, or low-sodium.

- Inspiration Pages: Curates themed collections and recipes, encouraging discovery and larger basket sizes.

Instacart's core grocery delivery service is a Star, benefiting from near-universal household penetration in North America and the continued growth of online grocery shopping.

The company's advertising platform is also a strong Star, with projected revenues reaching $1.18 billion in 2024 and $1.45 billion by 2025, highlighting its significant role in the expanding retail media sector.

Instacart+ is another Star, driving a 20% increase in order frequency and fostering customer loyalty through its subscription model and expanded benefits like free restaurant delivery via Uber Eats.

Instacart's Connected Stores Technology, including Caper Carts, is emerging as a Star, with pilot programs showing double-digit increases in average basket size and adoption by dozens of retailers.

| Initiative | BCG Category | Key Growth Driver | 2024 Data Point | 2025 Projection |

| Core Grocery Delivery | Star | High market penetration (98% of US/Canada households) & growing online grocery sector | N/A | N/A |

| Advertising Platform | Star | Direct brand-to-shopper connection & growing retail media market | $1.18 billion (revenue) | $1.45 billion (revenue) |

| Instacart+ | Star | Increased order frequency (20%) & subscription revenue | N/A | N/A |

| Connected Stores Tech (Caper Carts) | Star (Emerging) | Increased basket size (double-digit %) & retailer adoption | Dozens of retailers adopting | N/A |

What is included in the product

The Instacart BCG Matrix analyzes its various services, categorizing them as Stars, Cash Cows, Question Marks, or Dogs based on market share and growth.

This framework guides strategic decisions on resource allocation, highlighting which services to invest in, maintain, or divest.

The Instacart BCG Matrix provides a clear, one-page overview of its business units, simplifying complex strategic decisions for executives.

Cash Cows

Instacart's standard delivery and service fees from traditional grocery orders in mature markets are a significant cash cow. These fees, combined with product markups, are the primary source of the company's profitability, especially given its substantial base of regular customers.

While the growth in these fees might be modest in established areas, their reliable cash generation solidifies their status as a cash cow. For instance, in Q1 2024, Instacart reported gross transaction revenue of $11.0 billion, with a substantial portion stemming from these core service and delivery charges.

Instacart's extensive network, featuring over 1,500 retail partners including 24 of the top 25 U.S. grocers, forms a cornerstone of its business. This vast reach, covering 97% of American households, ensures a consistent and reliable revenue flow from transaction fees and platform access. These established relationships are vital for maintaining Instacart's comprehensive product offering and widespread market presence.

Instacart's marketplace platform, the engine behind its operations, is a prime example of a cash cow. Its established technology efficiently manages everything from order placement to shopper allocation and delivery logistics, securing a significant share of the online grocery market.

This mature and highly efficient operational infrastructure is a consistent generator of substantial cash flow. The routine functioning of this backbone, which smoothly processes millions of orders, now requires relatively low incremental development costs, solidifying its cash cow status.

Data and Insights Services for Retailers

Instacart's data and insights services for retailers act as a significant, albeit indirect, cash cow. By leveraging its vast proprietary dataset, which includes millions of grocery trips and detailed product information, Instacart provides invaluable insights to its retail partners. This data capability strengthens retailer loyalty and forms a core component of Instacart's enterprise solutions, contributing to stable, ongoing revenue streams.

This mature data offering supports existing partnerships and drives operational efficiencies for retailers. While not a direct revenue line item, the insights generated are crucial for maintaining strong relationships and demonstrating Instacart's value proposition. For instance, in 2023, Instacart reported a 30% increase in gross transaction revenue, partly driven by the enhanced services offered to its retail partners, which are underpinned by these data insights.

- Data Leverage: Instacart utilizes millions of grocery trips and product details from its proprietary dataset to offer actionable insights to retailers.

- Indirect Revenue Driver: While not a separate revenue stream, these data insights enhance retailer loyalty and support the value of Instacart's enterprise solutions, contributing to stable revenue.

- Partnership Support: This mature data capability is instrumental in sustaining ongoing partnerships and improving operational efficiencies for its retail clients.

- Growth Contribution: The value derived from these data insights has played a role in Instacart's overall revenue growth, with gross transaction revenue seeing substantial increases.

Bulk of Existing Customer Base

Instacart's substantial existing customer base is a cornerstone of its operations, functioning as a prime example of a Cash Cow within the BCG Matrix framework. In 2024, the company reported a significant 14.4 million active users. This large and engaged user group ensures a consistent flow of orders, directly translating into predictable revenue streams for Instacart.

These loyal customers, often exhibiting increasing order frequency, create a stable demand for Instacart's grocery delivery and pickup services. The company actively works to maintain this loyalty and encourage repeat business through initiatives such as the Instacart+ subscription program. This focus on retention is crucial for maximizing the ongoing cash generation from this established user segment.

- 14.4 million active users were recorded by Instacart in 2024.

- Consistent revenue generation is driven by this large and stable customer base.

- Brand loyalty and increasing order frequency contribute to predictable demand.

- Instacart+ is a key program for retaining these valuable customers.

Instacart's core grocery delivery and pickup services, particularly in mature markets, represent a significant cash cow. These services, bolstered by established partnerships and a vast user base, consistently generate substantial revenue through delivery fees, service charges, and product markups. The company's extensive retail network, covering 97% of American households and including 24 of the top 25 U.S. grocers, ensures a reliable and predictable cash flow from these mature operations.

The company's marketplace platform, a highly efficient operational infrastructure, also functions as a cash cow. This mature technology seamlessly manages millions of orders, requiring minimal incremental development costs while securing a dominant share of the online grocery market. This operational backbone is a consistent generator of substantial cash flow, underpinning the company's profitability.

Instacart's data and insights services for retailers, while indirect, are a crucial cash cow component. Leveraging proprietary data from millions of grocery trips, Instacart provides valuable insights to retail partners, strengthening loyalty and enterprise solutions. This data capability contributes to stable, ongoing revenue streams and has been a factor in Instacart's overall revenue growth, which saw a 30% increase in gross transaction revenue in 2023.

Instacart's large and active customer base, numbering 14.4 million in 2024, is a prime example of a cash cow. This engaged user group drives consistent order volume and predictable revenue, further strengthened by retention initiatives like the Instacart+ program, which encourages repeat business and increasing order frequency.

| Business Segment | BCG Matrix Category | Key Characteristics | Financial Impact |

| Core Grocery Delivery & Pickup | Cash Cow | Mature markets, established partnerships, large user base, high order volume | Consistent, predictable revenue generation, strong profitability |

| Marketplace Platform | Cash Cow | Highly efficient, mature technology, dominant market share, low incremental costs | Substantial and stable cash flow |

| Data & Insights Services | Cash Cow (Indirect) | Proprietary data leverage, retailer loyalty driver, enterprise solution component | Stable ongoing revenue, supports overall growth |

| Existing Customer Base | Cash Cow | Large active users (14.4M in 2024), high order frequency, loyalty programs | Predictable revenue streams, consistent demand |

Delivered as Shown

Instacart BCG Matrix

The Instacart BCG Matrix preview you're viewing is the identical, fully formatted document you will receive immediately after purchase. This means no watermarks or demo content, ensuring you get a professional, analysis-ready report for strategic decision-making.

Rest assured, the BCG Matrix report you're examining is the precise final version that will be delivered to you upon completing your purchase. It's crafted with detailed market analysis and strategic insights, ready for immediate application in your business planning.

What you see here is the actual, unedited Instacart BCG Matrix file that you will download after your purchase. This means you'll receive the complete, professionally designed document, perfect for presenting to stakeholders or integrating into your strategic roadmap.

You are previewing the genuine Instacart BCG Matrix report that will be yours once purchased. This isn't a mockup; it's a fully functional, analysis-ready document that you can edit, print, or present without any further modifications.

Dogs

Instacart's niche retail partnerships, particularly those in low-growth regions or highly competitive local markets, often struggle to gain significant traction. These collaborations may see minimal order volume and low market share, impacting overall profitability.

The cost associated with establishing and maintaining these smaller partnerships can outweigh the revenue generated. For instance, a partnership with a regional specialty grocer in a declining urban area might demand substantial operational investment without yielding a commensurate return, potentially classifying it as a cash cow or even a dog in the BCG matrix.

These underperforming ventures are subject to rigorous evaluation of their return on investment. Instacart's strategy would likely involve assessing the potential for improvement or considering divestiture if the partnership consistently fails to meet performance benchmarks, a common approach for optimizing a diverse partner portfolio.

Instacart's legacy or discontinued features, such as early experimental grocery delivery partnerships that didn't scale or niche service offerings that saw low adoption, would fall into the Dogs category of the BCG Matrix. These represent past investments that did not gain significant user traction. For instance, if a specific regional delivery model tested in 2022 failed to meet its projected user growth targets by mid-2023, it would be a prime candidate for this classification.

In geographic areas experiencing stagnant growth or high saturation, Instacart's market position could be classified as a Dog. These markets, often characterized by intense competition, make it challenging to gain or retain market share. For instance, in some mature urban centers in the US, the number of grocery delivery services has proliferated, leading to a plateau in Instacart's customer acquisition rates.

These regions may necessitate continuous marketing investment with minimal incremental gains. Data from 2024 indicated that in certain densely populated metropolitan areas, the cost per acquisition for new Instacart users had risen significantly, suggesting diminishing returns on promotional efforts. This situation demands a careful assessment of resource allocation.

The strategic decision for these Dog segments involves evaluating whether to maintain a minimal presence, reduce operational investment, or consider exiting the market altogether. For example, if a particular city's growth rate has been below 2% annually for the past three years and Instacart's market share has remained static around 15%, a divestment strategy might be considered to reallocate capital to more promising markets.

Less Efficient Operational Processes or Technologies

Less Efficient Operational Processes or Technologies within Instacart could be categorized as potential Dogs in a BCG Matrix analysis. These are internal elements, like outdated routing algorithms or manual inventory management systems, that require significant resources for upkeep but offer diminishing returns. For instance, if a legacy system for driver dispatch consumes 15% more processing power than a modern alternative, it directly impacts profitability without enhancing service quality.

These inefficiencies can drain capital that could otherwise be invested in growth areas. Consider the cost of maintaining older server infrastructure; if it represents a substantial portion of IT expenditure without providing a competitive edge, it fits the Dog profile. Instacart's 2024 focus on AI-driven optimization for delivery routes aims to address such legacy issues, aiming to reduce delivery times by an estimated 10-12% compared to previous methods.

- Outdated Routing Software: Consumes more time and fuel per delivery, increasing operational costs.

- Manual Order Processing: Slower fulfillment times and higher error rates compared to automated systems.

- Legacy Warehouse Management: Inefficient stock tracking leading to potential stockouts or overstocking, impacting inventory turnover.

- Aging Driver App Features: Lack of real-time updates or efficient communication tools can lead to driver dissatisfaction and delays.

Small-Basket, Low-Margin Orders without Instacart+

Small-basket, low-margin orders from non-Instacart+ members represent a potential challenge for Instacart. While the company aims for larger, more profitable orders, these smaller transactions can be costly to fulfill. In 2023, Instacart's gross transaction value (GTV) grew by 12% year-over-year to $32.6 billion, but the profitability of individual orders, especially smaller ones, is crucial.

These low-value orders, particularly when not offset by membership fees or advertising revenue, could strain Instacart's resources. The cost of a shopper picking and delivering a small order might exceed the revenue generated from that transaction. For instance, if a shopper receives a fixed minimum per delivery, a very small order could easily result in a net loss for that specific fulfillment.

- Low Profitability: Orders with fewer items and lower total value often yield less in terms of service fees and potential markups, making them less attractive from a margin perspective.

- Delivery Costs: The fixed costs associated with a delivery, including shopper pay and fuel, can disproportionately impact the profitability of small orders.

- Customer Acquisition Cost: Attracting and retaining customers who place infrequent, small orders can be expensive, especially if they don't convert to a subscription.

- Strategic Importance: While individually low-margin, these orders can be a gateway to acquiring new customers who may later increase their order frequency or value, or even subscribe to Instacart+.

Instacart's "Dogs" represent partnerships or market segments with low growth and low market share, demanding significant resources without proportional returns. These could include niche retail collaborations in saturated markets or legacy operational inefficiencies. For example, in 2024, Instacart continued to refine its strategy for smaller, less profitable markets, where customer acquisition costs often outpaced revenue generated by low-order volumes.

These underperforming areas or services often require ongoing investment for maintenance rather than growth, representing a drain on capital. Instacart's 2024 initiatives focused on optimizing logistics and potentially exiting or reducing investment in these low-potential segments to reallocate resources to more promising ventures, aiming for improved overall efficiency.

The strategic approach for these "Dog" categories typically involves a critical evaluation of their future potential. If improvements are unlikely, Instacart might consider divesting or minimizing operations to cut losses and focus on core, high-growth areas of its business.

Question Marks

Instacart's international expansion beyond North America, including early forays into markets like Austria, positions it to tap into the significant growth potential of largely undeveloped global online grocery sectors. These new territories represent opportunities for high growth, but Instacart's current market share in these regions is minimal.

The company faces the challenge of establishing a foothold in these nascent markets, which will necessitate substantial investment to build brand awareness and tailor services to local consumer preferences and regulatory landscapes. For instance, the online grocery market in Europe, while growing, is fragmented and highly competitive, requiring localized strategies.

Instacart is aggressively expanding its delivery services into non-grocery sectors such as convenience stores, pharmacies, and general merchandise. This strategic diversification aims to leverage its existing logistics infrastructure and customer base across a wider range of retail categories.

While the overall retail delivery market is experiencing significant growth, Instacart's penetration in these non-grocery segments remains nascent. For instance, in 2024, while grocery delivery saw robust adoption, Instacart's share in areas like general merchandise delivery was still developing compared to specialized players.

These non-grocery verticals represent high-potential growth avenues, but they necessitate considerable investment in technology, marketing, and partnerships to gain substantial market share and demonstrate long-term profitability. The company is actively pursuing these opportunities to solidify its position as a comprehensive delivery platform.

Instacart is actively broadening its B2B offerings beyond its core grocery delivery platform. New ventures include Instacart Business, catering to office supplies and bulk food needs, and more sophisticated enterprise solutions like fulfillment technology designed to bolster retailers' direct-to-consumer (DTC) capabilities.

These expanded services represent significant growth avenues as retailers increasingly prioritize enhancing their e-commerce infrastructure. For instance, the B2B e-commerce market is projected to reach $20.9 trillion by 2027, indicating a substantial opportunity for Instacart's new solutions.

While these specialized B2B technology solutions are positioned for high growth, Instacart's market share in this segment is still in its nascent stages. Significant investment will be crucial to scale these offerings effectively and establish a strong competitive advantage against existing technology providers in the retail tech space.

Advanced AI-Driven Retailer Tools (e.g., Inventory Management AI)

Instacart is pushing the boundaries with advanced AI tools designed to revolutionize retailer operations. Think of Caper Carts, which use AI to track items in real-time, or even shopper-provided videos that offer immediate inventory visibility. These innovations are targeting a burgeoning market focused on boosting retail efficiency.

These cutting-edge AI solutions, like real-time inventory tracking and 'Second Store Check' features, are poised to transform how retailers manage their stock. While the potential for these technologies to drive operational efficiency in the retail sector is immense, Instacart's footprint in this specialized, advanced AI domain is still developing. Significant investment in research and development, alongside robust pilot programs, will be crucial to proving their value and securing broad market acceptance.

- Market Potential: The retail AI market, encompassing inventory management and operational efficiency tools, is projected to grow significantly. For instance, the global retail analytics market was valued at approximately $6.8 billion in 2023 and is expected to expand at a compound annual growth rate (CAGR) of over 15% through 2030.

- Instacart's Position: Instacart's advanced AI tools, such as those integrated into Caper Carts and utilizing shopper-provided video data for inventory insights, are in the early stages of market penetration. This positions them as a potential 'Question Mark' in the BCG matrix, requiring strategic investment to capture market share.

- Investment Needs: To establish dominance, Instacart needs to continue substantial investment in R&D to refine these AI capabilities and demonstrate tangible ROI through successful pilot programs with key retail partners.

- Strategic Focus: The company's strategy should focus on showcasing the direct impact of these AI tools on reducing stockouts, optimizing replenishment, and improving overall in-store experience, thereby driving adoption and market leadership.

New Partnership Models (e.g., Uber Eats Restaurants Integration)

Instacart's integration with Uber Eats for restaurant ordering is a bold move into a rapidly expanding sector, positioning it to capture a piece of the substantial food delivery market. This strategic alliance aims to leverage Instacart's existing customer base and delivery infrastructure to offer a wider range of services beyond grocery shopping.

While this partnership significantly expands Instacart's addressable market, its current position within the restaurant delivery segment is nascent. Established competitors like DoorDash and Uber Eats itself hold dominant market shares, meaning Instacart faces an uphill battle to gain meaningful traction. For instance, in Q1 2024, DoorDash reported over $2 billion in revenue, highlighting the scale of the existing players.

Successfully capitalizing on this new venture will necessitate substantial investment. Instacart must allocate resources towards seamless technological integration, aggressive marketing campaigns to inform consumers of the new offering, and operational adjustments to efficiently handle diverse restaurant orders. The company's ability to execute these investments effectively will be critical to its success in this competitive landscape.

- Strategic Expansion: The Uber Eats integration is a Stars play, entering a high-growth market with significant potential.

- Market Share Challenge: Instacart's current share in restaurant delivery is minimal compared to leaders, presenting a Dogs characteristic in terms of relative market position.

- Investment Requirement: Significant capital is needed for integration, marketing, and operational scaling, reflecting the resource demands of a Star.

- Future Potential: If successful, this could transform Instacart into a more comprehensive delivery platform, potentially moving it out of the Dogs quadrant in this specific market segment.

Instacart's foray into advanced AI solutions for retail operations, such as real-time inventory tracking and shopper-provided video insights, positions these initiatives as potential Question Marks. These innovations operate in a high-growth market driven by the demand for retail efficiency, with the global retail analytics market projected to grow at a CAGR of over 15% through 2030. However, Instacart's current market share in this specialized AI domain is still developing, necessitating significant investment in research and development to prove their value and gain widespread adoption.

These AI tools represent opportunities for high growth, but Instacart's current market share is minimal, requiring substantial investment to build brand awareness and demonstrate tangible ROI. The company's strategy must focus on showcasing the direct impact of these AI tools on reducing stockouts and optimizing replenishment to drive adoption and market leadership.

The integration with Uber Eats for restaurant ordering, while a Star in terms of market potential, currently reflects a Dogs characteristic for Instacart in terms of relative market position due to minimal current share. Significant capital is needed for integration, marketing, and operational scaling to transform Instacart into a more comprehensive delivery platform.

| Initiative | Market Growth | Instacart's Market Share | Investment Needs | BCG Category |

| Retail AI Solutions | High | Low | High | Question Mark |

| Restaurant Delivery (Uber Eats Integration) | High | Low | High | Question Mark (potential Star, current Dog) |

BCG Matrix Data Sources

Our Instacart BCG Matrix leverages proprietary Instacart sales data, aggregated third-party market research, and consumer behavior analytics to provide a comprehensive view of product performance and market share.