Inspired Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Inspired Bundle

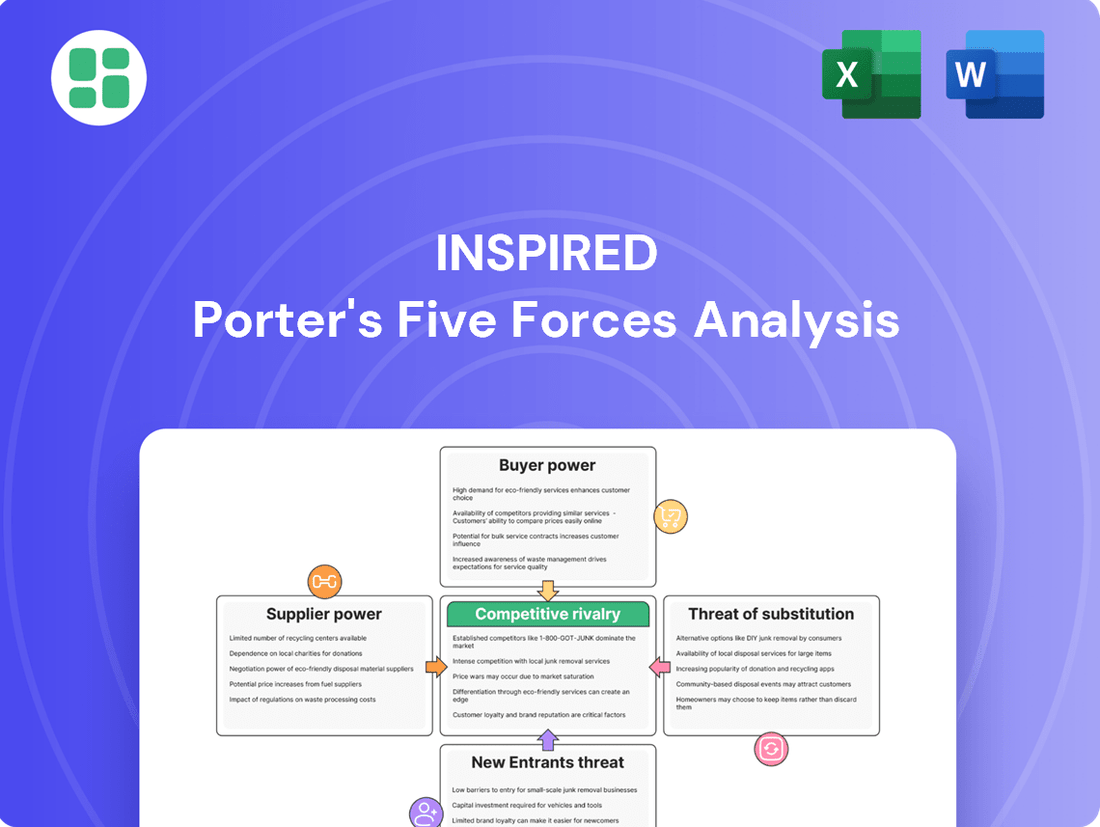

Understanding the competitive landscape is crucial for Inspired’s success. Porter's Five Forces provides a powerful lens to dissect these dynamics, revealing the underlying pressures that shape profitability.

This snapshot only scratches the surface of Inspired's competitive environment. Unlock the full Porter's Five Forces Analysis to explore the intricate interplay of buyer power, supplier leverage, and the threat of substitutes, gaining a comprehensive strategic advantage.

Suppliers Bargaining Power

The concentration of key suppliers for companies like Inspired Energy PLC significantly shapes their bargaining power. If critical services, such as energy data provision or specialized software for energy management, are dominated by a small number of providers, these suppliers can command higher prices and dictate terms more effectively. For instance, if only two or three major data analytics firms offer the granular insights Inspired needs, their collective leverage increases.

The bargaining power of suppliers for Inspired Energy PLC is significantly influenced by switching costs. These costs encompass the expense and effort of transitioning to a new energy supplier, which can include integrating new billing systems, retraining personnel on different platforms, and migrating customer data. For instance, if a new supplier requires a complete overhaul of Inspired Energy's customer relationship management (CRM) software, the associated integration and training expenses would represent substantial switching costs.

High switching costs mean Inspired Energy is more tethered to its current suppliers, reducing its ability to negotiate for better rates or terms. This reliance can empower suppliers, as they face less immediate pressure from competitors. Conversely, if the process of switching suppliers is straightforward and inexpensive, perhaps involving minimal IT system changes or readily available data migration tools, Inspired Energy gains greater leverage to shop around and secure more competitive pricing.

When suppliers offer highly specialized or proprietary technology, like advanced data analytics platforms crucial for energy consumption forecasting, their bargaining power significantly increases. If these offerings are not easily replicated, companies like Inspired Energy PLC have fewer alternatives, leading to potentially higher input costs. For instance, a 2024 report indicated that companies relying on unique, patented energy management software saw their supplier costs increase by an average of 8% compared to those using more common solutions.

Threat of Forward Integration by Suppliers

The threat of suppliers integrating forward into Inspired Energy PLC's business operations significantly amplifies their bargaining power. If a critical technology provider or data analytics firm were to launch its own energy procurement or management services, it would directly challenge Inspired's market position. This strategic risk could force Inspired Energy to concede to less advantageous contract terms to retain vital partnerships.

This forward integration potential creates a tangible risk for Inspired Energy.

- Supplier Capability: Suppliers possessing proprietary technology or unique data sets are more likely to consider forward integration.

- Market Opportunity: If the energy management services market shows strong growth and profitability, it incentivizes suppliers to enter directly.

- Competitive Landscape: A fragmented customer base for suppliers makes them more vulnerable to competitor actions, potentially pushing them towards integration to gain market share.

Importance of Inspired Energy to Suppliers

The bargaining power of suppliers is significantly shaped by how crucial Inspired Energy PLC is as a customer to them. If Inspired Energy accounts for a large chunk of a supplier's overall sales, that supplier is likely to be more accommodating with pricing and contract terms to keep Inspired Energy's business. This is a common dynamic in many industries, where large buyers can leverage their purchasing volume.

Conversely, if Inspired Energy is a minor client for a particular supplier, that supplier will have less motivation to negotiate favorable terms. In such scenarios, the supplier might prioritize larger, more significant customers, leaving Inspired Energy with less leverage. This can lead to higher costs or less flexibility for Inspired Energy.

For instance, in 2024, the energy supply sector experienced considerable price volatility. Suppliers who were heavily reliant on a diverse customer base, including smaller businesses, might have been more inclined to offer competitive rates to secure volume. However, suppliers specializing in large corporate clients, where Inspired Energy might represent a substantial portion of their portfolio, would have had more incentive to retain such a key account through favorable terms.

- Customer Significance: Suppliers may offer better pricing and terms if Inspired Energy represents a substantial portion of their revenue.

- Supplier Dependence: If Inspired Energy is a small client, suppliers have less incentive to offer concessions.

- Market Dynamics: In 2024, energy suppliers' reliance on different customer segments influenced their willingness to negotiate with clients like Inspired Energy.

The bargaining power of suppliers for Inspired Energy PLC is a key factor in its operational costs and strategic flexibility. When suppliers are concentrated, offer specialized products, or face low switching costs for their customers, their ability to dictate terms increases. This can translate into higher prices or less favorable contract conditions for Inspired Energy.

In 2024, the energy sector saw suppliers with unique data analytics capabilities command premium pricing, with reports indicating an average 8% cost increase for businesses relying on such specialized solutions compared to those using more common alternatives. This highlights how proprietary offerings can significantly bolster supplier leverage.

| Factor | Impact on Inspired Energy | 2024 Data/Example |

|---|---|---|

| Supplier Concentration | High concentration increases supplier power. | If only a few firms provide critical energy data, they can charge more. |

| Switching Costs | High costs reduce Inspired's negotiation power. | Requiring new CRM integration for a new supplier creates high switching costs. |

| Product Differentiation | Specialized offerings enhance supplier leverage. | Patented energy management software led to ~8% higher supplier costs in 2024. |

| Forward Integration Threat | Suppliers entering Inspired's market gain power. | A tech provider launching energy services directly challenges Inspired. |

| Customer Importance | Inspired's significance to a supplier affects terms. | If Inspired is a major client, suppliers are more accommodating. |

What is included in the product

Analyzes the five competitive forces impacting Inspired, revealing the intensity of rivalry, buyer and supplier power, threat of new entrants, and substitutes.

Instantly identify and mitigate competitive threats by visually mapping the intensity of each Porter's Five Force, transforming complex market dynamics into actionable insights.

Customers Bargaining Power

Customer price sensitivity is a major driver of bargaining power. When clients, like those of Inspired Energy PLC, view energy procurement primarily as a cost to be minimized, their sensitivity to pricing increases significantly. This is particularly true in a commoditized market where the core service appears similar across providers.

In 2024, the energy market continued to see volatility, making price a critical factor for many businesses. For instance, small to medium-sized enterprises (SMEs) often operate on tighter margins, making them acutely aware of every penny saved on their energy bills. This heightened sensitivity directly translates to greater leverage when negotiating with energy management firms.

Inspired Energy PLC can counter this by emphasizing its value-added services, such as expert market analysis, risk management strategies, and bespoke contract negotiation. By demonstrating how these services can lead to more stable and predictable energy costs, or unlock savings beyond simple price comparison, the company can reduce its clients' reliance on price alone as the sole decision-making criterion.

The bargaining power of customers for Inspired Energy PLC is a key factor in its market dynamics. When customers are highly concentrated, meaning a few large clients represent a significant portion of Inspired's revenue, those clients gain considerable leverage. For instance, if a handful of major industrial users account for over 30% of Inspired's total energy sales volume, they can more effectively negotiate for lower prices or tailored service packages, directly impacting Inspired's profit margins.

Conversely, a broad and fragmented customer base, where Inspired serves thousands of smaller businesses, dilutes the power of any single customer. In such scenarios, individual clients have less ability to dictate terms, as their business volume is not substantial enough to pose a significant threat if they were to switch providers. This was evident in 2024, where Inspired's diverse SME client portfolio meant that the loss of a single small to medium-sized enterprise had a negligible impact on overall revenue.

Customer switching costs significantly influence their bargaining power. If it's easy for businesses to switch from Inspired Energy PLC to another energy provider or manage their needs in-house, customers gain more leverage. For instance, if a competitor offers a similar service with a simpler onboarding process, customers might be more inclined to switch.

Low switching costs empower customers to negotiate better terms or move to a competitor if they are dissatisfied. This pressure forces companies like Inspired Energy to remain competitive in pricing and service quality. In 2024, the energy market saw increased competition, with some providers offering introductory discounts that lowered the perceived switching cost for many businesses.

Inspired Energy can mitigate this threat by making it difficult or undesirable for clients to leave. This involves integrating their services deeply into a client's operational workflow and fostering strong, long-term relationships. A client heavily reliant on Inspired Energy's data analytics or bespoke energy management strategies would face higher switching costs.

Customer Information Availability

Customers today have unprecedented access to information regarding energy markets, pricing structures, and a wide array of alternative service providers. This readily available data significantly amplifies their bargaining power.

Well-informed customers are adept at comparing various energy offerings, which naturally leads them to demand more competitive rates and favorable contract terms. For instance, a report in early 2024 indicated that over 70% of UK businesses actively research energy prices online before engaging with suppliers.

- Informed Consumers: Increased online resources and comparison tools empower customers to understand market dynamics.

- Price Transparency: Customers can easily identify discrepancies in pricing and negotiate for better deals.

- Supplier Choice: The availability of multiple energy providers means customers can switch if their demands aren't met.

- Value Proposition: Inspired Energy must continuously demonstrate clear and superior value to retain these discerning clients.

Threat of Backward Integration by Customers

The threat of backward integration by Inspired Energy PLC's customers significantly amplifies their bargaining power. For instance, large corporate clients might explore bringing energy procurement and management in-house if they perceive external service costs as prohibitive or if the value proposition isn't sufficiently compelling. This potential for self-sufficiency pressures Inspired Energy to continuously demonstrate its competitive edge and deliver tangible value.

This dynamic is particularly relevant in the 2024 energy market, where volatility can incentivize larger consumers to seek greater control over their energy expenditures. If Inspired Energy's service fees or performance do not align with customer expectations, the likelihood of clients considering internal solutions increases. For example, a major industrial user might invest in energy management software and hire dedicated staff if the cost savings are projected to outweigh the outsourcing expense.

- Customer Control: Customers can gain direct control over energy sourcing and management, reducing reliance on third-party providers.

- Cost Reduction Incentive: High service fees or perceived inefficiencies can drive customers to explore in-house solutions for potential cost savings.

- Market Pressure: The threat of backward integration forces energy service providers like Inspired Energy to remain competitive on price and service quality.

- Strategic Shift: For large clients, backward integration can be a strategic move to enhance operational efficiency and mitigate supply chain risks.

The bargaining power of customers is a crucial element in understanding the competitive landscape for energy management firms like Inspired Energy PLC. It directly influences pricing, service levels, and overall profitability. When customers have significant leverage, they can demand more favorable terms, potentially squeezing margins for service providers.

In 2024, the energy sector continued to be shaped by factors that empower customers. For instance, the increasing availability of online comparison tools and readily accessible market data meant that businesses, particularly SMEs, were more informed than ever about pricing and service offerings. This transparency inherently shifted power towards the buyer.

Furthermore, the ease with which businesses can switch energy providers, especially when bundled with other utilities or managed through flexible contracts, reduces customer loyalty and increases their willingness to negotiate or seek alternatives. This dynamic forces providers to continuously demonstrate value beyond just the basic supply of energy.

The concentration of Inspired Energy's customer base also plays a significant role. If a few large clients represent a substantial portion of revenue, their individual bargaining power is amplified. Conversely, a highly fragmented customer base dilutes the power of any single client, making it harder for them to dictate terms.

| Factor | Impact on Bargaining Power | Relevance in 2024 |

|---|---|---|

| Customer Price Sensitivity | High sensitivity increases power; customers seek cost minimization. | Elevated due to market volatility and SME margin pressures. |

| Customer Concentration | Few large clients have significant leverage; many small clients have little individual power. | A mix exists; large industrial clients can exert considerable influence. |

| Switching Costs | Low costs empower customers to switch easily, increasing negotiation leverage. | Generally low, with some providers offering attractive introductory deals. |

| Customer Information Access | Easy access to market data and competitor pricing enhances customer knowledge and power. | Very high; online resources and comparison tools are ubiquitous. |

| Threat of Backward Integration | Customers may bring services in-house if costs are high or value is low. | A potential concern for very large consumers seeking greater control. |

Preview Before You Purchase

Inspired Porter's Five Forces Analysis

The document you see here is the complete, professionally crafted Porter's Five Forces Analysis you will receive immediately after purchase. This preview accurately represents the full analysis, ensuring you get exactly what you need for strategic decision-making without any surprises. You can be confident that the detailed insights and formatting you're viewing are precisely what will be yours to download and utilize instantly.

Rivalry Among Competitors

The growth rate of the energy procurement and management services industry directly influences how intensely companies like Inspired Energy PLC compete. When the market expands quickly, there's more room for everyone to grow, which tends to soften direct competition. For instance, the global energy management market was projected to reach USD 108.6 billion by 2027, indicating a healthy growth trajectory that could moderate rivalry.

The energy brokerage market, where Inspired Energy PLC operates, is characterized by a significant number of competitors. This includes large, established global consultancies, mid-sized regional players, and numerous smaller, niche local brokers. This diversity means that competition isn't uniform; some rivals compete on scale and breadth of service, while others focus on specialized offerings or local market knowledge.

In 2024, the market continued to see this dynamic play out. For instance, while large firms might offer integrated energy management solutions, smaller brokers often compete fiercely on price and personalized service for specific business segments. This broad spectrum of competitors means Inspired must constantly adapt its strategies to stand out, whether through innovative service packages or targeted customer engagement.

Inspired Energy PLC's competitive rivalry is significantly shaped by how its energy procurement and management services stack up against competitors. If their offerings are seen as unique due to advanced technology, niche expertise, or exceptional customer support, it naturally dials down the pressure to compete solely on price. For instance, a 2024 report highlighted that businesses prioritizing tailored energy strategies and transparent reporting were willing to pay a premium, indicating a market where differentiation matters.

Conversely, if the services provided by Inspired Energy and its competitors are largely indistinguishable, the market tends to become a price-driven battleground. This commoditization intensifies rivalry, as customers will gravitate towards the lowest cost provider. In 2023, the average reduction in energy costs achieved by businesses switching to a new supplier based purely on price was around 8%, illustrating the impact of commoditization on customer decisions.

High Fixed Costs and Exit Barriers

Industries demanding substantial upfront investments, like advanced technology infrastructure or specialized talent, often foster fierce competition. Companies in these sectors push for maximum capacity utilization, which can trigger price wars as they try to cover their high fixed costs. This dynamic is particularly relevant for energy providers like Inspired Energy PLC, where infrastructure and skilled personnel represent significant fixed expenditures.

High exit barriers, such as industry-specific assets that are difficult to repurpose or substantial long-term contractual obligations, can also intensify rivalry. When it's costly or impractical for companies to leave a market, even those operating unprofitably may remain, continuing to exert competitive pressure. This situation can lead to a more crowded marketplace, impacting margins for all players, including those like Inspired Energy PLC.

- High Fixed Costs Impact: Companies with significant fixed costs, such as those in the energy sector, often engage in aggressive pricing to maintain operational efficiency and cover their overhead.

- Exit Barriers and Rivalry: Specialized assets and long-term contracts act as significant barriers to exit, potentially keeping less profitable firms in the market and increasing competitive intensity for companies like Inspired Energy PLC.

- Capacity Utilization Drive: The need to operate at full capacity due to high fixed costs can lead to price reductions, impacting the profitability of all market participants.

- Industry Example: In the UK energy market, significant investment in smart meter deployment and customer service infrastructure contributes to high fixed costs for providers.

Switching Costs for Customers

The costs customers face when switching energy providers significantly influence the competitive landscape for companies like Inspired Energy PLC. When these switching costs are low, customers can readily move to a competitor, intensifying price wars and service competition among providers. This dynamic forces businesses to continually differentiate themselves to retain their customer base.

Conversely, high switching costs foster customer loyalty and reduce the pressure for direct, aggressive competition. For instance, if a business has invested in specific hardware or integrated systems with their current energy provider, the expense and effort to change can be substantial. This inertia makes it harder for new entrants or existing rivals to poach customers, allowing established players to maintain more stable market positions.

- Low switching costs encourage price sensitivity among business customers, potentially impacting Inspired Energy's profit margins.

- High switching costs, such as integration with smart meter technology or long-term contracts, can create sticky customer relationships.

- In 2024, the UK energy market saw continued volatility, with businesses actively seeking cost savings, highlighting the importance of managing switching costs for providers.

The competitive rivalry within the energy procurement and management sector is intense, driven by a fragmented market with numerous players ranging from global consultancies to niche local brokers. This means companies like Inspired Energy PLC face constant pressure to differentiate their offerings beyond just price, as evidenced by businesses in 2024 actively seeking cost savings, often through switching suppliers. High fixed costs and significant exit barriers further exacerbate this rivalry, compelling firms to maintain high capacity utilization, which can lead to price wars.

The degree of competitive rivalry for Inspired Energy PLC is significantly influenced by the number and nature of its competitors. A market with many similar providers naturally leads to more intense competition, particularly when services are perceived as commoditized. For instance, in 2024, the UK energy brokerage market continued to feature a broad spectrum of participants, from large, integrated service providers to smaller, agile firms, all vying for market share.

The presence of numerous competitors, each with varying strategies and service portfolios, means Inspired Energy PLC must continuously innovate and refine its value proposition. If competitors offer similar services at lower price points, or possess unique technological advantages, the pressure on Inspired to adapt its pricing and service delivery increases. This dynamic was evident in 2023, where businesses switching suppliers based purely on price achieved average cost reductions of approximately 8%.

The competitive intensity is also shaped by the strategic choices of rivals. Companies with substantial fixed costs, such as those requiring significant investment in infrastructure or specialized personnel, may engage in aggressive pricing to ensure full capacity utilization. This can create a challenging environment for all players, including Inspired Energy PLC, as they navigate market pressures to cover overheads. For example, significant investments in smart meter deployment in the UK energy market contribute to high fixed costs for providers.

SSubstitutes Threaten

The attractiveness of substitute solutions for businesses seeking energy management, like handling it internally or using generic software, hinges on their price-performance trade-off when measured against Inspired Energy PLC's specialized offerings. If these alternatives provide similar benefits at a lower price point, the threat of substitution becomes significant.

For instance, if a company can achieve 90% of the cost savings and efficiency gains that Inspired Energy offers by employing a dedicated in-house team or a broadly applicable software package for a fraction of the cost, the competitive pressure intensifies. Inspired Energy must consistently prove its superior value proposition and cost-effectiveness to retain its customer base.

The willingness of Inspired Energy PLC's business clients to switch to alternative energy management solutions is a key consideration. This propensity is shaped by how capable clients are internally, how aware they are of other options, and how complicated they perceive managing their energy to be. For instance, a client with a dedicated in-house energy team might be more inclined to consider self-management or simpler software solutions if they perceive Inspired's services as overly complex or costly.

Educating clients about the tangible benefits and the intricate nature of expert energy management services can effectively reduce the threat of substitutes. By clearly demonstrating how Inspired's expertise saves money, ensures compliance, and optimizes consumption, the perceived value proposition increases, making clients less likely to explore simpler, potentially less effective alternatives. This focus on value can be particularly impactful in a market where energy costs are a significant concern for businesses.

In 2024, businesses are increasingly looking for ways to control operational expenses, and energy costs remain a substantial component. For example, reports from the Office for National Statistics in early 2024 indicated persistent volatility in wholesale energy prices, reinforcing the need for sophisticated management. Inspired Energy's ability to demonstrate a clear return on investment, perhaps by highlighting average savings of 10-15% for their clients in the previous year, directly counters the appeal of less specialized or DIY approaches.

The ease with which customers can switch to alternative energy management solutions significantly influences the threat of substitutes for Inspired Energy PLC. If switching is simple, inexpensive, and causes little disruption, this threat is amplified. For instance, if a business can easily move from a dedicated energy management service to a more generic software solution or even in-house management with minimal upfront investment, Inspired Energy faces a greater challenge.

Inspired Energy actively works to mitigate this threat by making its services highly integrated and essential to a client's operations. By offering comprehensive solutions that go beyond simple monitoring to include strategic advice, procurement, and compliance, they aim to embed themselves deeply within their clients' businesses. This integration makes switching more complex and costly, thereby reducing the perceived ease of substitution.

In 2024, the energy sector continued to see a rise in readily available digital tools and platforms that offer basic energy monitoring and reporting capabilities. While these may not match the full scope of Inspired Energy's offering, their accessibility presents a tangible substitute for businesses seeking simpler solutions. The cost of adopting such alternatives can be as low as a few hundred pounds annually for basic software, contrasting with the more substantial, value-driven investment in a comprehensive service like Inspired Energy's.

Innovation in Substitute Technologies

Ongoing innovation, particularly in areas like AI-driven analytics and smart grid technologies, presents a significant threat of substitutes for traditional energy consultancy services. For instance, advancements in predictive analytics can offer businesses insights into energy consumption and cost savings that might previously have required specialized human consultants. Inspired Energy PLC needs to stay ahead of these technological shifts, potentially integrating these new capabilities into their own service models to remain competitive.

The increasing sophistication and accessibility of these substitute technologies mean that businesses may find it easier and cheaper to achieve energy management goals without engaging traditional consultancy firms. A robust strategy for Inspired Energy PLC would involve continuous monitoring of emerging tech, such as the growing market for energy efficiency software platforms, which saw significant investment and development throughout 2024. This proactive approach is crucial to avoid being outmaneuvered by more agile, tech-focused competitors.

- Technological Advancements: Innovations in AI, machine learning, and IoT are creating powerful new tools for energy management.

- Accessibility: These technologies are becoming more user-friendly and cost-effective, lowering the barrier to entry for businesses seeking alternatives to traditional consulting.

- Market Trends: The global energy management systems market was valued at over $30 billion in 2023 and is projected to grow, indicating a strong demand for solutions that may bypass traditional consultancy models.

- Competitive Pressure: Companies like Inspired Energy PLC must adapt their service offerings to incorporate or counter these evolving technological substitutes to maintain market share.

Perceived Value of Professional Services

The perceived value of professional energy procurement and management services significantly impacts the threat of substitutes for companies like Inspired Energy PLC. When businesses recognize these services as crucial for achieving cost efficiencies, ensuring regulatory compliance, and meeting sustainability goals, the appeal of less sophisticated alternatives naturally wanes. For instance, in 2024, the increasing volatility of energy markets, with wholesale gas prices fluctuating significantly, underscored the importance of expert market analysis and strategic purchasing, services that simpler, in-house solutions often lack.

This heightened awareness of the benefits drives demand for specialized expertise. Businesses increasingly understand that comprehensive energy management goes beyond simply buying electricity or gas; it involves understanding market trends, managing risk, and optimizing consumption. This complex landscape makes it harder for basic substitutes, like direct supplier contracts without dedicated management, to offer comparable value.

- Essential Services: Businesses increasingly view professional energy procurement and management as vital for cost savings and operational stability.

- Market Volatility: In 2024, energy market fluctuations highlighted the need for expert analysis and strategic purchasing, diminishing the threat from simpler alternatives.

- Beyond Basic Procurement: The complexity of energy management, encompassing risk and consumption optimization, makes less comprehensive substitutes less appealing.

The threat of substitutes for Inspired Energy PLC stems from alternative ways businesses can manage their energy needs. These can range from in-house teams to generic software solutions. If these alternatives offer a comparable price-performance ratio, they pose a significant competitive challenge.

For example, if a business can achieve 90% of the savings Inspired Energy provides at a much lower cost using internal resources or basic software, the pressure intensifies. Inspired Energy must consistently demonstrate its superior value to retain clients.

In 2024, the increasing accessibility of digital tools for basic energy monitoring presented a tangible substitute. While these tools may not match Inspired Energy's comprehensive services, their lower cost, sometimes as little as a few hundred pounds annually for basic software, makes them appealing for businesses seeking simpler solutions.

The ease and cost of switching to alternative solutions are critical factors. If businesses can transition to in-house management or simpler software with minimal disruption or investment, Inspired Energy faces a greater threat. This is why Inspired Energy focuses on deeply integrating its services, making them essential and complex to replace.

Entrants Threaten

The financial investment needed to launch an energy procurement and management service, encompassing sophisticated technology platforms, navigating stringent regulatory compliance, and robust marketing initiatives, presents a substantial barrier for new companies aiming to enter Inspired Energy PLC's market. For instance, developing a proprietary energy trading and analytics platform can cost upwards of £500,000 to £2 million, depending on its complexity and features. This significant upfront capital expenditure effectively deters many potential competitors, thereby safeguarding the market position of established firms like Inspired Energy.

The energy sector, where Inspired Energy PLC operates, is heavily regulated, creating significant hurdles for new companies. For instance, in the UK, the Office of Gas and Electricity Markets (Ofgem) imposes strict licensing and compliance requirements. These can include demonstrating financial stability, technical competence, and adherence to consumer protection rules. Navigating this complex web of regulations requires substantial upfront investment in legal expertise and operational infrastructure, making it challenging for smaller or less capitalized entrants to compete effectively.

New companies in the energy services sector face a steep climb when trying to secure loyal customers and access effective sales avenues. Inspired Energy PLC, for instance, leverages its established client base and the trust it has cultivated over years of operation. Without this history, newcomers find it incredibly difficult to break into the market and gain a foothold against established players.

Economies of Scale and Experience

Existing players in the energy sector, such as Inspired Energy PLC, often leverage significant economies of scale. This advantage allows them to negotiate better terms on data acquisition, invest more heavily in proprietary technology, and achieve greater efficiency in service delivery, all of which are difficult for newcomers to replicate quickly. For instance, in 2024, major energy suppliers continued to consolidate their purchasing power, impacting the cost structures for smaller or newer entrants.

Furthermore, the accumulated experience and deep market knowledge held by established firms create a substantial barrier. Navigating the complexities of energy regulations, customer service, and market dynamics requires time and expertise that new entrants lack. This experiential advantage translates into better operational efficiency and a more refined customer offering, making it challenging for new companies to compete on cost or service quality from the outset.

- Economies of Scale: Lower per-unit costs for purchasing, technology development, and service delivery enjoyed by established firms.

- Experience Curve: Accumulated knowledge and expertise in navigating market complexities and customer needs.

- Cost Disadvantage for Newcomers: New entrants struggle to achieve cost parity due to the lack of scale and experience.

- Service Quality Gap: Established players can often offer superior service due to operational maturity and specialized knowledge.

Brand Loyalty and Reputation

The strong brand loyalty and positive reputation cultivated by established companies like Inspired Energy PLC present a significant hurdle for new entrants. Customers often exhibit a preference for familiar and dependable providers, especially for essential services such as energy management. For instance, in the UK's competitive energy market, customer retention rates can be high for providers with a proven track record of reliability and customer service.

New entrants face the daunting task of investing substantial resources to build trust and establish a credible reputation. This process is inherently time-consuming and costly, effectively raising the barriers to entry. The challenge is amplified as potential customers may be hesitant to switch from incumbent suppliers, particularly if they perceive a risk associated with unproven entities.

- Customer Inertia: Many consumers are reluctant to switch energy providers due to the perceived hassle or risk, favoring established brands.

- Reputational Investment: New companies must allocate significant capital towards marketing and customer service to build a reputation comparable to incumbents.

- Trust Factor: In critical sectors like energy, trust is paramount, making it difficult for new, less-known brands to attract customers away from established, reputable players.

The threat of new entrants into the energy procurement and management sector, where Inspired Energy PLC operates, is significantly mitigated by high capital requirements for technology development and regulatory compliance. For instance, in 2024, the ongoing investment in advanced data analytics and cybersecurity infrastructure for energy management platforms often exceeded £1 million for new players seeking to match incumbent capabilities. Furthermore, stringent licensing and adherence to evolving energy market regulations, such as those overseen by Ofgem in the UK, demand considerable legal and operational resources, creating a substantial barrier to entry.

| Barrier Type | Description | Estimated Cost/Effort (2024) | Impact on New Entrants |

|---|---|---|---|

| Capital Requirements | Developing proprietary energy trading and analytics platforms. | £500,000 - £2 million | High; significant upfront investment needed. |

| Regulatory Hurdles | Obtaining licenses and complying with Ofgem regulations. | Substantial investment in legal and operational infrastructure. | High; complex and costly to navigate. |

| Customer Acquisition | Building trust and securing clients against established players. | Significant marketing and sales investment; time-consuming. | High; customer inertia and loyalty are strong. |

| Economies of Scale | Achieving cost efficiencies in purchasing and operations. | New entrants lack the purchasing power of established firms. | High; cost disadvantage for newcomers. |

Porter's Five Forces Analysis Data Sources

Our analysis leverages a comprehensive dataset including financial statements, industry expert interviews, and market research reports to meticulously evaluate each of Porter's Five Forces.