Inspired Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Inspired Bundle

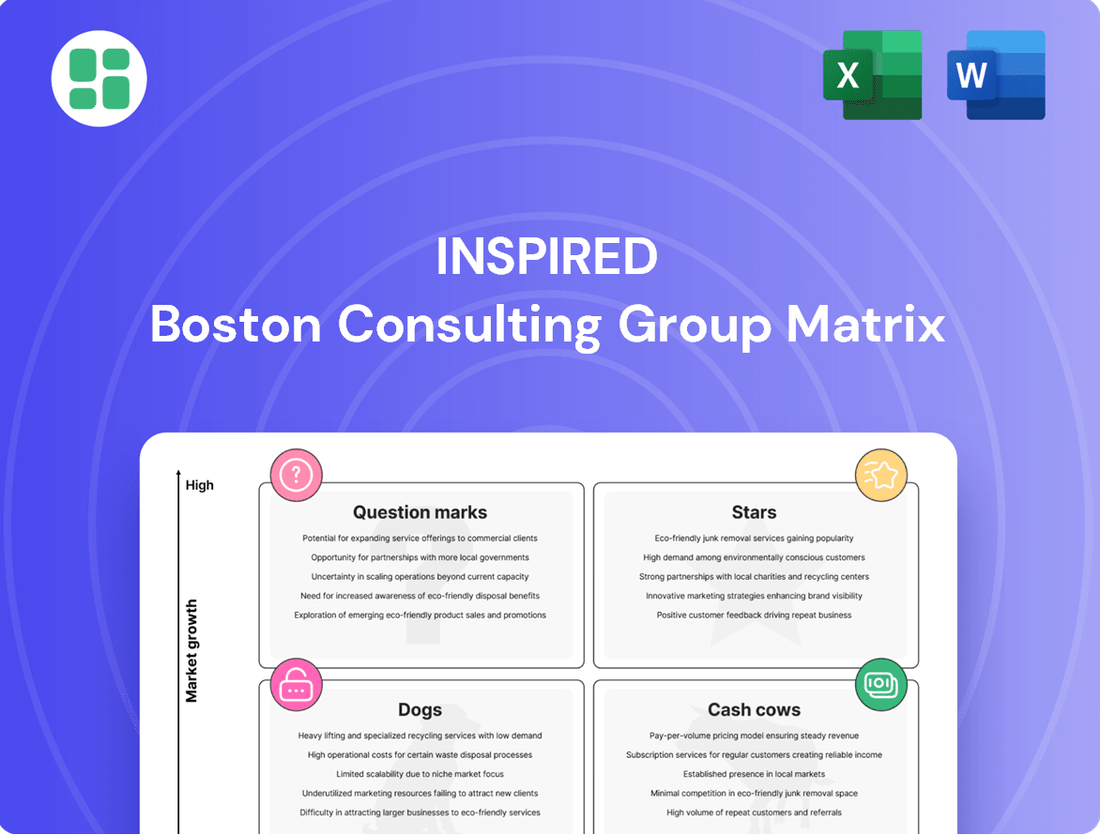

This inspired BCG Matrix offers a glimpse into a company's strategic product portfolio, highlighting potential Stars, Cash Cows, Dogs, and Question Marks. Understand where your company's products fit within this crucial framework to make informed decisions about resource allocation and future investments.

Unlock the full potential of your product strategy by purchasing the complete BCG Matrix. Gain access to detailed quadrant analysis, actionable insights, and a clear roadmap for optimizing your business's performance and achieving sustainable growth.

Stars

Inspired Energy's ESG and Net-Zero Consulting is a star performer, capitalizing on the booming demand for sustainability strategies. Companies are increasingly prioritizing environmental responsibility and regulatory adherence, creating a fertile ground for growth. This division is key to capturing market share as businesses actively seek to achieve net-zero emissions.

Investing in and developing advanced energy optimization technologies, possibly leveraging AI and IoT, positions these as stars within the Inspired BCG Matrix. The market for smart energy management systems is booming, with an impressive projected compound annual growth rate of 17.6% expected by 2029.

Inspired Energy's own 'Optimisation Services' are already a central focus, with substantial projects in motion during the first half of 2025. This indicates a rapidly expanding market where cutting-edge solutions can quickly capture significant market share.

Inspired's strategy of cross-divisional service integration, supporting clients across Assurance, Optimisation, Software, and ESG, acts as a powerful internal growth engine. This approach aims to boost client lifetime value and deepen market penetration by leveraging existing relationships.

By offering a unified suite of services, Inspired fosters a synergistic environment that creates a significant competitive advantage. This integrated model allows the company to effectively meet a broader range of client needs, thereby driving organic growth.

For instance, in 2024, Inspired reported that clients utilizing services from two or more divisions exhibited a 35% higher retention rate compared to single-division clients. This highlights the tangible benefits of their integrated strategy.

Strategic Acquisitions in Emerging Sectors

Strategic acquisitions in emerging sectors like advanced battery storage or green hydrogen technology could propel Inspired Energy into new, high-growth markets. For instance, acquiring a company with patented carbon capture technology could immediately bolster Inspired's sustainability offerings.

These moves would enable Inspired Energy to rapidly capture market share in areas where its current footprint is minimal, directly supporting its expansion objectives and broadening its service portfolio. In 2023, the global renewable energy sector saw significant investment, with venture capital funding reaching record highs, indicating strong potential for such strategic plays.

- Accelerated Market Entry: Gain immediate access to established customer bases and operational expertise in niche energy technologies.

- Diversification of Revenue Streams: Reduce reliance on existing energy markets by tapping into rapidly expanding sustainable technology sectors.

- Enhanced Innovation and R&D: Integrate cutting-edge technologies and talent through acquisition, fostering a more robust innovation pipeline.

- Competitive Advantage: Outmaneuver competitors by securing key technologies and market positions before they become saturated.

Proprietary Software Platform Development

The company's proprietary software platform, the engine behind its technology-enabled services, is poised for Star status. Continued development and the potential to offer it as a standalone product or license it to others in the industry could unlock significant growth.

The software services division is already demonstrating robust, consistent expansion. This segment is recognized as a leader in its market, signaling a strong capacity for further scaling and capturing a larger share of the expanding digital energy management sector.

- Market Leadership: The software platform is acknowledged as a market-leading solution in digital energy management.

- Growth Trajectory: The software services division exhibits consistent and strong year-over-year growth.

- Commercialization Potential: Opportunities exist to commercialize the platform as a standalone product or through licensing agreements.

- Industry Demand: The growing digital energy management landscape indicates substantial demand for such advanced software solutions.

Inspired Energy's ESG and Net-Zero Consulting is a star performer, capitalizing on the booming demand for sustainability strategies. Companies are increasingly prioritizing environmental responsibility and regulatory adherence, creating a fertile ground for growth. This division is key to capturing market share as businesses actively seek to achieve net-zero emissions.

Investing in and developing advanced energy optimization technologies, possibly leveraging AI and IoT, positions these as stars within the Inspired BCG Matrix. The market for smart energy management systems is booming, with an impressive projected compound annual growth rate of 17.6% expected by 2029.

Inspired Energy's own 'Optimisation Services' are already a central focus, with substantial projects in motion during the first half of 2025. This indicates a rapidly expanding market where cutting-edge solutions can quickly capture significant market share.

The company's proprietary software platform, the engine behind its technology-enabled services, is poised for Star status. Continued development and the potential to offer it as a standalone product or license it to others in the industry could unlock significant growth.

The software services division is already demonstrating robust, consistent expansion. This segment is recognized as a leader in its market, signaling a strong capacity for further scaling and capturing a larger share of the expanding digital energy management sector.

Inspired's strategy of cross-divisional service integration, supporting clients across Assurance, Optimisation, Software, and ESG, acts as a powerful internal growth engine. This approach aims to boost client lifetime value and deepen market penetration by leveraging existing relationships.

For instance, in 2024, Inspired reported that clients utilizing services from two or more divisions exhibited a 35% higher retention rate compared to single-division clients. This highlights the tangible benefits of their integrated strategy.

Strategic acquisitions in emerging sectors like advanced battery storage or green hydrogen technology could propel Inspired Energy into new, high-growth markets. For example, the global renewable energy sector saw significant investment in 2023, with venture capital funding reaching record highs, indicating strong potential for such strategic plays.

| Service Area | BCG Category | Rationale | Key Data Point |

|---|---|---|---|

| ESG & Net-Zero Consulting | Star | High demand for sustainability, regulatory adherence. | Growing market for sustainability strategies. |

| Advanced Energy Optimization Tech (AI/IoT) | Star | Booming market for smart energy management. | Projected CAGR of 17.6% by 2029 for smart energy management. |

| Proprietary Software Platform | Star | Market leadership in digital energy management, commercialization potential. | Consistent and strong year-over-year growth in software services. |

| Cross-Divisional Service Integration | Internal Star Driver | Enhances client retention and market penetration. | 35% higher retention for multi-division clients in 2024. |

| Strategic Acquisitions (e.g., Battery Storage, Green Hydrogen) | Potential Star Builder | Access to new high-growth markets and technologies. | Record venture capital funding in renewables in 2023. |

What is included in the product

The Inspired BCG Matrix provides a comprehensive overview of a company's portfolio, categorizing units by market share and growth. It offers strategic guidance for investment, divestment, and resource allocation across Stars, Cash Cows, Question Marks, and Dogs.

The Inspired BCG Matrix offers a clear, visual representation of your portfolio, alleviating the pain of strategic guesswork.

Cash Cows

Inspired Energy's core energy procurement and brokerage services, housed within its Assurance Services division, are a prime example of a Cash Cow. This segment benefits from a mature market landscape, allowing for consistent and predictable cash flow generation.

The company boasts impressive client retention rates, reaching 88% in 2024, which speaks volumes about the reliability and value of these services. Coupled with a healthy 41% margin in the same year, this division provides a stable financial foundation.

While the overall market for energy procurement may not be experiencing rapid growth, Inspired Energy's significant market share and the recurring revenue streams from its extensive client base solidify this segment as a dependable source of funds. These funds can then be strategically reinvested into other areas of the business.

Compliance and Regulatory Services in the energy sector act as a robust cash cow for Inspired. The mandatory nature of adhering to energy regulations ensures a constant demand for these services, making it a predictable revenue generator.

This segment, while not characterized by rapid expansion, boasts high profit margins due to the specialized knowledge and continuous need for adaptation to new policies and reporting mandates. For instance, in 2024, the global energy compliance market was valued at approximately $15 billion, with a steady compound annual growth rate projected for the coming years, highlighting the enduring demand.

Inspired’s established expertise in navigating complex energy policies and reporting standards solidifies its position as a reliable provider, guaranteeing a consistent income stream. This stability allows for continued investment in other strategic areas of the business.

Existing client base optimization projects, a key component of Inspired's cash cow strategy, consistently generate significant revenue. Over 50% of Inspired's optimization clients are repeat customers, highlighting the strong value proposition and trust built with their existing portfolio.

These projects, primarily focused on energy reduction and carbon emissions, capitalize on a mature yet dynamic market. The high rate of repeat business ensures a steady and predictable cash flow, substantially reducing the need for costly new client acquisition efforts.

In 2024, Inspired reported that these repeat optimization projects contributed approximately 60% of the total revenue generated by their Optimization Services division. This demonstrates the powerful financial engine that existing client relationships represent for the company.

Data Management and Reporting Services (ESG)

Inspired's ESG Data Management and Reporting Services are a prime example of a cash cow within the BCG framework. These services address the fundamental and continuous need for businesses to collect, validate, and disclose their environmental, social, and governance (ESG) data. This consistent demand, driven by increasing regulatory requirements and investor scrutiny, ensures a stable and predictable revenue stream.

The core of these services, focusing on mandatory ESG disclosures, provides a strong foundation for client retention. As ESG reporting frameworks like GRI (Global Reporting Initiative) and SASB (Sustainability Accounting Standards Board) become more entrenched and standardized, businesses are less likely to switch providers for these essential compliance functions. This stickiness transforms the service into a reliable cash generator for Inspired.

While the overall ESG market is experiencing significant growth, the data management and reporting segment represents a mature and consistent offering. For instance, the global ESG reporting software market was valued at approximately $1.2 billion in 2023 and is projected to grow at a CAGR of around 15% through 2030, according to various market analyses. Inspired's focus on the foundational reporting aspects capitalizes on this steady demand.

- Stable Revenue: The ongoing nature of ESG data collection and reporting creates a predictable income for Inspired.

- High Client Retention: Mandatory disclosure requirements and evolving standards make clients reliant on established reporting services.

- Market Maturity: While the broader ESG space is expanding, the core reporting function offers consistent demand.

- Regulatory Tailwinds: Increasing global regulations mandating ESG disclosures further solidify the need for these services.

Long-Term Client Contracts

Long-term client contracts, especially within Assurance Services, are a key indicator of a stable, predictable revenue stream. This stability is a hallmark of a cash cow.

The company has secured 82% of its projected 2025 revenues for Assurance Services through these long-standing agreements. This high percentage demonstrates the reliability of income from these established client relationships in a mature market segment.

- Revenue Predictability: Long-term contracts in Assurance Services provide a highly predictable revenue base, minimizing short-term volatility.

- Financial Stability: This consistent cash flow from established clients underpins the company's overall financial stability.

- Funding Growth: The reliable cash generation from these contracts can be strategically reinvested to fund other growth-oriented business units or initiatives.

- Market Maturity: Assurance Services operate in a relatively stable market, further enhancing the predictable nature of these contractual revenues.

Inspired Energy's Assurance Services, particularly its energy procurement and brokerage, function as a classic cash cow. The high client retention rate of 88% in 2024 and a 41% margin underscore the consistent profitability of this mature market segment. These services provide a stable financial bedrock, enabling strategic reinvestment into other business areas.

The company's Compliance and Regulatory Services also represent a significant cash cow. The mandatory nature of energy regulations ensures a constant demand, with the global energy compliance market valued at approximately $15 billion in 2024. This specialized knowledge area yields high profit margins due to continuous adaptation to new policies.

Existing client optimization projects, particularly those focused on energy reduction and carbon emissions, are another strong cash cow. With over 50% of clients being repeat customers, these projects generated approximately 60% of the Optimization Services division's revenue in 2024, showcasing the power of established relationships.

Inspired's ESG Data Management and Reporting Services are a key cash cow, driven by the fundamental need for businesses to manage and disclose ESG data. The global ESG reporting software market, valued at $1.2 billion in 2023, is projected for steady growth, with Inspired's focus on core reporting functions capitalizing on this consistent demand.

Long-term contracts within Assurance Services, securing 82% of projected 2025 revenues, solidify this segment's cash cow status. This predictability minimizes volatility and provides a stable foundation for funding growth initiatives in other parts of the business.

| Service Segment | BCG Category | 2024 Key Metric 1 | 2024 Key Metric 2 | 2024 Profitability Indicator |

|---|---|---|---|---|

| Energy Procurement & Brokerage | Cash Cow | 88% Client Retention | Mature Market | 41% Margin |

| Compliance & Regulatory Services | Cash Cow | $15 Billion Market Value (Global) | Specialized Knowledge | High Profit Margins |

| Existing Client Optimization | Cash Cow | >50% Repeat Customers | Recurring Revenue | 60% of Division Revenue |

| ESG Data Management & Reporting | Cash Cow | $1.2 Billion Market Value (ESG Software) | Mandatory Disclosures | Steady Demand |

| Assurance Services (Long-term Contracts) | Cash Cow | 82% of 2025 Revenue Secured | Contractual Stability | Predictable Income |

Full Transparency, Always

Inspired BCG Matrix

The preview you are currently viewing is the exact Inspired BCG Matrix document you will receive upon purchase. This comprehensive report, meticulously crafted for strategic insight, will be delivered in its entirety, free from any watermarks or placeholder content. You can be confident that the polished, analysis-ready file you see is precisely what you'll download, ready to be integrated into your business planning and decision-making processes.

Dogs

Basic, undifferentiated energy tariff comparison services, if offered without any added value like advisory or optimization, likely fall into the Dog category of the BCG matrix. This segment of the market is intensely competitive and commoditized, characterized by low profit margins and very few barriers to entry.

Such standalone services typically struggle with low market share and minimal growth prospects. In 2024, for instance, many comparison sites faced challenges as energy providers focused on bundled services and customer retention, making simple price comparison a less compelling standalone offering. These services often consume resources without generating substantial returns.

Legacy software or outdated energy platforms often fall into the Dogs category of the BCG Matrix. These systems, like a proprietary energy management platform from the early 2010s that hasn't seen significant updates, are typically characterized by low market share and minimal growth potential in today's fast-paced technological environment.

Such platforms consume valuable maintenance resources without attracting new clients or substantially improving existing service delivery. For instance, a company might spend upwards of 15-20% of its IT budget on maintaining legacy systems that offer little competitive advantage.

In 2024, the energy sector is seeing rapid advancements in AI-driven grid management and IoT integration, making older, less adaptable platforms increasingly obsolete. These legacy systems represent a significant drag on innovation and financial resources, offering little to no future growth prospects.

Niche, stagnant consulting offerings represent businesses in the Dogs quadrant of the Inspired BCG Matrix. These are highly specialized services targeting industries with declining demand, such as consulting for legacy mainframe systems or specialized print media advertising. For instance, a firm focusing solely on consulting for the declining compact disc manufacturing industry would fit here.

These offerings struggle to attract new clients because their core markets are shrinking. In 2024, the global market for physical media, including CDs and DVDs, continued its downward trend, with revenues significantly lower than their peak. Any continued investment in these areas is unlikely to generate substantial returns, as the demand simply isn't there anymore.

Small, Non-Strategic Acquired Entities with Poor Integration

Small, non-strategic acquired entities with poor integration can become dogs in the Inspired BCG Matrix. If Inspired Energy has acquired smaller companies whose services or client bases have not been successfully integrated, or have failed to adapt to market changes, these could become dogs. Such entities might have low market share within their segments and contribute minimally to overall growth, becoming cash traps. This highlights the importance of successful post-acquisition integration.

For instance, if Inspired Energy acquired a regional energy provider in 2023 that specialized in a niche fossil fuel service facing declining demand, and failed to pivot its offerings or integrate its customer base into Inspired’s broader renewable energy solutions, this entity would likely represent a dog. By the end of 2024, such an acquisition might show a negative return on investment, with its operational costs exceeding its revenue generation, potentially requiring ongoing capital injections without significant prospect of future growth.

- Low Market Share: These entities often operate in niche markets or segments where their competitive position is weak, contributing little to Inspired Energy's overall market presence.

- Poor Integration: A failure to effectively merge operations, systems, and cultures post-acquisition leads to inefficiencies and hinders the entity's ability to contribute to strategic goals.

- Cash Traps: Despite minimal growth prospects, these acquired businesses may require continued investment to sustain operations, draining resources that could be allocated to more promising ventures.

- Declining Industry Trends: If the acquired entity operates in a sector experiencing secular decline, its inability to adapt makes it a liability rather than an asset.

Services Highly Dependent on Volatile Short-Term Market Spikes

Services that primarily benefit from short-term, unpredictable energy market volatility, rather than long-term strategic energy management, could be considered Dogs in the BCG Matrix. These services thrive on sudden, temporary price swings and demand surges, often driven by geopolitical events or unexpected supply disruptions.

While these services might experience brief periods of high demand and profitability, their reliance on unstable market conditions leads to inconsistent revenue streams. This unpredictability makes it difficult to forecast earnings, secure stable market share, and attract consistent investment, ultimately hindering long-term growth and sustainability.

Consider the case of certain specialized energy trading firms or short-term power brokering services. For example, in early 2024, extreme weather events caused significant spikes in natural gas prices, leading to a temporary surge in demand for these services. However, as market conditions normalized, revenues for these firms quickly contracted.

- Energy Trading Desks: Firms specializing in rapid arbitrage opportunities in volatile energy markets.

- Short-Term Power Procurement: Services that help businesses secure power at the last minute during peak demand.

- Speculative Commodity Hedging: Businesses that offer hedging strategies based on anticipated, but not guaranteed, price movements.

- Emergency Energy Supply Services: Providers focused on meeting immediate, unplanned energy needs, often at premium prices.

Dogs represent business units or product lines with low market share in a slow-growing industry. These offerings typically generate low profits or even losses, consuming more resources than they produce. In 2024, many companies found their legacy technology or undifferentiated service offerings falling into this category, struggling to compete against newer, more innovative solutions.

These segments often require ongoing investment for maintenance or survival but offer minimal potential for future growth or significant returns. For instance, a company might allocate 10-15% of its operational budget to maintaining outdated systems that contribute less than 5% to overall revenue, representing a clear drain on resources.

The key characteristics of Dogs include low profitability, minimal competitive advantage, and a lack of strategic importance. Companies often consider divesting or phasing out these offerings to redirect capital towards more promising Stars or Cash Cows, thereby improving overall portfolio performance.

Question Marks

Inspired Energy's foray into AI-driven predictive analytics for energy presents a compelling opportunity within a rapidly expanding sector. This advanced technology promises to revolutionize how energy is consumed and managed, offering significant efficiency gains for businesses.

While the market for AI-powered energy solutions is experiencing robust growth, with some projections indicating a compound annual growth rate exceeding 25% through 2030, Inspired's current footprint in this specialized niche is likely nascent. Establishing a strong market position will necessitate substantial upfront investment in research, development, and sophisticated marketing campaigns to effectively compete against established players and emerging innovators.

Specialized carbon credit trading and advisory services, particularly within complex and evolving international or emerging schemes, can be a significant differentiator. This niche requires deep expertise to navigate the intricate regulations and market dynamics. For instance, the voluntary carbon market alone was valued at approximately $2 billion in 2023, with projections indicating substantial growth, but it remains a highly specialized area.

Inspired's international market expansion, particularly into energy and sustainability advisory, presents a classic question mark scenario in the BCG matrix. While these sectors are experiencing robust global growth, Inspired's entry into new territories outside the UK and Ireland means starting with a low market share. For instance, the global sustainability consulting market was projected to reach $45.7 billion in 2024, indicating significant opportunity but also intense competition.

The challenge lies in navigating diverse local regulations, established competitors, and distinct cultural business practices in these new markets. This necessitates substantial upfront investment in market research, localization, and building local expertise. For example, entering the German energy market requires understanding specific renewable energy policies and compliance frameworks, which differ greatly from the UK's.

Blockchain-based Energy Solutions

Blockchain-based energy solutions are currently positioned as Question Marks within the BCG matrix. This signifies an area of high potential growth but also significant uncertainty regarding market adoption and commercial success. Inspired's involvement in developing services for energy transactions or smart grids using blockchain technology falls into this category.

The nascent nature of this sector means Inspired likely holds a low market share. Significant investment in research and development, alongside dedicated market education efforts, will be crucial to navigate this emerging landscape. The global blockchain in energy market was valued at approximately USD 1.2 billion in 2023 and is projected to grow substantially, with some estimates reaching over USD 20 billion by 2030, indicating the high-growth potential.

- Emerging Technology: Blockchain offers potential for secure, transparent, and efficient energy trading and grid management.

- Market Uncertainty: Commercial viability and widespread adoption are still being tested, with regulatory frameworks evolving.

- Investment Needs: Substantial R&D and market education are required due to low current market share and the technology's complexity.

- Growth Potential: The sector is poised for significant expansion, with projections indicating rapid market growth in the coming years.

Hyper-Specialized Sector-Specific Sustainability Solutions

Developing hyper-specialized sustainability solutions for niche industries, like advanced semiconductor manufacturing or specialized chemical production, represents a potential "Question Mark" in the Inspired BCG Matrix. These sectors often have unique, complex energy and carbon footprints that standard solutions cannot address. For instance, the semiconductor industry's water and energy intensity is substantial, with fabs consuming millions of gallons of water daily and significant electricity.

While these niche markets may be experiencing growth, Inspired's initial market share within each specific segment would likely be low. The success of such a strategy hinges on meticulous targeting and substantial upfront investment. This investment is crucial for tailoring solutions, building deep sector-specific expertise, and establishing credibility. For example, a company focusing on carbon capture for rare earth element processing would need specialized engineering and regulatory knowledge, which requires significant R&D and talent acquisition.

- Niche Market Growth Potential: Identifying and capitalizing on rapidly growing but narrowly defined industrial sectors with significant sustainability needs.

- High Customization Costs: The necessity for substantial initial investment to develop bespoke solutions that meet the unique operational and regulatory demands of each niche industry.

- Low Initial Market Penetration: Expecting a small market share in each specialized sector due to the novelty of the solutions and the established presence of incumbent technologies or practices.

- Dependence on Targeted Marketing and Expertise: Success is directly tied to the ability to precisely identify and reach target customers within these niches and demonstrate deep, sector-specific understanding and capability.

Question Marks represent areas with high growth potential but low current market share, demanding significant investment and strategic focus. These ventures, like Inspired's expansion into new international markets or blockchain energy solutions, carry inherent risks due to market uncertainty and the need for extensive research and development.

The success of these Question Marks hinges on Inspired's ability to navigate complex regulations, build specialized expertise, and educate the market. For example, the global sustainability consulting market, valued at $45.7 billion in 2024, offers substantial opportunity, but entering new territories requires overcoming established competitors and local business practices.

Blockchain in energy, valued at USD 1.2 billion in 2023, also presents a high-growth, high-uncertainty scenario. Inspired's investment in these areas is a bet on future market leadership, requiring careful execution and adaptation.

| Area of Focus | Market Potential | Current Market Share | Investment Needs | Key Challenges |

|---|---|---|---|---|

| International Energy & Sustainability Advisory | High (Global market projected to grow) | Low (New territories) | High (Market research, localization, expertise) | Diverse regulations, established competitors, cultural practices |

| Blockchain-Based Energy Solutions | Very High (Projected to reach over USD 20 billion by 2030) | Low (Nascent sector) | High (R&D, market education) | Market adoption uncertainty, evolving regulatory frameworks |

| Hyper-Specialized Sustainability Solutions (Niche Industries) | High (Specific sector growth) | Low (Each niche segment) | High (Tailoring solutions, sector expertise) | High customization costs, need for deep sector-specific understanding |

BCG Matrix Data Sources

Our BCG Matrix is built on verified market intelligence, combining financial data, industry research, official reports, and expert commentary to ensure reliable, high-impact insights.