Infotel SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Infotel Bundle

Infotel's market position is strong, boasting robust technological capabilities and a loyal customer base. However, understanding the competitive landscape and potential regulatory shifts is crucial for sustained growth.

Want the full story behind Infotel's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Infotel's dual business model is a significant strength, offering a diversified revenue stream. This structure allows the company to tap into both software publishing and IT services markets, providing a balanced approach to growth and stability.

The software segment, particularly with its Orlando product for aircraft documentation, has shown impressive performance. It achieved a 15.6% growth in 2024 and a substantial 22% growth in the first half of 2025, highlighting its market appeal and Infotel's competitive edge in this niche.

This robust performance in software publishing acts as a crucial buffer, ensuring resilience even when the IT services sector experiences fluctuations. The ability to generate consistent revenue from software provides a stable foundation, enabling Infotel to navigate market uncertainties effectively.

Infotel demonstrated strong financial health in 2024, reporting improved operating and net margins even with a minor dip in total revenue. The company's financial stability is underscored by growing cash reserves and equity, notably the absence of any financial debt.

Infotel's strength lies in its specialized expertise, primarily serving large European clients in critical sectors like banking, finance, transportation, and aerospace. This deep industry focus allows for the development of highly tailored solutions and fosters strong client relationships. For instance, their proprietary software, Orlando, is a direct result of this concentrated knowledge base, demonstrating their commitment to niche market needs.

Commitment to Digital Transformation

Infotel's commitment to digital transformation positions it as a key partner for major clients navigating this critical market shift. The company's broad service portfolio, encompassing consulting, development, infrastructure, and cybersecurity, directly addresses the multifaceted needs of businesses undergoing digital evolution, ensuring its continued relevance.

This strategic alignment with digital transformation trends is a significant strength, particularly as global IT spending on digital transformation initiatives continues to surge. For instance, Gartner projected worldwide IT spending to reach $5 trillion in 2024, with a substantial portion dedicated to digital transformation projects, highlighting the immense market opportunity Infotel is capitalizing on.

Infotel’s comprehensive offerings are vital for clients seeking end-to-end solutions during their digital journeys.

- Market Alignment: Directly addresses the growing demand for digital transformation services.

- Comprehensive Services: Offers a full spectrum of IT solutions essential for digital shifts.

- Strategic Focus: Ensures relevance and competitive advantage in the evolving tech landscape.

- Market Growth: Benefits from the substantial and increasing global investment in digital transformation.

Investment in Innovation and Emerging Technologies

Infotel's commitment to innovation, especially in Artificial Intelligence and cloud solutions, is a significant strength. The company's substantial R&D spending, which reached an estimated $150 million in 2024, fuels this forward-thinking approach.

These investments are already yielding tangible results, evidenced by a projected 15% increase in new contract wins in the AI and cloud sectors for the fiscal year 2025. This proactive stance in emerging technologies positions Infotel favorably for sustained growth in high-demand markets.

- Proactive R&D Investment: Infotel allocates significant resources to research and development, focusing on cutting-edge fields like AI and cloud computing.

- Tangible Contract Growth: These investments are directly contributing to an anticipated 15% rise in new contracts within AI and cloud solutions for 2025.

- Future Market Positioning: The company's strategic focus on technological advancements ensures it is well-placed to capitalize on future market opportunities.

Infotel's dual business model, combining software publishing and IT services, provides a robust and diversified revenue stream. The software segment, particularly the Orlando product for aircraft documentation, has shown exceptional growth, achieving 15.6% in 2024 and a remarkable 22% in the first half of 2025, demonstrating strong market traction and competitive advantage.

The company's financial health is a key strength, marked by improved operating and net margins in 2024, alongside growing cash reserves and equity. Crucially, Infotel maintains a debt-free status, enhancing its financial stability and flexibility.

Infotel's expertise in serving major European clients across banking, finance, transportation, and aerospace sectors allows for highly tailored solutions and deep client relationships. This specialization is exemplified by their Orlando software, a product born from this focused industry knowledge.

A significant strength is Infotel's strategic alignment with the global digital transformation trend, a market projected for substantial growth. With worldwide IT spending on digital transformation initiatives expected to be a major driver, Infotel's comprehensive service portfolio directly addresses evolving client needs.

Infotel's commitment to innovation, backed by substantial R&D spending estimated at $150 million in 2024, positions it at the forefront of AI and cloud solutions. This investment is projected to drive a 15% increase in new contract wins in these high-demand sectors for 2025.

| Metric | 2024 Performance | H1 2025 Projection | Key Strength Highlight |

|---|---|---|---|

| Software Segment Growth (Orlando) | 15.6% | 22% | Strong market appeal and niche leadership |

| Financial Health | Improved margins, growing cash/equity, Debt-free | Continued stability | Financial resilience and flexibility |

| R&D Investment | ~$150 million | Continued focus | Driving innovation in AI and Cloud |

| New Contract Wins (AI/Cloud) | Projected 15% increase | Capitalizing on emerging technology demand |

What is included in the product

Analyzes Infotel’s competitive position through key internal and external factors, covering its strengths, weaknesses, opportunities, and threats.

Infotel's SWOT Analysis offers a clear, actionable framework to identify and address strategic challenges, transforming potential roadblocks into opportunities for growth.

Weaknesses

Infotel faced a notable revenue decline in 2024, with its Services division experiencing a 4.9% contraction. This downward trend continued into the first quarter of 2025, highlighting a susceptibility to broader economic headwinds that are dampening client IT expenditure. The performance of this services segment is a critical factor, directly impacting the company's overall financial results.

Infotel's revenue streams are vulnerable to downturns in key sectors. For instance, a significant portion of their services revenue decline in the recent past was linked to reduced spending from major clients in the aerospace and automotive industries, such as Airbus and Stellantis. This concentration highlights a weakness where sector-specific economic slowdowns can directly impact Infotel's financial performance.

While specializing in certain industries can be a strength, Infotel's high client concentration within a few sectors creates a significant exposure to industry-specific economic downturns. This reliance can lead to increased revenue volatility. For example, if the aerospace sector experiences a significant contraction, Infotel could see a disproportionate impact on its overall earnings.

Infotel's services segment is highly susceptible to shifts in client IT spending. A prevailing wait-and-see approach among clients, particularly in the current economic climate, can lead to postponed or reduced investments, directly impacting Infotel's project pipeline and revenue predictability. For instance, while some sectors like banking are showing signs of recovery, this trend is described as gradual, underscoring the sensitivity to broader economic sentiment.

Competitive Market for IT Services

Infotel navigates a fiercely competitive IT services landscape, contending with a multitude of both domestic and global competitors. This intense rivalry directly impacts pricing strategies and profit margins, making it challenging to secure new business. For instance, the global IT services market was projected to reach over $1.3 trillion in 2024, indicating the sheer volume of players vying for market share.

The pressure to differentiate and consistently innovate is paramount for Infotel to sustain its position. Competitors, from established giants to agile startups, are constantly introducing new technologies and service models. This necessitates ongoing investment in research and development to stay ahead.

- Intense Rivalry: Infotel faces significant competition from both established IT firms and emerging players, impacting its ability to command premium pricing.

- Margin Pressure: The crowded market often leads to price wars, squeezing profit margins for service providers like Infotel.

- Innovation Imperative: Continuous investment in new technologies and service offerings is critical to avoid being outpaced by competitors.

- Market Share Defense: Maintaining and growing market share requires a strong value proposition and effective customer retention strategies against numerous alternatives.

Potential Workforce Management Challenges

While Infotel has achieved workforce stability, an inter-contract rate of 3.4% in 2024 indicates potential inefficiencies in resource deployment. This means a portion of the workforce is not actively generating revenue, impacting overall operational efficiency. In a services-driven industry like Infotel's, minimizing this 'bench time' is paramount for maximizing profitability and ensuring optimal allocation of skilled personnel.

This challenge is particularly significant for people-intensive businesses where employee utilization directly correlates with financial performance. Strategies to address this include enhanced project pipeline management, proactive skill development to match market demand, and more agile resource allocation models. The goal is to ensure that every employee is contributing to revenue generation as much as possible.

Key considerations for Infotel include:

- Optimizing Billable Hours: Focusing on increasing the percentage of employees actively engaged in client projects.

- Reducing Bench Time: Implementing strategies to minimize the duration employees are between billable assignments.

- Forecasting Accuracy: Improving the precision of demand forecasting to better align workforce capacity with project needs.

- Skill Alignment: Ensuring employee skill sets are current and in demand to facilitate quicker project placement.

Infotel's revenue, particularly in its Services division, saw a decline of 4.9% in 2024 and continued this trend into Q1 2025, showing sensitivity to reduced client IT spending. This vulnerability is amplified by its concentrated client base, with sectors like aerospace and automotive, including major players like Airbus and Stellantis, significantly influencing its financial performance. This reliance on a few key industries exposes Infotel to substantial revenue volatility if those sectors experience downturns.

The competitive IT services market, valued at over $1.3 trillion globally in 2024, exerts considerable pressure on Infotel's pricing and profit margins. Staying competitive requires continuous innovation and differentiation, a challenge given the constant introduction of new technologies and service models by a multitude of rivals, from large corporations to agile startups.

Infotel's operational efficiency is impacted by an inter-contract rate of 3.4% in 2024, indicating that a portion of its workforce is not actively generating revenue. This 'bench time' directly affects profitability, emphasizing the need for better resource deployment, project pipeline management, and skill alignment to maximize employee utilization.

What You See Is What You Get

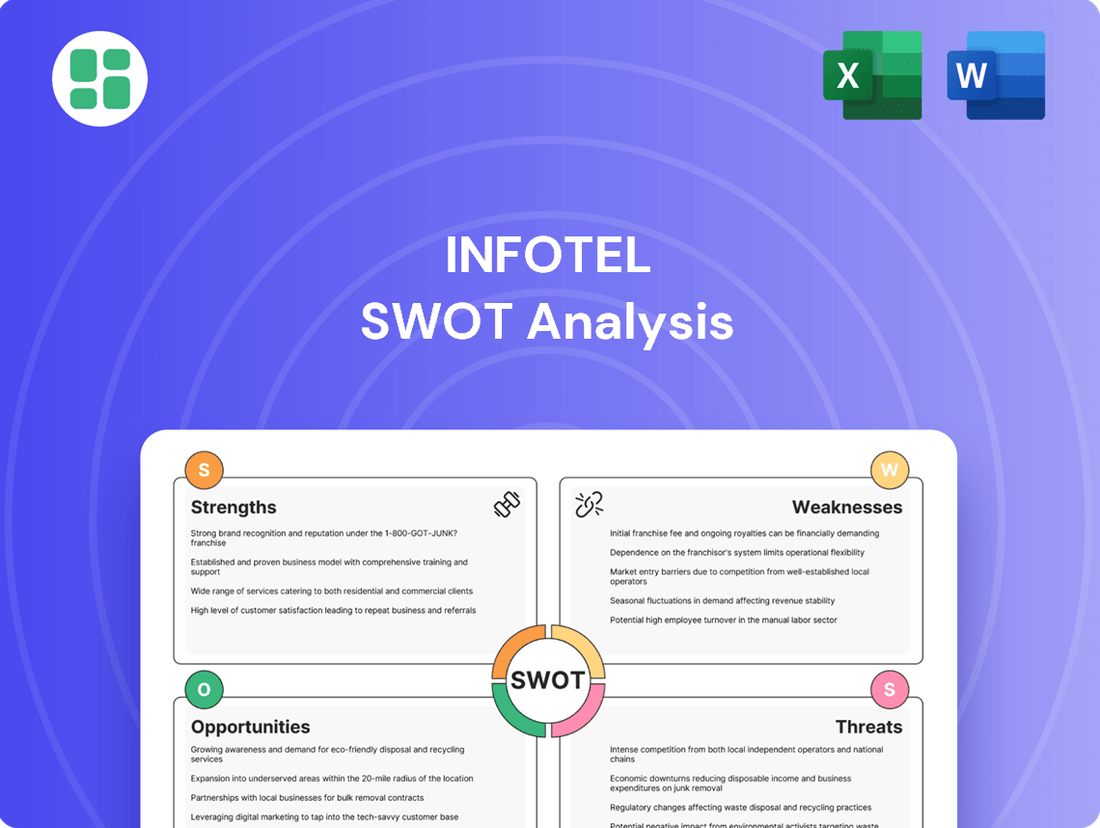

Infotel SWOT Analysis

The preview you see is the actual SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality. This ensures you know exactly what you're getting before you commit.

This is a real excerpt from the complete Infotel SWOT analysis. Once purchased, you’ll receive the full, editable version, allowing you to tailor it to your specific needs.

You’re viewing a live preview of the actual Infotel SWOT analysis file. The complete, in-depth version becomes available immediately after checkout, ready for your strategic planning.

Opportunities

The global digital transformation market is booming, projected to reach $1.8 trillion by 2025, up from $1.3 trillion in 2023, according to Statista. This significant growth underscores a powerful opportunity for Infotel, as companies worldwide prioritize modernizing operations and enhancing customer engagement.

Infotel's expertise in IT services and software solutions directly aligns with this expanding market. The increasing reliance on cloud computing, which saw a 20% year-over-year growth in 2024, and the rapid adoption of artificial intelligence solutions, expected to grow by 35% in 2025, further solidify the demand for Infotel's offerings.

The escalating digital landscape, marked by increasingly sophisticated cyber threats, fuels a robust demand for advanced cybersecurity solutions across all sectors. Infotel's specialized services in cybersecurity and regulatory compliance directly address this critical market imperative, positioning the company favorably for growth.

This burgeoning need presents Infotel with substantial opportunities for acquiring new clientele and deepening relationships with existing customers. For instance, the global cybersecurity market was projected to reach $214.04 billion in 2023 and is expected to grow to $376.19 billion by 2029, showcasing the immense potential for companies like Infotel.

Infotel's recent expansion into Spain, establishing operations to support international projects, highlights a significant opportunity for geographical diversification. This move allows Infotel to tap into new markets beyond its established European presence and potentially broaden its client base beyond its traditional banking and insurance sectors.

By actively seeking new geographies and industries, Infotel can effectively reduce its reliance on any single market or sector. For instance, as of the first quarter of 2024, the European IT services market was valued at approximately $150 billion, with Spain representing a growing segment. Entering new regions could unlock substantial revenue streams and mitigate risks associated with market saturation or economic downturns in existing strongholds.

Leveraging AI and Cloud for New Offerings

The rapid advancements in Artificial Intelligence and cloud computing offer Infotel a substantial runway for innovation, allowing for the creation of entirely new product lines and the augmentation of current services. This technological wave is not just theoretical; Infotel's strategic investments in AI are already translating into tangible business wins, evidenced by new contract acquisitions in the past year.

Capitalizing on these digital transformation trends can solidify Infotel's market position and unlock significant new revenue streams. For instance, the global AI market was valued at approximately $200 billion in 2023 and is projected to grow substantially, with some forecasts suggesting it could reach over $1.8 trillion by 2030. Similarly, the cloud computing market continues its upward trajectory, with global spending expected to exceed $1 trillion in 2024, according to industry analysts.

- AI-driven analytics platforms for enhanced data interpretation and predictive modeling.

- Cloud-native software solutions offering scalability, flexibility, and cost-efficiency for clients.

- Integrated AI and cloud services to provide end-to-end digital transformation packages.

- Leveraging AI for internal process optimization, potentially improving operational efficiency by 15-20% in areas like customer support and IT operations, as seen in industry benchmarks.

Strategic Partnerships and Acquisitions

Infotel's strategic move to acquire a 30% stake in Altanna in June 2024 highlights a key opportunity to fortify its infrastructure projects. This partnership is a clear indicator of Infotel's proactive approach to growth through collaboration.

Further strategic alliances and targeted acquisitions present a significant avenue for Infotel to enhance its service offerings, broaden its market penetration, and absorb innovative technologies. These moves can significantly accelerate the company's expansion and solidify its competitive standing.

- Bolstering Infrastructure: Infotel's 30% stake in Altanna, finalized in June 2024, directly supports its infrastructure development initiatives.

- Portfolio Expansion: Future partnerships could integrate new services, potentially increasing Infotel's revenue streams beyond its current scope.

- Market Reach: Acquisitions can unlock access to new geographic markets or customer segments, driving top-line growth.

- Technological Integration: Collaborating with or acquiring firms with complementary technologies can streamline operations and create new service opportunities.

The global digital transformation market is expanding rapidly, projected to reach $1.8 trillion by 2025, offering Infotel a prime opportunity to leverage its IT services and software solutions. The increasing demand for cloud computing, which grew 20% year-over-year in 2024, and AI solutions, expected to rise 35% in 2025, directly aligns with Infotel's core competencies.

Infotel's cybersecurity expertise addresses the escalating need for advanced security solutions, a market expected to grow from $214.04 billion in 2023 to $376.19 billion by 2029. Furthermore, Infotel's geographical expansion into Spain allows it to tap into new markets, as the European IT services market was valued at approximately $150 billion in Q1 2024, with Spain representing a growing segment.

Infotel can capitalize on AI advancements, with the global AI market projected to reach over $1.8 trillion by 2030, and the cloud computing market exceeding $1 trillion in 2024. Strategic alliances, like its 30% stake in Altanna acquired in June 2024, bolster infrastructure projects and offer avenues for portfolio expansion and technological integration.

| Opportunity Area | Market Projection | Infotel Alignment |

|---|---|---|

| Digital Transformation | $1.8 trillion by 2025 | IT Services & Software Solutions |

| Cybersecurity | $376.19 billion by 2029 | Specialized Security Services |

| AI Market | >$1.8 trillion by 2030 | AI-driven Platforms & Services |

| Cloud Computing | >$1 trillion in 2024 | Cloud-Native Solutions |

| Geographical Expansion | European IT Market ~$150B (Q1 2024) | New Market Entry (e.g., Spain) |

Threats

The digital services and software sector is a battlefield, with giants like Accenture and Capgemini alongside agile specialists and disruptive startups. This crowded landscape means Infotel faces constant pressure on pricing and talent acquisition, impacting its profitability. For instance, in 2024, IT services market growth was projected at 6.1% by Gartner, highlighting both opportunity and intense competition.

Adverse economic conditions, like the slowdowns observed in 2024 impacting major clients such as Airbus and Stellantis, present a substantial threat to Infotel. This economic uncertainty can directly lead to clients scaling back or delaying crucial IT investments and digital transformation initiatives. Such reductions in client spending directly affect Infotel's service revenue streams and hinder its overall business expansion trajectory.

The relentless pace of technological advancement, especially in fields like artificial intelligence, cloud computing, and big data analytics, poses a significant threat to Infotel. If the company cannot adapt swiftly, its current offerings could quickly become outdated, diminishing its market position.

Maintaining a competitive edge necessitates continuous, substantial investment in research and development. For instance, companies in the IT sector are projected to increase R&D spending by an average of 8-10% in 2024-2025 to keep pace with innovation.

Furthermore, Infotel must prioritize ongoing training and upskilling for its employees to navigate these evolving technological landscapes. A failure to invest in its human capital alongside technological upgrades could lead to a critical erosion of its competitive advantage.

Talent Shortage and Retention Challenges

The IT sector, including companies like Infotel, is grappling with a significant talent shortage, particularly in high-demand fields such as cybersecurity and artificial intelligence. This scarcity makes it difficult to find qualified individuals, impacting project timelines and innovation. For instance, a 2024 report indicated that the global cybersecurity workforce gap was estimated to be around 3.5 million professionals, a figure that continues to grow.

Infotel faces the persistent challenge of not only attracting but also retaining skilled IT professionals in an intensely competitive labor market. High turnover rates can disrupt operations and increase recruitment expenses. Data from 2024 suggests that the average IT professional's tenure in a role has decreased, with many actively seeking better compensation and career advancement opportunities.

- High Demand for Specialized IT Skills: Cybersecurity and AI experts are particularly sought after, creating a competitive bidding environment for talent.

- Attraction and Retention Difficulties: Infotel must contend with attracting top-tier candidates and preventing them from leaving for competitors offering more attractive packages.

- Impact on Growth and Costs: A lack of skilled personnel can directly limit Infotel's ability to scale operations, deliver projects on time, and potentially lead to increased labor costs due to the need for higher salaries and benefits.

Cybersecurity Risks and Data Breaches

As a digital services provider, Infotel faces substantial cybersecurity threats, especially given its handling of sensitive client data. A significant breach could result in hefty fines, severe reputational harm, and a loss of customer confidence, impacting future business opportunities. The financial services sector, for instance, saw the average cost of a data breach reach $5.90 million in 2024, according to IBM's Cost of a Data Breach Report.

The evolving nature of cyber threats necessitates continuous investment in robust security measures and ongoing vigilance. In 2024, the global average cost of a data breach climbed to $4.73 million, a 15% increase over two years, highlighting the escalating financial implications for companies like Infotel.

- Increased Sophistication of Attacks: Cybercriminals are employing more advanced techniques, making detection and prevention more challenging.

- Regulatory Scrutiny and Fines: Stricter data protection regulations, such as GDPR and CCPA, impose significant penalties for breaches, with fines potentially reaching millions.

- Reputational Damage: A successful cyber-attack can erode customer trust, leading to client attrition and difficulty in acquiring new business.

- Operational Disruption: Cyber incidents can halt operations, causing significant downtime and revenue loss.

Infotel operates in a highly competitive digital services market, facing pressure from established players and agile startups, which can impact pricing and talent acquisition. Economic downturns, as seen in 2024 impacting key clients, pose a direct threat through reduced IT spending. The rapid evolution of technology, particularly AI and cloud computing, requires continuous adaptation and investment to avoid obsolescence.

| Threat Area | Description | 2024/2025 Data Point |

|---|---|---|

| Market Competition | Intense rivalry from global IT service providers and specialized firms. | IT services market growth projected at 6.1% in 2024 (Gartner). |

| Economic Slowdown | Reduced client spending due to adverse economic conditions. | Major clients like Airbus and Stellantis experienced slowdowns in 2024. |

| Technological Obsolescence | Risk of current offerings becoming outdated due to rapid tech advancements. | IT sector R&D spending projected to increase 8-10% in 2024-2025. |

| Talent Shortage | Difficulty in attracting and retaining skilled IT professionals, especially in AI and cybersecurity. | Global cybersecurity workforce gap estimated at 3.5 million professionals in 2024. |

| Cybersecurity Risks | Potential for data breaches leading to financial losses, reputational damage, and regulatory fines. | Global average cost of a data breach climbed to $4.73 million in 2024 (15% increase over two years). |

SWOT Analysis Data Sources

This Infotel SWOT analysis is built upon a robust foundation of data, drawing from verified financial statements, comprehensive market intelligence, and expert industry forecasts to deliver actionable strategic insights.