Infotel Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Infotel Bundle

Infotel's competitive landscape is shaped by powerful forces, from the bargaining power of its customers to the constant threat of new entrants. Understanding these dynamics is crucial for strategic planning.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Infotel’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

Infotel's dependence on highly skilled IT professionals, especially in cutting-edge fields like artificial intelligence, cybersecurity, and cloud computing, directly translates to significant bargaining power for these individuals. The global IT skills gap, a persistent challenge through 2024 and into 2025, exacerbates this situation. This scarcity makes attracting and retaining top-tier talent a competitive endeavor, necessitating robust compensation packages and attractive benefits, thereby increasing Infotel's operational expenditures.

Infotel's software publishing division might depend on specialized third-party components, development tools, or hardware from a select group of suppliers. When these vendors provide proprietary or critical technologies, they gain significant leverage to influence pricing and licensing terms.

This reliance on a few specialized suppliers can directly impact Infotel's cost of goods sold and the timeline for its product development cycles. For instance, if a key software development kit (SDK) used by Infotel experiences a significant price increase, it could directly affect the profitability of Infotel's published software.

As Infotel's reliance on cloud infrastructure deepens, the bargaining power of major providers like Amazon Web Services (AWS), Microsoft Azure, and Google Cloud becomes a significant factor. These giants operate in an oligopolistic market, meaning a few dominant players control a large share, giving them considerable leverage. For instance, in 2024, the global cloud computing market was valued at over $600 billion, with these three providers holding a substantial portion of that revenue, underscoring their market dominance and ability to influence pricing and terms.

This concentrated market power allows cloud providers to dictate terms regarding service level agreements (SLAs), pricing structures, and even data residency requirements, directly impacting Infotel's operational costs and profit margins. Any changes in their pricing models or service offerings can necessitate swift adjustments from Infotel, potentially affecting its ability to offer competitive pricing to its own clients.

Data and Information Service Providers

Infotel's reliance on specialized data and information service providers, especially for Big Data and analytics projects, can significantly impact its operational costs and project timelines. The uniqueness and proprietary nature of the data these suppliers offer can create a strong bargaining position for them. For instance, in 2024, the global Big Data market was valued at over $200 billion, with a significant portion driven by specialized data providers whose services are often critical for advanced analytics.

- Critical Data Dependency: Infotel's ability to deliver cutting-edge digital transformation and consulting services, particularly in Big Data, hinges on access to specialized information.

- Supplier Leverage: The uniqueness and scarcity of certain datasets empower these providers, potentially leading to higher costs for Infotel.

- Market Context: The growing demand for data analytics means suppliers are in a strong position, as evidenced by the continued expansion of the data services sector.

Intellectual Property and Licensing Partners

Infotel's reliance on intellectual property and licensing, particularly through its software offerings like Orlando and historical IBM royalties, positions its licensors as significant suppliers. If a substantial portion of Infotel's software revenue or core functionality is tied to licenses from dominant technology firms, these partners can exert considerable bargaining power. This leverage impacts Infotel through negotiated terms, renewal clauses, and royalty percentages, directly influencing the company's profitability and operational flexibility.

For instance, in 2024, many software companies experienced increased pressure on licensing fees as major technology providers consolidated their intellectual property portfolios. Companies that depend heavily on third-party licensed components often face renegotiations that can lead to higher costs or restricted usage, impacting their margins. Infotel's specific agreements with entities like IBM, if still active and substantial in 2024, would place those licensors in a strong position to dictate terms.

- Software Licensing Dependence: Infotel's software products, such as Orlando, may incorporate or rely on technologies licensed from other companies.

- IBM Royalties: Past or ongoing royalty agreements with firms like IBM highlight a potential dependency on external intellectual property, granting licensors bargaining power.

- Revenue Impact: The terms of these licensing agreements, including royalty rates and renewal conditions, directly affect Infotel's revenue streams and cost structure.

- Market Dynamics in 2024: The software licensing landscape in 2024 saw increased scrutiny and potential cost adjustments from major IP holders, impacting companies like Infotel that utilize licensed technologies.

Infotel's reliance on specialized IT talent, particularly in high-demand areas like AI and cybersecurity, grants these professionals significant bargaining power. The persistent global IT skills gap, evident throughout 2024, intensifies this, forcing Infotel to offer competitive compensation to attract and retain top talent, thereby increasing operational costs.

Infotel's dependence on a limited number of suppliers for critical software components or hardware can empower these vendors. When these suppliers offer proprietary technology, they can dictate pricing and licensing terms, directly impacting Infotel's cost of goods sold and product development timelines. For instance, a price hike on a vital SDK could reduce profit margins on Infotel's software products.

The bargaining power of major cloud providers like AWS, Azure, and Google Cloud is substantial due to their oligopolistic market share. In 2024, the global cloud market exceeded $600 billion, with these providers dominating revenue, allowing them to influence pricing and service terms, which directly affects Infotel's operational expenses.

Infotel's need for specialized data and information services for Big Data projects gives unique data providers leverage. The scarcity of certain datasets, critical for advanced analytics, positions these suppliers strongly, as seen in the over $200 billion Big Data market valuation in 2024, where specialized data was a key driver.

| Supplier Type | Infotel's Dependence | Supplier Bargaining Power Factor | 2024 Market Context | Impact on Infotel |

| IT Professionals | High demand for specialized skills (AI, Cybersecurity) | Global skills gap | Persistent talent scarcity | Increased recruitment and retention costs |

| Software/Hardware Vendors | Reliance on proprietary components | Proprietary technology | Limited alternatives for critical tools | Higher costs, potential development delays |

| Cloud Providers | Deepening reliance on cloud infrastructure | Oligopolistic market share | Over $600B global market | Influence on pricing, SLAs, impacting operational costs |

| Data/Information Services | Need for specialized Big Data | Uniqueness/scarcity of data | Over $200B Big Data market | Higher costs for critical analytics inputs |

| Intellectual Property Licensors | Dependence on licensed software/technologies (e.g., IBM royalties) | Dominant IP holders | Increased licensing scrutiny in 2024 | Impact on royalty rates, usage terms, and profitability |

What is included in the product

Uncovers key drivers of competition, customer influence, and market entry risks tailored to Infotel's position in the telecommunications sector.

Effortlessly identify and quantify competitive threats with customizable dashboards that highlight key pressure points.

Customers Bargaining Power

Infotel's customer base is heavily concentrated among large enterprises in key European sectors like banking, insurance, industry, and transport. This concentration means a significant portion of Infotel's revenue comes from a relatively small number of major clients.

These large accounts, due to their substantial purchasing power and the complexity of their long-term contracts, possess considerable leverage. They can effectively negotiate for better pricing, more favorable service level agreements, and other advantageous terms, which can put pressure on Infotel's profitability.

For instance, in 2024, it was reported that Infotel's top 10 clients accounted for over 60% of its total revenue, highlighting the significant bargaining power these major customers wield in shaping contract conditions and pricing structures.

While large clients certainly hold sway, Infotel's deeply integrated IT services and proprietary software, such as their Orlando platform for infrastructure management, can erect significant barriers to switching. These embedded solutions, often involving custom application development, create high switching costs for clients once a project is underway. This integration effectively dampens a customer's immediate ability to change providers, thereby lessening their bargaining power.

Many of Infotel's major clients, particularly in the banking and insurance sectors, boast robust internal IT departments. These sophisticated in-house capabilities allow them to develop and manage complex systems, understand technological nuances, and even perform certain IT functions independently.

This client-side IT proficiency significantly enhances their bargaining power. It enables them to rigorously evaluate Infotel's service offerings, negotiate pricing and terms with greater leverage, and critically, consider insourcing solutions if they deem it more cost-effective or strategically advantageous.

For instance, a significant portion of large financial institutions have dedicated teams for custom software development and infrastructure management. This internal expertise means they are not entirely reliant on external vendors like Infotel, giving them the upper hand in discussions and contract negotiations.

Demand for Digital Transformation and AI

The robust and escalating demand for digital transformation, cloud computing, and artificial intelligence (AI) solutions among businesses in 2024 and 2025 presents significant opportunities for Infotel. However, this very demand also means that clients are becoming more sophisticated and selective in their choices.

Customers in this dynamic market are increasingly focused on achieving a clear return on investment (ROI) and expect providers to deliver genuinely innovative solutions. This heightened client expectation places pressure on Infotel to consistently prove its value proposition and highlight its unique differentiators, which can subtly shift bargaining power in favor of the customer.

- Growing Market Demand: The global digital transformation market was projected to reach over $11.5 trillion by 2025, with AI adoption rates accelerating.

- Client Sophistication: Businesses are more informed about technology's potential and are less likely to accept generic offerings.

- ROI Focus: Clients are demanding quantifiable business outcomes from their technology investments.

- Innovation Expectations: Customers seek cutting-edge solutions that provide a competitive advantage.

Economic Sensitivity in Service Sector

Infotel's Services segment felt the economic pinch in 2024, with a noticeable downturn directly linked to broader economic headwinds. Major clients, including aerospace giant Airbus and automotive manufacturer Stellantis, scaled back their IT investments, a clear signal of how economic sensitivity impacts this sector. This retrenchment by key customers amplifies their bargaining power, as Infotel finds itself vying for a smaller pool of projects or projects with reduced scopes.

The reduced IT spending by large clients in 2024 directly translates to increased bargaining power for these customers. When economic uncertainty looms, clients are more inclined to postpone or decrease their IT expenditures, forcing service providers like Infotel to compete more aggressively on price and terms for fewer opportunities. This dynamic is particularly evident when major clients, such as Airbus and Stellantis, adjust their project pipelines in response to market conditions.

- Economic Downturn Impact: Infotel's Services revenue saw a decline in 2024 due to unfavorable economic conditions.

- Client Investment Reductions: Key clients like Airbus and Stellantis reduced their IT spending, impacting Infotel's project pipeline.

- Increased Customer Bargaining Power: Economic uncertainty empowers clients to negotiate harder for IT services, leading to potential price pressures and scope reductions for Infotel.

Infotel's bargaining power with its customers is significantly influenced by client concentration and the sophistication of its client base. Large enterprises, particularly in sectors like banking and insurance, represent a substantial portion of Infotel's revenue, granting them considerable leverage in negotiations. This leverage is amplified by clients' internal IT capabilities, which enable them to scrutinize offerings and consider insourcing.

The increasing demand for digital transformation and AI solutions in 2024 and 2025 means clients are more informed and focused on ROI, pushing Infotel to demonstrate clear value. Furthermore, economic headwinds in 2024 led key clients like Airbus and Stellantis to scale back IT investments, intensifying competition and empowering customers to negotiate harder for services.

| Factor | Impact on Customer Bargaining Power | Supporting Data/Examples (2024) |

|---|---|---|

| Client Concentration | High | Top 10 clients accounted for >60% of revenue. |

| Client IT Sophistication | High | Financial institutions possess robust internal IT departments. |

| Market Demand & Client Expectations | Increasing | Focus on ROI and innovation for digital transformation services. |

| Economic Conditions | Increased | Clients like Airbus and Stellantis reduced IT spending due to economic headwinds. |

What You See Is What You Get

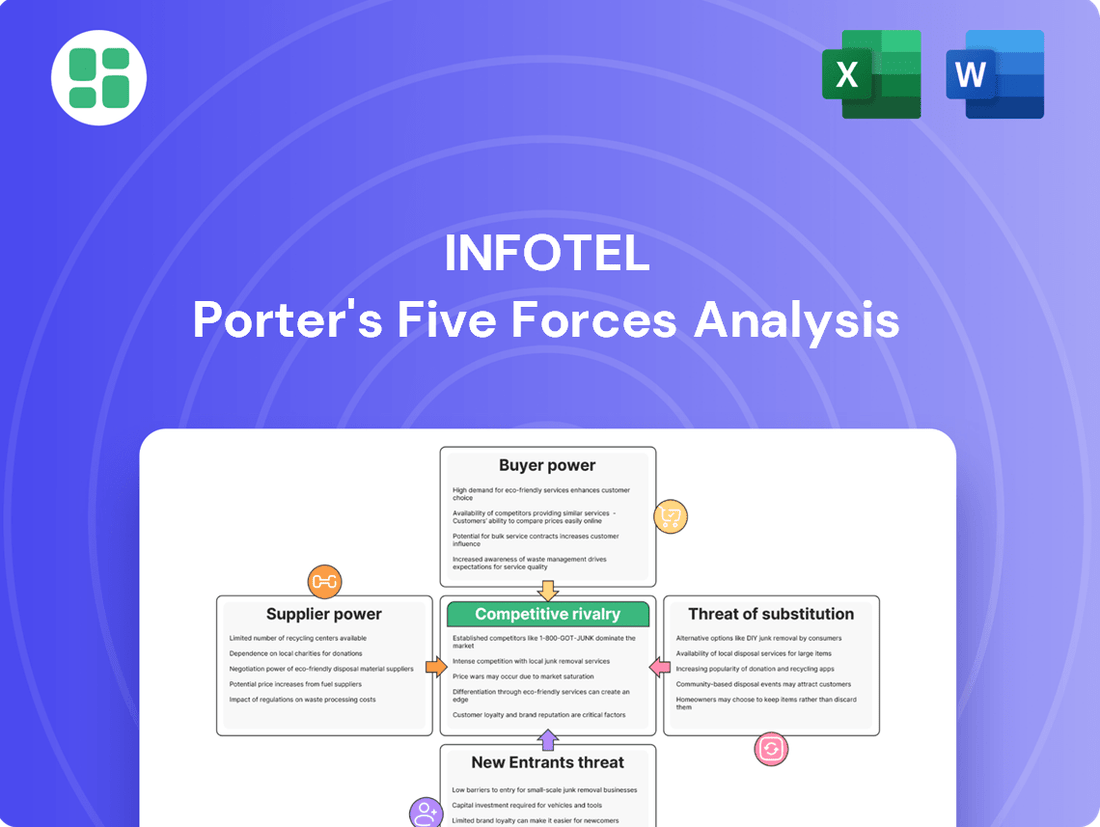

Infotel Porter's Five Forces Analysis

This preview displays the complete Infotel Porter's Five Forces Analysis, offering a thorough examination of the competitive landscape. The document you see here is precisely the same professionally formatted and ready-to-use analysis you'll receive immediately after purchase, ensuring no discrepancies or missing information.

Rivalry Among Competitors

The IT services and software publishing sectors are characterized by significant fragmentation, featuring a broad spectrum of competitors from global consultancies to highly specialized niche providers. This wide array of players means Infotel, despite its strong position as a digital transformation partner for major European clients, encounters a diverse competitive landscape across its various service lines and software products, thereby amplifying the intensity of rivalry.

Infotel faces intense competition from large, established global IT service providers and software companies. These giants, often publicly traded, possess significant advantages in terms of scale, worldwide presence, and substantial capital for research and development and strategic acquisitions. For instance, companies like ATOS Integration are direct rivals, actively competing in the lucrative digital transformation market, offering a wide array of services that mirror Infotel's core offerings.

Beyond the major tech consultancies, Infotel contends with a rising tide of niche players. These smaller, often AI-focused firms can undercut larger competitors on price and speed, particularly for specialized tasks. For instance, in the financial services sector, companies like iMocha provide targeted IT consulting and software solutions for banking, insurance, and fintech, offering a more focused alternative to broad-spectrum consultancies.

Price and Value-Based Competition

While Infotel aims to differentiate through expertise and digital transformation for its larger clients, the broader IT services landscape is characterized by fierce price competition, particularly for more standardized offerings. Many businesses are keenly focused on managing their IT expenditures, creating a constant need for service providers to offer compelling value propositions that justify their costs.

This dynamic forces companies like Infotel to carefully calibrate their pricing strategies. They must strike a delicate balance between remaining competitive on price, especially for less specialized services, and clearly demonstrating the superior value and outcomes they deliver to clients. For instance, in 2023, the global IT services market experienced significant growth, but reports indicated that price sensitivity remained a key client concern across various segments.

- Intense Price Pressure: The IT services market often sees aggressive pricing, especially for commoditized services like basic IT support or managed infrastructure.

- Value Demonstration: Clients increasingly scrutinize IT spending, demanding clear evidence of return on investment and tangible business benefits to justify costs.

- Balancing Act: IT service providers must navigate the challenge of offering competitive pricing without compromising the quality and specialized expertise that clients ultimately seek.

Talent Acquisition and Retention

The IT services sector is intensely competitive, with a significant portion of this rivalry stemming from the ongoing battle for skilled professionals, especially in burgeoning fields like artificial intelligence and cybersecurity. Companies are actively engaged in aggressive recruitment drives, making the ability to attract and keep top-tier talent a direct determinant of a firm's project delivery capabilities and its potential for innovation.

This talent war directly fuels the competitive landscape. For instance, in 2024, the demand for AI specialists saw salary increases of up to 20% in many regions, intensifying the pressure on companies to offer compelling compensation and benefits packages. Firms that excel at talent acquisition and retention are better positioned to secure lucrative contracts and maintain a competitive edge.

- Talent as a Differentiator: In 2024, companies reported that the availability of specialized skills, particularly in cloud computing and data analytics, was a key factor in winning new business.

- Retention Challenges: High employee turnover rates, averaging 15-20% annually in some IT service segments in 2024, force competitors to constantly invest in recruitment and training, increasing operational costs.

- Impact on Innovation: The ability to retain engineers and developers working on cutting-edge projects directly correlates with a company's capacity to bring new services and solutions to market faster than rivals.

The competitive rivalry within the IT services and software publishing sectors is fierce, driven by a fragmented market populated by global giants, specialized niche players, and emerging tech firms. This intense competition means Infotel must constantly innovate and offer compelling value to stand out.

Price sensitivity remains a significant factor for clients in 2024, forcing IT service providers to balance cost-effectiveness with the delivery of high-quality, specialized solutions. The ongoing demand for digital transformation projects ensures a dynamic marketplace where differentiation is key.

The battle for top talent, particularly in areas like AI and cybersecurity, significantly impacts competitive dynamics. Companies that can attract and retain skilled professionals gain a distinct advantage in delivering projects and driving innovation, a trend strongly evident in 2024 salary trends.

| Competitor Type | Key Characteristics | Impact on Infotel |

|---|---|---|

| Global IT Consultancies (e.g., ATOS Integration) | Large scale, global presence, extensive R&D budgets | Direct competition on large-scale digital transformation projects; pressure on pricing and service breadth. |

| Niche IT Specialists (e.g., iMocha in FinTech) | Focused expertise, agility, often lower price points | Compete for specialized project segments; can offer faster, more cost-effective solutions for specific needs. |

| Emerging Tech Firms | Innovation in AI, cloud, cybersecurity; disruptive pricing | Challenge established players with new technologies; pressure Infotel to stay ahead in cutting-edge solutions. |

SSubstitutes Threaten

Large enterprises, Infotel's core clientele, frequently possess robust internal IT departments. These in-house capabilities allow them to develop software solutions or manage IT projects internally, directly substituting for Infotel's outsourcing services. This is particularly true for critical or proprietary business functions where companies prioritize direct control and data security.

For instance, a 2024 survey indicated that over 60% of Fortune 500 companies have expanded their internal IT headcount to handle a greater portion of their digital transformation initiatives, reducing reliance on external vendors for core development.

Generic or open-source software solutions present a significant threat to Infotel, especially for less specialized needs. For instance, the global open-source software market was valued at approximately $23.2 billion in 2023 and is projected to grow substantially. Clients may choose these alternatives for their lower cost or greater adaptability compared to Infotel's proprietary offerings.

Clients increasingly have access to a wide array of alternative consulting models. This includes engaging independent, highly specialized consultants or smaller boutique firms that can offer tailored expertise at potentially lower costs than larger, full-service providers. For instance, the IT freelance market has seen significant growth, with platforms connecting businesses to skilled professionals for specific project needs, offering flexibility and cost-efficiency.

The rise of the gig economy presents a substantial threat of substitutes for traditional digital transformation companies like Infotel. Businesses can now source talent for discrete tasks, such as cybersecurity audits or cloud migration planning, from a global pool of freelancers. This trend is amplified by the increasing accessibility of specialized skills through online marketplaces, allowing companies to assemble project teams on demand without the overhead of a large consulting firm.

Cloud-Native Platforms and Low-Code/No-Code Tools

The growing sophistication of cloud-native platforms and the proliferation of low-code/no-code solutions present a significant threat of substitutes for traditional IT service providers. These tools empower businesses to develop and deploy applications internally, diminishing the need for external development expertise. For instance, Gartner projected that by 2024, the low-code development market would reach $26.9 billion, indicating a substantial shift towards self-service application creation.

This trend, fueled by the ongoing digital transformation initiatives across industries, directly impacts the demand for conventional application development services. Companies are increasingly leveraging these platforms to accelerate innovation and reduce costs associated with outsourcing IT projects. The ability to build custom solutions rapidly without extensive coding knowledge lowers the barrier to entry for application development.

- Increased Client Self-Sufficiency: Cloud-native platforms and low-code/no-code tools enable clients to build and deploy applications with minimal reliance on external IT service providers.

- Reduced Demand for Traditional Services: This empowerment trend can lead to a decrease in the demand for traditional application development and maintenance services.

- Market Growth in Low-Code/No-Code: The low-code development market is experiencing robust growth, with projections indicating significant expansion in the coming years, underscoring the shift in how applications are built.

- Digital Transformation Driver: The ongoing digital transformation across businesses is a key catalyst for the adoption of these alternative development approaches.

Standardized SaaS Solutions

The rise of standardized Software-as-a-Service (SaaS) solutions presents a significant threat of substitution for Infotel's custom software and IT consulting services. As businesses seek more agile and cost-effective solutions, they may opt for readily available SaaS platforms that fulfill specific functions, bypassing the need for bespoke development or extensive consulting engagements. This trend is particularly pronounced in areas like customer relationship management (CRM) and enterprise resource planning (ERP), where mature SaaS offerings are abundant.

For instance, the global SaaS market was projected to reach over $200 billion in 2024, indicating a strong customer preference for these scalable and often subscription-based models. This widespread adoption means that even Infotel's proprietary software could face substitution if clients find that a combination of off-the-shelf SaaS products can effectively replace a significant portion of its integrated offering at a lower total cost of ownership.

- Market Shift: Growing client preference for cloud-based, subscription-model SaaS solutions over custom-built software.

- Cost Efficiency: Standardized SaaS often offers a lower entry cost and predictable operational expenses compared to bespoke solutions.

- Functionality Over Customization: Many businesses find that the broad functionality of leading SaaS platforms meets their needs without the expense of customization.

- Competitive Landscape: The increasing number of robust SaaS providers across various business functions intensifies the substitution threat.

The threat of substitutes for Infotel stems from clients building capabilities in-house, utilizing open-source solutions, or engaging with independent consultants. The increasing accessibility of low-code/no-code platforms and standardized SaaS offerings further empowers businesses to develop solutions internally, bypassing traditional IT outsourcing and consulting services. This shift can significantly reduce the demand for Infotel's core offerings.

| Substitute Category | Description | Impact on Infotel | 2024 Market Insight |

|---|---|---|---|

| In-house IT Development | Large enterprises leveraging their own IT departments for software creation and project management. | Directly replaces the need for external outsourcing services. | Over 60% of Fortune 500 companies expanded internal IT headcount in 2024 for digital transformation. |

| Open-Source Software | Freely available software solutions that can be adapted for various business needs. | Offers a lower-cost alternative to proprietary solutions, especially for less specialized functions. | Global open-source software market valued at ~$23.2 billion in 2023, with substantial projected growth. |

| Freelance & Boutique Consulting | Engaging independent specialists or smaller firms for tailored expertise. | Provides flexibility and potentially lower costs than larger, full-service providers. | Significant growth in the IT freelance market, connecting businesses with skilled professionals. |

| Low-Code/No-Code Platforms | Tools enabling internal application development with minimal coding. | Reduces reliance on external developers for custom application creation. | Gartner projected the low-code market to reach $26.9 billion by 2024. |

| Standardized SaaS Solutions | Off-the-shelf software platforms for specific business functions (e.g., CRM, ERP). | Can replace custom development and consulting by fulfilling needs with readily available, cost-effective options. | Global SaaS market projected to exceed $200 billion in 2024. |

Entrants Threaten

While the IT services sector can be relatively accessible, Infotel's software publishing arm, featuring key products like Orlando, presents a formidable barrier to entry. This segment demands substantial upfront capital for extensive research and development, robust intellectual property safeguarding, and the significant costs associated with establishing market presence and brand recognition.

Infotel's strategic focus on large accounts within sensitive sectors like banking and insurance highlights the critical role of reputation and trust. New entrants aiming for these lucrative markets face a substantial hurdle in establishing the necessary credibility and a proven track record, especially for complex digital transformation initiatives. For instance, a 2024 report indicated that over 70% of financial institutions prioritize vendor stability and long-term partnership potential when selecting technology providers, underscoring the difficulty for newcomers to displace established players.

The ongoing shortage of skilled cybersecurity and IT professionals presents a significant barrier for new companies looking to enter the market. It's tough for them to quickly build a team with the expertise needed for complex digital transformation projects and specialized software development. For instance, in 2024, reports indicated a global deficit of millions of cybersecurity professionals, making it a costly and time-consuming endeavor for any newcomer to secure top talent.

Established companies like Infotel often possess a distinct advantage in talent acquisition and retention. They can leverage their brand reputation, existing employee benefits, and established career paths to attract and keep highly qualified individuals, further solidifying their competitive position against potential new entrants.

Regulatory and Compliance Complexity

Infotel's engagement in highly regulated sectors such as banking and insurance presents a formidable barrier to new entrants. Navigating and complying with intricate regulatory landscapes, including data privacy laws like GDPR and evolving financial reporting standards, demands substantial investment and specialized expertise. For instance, in 2024, the financial services industry saw continued increases in compliance spending, with many firms allocating over 10% of their IT budget to regulatory adherence alone.

The steep learning curve and significant upfront costs associated with meeting these stringent requirements act as a powerful deterrent. New companies must invest heavily in legal counsel, compliance officers, and robust technology infrastructure to ensure they operate within legal boundaries. This financial and operational burden makes it challenging for smaller or less capitalized players to compete effectively against established firms like Infotel, which have already absorbed these costs and developed institutional knowledge.

The threat of new entrants is therefore tempered by the sheer complexity and cost of regulatory compliance. Potential competitors must not only develop competitive technology and services but also demonstrate a proven ability to manage risk and adhere to a constantly evolving set of rules.

- High Compliance Costs: In 2023, the global cost of financial crime compliance was estimated to be over $200 billion annually, a figure expected to rise.

- Regulatory Expertise Gap: New entrants often lack the in-house legal and compliance teams that established players possess, creating a knowledge deficit.

- Data Security Mandates: Stringent data protection regulations require significant investment in secure infrastructure and ongoing audits, further increasing entry barriers.

- Capital Requirements: Many regulated industries have minimum capital requirements that new entrants must meet before they can even begin operations.

Network Effects and Ecosystem Lock-in

For established software like Infotel's Orlando, which serves over 50 airlines, network effects and ecosystem lock-in are significant deterrents to new entrants. The substantial costs associated with integration, specialized training, and data migration create a high barrier for airlines considering a switch. New software providers must offer demonstrably superior value to persuade clients to undertake such disruptive and expensive transitions.

The threat of new entrants is moderated by these factors:

- High Switching Costs: Airlines using Infotel's Orlando software face considerable expenses and operational disruptions when attempting to migrate to a new system.

- Data Integration Challenges: The complexity of integrating existing flight data, operational procedures, and historical records into a new platform is a major hurdle.

- Training and Familiarity: Existing staff are trained on Orlando, and retraining for a new system represents a significant investment in time and resources.

- Ecosystem Interdependencies: Orlando likely integrates with other airline systems, creating further lock-in and making a standalone replacement difficult without broader ecosystem changes.

The threat of new entrants in Infotel's market is significantly mitigated by substantial capital requirements, particularly in software development and market establishment. For instance, the global IT services market was valued at over $1.3 trillion in 2023, with software development alone representing a significant portion, demanding considerable upfront investment for research, talent, and marketing.

| Factor | Description | Impact on New Entrants | Infotel's Advantage |

| Capital Requirements | High R&D, marketing, and infrastructure costs | Significant barrier for undercapitalized firms | Established financial resources and scale |

| Brand Loyalty & Reputation | Trust built through years of service and successful projects | Difficulty in gaining initial customer trust | Strong brand recognition and client testimonials |

| Switching Costs | Integration complexity and training for existing clients | High cost and disruption for customers to switch | Deep integration into client workflows |

| Talent Acquisition | Scarcity of skilled IT and cybersecurity professionals | Challenging to build a competent team quickly | Attractive employer brand and competitive compensation |

Porter's Five Forces Analysis Data Sources

Our Infotel Porter's Five Forces analysis is built upon a robust foundation of data, integrating information from industry-specific market research reports, financial statements of key players, and publicly available company disclosures.