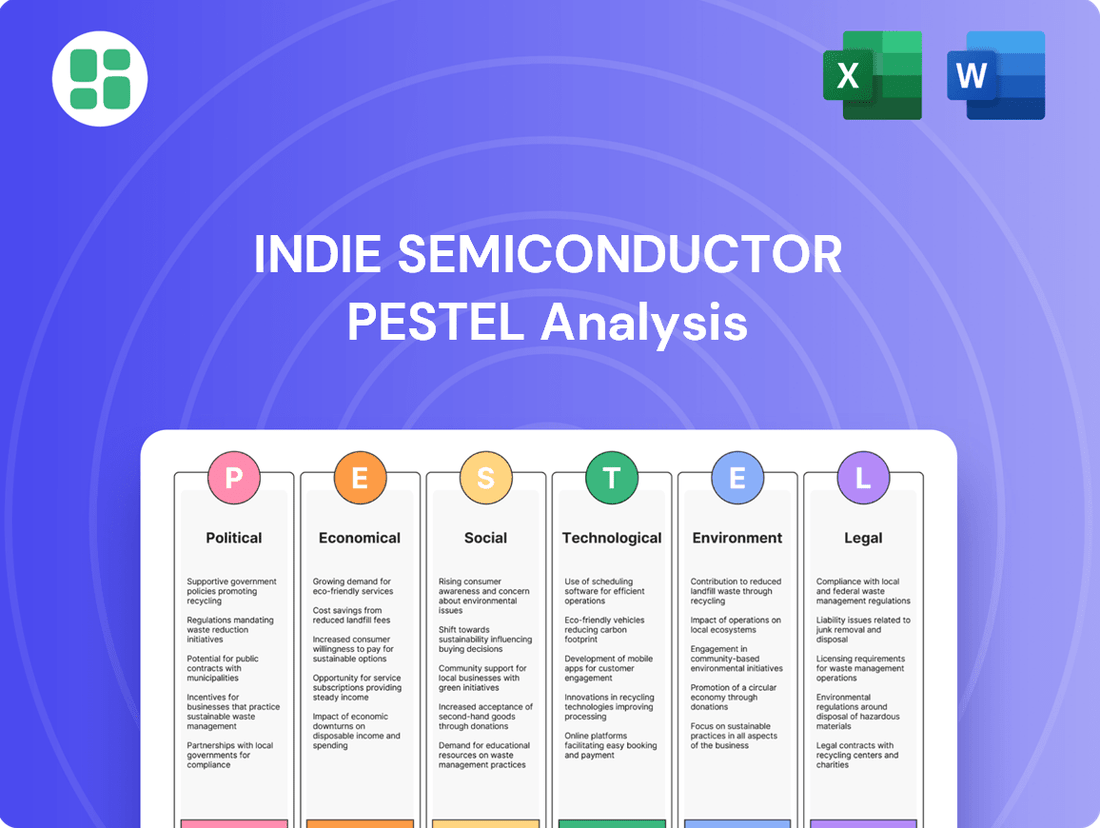

indie semiconductor PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

indie semiconductor Bundle

Uncover the critical political, economic, social, technological, legal, and environmental factors shaping indie semiconductor's landscape. This meticulously researched PESTLE analysis offers a strategic advantage, revealing opportunities and potential pitfalls. Equip yourself with the knowledge to navigate this dynamic industry—download the full version now and gain actionable intelligence.

Political factors

Governments globally are tightening vehicle safety standards, which directly fuels the market for advanced driver-assistance systems (ADAS) and autonomous driving technologies. For instance, the UNECE R155 regulation, focusing on automotive cybersecurity, sets specific design parameters for the semiconductors powering these systems.

This increasing regulatory focus on safety and cybersecurity presents a significant opportunity for companies like Indie Semiconductor. Their specialization in ADAS and autonomous driving solutions positions them well to capitalize on the growing demand for safer, more technologically advanced vehicles, driven by these governmental mandates.

Global trade policies and geopolitical tensions are major influences on indie Semiconductor. For instance, the US CHIPS Act, enacted in 2022 with significant funding allocated through 2024-2025, aims to boost domestic semiconductor manufacturing, potentially altering global supply chain dynamics and creating new opportunities or challenges for companies like indie Semiconductor.

Tariffs and export restrictions, particularly those impacting technology transfers between the US and China, directly affect the semiconductor industry. In 2023, the US expanded export controls on advanced semiconductor technology to China, a move that could increase costs and limit market access for companies involved in the global supply chain, including indie Semiconductor's potential partners or customers.

The trend of reshoring and nearshoring semiconductor production, driven by geopolitical concerns, is reshaping sourcing strategies. By 2025, significant investments are expected in new fabrication plants in the US and Europe, a shift that could redefine where indie Semiconductor sources its components and where it targets its market strategies.

Governments worldwide are actively promoting electric and autonomous vehicle adoption through various incentives. For instance, the U.S. Inflation Reduction Act of 2022 extended and modified tax credits for new and used EVs, aiming to boost consumer demand. Many countries are also providing significant grants for research and development in these sectors, fostering innovation in areas like advanced driver-assistance systems (ADAS) and vehicle-to-everything (V2X) communication, which directly benefit companies like indie Semiconductor.

Cybersecurity Regulations and National Security

The increasing interconnectedness of vehicles is a growing concern for national security, prompting the development of new cybersecurity regulations within the automotive sector. These regulations are designed to safeguard vehicles from sophisticated cyber threats.

A prime example is UNECE R155, which became mandatory for all newly manufactured vehicles starting in July 2024. This regulation mandates the implementation of comprehensive cybersecurity management systems, directly impacting how automotive components, including semiconductors, must be designed and secured.

This regulatory shift creates a significant market opportunity for companies like indie Semiconductor, which specialize in secure semiconductor solutions. The demand for chips that can meet these stringent cybersecurity standards is expected to rise substantially.

- UNECE R155 Mandatory: All new vehicles must comply from July 2024.

- National Security Focus: Regulations aim to protect connected vehicles from cyberattacks.

- Demand for Secure Chips: indie Semiconductor is positioned to benefit from this trend.

Data Privacy Legislation

Governments worldwide are implementing robust data privacy legislation, impacting how connected car data is handled. Regulations like the EU's General Data Protection Regulation (GDPR) and California's Consumer Privacy Act (CCPA) set strict rules for data collection, processing, and consent, directly affecting the automotive sector.

New legislation, such as the proposed Auto Data Privacy and Autonomy Act in the United States, aims to grant consumers greater authority over their vehicle data. This means companies must secure explicit consent for any data collection or sharing, a critical consideration for semiconductor providers like Indie Semiconductor.

Indie Semiconductor, by providing components for advanced driver-assistance systems (ADAS) and connected car functionalities, must ensure its technology facilitates adherence to these increasingly stringent privacy mandates. This includes building in capabilities for granular user consent and secure data management.

- Data Privacy Laws: GDPR and CCPA are setting global standards for data protection, influencing automotive data handling.

- Consumer Control: Proposed US legislation, like the Auto Data Privacy Act, emphasizes consumer consent for vehicle data usage.

- Indie Semiconductor's Role: Enabling compliance with these privacy frameworks is essential for components used in connected vehicles.

Governmental mandates for vehicle safety and cybersecurity, such as the mandatory UNECE R155 regulation from July 2024, directly drive demand for advanced automotive semiconductors. This regulatory push, alongside national security concerns regarding connected vehicles, creates a significant market for companies like Indie Semiconductor that specialize in secure solutions.

Global trade policies, exemplified by the US CHIPS Act (2022-2025 funding) and expanded export controls in 2023, are reshaping semiconductor supply chains. These geopolitical shifts, coupled with reshoring initiatives, influence where companies like Indie Semiconductor source components and target their market strategies, with substantial new fabrication plant investments expected in the US and Europe by 2025.

Government incentives promoting electric and autonomous vehicle adoption, like the US Inflation Reduction Act's EV tax credits, bolster consumer demand. Furthermore, R&D grants foster innovation in critical areas such as ADAS and V2X, directly benefiting companies like Indie Semiconductor.

The increasing focus on data privacy, with regulations like GDPR and CCPA influencing automotive data handling, necessitates that semiconductor providers enable compliance. Legislation like the proposed US Auto Data Privacy Act further emphasizes consumer control, requiring explicit consent for vehicle data usage, a key consideration for Indie Semiconductor's technologies.

What is included in the product

This PESTLE analysis offers a comprehensive examination of the external macro-environmental factors impacting the indie semiconductor industry, covering Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It provides actionable insights for strategic decision-making, helping stakeholders navigate industry challenges and capitalize on emerging opportunities.

A PESTLE analysis for indie semiconductors offers a strategic roadmap by identifying and mitigating external risks, thereby alleviating the pain of unpredictable market shifts and regulatory hurdles.

Economic factors

The global automotive market's performance is a key economic factor for indie Semiconductor. While 2024 showed positive growth, projections for 2025 suggest a more measured recovery, with global light vehicle sales anticipated to increase by 1.7% to 89.6 million units.

Despite potential market fluctuations, indie Semiconductor demonstrates resilience, evidenced by its substantial $7.1 billion backlog. This strong order book is largely fueled by the increasing demand for electric vehicles (EVs) and autonomous vehicles (AVs), sectors where indie's semiconductor solutions are critical.

The semiconductor industry is inherently cyclical, experiencing booms and busts. Following strong growth in 2024, the market is projected to expand further, reaching an estimated $697 billion in 2025, marking an 11% increase. This upward trend presents opportunities for companies like Indie Semiconductor.

As a fabless semiconductor company, Indie Semiconductor's success is tied to these industry-wide cycles. While overall market growth is beneficial, the company must also be prepared for potential inventory adjustments in sectors such as automotive, which can experience demand fluctuations.

As a fabless semiconductor company, indie Semiconductor's reliance on external foundries makes it vulnerable to the rising costs of raw materials, such as silicon wafers and specialized chemicals. These costs directly impact indie's manufacturing expenses and, consequently, its profitability. For instance, the average price of a 300mm silicon wafer saw a notable increase in 2023, impacting the entire industry.

Supply chain resilience is paramount for indie Semiconductor, especially given the global chip shortage that persisted through much of 2022 and into 2023, driven by increased demand and geopolitical factors. Ensuring a stable and predictable flow of components from foundries and other suppliers is crucial to meet customer demand and avoid production delays. The Semiconductor Industry Association (SIA) reported that global semiconductor sales reached $583.5 billion in 2023, underscoring the high demand but also the potential for supply chain bottlenecks.

Inflation, Interest Rates, and Consumer Affordability

Inflation and interest rate shifts significantly influence consumer spending on big-ticket items like vehicles, directly impacting demand for automotive semiconductors. For instance, the US Consumer Price Index (CPI) saw a notable increase, with annual inflation rates fluctuating around 3.0% to 3.5% in late 2024 and early 2025, though moderating from earlier peaks. This persistent inflationary pressure erodes purchasing power.

The Federal Reserve's monetary policy, particularly its benchmark interest rate, plays a crucial role. By mid-2025, interest rates were projected to remain elevated, potentially around 4.5% to 5.0% for the federal funds rate, making auto loans considerably more expensive. This increased cost of financing can deter consumers from purchasing new vehicles, especially those equipped with advanced, higher-priced semiconductor technologies.

Consequently, the demand for advanced automotive semiconductors could face headwinds. Even as auto manufacturers address inventory shortages, a slowdown in new vehicle sales due to affordability concerns might temper the uptake of cutting-edge features reliant on these chips. This creates a complex dynamic for semiconductor suppliers in the automotive sector.

- Inflationary Pressures: US annual inflation, while easing from previous highs, remained a factor in late 2024 and early 2025, impacting consumer budgets.

- Elevated Interest Rates: Federal Reserve rates, anticipated to hover around 4.5%-5.0% by mid-2025, increase the cost of auto financing.

- Affordability Concerns: Higher loan costs can dampen consumer appetite for new vehicles, particularly those with advanced, costly semiconductor components.

- Demand Impact: Reduced new vehicle sales could translate to slower adoption of next-generation automotive semiconductors, despite improving vehicle production.

Investment in Next-Generation Automotive Technologies

Automotive original equipment manufacturers (OEMs) and Tier 1 suppliers are making substantial investments in electric vehicles (EVs), autonomous driving (AD), and connected car technologies. This surge in R&D and production directly translates into increased demand for indie Semiconductor's specialized semiconductor solutions. The automotive sector's commitment to these next-generation platforms is a primary driver for the company's growth.

The automotive semiconductor market is experiencing robust expansion, with projections indicating it will reach $67.42 billion by 2025. This growth is underpinned by an impressive 11.3% compound annual growth rate (CAGR), fueled by the very automotive trends indie Semiconductor targets. This significant market expansion highlights a favorable environment for companies supplying critical components.

- Automotive semiconductor market growth: Projected to reach $67.42 billion by 2025.

- CAGR: Expected at 11.3% for the automotive semiconductor market.

- Key demand drivers: Electric vehicles, autonomous driving, and connected car technologies.

- indie Semiconductor's focus: Advanced Driver-Assistance Systems (ADAS), autonomous driving, and in-cabin user experience.

Economic factors present a mixed outlook for indie Semiconductor. While the global automotive market is expected to see a modest 1.7% growth to 89.6 million units in 2025, persistent inflation and elevated interest rates, projected around 4.5%-5.0% for the federal funds rate by mid-2025, could dampen consumer demand for new vehicles, impacting sales of advanced semiconductor features.

Despite these challenges, the semiconductor industry itself is projected for strong growth, with the overall market expected to reach $697 billion in 2025, an 11% increase. This broader industry expansion, coupled with indie Semiconductor's substantial $7.1 billion backlog driven by EV and AV demand, positions the company to benefit from these trends.

The automotive semiconductor market specifically is a significant growth area, anticipated to reach $67.42 billion by 2025 with an 11.3% CAGR. This is directly fueled by OEM investments in EVs, AD, and connected car technologies, which are core to indie Semiconductor's product strategy.

| Economic Factor | 2024/2025 Projection | Impact on indie Semiconductor |

|---|---|---|

| Global Light Vehicle Sales | 1.7% growth to 89.6 million units (2025) | Moderate demand driver, but potential for consumer spending constraints. |

| Global Semiconductor Market Growth | 11% increase to $697 billion (2025) | Overall positive industry trend benefiting semiconductor suppliers. |

| Automotive Semiconductor Market Growth | 11.3% CAGR to $67.42 billion (2025) | Strong growth area directly aligned with indie's focus. |

| US Inflation Rate | Around 3.0%-3.5% (late 2024/early 2025) | Erodes consumer purchasing power, potentially affecting vehicle affordability. |

| Federal Funds Rate | Projected 4.5%-5.0% (mid-2025) | Increases auto loan costs, potentially reducing demand for feature-rich vehicles. |

Same Document Delivered

indie semiconductor PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use for your indie semiconductor PESTLE analysis.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises, detailing the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the indie semiconductor market.

The content and structure shown in the preview is the same document you’ll download after payment, providing a comprehensive PESTLE analysis for indie semiconductor businesses.

Sociological factors

Consumers increasingly desire vehicles that offer enhanced safety and intelligent features. This trend fuels the demand for technologies like advanced driver-assistance systems (ADAS) and autonomous driving capabilities, creating a direct market for indie Semiconductor's edge sensors and integrated circuits. For instance, a 2024 survey indicated that over 70% of car buyers consider advanced safety features a top priority when purchasing a new vehicle.

This societal shift towards prioritizing safety and convenience translates into a higher demand for sophisticated in-cabin experiences and connectivity. People want their cars to be not just transportation, but extensions of their digital lives, making the semiconductor components that enable these features crucial. The global market for automotive semiconductors, which includes components for ADAS and infotainment, is projected to reach over $100 billion by 2025, highlighting the significant growth opportunity.

Consumer trust and the speed of adoption for Advanced Driver-Assistance Systems (ADAS) and fully autonomous driving features directly impact the market for indie Semiconductor's advanced chip solutions. While surveys from 2024 indicate strong consumer interest in ADAS features like adaptive cruise control, actual purchase decisions are often tempered by price points and concerns about system reliability. For instance, a late 2024 consumer survey revealed that over 70% of potential car buyers found ADAS features appealing, but only 30% were willing to pay a significant premium for them.

As vehicles increasingly integrate with digital ecosystems, collecting extensive personal data, consumer privacy concerns are growing significantly. A significant portion of consumers express worries about the types of data their connected cars gather, ranging from driving habits to location history.

Modern vehicles are often described as surveillance devices on wheels, capable of collecting highly sensitive information. This includes details about occupants, destinations, and even in-car conversations, raising serious privacy implications for users.

For Indie Semiconductor, addressing these escalating privacy concerns is paramount. Ensuring their semiconductor solutions inherently support robust data protection and anonymization within connected car systems is crucial for building consumer trust and maintaining market relevance in the evolving automotive landscape.

Demographic Shifts and Urbanization

Global demographic shifts, particularly the ongoing trend of urbanization, are reshaping mobility demands. By 2050, it's projected that 68% of the world's population will live in urban areas, a significant increase from today's figures. This concentration of people in cities fuels the need for efficient, safe, and often automated transportation solutions.

These evolving commuting patterns directly impact the automotive industry's focus. Semiconductor companies like Indie Semiconductor, which supply critical components for vehicles, must adapt their product development roadmaps to align with the growing demand for electric vehicles (EVs), advanced driver-assistance systems (ADAS), and connected car technologies that enhance urban mobility.

- Urbanization: Over half the world's population now resides in cities, a figure expected to climb to nearly 70% by 2050, driving demand for specialized urban transport.

- Mobility Solutions: Increased urban density necessitates innovations in shared mobility, micro-mobility, and intelligent traffic management systems, all reliant on advanced semiconductors.

- Automotive Technology Focus: The shift towards cleaner and smarter urban transport is accelerating the adoption of EVs and autonomous driving features, creating new market opportunities for semiconductor suppliers.

Sustainability and Environmental Consciousness

Growing global concern for environmental issues and sustainability is significantly shaping consumer preferences, driving demand for greener vehicles and manufacturing methods. This trend directly impacts the automotive sector, where a strong push towards emissions reduction and sustainable practices, particularly in electric vehicle (EV) adoption, resonates with consumer values. Indie Semiconductor, though a fabless company, benefits from its partners' and the wider automotive industry's dedication to these eco-friendly initiatives.

Indie Semiconductor's 2024 ESG report underscores its dedication to environmental stewardship, aligning its operations with the increasing demand for sustainable solutions. This commitment is crucial as the automotive industry navigates the transition to electrification and environmentally conscious production.

- Consumer Demand: A 2024 Deloitte survey indicated that 70% of consumers consider environmental impact when purchasing a vehicle, a significant increase from previous years.

- EV Market Growth: The global EV market is projected to reach over $1.5 trillion by 2030, reflecting a strong consumer shift towards sustainable transportation.

- Industry Partnerships: Indie Semiconductor's collaborations with major automotive manufacturers who are setting ambitious emissions reduction targets (e.g., many aiming for 100% EV sales by 2035) positions them favorably within this evolving landscape.

Societal expectations are increasingly focused on vehicle safety and intelligent features, directly boosting demand for technologies like advanced driver-assistance systems (ADAS). Consumer surveys from 2024 consistently show over 70% of car buyers prioritizing these safety enhancements. This societal shift fuels the market for indie Semiconductor's edge sensors and integrated circuits, essential for enabling these advanced automotive functionalities.

Technological factors

The accelerating pace of AI and machine learning is profoundly reshaping the automotive sector, especially in autonomous driving and advanced driver-assistance systems (ADAS). Indie Semiconductor's core competencies in computer vision and sensor fusion are directly amplified by these trends, necessitating more robust and energy-efficient AI-enabled silicon for real-time data processing.

The demand for sophisticated AI processing in vehicles is projected for significant growth. For instance, the global automotive AI market was valued at approximately $8.5 billion in 2023 and is expected to reach over $40 billion by 2030, demonstrating a compound annual growth rate of around 25%. This surge underscores the critical role of AI integration in driving next-generation semiconductor innovation.

The relentless advancement in sensor technologies like radar, lidar, ultrasound, and computer vision is a cornerstone for improving vehicle perception and safety. Indie Semiconductor's core business thrives on this evolution, focusing on creating more precise, smaller, and affordable edge sensor solutions.

These ongoing technological leaps directly translate into more dependable Advanced Driver-Assistance Systems (ADAS) and fully autonomous driving capabilities. For instance, lidar unit costs have seen significant reductions, with some automotive-grade lidar sensors now priced below $500, a stark contrast to earlier models costing thousands, making them more accessible for widespread adoption.

Next-generation vehicles, particularly electric ones, are pushing the boundaries of semiconductor capabilities. Autonomous driving systems, for instance, require immense processing power to interpret sensor data in real-time. Simultaneously, extending the range of electric vehicles (EVs) and managing heat dissipation necessitates exceptional energy efficiency in the chips powering these systems.

Indie Semiconductor is navigating this complex landscape by focusing on mixed-signal System-on-Chips (SoCs) that deliver both high performance and energy savings. This constant demand for innovation fuels advancements in chip architecture and design methodologies, ensuring their products meet the stringent requirements of the automotive sector.

The automotive semiconductor market is projected for robust growth, with analysts forecasting it to reach over $100 billion by 2027, driven largely by ADAS and electrification trends. This underscores the critical need for companies like Indie Semiconductor to deliver cutting-edge solutions that balance power and efficiency.

Software-Defined Vehicles (SDVs) and Over-the-Air (OTA) Updates

The automotive industry's pivot to Software-Defined Vehicles (SDVs) is fundamentally reshaping semiconductor requirements. SDVs leverage software to control vehicle functions, allowing for Over-the-Air (OTA) updates that deliver new features and critical security patches directly to the car. This necessitates semiconductor solutions capable of seamless software integration, robust security protocols, and efficient update delivery mechanisms.

This technological evolution is driving significant market expansion. Analysts project the SDV market to surge, with an estimated 7.6 million units expected to be on the road by 2025. This growth directly translates to increased demand for advanced semiconductors designed to support these complex, software-centric automotive architectures.

- SDV Growth: The market for Software-Defined Vehicles is projected to reach 7.6 million units by 2025.

- Semiconductor Impact: Chips must support advanced software integration, secure communication, and efficient OTA update capabilities.

- Feature Enhancement: OTA updates enable continuous improvement of vehicle performance and user experience through software.

- Security Focus: Robust software and hardware are crucial for protecting SDVs from cyber threats via secure OTA updates.

Cybersecurity Threats and Solutions for Connected Vehicles

As vehicles become more connected, they are increasingly vulnerable to cyberattacks, creating a significant cybersecurity gap in the automotive industry. This necessitates advanced cybersecurity solutions embedded within both hardware and software to protect against malicious actors.

Indie Semiconductor's position, providing integrated circuits for connected car applications, places a critical emphasis on security-by-design. Its products must actively contribute to the overall cybersecurity posture of vehicles, mitigating risks associated with increasingly sophisticated threats.

- Growing Threat Landscape: By 2025, the automotive cybersecurity market is projected to reach $10.2 billion, highlighting the escalating need for robust defenses against cyberattacks targeting connected vehicles.

- Indie's Role: Indie Semiconductor's silicon solutions are integral to enabling advanced driver-assistance systems (ADAS) and infotainment, areas that are prime targets for cyber intrusions.

- Security Integration: The company's focus on hardware-based security features, such as secure boot and hardware security modules (HSMs), is crucial for building trust and resilience in the connected automotive ecosystem.

The increasing sophistication of vehicle electronics, driven by AI and connectivity, demands advanced semiconductor solutions. Indie Semiconductor's focus on mixed-signal SoCs for automotive applications directly addresses this, needing to deliver both high performance for AI processing and energy efficiency for EVs. The global automotive semiconductor market is expected to exceed $100 billion by 2027, with ADAS and electrification being key drivers.

Software-Defined Vehicles (SDVs) are transforming automotive architecture, requiring semiconductors that support seamless software integration and secure Over-the-Air (OTA) updates. The SDV market is projected to grow significantly, with an estimated 7.6 million units on the road by 2025, boosting demand for such advanced chips. This shift necessitates robust hardware-software co-design for enhanced vehicle functionality and user experience.

Cybersecurity is paramount in connected vehicles, creating a need for integrated hardware and software security solutions. Indie Semiconductor's role in providing ICs for connected car applications means its products must incorporate strong security features to protect against evolving threats. The automotive cybersecurity market is anticipated to reach $10.2 billion by 2025, underscoring the critical importance of security-by-design in automotive semiconductors.

Legal factors

Adherence to stringent automotive safety standards, like ISO 26262 for functional safety, is absolutely crucial for indie Semiconductor. Their components are integral to advanced driver-assistance systems (ADAS) and autonomous driving, meaning they need to meet high Automotive Safety Integrity Levels (ASIL).

Indie Semiconductor recently showcased this commitment by launching a new chip specifically designed with safety integrated, and it's certified to ASIL-D. This certification is a significant legal and industry benchmark, underscoring the company's dedication to producing reliable and safe automotive electronics.

Indie Semiconductor, like all companies in the automotive tech sector, must navigate a complex web of data privacy regulations. Laws such as the GDPR in Europe and the CCPA in California dictate how personal data, including that generated by connected vehicles, can be collected, processed, and stored. This means Indie Semiconductor needs robust systems to ensure user consent and data security are paramount for its automotive clients.

The evolving regulatory environment presents ongoing challenges and opportunities. For instance, proposed legislation like the Car Privacy Rights Act of 2024, expected to see significant debate in 2024 and potential passage in 2025, aims to give consumers even greater control over their vehicle data. This will likely push for more transparency and stricter data handling protocols across the industry, influencing how Indie Semiconductor designs and implements its solutions.

Intellectual property laws are paramount for indie Semiconductor, especially concerning its innovative integrated circuit designs. Strong patent protection is essential to maintain its competitive advantage in the fast-paced semiconductor market, preventing rivals from copying its technology. This focus on IP safeguards against reverse engineering and unauthorized reproduction of its proprietary chip architectures.

Product Liability and Warranty Laws

As a supplier of semiconductors crucial for automotive systems, indie Semiconductor operates under stringent product liability and warranty laws. Any defect in their chips that compromises vehicle safety, such as in advanced driver-assistance systems (ADAS), could lead to substantial legal claims and financial penalties.

The automotive industry, in particular, has rigorous standards for component reliability. For instance, in 2023, the automotive sector saw a significant number of recalls related to electronic component failures, highlighting the critical nature of semiconductor quality. indie Semiconductor's commitment to robust quality control and comprehensive testing is therefore paramount to avoid costly litigation and maintain customer trust.

- Product Liability: indie Semiconductor faces potential liability for damages caused by defective semiconductor products, especially in safety-critical automotive applications.

- Warranty Provisions: Clear and compliant warranty terms are essential to manage customer expectations and limit exposure to claims arising from component malfunctions.

- Regulatory Scrutiny: Increased focus on automotive safety and cybersecurity means heightened scrutiny of component suppliers' adherence to industry standards and regulations.

- Mitigation Strategies: Implementing rigorous testing, comprehensive quality assurance, and transparent warranty policies are key to mitigating legal and financial risks associated with product defects.

International Trade Laws and Sanctions

Compliance with international trade laws, export controls, and sanctions is absolutely crucial for indie Semiconductor's global business. Failure to adhere can lead to significant penalties and operational disruptions.

Restrictions on technology transfer, particularly for advanced semiconductor manufacturing, directly affect indie Semiconductor's access to necessary materials and its ability to sell products in key regions. For instance, the US Department of Commerce's Bureau of Industry and Security (BIS) continually updates its Entity List, impacting companies involved in advanced technology exports. As of late 2024, these regulations are becoming increasingly stringent, especially concerning AI-related hardware.

Geopolitical shifts and evolving trade policies necessitate constant vigilance and strategic adaptation. The ongoing trade tensions between major economic blocs mean that indie Semiconductor must be prepared to navigate a dynamic regulatory landscape. This requires proactive risk assessment and flexible supply chain management to mitigate potential impacts.

- Export Controls: Adherence to regulations like those from the BIS is paramount, impacting the transfer of advanced semiconductor technologies.

- Sanctions Compliance: Monitoring and complying with international sanctions regimes is vital to avoid legal repercussions and maintain market access.

- Geopolitical Impact: Evolving trade policies and international relations directly influence market access and supply chain stability for companies like indie Semiconductor.

- Technology Transfer Restrictions: Limitations on the movement of advanced semiconductor manufacturing knowledge and equipment can significantly shape business strategy and operational capabilities.

Indie Semiconductor must navigate evolving data privacy laws, such as GDPR and CCPA, which govern how vehicle data is handled, impacting their clients' compliance. The potential passage of legislation like the Car Privacy Rights Act of 2024 will likely enforce greater transparency and stricter data protocols for automotive electronics suppliers.

Environmental factors

Stringent vehicle emissions standards, like the U.S. Environmental Protection Agency's (EPA) proposed rules for 2027 and beyond, are a major catalyst for the automotive industry's transition to electric and hybrid powertrains. These regulations are designed to significantly cut greenhouse gas emissions and air pollutants from new vehicles.

This regulatory push directly translates into increased demand for the advanced semiconductors that enable electrification. Specifically, power management chips, crucial for battery efficiency and electric motor control, are becoming indispensable. indie Semiconductor's strategic focus on these highly efficient and sustainable automotive semiconductor solutions positions them favorably to capitalize on this accelerating market shift.

While indie Semiconductor operates on a fabless model, its reliance on foundry partners means it's indirectly impacted by the significant environmental footprint of chip manufacturing. These processes are notoriously water-intensive and energy-consuming, with substantial waste generation also being a concern.

Growing global awareness of climate change and resource scarcity is pushing the semiconductor industry, including companies like indie Semiconductor, to prioritize sustainability. This trend is amplified by increasing regulatory scrutiny and investor demand for Environmental, Social, and Governance (ESG) performance.

Indie Semiconductor's commitment to ESG principles necessitates a proactive approach to its supply chain. The company actively works with its foundry partners to ensure they adhere to stringent environmental standards, aiming to mitigate the collective impact of chip production on the planet.

The growing amount of electronic components in cars presents a significant challenge for e-waste management when vehicles reach their end of life. For instance, by 2030, it's estimated that the global e-waste will reach 74 million metric tons annually, with a substantial portion coming from consumer electronics and vehicles.

While indie Semiconductor doesn't directly manage vehicle recycling, its design choices for automotive semiconductors can impact how easily these components can be repaired, refurbished, or have their materials recovered. This focus on design for disassembly and material selection is crucial for future recyclability.

The automotive industry is increasingly embracing circular economy principles, aiming to reduce waste and maximize resource utilization. This trend encourages a shift towards more sustainable product lifecycles, influencing how components like those from indie Semiconductor are integrated and managed throughout the vehicle's journey.

Resource Scarcity and Material Sourcing

The semiconductor industry's reliance on critical minerals like silicon, copper, and rare earth elements presents a significant environmental challenge. For instance, the extraction of rare earth minerals, crucial for certain advanced semiconductor components, can involve environmentally damaging processes. While indie semiconductor operates on a fabless model, its foundry partners must navigate these sourcing complexities. The increasing global demand for electronics, projected to reach trillions of dollars by 2025, intensifies the pressure on these limited resources.

Supply chain disruptions, whether due to geopolitical factors or environmental regulations impacting mining operations, can directly affect production costs and delivery schedules for foundries. For example, a significant portion of global rare earth supply originates from a limited number of countries, creating potential vulnerabilities. This underscores the growing importance for companies like indie semiconductor to encourage and prioritize sustainable and ethically sourced materials from their manufacturing partners to mitigate risks and ensure long-term production stability.

- Critical Minerals Dependency: Semiconductors require materials like silicon, copper, cobalt, and rare earth elements, the extraction of which can have environmental impacts.

- Supply Chain Vulnerabilities: Geopolitical concentration of key mineral extraction (e.g., rare earths) poses risks to consistent material availability for foundries.

- Ethical Sourcing Imperative: Growing consumer and regulatory pressure necessitates that foundry partners demonstrate responsible and sustainable material sourcing practices.

- Cost and Lead Time Impact: Scarcity or sourcing challenges for essential materials can directly translate to increased production costs and longer lead times for chip manufacturing.

Climate Change and Extreme Weather Impacts on Supply Chains

Climate change is increasingly manifesting as extreme weather events, posing significant threats to global supply chains, including the intricate network supporting the semiconductor industry. Floods, droughts, and severe storms in critical manufacturing or logistics hubs can directly impact production facilities, leading to component shortages and price volatility. For instance, the 2021 Texas freeze significantly disrupted chip production due to power outages affecting major fabrication plants. Indie Semiconductor, operating a fabless model, must proactively assess the climate resilience of its foundry partners and logistics providers to mitigate these risks.

The financial implications of these disruptions are substantial. A report from the World Economic Forum in early 2024 highlighted that supply chain disruptions, often exacerbated by climate-related events, cost the global economy an estimated $1.5 trillion in 2023 alone. This underscores the need for robust risk management strategies. Indie Semiconductor's ability to secure consistent supply of its advanced automotive-grade semiconductors hinges on the operational stability of its manufacturing partners, who are increasingly vulnerable to environmental shifts.

- Supply Chain Vulnerability: Extreme weather events like typhoons in Taiwan or droughts impacting water-intensive chip manufacturing processes can halt or slow production.

- Increased Costs: Disrupted supply chains lead to higher transportation costs and component prices, impacting profit margins.

- Operational Risk: Foundry partners’ reliance on stable power grids and water availability, both threatened by climate change, presents a direct operational risk for fabless companies like Indie Semiconductor.

The increasing demand for electric vehicles, driven by stringent emissions standards like the US EPA's proposed 2027 rules, directly fuels the need for advanced automotive semiconductors. This regulatory push highlights the environmental imperative for electrification, a market where indie Semiconductor is strategically positioned with its power management solutions.

The semiconductor manufacturing process itself is resource-intensive, with significant water and energy consumption, and waste generation. indie Semiconductor, as a fabless company, must ensure its foundry partners adhere to strict environmental standards to mitigate the collective ecological footprint of chip production.

Climate change poses a tangible threat to the semiconductor supply chain through extreme weather events, impacting production facilities and leading to price volatility. The estimated $1.5 trillion cost to the global economy from supply chain disruptions in 2023, often linked to climate events, underscores the critical need for resilience in manufacturing partnerships.

The industry's reliance on critical minerals, whose extraction can be environmentally damaging, along with supply chain vulnerabilities due to geopolitical concentration, necessitates a focus on ethical and sustainable sourcing from manufacturing partners.

PESTLE Analysis Data Sources

Our PESTLE Analysis for the indie semiconductor sector is built on a robust foundation of data from government patent offices, industry consortiums, and leading technology research firms. We incorporate economic reports from organizations like the Semiconductor Industry Association (SIA) and track geopolitical shifts through reputable news outlets and think tanks.