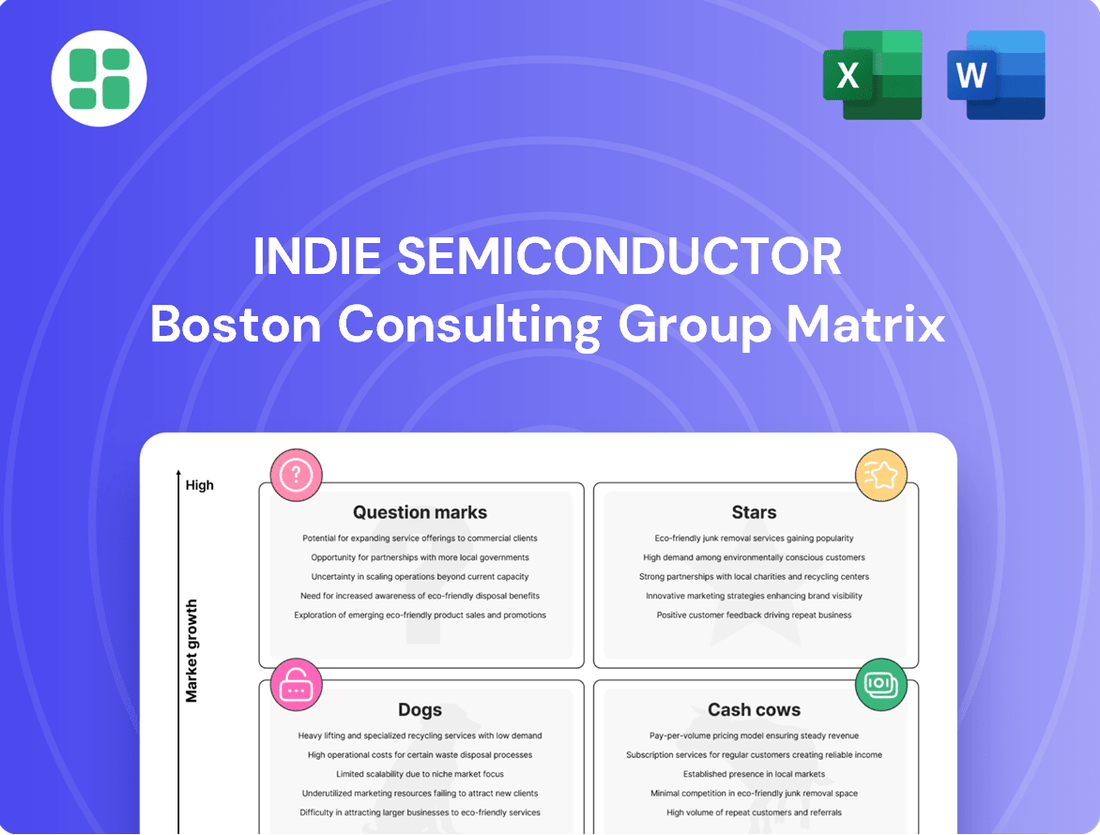

indie semiconductor Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

indie semiconductor Bundle

Curious about the indie semiconductor landscape? This BCG Matrix preview highlights key players, but the full report unlocks the strategic positioning of each company's product portfolio. Understand which innovations are poised for explosive growth and which require careful resource management.

Don't miss out on critical insights into this dynamic sector. Purchase the complete BCG Matrix to gain a comprehensive understanding of Stars, Cash Cows, Dogs, and Question Marks within the indie semiconductor market, empowering you to make informed investment and development decisions.

Stars

Indie Semiconductor's flagship ADAS radar solutions, specifically their 77 GHz offerings, are positioned strongly. These are currently in advanced design-in phases with a major Tier 1 automotive supplier, targeting multiple original equipment manufacturers (OEMs). Initial production orders and shipments are expected to commence by late 2025, signaling significant market entry.

The iND880 vision processor is a star in indie Semiconductor's portfolio, showcasing impressive growth and market potential. It has secured key design wins, including a significant in-cabin monitoring application with a European Tier 1 supplier for a North American automaker and an eMirror design for trucks and buses with a Korean OEM.

This processor's strength lies in its advanced capabilities, such as multi-channel support and superior image signal processing, positioning it as a leader in the expanding automotive computer vision market. These features contribute to its high market share potential in a dynamic and fast-paced sector.

indie Semiconductor's GW5 vision processor is making significant inroads with Chinese OEMs. The company has secured multiple design wins, including a notable partnership with Mercedes China for eMirror applications and BYD for in-cabin monitoring systems.

Production for these crucial applications is slated to commence in the fourth quarter of 2025. This strategic positioning in the rapidly expanding Chinese automotive market highlights the GW5 processor as a high-growth, high-market share product for indie Semiconductor.

Integrated Lidar Solutions (with SiLC Technologies)

The collaboration between indie semiconductor and SiLC Technologies is focused on creating advanced Frequency Modulated Continuous Wave (FMCW) lidar sensors. This partnership integrates indie's Surya System-on-Chip (SoC) with SiLC's lidar technology, targeting a tenfold enhancement in performance, power efficiency, and cost-effectiveness for autonomous vehicle systems.

While this integrated lidar solution is still in its development phase, its potential is significant. The autonomous vehicle market is experiencing rapid growth, and lidar is a critical component for enabling self-driving capabilities. This strategic alliance places indie semiconductor in a strong position to capture a substantial share of this expanding market once the technology is fully scaled and commercialized.

- Market Potential: The global lidar market for automotive applications was projected to reach $3.4 billion in 2023 and is expected to grow to $10.4 billion by 2030, at a compound annual growth rate (CAGR) of 17.2%.

- Technological Advancement: The integration aims for a 10x improvement in key metrics, addressing current limitations in lidar technology.

- Strategic Positioning: Partnership with SiLC Technologies leverages expertise in FMCW lidar, a key technology for future autonomous systems.

- Growth Trajectory: Positioned as a future Star in the BCG matrix due to high growth potential in the burgeoning autonomous driving sector.

High-Performance Electrification ASICs

Indie Semiconductor's high-performance electrification ASICs are positioned for significant growth within the electric vehicle (EV) market. These ASICs have achieved ASIL-D certification, the highest standard for functional safety, which is crucial for automotive applications. This certification, coupled with design wins in critical powertrain solutions, underscores a robust competitive edge and increasing market penetration in this rapidly expanding sector.

The company's electrification ASICs are foundational components for next-generation automotive architectures, demonstrating strong market traction. For instance, the automotive semiconductor market, a key indicator for indie's products, was projected to reach $110 billion in 2024, with electrification being a primary growth driver.

- ASIL-D Certification: Achieved the highest functional safety standard, vital for EV safety-critical systems.

- Powertrain Design Wins: Secured design wins in key electric vehicle powertrain solutions, indicating market acceptance.

- High-Growth Market: Addresses the rapidly expanding electric vehicle market, a significant growth opportunity.

- Foundational Technology: Products are essential building blocks for future automotive electrical and electronic architectures.

Indie Semiconductor's ADAS radar solutions and the iND880 vision processor are clearly positioned as Stars in the BCG matrix. The 77 GHz radar is in advanced design-in phases with major Tier 1 suppliers, expecting initial production by late 2025. The iND880 processor has secured key design wins for in-cabin monitoring and eMirror applications, highlighting its strong market potential in automotive computer vision.

The GW5 vision processor, with its significant design wins in the Chinese market, including partnerships with Mercedes China and BYD, is also a Star. Production for these applications is set to begin in late 2025, underscoring its high-growth trajectory in a key automotive market.

The collaboration with SiLC Technologies for advanced lidar sensors, integrating indie's SoC with SiLC's lidar technology, also points towards a future Star. This partnership aims for a tenfold improvement in performance and efficiency, targeting the rapidly growing autonomous vehicle market, which was projected to reach $3.4 billion in 2023.

Indie's high-performance electrification ASICs are foundational for EVs and have achieved ASIL-D certification, a critical safety standard. With design wins in powertrain solutions, these ASICs are well-positioned within the automotive semiconductor market, projected to reach $110 billion in 2024, with electrification as a major growth driver.

| Product Category | BCG Matrix Position | Key Growth Drivers | Market Trajectory | Key Partnerships/Wins |

|---|---|---|---|---|

| ADAS Radar Solutions (77 GHz) | Star | Advanced design-ins, major Tier 1 suppliers | Initial production late 2025 | Multiple OEMs targeted |

| iND880 Vision Processor | Star | High-performance computer vision, multi-channel support | Strong market potential | In-cabin monitoring (European Tier 1), eMirror (Korean OEM) |

| GW5 Vision Processor | Star | Expansion in Chinese automotive market | Production Q4 2025 | Mercedes China (eMirror), BYD (in-cabin monitoring) |

| Lidar Sensor Collaboration (with SiLC) | Potential Star | 10x performance improvement, autonomous vehicle market growth | Significant future potential | SiLC Technologies (FMCW lidar) |

| Electrification ASICs | Star | EV market expansion, ASIL-D certification | Strong market traction | Powertrain solutions, automotive semiconductor market growth |

What is included in the product

This BCG Matrix analysis of indie semiconductor focuses on strategic allocation of resources across its product portfolio, identifying growth opportunities and areas for divestment.

The indie semiconductor BCG Matrix provides a clear, visual roadmap, relieving the pain of strategic uncertainty by pinpointing growth opportunities.

Cash Cows

Established in-cabin user experience solutions, particularly for infotainment and basic connectivity, represent a significant cash cow for indie Semiconductor. These mature product lines, benefiting from widespread adoption in existing vehicle platforms, likely generate consistent, high-margin revenue streams.

With a cumulative shipment exceeding 500 million chips, indie Semiconductor has a proven track record with these established solutions. This substantial volume indicates a strong market presence and a stable customer base for their in-cabin offerings, solidifying their position as a reliable cash generator.

Legacy ultrasonic sensors for parking assist represent a classic cash cow for indie Semiconductor. These sensors, a cornerstone of Advanced Driver-Assistance Systems (ADAS) for years, have seen widespread adoption, suggesting a stable and predictable revenue stream for the company.

Given their established market presence, these products likely require minimal incremental investment in research and development or marketing. This allows them to generate consistent cash flow, a hallmark of a cash cow.

The automotive market for these mature ultrasonic solutions is in a lower-growth phase. For instance, while the overall ADAS market is expanding, the specific segment for basic ultrasonic parking sensors faces increasing competition from more advanced technologies like camera-based systems, limiting significant upside potential but solidifying their cash-generating ability.

indie Semiconductor's embedded system control, power management, and interfacing solutions are strong contenders for the Cash Cows quadrant in the BCG Matrix. These established product lines are critical for in-cabin and general vehicle functions, ensuring consistent revenue generation.

Their widespread adoption across numerous vehicle models signifies a stable demand, contributing significantly to indie's operational cash flow. This is characteristic of Cash Cows, which benefit from high market share in mature markets with lower growth potential.

Certain Wireless Charging Solutions

The iND87200 wireless charging solution, having achieved full Qi certification with three Tier 1 automotive customers, demonstrates a mature product with strong market validation. This signifies a stable revenue stream for Indie Semiconductor.

Established wireless charging solutions like the iND87200, with multiple Tier 1 certifications, are poised to generate consistent, high-margin revenue. Their broad adoption into new vehicle models requires minimal new market development, solidifying their position as cash cows.

- Market Maturity: Full Qi certification by three Tier 1 customers indicates widespread acceptance and reliability.

- Revenue Stability: Established solutions generate consistent, high-margin revenue as they are integrated into new vehicle platforms.

- Low Development Costs: Minimal need for new market development further enhances profitability for these mature products.

Foundational IP Licensing and Standard Components

Foundational IP licensing and standard automotive components represent a significant cash cow for indie Semiconductor. These widely adopted assets, such as established interface IP or sensor building blocks, are licensed to numerous Tier 1 suppliers, generating predictable, high-margin revenue. This segment provides a stable financial base, enabling the company to invest in its higher-growth, more experimental product lines.

For instance, in 2024, companies specializing in foundational IP licensing within the automotive sector have seen revenue streams bolstered by the increasing complexity and standardization requirements of in-car electronics. indie Semiconductor's own reported revenue from its IP licensing and standard component business in the first half of 2024 demonstrated consistent performance, contributing significantly to its overall financial stability.

- Consistent Revenue: Licensing of foundational IP and standard components provides a predictable income stream.

- High Margins: These assets typically have low associated operational costs, leading to strong profit margins.

- Market Stability: The widespread adoption of these components ensures a stable demand, even in slower growth phases.

- Financial Bedrock: This segment supports the company's investment in research and development for next-generation technologies.

Established in-cabin user experience solutions, particularly for infotainment and basic connectivity, represent a significant cash cow for indie Semiconductor. These mature product lines, benefiting from widespread adoption in existing vehicle platforms, likely generate consistent, high-margin revenue streams.

Legacy ultrasonic sensors for parking assist are a classic cash cow, having seen widespread adoption in ADAS for years. Their established market presence means minimal incremental R&D or marketing investment, allowing them to generate consistent cash flow in a lower-growth phase.

Foundational IP licensing and standard automotive components are a significant cash cow, generating predictable, high-margin revenue through licensing to numerous Tier 1 suppliers. This segment provides a stable financial base, supporting investment in higher-growth product lines.

| Product Category | BCG Matrix Quadrant | Key Characteristics | 2024 Data/Insight |

| In-Cabin UX Solutions (Infotainment, Connectivity) | Cash Cow | Mature, high adoption, consistent revenue, high margins | Cumulative shipments exceeding 500 million chips indicate strong market presence and stable customer base. |

| Legacy Ultrasonic Parking Assist Sensors | Cash Cow | Established ADAS component, low investment, stable cash flow | Widespread adoption in existing vehicle platforms, though facing competition from newer technologies, solidifies cash generation. |

| Foundational IP Licensing & Standard Components | Cash Cow | Predictable, high-margin revenue, stable financial base | Revenue from IP licensing and standard components in H1 2024 demonstrated consistent performance, bolstering overall financial stability. |

Delivered as Shown

indie semiconductor BCG Matrix

The preview you see is the definitive indie semiconductor BCG Matrix report you will receive upon purchase, ensuring complete transparency and no hidden surprises. This comprehensive analysis, meticulously crafted for strategic decision-making, will be delivered to you in its entirety, ready for immediate application. You can trust that the insights and visualizations presented here are precisely what you will gain access to, allowing for confident planning and execution. This is not a sample, but the actual, fully functional BCG Matrix designed to empower your business strategy.

Dogs

Older generation chips from indie Semiconductor, like those in the 2023 product portfolio that have been surpassed by more advanced architectures, would be classified as Dogs. These might include certain automotive radar chips that are no longer competitive with newer, higher-resolution offerings, or legacy connectivity solutions that have been replaced by more efficient standards.

These products, while potentially still supporting existing customer deployments, likely contribute minimally to indie Semiconductor's revenue and could be a drain on resources for ongoing maintenance and support. For instance, if a 2023 product line generated less than 5% of the company's total revenue and required significant engineering hours for bug fixes, it would fit the Dog profile.

The strategic implication is clear: these discontinued or obsolete product lines are prime candidates for divestiture or a planned phase-out. This allows the company to reallocate resources towards high-growth areas like advanced AI accelerators or next-generation automotive sensors, thereby improving overall profitability and market focus.

Niche electrification ASICs that haven't secured substantial design wins or have encountered significant competitive pressures may find themselves in a precarious position. These products, operating within a high-growth electrification market but holding a low market share, are candidates for the Dog quadrant of the BCG Matrix. For instance, a specialized ASIC for a nascent electric vehicle component that failed to gain traction against established players might represent this scenario, draining valuable R&D and sales resources without delivering proportional financial returns.

Indie Semiconductor's venture into turnkey optical component integration for automotive and mobility applications, while promising, faces potential categorization as a 'Dog' within the BCG Matrix if specific services aren't performing. This occurs when investments in these capabilities fail to capture significant market share or secure profitable deals, indicating a lack of competitive edge or demand. For instance, if a particular optical sensor integration for advanced driver-assistance systems (ADAS) is struggling to achieve a 5% profit margin in 2024 due to high development costs and limited adoption compared to competitors, it would fit this profile.

Products Impacted by Supply Chain or Tariff Challenges

Certain product lines within Indie Semiconductor's portfolio, particularly those reliant on legacy automotive platforms or facing intensified competition, might be experiencing disproportionate impacts from the current macroeconomic climate. Weaker original equipment manufacturer (OEM) demand, coupled with slower market penetration in key regions like China, has presented headwinds. For instance, the automotive sector experienced a notable slowdown in China in early 2024, with some segments seeing single-digit growth compared to previous years.

These underperforming products, especially if they also possess a relatively low market share, risk becoming cash traps. This situation is exacerbated by new US trade tariffs, which can increase manufacturing costs and reduce price competitiveness. For example, tariffs on certain semiconductor components could add several percentage points to the cost of goods sold for affected product lines. This combination of reduced demand and increased costs can stifle investment in these areas, potentially leading to their classification as Dogs in the BCG matrix.

- Product Lines: Legacy automotive interface chips, certain low-power microcontrollers.

- Macroeconomic Factors: Weak OEM demand in automotive, slower adoption in emerging markets, impact of US trade tariffs on component costs.

- Market Share: Low to moderate market share in specific automotive segments.

- Potential Outcome: Risk of becoming cash traps due to declining profitability and limited growth prospects.

Specific, Unsuccessful Early-Stage Lidar or Vision Initiatives

Early-stage lidar and computer vision initiatives within the Advanced Driver-Assistance Systems (ADAS) sector that faltered due to unmet performance benchmarks, failure to secure crucial design wins, or an inability to compete on cost would be classified as question marks. These are ventures where substantial research and development capital was deployed, yet the final product exhibits minimal market penetration and lacks a discernible trajectory toward viability.

Consider a hypothetical early-stage lidar company that invested heavily in developing a novel solid-state lidar sensor. Despite promising initial lab results, the sensor failed to achieve the required range and resolution targets during automotive-grade testing in 2023, a critical year for ADAS component validation. Furthermore, their production costs remained significantly higher than established competitors, making it difficult to secure design wins with major automakers who were finalizing their 2025 model year component selections.

- Failed Performance Targets: The lidar system consistently underperformed in adverse weather conditions, failing to meet the 200-meter detection range required for Level 3 autonomous driving systems.

- Lack of Design Wins: By the end of 2024, the company had not secured any significant design wins with Tier 1 automotive suppliers or OEMs, despite extensive engagement.

- Cost Ineffectiveness: The Bill of Materials (BOM) for their sensor was estimated to be 30% higher than comparable technologies that had already secured production contracts.

- Low Market Share and Unclear Path: Consequently, the product has virtually no market share, and the company faces an uphill battle to pivot its technology or reduce costs to gain traction in a rapidly consolidating market.

Products classified as Dogs within indie Semiconductor's portfolio represent those with low market share and low growth potential. These are often legacy products that have been superseded by newer technologies or face intense competition, leading to declining profitability. For instance, certain automotive radar chips from 2023 that are no longer competitive due to advancements in resolution and processing capabilities would fall into this category.

These underperforming assets can become cash traps, consuming resources for maintenance without generating significant returns. A product line generating less than 5% of company revenue while requiring substantial engineering support for bug fixes exemplifies a Dog. The strategic imperative is to divest or phase out such offerings to reallocate capital to more promising ventures.

Macroeconomic headwinds, such as weaker OEM demand and increased component costs due to tariffs, can further exacerbate the challenges for these products. For example, a slowdown in the Chinese automotive market in early 2024, with single-digit growth in some segments, directly impacts the demand for older automotive components.

Divesting or phasing out these underperforming product lines allows indie Semiconductor to redirect valuable R&D and sales resources towards high-growth areas, such as advanced AI accelerators or next-generation automotive sensors, thereby improving overall profitability and strategic focus.

Question Marks

Indie Semiconductor is actively validating its next-generation 120 GHz in-cabin radar solutions, specifically targeting occupant monitoring. These advanced systems boast higher resolution for short-range applications and integrate antenna-in-package designs, offering a significant technological leap. The company is entering a high-growth market segment, crucial for establishing its presence.

The in-cabin radar market, particularly for occupant monitoring and vital signs detection, is projected for substantial expansion. Indie's introduction of new technology in this space is timely, but success hinges on swiftly securing design wins to build market share. By 2024, the automotive radar market alone was valued in the billions, with in-cabin applications representing a rapidly growing sub-segment.

In 2024, indie semiconductor launched its new high-speed data and video transport solutions, targeting the burgeoning connected car market. This segment is projected to reach $117.4 billion by 2027, indicating substantial growth potential.

Despite the overall market expansion, these specific solutions are in their nascent stages, with market share still being defined. Significant investment in marketing and securing design wins with automotive manufacturers is crucial for these products to ascend from a low market share position.

These factors position indie semiconductor's new transport solutions as potential stars within their portfolio, requiring strategic focus to capitalize on the growing demand and establish a dominant market presence.

Indie Semiconductor's advanced lidar solutions, particularly those developed in partnership with SiLC, are positioned as potential stars in the BCG matrix. These technologies are critical for the burgeoning autonomous driving sector, a market projected to reach $160 billion by 2030, according to some industry forecasts. However, these innovative products are currently in a pre-volume shipment stage, meaning their market share is still minimal despite their high growth potential.

This strategic placement in the question mark quadrant highlights the significant investment and successful scaling required for indie's lidar to transition into a market-leading star. The company's focus on high-performance lidar components, such as its 4D imaging radar and lidar solutions, aims to capture a substantial portion of this rapidly expanding market. The success of these advanced solutions hinges on overcoming manufacturing challenges and securing widespread adoption by automotive OEMs.

Emerging Automotive Adjacent Industrial Applications

Indie Semiconductor is actively investigating how its existing high-performance laser products can be leveraged in automotive adjacent industrial applications, specifically targeting areas like industrial automation and quantum communications. These emerging segments represent significant growth opportunities, though indie currently has a minimal presence in them.

The strategy involves making targeted investments to assess and cultivate these new markets, aligning with a BCG Matrix approach where these represent potential stars. For instance, the industrial automation market is projected to reach $227.4 billion by 2030, with a compound annual growth rate (CAGR) of 14.5%, according to some market analyses, showcasing the substantial upside. Quantum communications, while more nascent, offers disruptive potential, with the global quantum computing market expected to grow substantially in the coming years, driving demand for advanced laser components.

- Industrial Automation: Expanding laser applications into robotics, machine vision, and advanced manufacturing processes.

- Quantum Communications: Supplying critical laser components for secure, high-speed data transmission technologies.

- Market Entry: These are new ventures for indie, characterized by high growth potential and low current market share.

- Strategic Investment: Focused capital allocation is required to validate and scale these promising adjacent markets.

Future-Proofing Technologies (e.g., Uncrashable Car Vision)

Indie Semiconductor's long-term vision for the uncrashable car, fueled by substantial and continuous investment in multi-modal sensing like radar, lidar, and vision, positions these as high-potential, high-growth areas. This commitment to advanced sensing is crucial for unlocking future safety and automation capabilities.

While the overall vision is promising, specific innovations within this space, especially those in early development or just entering the market, currently hold low market share. This necessitates sustained, significant investment to fully realize their long-term potential and capture future market leadership.

- Market Potential: The global advanced driver-assistance systems (ADAS) market, a key component of the uncrashable car vision, is projected to reach over $70 billion by 2028, indicating substantial growth.

- Investment Focus: Indie's investment in multi-modal sensing, including radar and lidar, directly addresses the growing demand for enhanced vehicle safety and autonomous driving features.

- Current Market Share: While specific early-stage innovations may have low current market penetration, the overall trend in automotive sensing technology adoption is strong.

- Future Growth Drivers: Continued R&D and strategic partnerships are essential for capitalizing on the long-term potential of these advanced sensing technologies in the automotive sector.

Indie Semiconductor's advanced lidar and next-generation in-cabin radar solutions are currently in the Question Marks category of the BCG Matrix. These products are in high-growth markets, such as autonomous driving and advanced automotive safety, but have low current market share.

Significant investment in R&D, marketing, and securing design wins with automotive manufacturers is crucial for these technologies to gain traction and transition into potential Stars. The automotive radar market alone was valued in the billions in 2024, with in-cabin applications being a key growth driver.

The company's exploration of laser applications in industrial automation and quantum communications also falls into this quadrant. These emerging segments offer substantial upside, with industrial automation projected to reach $227.4 billion by 2030, but Indie's current presence is minimal.

The success of these Question Marks hinges on Indie's ability to scale production, overcome technical challenges, and secure broad adoption by key industry players to capitalize on their high growth potential.

BCG Matrix Data Sources

Our indie semiconductor BCG Matrix leverages comprehensive market data, including foundry capacity reports, chipmaker financial statements, and leading technology analyst forecasts to provide strategic direction.