Ikuyo PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Ikuyo Bundle

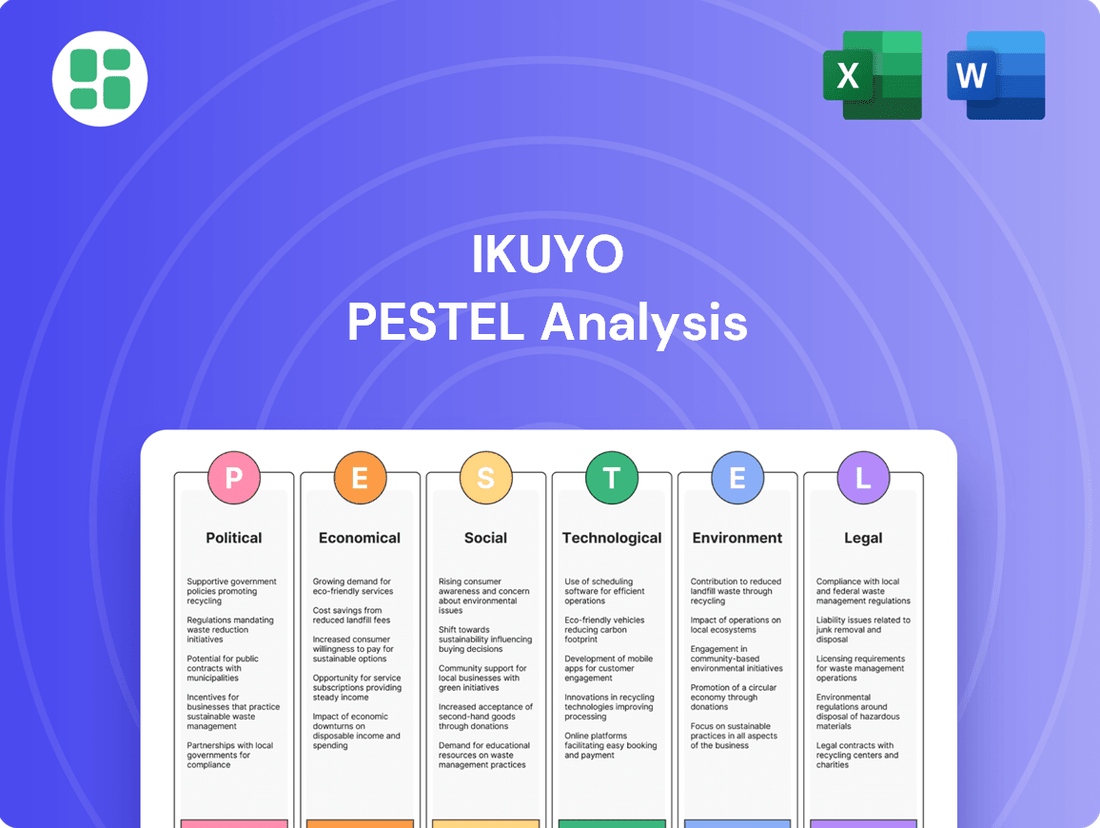

Unlock the secrets to Ikuyo's market positioning with our comprehensive PESTLE analysis. Understand the political, economic, social, technological, legal, and environmental forces shaping its trajectory. Make informed decisions and gain a competitive edge. Download the full report now for actionable insights.

Political factors

Changes in international trade agreements and tariffs directly affect Ikuyo's operating costs and market access. For instance, the ongoing trade discussions between Japan and the United States, a crucial market for automotive exports, could lead to adjustments in tariffs impacting vehicle pricing and sales volumes.

Fluctuations in trade relations with major markets like China and the European Union also play a significant role. In 2024, the automotive sector globally experienced shifts due to evolving trade policies, with some regions imposing new duties on imported vehicles, potentially increasing Ikuyo's component sourcing expenses or the landed cost of its finished products in those markets.

Government incentives for electric vehicles (EVs) and sustainable automotive technologies are a significant political factor for Ikuyo. For instance, the Inflation Reduction Act in the United States, enacted in 2022, provides substantial tax credits for EV purchases and for domestic manufacturing of clean energy components. This can directly boost demand for components that Ikuyo might supply for EVs.

These incentives, such as subsidies for battery production and charging infrastructure development, create opportunities for Ikuyo to expand its offerings in the sustainable tech space. However, they also necessitate strategic adaptation, potentially requiring investment in new manufacturing capabilities or research and development to align with evolving market demands and government priorities. For example, many countries are setting targets for EV adoption, with some aiming for 50% of new car sales to be electric by 2030, creating a strong market pull.

Geopolitical stability in key markets directly impacts Ikuyo's operations. For instance, ongoing conflicts in Eastern Europe, a region supplying critical raw materials for automotive manufacturing, have led to price volatility and supply chain disruptions throughout 2024. This instability can significantly increase operational risks and dampen global demand for vehicles, affecting Ikuyo's sales forecasts.

To counter these risks, Ikuyo is actively diversifying its manufacturing bases. By establishing new facilities in Southeast Asia, which has shown greater political stability in 2024, the company aims to reduce reliance on single-source regions. Robust risk management strategies, including enhanced inventory management and alternative supplier identification, are essential to navigate these complex geopolitical landscapes and ensure continued production and sales.

Regulatory environment for manufacturing

The regulatory landscape for manufacturing significantly impacts Ikuyo's operations. Government mandates concerning production methods, employee well-being, and industrial pollutant discharge directly affect operational expenses and the need for adherence to legal standards. For instance, in 2024, the average compliance cost for new environmental regulations in the manufacturing sector globally saw an increase, potentially impacting companies like Ikuyo.

More stringent environmental or labor legislation can compel Ikuyo to allocate capital towards updated machinery or revised production workflows, thereby influencing profit margins and output effectiveness. For example, recent proposals in key markets for 2025 aim to tighten emissions standards for industrial facilities, which could require substantial upgrades for manufacturers.

- Increased compliance costs: Manufacturers may face higher operational expenses due to new or stricter regulations.

- Investment in technology: Adherence to evolving standards often necessitates investment in cleaner or safer production technologies.

- Potential for fines: Non-compliance with manufacturing regulations can result in significant financial penalties.

- Market access implications: Meeting regulatory requirements is crucial for accessing certain international markets.

Labor laws and industrial relations

Changes in labor laws, such as the recent push in some regions to increase minimum wages, could directly impact Ikuyo's operational costs. For instance, if Japan were to significantly raise its statutory minimum wage, it would necessitate adjustments in Ikuyo's payroll expenses, potentially affecting profit margins. The strength and influence of labor unions also play a crucial role; a more assertive union presence might lead to increased demands for benefits or improved working conditions, requiring careful negotiation and management.

Maintaining positive industrial relations is paramount for Ikuyo's production stability. Disruptions caused by labor disputes can halt manufacturing processes, leading to significant financial losses and delivery delays. For example, a prolonged strike at a key Ikuyo facility could have ripple effects across its supply chain. As of early 2024, Japan's labor union density was around 16.5%, a figure that, while not exceptionally high, still represents a significant portion of the workforce that can influence industrial relations.

- Minimum Wage Impact: Potential increases in Japan's national minimum wage could raise Ikuyo's labor costs.

- Union Influence: The bargaining power of labor unions in countries where Ikuyo operates can affect wage demands and working conditions.

- Production Stability: Positive industrial relations are key to preventing costly production stoppages.

- Labor Law Compliance: Adherence to evolving labor laws in different operating regions is essential for avoiding penalties and maintaining a good corporate reputation.

Government policies on trade, such as tariffs and trade agreements, directly influence Ikuyo's market access and operational costs. For instance, evolving trade relations with major markets in 2024 and 2025 could alter import duties, impacting vehicle pricing and component sourcing expenses. Furthermore, government incentives for electric vehicles (EVs) and sustainable technologies, like those seen in the United States and other nations aiming for significant EV adoption by 2030, create opportunities for Ikuyo's components in the growing EV market.

Geopolitical stability in key operational regions is a critical political factor. Instability, as observed with raw material supply chains in 2024 due to conflicts, can lead to price volatility and production disruptions, necessitating strategic diversification of manufacturing bases, such as Ikuyo's expansion into Southeast Asia for greater political stability.

Regulatory frameworks, including environmental and labor laws, significantly shape Ikuyo's operational expenses and strategic planning. Stricter regulations, with proposals in key markets for 2025 to tighten emissions standards, may require capital investment in updated machinery and workflows. Changes in labor laws, such as potential minimum wage increases in Japan, also directly impact payroll costs and require careful management of industrial relations to ensure production stability.

| Political Factor | Impact on Ikuyo | 2024/2025 Relevance |

|---|---|---|

| Trade Agreements & Tariffs | Affects market access, import/export costs, and vehicle pricing. | Ongoing trade discussions and policy shifts in major markets like the US and EU. |

| Government Incentives (EVs) | Boosts demand for EV components and sustainable technologies. | Continued global push for EV adoption, with many countries targeting 50% EV sales by 2030. |

| Geopolitical Stability | Influences raw material prices, supply chain reliability, and global demand. | Price volatility and supply chain disruptions observed in 2024 due to regional conflicts. |

| Regulatory Landscape (Environment & Labor) | Impacts operational costs, compliance requirements, and investment needs. | Increasingly stringent environmental standards and potential labor law changes in key markets. |

What is included in the product

The Ikuyo PESTLE Analysis systematically examines the Political, Economic, Social, Technological, Environmental, and Legal forces impacting Ikuyo's operations and strategic positioning.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, transforming complex external factors into actionable insights for strategic decision-making.

Economic factors

Global economic growth remains a critical factor for Ikuyo, as a healthy economy typically translates to increased consumer spending on new vehicles, directly boosting demand for automotive components. However, persistent recession risks, particularly with ongoing geopolitical tensions and inflation concerns, could significantly dampen vehicle production and sales volumes for suppliers like Ikuyo.

As of mid-2024, the International Monetary Fund (IMF) projected global growth to be around 3.2%, a modest but positive outlook. Yet, this forecast is subject to considerable downside risks, including potential supply chain disruptions and tighter financial conditions, which could negatively impact Ikuyo's revenue streams.

Automotive sales trends significantly impact Ikuyo's component demand. For instance, the continued consumer preference for SUVs and crossovers, which gained momentum in 2023 and is projected to hold strong through 2025, means Ikuyo likely sees increased demand for larger, more robust components. Conversely, a potential slowdown in the compact car segment could reduce demand for smaller, lighter parts.

The overall pace of vehicle sales is a critical indicator for Ikuyo. In 2024, global light vehicle sales are expected to see moderate growth, potentially around 2-3%, following a stronger rebound in 2023. This growth directly translates to higher production volumes for Ikuyo's automotive clients, influencing revenue and operational capacity.

International sales performance is also key. While North America and Europe are mature markets, emerging markets in Asia, particularly India and Southeast Asia, are showing robust growth potential for vehicle sales through 2025. Ikuyo's international sales figures will therefore be heavily influenced by its penetration and success in these expanding regions.

Currency exchange rate fluctuations, particularly for the Japanese Yen (JPY), present a significant economic factor for Ikuyo, a Japanese manufacturer operating globally. For instance, during 2024, the JPY experienced considerable volatility against the US Dollar, trading in a range that impacted import costs and export pricing. A stronger yen, as seen in certain periods of 2024, would make Ikuyo's products more expensive for overseas buyers, potentially dampening demand, while simultaneously lowering the cost of imported raw materials.

Conversely, a weaker yen, which has also been a feature of the 2024 economic landscape, can enhance Ikuyo's export competitiveness by making its goods more affordable internationally. However, this same depreciation can lead to higher costs for essential imported components and raw materials, squeezing profit margins. For example, if the yen weakens significantly against the Euro, Ikuyo's European sales revenue, when converted back to yen, would appear higher, but the cost of any materials sourced from the Eurozone would also increase.

Raw material costs and supply chain inflation

The cost of essential raw materials such as steel, aluminum, and rare earth metals, combined with ongoing inflation throughout the supply chain, significantly impacts Ikuyo's manufacturing expenses. For instance, global steel prices saw a notable increase in early 2024, influenced by production cuts in major exporting nations and robust demand from the automotive sector.

Effectively managing these rising input costs is crucial for Ikuyo to preserve its profit margins. This involves strategies like optimizing procurement processes and securing long-term supply agreements to hedge against price volatility.

- Steel prices: Global benchmark prices for steel have fluctuated, with some projections indicating a 5-10% increase in average costs for industrial buyers in 2024 compared to 2023 due to energy costs and demand.

- Aluminum costs: The price of aluminum, a key component in many manufacturing processes, has been sensitive to energy prices and geopolitical factors, with spot prices trading around $2,200-$2,400 per metric ton in early 2024.

- Rare earth metal supply: Supply chain disruptions and concentrated production in certain regions continue to create price uncertainty for rare earth metals, vital for electronics and advanced manufacturing.

- Logistics inflation: Shipping and freight costs, while moderating from pandemic highs, remain elevated compared to pre-2020 levels, adding to overall supply chain inflation and impacting landed costs for raw materials.

Consumer spending power and disposable income

Consumer spending power is a significant driver for the automotive sector. In 2024, a key consideration is how inflation and interest rates impact disposable income. For instance, if inflation outpaces wage growth, consumers may have less discretionary income available for large purchases like vehicles, potentially leading to delayed buying decisions.

Economic stability directly correlates with consumer confidence and willingness to spend. When consumers feel financially secure, they are more likely to finance new vehicle purchases. Conversely, economic uncertainty, such as fears of recession or job losses, can cause consumers to hold onto existing vehicles longer, impacting demand across the automotive supply chain.

- Consumer Confidence Index: In Q1 2024, the Conference Board Consumer Confidence Index showed fluctuations, indicating sensitivity to economic news and its impact on spending intentions.

- Disposable Income Growth: While wage growth has shown some resilience, the pace of disposable income increase in major markets like the US and Europe needs to be monitored against rising costs of living in 2024.

- Vehicle Affordability: Rising vehicle prices, coupled with higher interest rates for auto loans in 2024, are creating affordability challenges for a segment of the consumer base, potentially shifting demand towards used vehicles or delaying new car purchases.

Global economic growth projections for 2024, such as the IMF's 3.2% forecast, directly influence Ikuyo's demand, with risks like inflation and geopolitical tensions potentially slowing vehicle production. Currency fluctuations, particularly the Yen's volatility against major currencies like the USD and EUR in 2024, significantly impact Ikuyo's export competitiveness and import costs for raw materials.

Rising raw material costs, including steel and aluminum, coupled with logistics inflation throughout 2024, are increasing Ikuyo's manufacturing expenses, necessitating strategies to manage these pressures. Consumer spending power, affected by 2024 inflation and interest rates, is critical, as affordability challenges for new vehicles could lead consumers to delay purchases, impacting component demand.

| Economic Factor | 2024 Projection/Trend | Impact on Ikuyo |

|---|---|---|

| Global GDP Growth | IMF projects 3.2% for 2024 | Modest positive impact on demand, but downside risks exist |

| JPY Exchange Rate | Volatile against USD and EUR in 2024 | Affects export pricing and import costs |

| Steel Prices | Projected 5-10% increase for industrial buyers in 2024 | Increases manufacturing expenses |

| Aluminum Prices | Trading around $2,200-$2,400/metric ton in early 2024 | Increases manufacturing expenses |

| Consumer Confidence | Fluctuating in Q1 2024 | Impacts willingness to purchase new vehicles |

What You See Is What You Get

Ikuyo PESTLE Analysis

The preview shown here is the exact Ikuyo PESTLE Analysis document you’ll receive after purchase—fully formatted and ready to use.

This comprehensive analysis breaks down the Political, Economic, Social, Technological, Legal, and Environmental factors impacting Ikuyo.

What you’re previewing here is the actual file, offering deep insights for strategic planning and decision-making.

Sociological factors

Consumer preferences are rapidly shifting, with electric vehicle (EV) adoption surging. In 2023, global EV sales surpassed 13 million units, a significant increase from previous years, indicating a strong move away from traditional internal combustion engine vehicles. This trend directly impacts demand for components like engines and exhaust systems, requiring Ikuyo to re-evaluate its product portfolio.

The rise of ride-sharing and mobility-as-a-service (MaaS) platforms is another key factor. As more consumers opt for on-demand transportation, the personal ownership of vehicles may decline, altering the overall automotive market size and the types of vehicles in demand. Ikuyo needs to consider how these evolving mobility patterns affect the long-term market for its current offerings.

Demographic shifts, like aging populations in Japan and other developed economies, are creating significant labor shortages, impacting the availability of skilled workers for manufacturing. For instance, Japan's working-age population (15-64) is projected to fall to around 68 million by 2030, a notable decrease that directly affects companies like Ikuyo. This necessitates proactive workforce planning, increased investment in automation, and robust talent retention strategies to maintain operational capacity.

Urbanization continues to reshape automotive demand, pushing for more compact and energy-efficient vehicles. In 2024, cities globally are grappling with increased population density, directly impacting traffic flow and the need for innovative transportation solutions. For instance, the growth of shared mobility services and the anticipation of autonomous vehicle integration are driving component manufacturers to adapt vehicle designs for urban environments.

Smart city initiatives are accelerating infrastructure development, creating new opportunities and challenges for the automotive sector. By 2025, many metropolitan areas are expected to have advanced connectivity infrastructure, supporting the rollout of connected car technologies and advanced driver-assistance systems (ADAS). This trend necessitates a focus on vehicle components that can seamlessly integrate with smart city networks, potentially influencing the demand for specialized sensors and communication modules.

Workforce expectations and skill development

Modern workforces, particularly in skilled sectors like engineering and technology, increasingly prioritize work-life balance and flexible arrangements. Companies that fail to adapt risk losing valuable talent. For instance, a 2024 survey indicated that over 60% of tech professionals would consider leaving a job that offered poor work-life balance, even for a slightly lower salary.

Ikuyo must proactively address these evolving expectations by investing in continuous skill development and fostering an attractive work environment. This includes offering opportunities for upskilling and reskilling to keep employees engaged and competitive. In 2025, the demand for specialized skills in areas like AI and advanced manufacturing is projected to grow by 15%, making talent retention a critical challenge.

To remain competitive, Ikuyo should focus on:

- Offering flexible work options: This could include remote work policies or compressed workweeks, aligning with employee preferences observed in recent labor market trends.

- Investing in continuous learning: Providing access to training programs, certifications, and internal development opportunities is crucial for retaining skilled engineers and technicians.

- Creating a supportive culture: Fostering a positive work environment that values employee well-being and recognizes contributions can significantly impact retention rates.

- Competitive compensation and benefits: Ensuring that salary and benefits packages are benchmarked against industry standards is essential in a tight labor market.

Brand perception and corporate social responsibility

Societal expectations for corporate social responsibility (CSR) are significantly shaping brand perception. Consumers and investors alike are increasingly scrutinizing companies for their ethical sourcing, sustainable practices, and community involvement. For instance, a 2024 survey by GlobeScan found that 70% of global consumers believe companies have a responsibility to act on environmental and social issues. This trend means Ikuyo's proactive engagement in these areas is crucial for building trust and a positive brand image, directly impacting its market standing and ability to attract investment.

Ikuyo’s commitment to CSR can translate into tangible benefits. Companies demonstrating strong social and environmental performance often experience enhanced brand loyalty and a competitive edge. A 2025 report by McKinsey highlighted that companies with leading sustainability practices saw an average 13% higher valuation compared to their peers. By aligning its operations with societal values, Ikuyo can cultivate a reputation that resonates with a growing segment of socially conscious consumers and investors, potentially leading to increased sales and a stronger financial position.

- Ethical Sourcing: Ikuyo’s adherence to fair labor practices and responsible raw material procurement builds consumer confidence.

- Sustainable Practices: Investments in eco-friendly production methods and waste reduction appeal to environmentally aware stakeholders.

- Community Engagement: Local support initiatives and philanthropic efforts foster goodwill and positive brand association.

- Transparency: Open communication about CSR efforts and performance metrics enhances credibility and trust among consumers and investors.

Societal expectations are increasingly influencing consumer behavior and corporate responsibility. Consumers in 2024 are more informed and demand transparency regarding ethical sourcing and environmental impact, with studies showing a significant portion willing to pay more for sustainable products. This societal shift pressures companies like Ikuyo to integrate robust CSR strategies into their core operations, impacting brand reputation and market share.

The growing emphasis on work-life balance and employee well-being is reshaping workforce expectations. By 2025, companies prioritizing flexible work arrangements and professional development are better positioned to attract and retain top talent, especially in skilled sectors. For Ikuyo, adapting to these evolving labor dynamics is crucial for maintaining a competitive edge and operational efficiency.

Demographic changes, such as aging populations in key markets, present both challenges and opportunities. A shrinking workforce in developed nations necessitates greater investment in automation and upskilling existing employees. Ikuyo must consider these demographic trends when planning its long-term human capital strategy and operational resilience.

The evolving landscape of mobility, including the rise of ride-sharing and electric vehicles, is altering consumer preferences. As EV adoption continues its upward trajectory, with global sales projected to exceed 15 million units in 2025, Ikuyo needs to align its product development with these market shifts to remain relevant.

Technological factors

Rapid advancements in electric vehicle (EV) powertrains and autonomous driving systems are reshaping the automotive landscape, demanding substantial research and development investment from companies like Ikuyo. These technological shifts are not just trends; they are fundamental changes requiring the creation of compatible and innovative components to stay competitive. For instance, the global EV market is projected to reach over $1.5 trillion by 2030, highlighting the immense growth potential and the necessity for suppliers to adapt.

Ikuyo's ability to adapt to these evolving technologies is paramount for its future growth and the maintenance of its market share. Companies that fail to integrate with the accelerating pace of EV and autonomous driving development risk becoming obsolete. By 2024, it's estimated that over 30% of new vehicle sales in many major markets will be electric, underscoring the urgency for component manufacturers to align their product roadmaps.

Industry 4.0, encompassing automation and AI in manufacturing, presents a significant technological shift. For Ikuyo, this means leveraging advanced robotics and intelligent systems to streamline production lines, potentially boosting output by 20-30% based on industry benchmarks from 2024. This integration is crucial for maintaining competitiveness and improving overall operational efficiency.

Innovation in materials science is a significant technological factor for Ikuyo. The development of lightweight and high-strength composites, for instance, directly influences vehicle design and fuel efficiency, key considerations in the automotive sector. By 2024, the global composites market was valued at over $100 billion, with significant growth projected due to demand for lighter, more durable materials across industries.

Ikuyo needs to actively explore and adopt these advanced materials in its component manufacturing processes. This strategic adoption is crucial for meeting increasingly stringent industry standards, such as those for emissions and safety, and for responding to evolving customer demands for more fuel-efficient and performance-oriented products. For example, the automotive industry is increasingly using carbon fiber composites, which can be up to 50% lighter than steel, leading to substantial fuel savings.

Cybersecurity threats to connected vehicles/systems

As vehicles increasingly rely on connected systems, cybersecurity threats become a significant concern for manufacturers like Ikuyo. The integration of digital platforms into automotive components opens avenues for data breaches and system manipulation, directly impacting product integrity and customer trust.

The automotive industry is a prime target for cyberattacks, with the potential for disruption and data theft. For instance, a 2024 report highlighted a 300% increase in reported cyber incidents targeting connected vehicle systems over the preceding two years, underscoring the escalating risk landscape.

Ikuyo must prioritize robust cybersecurity measures to safeguard its products and internal operations. This includes protecting sensitive customer data and ensuring the operational security of its automotive components against evolving cyber threats.

- Escalating Threat Landscape: Automotive cybersecurity incidents saw a 300% rise between 2022 and 2024.

- Data Protection Imperative: Protecting customer data and vehicle operational integrity is critical for maintaining trust.

- Manufacturer Responsibility: Component suppliers like Ikuyo are increasingly accountable for the cybersecurity of their integrated systems.

- Proactive Defense: Implementing advanced security protocols is essential to mitigate risks associated with connected vehicle technology.

R&D investment and innovation pace

Ikuyo must maintain high R&D investment to keep pace with the automotive industry's rapid technological advancements. This includes developing cutting-edge components and more efficient manufacturing methods to stay competitive. For example, the global automotive R&D spending was projected to reach over $200 billion in 2024, highlighting the intense focus on innovation across the sector.

Key areas of technological focus for Ikuyo include:

- Electric Vehicle (EV) Powertrain Technology: Investing in battery efficiency, charging infrastructure compatibility, and advanced motor designs.

- Autonomous Driving Systems: Developing sophisticated sensor suites, AI algorithms, and robust software for self-driving capabilities.

- Advanced Materials: Researching lightweight, high-strength materials to improve vehicle performance and fuel efficiency.

- Connectivity and Software: Enhancing in-car infotainment, over-the-air updates, and cybersecurity measures.

Technological advancements are fundamentally altering the automotive sector, necessitating significant R&D investment for companies like Ikuyo. The rapid evolution of electric vehicle (EV) powertrains and autonomous driving systems demands innovative component development to maintain market competitiveness. By 2024, over 30% of new vehicle sales in key markets were projected to be electric, underscoring the urgency for component manufacturers to adapt their product roadmaps.

The integration of Industry 4.0 principles, including automation and AI in manufacturing, offers substantial efficiency gains. Ikuyo can leverage advanced robotics and intelligent systems to streamline production, potentially boosting output by 20-30% based on 2024 industry benchmarks. Furthermore, innovations in materials science, such as lightweight composites valued at over $100 billion globally by 2024, are crucial for enhancing vehicle performance and meeting stringent industry standards.

Connected vehicle systems introduce escalating cybersecurity risks, with a reported 300% increase in cyber incidents targeting these systems between 2022 and 2024. Ikuyo must prioritize robust cybersecurity measures to protect sensitive data and ensure the operational integrity of its integrated automotive components against evolving threats.

| Key Technological Factor | Impact on Ikuyo | Supporting Data (2024/2025 Projections/Trends) |

| EV Powertrain & Autonomous Driving | Requires significant R&D for new component development and integration. | Global EV market projected to exceed $1.5 trillion by 2030; over 30% of new vehicle sales in major markets expected to be electric by 2024. |

| Industry 4.0 (Automation & AI) | Enhances manufacturing efficiency and output. | Potential for 20-30% output increase through advanced robotics and intelligent systems. |

| Advanced Materials | Improves vehicle performance, fuel efficiency, and compliance with standards. | Global composites market valued over $100 billion by 2024; carbon fiber composites up to 50% lighter than steel. |

| Cybersecurity for Connected Systems | Demands robust security protocols to protect data and product integrity. | 300% increase in cyber incidents targeting connected vehicle systems between 2022 and 2024. |

Legal factors

Global vehicle safety and emissions regulations are becoming increasingly stringent, directly influencing Ikuyo's product development. For instance, the European Union's Euro 7 emissions standards, expected to be fully implemented by 2027, will require significant reductions in pollutants, impacting exhaust system component design. Similarly, evolving safety mandates, such as those requiring advanced driver-assistance systems (ADAS) for new vehicle certifications in many markets, necessitate the integration of sophisticated sensors and control modules.

Protecting Ikuyo's intellectual property, particularly its proprietary precision machining techniques and innovative component designs, is paramount to sustaining its competitive edge in the market. This includes securing robust patent protection for these advancements.

Navigating the intricate landscape of international intellectual property laws presents a significant legal challenge for Ikuyo. Effectively enforcing patent rights across various jurisdictions is a critical consideration to prevent infringement and safeguard its innovations.

Product liability laws hold Ikuyo accountable for any defects in its automotive components that could cause vehicle malfunctions or injuries. This means rigorous testing and quality assurance are paramount to avoid costly lawsuits and reputational damage.

For instance, in 2024, the automotive industry saw significant recalls. General Motors recalled over 1 million vehicles due to airbag inflator issues, highlighting the substantial financial and brand impact of product defects. Ikuyo must maintain stringent quality control to prevent similar scenarios.

Robust recall procedures are also crucial. In 2025, regulatory bodies are expected to increase scrutiny on automotive safety, making swift and effective recall management essential for Ikuyo to mitigate legal liabilities and maintain consumer trust.

International trade agreements and compliance

Ikuyo's extensive global footprint necessitates strict adherence to a myriad of international trade agreements, sanctions, and evolving customs regulations. Navigating these intricate legal landscapes is paramount for facilitating the seamless international flow of its products and mitigating the risk of costly legal entanglements.

For instance, the World Trade Organization (WTO) agreements, which govern 98% of global trade in 2024, provide a foundational framework. Ikuyo must ensure its operations align with these principles, including most-favored-nation treatment and national treatment, to avoid tariffs and trade barriers in its key markets.

- WTO Agreements: Ikuyo must comply with WTO rules to ensure fair trade practices and avoid punitive tariffs in its global supply chain.

- Sanctions Compliance: Adherence to international sanctions, such as those imposed by the United Nations and major economic blocs, is critical to prevent legal repercussions and reputational damage.

- Customs Regulations: Understanding and correctly implementing customs procedures in each operating country is vital for efficient import/export operations and avoiding delays or fines.

- Trade Facilitation: Agreements like the WTO's Trade Facilitation Agreement aim to streamline customs procedures, which Ikuyo can leverage to improve its cross-border logistics efficiency.

Data privacy regulations (e.g., GDPR, local equivalents)

As Ikuyo integrates more digital platforms, adherence to data privacy laws like the EU's General Data Protection Regulation (GDPR) and Japan's Act on the Protection of Personal Information (APPI) is paramount. These regulations govern how personal data is collected, processed, and stored, impacting customer trust and operational integrity. Failure to comply can result in substantial fines; for instance, GDPR penalties can reach up to 4% of global annual revenue or €20 million, whichever is higher.

Protecting sensitive information related to customers, employees, and internal operations is not just a legal obligation but also an ethical imperative for Ikuyo. The increasing sophistication of cyber threats in 2024 and 2025 underscores the need for robust data security measures and transparent data handling practices.

- GDPR Fines: Potential penalties up to 4% of global annual revenue or €20 million.

- APPI Compliance: Japan's data protection law requires consent for data transfer and mandates breach notifications.

- Data Breach Costs: The average cost of a data breach globally reached $4.45 million in 2024, according to IBM's Cost of a Data Breach Report.

- Consumer Trust: Strong data privacy practices are crucial for maintaining customer confidence in an era of heightened digital awareness.

Ikuyo must navigate evolving global vehicle safety and emissions regulations, such as the EU's Euro 7 standards impacting exhaust systems by 2027, and mandates for ADAS integration. Protecting intellectual property through patents is crucial for maintaining a competitive edge.

Product liability laws require rigorous quality control to prevent costly lawsuits and reputational damage, as seen with industry recalls in 2024. Robust recall procedures are essential for mitigating legal liabilities and maintaining consumer trust, with increased scrutiny expected in 2025.

Compliance with international trade agreements, sanctions, and customs regulations is vital for seamless global operations. Adherence to WTO agreements, like those governing 98% of global trade in 2024, helps avoid tariffs and trade barriers.

Data privacy laws, including GDPR and Japan's APPI, are critical for digital platforms, with GDPR penalties potentially reaching 4% of global annual revenue. The average cost of a data breach globally was $4.45 million in 2024, underscoring the need for robust data security and consumer trust.

| Legal Factor | Impact on Ikuyo | Key Considerations | Relevant Data/Examples |

|---|---|---|---|

| Emissions & Safety Regulations | Product design and development costs | Adherence to Euro 7 (2027), ADAS mandates | Stricter pollutant reduction targets |

| Intellectual Property | Competitive advantage, market exclusivity | Patent protection for proprietary technologies | Securing patents for precision machining |

| Product Liability | Financial risk, brand reputation | Rigorous quality assurance, recall procedures | GM recall cost millions in 2024; increased scrutiny in 2025 |

| International Trade & Sanctions | Supply chain efficiency, market access | WTO compliance, sanctions adherence | WTO agreements cover 98% of global trade (2024) |

| Data Privacy | Customer trust, operational integrity | GDPR, APPI compliance, data security | GDPR fines up to 4% global revenue; data breach cost $4.45M (2024) |

Environmental factors

Stricter emissions standards for manufacturing processes directly impact Ikuyo's operational costs and strategic planning. For instance, in 2024, the European Union's Carbon Border Adjustment Mechanism (CBAM) began its transitional phase, requiring importers to purchase emissions certificates for carbon-intensive goods, which could influence Ikuyo's supply chain and production costs if manufacturing is located in or exports to the EU.

Failure to meet evolving environmental regulations, such as those targeting particulate matter or greenhouse gas emissions, can lead to significant financial penalties and reputational damage. Companies that proactively invest in advanced emissions control technologies, like selective catalytic reduction or carbon capture systems, often find these investments translate into long-term operational efficiencies and a stronger market position, especially as consumer and investor focus on sustainability intensifies through 2025.

Waste management and recycling regulations significantly shape Ikuyo's operational landscape. Laws concerning waste disposal, hazardous materials handling, and extended producer responsibility for product recycling directly influence manufacturing techniques and product development, particularly for electronics and packaging. For instance, the EU's Waste Framework Directive, updated in 2024, mandates higher recycling rates and stricter controls on hazardous substances, potentially increasing compliance costs for companies like Ikuyo that operate globally.

To navigate these evolving requirements and maintain a competitive edge, Ikuyo must prioritize robust waste reduction and recycling initiatives. This commitment is not only vital for environmental stewardship but also for ensuring ongoing regulatory compliance and enhancing brand reputation. Companies that proactively invest in circular economy principles, such as designing for disassembly and using recycled content, often find cost savings and improved resource efficiency. For example, a report from the Ellen MacArthur Foundation in early 2025 highlighted that businesses adopting circular models saw an average reduction in waste disposal costs by 15% compared to linear models.

Ikuyo faces growing pressure to address resource scarcity, with global demand for key agricultural inputs projected to rise. For instance, the United Nations projects that global food demand could increase by 50% by 2050, directly impacting the availability and cost of raw materials Ikuyo relies on. This escalating demand underscores the critical need for Ikuyo to prioritize sustainable sourcing practices and integrate circular economy principles to ensure long-term supply chain resilience.

Regulatory landscapes are also tightening, with many nations implementing stricter environmental standards for agricultural production and supply chains. For example, the European Union's Farm to Fork Strategy, aiming for a more sustainable food system, will likely influence sourcing requirements for companies operating within or supplying to the EU market. Ikuyo must proactively evaluate the environmental footprint of its entire supply chain, from farm to processing, and actively seek out eco-friendly material alternatives to comply with these evolving regulations and mitigate risks.

Climate change policies and carbon footprint reduction

Global and national climate change policies are increasingly pressuring companies like Ikuyo to actively reduce their carbon footprint. For instance, the European Union's Fit for 55 package aims for a 55% net reduction in greenhouse gas emissions by 2030 compared to 1990 levels. This necessitates a significant shift for businesses, potentially involving investments in renewable energy sources and more efficient supply chain logistics to meet these stringent targets.

Ikuyo faces pressure to decarbonize its operations and supply chain due to evolving climate change policies. This includes navigating carbon pricing mechanisms and emission reduction targets set by various governments. For example, many nations are implementing or expanding carbon taxes, which directly impact operational costs for energy-intensive industries.

- Renewable Energy Transition: Ikuyo may need to invest in or procure renewable energy to power its facilities, aligning with targets such as the global goal of tripling renewable energy capacity by 2030.

- Supply Chain Optimization: Reducing emissions from logistics and sourcing raw materials is crucial. This could involve shifting to lower-emission transportation methods or working with suppliers committed to sustainability.

- Carbon Pricing Impact: The increasing prevalence of carbon pricing, such as the EU Emissions Trading System (ETS) which saw average prices around €80-€90 per tonne of CO2 in late 2023 and early 2024, directly affects Ikuyo's operational costs and strategic planning.

- Regulatory Compliance: Adhering to evolving emissions standards and reporting requirements is essential to avoid penalties and maintain market access.

Energy efficiency requirements and renewable energy adoption

Governments worldwide are increasingly mandating stricter energy efficiency standards for industrial facilities. For instance, by 2025, many regions aim for a significant reduction in energy intensity for manufacturing processes. These regulations directly impact Ikuyo's operational costs and necessitate investments in more efficient machinery and processes.

Incentives for adopting renewable energy sources, such as tax credits and subsidies, are becoming more prevalent. In 2024, several countries are offering substantial financial support for companies that transition to solar, wind, or other green energy solutions. This presents an opportunity for Ikuyo to lower its long-term energy expenditures and improve its environmental footprint.

- Regulatory Push: Expect increased enforcement of energy efficiency mandates in industrial sectors, potentially impacting Ikuyo's compliance costs.

- Renewable Energy Incentives: Government programs in 2024-2025 are designed to make renewable energy adoption financially attractive, offering pathways to cost savings for Ikuyo.

- Cost Reduction Potential: A strategic shift towards green energy can lead to a notable decrease in operational expenses for Ikuyo, especially with fluctuating fossil fuel prices.

- Environmental Performance: Embracing renewable energy sources directly contributes to Ikuyo's corporate social responsibility goals and enhances its brand image.

Ikuyo must adapt to increasingly stringent environmental regulations concerning emissions and waste management. For example, the EU's updated Waste Framework Directive in 2024 mandates higher recycling rates, impacting manufacturing and product design. Furthermore, global climate policies, like the EU's Fit for 55 package targeting a 55% emissions reduction by 2030, necessitate a shift towards renewable energy and optimized supply chains. The increasing prevalence of carbon pricing, with EU ETS prices around €80-€90 per tonne of CO2 in early 2024, directly affects operational costs.

| Environmental Factor | Impact on Ikuyo | 2024/2025 Data/Trend |

|---|---|---|

| Emissions Standards | Increased operational costs, need for advanced technology | EU CBAM transitional phase (2024), stricter particulate matter regulations |

| Waste Management | Changes in manufacturing and product development | EU Waste Framework Directive updates (2024) mandating higher recycling rates |

| Climate Change Policies | Pressure to decarbonize, potential for higher energy costs | EU Fit for 55 package (55% GHG reduction by 2030), carbon pricing (EU ETS ~€80-€90/tonne CO2 in early 2024) |

| Energy Efficiency | Need for investment in efficient machinery, potential cost savings | Many regions aiming for significant reduction in energy intensity by 2025 |

PESTLE Analysis Data Sources

Our PESTLE Analysis for Ikuyo draws from a robust blend of official government publications, reputable market research firms, and international economic databases. This ensures comprehensive coverage of political, economic, social, technological, legal, and environmental factors impacting Ikuyo's operations and strategy.