iKang Group PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

iKang Group Bundle

Navigate the complex external forces shaping iKang Group's future with our comprehensive PESTLE analysis. Understand how political shifts, economic fluctuations, and technological advancements are creating both opportunities and challenges for the company. Download the full version to gain actionable intelligence and refine your strategic planning.

Political factors

The Chinese government's commitment to deepening medical and healthcare reforms throughout 2024 and 2025 is a significant political factor. These initiatives are designed to bolster public healthcare services, streamline hospital payment systems, and refine healthcare insurance frameworks.

The primary objectives are to ensure more accessible and affordable medical care, particularly at the primary care level, thereby easing financial strains on patients. For instance, reforms in 2024 are targeting a 10% increase in primary care utilization rates in urban areas.

Furthermore, there's a strategic push towards advancing medical technology, establishing multi-tiered healthcare delivery systems, and expanding digital health services, aiming to create a more efficient and patient-centric healthcare ecosystem.

China's relaxation of foreign investment rules in healthcare, notably from September 2024, is a significant political shift. This allows for wholly foreign-owned hospitals in key cities and pilot free-trade zones, expanding market access for international players.

Further, these new policies permit foreign firms to offer advanced biotechnology services, including stem cell and gene therapy. This move is designed to attract foreign capital and expertise, aiming to bolster China's healthcare infrastructure and address escalating patient needs.

The 'Healthy China 2030' strategy continues to be a significant political influence, steering the healthcare industry towards preventive care and technological advancement. This national blueprint, launched in 2016, underscores a fundamental shift from reactive treatment to proactive health management, directly benefiting companies like iKang Group whose business model centers on early detection and wellness.

This initiative is projected to boost healthcare spending, with the Chinese government aiming to increase per capita healthcare expenditure significantly by 2030. For instance, in 2023, China's healthcare spending reached approximately 9% of its GDP, a figure expected to grow as the 'Healthy China 2030' agenda is implemented, creating a more favorable market for iKang's services.

Furthermore, the strategy prioritizes digital health solutions and environmental sustainability within healthcare. This focus on digital transformation aligns with iKang's investment in online platforms and telemedicine, while the emphasis on sustainability encourages greener practices across the sector, potentially impacting operational costs and compliance for iKang.

Policy Support for Innovative Drugs and Devices

Since mid-2024, China has significantly increased its policy support for innovative drugs and medical devices. This includes substantial fiscal subsidies earmarked for research and development activities, alongside streamlined, expedited review processes for clinical trials, particularly in designated pilot zones. This strategic initiative is designed to foster the creation of superior medical products and healthcare services.

These government initiatives can indirectly benefit preventive healthcare providers like iKang Group. The expansion of advanced diagnostic tools and novel treatment options, driven by this policy push, directly enhances the capabilities and offerings of such service providers. For instance, the availability of new, more accurate biomarkers for early disease detection could be a direct result of this supportive environment.

- R&D Subsidies: China's government has allocated increased funding to support pharmaceutical and biotech companies in their research endeavors, aiming to accelerate the discovery and development of new therapies.

- Expedited Review: Pilot programs have been established to fast-track the approval process for innovative medical products, reducing time-to-market for groundbreaking treatments and diagnostics.

- Market Access: Policies are being introduced to improve market access for domestically developed innovative medical technologies, encouraging their adoption within the healthcare system.

Anti-Corruption Campaigns and Regulatory Scrutiny

Ongoing anti-corruption campaigns within China's healthcare sector, including those targeting pharmaceutical sales practices and medical equipment procurement, can create a more cautious operating environment for private healthcare providers like iKang Healthcare Group. This heightened scrutiny necessitates strict adherence to compliance and ethical standards to mitigate legal risks and protect brand reputation.

Companies are facing increased oversight on pricing strategies and supply chain management. For instance, the National Healthcare Security Administration (NHSA) has been actively working to curb illicit practices, which could impact the profitability of services reliant on opaque pricing structures. iKang's commitment to transparency in its operations is crucial for navigating this evolving regulatory landscape.

- Increased Compliance Costs: Adhering to stricter anti-corruption regulations may lead to higher operational costs for iKang due to enhanced internal controls and legal counsel.

- Reputational Risk Mitigation: Proactive compliance efforts are essential to avoid negative publicity and maintain trust with patients and stakeholders, especially in a sector sensitive to public perception.

- Market Access and Partnerships: Demonstrating robust anti-corruption policies can be a prerequisite for securing partnerships and maintaining access to government-supported healthcare initiatives.

The Chinese government's continued emphasis on healthcare reform, particularly the drive for greater accessibility and affordability in primary care, directly benefits iKang's preventive health focus. Coupled with the 'Healthy China 2030' strategy, which prioritizes wellness and technological integration, the political landscape in 2024-2025 is highly supportive of iKang's business model.

The relaxation of foreign investment rules in the healthcare sector from late 2024, allowing wholly foreign-owned hospitals, opens new avenues for collaboration and market expansion. Furthermore, increased policy support for innovative drugs and medical devices, including R&D subsidies and expedited review processes, indirectly bolsters the advanced diagnostic capabilities that iKang utilizes.

However, ongoing anti-corruption campaigns necessitate stringent compliance from companies like iKang, impacting operational costs and requiring a proactive approach to transparency. This heightened regulatory scrutiny, while posing challenges, also creates a more level playing field for ethically operated businesses.

What is included in the product

This PESTLE analysis provides a comprehensive examination of the external forces impacting iKang Group, covering political stability, economic growth, social trends, technological advancements, environmental regulations, and legal frameworks.

It offers actionable insights for strategic decision-making, highlighting key opportunities and threats within iKang Group's operating environment.

A clear, actionable summary of iKang Group's PESTLE analysis, designed to directly address the pain point of navigating complex external factors, enabling strategic decision-making and risk mitigation.

Economic factors

China's healthcare expenditure is on a strong upward trajectory, with projections indicating continued significant growth. This expansion is fueled by a rising demand for healthcare services and an overall enlarging market.

The total healthcare industry market size is anticipated to hit between RMB 11.5 trillion and RMB 12.0 trillion (approximately USD 1.5 to 1.6 trillion) in 2024. Such robust year-on-year growth highlights the dynamic nature of the sector.

This expanding market presents a particularly promising environment for private preventive healthcare services, like those offered by iKang Group, as consumer focus shifts towards proactive health management.

As China's middle class expands, disposable incomes are on the rise, empowering consumers to prioritize health and wellness. This economic shift means more people can afford and are actively seeking out premium healthcare solutions, moving beyond essential public services.

This growing willingness to spend on personal well-being directly fuels demand for specialized and preventive healthcare. Consumers are now looking for tailored services that offer a higher quality of care and focus on long-term health management.

iKang Group, with its strategic focus on private preventive healthcare, is perfectly positioned to benefit from this evolving consumer behavior. The company's offerings align directly with the increasing desire for proactive health investments among China's burgeoning middle-income population.

There's a noticeable rise in the desire for private healthcare, even with public options available. People are increasingly seeking out private facilities for their better care standards, specialized treatments, and quicker appointments. This trend is particularly strong in urban areas where these facilities are more common.

This growing demand directly benefits companies like iKang Group, which are positioned to meet this need for quality and convenience in medical services. For instance, in 2024, the private healthcare sector in many developed economies saw a growth rate exceeding 5%, driven by an aging population and increased health awareness.

Commercial Medical Insurance Growth

Reforms in China's commercial medical insurance sector, including potential tax deductions, are poised to inject significant new funding into the healthcare system. This is projected to boost private insurance coverage, making private preventive healthcare services more accessible and affordable for a wider segment of the population. This growing demand directly benefits companies like iKang by substantially expanding their potential customer base.

The expansion of commercial medical insurance is a key driver for iKang's growth. As more individuals gain access to private healthcare coverage, the demand for preventive health services, a core offering of iKang, is expected to surge. For instance, by the end of 2023, the penetration rate of commercial health insurance in China was reported to be around 15%, a figure anticipated to climb in the coming years due to policy support.

- Increased Affordability: Policy incentives like tax deductions make private health insurance more attractive, lowering out-of-pocket costs for consumers.

- Expanded Market Reach: A larger insured population translates to a broader market for preventive health check-ups and services offered by iKang.

- Government Support: Reforms signal a strategic direction towards a multi-tiered healthcare system, where private insurance plays a vital role.

Impact of Volume-Based Procurement (VBP)

The expansion of Volume-Based Procurement (VBP) policies, notably in China's pharmaceutical sector, exerts indirect price pressure across the broader healthcare landscape. While iKang Group's core business of health management services isn't directly tied to drug procurement, the nationwide push for cost efficiency, exemplified by VBP's success in lowering drug prices, can shape consumer perceptions of value and affordability in medical services. For instance, China's VBP program has achieved significant price reductions; by late 2023, over 500 drugs had been included in VBP, with average price cuts often exceeding 50% for high-volume items. This creates an environment where consumers may become more sensitive to the pricing of health check-ups and other preventative care services.

This systemic focus on cost containment, driven by government initiatives like VBP, encourages healthcare providers to optimize operational expenses. For iKang, this translates to a need for continued emphasis on service efficiency and demonstrating clear value propositions to customers. The overall healthcare ecosystem's move towards greater price transparency and value-based purchasing, even if indirectly impacting iKang, necessitates a proactive approach to managing costs and communicating the benefits of their offerings. In 2024, the Chinese government continued to expand VBP to more medical consumables, further reinforcing the trend of cost reduction across the healthcare industry.

The indirect impact of VBP on iKang can be summarized as follows:

- Increased consumer price sensitivity: Broad healthcare cost-saving measures can lead individuals to scrutinize the pricing of all health-related services, including iKang's offerings.

- Focus on operational efficiency: The industry-wide drive for cost reduction compels companies like iKang to maintain lean operations and optimize resource allocation.

- Emphasis on demonstrable value: As prices become more transparent, providers must clearly articulate the benefits and return on investment of their services to justify costs.

- Potential for competitive pricing adjustments: While not directly participating in VBP, iKang may face competitive pressure to align its pricing strategies with the broader trend of affordability in healthcare.

China's healthcare market is experiencing substantial growth, with the total market size projected to reach RMB 11.5-12.0 trillion (USD 1.5-1.6 trillion) in 2024. This expansion, driven by an increasing middle class and rising disposable incomes, directly benefits private preventive healthcare providers like iKang Group. The growing consumer demand for proactive health management and higher quality medical services creates a fertile ground for iKang's specialized offerings.

Government reforms, particularly in the commercial medical insurance sector, are expected to further boost private healthcare. Policies like potential tax deductions for private insurance are anticipated to increase coverage and affordability, thereby broadening the customer base for preventive health services. By the end of 2023, commercial health insurance penetration in China stood at approximately 15%, a figure poised for significant growth due to this supportive policy environment.

While Volume-Based Procurement (VBP) primarily impacts pharmaceuticals, its success in driving down costs across the healthcare sector indirectly influences consumer price sensitivity for all medical services. For iKang, this necessitates a continued focus on operational efficiency and clearly demonstrating the value of its preventive health check-ups and services to justify pricing in an increasingly cost-conscious market.

| Economic Factor | Description | Impact on iKang Group | Data Point (2024/2025) |

|---|---|---|---|

| Healthcare Expenditure Growth | Rising spending on healthcare services in China. | Increased demand for preventive services. | Market size projected at RMB 11.5-12.0 trillion. |

| Middle Class Expansion & Disposable Income | Growing affluent population with more spending power. | Higher willingness to invest in personal health and wellness. | Continued growth in consumer spending on health services. |

| Commercial Medical Insurance Reforms | Government initiatives to promote private health insurance. | Enhanced affordability and accessibility of private healthcare. | Commercial health insurance penetration around 15% (end-2023), expected to rise. |

| Cost Containment Initiatives (e.g., VBP) | Government push for efficiency and lower prices in healthcare. | Increased consumer price sensitivity, need for operational efficiency. | VBP achieving >50% price cuts on average for included drugs. |

Preview the Actual Deliverable

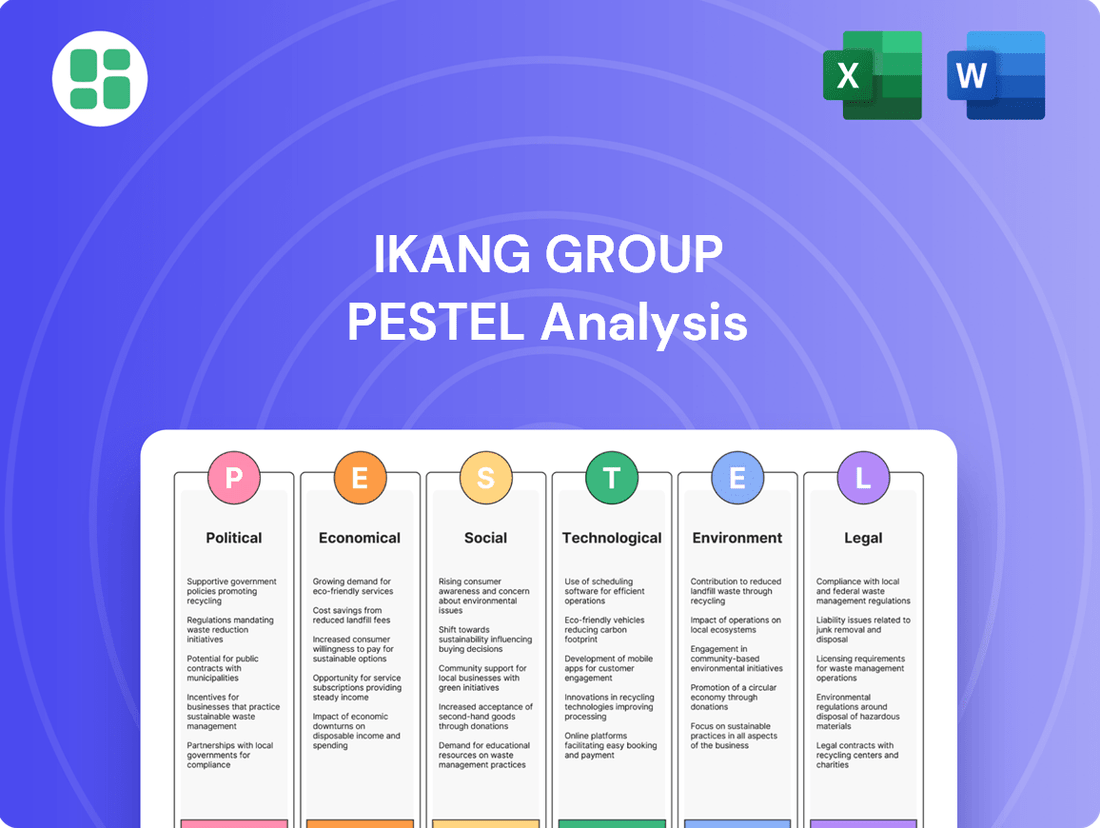

iKang Group PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use, offering a comprehensive PESTLE analysis of the iKang Group.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises, detailing the Political, Economic, Social, Technological, Legal, and Environmental factors impacting iKang.

The content and structure shown in the preview is the same document you’ll download after payment, providing actionable insights into the iKang Group's strategic landscape.

Sociological factors

China's demographic landscape is undergoing a profound transformation with a rapidly aging population. This shift is a significant driver for increased demand across the healthcare sector, especially for services catering to chronic disease management and specialized geriatric care.

Projections indicate that by 2037, China will have approximately 355 million individuals aged 60 and above. This substantial elderly demographic will amplify the need for preventative health screenings and continuous health management solutions, directly impacting companies like iKang Group.

Chinese consumers are demonstrating a marked increase in health consciousness. This trend is fueled by evolving lifestyles, a growing incidence of chronic illnesses, and a heightened awareness of health matters, particularly following recent global health events. For instance, by the end of 2023, the prevalence of chronic diseases in China continued to be a significant concern, with cardiovascular diseases remaining a leading cause of mortality.

This heightened awareness translates into a greater demand for preventive healthcare services. Consumers are actively seeking out services focused on early detection and proactive health management, such as comprehensive health checkups and specialized disease screening programs. This shift in consumer behavior directly supports the market for businesses like iKang Group, which specializes in these very services.

Modern lifestyles in China have unfortunately led to a significant increase in chronic health issues like obesity, diabetes, and heart disease. This trend is creating a greater demand for proactive health management, particularly early detection and intervention services.

The growing prevalence of these lifestyle-related diseases is directly boosting the market for thorough health checkup packages and specialized screening services. iKang Group's strategic emphasis on preventive healthcare positions it well to meet this escalating societal need.

For instance, data from 2024 indicates that over 11.9% of Chinese adults are now classified as obese, a stark rise that underscores the urgency for accessible and effective preventative health solutions.

Demand for Mental Health Services

Mental health is a growing concern in China, driving increased demand for psychological support and services. This societal shift is particularly evident among younger demographics, who are increasingly prioritizing investments in both their mental and physical well-being.

This trend presents a significant opportunity for preventive healthcare providers like iKang Group to expand their offerings. The expansion could encompass mental health screenings and comprehensive wellness programs, aligning with the evolving health priorities of the population.

- Rising Mental Health Awareness: A 2023 survey indicated that over 70% of Chinese urban residents believe mental health is as important as physical health.

- Youth Investment in Wellness: Data from 2024 shows that individuals aged 18-35 in China are spending an average of 15% more on health and wellness services compared to the previous year.

- Service Expansion Potential: This growing demand suggests a market ripe for integrated health solutions that address both physical and mental wellness needs.

Urban-Rural Disparities in Healthcare Access

Despite ongoing efforts to improve healthcare infrastructure, considerable gaps in access and quality of medical services remain between China's urban and rural populations. iKang Group's business model, while extensive, is predominantly focused on urban areas where demand for its private health management services is highest. By the end of 2023, iKang operated over 400 medical centers, the vast majority situated in major cities.

This concentration means iKang is well-positioned to serve the urban demographic but less directly addresses the needs of rural communities. However, government initiatives aimed at strengthening primary healthcare in rural regions could indirectly impact the broader healthcare market. For instance, the National Health Commission's plans for 2024-2025 include expanding telemedicine services and increasing the number of village doctors, potentially creating a more robust foundational healthcare system nationwide.

The sociological factor of urban-rural disparities presents both a challenge and an opportunity for iKang. While its current operational focus aligns with concentrated demand, future expansion or partnership strategies might consider the evolving rural healthcare landscape.

- Urban Concentration: iKang's network of over 400 centers as of late 2023 is heavily weighted towards major metropolitan areas.

- Rural Healthcare Initiatives: Government plans for 2024-2025 aim to bolster rural primary care through measures like telemedicine expansion.

- Demand Dynamics: The demand for premium health management services, iKang's core offering, is significantly higher in urban centers.

China's rapidly aging population, with projections of 355 million individuals over 60 by 2037, fuels demand for geriatric and chronic disease management services, directly benefiting companies like iKang Group.

Increased health consciousness, spurred by modern lifestyles and a higher incidence of chronic diseases like obesity (affecting over 11.9% of Chinese adults in 2024), drives demand for preventive healthcare and early detection services.

Growing mental health awareness, with over 70% of urban Chinese residents in 2023 viewing mental health as crucial as physical health, opens avenues for iKang to expand into integrated wellness programs.

Significant urban-rural disparities in healthcare access persist, with iKang's over 400 centers (late 2023) concentrated in urban areas, while government initiatives in 2024-2025 aim to improve rural primary care.

| Sociological Factor | Description | Impact on iKang Group | Supporting Data (2023-2025) |

|---|---|---|---|

| Aging Population | China's population is aging rapidly. | Increased demand for geriatric and chronic care. | 355 million over 60 by 2037; 2024 saw continued rise in elderly care needs. |

| Health Consciousness | Growing awareness of health and wellness. | Boosts demand for preventive and diagnostic services. | 11.9% adult obesity rate (2024); 70%+ urban Chinese prioritize mental health (2023). |

| Urban-Rural Divide | Uneven distribution of healthcare resources. | iKang's urban focus aligns with current demand, but rural expansion is a future consideration. | 400+ centers (late 2023) mainly in cities; 2024-2025 plans to boost rural telemedicine. |

Technological factors

China's healthcare landscape is rapidly evolving, with digital health and AI at the forefront of this transformation. By 2024, the market for AI in healthcare in China was projected to reach billions of dollars, reflecting significant investment and adoption.

AI is revolutionizing diagnostics, drug discovery, and patient care through tools like AI-powered virtual physicians and advanced imaging analysis. This technological surge is estimated to improve diagnostic accuracy by up to 30% in certain areas, leading to more efficient and precise medical outcomes.

The integration of AI into smart hospital operations and telemedicine platforms is further enhancing healthcare accessibility and operational efficiency. For instance, by 2025, it's anticipated that a substantial percentage of routine patient consultations in major Chinese cities will be conducted via telemedicine, supported by AI triage systems.

The telemedicine and online health platform sector in China is experiencing significant growth, fundamentally altering how healthcare is accessed and delivered. This digital transformation is particularly impactful in extending services to underserved rural populations and improving the efficiency of patient interactions. For instance, by the end of 2023, China's online healthcare market was projected to reach approximately $230 billion, highlighting the scale of this digital shift.

Leading players such as JD Health and Ali Health are leveraging advanced technologies like artificial intelligence to offer a suite of services. These include virtual consultations, remote patient monitoring, and AI-powered self-diagnosis tools, making healthcare more convenient and accessible. This digital infrastructure is reshaping patient expectations for healthcare delivery.

This burgeoning digital health landscape presents a substantial opportunity for iKang Group. By integrating online consultations and robust digital health management solutions into its existing preventive healthcare services, iKang can expand its reach, enhance patient engagement, and offer more comprehensive, convenient care pathways. This strategic integration aligns with the evolving demands of the Chinese healthcare consumer.

The widespread adoption of Electronic Health Records (EHR) in China, particularly in tertiary and secondary hospitals, is a significant technological shift. This trend, which is also gaining traction in primary care settings, is driven by a national effort to standardize data and implement unique patient identifiers. For iKang Group, this presents a valuable opportunity to leverage more comprehensive and integrated patient data, thereby enhancing the personalization and efficiency of its preventive healthcare services.

Wearable Technology and IoT for Health Monitoring

Wearable technology and the Internet of Things (IoT) are rapidly transforming health monitoring, presenting significant opportunities for companies like iKang. The market for these devices is expanding, with projections indicating continued strong growth through 2025 and beyond. For instance, the global wearable technology market was valued at approximately $116 billion in 2023 and is expected to reach over $300 billion by 2028, demonstrating a compound annual growth rate (CAGR) of around 20%. This surge is driven by increased consumer interest in health and fitness, coupled with advancements in sensor technology and data analytics.

These technologies enable continuous, real-time tracking of vital signs and health metrics, facilitating early detection of potential health issues. This aligns directly with the growing emphasis on preventive healthcare, a key area for iKang's service offerings. By integrating wearable and IoT solutions, iKang can offer more personalized and proactive health management programs, moving beyond traditional episodic check-ups to continuous wellness support. This integration can enhance customer engagement and provide valuable data for personalized health insights.

iKang can leverage these technological advancements in several ways:

- Enhanced Data Collection: Integrating data from wearables allows for a more comprehensive and continuous view of a client's health status.

- Proactive Health Management: Early detection of anomalies through constant monitoring enables timely interventions and personalized health recommendations.

- New Service Offerings: Development of subscription-based services or premium packages that incorporate wearable data analysis and remote monitoring.

- Improved Customer Engagement: Providing clients with accessible platforms to view and understand their health data fosters greater involvement in their well-being.

Innovation in Diagnostic Technologies

Technological advancements are revolutionizing medical diagnostics, enabling earlier and more accurate disease detection. Innovations like blood tests for Alzheimer's, potentially years before symptoms manifest, and sophisticated gene therapies are transforming preventive healthcare. For iKang Group, these developments are crucial, directly aligning with their emphasis on early detection and screening. This allows for more precise and effective preventive interventions, a core component of their service offering.

The global market for in-vitro diagnostics (IVD) is projected to reach approximately $130 billion by 2027, with significant growth driven by technological innovation. iKang's strategic positioning benefits from this trend, as advancements in areas like liquid biopsies and AI-powered image analysis enhance the precision and scope of their screening services. For instance, AI algorithms are showing remarkable accuracy in detecting early signs of cancer from medical scans, a capability iKang can leverage to strengthen its diagnostic portfolio.

- Advancements in Alzheimer's diagnostics: New blood tests are emerging that can detect biomarkers associated with Alzheimer's disease years before cognitive decline becomes apparent, offering a critical window for intervention.

- Growth in gene therapy: The gene therapy market is expanding rapidly, with numerous clinical trials underway for various genetic disorders, indicating a future where personalized genetic treatments become more mainstream.

- AI in medical imaging: Artificial intelligence is increasingly being integrated into diagnostic imaging, improving the speed and accuracy of identifying abnormalities in X-rays, CT scans, and MRIs.

Technological advancements in China's healthcare sector are rapidly reshaping preventive care. AI-driven diagnostics, for instance, are improving accuracy by up to 30% in certain medical areas, while telemedicine is expected to handle a significant portion of routine consultations in major cities by 2025. The burgeoning online health market, valued at approximately $230 billion by the end of 2023, underscores this digital shift.

Wearable technology and IoT devices are also key, with the global market projected to grow from $116 billion in 2023 to over $300 billion by 2028. This enables continuous health monitoring, aligning with iKang's focus on proactive wellness. Furthermore, innovations in diagnostics, such as AI in medical imaging and emerging blood tests for early disease detection, directly support iKang's early intervention strategies.

Legal factors

Operating medical facilities in China demands strict adherence to licensing and accreditation, a critical legal factor for iKang Group. The establishment of new medical institutions, including those with foreign investment, requires navigating complex qualification standards and detailed approval processes.

While China has been easing foreign investment limits, wholly foreign-owned hospitals still face specific regulatory hurdles. iKang's ability to maintain and expand its widespread network hinges on its continuous compliance with these evolving legal frameworks, ensuring all its facilities meet the necessary legal benchmarks.

China's Cybersecurity Law and Personal Information Protection Law (PIPL) impose strict requirements on how health data is collected, stored, and transferred, impacting iKang's digital health operations. Non-compliance can result in significant fines, with PIPL allowing penalties up to 5% of annual turnover or 50 million yuan for serious violations. iKang must invest in advanced data encryption and access control systems to meet these evolving legal standards and protect sensitive patient information.

Consumer protection laws in healthcare are vital for safeguarding patient rights, ensuring quality of care, and promoting fair pricing. For a private healthcare provider like iKang, these regulations directly impact marketing strategies, complaint resolution processes, and the transparency of its services. For instance, in 2024, China's State Administration for Market Regulation continued to emphasize stricter enforcement of advertising laws, impacting how health services can be promoted.

Anti-Monopoly and Fair Competition Laws

China's commitment to fostering fair competition and curbing monopolistic tendencies significantly impacts the healthcare sector. This regulatory stance ensures that companies like iKang Group operate in a market where a level playing field is prioritized, preventing any single entity from dominating unfairly. The government actively monitors industries to uphold these principles.

iKang must navigate these legal structures carefully, ensuring its business practices align with anti-monopoly regulations. This includes avoiding price-fixing, market allocation, or predatory pricing that could stifle competition. Adherence to these laws is crucial for maintaining operational legitimacy and market access.

- Regulatory Focus: The Chinese State Administration for Market Regulation (SAMR) is empowered to enforce anti-monopoly laws, with significant fines levied for violations.

- Industry Impact: In 2023, SAMR investigated numerous cases across various sectors, signaling a robust enforcement environment that extends to healthcare services.

- Compliance Imperative: iKang's strategy must proactively incorporate compliance measures to prevent any actions that could be construed as anti-competitive.

Medical Liability and Malpractice Regulations

Medical liability and malpractice regulations are critical for iKang Group, given its extensive healthcare service offerings. These laws define the accountability of medical professionals for errors or negligence, directly impacting patient safety and iKang's operational framework. Adherence to stringent professional standards and maintaining adequate malpractice insurance are non-negotiable requirements for the company.

The evolving landscape of medical malpractice litigation in China presents both challenges and opportunities for iKang. For instance, while specific nationwide malpractice claim statistics for 2024-2025 are still emerging, reports from earlier years indicate a consistent need for robust risk management. In 2023, China's healthcare sector continued to focus on improving patient safety protocols, influenced by global trends and domestic legal reforms aimed at balancing patient rights with provider responsibilities.

iKang's commitment to quality care and compliance with these regulations is paramount. This includes investing in advanced training for its medical staff and implementing rigorous internal quality control measures. The potential financial implications of malpractice claims, including legal defense costs and potential settlements, necessitate a proactive approach to risk mitigation and insurance coverage, ensuring the company's financial stability and reputation.

- Legal Framework: Medical liability laws dictate the responsibilities and potential liabilities of healthcare providers in cases of medical negligence or errors.

- Patient Safety Focus: These regulations are designed to protect patients and ensure that healthcare services are delivered with a high degree of care and professionalism.

- Operational Impact: Compliance with malpractice regulations influences iKang's operational procedures, staff training, and the necessity of comprehensive insurance coverage.

- Risk Management: iKang must maintain robust risk management strategies to mitigate potential legal challenges and financial repercussions stemming from malpractice claims.

China's evolving regulatory landscape for medical licensing and foreign investment significantly shapes iKang Group's operational capacity. Navigating the complexities of qualification standards and approval processes for new medical facilities, particularly those with foreign capital, remains a key legal consideration. The government's ongoing efforts to streamline these procedures, while maintaining stringent quality controls, directly impact iKang's expansion strategies and the establishment of new service centers.

The stringent data privacy laws, including the Cybersecurity Law and PIPL, impose substantial compliance burdens on iKang's digital health services. Penalties for non-compliance can reach up to 5% of annual turnover or 50 million yuan, underscoring the critical need for robust data protection measures. iKang's investment in advanced encryption and access control systems is therefore essential to safeguard sensitive patient information and avoid significant financial and reputational damage.

Consumer protection laws mandate transparency and fair practices in healthcare, influencing iKang's marketing and service delivery models. Strict enforcement of advertising regulations, as seen with continued emphasis from the State Administration for Market Regulation (SAMR) in 2024, requires careful adherence to avoid penalties. iKang must ensure its promotional activities and pricing structures are compliant and clearly communicated to patients.

Anti-monopoly regulations in China's healthcare sector aim to foster fair competition, directly impacting iKang's market strategies. SAMR's active enforcement, with numerous investigations across sectors in 2023, signals a commitment to preventing monopolistic practices. iKang must proactively ensure its operations, including pricing and market conduct, align with these anti-competitive laws to maintain market access and operational legitimacy.

Medical liability and malpractice regulations are paramount for iKang, influencing patient safety protocols and operational procedures. While specific 2024-2025 national statistics on malpractice claims are still consolidating, the sector's focus in 2023 on improving patient safety, influenced by legal reforms, highlights the ongoing importance of risk management. iKang's investment in staff training and comprehensive malpractice insurance is crucial to mitigate legal risks and financial exposure.

Environmental factors

Recent public health crises, like the COVID-19 pandemic, have dramatically increased global focus on health and disease prevention. This heightened awareness directly benefits iKang Group, as both individuals and businesses are now more inclined to invest in preventive health services and regular check-ups to safeguard against future health threats.

Environmental pollution, especially concerning air and water quality, remains a significant issue in China, leading to a rise in various health problems and chronic diseases. This growing awareness directly fuels demand for health checkups that can identify early indicators of environmentally-linked health conditions.

iKang Group can capitalize on this trend by developing and promoting specialized health screenings and offering expert advice on mitigating the health impacts of pollution. For instance, in 2023, China's Ministry of Ecology and Environment reported that 37.7% of monitored surface water bodies were rated as "poor" or "very poor," underscoring the need for proactive health monitoring.

There's a significant global push for environmental sustainability, and the healthcare sector is no exception. This means healthcare providers, including iKang, are increasingly scrutinized for their environmental impact.

Healthcare facilities are actively working to reduce their carbon footprint through better waste management and energy efficiency initiatives. For example, many hospitals are investing in renewable energy sources and implementing advanced recycling programs to handle medical waste more responsibly.

As a result, iKang can expect heightened expectations from both corporate clients and individual consumers who are prioritizing environmentally conscious service providers. This trend is likely to influence purchasing decisions and partnerships in the coming years.

Resource Management and Waste Reduction

The healthcare industry, including companies like iKang Group, faces significant environmental challenges related to resource consumption and waste generation. Medical waste, in particular, requires specialized handling and disposal to prevent environmental contamination and health risks. For instance, in 2023, the global healthcare sector was estimated to produce over 5.9 million tons of medical waste, with a substantial portion being hazardous. This underscores the critical need for robust waste management protocols.

Compliance with stringent environmental regulations is paramount for iKang. These regulations govern everything from the segregation and treatment of medical waste to its final disposal. Failure to adhere to these standards can result in hefty fines and reputational damage. For example, in China, where iKang operates extensively, regulations such as the Law on the Prevention and Control of Environmental Pollution by Solid Waste are strictly enforced, with penalties for non-compliance being substantial.

Beyond regulatory compliance, adopting sustainable resource management practices offers strategic advantages. iKang can achieve operational efficiencies by minimizing waste and optimizing resource use, potentially lowering costs. Furthermore, a commitment to environmental sustainability can enhance its brand image, attracting environmentally conscious customers and investors. By investing in advanced waste treatment technologies and circular economy principles, iKang can differentiate itself in the market.

- Medical Waste Generation: The global healthcare sector produced an estimated 5.9 million tons of medical waste in 2023.

- Regulatory Landscape: China's Law on the Prevention and Control of Environmental Pollution by Solid Waste imposes strict disposal requirements.

- Sustainability Benefits: Efficient resource management can lead to cost savings and a stronger brand reputation for iKang.

Climate Change and Health Implications

Climate change presents a growing concern for public health, with potential long-term implications such as increased occurrences of certain diseases and exacerbated respiratory problems. For instance, the World Health Organization (WHO) has highlighted that by 2030, climate change is expected to cause approximately 250,000 additional deaths per year from malnutrition, malaria, diarrhoea, and heat stress alone.

A forward-thinking preventive healthcare provider like iKang Group can proactively adapt its services to address health challenges intensified by environmental shifts. This strategic adaptation could involve developing specialized screening packages designed to detect and manage conditions linked to environmental factors, thereby influencing future service offerings and market positioning.

Consider how iKang might integrate:

- Enhanced respiratory health screenings to detect early signs of pollution-related lung conditions.

- Nutritional assessments focusing on dietary resilience and potential deficiencies linked to climate-impacted food supplies.

- Infectious disease monitoring for vector-borne illnesses that may expand their geographic range due to warming temperatures.

- Heat-related illness preparedness, including advice and screening for individuals at higher risk during extreme weather events.

Growing public awareness of environmental issues, particularly pollution and climate change, directly benefits iKang Group by increasing demand for health checkups that identify environmentally-linked conditions. The global healthcare sector generated an estimated 5.9 million tons of medical waste in 2023, highlighting the critical need for robust waste management, a key area for iKang's operational focus and compliance with China's stringent environmental regulations.

PESTLE Analysis Data Sources

Our PESTLE Analysis for iKang Group is meticulously constructed using a blend of official government publications, reputable financial news outlets, and industry-specific market research reports. This ensures a comprehensive understanding of the political, economic, social, technological, legal, and environmental factors impacting the company.