iKang Group Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

iKang Group Bundle

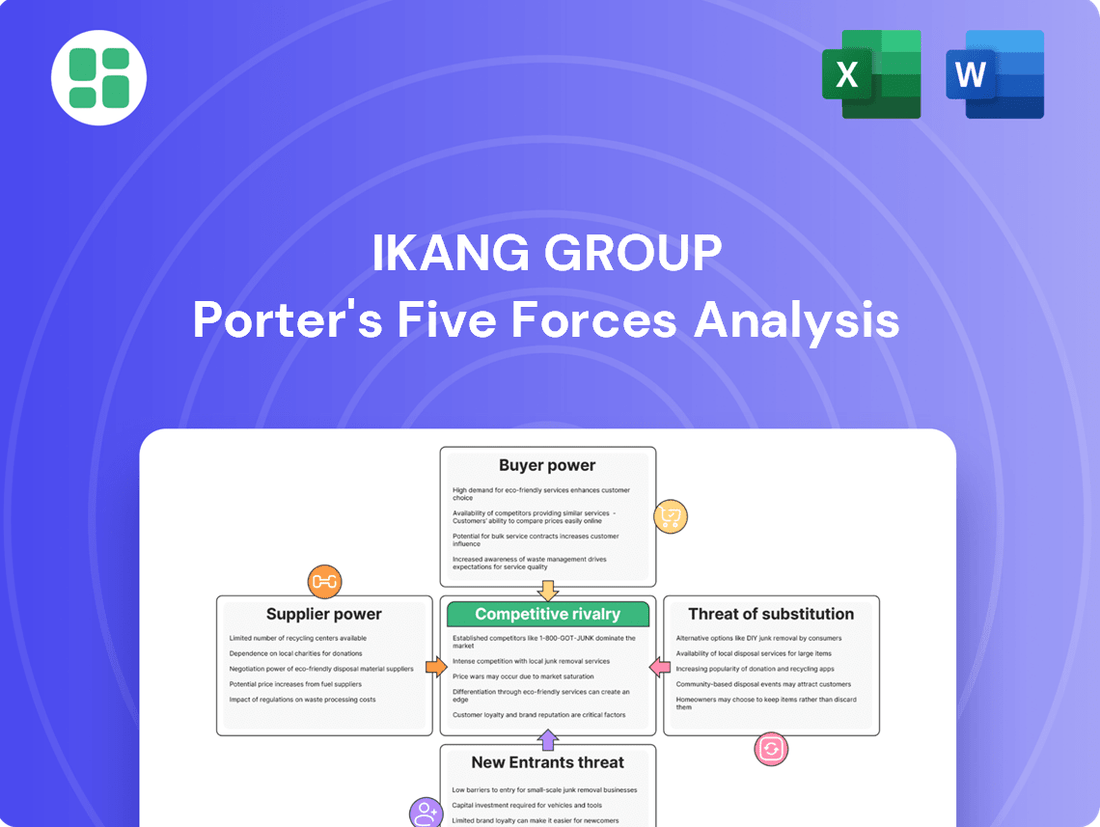

The iKang Group operates in a dynamic healthcare landscape, facing significant competitive pressures. Understanding the interplay of buyer power, supplier influence, and the threat of new entrants is crucial for navigating this market.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore iKang Group’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

The concentration of key suppliers for medical equipment, pharmaceuticals, and specialized diagnostic tools in China presents a significant factor influencing iKang Group's bargaining power. When a limited number of dominant suppliers control critical inputs, these suppliers can wield considerable influence over pricing and contract terms, potentially increasing costs for iKang.

However, the evolving landscape in China, marked by an increasing number of new drug approvals and a strong governmental push for domestic production, offers a glimmer of diversification for iKang. This trend could, over time, dilute the concentrated power of existing suppliers and introduce more competitive options, thereby enhancing iKang's negotiating position.

The bargaining power of suppliers for iKang is significantly influenced by switching costs. For instance, the expense of re-calibrating diagnostic equipment or retraining staff to use new systems can deter iKang from changing suppliers, even if current terms are unfavorable. This is particularly true for specialized reagents crucial for accurate disease screening, where a switch could involve substantial upfront investment and potential disruptions to service quality.

The bargaining power of suppliers is a critical factor for iKang Group, as the quality of their medical supplies and equipment directly impacts the accuracy of health check-ups and disease screenings. For instance, in 2024, iKang's ability to maintain its reputation for reliable diagnostic services hinges on securing high-quality reagents and advanced imaging technology from its suppliers. Suppliers of specialized diagnostic equipment, especially those offering cutting-edge technologies, possess significant leverage due to the limited availability of alternatives and the direct correlation between their products and iKang's core service delivery.

Threat of Forward Integration by Suppliers

The threat of forward integration by suppliers could significantly impact iKang's bargaining power. If suppliers, such as large pharmaceutical or medical device companies, were to establish their own healthcare service platforms or clinics, they could directly compete with iKang. This would reduce iKang's reliance on these suppliers for their service offerings, potentially shifting the balance of power. For instance, a major diagnostic equipment manufacturer could decide to offer its own testing services, thereby leveraging its existing infrastructure and brand recognition to capture a share of the market iKang currently serves.

This potential for suppliers to move into iKang's operational space presents a strategic challenge. It means that iKang must not only manage its relationships with current suppliers but also anticipate and potentially counter moves that could undermine its market position. The bargaining power of suppliers increases if they can credibly threaten to enter the buyer's market. As of 2024, the healthcare services sector continues to see consolidation and innovation, making such forward integration a plausible, albeit not universally applicable, threat across different supplier segments.

- Suppliers entering iKang's market directly increases their leverage.

- Large medical device or pharma companies are potential candidates for forward integration.

- This could lead to iKang facing direct competition from its own suppliers.

Availability of Substitute Inputs

The availability of substitute inputs significantly impacts the bargaining power of suppliers for companies like iKang Group. If alternative medical supplies, diagnostic kits, or equipment are readily available, it weakens a supplier's ability to dictate terms and prices.

China's strategic emphasis on domestic innovation and manufacturing in the healthcare sector is a key factor. This push aims to increase the availability of locally produced medical devices and pharmaceuticals. For instance, by 2024, China's investment in its domestic biopharmaceutical industry reached substantial figures, fostering a more competitive landscape. This growing domestic capacity means iKang Group, and similar entities, can potentially source essential inputs from multiple local providers, thereby reducing reliance on any single supplier and diminishing their bargaining leverage.

- Increased domestic production of medical consumables and diagnostic reagents in China.

- Government incentives for local medical technology development.

- Potential for price competition among a wider range of domestic suppliers.

- Reduced dependence on imported, potentially higher-cost, specialized medical equipment.

The bargaining power of suppliers for iKang Group is a crucial element, directly affecting operational costs and service quality. As of 2024, the concentration of suppliers for specialized diagnostic equipment and reagents in China presents a notable challenge, as a limited number of dominant providers can exert significant pricing influence. However, a growing domestic manufacturing base, supported by substantial government investment in the biopharmaceutical sector, is fostering greater competition and offering iKang more diversified sourcing options, thereby mitigating supplier leverage.

| Supplier Characteristic | Impact on iKang | 2024 Data/Trend |

|---|---|---|

| Supplier Concentration | High concentration increases supplier power. | Key suppliers for advanced diagnostics remain consolidated. |

| Switching Costs | High costs empower incumbent suppliers. | Significant investment needed for new diagnostic equipment calibration. |

| Availability of Substitutes | More substitutes reduce supplier power. | Growing domestic production of reagents offers alternatives. |

| Threat of Forward Integration | Suppliers entering iKang's market increase their leverage. | Plausible threat from large medical device manufacturers in 2024. |

What is included in the product

This analysis uncovers the competitive landscape for iKang Group, detailing the intensity of rivalry, buyer and supplier power, threat of new entrants, and the impact of substitutes on its market position.

Instantly visualize iKang Group's competitive landscape with a dynamic Porter's Five Forces analysis, simplifying complex market pressures for strategic clarity.

Customers Bargaining Power

Customer price sensitivity is a significant factor for iKang Group. Both corporate clients and individual consumers exhibit this trait. Large corporations often leverage their purchasing power to negotiate discounts on employee health check-up packages, directly impacting iKang's revenue per customer.

Individual consumers are also increasingly vigilant about costs, actively seeking out more affordable preventive healthcare solutions. This trend was evident in 2024 as many individuals prioritized value for money in their healthcare spending, a behavior likely to continue as economic conditions evolve.

Customers in China have a wealth of options for preventive healthcare, significantly boosting their bargaining power. They can choose from public hospitals, numerous private health check-up centers, and specialized clinics, offering a wide range of services and price points.

This abundance of alternatives means customers can readily switch providers if they find better pricing, superior service quality, or greater convenience elsewhere. For instance, the Chinese healthcare market is highly competitive, with thousands of private medical institutions operating alongside public facilities, giving consumers considerable leverage.

Customers of iKang Group are increasingly empowered due to greater access to information. The proliferation of digital health platforms and a general rise in health consciousness mean consumers can readily compare service providers, scrutinize pricing, and evaluate the quality of medical examinations and health management services. This heightened awareness significantly boosts their ability to negotiate or seek better value.

Online reviews and comparison websites are pivotal in this shift, providing a transparent view of iKang's competitors and their offerings. For instance, in 2024, platforms like Dianping and various health forums allow potential customers to share experiences and rate services, directly influencing purchasing decisions and amplifying customer bargaining power.

Switching Costs for Customers

For iKang Group, the bargaining power of customers is influenced by switching costs, which are generally low for standard health check-ups. This is because these services typically don't require long-term commitments or intricate integration with other personal health records, allowing customers to easily move between providers. For instance, in 2023, the health check-up market in China saw numerous new entrants offering competitive pricing, further lowering the barrier to switching for basic services.

However, the situation changes for more specialized or ongoing preventive care programs. Switching in these instances can present some inconvenience for customers. This might include the need to transfer medical history, re-establish relationships with new physicians, or adapt to different diagnostic protocols, thereby slightly diminishing their bargaining power. For example, a customer enrolled in a multi-year personalized cancer screening program might find it more cumbersome to switch providers compared to a one-off annual physical.

- Low switching costs for standard health check-ups allow customers flexibility.

- Specialized or ongoing care programs introduce minor inconveniences upon switching.

- Market competition in basic health checks further empowers customers.

Large Corporate Client Concentration

iKang Group's reliance on a concentrated base of large corporate clients significantly amplifies customer bargaining power. If a substantial portion of iKang's revenue is derived from just a handful of major corporate customers, these clients gain considerable leverage.

This leverage allows them to negotiate more favorable terms, such as reduced pricing or enhanced service packages. For instance, if a significant percentage of iKang's revenue in 2024 was tied to a few key enterprise contracts, those clients could effectively dictate terms due to the potential loss of substantial business.

- Concentrated Client Base: iKang's revenue streams may be heavily dependent on a limited number of large corporate accounts.

- Negotiating Leverage: Large clients can use their significant purchasing volume to demand lower prices or better service conditions.

- Risk of Churn: The potential loss of a major client can have a disproportionate impact on iKang's financial performance.

- Customization Demands: Large corporate clients often require tailored solutions, which can increase operational complexity and costs for iKang.

The bargaining power of customers for iKang Group is considerable, driven by market saturation and low switching costs for standard services. In 2024, the competitive landscape in China's preventive healthcare sector offered consumers numerous alternatives, from public hospitals to private clinics, enabling them to readily compare prices and service quality. This abundance of choice means customers can easily shift providers if better value or convenience is found, a trend amplified by online platforms where reviews and pricing are transparently displayed. While specialized or long-term care programs might introduce minor switching inconveniences, the overall ability for customers to exert pressure on pricing and service terms remains high.

| Factor | Impact on iKang | 2024 Data/Trend |

|---|---|---|

| Availability of Alternatives | High customer bargaining power | Thousands of private and public healthcare providers in China. |

| Switching Costs (Standard Checks) | Low, empowering customers | Minimal data transfer or relationship building needed for basic check-ups. |

| Information Accessibility | Increased customer leverage | Proliferation of online health platforms and review sites. |

| Corporate Client Concentration | Significant leverage for large clients | Dependence on major corporate accounts allows them to negotiate terms. |

Preview Before You Purchase

iKang Group Porter's Five Forces Analysis

This preview showcases the complete iKang Group Porter's Five Forces Analysis, offering a detailed examination of competitive forces within the healthcare industry. The document you see here is precisely what you’ll receive immediately after purchase, providing actionable insights into the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry. Rest assured, no placeholders or mockups are used; you are viewing the actual, professionally formatted analysis ready for your strategic planning needs.

Rivalry Among Competitors

The competitive landscape for iKang Group within China's preventive healthcare sector is notably crowded. This market features a wide array of players, from public hospitals offering health check-ups to extensive private health examination chains and a multitude of smaller, specialized clinics, all contributing to a highly fragmented and competitive environment.

This diversity of competitors, each vying for market share, significantly intensifies the rivalry for iKang Group. For instance, as of 2024, China's private healthcare market, which preventive services are a part of, is projected to continue its robust growth, indicating a strong influx of both established and emerging players.

The preventive healthcare market in China is booming, with projections indicating it will reach US$53,877.1 million by 2031. This rapid expansion, fueled by rising health consciousness and a growing elderly demographic, offers a buffer against the fiercest price wars by creating space for multiple participants.

However, even with this robust growth, the intense desire for market share among numerous players means that competitive rivalry remains a significant force. Companies are actively vying for customers, leading to aggressive strategies that can still impact profitability.

Healthcare providers, including iKang Group, face intense rivalry stemming from significant fixed costs. These costs are tied to expensive medical equipment, state-of-the-art facilities, and highly skilled medical professionals. To recoup these substantial investments, companies are compelled to maximize their operational capacity.

This drive for high utilization often translates into aggressive pricing strategies and intensified marketing efforts. When multiple players in the market are all trying to fill their capacity, it naturally fuels a competitive environment where price and market share become key battlegrounds. For instance, in 2023, the diagnostics and screening sector in China, where iKang operates, saw continued pressure on service fees as providers sought to attract higher patient volumes.

Differentiation Among Competitors

The health check-up market, while offering comprehensive services like iKang, often sees providers differentiated by more than just the breadth of their offerings. If services are viewed as largely interchangeable, price becomes a dominant driver of competition.

However, iKang and its rivals can carve out distinct market positions through specialized medical equipment, unique wellness programs, or a strong emphasis on customer experience. For instance, advanced diagnostic technologies or personalized health reports can serve as significant differentiators.

- Brand Reputation: Established players like iKang benefit from years of service, building trust and recognition.

- Service Specialization: Some competitors might focus on niche areas like genetic testing or specific disease screenings, attracting a targeted clientele.

- Technological Advancement: Investment in cutting-edge medical imaging or data analytics can set providers apart.

- Customer Experience: Offering a seamless booking process, comfortable facilities, and attentive staff contributes to differentiation.

Exit Barriers

iKang Group, like many in the healthcare diagnostics sector, faces significant exit barriers. These barriers can force companies to stay in the market even when facing low profitability, thereby intensifying competition. Specialized assets, such as advanced medical equipment and dedicated clinic facilities, are difficult to repurpose or sell quickly, locking in capital and making withdrawal costly.

Contractual obligations with suppliers, service providers, and even patients can also create substantial hurdles to exiting the market. Furthermore, the social responsibility inherent in healthcare provision means that simply shutting down operations is often not a viable or ethical option, adding another layer to exit difficulties.

- Specialized Assets: iKang's investment in sophisticated diagnostic machinery and its network of physical clinics represent substantial, illiquid assets that are hard to divest without significant loss.

- Contractual Commitments: Long-term leases on facilities and service agreements for equipment can bind iKang to ongoing expenses, even if market conditions deteriorate.

- Social and Regulatory Factors: The nature of healthcare services often involves regulatory oversight and public expectation that complicates abrupt market exits, potentially requiring phased closures or transfers of care.

Competitive rivalry is a defining characteristic of iKang Group's operating environment in China's preventive healthcare market. The sector is populated by a diverse range of entities, from public hospitals to numerous private chains and smaller clinics, all vying for market share. This fragmentation, coupled with substantial fixed costs associated with advanced medical equipment and facilities, compels providers to maximize utilization, often leading to aggressive pricing and marketing. As of 2024, the ongoing growth in China's private healthcare market signals continued competition, with players differentiating through technology, service specialization, and customer experience to capture a larger client base.

SSubstitutes Threaten

Public hospitals in China represent a significant threat of substitutes for private health check-up providers like iKang Group. These public institutions often provide services at considerably lower price points, frequently subsidized or covered by China's extensive basic health insurance system, making them highly accessible. For instance, a comprehensive health check-up at a public hospital might cost a fraction of what a private clinic charges, even if the latter offers more advanced amenities or quicker appointments.

While public hospitals may contend with longer waiting periods and a less personalized patient experience, their fundamental advantage lies in affordability and a widespread perception of reliability. This makes them a compelling alternative for a large segment of the population prioritizing cost-effectiveness over convenience or premium service. In 2023, China's healthcare expenditure reached approximately 9 trillion yuan, with a substantial portion allocated to public healthcare services, underscoring the scale of this substitute offering.

The growing prevalence of wearable health devices and mobile health applications presents a significant threat of substitutes for iKang Group. For instance, by early 2024, the global wearable technology market was projected to reach over $150 billion, with a substantial portion dedicated to health and fitness tracking.

These digital solutions, including AI-powered diagnostic tools, enable individuals to proactively monitor their well-being and conduct basic health assessments remotely. This accessibility can directly substitute for certain traditional in-person preventive check-ups, particularly for routine screenings, potentially reducing demand for iKang's core services.

Increased public awareness about healthy lifestyles, including diet, exercise, and stress management, is driving individuals to seek alternatives to traditional medical screenings. This trend sees people investing in wellness programs, fitness trackers, and nutritional supplements, which can be seen as substitutes for some of iKang Group's core services.

For instance, the global digital health market, which includes many of these wellness technologies, was valued at approximately $200 billion in 2023 and is projected to grow significantly. This growth indicates a tangible shift where consumers are adopting these preventive measures, potentially reducing their reliance on formal clinical check-ups as their primary health management strategy.

Traditional Chinese Medicine (TCM) and Alternative Therapies

For some consumers, Traditional Chinese Medicine (TCM) and other alternative therapies represent a distinct approach to health management. While not direct replacements for diagnostic medical services, these practices can shape how individuals seek healthcare, potentially leading to reduced demand for conventional health check-ups. In 2023, the global wellness market, which includes many alternative therapies, was valued at over $5.6 trillion, indicating a significant consumer interest in diverse health approaches.

These alternative options can influence consumer choices by offering different philosophies on well-being and disease prevention. For instance, a consumer opting for acupuncture as a form of pain management might forgo a standard physical therapy session. This shift in health-seeking behavior can impact the customer base for traditional health screening services.

- Alternative Therapies as Preventive Care: Consumers increasingly view TCM and other holistic practices as proactive measures for maintaining health, potentially reducing the perceived necessity of routine Western medical check-ups.

- Influence on Health-Seeking Behavior: The growing acceptance and accessibility of these therapies can divert some individuals from traditional medical pathways, especially for non-acute health concerns.

- Market Growth of Wellness: The substantial global wellness market, exceeding $5.6 trillion in 2023, underscores a broad consumer appetite for diverse health and preventive solutions, including those outside conventional medicine.

Employer-provided Basic Health Screenings

The threat of substitutes for iKang Group's comprehensive health screening services, particularly from employer-provided basic health screenings, is a notable factor. Large corporations may choose to implement in-house basic health checks or collaborate with occupational health providers for more limited, convenient employee check-ups. This can reduce the demand for iKang's more extensive external health screening packages.

For instance, while specific 2024 data for this exact substitution is still emerging, the trend towards corporate wellness programs suggests a growing internal focus on employee health. Companies might prioritize routine checks like blood pressure and basic blood work, which can be managed internally or through local partnerships, thereby bypassing the need for specialized external providers for these specific services.

This creates a competitive pressure where the convenience and cost-effectiveness of in-house or localized basic screenings can be attractive alternatives. For iKang, this means highlighting the added value and depth of their diagnostic capabilities beyond what basic employer-sponsored programs typically offer.

- Reduced Demand: In-house or localized basic health screenings by large corporations can directly reduce the customer base for iKang's comprehensive external services.

- Cost and Convenience: Employer-provided options often offer a perceived advantage in terms of cost savings and employee convenience, making them a viable substitute for routine checks.

- Focus on Value Differentiation: iKang must emphasize the superior diagnostic accuracy, breadth of tests, and personalized health insights provided by its services to counter the appeal of simpler, employer-managed alternatives.

Public hospitals in China represent a significant threat of substitutes for iKang Group due to their lower costs, often subsidized by the government. While they may involve longer waits, their affordability and perceived reliability make them a strong alternative for many Chinese citizens. In 2023, China's healthcare expenditure was around 9 trillion yuan, with public services receiving a substantial portion.

The rise of wearable health devices and mobile health apps, with the global market projected over $150 billion by early 2024, offers individuals tools for self-monitoring and basic health assessments. This digital health trend, valued at approximately $200 billion in 2023, can substitute for routine in-person check-ups, potentially impacting iKang's service demand.

Increased consumer focus on healthy lifestyles, including diet and exercise, and the substantial global wellness market, exceeding $5.6 trillion in 2023, also presents a threat. Individuals investing in wellness programs and fitness trackers may reduce their reliance on traditional health screenings.

| Substitute Type | Key Advantage | Market Data Point (approx.) |

|---|---|---|

| Public Hospitals | Affordability & Perceived Reliability | China Healthcare Expenditure: ~9 trillion yuan (2023) |

| Wearables & Mobile Health | Convenience & Self-Monitoring | Global Wearable Tech Market: >$150 billion (early 2024 proj.) |

| Wellness Programs & Lifestyle | Proactive Health Management | Global Wellness Market: >$5.6 trillion (2023) |

Entrants Threaten

Establishing a private preventive healthcare service comparable to iKang Group demands considerable financial resources. Significant upfront investment is necessary for state-of-the-art medical facilities, cutting-edge diagnostic equipment, and robust technology infrastructure to support operations and data management.

These substantial capital requirements serve as a formidable barrier to entry for potential new competitors. For instance, equipping a comprehensive diagnostic center can easily run into tens of millions of dollars, making it challenging for smaller entities or startups to enter the market and compete effectively with established players like iKang.

The healthcare sector in China presents significant regulatory hurdles for new entrants. Stringent licensing requirements, evolving quality standards, and detailed operational guidelines create a complex landscape that demands substantial investment in compliance and time for approvals. For instance, obtaining the necessary certifications for a new medical facility or diagnostic service can take years and involve navigating multiple government agencies, significantly raising the barrier to entry.

Established players like iKang Group have cultivated significant brand recognition and patient trust over many years, a critical factor in the highly sensitive healthcare sector. New entrants face a substantial hurdle, requiring considerable investment and a prolonged period to replicate this deeply ingrained trust and reputation.

Access to Qualified Personnel

The threat of new entrants to iKang Group, specifically concerning access to qualified personnel, is a significant consideration. China's healthcare sector is highly competitive, making the recruitment and retention of skilled medical professionals—doctors, nurses, and technicians—a persistent challenge. New companies entering the market often face difficulties in attracting the top talent needed to deliver high-quality healthcare services, which is a critical differentiator.

For instance, in 2024, the demand for specialized medical talent in China continued to outstrip supply. Reports indicated that the ratio of physicians to the population remained a concern in many regions, exacerbating the hiring difficulties for all players, including new entrants. This scarcity directly impacts the ability of new entities to establish a strong operational foundation and compete effectively with established providers like iKang Group, which have built robust talent pipelines over time.

- Talent Scarcity: China's healthcare market faces an ongoing shortage of qualified medical professionals, particularly specialists.

- Recruitment Costs: New entrants may incur higher recruitment costs to attract experienced personnel away from established institutions.

- Retention Challenges: Retaining skilled staff is difficult due to competitive compensation and career advancement opportunities offered by existing healthcare providers.

Economies of Scale and Network Effects

Existing large players like iKang benefit from significant economies of scale. This is evident in their procurement power for medical supplies and equipment, as well as their widespread marketing reach and operational efficiencies across a broad network of medical centers. For instance, in 2023, iKang reported revenue of RMB 7.1 billion, demonstrating its substantial market presence.

New entrants would face considerable challenges in matching these cost advantages and market penetration. Without achieving a comparable scale, new companies would struggle to compete effectively on price or accessibility against established entities.

- Economies of Scale: iKang's large operational footprint allows for lower per-unit costs in procurement and service delivery.

- Network Effects: A larger customer base can lead to enhanced brand recognition and customer loyalty, creating a barrier for newcomers.

- Capital Investment: Establishing a network of medical centers comparable to iKang would require substantial upfront capital, making market entry costly.

- Competitive Pricing: Established players can often offer more competitive pricing due to their scale, squeezing profit margins for new entrants.

The threat of new entrants in China's preventive healthcare sector is moderate, primarily due to high capital requirements and stringent regulations. Establishing a comprehensive diagnostic and health management service comparable to iKang necessitates significant investment in advanced equipment and technology, creating a substantial financial barrier.

Regulatory complexities, including licensing and compliance, further deter new players. For instance, obtaining the necessary certifications for new medical facilities can be a lengthy and intricate process, requiring substantial time and resources. This environment favors established entities with proven track records and robust compliance frameworks.

Furthermore, building brand trust and a strong talent pipeline in the sensitive healthcare industry is a long-term endeavor. New entrants must overcome the established reputation and patient loyalty enjoyed by companies like iKang, which has been cultivated over years of operation. In 2024, the competitive landscape for skilled medical professionals remained intense, making talent acquisition a significant challenge for any new market participant.

| Barrier Type | Description | Impact on New Entrants |

|---|---|---|

| Capital Requirements | High investment needed for facilities, equipment, and technology. | Significant financial hurdle, requiring substantial funding. |

| Regulatory Hurdles | Complex licensing, evolving standards, and compliance demands. | Lengthy approval processes, increasing time-to-market and costs. |

| Brand Reputation & Trust | Established players have strong patient loyalty and recognition. | Difficult and time-consuming to replicate, requiring sustained marketing and service excellence. |

| Talent Acquisition | Scarcity of qualified medical professionals in China. | Challenges in recruiting and retaining skilled staff, impacting service quality. |

Porter's Five Forces Analysis Data Sources

Our iKang Group Porter's Five Forces analysis is built upon a foundation of verified data, including iKang's annual reports, industry-specific market research from firms like Frost & Sullivan, and regulatory filings from relevant health authorities.