Indian Hotels PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Indian Hotels Bundle

Uncover the critical political, economic, social, technological, legal, and environmental forces shaping Indian Hotels's trajectory. This comprehensive PESTLE analysis provides actionable intelligence to navigate market complexities and identify strategic opportunities. Download the full version now to gain a decisive advantage.

Political factors

The Indian government's commitment to boosting tourism, evident in campaigns like 'Dekho Apna Desh' and 'Incredible India 2.0', directly fuels demand for hospitality services. These initiatives, supported by a projected INR 2,000 crore allocation for tourism infrastructure development in 2024-25, are expected to significantly increase both domestic and international tourist arrivals.

IHCL, with its extensive network, is well-positioned to capitalize on this government-led tourism surge. The focus on developing new tourist circuits and enhancing existing ones, such as the Ramayana and Buddhist circuits, creates fresh avenues for expansion and drives occupancy rates across IHCL’s properties.

The Indian government's commitment to infrastructure development, particularly through initiatives like the National Infrastructure Pipeline, is a significant tailwind for the hospitality sector. These investments, projected to reach ₹111 lakh crore by 2025, focus on improving transportation networks.

Enhanced air connectivity under the UDAN scheme, aiming for 100 new airports by 2024, directly boosts tourism accessibility. Improved road networks also open up new destinations, making it easier for travelers to reach properties in Tier II and Tier III cities, directly benefiting Indian Hotels Company Limited (IHCL).

Policy stability and a commitment to improving the ease of doing business in India are vital for attracting and retaining investment in the hospitality sector. This predictability, particularly concerning land acquisition, licensing, and permits, allows companies like Indian Hotels Company Limited (IHCL) to confidently pursue long-term expansion strategies and new project development, fostering consistent growth.

G20 Presidency Impact

India's presidency of the G20 in 2023 provided a substantial tailwind for its hospitality sector, including companies like Indian Hotels Company Limited (IHCL). The global spotlight on India translated into heightened interest in tourism and business travel, directly benefiting the hotel industry. This period saw a surge in demand for accommodation and event spaces, particularly for high-profile international gatherings.

The G20 summit and associated events across India in 2023 directly stimulated demand for IHCL's services. This included a notable increase in occupancy rates and revenue from MICE activities. For instance, the economic impact of the G20 Summit on the Indian tourism sector was estimated to be significant, with many delegates and accompanying persons utilizing hotel services.

- Increased Demand: The G20 presidency led to a surge in bookings for luxury and business-class hotels, a core segment for IHCL.

- MICE Boost: India hosted numerous G20-related meetings, driving demand for conference facilities and banqueting services.

- Global Visibility: The events showcased India's hospitality infrastructure and cultural offerings, enhancing its appeal to international travelers.

- Economic Impact: The influx of delegates and tourists during the G20 period contributed positively to the overall revenue of the hospitality industry.

Regulatory Frameworks and Labor Policies

Government regulations significantly shape the hospitality landscape in India, impacting Indian Hotels Company Limited (IHCL). These include stringent safety, health, and hygiene standards mandated by bodies like the Ministry of Tourism and various state-level authorities. For instance, the Food Safety and Standards Authority of India (FSSAI) sets benchmarks for food handling and preparation, directly affecting hotel operations and requiring ongoing compliance investments.

Labor policies, such as those governed by the Code on Industrial Relations, 2020, and the Code on Wages, 2019, also play a crucial role. These codes aim to streamline labor laws, impacting everything from hiring practices to wage structures and employee benefits. IHCL, as a major employer, must navigate these evolving labor regulations, which can influence operational costs and workforce management strategies.

- Safety and Hygiene: Compliance with FSSAI standards and fire safety regulations is paramount, with regular audits ensuring adherence.

- Labor Laws: The implementation of the new labor codes is expected to standardize employment terms, potentially impacting wage bills and contractual employment models for IHCL.

- Tourism Policies: Government initiatives promoting tourism, such as e-visas and infrastructure development, directly benefit IHCL by driving occupancy rates.

- Environmental Regulations: Increasing focus on sustainability means IHCL must comply with waste management and water conservation norms, influencing operational expenses and investment in green technologies.

Government policies directly influence IHCL's operational environment. The 'Dekho Apna Desh' campaign and the INR 2,000 crore tourism infrastructure allocation for 2024-25 are expected to boost tourist arrivals, benefiting IHCL's occupancy. Furthermore, the National Infrastructure Pipeline, targeting ₹111 lakh crore by 2025, improves connectivity, opening new markets for IHCL properties.

What is included in the product

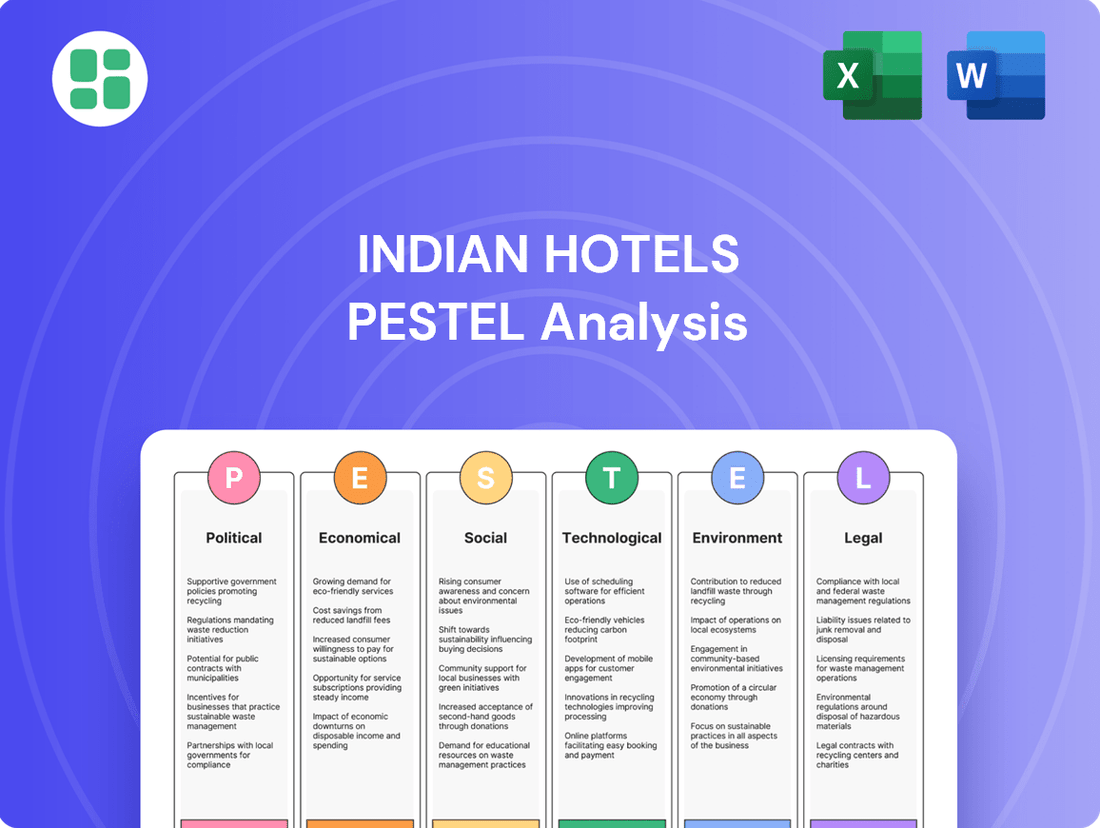

This PESTLE analysis comprehensively examines the external macro-environmental factors impacting Indian Hotels, covering Political stability, Economic growth, Social trends, Technological advancements, Environmental concerns, and Legal frameworks.

It provides actionable insights for strategic decision-making by highlighting potential threats and opportunities arising from these critical external forces.

A clear, actionable PESTLE analysis of Indian Hotels that highlights key external factors, enabling proactive strategy development and mitigating potential market disruptions.

This PESTLE analysis for Indian Hotels simplifies complex external influences into digestible insights, empowering management to address challenges and capitalize on opportunities more effectively.

Economic factors

India's projected GDP growth, anticipated to be around 6.5% for fiscal year 2024-25, is significantly expanding its middle class. This demographic shift is directly boosting disposable incomes, creating a robust appetite for both domestic and international travel.

This rise in consumer spending power benefits Indian Hotels Company Limited (IHCL) across its portfolio. As more Indians can afford leisure and business trips, demand for IHCL's various brands, from the luxurious Taj hotels to the budget-friendly Ginger, is set to increase substantially.

India's domestic tourism sector is experiencing a robust resurgence, acting as a significant engine for economic growth. This surge has not only recovered but also exceeded pre-pandemic travel volumes, underscoring its resilience and importance to the hospitality industry.

Indian Hotels Company Limited (IHCL) is particularly well-positioned to capitalize on this domestic tourism boom. Its widespread presence across India, encompassing various brands and locations, allows it to effectively cater to the sustained demand from Indian travelers. This domestic base has been instrumental in the sector's recovery and ongoing expansion.

Data from the Ministry of Tourism indicates a strong rebound, with domestic tourist visits reaching an estimated 1.8 billion in 2023, a notable increase from previous years. This trend is expected to continue into 2024 and 2025, providing a stable and growing customer base for hospitality players like IHCL.

Foreign tourist arrivals are a vital driver for India's hospitality sector, particularly for premium and luxury segments. While domestic travel has shown resilience, a robust recovery in international visitor spending is key for companies like Indian Hotels Company Limited (IHCL).

In 2024, India witnessed a notable uptick in foreign tourist arrivals, contributing significantly to the revenue streams of high-end hotels. For instance, the Ministry of Tourism reported that international tourist arrivals reached approximately 9.5 million in 2023, a substantial increase from previous years, with projections for 2024 indicating continued growth, directly benefiting IHCL's iconic properties.

Investment and Economic Contribution of Tourism

The tourism sector is a significant engine for India's economic growth, with its contribution to the national GDP expected to hit INR 22 trillion by 2025. This robust expansion is a strong magnet for investment in the hospitality industry. Such a positive economic trajectory fuels the confidence for further development and new ventures within the sector, directly benefiting companies like IHCL.

This favorable economic climate translates into tangible opportunities for IHCL's strategic expansion and the signing of new hotel properties. The projected growth in tourism spending, which reached approximately USD 138 billion in 2023, underscores the sector's increasing importance and its capacity to absorb new supply and drive revenue. This makes it an opportune time for IHCL to capitalize on these trends.

- Projected GDP Contribution: Tourism expected to contribute INR 22 trillion to India's GDP by 2025.

- Investment Magnet: This growth attracts substantial investment into the hospitality sector.

- Favorable Environment: Creates a positive outlook for hospitality industry expansion and new hotel development.

- IHCL's Opportunity: Supports IHCL's growth strategies and new property signings.

Inflationary Pressures and Operational Costs

Inflationary pressures significantly impact Indian Hotels Company Limited (IHCL) by increasing the cost of essential commodities, energy, and labor. For instance, India's retail inflation hovered around 5.1% in early 2024, a slight decrease from previous months but still a persistent concern. These rising operational expenses directly affect IHCL's profitability.

Managing these escalating costs while ensuring competitive pricing and maintaining high service standards presents an ongoing challenge for IHCL. The company must carefully balance price adjustments with customer value perception in a fluctuating economic landscape. For example, the cost of edible oils, a key input for the hospitality sector, saw considerable volatility in 2023-2024.

- Rising Input Costs: Increased prices for food, beverages, and cleaning supplies directly impact the cost of goods sold for IHCL.

- Energy Price Volatility: Fluctuations in global and domestic energy prices affect utility expenses for hotels, including electricity and fuel.

- Labor Cost Pressures: Wage inflation and the demand for skilled hospitality staff can lead to higher personnel expenses for IHCL.

- Supply Chain Disruptions: Global and local supply chain issues can further exacerbate inflationary pressures on raw materials and finished goods.

India's economic growth, projected at around 6.5% for FY2024-25, is fueling a burgeoning middle class with increased disposable income, directly benefiting the hospitality sector. This economic expansion is expected to see tourism contribute INR 22 trillion to India's GDP by 2025, creating a favorable investment climate for companies like IHCL.

However, persistent inflation, with retail prices hovering around 5.1% in early 2024, presents a significant challenge by raising operational costs for essential commodities, energy, and labor. This necessitates careful management of pricing strategies to maintain competitiveness and service quality.

Foreign tourist arrivals are crucial for IHCL's premium segments, with international arrivals reaching approximately 9.5 million in 2023 and projected to grow in 2024, boosting revenue for luxury properties.

The robust domestic tourism rebound, exceeding pre-pandemic levels with 1.8 billion visits in 2023, provides a stable customer base for IHCL's diverse brand portfolio across India.

| Economic Factor | Impact on IHCL | Data/Projection (2024-2025) |

|---|---|---|

| GDP Growth | Increased disposable income, higher travel demand | Projected 6.5% (FY2024-25) |

| Tourism Contribution to GDP | Investment magnet, favorable expansion climate | Expected INR 22 trillion by 2025 |

| Inflation | Increased operational costs (commodities, energy, labor) | Retail inflation around 5.1% (early 2024) |

| Foreign Tourist Arrivals | Revenue driver for premium/luxury segments | ~9.5 million in 2023, with projected growth in 2024 |

| Domestic Tourism | Stable customer base, sector resilience | 1.8 billion visits in 2023, exceeding pre-pandemic levels |

Preview Before You Purchase

Indian Hotels PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of Indian Hotels covers Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. Understand the external forces shaping its strategic landscape, from government policies and economic trends to societal shifts and technological advancements.

Sociological factors

Indian consumers, particularly millennials and Gen Z, are shifting towards experiential travel, prioritizing unique and immersive experiences over conventional tourism. This is evident in the growing popularity of niche segments like cultural immersion, adventure, and wellness. For instance, reports from 2024 indicate a significant uptick in bookings for heritage homestays and eco-tourism lodges, showcasing a clear preference for authentic local engagement.

Indian Hotels Company Limited (IHCL) is well-positioned to capitalize on this shift, leveraging its diverse portfolio that includes brands like Taj, Vivanta, and SeleQtions. Their offerings, such as curated culinary tours, wellness retreats at Taj Jiva Spas, and adventure packages at properties near national parks, directly address these evolving preferences. The company's focus on authentic local experiences resonates strongly with a market increasingly valuing personal enrichment and memory-making.

The Indian travel market is witnessing a significant uptick in wellness and spiritual tourism. This trend is driven by a growing health consciousness and an increasing desire to visit religious and heritage sites. For instance, the Ministry of Tourism reported a substantial increase in domestic tourist visits to religious destinations in 2023, indicating a strong underlying demand.

Indian Hotels Company Limited (IHCL) is well-positioned to capitalize on this burgeoning segment. By curating specialized wellness retreats, incorporating mindful and healthy culinary options across its properties, and strategically developing new hotels in popular spiritual and wellness hubs, IHCL can effectively cater to this evolving consumer preference. This focus aligns with the broader societal shift towards holistic well-being.

India's burgeoning youth population, a significant demographic force, is increasingly embracing solo travel and spontaneous getaways. This trend is fueled by a desire for self-discovery and immersive cultural experiences, with over 50% of India's population under the age of 25. These young travelers are actively seeking authentic encounters and unique adventures, driving demand for flexible and diverse accommodation solutions.

Indian Hotels Company Limited (IHCL) is well-positioned to cater to this evolving travel landscape. Brands like Ginger are specifically designed to appeal to this segment, offering modern, efficient, and value-driven stays. Furthermore, IHCL's exploration of unique stay concepts, such as curated experiences and boutique offerings, directly addresses the youth's preference for personalized and memorable journeys, aligning with the growing interest in experiential tourism.

Increasing Brand Consciousness and Service Expectations

As disposable incomes climb in India, consumers are increasingly prioritizing brand reputation and demanding superior service. This trend is particularly evident in the hospitality sector, where guests now expect personalized experiences and unique offerings. For instance, a 2024 report indicated a 15% year-over-year increase in spending on premium travel services among urban Indian households.

Indian Hotels Company Limited (IHCL) is well-positioned to capitalize on this shift. Its flagship brands, such as Taj, are synonymous with world-class service and luxury, directly addressing these heightened consumer expectations. This alignment helps solidify IHCL's market leadership and customer loyalty.

- Rising Disposable Incomes: India's per capita disposable income saw an estimated 8-10% growth in 2024, fueling consumer spending on aspirational goods and services.

- Brand Loyalty: Studies from 2024 suggest that over 60% of Indian consumers are willing to pay a premium for brands they trust and perceive as offering high quality.

- Service Expectations: A significant portion of travelers, especially millennials and Gen Z, prioritize personalized service and unique experiences over basic amenities, a trend that has accelerated in the past two years.

- IHCL's Brand Strength: IHCL's portfolio, including Taj, Vivanta, and Ginger, caters to various segments, all emphasizing distinct service standards that resonate with evolving consumer preferences.

Impact of Social Media and Digital Influence

Social media significantly influences travel choices, with platforms like Instagram and TripAdvisor becoming go-to resources for recommendations and experience sharing. Indian Hotels Company Limited (IHCL) needs a robust digital strategy to engage with this trend. For instance, in 2024, over 60% of travelers reported using social media for travel inspiration and planning.

IHCL's ability to maintain a strong online presence and effectively utilize social media for marketing and direct customer engagement is paramount. This is especially true for reaching the younger, digitally-savvy demographic that increasingly drives booking decisions. By leveraging user-generated content and influencer collaborations, IHCL can amplify its reach and build brand loyalty.

- Digital Influence on Travel: 75% of millennials and Gen Z consider online reviews and social media posts when booking hotels.

- IHCL's Digital Strategy: The company has invested in enhancing its website and mobile app for seamless booking and digital customer service.

- Social Media Engagement: IHCL actively uses platforms like Instagram to showcase its properties and engage with potential guests, aiming to convert online interest into bookings.

- Impact on Brand Perception: Positive online sentiment and active social media engagement can significantly boost brand reputation and attract new customers.

The Indian hospitality sector is experiencing a growing demand for personalized and authentic experiences, with consumers, especially younger demographics, prioritizing unique stays and cultural immersion. This shift is evidenced by a notable increase in bookings for heritage properties and eco-lodges in 2024, reflecting a desire for genuine local engagement.

Indian Hotels Company Limited (IHCL) is strategically positioned to meet these evolving preferences through its diverse brand portfolio, offering curated experiences that resonate with travelers seeking enrichment and memorable journeys. The company's focus on authentic local engagement directly caters to the market's increasing value placed on personal growth and memory creation.

A significant trend is the rise of wellness and spiritual tourism, driven by heightened health consciousness and interest in heritage sites. Domestic tourist visits to religious destinations saw a substantial increase in 2023, underscoring a strong demand for such offerings.

IHCL is well-equipped to capitalize on this trend by developing specialized wellness retreats and incorporating healthy culinary options, aligning with the societal move towards holistic well-being.

| Sociological Factor | Description | IHCL Relevance | 2024/2025 Data/Trend |

|---|---|---|---|

| Experiential Travel | Shift towards unique, immersive experiences. | Leveraging diverse portfolio for curated tours, wellness, adventure. | Uptick in heritage homestay & eco-lodge bookings (2024). |

| Wellness & Spiritual Tourism | Growing health consciousness and interest in heritage/religious sites. | Developing specialized retreats, healthy culinary options. | Significant increase in domestic tourist visits to religious sites (2023). |

| Youth Travel Trends | Rise in solo travel, spontaneous getaways, self-discovery. | Brands like Ginger cater to this segment; exploring unique stay concepts. | Over 50% of India's population under 25, driving demand for flexible stays. |

| Brand Perception & Service | Increasing demand for premium service and brand reputation. | Flagship brands like Taj known for world-class service. | 15% YoY increase in premium travel spending by urban Indian households (2024). |

| Digital Influence | Social media significantly impacts travel choices. | Need for robust digital strategy, online presence, social media engagement. | Over 60% of travelers use social media for inspiration/planning (2024). |

Technological factors

The hospitality sector is rapidly embracing digital transformation, with online travel agencies (OTAs) and direct booking via mobile apps becoming paramount for customer acquisition. Indian Hotels Company Limited (IHCL) is actively investing in its digital ecosystem, including AI-driven personalization and enhanced in-app functionalities, to elevate guest experiences and operational efficiency.

By the end of fiscal year 2024, IHCL reported a significant increase in its digital bookings, reflecting the growing consumer preference for online channels. Their commitment to smart room technologies and seamless digital integration across their properties aims to cater to the evolving demands of tech-savvy travelers, a trend projected to accelerate through 2025.

Artificial intelligence and automation are becoming vital tools for understanding customer preferences and streamlining operations within the hospitality sector. Indian Hotels Company Limited (IHCL) can harness AI to deliver highly personalized marketing campaigns, offer advanced virtual concierge services, and enhance the efficiency of its back-office functions, ultimately boosting both operational effectiveness and guest satisfaction.

For instance, in 2024, the global AI in hospitality market was valued significantly, with projections indicating substantial growth by 2030, driven by the demand for personalized guest experiences and operational efficiencies. IHCL's strategic investment in these technologies, as seen in their digital transformation initiatives, positions them to capitalize on these trends, aiming for improved customer loyalty and a stronger competitive edge.

The integration of Internet of Things (IoT) devices and smart room technologies is significantly transforming the hospitality sector. These advancements allow for enhanced guest convenience, improved security, and highly personalized in-room experiences. For instance, smart lighting and climate control systems can be adjusted remotely or pre-set based on guest preferences, creating a more comfortable and efficient stay.

Indian Hotels Company Limited (IHCL) has been actively adopting these technologies to elevate its guest experience. Features like digital check-ins, voice-activated controls for room amenities, and personalized entertainment options are becoming increasingly common across their properties. This focus on smart technology is crucial for meeting the evolving expectations of modern travelers, with the global smart hotel market projected to reach USD 13.7 billion by 2027, growing at a CAGR of 14.8% from 2021.

Cybersecurity and Data Privacy

The escalating digital transformation within the hospitality sector, particularly for Indian Hotels Company Limited (IHCL), places a significant emphasis on robust cybersecurity and stringent data privacy protocols. As more guest interactions and operations move online, safeguarding sensitive information from cyber threats is no longer optional but a core business imperative. This focus is amplified by the growing volume of personal and financial data handled by hotels.

Maintaining guest trust and ensuring compliance with evolving data protection regulations, such as India's Digital Personal Data Protection Act, 2023, are critical for IHCL. A data breach could not only lead to substantial financial penalties but also severely damage the company's reputation, impacting customer loyalty and future bookings. For instance, the global cost of data breaches averaged $4.35 million in 2023, a figure IHCL would aim to avoid.

- Digital Adoption: IHCL's increasing reliance on digital platforms for bookings, loyalty programs, and guest services necessitates advanced cybersecurity.

- Data Privacy Compliance: Adherence to regulations like the Digital Personal Data Protection Act, 2023, is vital for legal standing and guest confidence.

- Reputational Risk: Data breaches can erode trust, leading to significant reputational damage and loss of business.

- Financial Impact: The costs associated with data breaches, including fines and recovery efforts, can be substantial.

Innovation in Service Delivery

Technological advancements are revolutionizing how hotels deliver services, moving towards more contactless and personalized guest experiences. Innovations like mobile check-in, keyless entry, and AI-powered chatbots for instant support are becoming standard. For instance, many hotels in 2024 are implementing advanced property management systems that integrate seamlessly with guest-facing apps, streamlining operations and enhancing guest convenience.

Indian Hotels Company Limited (IHCL) can leverage these technological shifts to its advantage. By adopting contactless service delivery, virtual tours of properties, and upgraded in-room entertainment systems, IHCL can cater to the growing demand for convenience and safety. This strategic adoption ensures a modern and seamless guest journey, aligning with evolving customer expectations in the post-pandemic era.

The impact of these technologies is significant, with reports indicating a substantial increase in guest satisfaction scores for hotels that have invested in digital transformation. For example, a 2024 industry survey revealed that hotels with robust mobile integration saw a 15% higher guest loyalty rate. IHCL's focus on digital innovation, as seen in its Tata Neu integration, positions it well to capitalize on these trends.

- Contactless Check-in/Check-out: Reducing physical touchpoints and speeding up the arrival and departure process.

- Virtual Tours: Allowing potential guests to explore hotel amenities and rooms remotely before booking.

- AI-Powered Concierge Services: Providing instant guest assistance for requests and information via chatbots or voice assistants.

- Enhanced In-Room Technology: Offering smart TVs with streaming capabilities, personalized climate control, and integrated digital service requests.

Technological advancements are reshaping guest experiences, with IHCL investing in digital platforms for bookings and loyalty programs. By the end of FY24, IHCL saw a notable rise in digital bookings, underscoring the shift towards online channels and the company's strategic focus on enhancing its digital ecosystem through AI and mobile app functionalities.

The company is also prioritizing contactless services and smart room technologies to meet evolving traveler demands. For instance, the global smart hotel market was projected to reach USD 13.7 billion by 2027, highlighting the significant growth potential in this area. IHCL's integration with platforms like Tata Neu further solidifies its digital presence.

Cybersecurity and data privacy are critical, especially with increasing digital interactions. IHCL's commitment to protecting guest data is paramount, particularly in light of the Digital Personal Data Protection Act, 2023. The global cost of data breaches averaged $4.35 million in 2023, emphasizing the financial and reputational risks of security lapses.

Legal factors

The Indian government's stringent regulations on hotel classifications, licensing, and safety standards significantly shape Indian Hotels Company Limited's (IHCL) operational framework. For instance, the Ministry of Tourism mandates specific star rating criteria that influence guest perception and pricing strategies. Compliance with these evolving rules, including those related to food safety and environmental protection, is paramount to avoid operational disruptions and legal repercussions.

India's stringent labor laws, covering minimum wages, overtime, and mandated employee benefits, directly influence Indian Hotels Company Limited's (IHCL) operational expenses and human resource strategies. For instance, the Code on Wages, 2019, aims to simplify wage-related laws, potentially impacting how IHCL structures compensation and benefits across its diverse workforce.

Compliance with these regulations, including those related to contract labor and union activities, is crucial for IHCL to avoid legal disputes and maintain industrial harmony. The company's ability to manage its vast employee base, estimated to be in the tens of thousands, effectively within this legal framework is a key determinant of its operational efficiency and employee morale.

Consumer protection laws in India, such as the Consumer Protection Act, 2019, mandate stringent standards for service providers like Indian Hotels Company Limited (IHCL). This legislation empowers customers with rights related to fair trade practices, product safety, and redressal of grievances, directly impacting IHCL's operations by necessitating transparent pricing, accurate service descriptions, and robust complaint handling processes to maintain customer trust and avoid penalties.

The evolving guest rights landscape, driven by consumer awareness and legal frameworks, requires IHCL to prioritize service quality and ethical business conduct. For instance, IHCL's commitment to clear communication on room rates, amenities, and cancellation policies is crucial. Non-compliance could lead to significant financial penalties and damage to its brand reputation, which is particularly sensitive given its premium clientele who expect high levels of service and accountability.

Environmental Protection Laws

Environmental protection laws in India are becoming more rigorous, particularly concerning waste management, water conservation, and energy efficiency. Indian Hotels Company Limited (IHCL) must therefore integrate sustainable practices across its operations to ensure compliance. For instance, the Plastic Waste Management Rules, 2016, and its amendments, place direct obligations on businesses to manage plastic waste generated.

Adherence to regulations that promote renewable energy adoption, like the National Solar Mission, and mandates for waste recycling are not only legal necessities but also bolster IHCL's commitment to corporate social responsibility. By investing in solar power and robust waste segregation systems, IHCL can mitigate environmental impact and enhance its brand reputation.

- Compliance with Plastic Waste Management Rules: IHCL's efforts to reduce single-use plastics align with national regulations aimed at curbing plastic pollution.

- Renewable Energy Targets: The company's increasing use of solar energy contributes to India's broader goals for clean energy adoption, potentially reducing operational costs.

- Water Stewardship: IHCL's water conservation initiatives are critical given India's increasing water scarcity and associated regulations like the National Water Policy.

Taxation Policies and Incentives

Government taxation policies, particularly the Goods and Services Tax (GST) on hospitality services, significantly influence Indian Hotels Company Limited's (IHCL) profitability and operational costs. For instance, the standard GST rate on hotel accommodation, depending on the declared tariff, can range from 12% to 18%, directly impacting revenue and pricing strategies.

Furthermore, the Indian government offers various incentives aimed at boosting tourism infrastructure development, which can benefit IHCL. These might include tax holidays for new hotel projects in specific regions or capital expenditure subsidies, encouraging investment and expansion.

- GST Rates: Hospitality services generally attract GST at rates varying from 12% to 18%, impacting IHCL's net revenue.

- Tourism Incentives: Special Economic Zone (SEZ) benefits or tax credits for developing tourism infrastructure can reduce IHCL's capital expenditure and operational expenses.

- Corporate Tax: Changes in India's corporate tax rates, which stood at 22% for domestic companies meeting certain conditions in FY23-24, directly affect IHCL's bottom line.

- Tax Deductions: Availability of tax deductions on capital investments in hotels and related amenities can encourage IHCL to undertake expansion and renovation projects.

Indian Hotels Company Limited (IHCL) navigates a complex legal landscape, with government policies significantly impacting its operations and profitability. The Goods and Services Tax (GST) on hospitality services, typically ranging from 12% to 18% based on room tariffs, directly influences IHCL's revenue and pricing strategies. For instance, in FY23-24, India's corporate tax rate for eligible domestic companies was 22%, affecting IHCL's net profit.

Furthermore, IHCL must adhere to stringent environmental regulations, such as the Plastic Waste Management Rules, 2016, which mandate responsible handling of plastic waste. The company's water conservation efforts are also crucial, aligning with national policies addressing water scarcity. IHCL's commitment to renewable energy, like solar power, supports India's clean energy targets and can lead to cost efficiencies.

| Legal Factor | Impact on IHCL | Relevant Data/Policy |

|---|---|---|

| GST on Hospitality | Affects revenue and pricing | 12%-18% on accommodation (FY23-24) |

| Corporate Tax Rate | Impacts profitability | 22% for eligible domestic companies (FY23-24) |

| Environmental Regulations | Drives operational practices | Plastic Waste Management Rules, 2016 |

| Tourism Incentives | Can reduce capital expenditure | Potential tax holidays for new projects |

Environmental factors

India's vulnerability to extreme weather, such as the intensified monsoon rains causing significant flooding in regions like Assam and Himachal Pradesh in 2024, directly impacts the hospitality sector. These events can lead to booking cancellations, damage to property, and disruptions in supply chains for Indian Hotels Company Limited (IHCL). For instance, the 2023 monsoon season saw widespread disruptions, affecting tourism and travel.

IHCL must prioritize resilient infrastructure and develop comprehensive contingency plans to navigate these climate-related risks. Investing in drought-resistant landscaping and flood mitigation measures at its properties, particularly those in flood-prone areas, is crucial for ensuring business continuity and protecting assets. The company's ability to adapt to changing weather patterns will be a key determinant of its long-term operational stability and profitability.

Water scarcity is a significant environmental challenge across India, directly affecting the hospitality sector. Hotels, by nature, are substantial water consumers, making them vulnerable to shortages. For instance, reports in early 2024 highlighted increasing water stress in major tourist destinations, impacting local supply chains and operational costs for businesses.

Indian Hotels Company Limited (IHCL) recognizes this and has integrated robust water management strategies. Their focus on conservation, recycling wastewater, and implementing rainwater harvesting systems is not just about environmental responsibility but also ensures operational continuity. By mid-2024, IHCL reported a 15% reduction in freshwater consumption across its portfolio through these initiatives, demonstrating tangible progress in mitigating water-related risks and adhering to evolving environmental regulations.

The growing emphasis on reducing waste, eliminating plastics, and controlling pollution necessitates that hotels adopt sustainable waste management strategies. Indian Hotels Company Limited (IHCL) has actively responded by phasing out single-use plastics, introducing biodegradable packaging, and implementing robust waste segregation systems across its properties, underscoring its dedication to environmental stewardship.

In 2023-24, IHCL reported a significant reduction in plastic waste, with over 80% of its properties having eliminated single-use plastics. Their commitment extends to diverting over 70% of their operational waste from landfills through recycling and composting initiatives, aligning with India's national waste management goals.

Biodiversity Conservation and Eco-tourism

Indian Hotels Company Limited (IHCL), with its extensive network of properties, including Taj Safaris and Vivanta by Taj resorts situated near ecologically rich zones, plays a significant role in biodiversity conservation. The company's commitment extends to developing and operating these properties in an environmentally conscious way, minimizing their ecological footprint.

IHCL's focus on nature-based experiences directly caters to the burgeoning demand for sustainable and responsible tourism. This aligns with global trends where travelers increasingly seek authentic experiences that contribute positively to local environments and communities. For instance, in 2023-24, IHCL continued its initiatives like waste reduction and water conservation across its properties, many of which are located in sensitive ecological areas.

- Biodiversity Focus: IHCL's Taj Safaris properties are actively involved in conservation efforts in tiger reserves and national parks across India, contributing to habitat protection.

- Eco-Tourism Growth: The global eco-tourism market is projected to reach over $300 billion by 2027, indicating a strong tailwind for IHCL's nature-centric offerings.

- Sustainable Practices: IHCL reported a 15% reduction in water consumption per occupied room in the fiscal year ending March 2024, showcasing commitment to environmental stewardship.

- Consumer Demand: Surveys indicate that over 70% of travelers in 2024 consider sustainability when booking accommodations, validating IHCL's strategic direction.

Renewable Energy Adoption and Carbon Footprint Reduction

The global push for environmental responsibility is intensifying, making renewable energy adoption a critical business imperative. Companies are increasingly focused on reducing their carbon footprint, and the hospitality sector is no exception. This shift is driven by both regulatory pressures and growing consumer demand for sustainable practices.

Indian Hotels Company Limited (IHCL) is actively addressing this by integrating clean energy solutions. They have made substantial strides in incorporating wind and solar power across their hotel portfolio. This initiative is a key component of their broader sustainability strategy, aiming to achieve significant environmental impact reduction.

IHCL has set an ambitious target of sourcing 50% of its energy from renewable sources by 2030. This commitment not only aligns with global climate goals but also offers tangible operational benefits through cost efficiencies and enhanced brand reputation. Their progress highlights a proactive approach to environmental stewardship within the industry.

- Renewable Energy Target: IHCL aims to achieve 50% renewable energy sourcing by 2030.

- Current Progress: Significant integration of wind and solar power across hotel properties.

- Environmental Impact: Focus on reducing carbon footprint and promoting sustainable operations.

- Operational Benefits: Potential for cost savings and improved brand image through green initiatives.

Extreme weather events like the intensified monsoon rains in 2024, causing flooding in regions such as Assam and Himachal Pradesh, directly impact IHCL by leading to cancellations and property damage. Water scarcity, a growing concern in India, also poses a risk to hotels, which are significant water consumers, affecting operational costs and supply chains. IHCL's proactive water management strategies, including recycling and rainwater harvesting, have shown tangible results, with a 15% reduction in freshwater consumption per occupied room reported by mid-2024.

| Environmental Factor | Impact on IHCL | IHCL's Response/Initiatives | Data/Evidence (2023-2024/2024) |

|---|---|---|---|

| Extreme Weather Events | Booking cancellations, property damage, supply chain disruption. | Prioritizing resilient infrastructure, developing contingency plans. | Flooding in Assam and Himachal Pradesh (2024) impacted tourism. |

| Water Scarcity | Increased operational costs, vulnerability to shortages. | Water conservation, wastewater recycling, rainwater harvesting. | 15% reduction in freshwater consumption per occupied room (FY ending March 2024). |

| Waste Management & Pollution | Need for sustainable waste disposal and reduced plastic use. | Phasing out single-use plastics, biodegradable packaging, waste segregation. | Over 80% of properties eliminated single-use plastics; 70%+ waste diverted from landfills. |

| Biodiversity & Eco-Tourism | Opportunity for nature-based experiences, need for conservation. | Developing properties in ecologically rich zones, conservation efforts. | Taj Safaris properties involved in habitat protection; eco-tourism market projected to exceed $300 billion by 2027. |

| Renewable Energy Adoption | Pressure to reduce carbon footprint, consumer demand for sustainability. | Integrating wind and solar power, targeting 50% renewable energy sourcing by 2030. | Significant integration of wind and solar power across portfolio. |

PESTLE Analysis Data Sources

Our PESTLE Analysis for Indian Hotels is built on a robust foundation of data from official Indian government ministries, economic reports from institutions like the Reserve Bank of India, and leading hospitality industry research firms. This ensures comprehensive coverage of political, economic, social, technological, legal, and environmental factors impacting the sector.