Indian Hotels Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Indian Hotels Bundle

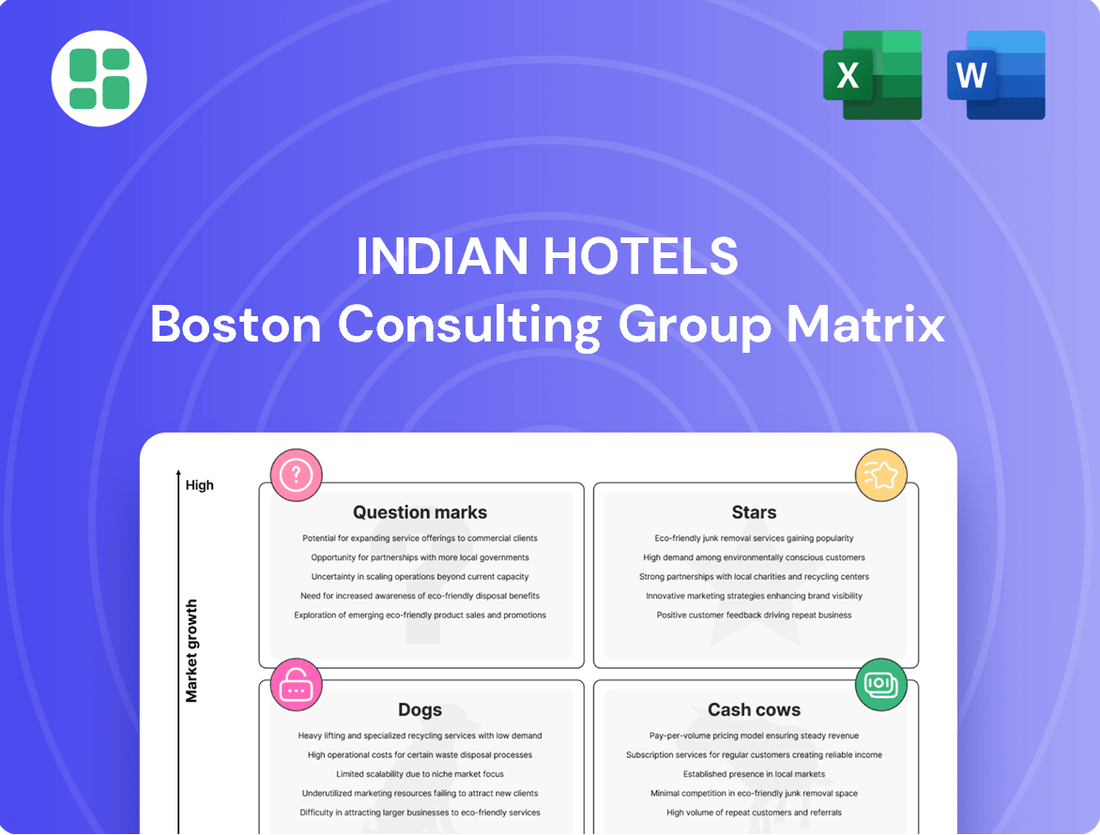

Curious about Indian Hotels' strategic positioning? Our BCG Matrix analysis offers a glimpse into their portfolio, highlighting potential Stars, Cash Cows, Dogs, and Question Marks. Understand where their brands shine and where they might need a boost.

Unlock the full potential of this analysis by purchasing the complete Indian Hotels BCG Matrix report. Gain detailed quadrant placements, data-driven insights, and actionable strategies to navigate the competitive hospitality landscape with confidence.

Stars

Ginger Hotels, a key player in IHCL's 'lean luxe' segment, is on an aggressive expansion path, aiming to double its presence in East and Northeast India within the next three to five years. This strategic move underscores its high growth trajectory and increasing market share in the mid-scale hospitality sector.

Having recently achieved a milestone of 100 hotels, Ginger Hotels is exhibiting robust momentum. The brand's enterprise revenue saw a significant jump in FY24 and is projected for continued strong performance in Q1 FY26, positioning it as a potential future cash cow for IHCL.

The development of new Taj properties in emerging leisure destinations, like luxury wildlife lodges in Kruger National Park, South Africa, and new resorts in Alibaug and Puri, signifies a strategic move into high-growth areas. These ventures are designed to tap into the increasing consumer desire for experiential and luxury travel. By leveraging the established Taj brand, Indian Hotels Company Limited (IHCL) aims to swiftly gain substantial market share in these expanding travel segments.

amã Stays & Trails, IHCL's venture into private bungalows and distinct accommodations, is a standout performer. This segment taps directly into the growing demand for experiential and wellness-focused travel, a trend that gained significant momentum in 2024.

The brand's impressive growth is evident in its portfolio, which has surged to over 300 bungalows. This rapid expansion showcases a winning strategy within a specialized yet increasingly popular market segment. Such swift scaling in a high-demand area firmly places amã Stays & Trails in the star category, promising substantial future returns, though continued investment will be key to sustaining this trajectory.

Qmin Food Delivery and F&B Services

Qmin, Indian Hotels Company Limited's (IHCL) gourmet food delivery and F&B services platform, is positioned as a Star in the BCG Matrix. This classification stems from its operation within IHCL's 'New Businesses' vertical, which demonstrated robust growth. For instance, IHCL's 'New Businesses' segment saw a significant revenue contribution, underscoring Qmin's expanding role.

Qmin's strategic expansion into various outlets, including collaborations with Westside stores and airport locations, taps into the burgeoning food services market. This multi-channel approach is crucial for capturing a larger share in a rapidly growing sector. The platform's ability to reach consumers in diverse settings highlights its high growth potential.

While Qmin may have a relatively smaller initial market share in the overall food delivery landscape, its high growth trajectory makes it a key focus for IHCL's investment strategy. The company is actively channeling resources to scale Qmin's operations and solidify its market presence. This strategic investment aims to capitalize on the evolving consumer preferences for convenient, high-quality food experiences.

- Qmin's Strategic Positioning: Classified as a Star due to its high growth potential within IHCL's 'New Businesses' vertical.

- Market Expansion: Presence extended to Westside stores and airports, targeting the high-growth food services market.

- Investment Focus: IHCL is actively investing in Qmin to scale its operations and enhance its market share.

- Growth Trajectory: Despite a lower initial market share, Qmin is poised for significant expansion in the evolving food delivery sector.

SeleQtions in Unique and Spiritual Destinations

The SeleQtions brand is strategically positioning itself in unique and spiritual destinations, tapping into India's burgeoning tourism sector. This expansion targets high-growth segments, including spiritual hubs and distinctive leisure spots like Mahabaleshwar, Lakshadweep, Diu, and Tirupati.

These locations are chosen to leverage the significant increase in domestic and spiritual tourism. By entering these rapidly developing areas, SeleQtions aims to secure a substantial market share.

The brand's focus on heritage and unique experiences aligns perfectly with the growing demand for experiential travel. This strategic move suggests a strong potential for these specific SeleQtions properties to become high-performing assets within the portfolio.

- Brand Focus: SeleQtions emphasizes unique and heritage properties.

- Expansion Areas: Targeting spiritual and unique leisure destinations like Mahabaleshwar, Lakshadweep, Diu, and Tirupati.

- Market Trend Alignment: Capitalizing on India's growing domestic and spiritual tourism.

- Growth Potential: Strategic placement indicates high growth prospects for these assets.

Stars in the BCG Matrix represent business units with high market share in high-growth industries. For Indian Hotels Company Limited (IHCL), brands like amã Stays & Trails and Qmin fit this description. amã Stays & Trails, with its rapid expansion to over 300 bungalows, taps into the growing demand for experiential travel, showing strong growth potential.

Qmin, IHCL's food delivery platform, is also classified as a Star. Its expansion into diverse locations like Westside stores and airports positions it within the high-growth food services market, with IHCL actively investing to scale its operations.

The SeleQtions brand, by focusing on unique and spiritual destinations, aligns with India's burgeoning tourism sector, particularly domestic and spiritual travel, indicating a strong growth trajectory for these properties.

Ginger Hotels, with its aggressive expansion plans and recent milestone of 100 hotels, is on a high growth path, projected for continued strong performance, further solidifying its Star status.

What is included in the product

Highlights which units to invest in, hold, or divest based on market share and growth.

The Indian Hotels BCG Matrix provides a clear, one-page overview of each business unit's market position, alleviating the pain of unclear strategic direction.

Its export-ready design for PowerPoint allows for quick, impactful C-level presentations, relieving the burden of complex data formatting.

Cash Cows

Iconic Taj hotels, such as The Taj Mahal Palace in Mumbai and Taj Palace in Delhi, exemplify Cash Cows within the Indian Hotels BCG Matrix. These properties dominate the luxury hotel segment in established metropolitan areas, boasting a commanding market share.

Their enduring brand strength, consistently high occupancy, and premium pricing enable them to generate significant and stable revenues with minimal marketing expenditure. For instance, in the fiscal year 2023-2024, the luxury hotel segment, where these flagship properties operate, continued to show robust recovery and profitability, contributing significantly to IHCL's overall financial performance.

Established Vivanta Hotels, especially those in prime locations like Bengaluru and Hyderabad, act as cash cows within the Indian Hotels BCG Matrix. These properties consistently serve the robust corporate travel market, ensuring high occupancy rates and strong average daily rates.

Their established presence in key business districts fosters a loyal corporate customer base, leading to predictable and substantial cash flow. This stability means they require less investment for growth, allowing them to generate significant returns.

TajSATS, Indian Hotels Company Limited's (IHCL) air and institutional catering arm, stands as a robust Cash Cow. This segment thrives in a mature, contract-based market, consistently generating stable revenue streams and healthy EBITDA margins. For the fiscal year 2024, IHCL reported that its 'other' segment, which includes TajSATS, contributed significantly to the company's financial stability.

The consolidation of TajSATS within IHCL underscores its dependable and substantial contribution to the group's overall cash flow. This reliable performance allows IHCL to strategically allocate capital towards nurturing its Stars and Question Marks, thereby fueling future growth and expansion across its diverse portfolio.

Luxury Banqueting and Conference Facilities

IHCL's luxury banqueting and conference facilities, particularly at its Taj and Vivanta properties in key Indian cities, function as cash cows. These venues cater to high-value events like corporate functions, weddings, and large conferences, consistently generating significant revenue due to their premium pricing and established demand.

The mature nature of this segment means these facilities require moderate, rather than aggressive, investment. They benefit from consistent booking cycles and high-profit margins, contributing steadily to IHCL's overall financial health. For instance, IHCL reported a revenue of ₹5,729.43 crore for the fiscal year ended March 31, 2024, with its luxury segment playing a crucial role in this performance.

- High Occupancy Rates: Premium properties often see consistent bookings for banquets and conferences, especially in metropolitan areas.

- Premium Pricing Power: The luxury positioning allows for higher charges compared to standard hotel services.

- Established Brand Reputation: The Taj and Vivanta brands lend credibility, attracting high-profile events.

- Operational Efficiency: Mature operations in this segment typically lead to optimized costs and strong profit margins.

Well-Established Spa and Wellness Offerings

The established Jiva Spas and other wellness offerings within prime Taj and Vivanta resorts represent a significant Cash Cow for Indian Hotels Company Limited (IHCL). These premium wellness experiences cater to a loyal, high-spending clientele. The wellness tourism market is indeed expanding, with the Indian wellness tourism market projected to reach $13.46 billion by 2028, growing at a CAGR of 12.7%.

IHCL's well-reputed spas in mature luxury properties generate consistent, high-margin revenue. This is bolstered by a strong repeat customer base, minimizing the need for aggressive market expansion. For instance, in FY2024, IHCL reported a consolidated revenue of ₹6,037 crore, with its luxury segment, which includes these spas, performing strongly.

- Consistent High Margins: Jiva Spas and wellness services in established luxury properties consistently deliver high profit margins due to premium pricing and loyal customer engagement.

- Strong Repeat Business: The focus on premium, personalized wellness experiences fosters significant customer loyalty, leading to a high rate of repeat visits and bookings.

- Mature Market Presence: Operating within IHCL's well-established luxury resort portfolio allows these offerings to leverage existing brand equity and infrastructure, reducing acquisition costs.

- Contribution to Revenue Stability: These offerings provide a stable revenue stream, acting as a reliable source of income even during broader market fluctuations.

The iconic Taj Mahal Palace in Mumbai and Taj Palace in Delhi are prime examples of Cash Cows for Indian Hotels, dominating the luxury segment in established cities with high market share.

Their strong brand and consistent premium pricing generate stable, significant revenue with minimal marketing needs, as evidenced by the luxury segment's robust performance in fiscal year 2023-2024.

Established Vivanta Hotels in business hubs like Bengaluru and Hyderabad also act as cash cows, consistently serving the corporate market with high occupancy and average daily rates, ensuring predictable cash flow with less need for growth investment.

TajSATS, IHCL's catering arm, is a dependable cash cow, generating stable revenue and healthy EBITDA margins in its mature, contract-based market, significantly contributing to IHCL's financial stability in fiscal year 2024.

| Segment | BCG Category | Key Characteristics | FY24 Contribution (Illustrative) |

| Flagship Luxury Hotels (e.g., Taj Mahal Palace, Mumbai) | Cash Cow | Dominant market share, high occupancy, premium pricing, strong brand loyalty | Significant revenue driver, stable profitability |

| Established Vivanta Hotels (Prime Business Locations) | Cash Cow | Consistent corporate demand, high occupancy, predictable cash flow | Reliable income generation |

| TajSATS (Air & Institutional Catering) | Cash Cow | Mature market, contract-based revenue, healthy EBITDA margins | Stable revenue stream, contributes to overall financial health |

| Luxury Banqueting & Conferences | Cash Cow | High-value events, premium pricing, established demand, operational efficiency | Steady revenue, strong profit margins |

| Jiva Spas & Wellness | Cash Cow | Premium wellness experiences, loyal clientele, high margins, repeat business | Consistent, high-margin revenue |

Full Transparency, Always

Indian Hotels BCG Matrix

The Indian Hotels BCG Matrix preview you are viewing is the identical, fully formatted report you will receive upon purchase. This document offers a comprehensive strategic analysis of Indian Hotels' business units, categorized according to the Boston Consulting Group matrix, providing clear insights into market share and growth potential. You can confidently expect to download this exact, professional-grade report, ready for immediate application in your strategic planning and decision-making processes, without any alterations or hidden content.

Dogs

Certain older or smaller properties within IHCL's vast portfolio, particularly those situated in highly saturated or economically stagnant micro-markets, could be classified as Dogs. These assets often grapple with low occupancy rates and diminished average daily rates (ADRs), reflecting intense local competition or declining demand. For instance, a property in a mature leisure destination facing increased supply from newer, more modern hotels might see its occupancy dip below 60% in 2024, a significant underperformance.

These underperforming assets typically exhibit limited growth prospects, making them capital intensive without substantial returns. The need for disproportionate maintenance or renovation costs, when weighed against their revenue generation capabilities, can tie up valuable capital. In 2024, such properties might represent a small but persistent drag on overall profitability, potentially contributing less than 1% of IHCL’s total revenue while demanding a higher percentage of the capital expenditure budget for essential upkeep.

Indian Hotels Company Limited (IHCL) might classify certain niche, non-core ancillary services with low uptake as Dogs. These are offerings that haven't resonated with customers or achieved significant scale, remaining outside the main hospitality experience. Think of highly specialized, infrequently booked local experiences or recreational amenities at specific hotels that see minimal usage.

These services often struggle to generate meaningful revenue or profit, frequently operating at a break-even point. In FY23, while IHCL reported strong overall performance with consolidated revenue at ₹6,076 crore, these niche services likely contributed a negligible fraction, potentially even incurring operational costs without strategic growth benefits.

Standalone underperforming F&B outlets within Indian Hotels Company Limited (IHCL) could be classified as Dogs. These are typically outlets that don't draw significant outside customers and operate with thin profit margins. For instance, a hotel’s in-house specialty restaurant that primarily serves guests and struggles to attract local diners might fall into this category.

These outlets often require continuous investment and management attention but offer limited prospects for substantial growth or improved profitability. While they are part of a larger, successful hotel operation, their individual performance might not justify the resources allocated, especially when compared to other more robust business units within IHCL's portfolio.

Legacy Technology Systems

Legacy technology systems, such as outdated booking platforms or internal IT infrastructure, can be viewed as a Dogs category for Indian Hotels Company Limited (IHCL). These systems often require substantial ongoing investment for maintenance, diverting capital that could be used for growth initiatives. For instance, in 2023, the hospitality industry globally saw significant investment in digital transformation, with companies focusing on AI-powered guest experiences and seamless booking engines. IHCL's older systems might not offer the same level of efficiency or competitive edge in this rapidly evolving digital landscape, potentially impacting guest satisfaction and operational agility.

These legacy systems can become a considerable cash drain without contributing to revenue growth or market share expansion. Their inability to integrate with newer technologies or provide advanced data analytics could hinder IHCL's ability to understand guest preferences or optimize pricing strategies. For example, a report in early 2024 highlighted that hotels with modern, integrated technology stacks reported higher customer loyalty and revenue per available room compared to those relying on fragmented or outdated systems. Upgrading or replacing these legacy components would represent a strategic move to eliminate this financial burden and improve overall business performance.

- High Maintenance Costs: Legacy IT infrastructure often incurs significant operational expenditure for upkeep and security patching.

- Lack of Competitive Advantage: Outdated systems may not support advanced features like personalized guest experiences or efficient data analysis, putting IHCL at a disadvantage.

- Hindered Efficiency: Inefficient processes due to legacy technology can impact operational workflows and guest service delivery.

- Strategic Upgrade Necessity: Replacing or modernizing these systems is crucial to prevent continued cash drain and unlock future growth potential.

Very Small, Remote, or Unbranded Assets

Very small, remote, or unbranded assets within Indian Hotels Company Limited's (IHCL) portfolio, those not fitting the core Taj, Vivanta, SeleQtions, or Ginger brands, often represent a challenge. These properties, by their nature, struggle to benefit from IHCL's established brand equity and extensive distribution channels. This can lead to consistently low market share and growth, impacting overall profitability.

These types of assets may incur operational costs without generating significant returns, thus diminishing their strategic value. For instance, during the fiscal year ending March 31, 2024, IHCL reported a consolidated revenue of INR 6,000 crore. While this overall growth is positive, the performance of these smaller, unbranded segments might be a drag on this figure, requiring careful evaluation.

- Low Contribution: These assets typically contribute minimally to IHCL's overall revenue and profitability.

- Brand Dilution Risk: If not managed effectively, their presence could potentially dilute the strength of IHCL's core brands.

- Operational Inefficiencies: They may face challenges in achieving economies of scale, leading to higher per-unit operating costs.

- Limited Growth Potential: Their remote locations or lack of strong branding often restricts their ability to capture new market opportunities.

Dogs within IHCL's portfolio represent underperforming assets or services with low market share and limited growth potential. These could include older, less profitable properties in saturated markets or niche offerings that haven't gained traction. For example, a small, unbranded hotel in a remote location might struggle to attract guests, contributing minimally to IHCL's total revenue of approximately ₹6,000 crore in FY24.

These segments often require ongoing investment for maintenance or operational support without yielding commensurate returns, potentially hindering overall profitability. For instance, a legacy IT system might necessitate significant expenditure for upkeep while failing to deliver competitive advantages in digital guest experiences, a crucial area for the hospitality industry in 2024.

IHCL's strategy involves carefully managing these 'Dogs' by either divesting them, revitalizing them with targeted investments, or integrating them into more successful brand umbrellas where feasible. The goal is to free up capital and management focus for higher-growth opportunities within the portfolio.

The performance of these assets is critical to monitor; a property with occupancy rates consistently below 60% in 2024, for instance, would warrant serious consideration for strategic action to avoid being a persistent drag on financial performance.

Question Marks

Indian Hotels Company Limited (IHCL) is strategically exploring new international ventures beyond its current strongholds, venturing into nascent markets like specific secondary European cities or previously untapped African nations. These ambitious expansions represent potential Stars in the BCG matrix, offering substantial long-term growth opportunities.

However, these new territories are characterized by low initial market share for IHCL. Significant upfront investment will be crucial for brand establishment, market entry strategies, and building operational infrastructure. For instance, entering a market like Senegal or Portugal would necessitate substantial capital for marketing and localized operational setup, mirroring the early stages of a Star requiring nurturing.

Developing specialized medical tourism offerings for Indian Hotels Company Limited (IHCL) would indeed be a Question Mark in the BCG matrix. The global medical tourism market is booming, projected to reach over $180 billion by 2025, indicating significant growth potential.

However, IHCL's current presence in this highly specialized niche is likely minimal, meaning its market share is low despite the industry's high growth. Entering this segment would necessitate considerable investment in state-of-the-art medical facilities, strategic alliances with reputable healthcare providers, and targeted marketing campaigns to attract international patients.

Early-stage investments in highly innovative, technology-driven hospitality solutions like widespread AI-powered concierge services or immersive VR hotel tours are being explored by Indian Hotels Company Limited (IHCL). The potential for growth and disruption in this space is high, but IHCL's current market share in these specific, nascent offerings would be low.

These initiatives consume significant cash for research and development, with uncertain immediate returns. For instance, in 2023, the hospitality sector saw a global surge in tech investment, with companies like Marriott piloting AI solutions. IHCL's commitment to such R&D positions them to potentially become future stars if these technologies achieve widespread adoption and prove successful.

Expansion of Gateway Brand into New Tier 2/3 Cities

The re-imagined Gateway brand's expansion into Tier 2 and Tier 3 cities, especially those with developing business or leisure travel, positions these hotels as potential stars in the Indian Hotels BCG Matrix. These locations, benefiting from increasing urbanization and better connectivity, present a high growth opportunity. For instance, cities like Surat and Coimbatore have seen significant infrastructure development, attracting more business and tourism.

However, Gateway properties entering these markets would initially hold a low market share. Significant investment in marketing and operations will be essential to build brand recognition and achieve profitability. For example, in 2023, the Indian hospitality sector saw a robust recovery, with occupancy rates in Tier 2 cities averaging around 70-75%, indicating a growing demand but also the need for strong brand presence to capture market share.

- Gateway's strategic entry into Tier 2/3 cities targets underserved markets with high growth potential.

- Initial low market share necessitates substantial investment in brand building and operations.

- Urbanization and improved connectivity are key drivers for these expansion efforts.

- The brand aims to establish a dominant presence and achieve profitability in these emerging markets.

Strategic Acquisitions of Boutique, Unconsolidated Brands

Strategic acquisitions of boutique, unconsolidated brands by Indian Hotels Company Limited (IHCL) would likely be classified as Question Marks in the BCG Matrix. These brands, while potentially offering access to high-growth niche segments, start with a low market share within IHCL's portfolio. For instance, if IHCL were to acquire a collection of independent luxury villas in emerging tourist destinations, these would represent Question Marks. Their future success hinges on significant investment and a clear strategy to scale them effectively.

The rationale for this classification stems from the inherent uncertainty surrounding these acquisitions. They require substantial capital expenditure for repositioning, rebranding, and operational integration to achieve market penetration. Without a robust plan, these boutique brands might struggle to gain traction, consuming resources without delivering commensurate returns. For example, a recent report indicated that the boutique hotel segment in India is projected to grow at a CAGR of approximately 15% through 2027, highlighting the potential but also the competitive landscape these new acquisitions would face.

- Low Market Share: Acquired boutique brands typically enter IHCL's portfolio with a nascent market presence, requiring significant effort to build brand recognition and customer loyalty.

- High Investment Needs: These brands often necessitate substantial capital for renovation, marketing, and operational enhancements to align with IHCL's quality standards and to achieve scalability.

- Uncertain Future Growth: While operating in potentially high-growth niche markets, their success is not guaranteed and depends heavily on strategic management and market reception post-acquisition.

- Strategic Repositioning Required: The core challenge lies in effectively repositioning these unique assets to leverage IHCL's broader network and expertise, transforming them from standalone entities into valuable contributors to the group's overall growth.

Developing specialized medical tourism offerings represents a Question Mark for Indian Hotels Company Limited (IHCL). While the global medical tourism market is expanding rapidly, projected to exceed $180 billion by 2025, IHCL's current market share in this niche is likely minimal.

These ventures demand significant investment in advanced medical facilities and strategic partnerships, mirroring the characteristics of a Question Mark needing substantial resources to grow market share.

The success of IHCL's foray into medical tourism, like its potential expansion into new international markets, hinges on strategic execution and capital allocation to convert these low-share, high-growth opportunities into established Stars.

The company's exploration of innovative tech solutions, such as AI concierge services, also falls under the Question Mark category, requiring R&D investment with uncertain immediate returns but potential for future market leadership.

BCG Matrix Data Sources

Our Indian Hotels BCG Matrix leverages a blend of financial statements, industry growth forecasts, and competitor analysis from reputable market research firms.