IDEXX Laboratories PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

IDEXX Laboratories Bundle

Navigate the complex external forces shaping IDEXX Laboratories's future with our comprehensive PESTLE analysis. Understand how political shifts, economic volatility, and technological advancements are impacting the animal health industry, and leverage these insights to refine your strategic planning. Download the full version now to gain a critical competitive advantage and unlock actionable intelligence.

Political factors

Government policies concerning animal health, disease surveillance, and veterinary drug approvals are pivotal for IDEXX Laboratories, directly shaping its diagnostic and pharmaceutical product lines. For instance, in 2024, the U.S. Food and Drug Administration (FDA) continues to emphasize robust disease surveillance, a trend expected to bolster demand for IDEXX's diagnostic solutions. Stricter regulations, particularly those targeting zoonotic diseases and the critical issue of antibiotic resistance, are anticipated to fuel the need for IDEXX's advanced testing capabilities and services, as seen with increased investment in pathogen detection technologies.

IDEXX Laboratories' dairy and water testing businesses are significantly influenced by government regulations concerning food safety and water quality. Stricter standards, like those from the EPA or FDA, directly drive demand for IDEXX's diagnostic tools as businesses seek to comply and safeguard public health. For instance, ongoing updates to the EPA's Lead and Copper Rule Revisions necessitate more frequent and advanced water testing, benefiting IDEXX's water segment.

Changes in international trade policies and tariffs directly impact IDEXX Laboratories' operational costs and market access. For instance, the US-China trade tensions and subsequent tariff adjustments in 2023-2024 could increase the expense of sourcing components or exporting finished goods, affecting profit margins.

Political instability or shifts in trade agreements, such as potential renegotiations of existing pacts or the imposition of new trade barriers, pose a risk to IDEXX's global supply chain and distribution networks. Disruptions in key markets could hinder the company's ability to serve its international customer base, thereby impacting its projected revenue growth for 2024-2025.

Public Health Initiatives and Disease Control

Governmental focus on controlling animal diseases, especially those that can spread to humans (zoonotic diseases), directly fuels demand for IDEXX's diagnostic tools. For instance, the US Department of Agriculture's (USDA) continued efforts in monitoring and controlling avian influenza, a zoonotic threat, necessitate widespread testing solutions. This creates a robust market for IDEXX's avian diagnostic products.

Increased public health budgets allocated to animal welfare and disease prevention programs translate into a larger addressable market for IDEXX. In 2024, many countries, including those in the European Union, have seen commitments to bolster veterinary public health infrastructure, potentially increasing spending on diagnostic services and equipment.

- Zoonotic Disease Control: Government programs targeting diseases like West Nile virus or Lyme disease in animals require advanced diagnostics, benefiting IDEXX.

- Veterinary Public Health Funding: Increased budgets for animal disease surveillance and control directly support the market for IDEXX's testing platforms.

- International Collaboration: Global efforts to combat emerging infectious diseases in animals, often supported by international health organizations, expand the reach of diagnostic solutions.

Veterinary Practice Regulation and Licensing

Government policies dictating veterinary practice, such as licensing and scope of practice, directly influence how IDEXX's diagnostic tools are adopted. Stricter regulations might necessitate specific training or certifications for using advanced equipment, potentially slowing adoption, while streamlined processes can accelerate it.

Supportive regulatory frameworks that promote high standards in animal healthcare can indirectly boost demand for sophisticated diagnostic solutions like those offered by IDEXX. For instance, in 2024, several regions saw updated guidelines emphasizing preventative care, which often relies on advanced diagnostics.

- Licensing Requirements: Varying state and national licensing boards set the bar for veterinary professionals, impacting their ability to operate and utilize advanced diagnostic equipment.

- Scope of Practice: Regulations defining what veterinarians can and cannot do can influence the demand for specific diagnostic tests and the technologies that support them.

- Professional Standards: Adherence to professional standards often correlates with investment in cutting-edge technology, benefiting companies like IDEXX.

- Government Health Initiatives: Public health programs focused on animal welfare or disease surveillance can create opportunities for diagnostic companies.

Government policies on animal health, disease surveillance, and veterinary drug approvals are critical for IDEXX. In 2024, continued emphasis on disease surveillance by bodies like the U.S. FDA is expected to increase demand for IDEXX's diagnostic tools. Stricter regulations on zoonotic diseases and antibiotic resistance further drive the need for advanced testing capabilities.

Government regulations concerning food and water safety directly impact IDEXX's dairy and water testing segments. For example, ongoing updates to the EPA's Lead and Copper Rule Revisions necessitate more frequent water testing, benefiting IDEXX. Similarly, government initiatives focused on controlling animal diseases, such as avian influenza, create a robust market for IDEXX's avian diagnostic products.

Political stability and international trade policies significantly affect IDEXX's global operations and market access. Trade tensions and tariff adjustments in 2023-2024 impacted sourcing and export costs, potentially affecting profit margins. Disruptions from shifts in trade agreements or new barriers pose risks to IDEXX's supply chain and distribution networks for 2024-2025.

Increased public health budgets for animal welfare and disease prevention directly expand IDEXX's addressable market. In 2024, commitments from countries like those in the EU to bolster veterinary public health infrastructure are likely to boost spending on diagnostic services and equipment.

| Political Factor | Impact on IDEXX | Example/Data |

| Animal Health Regulations | Drives demand for diagnostics and pharmaceuticals. | U.S. FDA's focus on disease surveillance in 2024. |

| Food and Water Safety Standards | Boosts sales for testing segments. | EPA's Lead and Copper Rule Revisions. |

| Trade Policy | Affects operational costs and market access. | US-China trade tensions impacting tariffs in 2023-2024. |

| Public Health Funding | Expands market opportunities. | EU commitments to veterinary public health infrastructure in 2024. |

What is included in the product

This PESTLE analysis offers a comprehensive examination of the external macro-environmental factors impacting IDEXX Laboratories, covering political, economic, social, technological, environmental, and legal dimensions.

It provides actionable insights into how these global forces create both strategic opportunities and potential threats for the company's growth and operations.

Provides a concise version of the IDEXX Laboratories PESTLE analysis that can be dropped into PowerPoints or used in group planning sessions to quickly identify and address external market challenges.

Economic factors

Global economic growth is a key driver for IDEXX Laboratories, particularly its Companion Animal Group. As economies expand, disposable income tends to rise, allowing pet owners to spend more on their pets' well-being, including advanced diagnostic services. For instance, the International Monetary Fund (IMF) projected global growth to be around 3.2% in 2024, a slight uptick from 2023, signaling potential for increased consumer spending on pet healthcare.

Conversely, economic slowdowns or periods of high inflation can significantly impact discretionary spending. If consumers face tighter budgets, they may cut back on non-essential veterinary services or opt for less advanced diagnostic options. This could directly affect IDEXX's revenue streams, especially in regions experiencing economic headwinds. Inflationary pressures in 2023 and early 2024, while showing signs of easing in some major economies, continued to challenge household budgets globally.

The growing trend of pet humanization, where pets are increasingly viewed as integral family members, is a significant economic driver for the pet care industry. This societal shift directly translates into higher consumer spending on veterinary services, premium pet foods, and advanced diagnostic tools. For instance, the American Pet Products Association (APPA) reported that U.S. pet owners spent an estimated $136.8 billion on their pets in 2022, a figure projected to rise. This sustained demand for high-quality pet care, including diagnostic testing, provides a resilient market for companies like IDEXX Laboratories, even during periods of economic volatility, as owners remain committed to their pets' well-being.

Inflationary pressures in 2024 and early 2025 are directly impacting IDEXX Laboratories by increasing the cost of essential operational inputs. This includes everything from the raw materials needed for their diagnostic tests and instruments to the wages of their skilled workforce and the energy required to power their facilities. These rising costs can put a squeeze on profit margins if not managed carefully.

To counter these effects, IDEXX has been implementing strategic pricing adjustments. For instance, recent price increases for veterinary services, a key market for IDEXX's offerings, demonstrate their proactive approach to maintaining profitability amidst these economic headwinds. This strategy aims to offset the increased operational expenses and preserve the company's financial health.

Research and Development Investment Trends

IDEXX Laboratories' commitment to research and development (R&D) is a cornerstone of its growth, particularly in the dynamic veterinary diagnostics sector. Economic climates significantly influence R&D budgets, impacting the pace of innovation for IDEXX and its rivals. For instance, in 2023, IDEXX reported R&D expenses of $517.7 million, a testament to its ongoing investment in future solutions. This spending is critical for developing next-generation diagnostic tests and digital health platforms.

Shifts in economic conditions, such as interest rate changes or inflation, can directly affect the availability of capital for R&D. Companies like IDEXX must navigate these economic factors to maintain their competitive edge. The ability to secure funding for new product development is paramount, especially when considering the lengthy and costly process of bringing veterinary diagnostics to market. Competitors' R&D investments also play a crucial role, as they can introduce disruptive technologies that alter market dynamics.

- R&D Spending: IDEXX's R&D expenditure reached $517.7 million in 2023, highlighting its dedication to innovation.

- Economic Impact: Favorable economic conditions can boost R&D investment, accelerating new product introductions in veterinary diagnostics.

- Competitive Landscape: Competitor R&D activities directly influence IDEXX's strategic focus and investment priorities.

- Innovation Pipeline: Continued R&D is essential for IDEXX to maintain its leadership in diagnostic solutions and digital health services.

Competition and Market Share Dynamics

The veterinary diagnostics market is intensely competitive. Major players like Zoetis and Thermo Fisher Scientific present significant challenges, alongside emerging companies introducing novel diagnostic solutions. This dynamic environment directly influences IDEXX Laboratories' pricing flexibility and its ability to grow or maintain its market share.

IDEXX's leadership position, evidenced by its substantial market share, is not guaranteed. In 2024, IDEXX held an estimated 45% of the companion animal diagnostics market. Sustaining this dominance requires relentless innovation in its product offerings and highly effective commercial strategies to reach and retain customers.

- Competitive Landscape: Key rivals include Zoetis and Thermo Fisher Scientific, with new entrants constantly developing advanced diagnostic tools.

- Market Share: IDEXX maintained approximately 45% of the companion animal diagnostics market in 2024.

- Factors for Success: Continued market leadership hinges on IDEXX's commitment to ongoing research and development and strong sales and marketing execution.

- Impact on IDEXX: Competitive pressures affect IDEXX's pricing power and necessitate continuous investment to defend its market position.

Global economic growth directly fuels IDEXX's Companion Animal Group, as rising disposable incomes translate to increased spending on pet healthcare. The IMF projected global growth at 3.2% for 2024, suggesting a positive outlook for consumer spending on veterinary services. Conversely, economic downturns and inflation can curb discretionary spending, impacting IDEXX's revenue, especially as inflation continued to challenge household budgets through early 2024.

The trend of pet humanization is a significant economic tailwind, with owners increasingly treating pets as family members. This drives higher spending on advanced diagnostics and veterinary care, as seen in the APPA's report of $136.8 billion spent on pets in the U.S. in 2022. This sustained demand provides a resilient market for IDEXX, even amidst economic fluctuations.

Inflationary pressures in 2024 and early 2025 are increasing IDEXX's operational costs, from raw materials to labor and energy. The company is responding with strategic pricing adjustments, such as price increases for veterinary services, to offset these rising expenses and maintain profitability.

IDEXX's substantial R&D investment, totaling $517.7 million in 2023, is crucial for innovation in veterinary diagnostics. Economic conditions, including interest rates, can influence capital availability for R&D, impacting the pace of new product development and the company's competitive edge. Competitors' R&D activities also shape IDEXX's strategic investment priorities.

| Economic Factor | Impact on IDEXX | Data/Trend (2023-2025) |

|---|---|---|

| Global Economic Growth | Drives consumer spending on pet healthcare. | IMF projected 3.2% global growth in 2024. |

| Inflation | Increases operational costs; may reduce discretionary pet spending. | Inflationary pressures persisted through early 2024. |

| Pet Humanization | Sustains demand for advanced veterinary services and diagnostics. | U.S. pet spending reached $136.8 billion in 2022 (APPA). |

| R&D Investment | Crucial for innovation; influenced by capital availability. | IDEXX R&D: $517.7 million in 2023. |

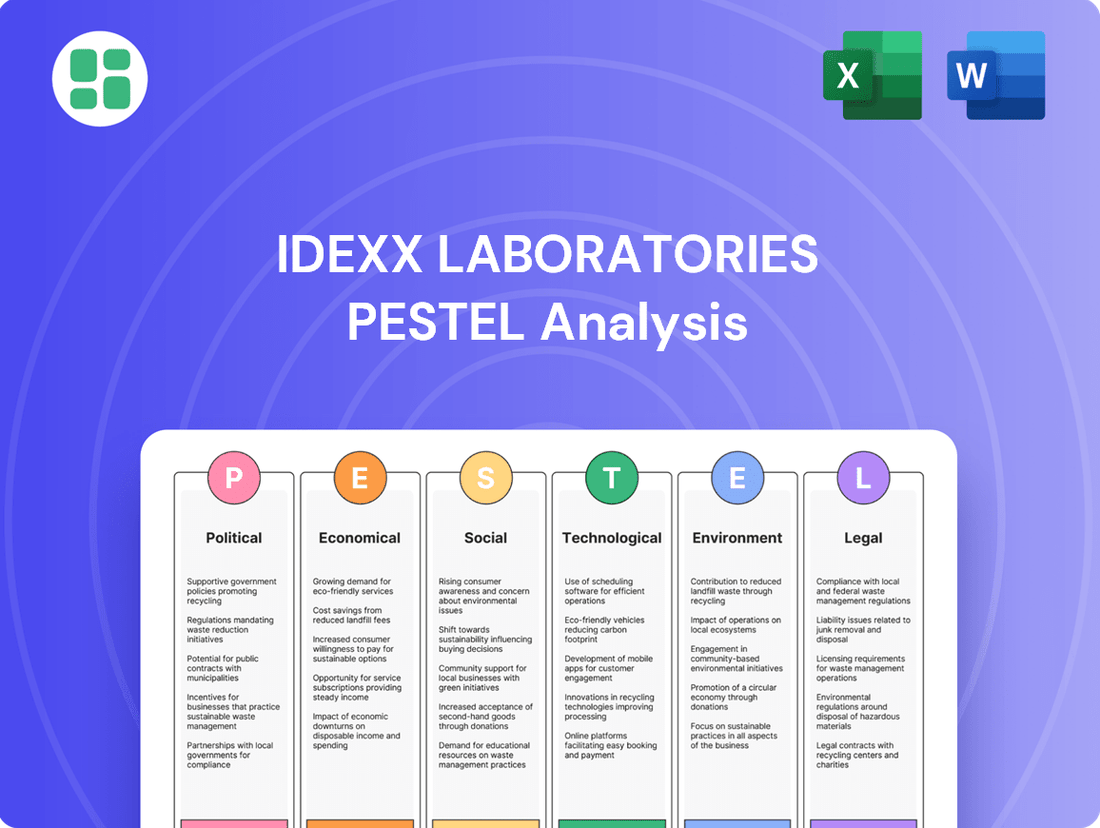

Preview the Actual Deliverable

IDEXX Laboratories PESTLE Analysis

The preview you see here is the exact IDEXX Laboratories PESTLE Analysis document you’ll receive after purchase—fully formatted and ready to use.

This is a real screenshot of the product you’re buying, detailing the Political, Economic, Social, Technological, Legal, and Environmental factors affecting IDEXX Laboratories, delivered exactly as shown, no surprises.

The content and structure shown in this preview is the same comprehensive IDEXX Laboratories PESTLE Analysis document you’ll download after payment, providing valuable strategic insights.

Sociological factors

The global pet population continues to surge, with an estimated 86.9 million households in the U.S. owning at least one pet as of 2023, a notable increase from previous years. This expanding base of companion animals, driven by evolving societal views on pets as family members, directly translates to a larger addressable market for IDEXX Laboratories' diagnostic solutions.

Lifestyle shifts, including increased urbanization and a greater emphasis on mental well-being, are fostering deeper human-animal bonds. This sociological trend fuels demand for advanced veterinary care, including sophisticated diagnostic testing, which IDEXX is well-positioned to supply. The company's revenue from its companion animal group, a significant portion of its overall business, is expected to benefit from this sustained growth in pet ownership.

There's a significant rise in how much people care about animal health and how animals are treated. This growing awareness directly fuels the demand for better diagnostic tools and services. As more people understand the importance of keeping their pets healthy and catching diseases early, they are more likely to seek out and pay for advanced veterinary care.

This trend means pet owners are increasingly open to spending more on regular check-ups and thorough health screenings for their animals. For a company like IDEXX Laboratories, this translates into a stronger market for their diagnostic tests and related products, as the willingness to invest in preventive and comprehensive pet care continues to climb.

Modern life is undeniably busy. With packed schedules, people are increasingly seeking solutions that save time and effort. This trend directly impacts the veterinary industry, fueling a demand for quick, accessible diagnostic services. Think about point-of-care testing in clinics or even remote consultations through telehealth – these are direct responses to consumers wanting faster results and less disruption.

IDEXX Laboratories is well-positioned to capitalize on this. Their commitment to developing diagnostic tools that streamline veterinary workflows and deliver rapid, accurate results perfectly matches these evolving customer expectations. For instance, IDEXX's in-clinic analyzers provide results in minutes, a significant convenience for both pet owners and veterinarians compared to sending samples to external labs. This efficiency is key in a market where convenience is king.

Food Consumption Trends and Safety Concerns

Societal shifts are increasingly prioritizing food safety and the consumption of animal proteins. This trend directly boosts the demand for sophisticated testing solutions in the dairy and livestock sectors, areas where IDEXX Laboratories offers significant expertise. For instance, a growing awareness of zoonotic diseases and the desire for traceable food origins are driving investments in diagnostic technologies.

Public health concerns regarding foodborne illnesses and chemical contaminants remain a constant driver for rigorous food safety protocols. Consequently, the need for reliable and efficient testing methods, such as those provided by IDEXX, is paramount. This heightened scrutiny impacts regulatory landscapes and consumer expectations, pushing for greater transparency in food production.

- Increased Demand for Animal Protein: Global per capita meat consumption is projected to rise, creating a larger market for livestock health and safety testing.

- Food Safety Regulations: Stricter regulations worldwide, like those enforced by the FDA and EFSA, mandate comprehensive testing throughout the food supply chain.

- Consumer Awareness: Surveys consistently show consumers are willing to pay more for food they perceive as safer and more ethically produced, influencing industry practices and testing adoption.

- Technological Advancements: Innovations in molecular diagnostics and rapid testing are making it easier and faster to detect pathogens and contaminants, supporting IDEXX's product development.

Aging Pet Population and Chronic Diseases

The increasing lifespan of pets, a significant sociological trend, directly fuels demand for advanced veterinary diagnostics. As animals age, they are more susceptible to chronic conditions like cancer, diabetes, and kidney disease, necessitating continuous monitoring and specialized diagnostic tests. This demographic shift means pet owners are investing more in their pets' long-term health, creating a stable and expanding market for recurring diagnostic services and specialized testing panels.

For IDEXX Laboratories, this translates into a robust opportunity. For instance, the U.S. pet population reached an estimated 165.1 million animals in 2024, with a notable increase in older pets. This aging demographic requires more frequent veterinary visits and diagnostic testing, directly benefiting IDEXX's business model, which relies on the sale of diagnostic instruments and consumables for ongoing patient care.

- Rising Pet Lifespans: Pets are living longer due to improved nutrition, preventative care, and advanced veterinary medicine.

- Increased Chronic Disease Prevalence: Age-related and chronic illnesses such as arthritis, heart disease, and cancer are becoming more common in older pets.

- Sustained Diagnostic Demand: Ongoing monitoring for these chronic conditions creates a consistent revenue stream for diagnostic companies like IDEXX.

- Market Growth: The trend supports the growth of specialized veterinary diagnostics, including advanced imaging, genetic testing, and comprehensive blood work panels.

Societal shifts are increasingly prioritizing pet health and well-being, viewing pets as integral family members. This elevated status drives demand for advanced veterinary care, directly benefiting IDEXX Laboratories. For example, in 2024, an estimated 65.1 million U.S. households owned at least one dog, reflecting a sustained commitment to pet companionship and associated healthcare spending.

The growing humanization of pets fuels a willingness among owners to invest more in preventative care and sophisticated diagnostics. This trend is evident in the increasing adoption of regular health screenings and specialized testing, creating a robust market for IDEXX's comprehensive diagnostic solutions. The company's revenue from its companion animal group, a key segment, is poised to grow with this ongoing societal emphasis on pet welfare.

Technological factors

Rapid advancements in diagnostic technologies are a key driver for IDEXX Laboratories. Innovations like AI-powered analyzers and molecular diagnostics are crucial for their competitive advantage, enabling quicker and more accurate results for veterinarians.

The company's commitment to leveraging these technological leaps is evident in product launches such as the IDEXX inVue Dx Cellular Analyzer. This focus on cutting-edge diagnostics allows IDEXX to offer enhanced accuracy and speed in veterinary care.

Furthermore, the introduction of IDEXX Cancer Dx highlights the company's strategic investment in genomics and advanced diagnostic solutions. These developments are critical for meeting the evolving needs of the animal health market and solidifying IDEXX's market position.

The veterinary industry's rapid digitalization, marked by the widespread adoption of practice management software and cloud solutions, presents a significant opportunity for integrated diagnostic offerings. IDEXX's strategic investments in platforms like VetConnect PLUS and Vello exemplify this trend, directly addressing the need for enhanced workflow efficiency and streamlined data management within clinics.

These integrated software solutions not only improve the day-to-day operations of veterinary practices but also strengthen the crucial communication link between veterinarians and pet owners. By facilitating better data sharing and accessibility, IDEXX's technology fosters deeper customer loyalty and reinforces its position as a key partner in modern veterinary care.

The increasing need for quick, in-clinic diagnostic results is a major force pushing point-of-care (POC) testing forward. This trend directly benefits companies like IDEXX Laboratories.

IDEXX's ongoing advancements in POC technology, including its well-established Catalyst platform and newer devices, are crucial. These innovations empower veterinarians to diagnose and treat animals more swiftly, ultimately leading to better patient care and outcomes. For example, IDEXX's diagnostic solutions are designed to provide results within minutes, reducing the need for external labs and accelerating the diagnostic process for common conditions.

Telemedicine and Remote Monitoring

The increasing adoption of telemedicine and wearable health monitoring devices for pets is a significant technological trend impacting the veterinary industry. This shift offers IDEXX Laboratories a dual opportunity: to expand its reach and gather valuable data, but also necessitates adaptation to stay competitive. For instance, the global veterinary telemedicine market was valued at approximately USD 1.5 billion in 2023 and is projected to grow substantially, driven by convenience and accessibility.

IDEXX needs to strategically integrate its diagnostic solutions and data platforms with these burgeoning remote care technologies. This integration is crucial for maintaining relevance and capturing new market segments.

- Expanded Access: Telemedicine allows for broader geographic reach and more frequent patient check-ins, potentially increasing the volume of diagnostic tests ordered.

- Data Generation: Wearable devices can provide continuous health data, offering richer insights for IDEXX's diagnostic capabilities and predictive analytics.

- Integration Imperative: Failure to connect with remote monitoring platforms could lead to IDEXX’s solutions becoming siloed and less valuable in a connected veterinary ecosystem.

Automation in Laboratory Diagnostics

Automation and robotics are significantly enhancing efficiency, throughput, and accuracy within veterinary reference laboratories. IDEXX Laboratories, leveraging its expansive network of reference labs, is a prime beneficiary of these technological strides. This allows the company to process greater sample volumes and achieve more cost-effective operational outcomes.

The integration of advanced automation directly impacts IDEXX's ability to scale its services. For instance, in 2023, IDEXX reported a 7.3% increase in revenue for its Diagnostics segment, partly driven by the efficient processing capabilities enabled by their automated systems. This technological advantage translates into faster turnaround times for diagnostic results, a critical factor for veterinarians relying on timely information for patient care.

- Increased Throughput: Automated systems can process hundreds or even thousands of samples per day, far exceeding manual capabilities.

- Enhanced Accuracy: Robotics minimize human error in sample handling and analysis, leading to more reliable results.

- Cost Efficiency: While initial investment is high, automation reduces labor costs per sample over time, improving profitability.

- Scalability: IDEXX's investment in automation allows it to readily accommodate growing demand for veterinary diagnostic services.

The ongoing integration of artificial intelligence (AI) and machine learning (ML) into diagnostic platforms is a significant technological factor for IDEXX Laboratories. These advancements are enabling more sophisticated analysis of complex biological data, leading to earlier disease detection and personalized treatment plans. For example, IDEXX's AI-driven image analysis tools are improving the accuracy and speed of interpreting diagnostic images, such as radiographs and cytology slides, directly benefiting veterinary practitioners.

The company's investment in cloud-based platforms and data analytics is crucial for managing the vast amounts of information generated by modern veterinary diagnostics. These technologies facilitate seamless data sharing, remote access to results, and the development of predictive health insights. IDEXX's VetConnect PLUS platform exemplifies this, offering veterinarians integrated access to patient records, diagnostic results, and practice management tools, thereby enhancing workflow efficiency and client engagement.

The increasing sophistication of point-of-care (POC) diagnostic devices, driven by miniaturization and improved assay technologies, directly supports IDEXX's strategy. Innovations in POC testing allow for rapid, in-clinic results for a wider range of conditions, reducing turnaround times and improving patient outcomes. IDEXX's Catalyst Dx platform, for instance, provides a comprehensive suite of in-house diagnostic tests, enabling veterinarians to make immediate clinical decisions.

The burgeoning field of telemedicine and remote pet monitoring presents both opportunities and challenges for IDEXX. As pet owners increasingly adopt these technologies, the demand for integrated diagnostic solutions that can feed into remote health monitoring systems will grow. IDEXX's ability to connect its diagnostic data with these emerging platforms will be key to maintaining its competitive edge in a rapidly evolving veterinary landscape.

Legal factors

IDEXX Laboratories' success hinges on obtaining regulatory clearance for its innovative diagnostic products. Agencies like the U.S. Food and Drug Administration (FDA) and their international counterparts scrutinize these advancements. For instance, in 2023, the FDA's Center for Devices and Radiological Health (CDRH) continued its focus on streamlining review pathways for novel diagnostic technologies, a process IDEXX actively engages with.

Navigating these regulatory hurdles is crucial for market entry. Delays in FDA approval, or even stricter requirements than anticipated, can significantly push back product launch dates. This directly affects revenue projections and the ability to capitalize on market opportunities, as seen with the extended review periods for certain complex diagnostic platforms in the veterinary sector during 2024.

IDEXX Laboratories' reliance on digital platforms and the management of sensitive patient data necessitates strict adherence to evolving data privacy and cybersecurity laws. Regulations like GDPR and similar frameworks for animal health data are paramount, requiring robust data protection measures. In 2024, the global cybersecurity market was valued at approximately $215 billion, highlighting the significant investment and legal scrutiny in this area.

Failure to comply with these legal mandates can result in substantial fines and reputational damage. IDEXX must maintain strong cybersecurity protocols to safeguard customer information, ensuring trust and uninterrupted service delivery. The average cost of a data breach in 2024 was estimated at over $4.45 million globally, underscoring the financial implications of non-compliance.

Intellectual property rights, particularly patents for diagnostic technologies and proprietary tests, are a cornerstone of IDEXX Laboratories' competitive edge. These legal protections are crucial for safeguarding their innovations in areas like veterinary diagnostics, preventing competitors from easily replicating their advancements. As of early 2024, IDEXX held a significant portfolio of patents, reflecting ongoing investment in research and development to maintain market leadership.

Animal Welfare Legislation

Evolving animal welfare legislation presents a critical consideration for IDEXX Laboratories. As societal expectations and legal frameworks around animal treatment become more stringent, IDEXX must ensure its diagnostic products and services, particularly those used in veterinary practices or research, adhere to these evolving standards. This includes scrutiny of animal testing protocols and ethical sourcing of biological samples.

The increasing emphasis on animal welfare can directly impact the types of diagnostic procedures deemed acceptable and the data collection methods employed. For instance, regulations may influence the development and use of in vitro diagnostic tools over traditional animal-based testing. IDEXX's commitment to ethical practices and compliance with these laws is paramount for maintaining its reputation and market access.

- Regulatory Landscape: Growing global focus on animal welfare legislation, with key markets like the European Union and North America often leading in establishing stricter guidelines for animal research and veterinary care.

- Product Development Impact: IDEXX's R&D efforts must proactively consider animal welfare implications, potentially driving innovation towards non-invasive or less impactful diagnostic methodologies.

- Ethical Sourcing: Ensuring that any biological samples or materials used in product development or testing are sourced ethically and in compliance with all relevant animal welfare laws is crucial for operational integrity.

Environmental and Waste Disposal Regulations

Environmental and waste disposal regulations directly influence IDEXX Laboratories' operations, particularly concerning the handling and disposal of laboratory waste, chemicals, and biohazardous materials. Adherence to these stringent rules is paramount for preventing environmental contamination and ensuring the safety of both employees and the public. For instance, in 2024, the US Environmental Protection Agency (EPA) continued to enforce regulations like the Resource Conservation and Recovery Act (RCRA), which governs hazardous waste management. Companies like IDEXX must meticulously track and dispose of regulated waste streams, often requiring specialized treatment and disposal services.

Failure to comply with these environmental mandates can result in significant financial penalties and reputational damage. IDEXX, like many in the life sciences sector, invests in robust waste management protocols and technologies to ensure compliance. The company’s commitment to sustainability, often detailed in their annual reports, includes efforts to minimize waste generation and responsibly manage unavoidable waste. For example, in their 2023 sustainability reporting, many companies highlighted reductions in hazardous waste per unit of production, a trend expected to continue into 2024 and 2025 as regulatory scrutiny intensifies.

- RCRA Compliance: IDEXX must manage hazardous waste according to EPA standards, impacting disposal costs and processes.

- Biohazardous Waste Management: Strict protocols for handling and disposing of biological materials are essential for laboratory safety and regulatory adherence.

- Environmental Penalties: Non-compliance can lead to substantial fines, potentially impacting financial performance.

- Sustainability Reporting: Companies are increasingly disclosing waste reduction efforts, reflecting growing environmental responsibility and regulatory pressure.

IDEXX Laboratories operates within a stringent regulatory framework, necessitating approvals from bodies like the FDA for its diagnostic products. The evolving landscape of veterinary medicine and diagnostics means continuous adaptation to new guidelines. For instance, the 2024 focus on companion animal health innovation implies heightened scrutiny on the safety and efficacy of new testing platforms.

Intellectual property protection is vital, with IDEXX actively securing patents for its proprietary diagnostic technologies. This legal shield is crucial for maintaining a competitive advantage in the rapidly advancing veterinary diagnostics market. As of early 2024, IDEXX held a substantial patent portfolio, underscoring its commitment to innovation and market exclusivity.

Data privacy and cybersecurity are paramount, especially with the increasing digitization of veterinary records and diagnostic results. Compliance with regulations such as GDPR and similar global data protection laws is essential to safeguard sensitive patient information. The global cybersecurity market, valued at over $215 billion in 2024, highlights the significant legal and operational implications of data security.

Animal welfare legislation also directly impacts IDEXX's product development and operational practices. Adherence to ethical sourcing of biological samples and responsible use of diagnostic tools in veterinary settings is critical. Emerging regulations in 2024 continued to emphasize humane treatment and minimal invasiveness in animal research and care, influencing the design of diagnostic solutions.

| Legal Factor | Relevance to IDEXX | 2024/2025 Trend/Data |

|---|---|---|

| Regulatory Approvals | Essential for product launch and market access | Continued focus on streamlining pathways for novel diagnostics; increased scrutiny on efficacy and safety data. |

| Intellectual Property | Protects R&D investments and competitive edge | Significant patent portfolio maintained; ongoing litigation in the diagnostics sector is common. |

| Data Privacy & Cybersecurity | Crucial for handling sensitive patient and client data | Global cybersecurity market >$215 billion in 2024; increased regulatory enforcement of data protection laws. |

| Animal Welfare Legislation | Influences product development and ethical practices | Growing emphasis on non-invasive diagnostics and ethical sourcing of biological materials; potential for stricter testing protocols. |

Environmental factors

Climate change is a significant environmental factor impacting animal health, and by extension, IDEXX Laboratories. Shifting weather patterns and rising global temperatures can alter the geographic distribution and prevalence of various animal diseases. For instance, warmer climates may foster the spread of vector-borne diseases like Lyme disease or West Nile virus in new regions, affecting both companion animals and livestock. This necessitates continuous adaptation of diagnostic tools and proactive surveillance strategies to identify and track these emerging threats.

IDEXX's long-term relevance hinges on its capacity to innovate and adjust its product portfolio in response to these environmentally driven disease shifts. As new pathogens emerge or existing ones expand their reach, the demand for rapid, accurate diagnostic tests will grow. The company's investment in research and development to anticipate and address these evolving health challenges, such as developing tests for novel zoonotic diseases that may become more prevalent due to climate change, is therefore critical for maintaining its market leadership.

Growing pressure on companies to be environmentally responsible is fueling a greater need for sustainable manufacturing. This means businesses are increasingly expected to minimize their ecological footprint throughout their operations.

IDEXX Laboratories is actively addressing this by implementing initiatives aimed at reducing greenhouse gas emissions. For instance, in 2023, the company reported a 15% reduction in Scope 1 and Scope 2 greenhouse gas emissions compared to their 2019 baseline.

Furthermore, IDEXX is committed to sourcing renewable electricity, with 75% of its global electricity consumption coming from renewable sources as of the end of 2023. They are also focusing on improving product circularity, looking for ways to design products for longevity and easier recycling.

The environmental footprint of diagnostic kits, reagents, and instruments, encompassing packaging and disposal, is increasingly scrutinized. IDEXX is actively pursuing product circularity, evidenced by their instrument servicing programs and adoption of more sustainable packaging solutions to mitigate these environmental impacts.

Water Scarcity and Quality Concerns

Global water scarcity and concerns over water quality are increasingly critical issues, directly impacting the demand for IDEXX Laboratories' water testing solutions. As populations grow and climate change intensifies, the need for reliable access to clean water becomes paramount. This trend is particularly relevant to IDEXX's environmental health segment, which provides essential diagnostic tools for monitoring water safety.

The rising demand for clean water, coupled with more stringent regulatory frameworks worldwide, is creating a significant growth opportunity for IDEXX. For instance, in 2024, many regions experienced unprecedented drought conditions, leading to heightened public and governmental focus on water management and testing. This environmental pressure translates into increased market penetration for advanced water testing technologies.

- Growing Market: The global water quality testing market was valued at approximately $5.5 billion in 2023 and is projected to grow at a CAGR of over 6% through 2030, driven by these environmental factors.

- Regulatory Push: Stricter regulations, such as the U.S. Environmental Protection Agency's (EPA) ongoing efforts to update the Safe Drinking Water Act, mandate more frequent and comprehensive water testing, benefiting companies like IDEXX.

- IDEXX's Role: IDEXX's portfolio, including its Colilert and Enterolert tests, offers rapid and accurate detection of microbial contaminants, crucial for ensuring public health in the face of water quality challenges.

Biodiversity and Ecosystem Health

IDEXX Laboratories plays a crucial role in safeguarding biodiversity and ecosystem health through its advanced diagnostic solutions for livestock and wildlife. By enabling the early detection and management of diseases in animal populations, IDEXX's technology helps prevent the spread of pathogens that could have devastating wider ecological consequences. This is particularly vital in agricultural settings, where disease outbreaks in livestock can lead to significant economic losses and disrupt sustainable farming practices.

The company's commitment to animal health directly supports efforts to maintain healthy ecosystems. For instance, monitoring and controlling diseases in wildlife populations, such as avian influenza or chronic wasting disease, is essential to prevent their transmission to domestic animals or even humans, thereby protecting biodiversity. IDEXX's diagnostic tools are instrumental in these surveillance and control programs, providing veterinarians and researchers with the data needed to make informed decisions.

In 2023, IDEXX reported strong performance in its Livestock, Poultry, and Water (LPW) segment, underscoring the demand for its disease management solutions. The company's continued investment in research and development for new diagnostic tests further solidifies its position as a key contributor to global animal health and, by extension, environmental well-being. This focus is critical as climate change and increased human-wildlife interaction create new challenges for disease emergence and spread.

Key contributions of IDEXX to biodiversity and ecosystem health include:

- Early disease detection in livestock: Preventing outbreaks that could impact food security and agricultural sustainability.

- Wildlife disease surveillance: Supporting conservation efforts by monitoring and controlling the spread of zoonotic diseases.

- Water quality testing: Ensuring the safety of water sources, which are vital for both animal and human health, and broader ecosystem function.

- Development of advanced diagnostics: Providing tools that enhance the ability to understand and manage animal health across diverse environments.

Environmental regulations are increasingly shaping business practices, pushing companies like IDEXX to adopt more sustainable operations and product development. The growing awareness of climate change impacts, such as altered disease patterns in animals, directly influences the demand for IDEXX's diagnostic solutions, requiring continuous innovation to address emerging threats.

IDEXX's proactive approach to environmental stewardship is evident in its commitment to reducing greenhouse gas emissions, with a 15% decrease in Scope 1 and 2 emissions reported by the end of 2023 compared to a 2019 baseline. Furthermore, the company is prioritizing renewable energy, sourcing 75% of its global electricity from renewables as of year-end 2023, and focusing on product circularity to minimize its ecological footprint.

Water scarcity and quality concerns are driving significant growth in IDEXX's water testing segment, particularly as regulatory bodies like the EPA strengthen drinking water standards. The global water quality testing market, valued at approximately $5.5 billion in 2023, is expected to expand at over 6% annually, highlighting the critical role of companies like IDEXX in ensuring public health and environmental safety.

IDEXX's contributions to biodiversity and ecosystem health are substantial, through early disease detection in livestock to prevent agricultural disruptions and wildlife disease surveillance to curb zoonotic spread. Their advanced diagnostic tools are vital for managing animal health across diverse environments, supporting conservation efforts and ensuring the safety of water sources essential for all life.

PESTLE Analysis Data Sources

Our IDEXX Laboratories PESTLE Analysis is built on a robust foundation of data from leading veterinary and animal health industry reports, government regulatory bodies, and global economic databases. We integrate insights from market research firms, scientific journals, and public company filings to ensure comprehensive coverage of all PESTLE factors.