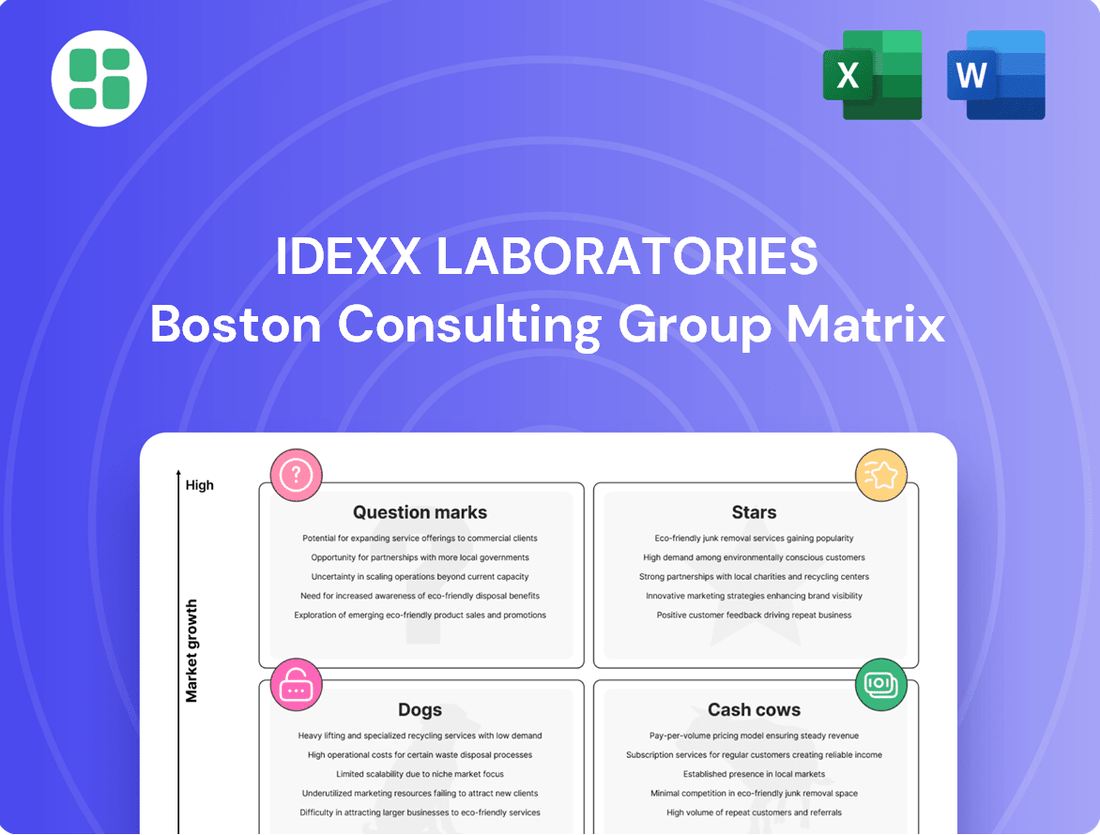

IDEXX Laboratories Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

IDEXX Laboratories Bundle

Curious about IDEXX Laboratories' product portfolio performance? Our BCG Matrix analysis highlights their Stars, Cash Cows, Dogs, and Question Marks. Don't miss out on understanding their strategic positioning.

Unlock the full potential of IDEXX Laboratories' strategic landscape by purchasing our comprehensive BCG Matrix report. Gain actionable insights into their market share and growth potential to inform your next investment decision.

This is your chance to see exactly where IDEXX Laboratories' products fit within the BCG framework. Get the full report for a detailed breakdown and the strategic clarity you need to navigate the competitive animal health market.

Stars

The IDEXX inVue Dx Cellular Analyzer is a clear Star in the BCG Matrix for IDEXX Laboratories. It's experiencing robust growth, evidenced by nearly 2,400 units placed in the second quarter of 2025, a new record. This high adoption rate in a rapidly expanding in-clinic diagnostics market indicates a strong and growing market share.

This advanced, slide-free, AI-powered analyzer is a key driver for IDEXX's integrated diagnostic ecosystem. Its ability to provide fast, high-quality results comparable to reference labs directly translates into substantial consumable sales, further solidifying its position as a high-growth, high-market-share product.

The IDEXX Cancer Dx Panel, launched in North America in March 2025, targets canine lymphoma, a significant unmet need in early cancer detection. Its rapid uptake, with over 1,000 veterinary practices ordering within its first month, highlights strong market reception and substantial growth potential in a vital veterinary specialty.

IDEXX's strategic expansion plans aim to broaden the panel's coverage to encompass most canine cancer cases within the next three years, positioning it as a key offering in their diagnostic portfolio.

IDEXX Laboratories saw a significant surge in global premium diagnostic instrument placements during the second quarter of 2025, reaching an impressive 6,070 units. This record-breaking performance includes key analyzers like Catalyst, Premium Hematology instruments, and SediVue Dx, underscoring the company's expanding reach in advanced veterinary diagnostics.

These strategic placements are crucial for IDEXX's growth, as they not only broaden the installed base but also generate a steady stream of high-margin recurring revenue through associated consumables. This consistent revenue stream highlights IDEXX's dominant market share and the strong demand for its sophisticated veterinary instrumentation.

International Companion Animal Group (CAG) Diagnostics Recurring Revenue

The international segment of IDEXX Laboratories' Companion Animal Group (CAG) Diagnostics recurring revenue demonstrated impressive strength in Q2 2025, growing 15% as reported and 11% organically. This performance substantially outpaced U.S. growth, highlighting IDEXX's expanding global footprint in the companion animal health sector. The company is effectively capitalizing on new business opportunities and an increasing installed base of its premium diagnostic instruments worldwide.

This robust international expansion is a key indicator of IDEXX's competitive positioning and its ability to capture market share in dynamic global markets. The growth is underpinned by strategic business development and the increasing adoption of advanced diagnostic solutions by veterinary practices across various regions.

- International CAG Diagnostics recurring revenue grew 15% reported and 11% organically in Q2 2025.

- This growth significantly outpaced U.S. domestic CAG Diagnostics recurring revenue growth.

- The expansion reflects strong new business gains and a growing installed base of premium instruments internationally.

- This performance underscores IDEXX's increasing market share in rapidly expanding global companion animal health markets.

AI-Powered Diagnostic Tools and Integrated Solutions

IDEXX Laboratories is strategically investing in AI-powered diagnostic tools, exemplified by innovations like the inVue Dx analyzer. This focus taps into the burgeoning market for advanced veterinary diagnostics. The company's AI-leveraged SDMA test kits, for instance, are enhancing the precision of kidney function assessment for pets.

These integrated solutions are designed to significantly improve diagnostic accuracy and optimize veterinary practice workflows. By streamlining operations and providing more reliable results, IDEXX strengthens its relationships with veterinary clinics, fostering customer loyalty and solidifying its market position in the rapidly evolving field of data-driven veterinary medicine.

- AI Integration: IDEXX's inVue Dx analyzer and AI-enhanced SDMA tests represent a significant push into AI-driven veterinary diagnostics.

- Market Leadership: This technological advancement positions IDEXX as a leader in a high-growth segment of the animal health market.

- Workflow Enhancement: Integrated solutions improve diagnostic precision and streamline laboratory processes for veterinarians.

- Customer Retention: Enhanced accuracy and efficiency bolster customer loyalty, securing IDEXX's market share.

The IDEXX inVue Dx Cellular Analyzer is a prime example of a Star within IDEXX Laboratories' BCG Matrix. Its rapid adoption, with nearly 2,400 units placed in Q2 2025, highlights strong market demand in the growing in-clinic diagnostics sector. This AI-powered analyzer significantly boosts consumable sales and reinforces IDEXX's integrated diagnostic ecosystem.

The IDEXX Cancer Dx Panel, launched in March 2025, has seen swift uptake, with over 1,000 veterinary practices ordering it within its first month. This indicates substantial growth potential and addresses a critical need in canine cancer detection, further cementing its Star status.

IDEXX's global premium diagnostic instrument placements reached a record 6,070 units in Q2 2025, including key products like Catalyst and SediVue Dx. This broad placement strategy fuels recurring revenue from high-margin consumables, showcasing both market dominance and strong demand.

| Product/Segment | BCG Category | Key Performance Indicator (Q2 2025) | Growth Driver |

| inVue Dx Cellular Analyzer | Star | ~2,400 units placed | AI-powered, slide-free, integrated ecosystem |

| Cancer Dx Panel | Star | >1,000 practices ordered (first month) | Addresses unmet need in canine cancer detection |

| Global Premium Instruments | Star | 6,070 units placed (record) | Broad installed base, recurring consumable revenue |

| International CAG Diagnostics Recurring Revenue | Star | 15% reported, 11% organic growth | Expanding global footprint, new business gains |

What is included in the product

IDEXX Laboratories' BCG Matrix offers a tailored analysis of its product portfolio, categorizing units as Stars, Cash Cows, Question Marks, or Dogs.

This framework provides clear descriptions and strategic insights, highlighting which units to invest in, hold, or divest for optimal growth.

IDEXX's BCG Matrix offers a clear, one-page overview of its business units, simplifying complex strategic decisions.

Cash Cows

IDEXX's Reference Laboratory Diagnostic and Consulting Services are a strong Cash Cow, bringing in $368 million in revenue for Q2 2025. This segment is showing steady growth, with reported growth at 6% and organic growth at 5%.

These services command a large share of the veterinary diagnostics market, which is considered mature. The consistent, high-volume nature of testing and consulting provided here is a major contributor to IDEXX's overall cash generation.

IDEXX VetLab Consumables are a cornerstone Cash Cow for IDEXX Laboratories. In Q2 2025, this segment generated an impressive $375 million in revenue, showcasing robust reported growth of 15% and a solid 14% organic growth rate. This performance is directly linked to the high utilization of IDEXX VetLab instruments and the continuous expansion of their installed base, highlighting a stable and profitable revenue engine.

The consumables hold a significant market share within the mature and indispensable sector of in-clinic veterinary diagnostics. This dominant position ensures highly recurring and profitable revenue streams, underscoring their status as a reliable Cash Cow within IDEXX's portfolio.

IDEXX Laboratories' Catalyst platform, particularly its established units, firmly sits in the Cash Cow quadrant of the BCG Matrix. This is driven by its dominant market share within the critical in-clinic veterinary chemistry diagnostics sector. The consistent and predictable demand for the platform's proprietary consumables ensures a steady revenue stream.

The Catalyst platform generates substantial and reliable profit margins, contributing significantly to IDEXX's overall cash flow. Given its mature status and deep integration into veterinary workflows, the need for extensive promotional investment is minimal, allowing for efficient cash generation.

In 2023, IDEXX reported that its diagnostics portfolio, which includes the Catalyst platform, continued to be a strong driver of growth, with consumables representing a significant portion of recurring revenue. This highlights the enduring cash-generating power of the established Catalyst base.

Core Companion Animal Group (CAG) Diagnostics Recurring Revenue

IDEXX Laboratories' Core Companion Animal Group (CAG) Diagnostics recurring revenue is a prime example of a Cash Cow within its business portfolio. This segment is the bedrock of the company's financial strength, generating over 92% of IDEXX's total revenue.

Despite facing some economic challenges that can impact veterinary clinic visits, this critical revenue stream demonstrated impressive resilience. In the second quarter of 2025, it achieved a solid 9% reported growth and a 7% organic growth rate.

This sustained performance underscores the segment's dominant market share within the expansive and generally stable companion animal diagnostics sector. Its consistent ability to generate substantial cash flow makes it a vital component of IDEXX's overall financial strategy.

- CAG Diagnostics recurring revenue exceeds 92% of IDEXX's total revenue.

- Q2 2025 saw 9% reported and 7% organic growth in this segment.

- High market share in a large, stable market fuels consistent cash generation.

Veterinary Software and Practice Management Solutions

IDEXX's established veterinary software, services, and diagnostic imaging systems are a prime example of a Cash Cow within their business portfolio. In the second quarter of 2025, these solutions brought in $86 million in revenue, demonstrating a healthy 9% reported and organic growth.

These offerings are designed to create a strong ecosystem for veterinarians, often referred to as 'ecosystem lock-in.' This strategy fosters high customer retention rates, which translates into predictable and stable recurring revenue streams for IDEXX. The mature nature of the practice management market means growth may not be explosive, but the consistent income is crucial.

- Revenue Generation: $86 million in Q2 2025.

- Growth Rate: 9% reported and organic growth.

- Strategic Role: Enhances veterinarian efficiency and maintains market leadership.

- Market Position: Dominant player in the mature practice management sector.

IDEXX Laboratories' Reference Laboratory Diagnostic and Consulting Services, along with VetLab Consumables and the Catalyst platform, represent significant Cash Cows. These segments benefit from high market share in mature, essential veterinary diagnostics sectors, ensuring consistent, high-volume revenue and strong profit margins. The recurring nature of consumables and services, coupled with established instrument bases, provides a stable and predictable cash flow, minimizing the need for aggressive marketing spend.

| Segment | Q2 2025 Revenue | Reported Growth | Organic Growth | Market Position |

| Reference Lab Diagnostics & Consulting | $368 million | 6% | 5% | Mature, High Share |

| VetLab Consumables | $375 million | 15% | 14% | Mature, Dominant Share |

| Catalyst Platform (Consumables) | N/A (part of Diagnostics) | N/A | N/A | Mature, Dominant Share |

| CAG Diagnostics Recurring Revenue | >92% of Total Revenue | 9% | 7% | Large, Stable Market Dominance |

| Vet Software, Services & Imaging | $86 million | 9% | 9% | Mature, Ecosystem Lock-in |

Delivered as Shown

IDEXX Laboratories BCG Matrix

The IDEXX Laboratories BCG Matrix you are currently previewing is the exact, fully formatted document you will receive immediately after purchase. This comprehensive analysis, designed for strategic clarity, contains no watermarks or demo content, ensuring you get a professional and ready-to-use report. You can confidently download this precise version to inform your business planning and competitive strategy.

Dogs

IDEXX's Global Rapid Assay products are currently positioned as a Dog in the BCG Matrix. These products experienced a 3% organic revenue decline in the second quarter of 2025.

This downturn is primarily attributed to a customer shift towards more sophisticated, analyzer-based testing solutions, such as IDEXX's Catalyst instrument. This trend suggests a diminishing market presence for rapid assays as newer technologies gain traction.

The declining demand and the availability of superior alternatives position Global Rapid Assay products as a potential cash trap for IDEXX Laboratories, indicating a need for strategic re-evaluation.

The Livestock, Poultry, and Dairy (LPD) segment at IDEXX Laboratories is currently positioned as a Dog in the BCG Matrix. In Q2 2025, this segment generated a modest $31.8 million in revenue, accompanied by a sluggish organic growth rate of just 3%.

More concerning is the segment's financial performance, with a negative operating margin of -1.6% (GAAP) in Q2 2025. This indicates that the LPD segment is a cash drain for IDEXX, consuming more resources than it produces, a hallmark of a Dog in the BCG framework.

Older, non-integrated point-of-care tests at IDEXX Laboratories likely reside in the Dogs quadrant of the BCG Matrix. These diagnostics, while once useful, are being overshadowed by the market's strong pivot towards sophisticated, automated, and integrated veterinary diagnostic systems.

The demand for these standalone tests is expected to wane as veterinary practices prioritize efficiency and comprehensive data integration, leading to a decline in their market share and revenue generation for IDEXX. For instance, while IDEXX's overall diagnostic solutions are growing, older test formats often represent a shrinking portion of this growth, potentially tying up resources with limited future upside.

Legacy Standalone Diagnostic Instruments

Legacy standalone diagnostic instruments are likely positioned as Dogs in IDEXX Laboratories' BCG Matrix. These older systems are gradually being replaced by newer, more sophisticated, and integrated diagnostic platforms. For instance, IDEXX's inVue Dx and updated Catalyst models offer enhanced capabilities that are drawing customers away from their predecessors.

The market share for these legacy instruments is shrinking as new placements decline and the existing installed base ages. This trend directly impacts consumable sales, which are a significant revenue driver for diagnostic equipment. As of late 2024, the shift towards integrated platforms is accelerating, further marginalizing the demand for standalone, older technologies.

- Declining Market Share: Older standalone diagnostic instruments are experiencing a reduction in their market share as newer technologies gain traction.

- Superseded by Advanced Platforms: These legacy products are being phased out in favor of more integrated and technologically advanced solutions like IDEXX's inVue Dx and newer Catalyst models.

- Reduced Consumable Sales: The aging installed base and diminishing new placements lead to a decrease in the sale of associated consumables over time.

- Focus on Modernization: IDEXX's strategic focus is on promoting its newer, more capable platforms, which naturally de-emphasizes investment in legacy product support and development.

Less Differentiated or Commoditized Diagnostic Tests

Within IDEXX Laboratories' extensive range of veterinary diagnostics, certain tests might fall into the category of less differentiated or commoditized offerings. These are likely found in markets characterized by intense competition and slow growth, meaning they probably hold a smaller market share and contribute less to the company's bottom line. For instance, basic blood chemistry panels or simple urinalysis, while essential, face numerous competitors offering similar services.

These types of tests could be considered potential cash traps if not managed carefully. Their limited growth potential and lower margins mean that continued significant investment might not yield substantial returns. IDEXX might consider strategies such as divesting these specific product lines or significantly reducing investment to free up resources for more promising areas of their business.

- Low Market Share: Tests with minimal differentiation often struggle to capture a significant portion of their respective markets.

- Low Growth Markets: These diagnostics operate in segments where overall market expansion is minimal, limiting revenue upside.

- Potential Cash Traps: Continued investment in commoditized products can drain resources without generating commensurate profits.

- Strategic Review: IDEXX may analyze these offerings for potential divestiture or reduced R&D focus.

Certain older, less differentiated diagnostic tests offered by IDEXX Laboratories likely reside in the Dogs quadrant. These products face a market characterized by intense competition and slow growth, resulting in a low market share and minimal contribution to overall revenue. For example, basic blood chemistry panels, while fundamental, are offered by numerous competitors with similar capabilities.

These commoditized tests can become cash traps if significant investment continues without proportional returns. IDEXX may need to consider divesting these product lines or reducing investment to reallocate capital to more promising ventures. In Q2 2025, IDEXX reported overall revenue growth of 6% organically, but specific segments with older technologies may be lagging significantly behind this average.

The Livestock, Poultry, and Dairy (LPD) segment, with a 3% organic revenue growth in Q2 2025 and a negative operating margin of -1.6% (GAAP), exemplifies a Dog. This segment is consuming resources without generating sufficient profit, indicating a need for strategic reassessment.

| Product Category | BCG Quadrant | Q2 2025 Performance (Illustrative) | Strategic Implication |

|---|---|---|---|

| Global Rapid Assays | Dog | 3% organic revenue decline | Diminishing market, potential cash trap |

| Livestock, Poultry, Dairy (LPD) | Dog | 3% organic revenue growth, -1.6% operating margin (GAAP) | Cash drain, requires strategic review |

| Legacy Standalone Instruments | Dog | Shrinking market share, declining consumable sales | Being superseded by advanced platforms |

| Commoditized Tests (e.g., basic panels) | Dog | Low market share, low growth markets | Potential cash traps, consider divestiture or reduced investment |

Question Marks

IDEXX's strategy to broaden its canine Cancer Dx testing beyond lymphoma to encompass most canine cancers within three years positions these new offerings as Question Marks. This expansion taps into the burgeoning cancer diagnostics market, a sector poised for substantial growth. For instance, the global veterinary diagnostics market was valued at approximately $5.1 billion in 2023 and is projected to reach $8.2 billion by 2030, with oncology diagnostics being a significant driver.

IDEXX Laboratories is strategically introducing new, specific diagnostic tests onto its existing, robust platforms. A prime example is the Catalyst Cortisol Test, launched in June 2025. This move allows IDEXX to capitalize on its established technology infrastructure.

While these new tests benefit from existing platform strength, they are currently in the early stages of market penetration. The Catalyst Cortisol Test, for instance, holds a low market share in its specific niche as of mid-2025. However, it targets high-growth segments within veterinary diagnostics, such as the detection of endocrine disorders in companion animals.

IDEXX Laboratories is poised to introduce groundbreaking advanced diagnostic innovations, such as the anticipated Fine Needle Aspirate (FNA) test for its inVue Dx analyzer, slated for release later in 2025. These developments are strategically positioned within high-growth, cutting-edge segments of the market, incorporating artificial intelligence and sophisticated cytology techniques.

Currently, these innovative offerings hold a zero percent market share, reflecting their pre-launch or nascent rollout phases. Significant investment will be necessary to cultivate market penetration and elevate these products from Question Marks to Stars within IDEXX's portfolio, mirroring the typical trajectory for disruptive technologies.

Targeted International Market Penetration for Advanced Diagnostics

Targeted international market penetration for advanced diagnostics represents a strategic move for IDEXX, particularly within its Companion Animal Diagnostics (CAG) segment. While the overall CAG diagnostics business is generally considered a Star, focusing on specific advanced platforms in underdeveloped international markets can be viewed as a potential Question Mark. This strategy aims to capture high growth in new regions where IDEXX's current penetration of these sophisticated offerings is limited, necessitating significant investment to build market leadership.

For instance, IDEXX might identify a burgeoning market in Southeast Asia where the adoption of advanced in-clinic diagnostic equipment is still nascent. By strategically investing in sales, marketing, and local support for its latest analyzers and software solutions in these areas, IDEXX aims to establish a strong foothold. This approach acknowledges that while the global CAG market is robust, specific advanced product adoption in new territories requires a focused, resource-intensive effort to overcome initial barriers and secure future market dominance.

- Strategic Investment in Emerging Markets: IDEXX's focus on penetrating new international markets with advanced diagnostic platforms can be seen as a Question Mark if the initial market share for these specific offerings is low, requiring substantial investment for growth.

- High Growth Potential: These initiatives target high growth in geographies where IDEXX's advanced diagnostic solutions are not yet widely adopted, aiming to establish market leadership through strategic resource allocation.

- Example: In 2023, IDEXX reported that its international revenue grew by 10% year-over-year, with particular strength in emerging markets, indicating the potential for advanced diagnostics to follow this trend.

- Resource Allocation: Successfully transforming these Question Mark opportunities into Stars will depend on IDEXX's ability to effectively allocate capital and resources to build awareness, demonstrate value, and establish distribution channels for its cutting-edge diagnostic technologies.

Exploration of New Diagnostic Modalities or Animal Segments

IDEXX Laboratories' substantial research and development expenditure, reaching $219.79 million in 2024, indicates a strategic push into novel diagnostic technologies or untapped animal markets. These initiatives represent classic 'question mark' plays within the BCG framework, characterized by significant investment and uncertain outcomes.

These ventures are inherently high-risk, high-reward. While their current market penetration is likely minimal, successful innovation could unlock substantial future revenue streams by addressing unmet or emerging needs in veterinary diagnostics.

- R&D Investment: $219.79 million in 2024 demonstrates commitment to innovation.

- Market Potential: Targeting new diagnostic modalities or underserved animal segments.

- Risk/Reward Profile: Low current market share but high potential for future growth.

- Strategic Goal: Addressing emerging veterinary needs and expanding service offerings.

IDEXX's investments in new diagnostic tests and international market penetration for advanced platforms are considered Question Marks. These initiatives require significant capital to build market share, as evidenced by IDEXX's $219.79 million R&D expenditure in 2024. While current market penetration for these specific offerings is low, they target high-growth segments within veterinary diagnostics.

| Category | Description | Market Share | Growth Rate | Investment Need |

| New Cancer Dx Tests | Expanding canine cancer testing beyond lymphoma. | Low | High | Substantial |

| Catalyst Cortisol Test | New test on existing platform. | Low (as of mid-2025) | High (endocrine disorders) | Moderate |

| Advanced FNA Test (inVue Dx) | AI-integrated cytology for inVue Dx. | Zero (pre-launch) | Very High | High |

| Advanced Diagnostics (Int'l) | Penetrating new markets with sophisticated tech. | Low (in specific regions) | High (emerging markets) | High |

BCG Matrix Data Sources

Our IDEXX Laboratories BCG Matrix leverages comprehensive data from financial reports, market research, and internal performance metrics to accurately assess product portfolio strength.