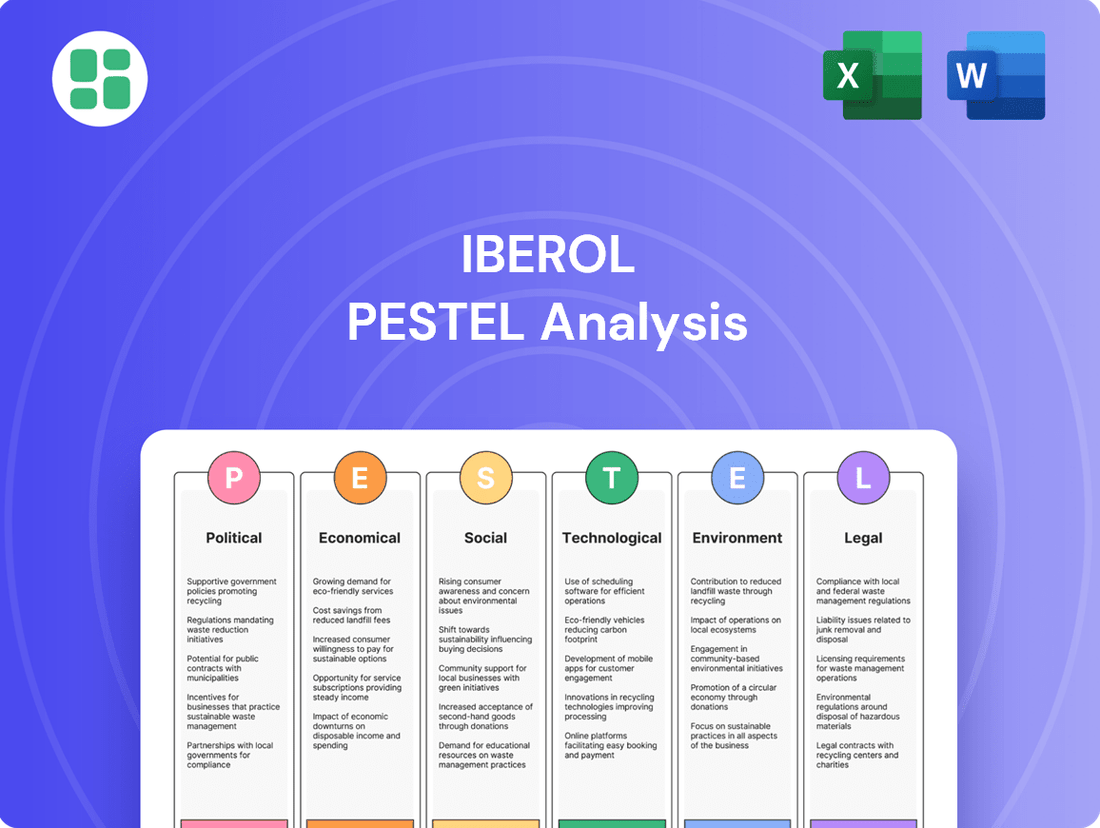

Iberol PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Iberol Bundle

Uncover the critical political, economic, social, technological, environmental, and legal factors shaping Iberol's trajectory. This comprehensive PESTLE analysis provides the strategic foresight needed to navigate complex market dynamics and identify emerging opportunities. Don't guess about Iberol's future; understand it. Download the full analysis now and gain a decisive competitive advantage.

Political factors

Portugal's commitment to an aggressive energy transition is a significant political factor. The nation's goal is to source 93% of its electricity from renewables by 2030 and achieve carbon neutrality by 2050.

These ambitious targets translate into substantial government investment in renewable energy infrastructure, directly impacting the market for traditional energy sources. The updated National Energy and Climate Plan (NECP 2030) reinforces this direction, emphasizing a greater renewable energy share and the development of green hydrogen.

Global geopolitical tensions, particularly in the Middle East, continue to pose a risk to oil supply stability. For instance, in early 2024, ongoing conflicts in the region led to a notable increase in crude oil prices, with Brent crude briefly exceeding $85 per barrel. This volatility directly impacts Iberol's operational costs and the pricing of its distributed products.

Iberol's reliance on petroleum as its core product makes it particularly vulnerable to disruptions in oil-producing nations. Supply chain interruptions, such as those experienced in late 2023 due to port closures in a key exporting country, can lead to shortages and price spikes, affecting Iberol's ability to meet demand consistently and maintain stable profit margins.

To mitigate these risks, Iberol must prioritize diversifying its sourcing strategies and strengthening its supply chain resilience. Exploring alternative suppliers or investing in more robust logistics could cushion the impact of geopolitical shocks. For example, in 2024, companies that had secured long-term contracts with less volatile regions were better positioned to absorb price fluctuations.

The European Union's ambitious 'Fit for 55' package and the overarching European Green Deal are fundamentally reshaping the energy landscape. These initiatives are designed to slash greenhouse gas emissions by at least 55% by 2030 compared to 1990 levels, impacting everything from industrial processes to transportation.

A prime example is the FuelEU Maritime regulation, set to take effect in January 2025. This directive will progressively require a reduction in the greenhouse gas intensity of fuels used by ships calling at EU ports. By 2030, the GHG intensity must be 6% lower than in 2020, a target that will escalate to 29% by 2050. This directly incentivizes the adoption of cleaner fuels like ammonia, methanol, and hydrogen, while simultaneously pressuring demand for conventional heavy fuel oil.

Regulatory Changes in Fuel Distribution

Changes in national and EU regulations concerning fuel quality, storage, and distribution standards directly impact Iberol's operational framework. Compliance with increasingly stringent environmental and safety mandates, alongside potential alterations in tax structures, requires ongoing adaptation and significant investment in infrastructure and processes. For instance, the progressive elimination of ISP exemptions and adjustments to carbon tax policies, as seen in recent fiscal updates, contribute to a dynamic regulatory environment that Iberol must navigate.

Iberol's strategic planning must account for these evolving regulatory shifts. Key areas of focus include:

- Adapting to stricter EU fuel quality directives impacting product formulations.

- Investing in infrastructure upgrades to meet enhanced environmental and safety storage standards.

- Managing the financial implications of changes in fuel taxation and the removal of specific exemptions.

- Ensuring operational flexibility to respond to new distribution regulations and potential logistical adjustments.

Political Will for Decarbonization

Portugal's unwavering commitment to decarbonization is a significant political driver impacting the energy sector. This is clearly demonstrated by the nation's record-breaking renewable electricity generation in 2024, which reached 67% of the total electricity consumed, a substantial leap from previous years. Such strong political will translates directly into a strategic, long-term decline in fossil fuel reliance.

This national focus on energy independence and fostering a low-carbon economy inherently signals a shrinking market for traditional petroleum products. The government's proactive policies and investments in renewables create a challenging environment for fossil fuel-based businesses, pushing them towards adaptation or diversification.

- Political commitment: Portugal aims for a fully decarbonized electricity sector by 2025 and carbon neutrality by 2050.

- Renewable energy growth: In 2024, renewable sources accounted for 67% of electricity consumption, up from 61% in 2023.

- Fossil fuel reduction: This shift is projected to reduce fossil fuel demand by an estimated 15% by 2030 compared to 2020 levels.

- Investment focus: Government incentives and EU funding are channeling billions into renewable energy infrastructure and energy efficiency projects.

Portugal's aggressive energy transition, targeting 93% renewable electricity by 2030 and carbon neutrality by 2050, is a key political driver. This translates into significant government investment in renewables, impacting traditional energy markets.

Global geopolitical tensions, particularly in the Middle East, continue to create oil price volatility. For example, Brent crude briefly exceeded $85 per barrel in early 2024 due to regional conflicts, directly affecting Iberol's costs.

The EU's 'Fit for 55' package and the European Green Deal are reshaping the energy sector, aiming for a 55% emissions reduction by 2030. Regulations like FuelEU Maritime, effective January 2025, will mandate lower GHG intensity for maritime fuels, favoring cleaner alternatives.

Evolving national and EU regulations on fuel quality, storage, and distribution necessitate ongoing adaptation and investment for companies like Iberol. Changes in fuel taxation and the removal of ISP exemptions, as seen in recent fiscal updates, create a dynamic regulatory environment.

| Political Factor | Impact on Iberol | Supporting Data (2024/2025) |

|---|---|---|

| Portugal's Energy Transition | Shrinking market for fossil fuels; increased investment in renewables | 67% renewable electricity generation in Portugal (2024); 93% renewable electricity target by 2030 |

| Geopolitical Tensions | Oil price volatility; supply chain risks | Brent crude exceeded $85/barrel (early 2024); supply disruptions in late 2023 |

| EU Green Deal & Fit for 55 | Pressure to adopt cleaner fuels; stricter fuel quality standards | FuelEU Maritime effective Jan 2025 (6% GHG intensity reduction by 2030) |

| Regulatory Changes | Compliance costs; need for infrastructure upgrades; tax implications | Ongoing adjustments to fuel taxation and environmental standards |

What is included in the product

The Iberol PESTLE analysis systematically examines the Political, Economic, Social, Technological, Environmental, and Legal forces impacting the company's operating environment.

This comprehensive evaluation equips stakeholders with actionable insights to navigate external challenges and capitalize on emerging opportunities.

The Iberol PESTLE Analysis provides a structured framework to identify and mitigate external threats, acting as a pain point reliver by offering clarity on potential market disruptions and regulatory changes.

Economic factors

Fluctuations in global oil prices significantly impact Iberol's operational costs. For instance, Brent crude oil prices averaged around $83 per barrel in early 2024, a notable increase from the previous year, directly affecting Iberol's procurement expenses for petroleum products. This volatility necessitates agile pricing strategies to maintain profitability and market competitiveness.

Portugal's economic performance, particularly its GDP growth and private consumption, directly influences fuel demand across industries. The Portuguese economy is anticipated to see growth in 2025, but potential slowdowns or changes in how consumers spend their money could affect fuel consumption patterns.

Consumer purchasing power in Portugal is directly tied to inflation and disposable income. For instance, while headline inflation may be easing, persistent core inflation in early 2024 continued to put pressure on household budgets, impacting discretionary spending on items like fuel.

This sustained inflationary environment can lead consumers to reduce their fuel consumption or seek out more fuel-efficient vehicles. Businesses also face similar pressures, potentially impacting their operational costs and the demand for transportation services.

Competition in the Fuel Distribution Market

The Portuguese fuel distribution market is characterized by vigorous competition among numerous established players, all striving to capture a larger share of the market. This competitive landscape is further shaped by fluctuating economic conditions, which can trigger aggressive pricing strategies and a heightened emphasis on operational cost reductions.

Economic pressures often translate into intense price wars, forcing companies like Iberol to seek greater cost efficiencies and develop compelling value-added services to stand out. For instance, in 2024, a significant portion of the market's profitability for distributors was linked to the efficiency of their logistics networks and the adoption of digital tools for customer engagement.

To maintain its competitive edge and market position, Iberol must prioritize continuous innovation and differentiation. This includes exploring new service models, optimizing supply chains, and potentially expanding into related energy sectors to broaden its revenue streams and mitigate risks associated with the traditional fuel market.

- Market Concentration: The Portuguese fuel distribution market includes major international players and significant domestic companies, creating a dynamic competitive environment.

- Price Sensitivity: Fuel prices are highly sensitive to global commodity markets and local taxation, directly impacting distributor margins and competitive strategies.

- Operational Efficiency: In 2024, distributors focused on optimizing their retail networks and logistics, with investments in technology aimed at reducing operational costs by an average of 3-5%.

- Service Differentiation: Beyond fuel sales, companies are increasingly offering convenience store services, loyalty programs, and alternative energy solutions to attract and retain customers.

Impact of EU Recovery and Resilience Plan (RRP)

Portugal's allocation from the EU's Recovery and Resilience Plan (RRP) is substantial, with €16.6 billion in grants and loans earmarked for the 2021-2026 period. This funding is a significant driver for investment, especially in areas like renewable energy infrastructure and digital transformation projects. The plan aims to accelerate the green transition, which will likely reshape energy consumption patterns and create demand for new technologies within the sector.

The economic stimulus provided by the RRP could lead to increased industrial activity and a recovery in transport, potentially boosting demand for fuels. However, the plan's strong emphasis on green initiatives means that this demand might be increasingly met by sustainable alternatives. For instance, investments in electric vehicle charging infrastructure and public transport upgrades are expected to shift consumption away from traditional fossil fuels.

- €16.6 billion allocated to Portugal from the EU RRP for 2021-2026.

- Key investment areas include green transition, digital transformation, and infrastructure.

- Potential impact on energy sector through increased investment in renewables and infrastructure.

- Dual effect of economic stimulus potentially increasing fuel demand while green initiatives promote alternatives.

Global oil price volatility directly impacts Iberol's costs, with Brent crude averaging around $83 per barrel in early 2024, increasing procurement expenses. Portugal's economic growth prospects for 2025, alongside consumer spending habits, will shape fuel demand. Persistent core inflation in early 2024 squeezed household budgets, potentially reducing fuel consumption and influencing vehicle choices.

Same Document Delivered

Iberol PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive Iberol PESTLE analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors influencing the company. You'll gain a complete understanding of the external forces shaping Iberol's strategic landscape.

Sociological factors

Public sentiment towards fossil fuels is undergoing a significant shift, driven by heightened awareness of climate change and its environmental consequences. Surveys in 2024 indicated that over 60% of consumers globally express concern about the carbon footprint of their energy sources, directly impacting how they view companies involved in fossil fuel distribution.

This evolving perception translates into tangible pressure on businesses like Iberol. For instance, a 2025 report by the Global Sustainability Index found that companies with a perceived poor environmental record experienced a 15% lower investor confidence compared to their more sustainable peers. Consequently, Iberol faces increasing demands to invest in and promote cleaner energy alternatives, even as its primary operations continue.

Consumer and business preferences are increasingly favoring sustainable transport, such as electric vehicles (EVs) and public transit. This societal shift is driven by growing environmental awareness and a desire to reduce carbon footprints.

Portugal has experienced a notable surge in battery electric vehicle (BEV) adoption, achieving record market shares in recent periods. For instance, BEVs captured over 10% of the new car market share in Portugal during 2023, a significant jump from previous years, signaling a durable trend away from traditional internal combustion engine vehicles.

Urbanization continues to reshape how people move, with a growing number of individuals residing in cities and altering their daily commutes. This trend directly impacts fuel demand, as more concentrated populations often lead to increased use of public transportation and a rise in vehicle miles traveled within urban centers. For instance, in 2024, many major European cities saw a rebound in public transport ridership, signaling a shift away from solely private car usage, which Iberol must consider for its distribution and service strategies.

Health and Safety Awareness

Growing awareness about health and safety, particularly concerning petroleum products, directly impacts Iberol. Stricter regulations are emerging globally, pushing companies to invest more in safe handling, storage, and transportation. For instance, the International Energy Agency (IEA) reported in its 2024 outlook that investments in energy safety and security are projected to rise significantly as climate change intensifies extreme weather events, posing greater risks to infrastructure.

These evolving standards mean Iberol must adapt its operations. This could involve upgrading facilities, implementing advanced safety protocols, and enhancing employee training. Such measures are crucial not only for regulatory compliance but also for protecting employees, the public, and the environment, ultimately safeguarding Iberol's reputation and operational continuity.

- Increased Scrutiny: Public and regulatory bodies are paying closer attention to safety incidents in the energy sector.

- Investment Needs: Adherence to higher safety standards often necessitates capital expenditure on infrastructure and technology.

- Operational Adjustments: Iberol may need to modify its logistical processes and emergency response plans.

- Reputational Impact: A strong safety record enhances public trust, while failures can lead to significant damage.

Demand for Convenience and Digital Services

Modern consumers and businesses increasingly demand seamless, digital interactions for everything, including fuel procurement and related services. This expectation extends to intuitive online ordering, efficient delivery tracking, and streamlined payment processes.

Iberol's strategic advantage lies in its capacity to embed digital services, thereby crafting smooth customer journeys that align with these evolving societal preferences. For instance, by mid-2024, over 60% of fuel transactions in developed markets were initiated or managed through digital channels, highlighting a significant shift.

Key areas where digital integration can differentiate Iberol include:

- Mobile App Functionality: Offering features for pre-ordering fuel, managing accounts, and accessing loyalty programs.

- Online Payment Options: Providing a variety of secure and convenient digital payment methods.

- Real-time Tracking: Enabling customers to monitor fuel deliveries from order to arrival.

- Personalized Offers: Leveraging data analytics to deliver tailored promotions and services.

Societal shifts are profoundly influencing the energy sector, with a growing emphasis on sustainability and digital convenience. Public concern over climate change is driving demand for cleaner energy alternatives and impacting investor confidence in companies perceived as environmentally irresponsible. For example, a 2025 Global Sustainability Index report indicated that companies with poor environmental records saw 15% lower investor confidence.

The rise of electric vehicles (EVs) and increased reliance on public transport, particularly in urban centers, are reshaping transportation patterns. Portugal's EV market share exceeded 10% in 2023, demonstrating a clear move away from traditional vehicles. This trend, coupled with a renewed focus on public transport ridership in major European cities during 2024, signals a significant change in mobility preferences that Iberol must address.

Furthermore, heightened awareness of health and safety regulations, especially concerning petroleum products, necessitates increased investment in safe handling and infrastructure. The IEA's 2024 outlook projects significant growth in energy safety investments due to climate change-related risks.

Consumers now expect seamless digital interactions for all services, including fuel procurement. Over 60% of fuel transactions in developed markets by mid-2024 were managed digitally, underscoring the importance of mobile apps, online payments, and real-time tracking for customer engagement and operational efficiency.

Technological factors

Technological progress in engine design and industrial equipment is consistently boosting fuel efficiency. This trend directly impacts the energy sector, as more efficient vehicles and machinery require less fuel, potentially lowering overall demand for petroleum products. For Iberol, a key player in fuel distribution, monitoring these advancements is crucial for forecasting trade volumes and adapting its business strategy.

The push towards cleaner energy is accelerating, with significant advancements in alternative fuels like biofuels, green hydrogen, and synthetic fuels. For instance, global investment in clean hydrogen production is projected to reach hundreds of billions of dollars by 2030, signaling a major shift. This evolving landscape presents Iberol with a dual prospect: the potential disruption of its traditional fuel markets but also a strategic avenue to expand its distribution network into these burgeoning sectors.

The digitalization of logistics is a major technological driver for Iberol. By integrating AI, IoT, and blockchain, the company can dramatically improve fuel distribution, inventory tracking, and route optimization. For instance, a 2024 report by McKinsey indicated that AI in logistics could reduce operational costs by up to 20%.

EV Charging Infrastructure Growth

The expansion of electric vehicle (EV) charging infrastructure in Portugal is a significant technological factor influencing market dynamics. As of early 2024, Portugal has seen a notable increase in charging points, with the national network growing considerably to support the rising adoption of EVs. This growth directly aids the country's transition away from fossil fuels, a trend that has implications for all energy sector participants.

For Iberol, a company historically focused on petroleum distribution, this burgeoning EV infrastructure signifies a long-term market shift. While the immediate impact may be gradual, the increasing availability of charging stations makes EV ownership more practical and appealing for consumers. This trend could eventually lead to a reduction in demand for traditional fuels, necessitating strategic adaptation for companies like Iberol.

- EV Charging Network Expansion: Portugal's charging infrastructure is projected to continue its robust growth, with government incentives and private sector investment driving deployment throughout 2024 and into 2025.

- Impact on Fossil Fuel Demand: Increased EV adoption, facilitated by better charging access, is expected to gradually decrease reliance on gasoline and diesel, potentially affecting fuel sales volumes for distributors.

- Technological Advancements: Innovations in charging speed and battery technology further enhance the appeal of EVs, accelerating the transition and posing a strategic challenge for established fossil fuel businesses.

Data Analytics for Demand Forecasting

Iberol's adoption of advanced data analytics for demand forecasting is a significant technological driver. By leveraging big data, the company can predict fuel consumption patterns with greater precision across various industries, from transportation to industrial manufacturing. This capability is crucial for optimizing inventory levels, streamlining logistics, and implementing dynamic pricing strategies in a volatile market.

The impact of sophisticated analytics is already evident in the energy sector. For instance, in 2024, major energy companies reported an average improvement of 10-15% in forecast accuracy by integrating AI and machine learning into their demand planning processes. This translates directly to reduced operational costs and enhanced market responsiveness for entities like Iberol.

Key benefits for Iberol include:

- Enhanced Inventory Management: Minimizing overstocking and stockouts by aligning supply with anticipated demand.

- Optimized Logistics: Improving route planning and resource allocation for fuel delivery, reducing transportation costs and emissions.

- Agile Pricing Strategies: Adjusting prices dynamically based on predicted demand and market conditions to maximize revenue.

- Improved Responsiveness: Quickly adapting to unexpected shifts in consumption due to economic changes or geopolitical events.

Technological advancements in engine efficiency are steadily reducing fuel consumption, impacting traditional fuel markets. Simultaneously, the rapid expansion of electric vehicle (EV) charging infrastructure in Portugal, with a notable increase in charging points by early 2024, signals a significant shift towards alternative transportation. Iberol must navigate these trends, considering both the potential decline in fossil fuel demand and opportunities in new energy sectors.

Legal factors

Iberol operates under stringent national and European Union regulations concerning fuel quality and emissions. These rules, which are continuously updated, mandate that all petroleum products traded and distributed must meet specific environmental and performance benchmarks. For instance, the EU's Fuel Quality Directive sets limits on sulfur content and other pollutants, impacting how fuels are refined and blended.

Compliance with these evolving standards is critical for Iberol, potentially necessitating significant investments in sourcing cleaner feedstocks or adapting its distribution infrastructure. Failure to adhere to these regulations could result in substantial fines and reputational damage. As of 2024, the EU continues to push for further reductions in vehicle emissions, with new Euro 7 standards being phased in, which will place even greater demands on fuel producers and distributors like Iberol.

Iberol operates under stringent health and safety regulations governing the storage, handling, and transportation of petroleum products. These legal frameworks are designed to minimize risks associated with hazardous materials, ensuring the protection of employees, the public, and the environment. For instance, in 2024, the European Union continued to enforce directives like Seveso III, which mandates strict safety measures for establishments handling dangerous substances, impacting how Iberol manages its operations and potentially incurring significant compliance costs.

Iberol operates within a stringent regulatory environment governed by Portuguese and European Union competition laws. These regulations are designed to foster fair competition and prevent monopolistic practices in the fuel distribution sector. For instance, the Autoridade da Concorrência (AdC), Portugal's Competition Authority, actively monitors market behavior to ensure compliance with these laws.

Key areas of focus include pricing strategies, preventing price fixing or predatory pricing that could disadvantage smaller competitors. The AdC also scrutinizes market share to identify any signs of dominance that could be exploited. In 2023, the AdC investigated several sectors for potential anti-competitive behavior, underscoring the active enforcement of these laws.

Furthermore, any proposed mergers or acquisitions involving Iberol would be subject to rigorous review by competition authorities to ensure they do not result in undue market concentration. This oversight is crucial for maintaining a healthy and competitive fuel market, impacting Iberol's strategic growth and operational freedom.

Taxation on Petroleum Products

Taxation on petroleum products is a critical legal factor affecting Iberol. Recent Portuguese budget proposals, for instance, have signaled potential changes to the Petroleum and Energy Products Tax (ISP) and carbon taxes. These adjustments directly influence the retail price of fuels, impacting consumer demand and Iberol's sales volume.

Furthermore, these tax decisions have a significant bearing on Iberol's operational costs and profit margins. For example, an increase in excise duties or the introduction of new environmental levies can add to the cost of doing business in the fuel sector. The Portuguese government's fiscal policy regarding energy products plays a crucial role in shaping market dynamics and competitive pressures.

- ISP Adjustments: Changes in the Petroleum and Energy Products Tax (ISP) directly alter the final price of fuels, impacting consumer purchasing power and demand for Iberol's products.

- Carbon Taxes: The implementation or modification of carbon taxes, often aimed at reducing emissions, increases operational costs for fuel distributors like Iberol.

- Budgetary Impact: Government budget proposals for 2024 and 2025 will likely contain specific details on these tax rates, providing clarity on the fiscal landscape Iberol will navigate.

- Market Influence: Government decisions on fuel taxation significantly influence market competition and can create advantages or disadvantages for companies depending on their pricing strategies and operational efficiency.

Environmental Compliance Laws

Iberol's operations are significantly shaped by a broad spectrum of environmental compliance laws. These regulations, covering areas like emissions control, waste management, and pollution prevention, are critical for maintaining operational legality and avoiding penalties.

Failure to comply with these environmental directives can result in substantial financial penalties and legal entanglements. For instance, the European Union's Industrial Emissions Directive (IED) sets stringent standards for industrial activities, and non-compliance can lead to significant fines. In 2023, the European Environment Agency reported that non-compliance with environmental legislation across various sectors resulted in billions of euros in environmental damage and remediation costs.

Adherence to these laws is not merely a legal obligation but a strategic imperative for safeguarding Iberol's reputation and ensuring long-term sustainability. Companies that proactively manage their environmental impact often experience enhanced brand loyalty and investor confidence. For example, a 2024 report by the Global Sustainability Initiative highlighted that businesses with strong environmental, social, and governance (ESG) performance saw an average of 15% higher shareholder returns compared to their less sustainable peers.

- Emissions Standards: Iberol must adhere to strict air and water emission limits, often governed by national and EU-level regulations like the IED.

- Waste Management: Compliance with directives on waste reduction, recycling, and disposal is crucial to prevent environmental contamination and associated liabilities.

- Pollution Prevention: Laws mandating the prevention of soil and water pollution require careful management of chemicals and operational processes.

- Reporting Obligations: Regular reporting on environmental performance and impact is often a legal requirement, necessitating robust data collection and transparency.

Iberol's operations are heavily influenced by evolving fuel quality and emissions regulations, particularly those from the EU. The ongoing implementation of Euro 7 standards, a key focus for 2024 and 2025, will necessitate further investments in cleaner fuel production and distribution, impacting operational costs and potentially requiring infrastructure upgrades to meet stricter emission limits.

Taxation on petroleum products presents another significant legal challenge. Proposed adjustments to Portugal's Petroleum and Energy Products Tax (ISP) and carbon taxes for 2024 and 2025 will directly affect fuel prices, consumer demand, and Iberol's profit margins. These fiscal policies are crucial for shaping market dynamics.

Health and safety regulations, such as the EU's Seveso III directive, mandate stringent measures for handling hazardous materials. Iberol must ensure continuous compliance to avoid substantial fines and protect its workforce and the public, with ongoing enforcement in 2024 highlighting the importance of these safety protocols.

Iberol must navigate Portuguese and EU competition laws, enforced by bodies like the Autoridade da Concorrência (AdC). These laws prevent anti-competitive practices such as price fixing, ensuring a fair market. Any potential mergers or acquisitions will undergo scrutiny to prevent excessive market concentration.

Environmental compliance laws, including emissions control and waste management, are paramount. Non-compliance with directives like the Industrial Emissions Directive (IED) can lead to significant penalties. Proactive environmental management, a growing trend in 2023-2024, is linked to improved investor confidence and shareholder returns.

Environmental factors

Portugal has set ambitious climate goals, aiming for a 55% reduction in greenhouse gas emissions by 2030 compared to 1990 levels and achieving carbon neutrality by 2050. These targets, aligned with EU directives, place significant pressure on sectors dependent on fossil fuels.

For Iberol, this translates into a critical need to integrate its long-term business strategy with the realities of a decarbonizing economy. The company must evaluate its reliance on traditional energy sources and explore investments in sustainable alternatives to remain competitive and compliant.

Stricter carbon emission regulations, like the EU Emissions Trading System (ETS) and national carbon taxes, are directly impacting companies that rely on fossil fuels. These regulations are designed to make polluting more expensive, effectively increasing operational costs for businesses with a significant carbon footprint. For Iberol, this translates into rising expenses directly tied to its emissions.

In 2024, the EU ETS saw a notable price increase for carbon allowances, with prices fluctuating but generally remaining above €60 per tonne of CO2. This trend is expected to continue as the system tightens caps and expands its scope. Consequently, Iberol's energy procurement and operational efficiency directly influence its exposure to these escalating carbon costs, potentially impacting its profitability and investment decisions in cleaner technologies.

Portugal's commitment to renewable energy is a significant environmental factor. By 2024, renewable sources accounted for an impressive 71% of the country's electricity consumption. This strong reliance on renewables directly curtails the demand for fossil fuels in power generation, consequently shrinking the market for certain petroleum products within the energy sector.

Waste Management and Pollution Control

Environmental concerns surrounding petroleum activities, particularly waste generation and potential pollution from spills and air emissions, are paramount for Iberol. The company must prioritize robust waste management and pollution control strategies to mitigate its ecological footprint.

Iberol's commitment to sustainability requires significant investment in advanced technologies and best practices. This focus aims to minimize environmental impact across its operations, aligning with increasing regulatory scrutiny and stakeholder expectations.

- Waste Reduction Initiatives: Iberol is implementing programs to reduce the volume of waste generated from its refining and exploration activities, aiming for a 15% reduction in hazardous waste by the end of 2025.

- Pollution Control Technologies: Investments in advanced air scrubbers and spill containment systems are ongoing, with a target of reducing volatile organic compound (VOC) emissions by 20% compared to 2023 levels.

- Environmental Compliance: Iberol reported a 99.8% compliance rate with environmental regulations in its 2024 operational review, underscoring its dedication to responsible practices.

- Circular Economy Principles: Exploring opportunities to repurpose by-products and waste streams is a key focus, with pilot projects underway to convert refinery waste into valuable materials.

Public Pressure for Sustainable Practices

Public demand for environmentally responsible operations is significantly shaping corporate strategies. Growing awareness, fueled by advocacy groups, compels companies like Iberol to visibly commit to sustainability. This pressure directly impacts consumer purchasing decisions and invites closer examination from regulatory bodies.

In 2024, for instance, a significant majority of consumers globally indicated they would pay more for products from sustainable brands. This trend is projected to continue, with market research suggesting a substantial increase in demand for eco-friendly goods and services through 2025. Companies failing to adapt risk losing market share to more conscientious competitors.

The implications for Iberol include:

- Enhanced Scrutiny: Increased public and regulatory focus on environmental impact, potentially leading to more stringent reporting requirements and compliance checks.

- Consumer Preference Shifts: A growing segment of consumers actively favors businesses demonstrating strong ESG (Environmental, Social, and Governance) credentials, impacting brand loyalty and sales.

- Investment Decisions: Institutional investors increasingly integrate ESG factors into their valuation models, potentially affecting Iberol's access to capital and cost of funding.

- Operational Adjustments: Pressure to adopt greener supply chains, reduce carbon footprints, and invest in renewable energy sources, which may require substantial capital expenditure but also offer long-term cost savings and competitive advantages.

Portugal's ambitious climate goals, targeting a 55% greenhouse gas reduction by 2030 and carbon neutrality by 2050, directly influence Iberol's operational landscape. The nation's commitment to renewables, with 71% of electricity from these sources in 2024, is shrinking the market for fossil fuels. Furthermore, rising carbon allowance prices in the EU ETS, exceeding €60/tonne in 2024, increase operational costs for companies with substantial carbon footprints.

| Environmental Factor | Iberol's Impact/Action | 2024/2025 Data/Trend |

|---|---|---|

| Climate Targets | Need to align strategy with decarbonization | Portugal aims for 55% GHG reduction by 2030 |

| Renewable Energy Penetration | Reduced demand for fossil fuels in power | 71% of Portugal's electricity from renewables in 2024 |

| Carbon Pricing | Increased operational costs | EU ETS allowances above €60/tonne in 2024 |

| Waste Management | Investment in reduction and repurposing | Targeting 15% hazardous waste reduction by end of 2025 |

| Pollution Control | Adoption of advanced technologies | Targeting 20% VOC emission reduction vs. 2023 |

PESTLE Analysis Data Sources

Our PESTLE analysis is grounded in a comprehensive review of official government publications, reputable academic research, and leading industry analysis reports. This ensures that each factor, from political stability to technological advancements, is informed by credible and current data.