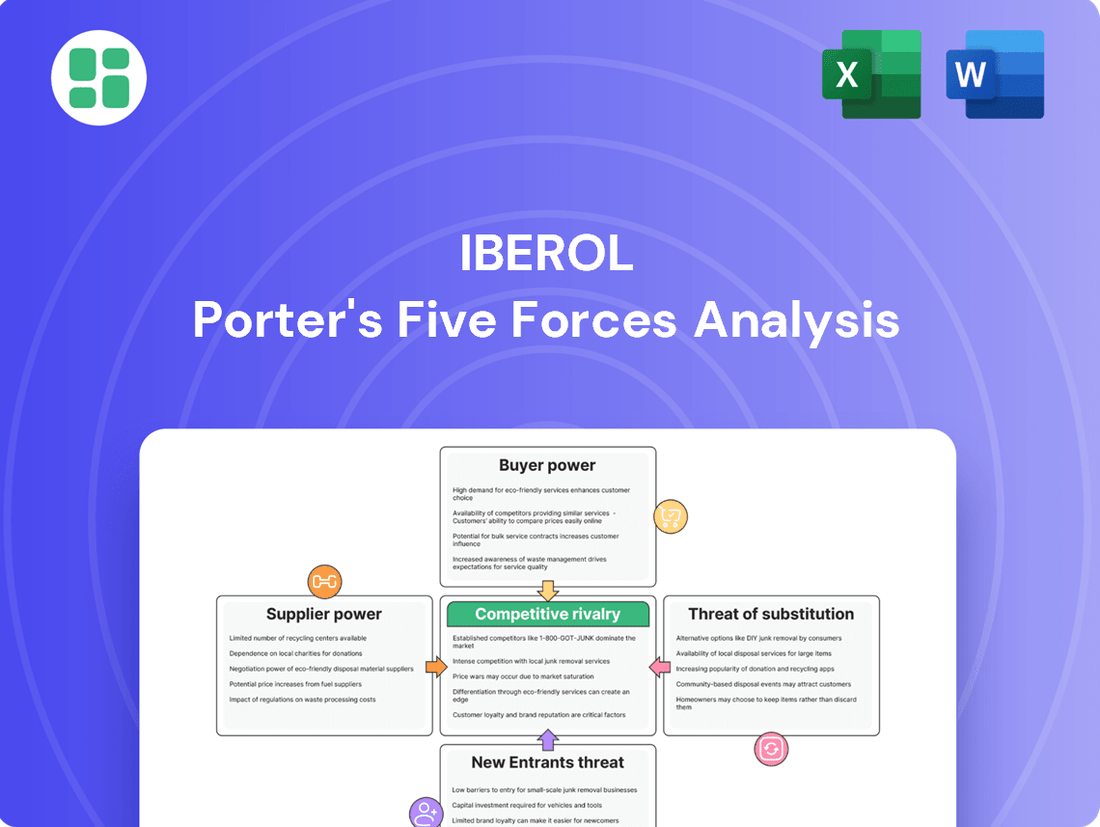

Iberol Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Iberol Bundle

Iberol faces significant competitive pressures, with moderate buyer power and a growing threat from substitutes impacting its profitability. Understanding these forces is crucial for navigating its market landscape effectively.

The complete report reveals the real forces shaping Iberol’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Iberol, a petroleum product distributor, faces a concentrated global crude oil market. This concentration, often dominated by a few major producing nations and OPEC+, grants suppliers considerable leverage over pricing. Portugal's significant dependence on imported mineral fuels amplifies this supplier power, making it vulnerable to price fluctuations and supply disruptions from key sources like Nigeria and Angola.

Portugal's refining landscape is dominated by the Sines refinery, operated by Galp, which represents the country's sole major domestic refining facility. This limited domestic capacity means Iberol, like other fuel distributors, faces a concentrated supplier base for refined products, whether sourced locally or imported. Consequently, Iberol's bargaining power with these few large refiners is inherently weakened, as their output and pricing decisions significantly influence product availability and cost.

For Iberol, the bargaining power of suppliers is significantly influenced by the high switching costs associated with crude oil and refined product procurement. Imagine the effort and expense involved in finding a new oil producer, negotiating terms, and ensuring the new supply meets Iberol's precise quality and delivery standards. These hurdles can be substantial, making it difficult and costly for Iberol to simply change suppliers.

Importance of Raw Materials to Downstream Operations

For Iberol, the availability and price of petroleum products are absolutely central to its entire trade and distribution operation. Any shifts in crude oil prices directly influence how much Iberol spends on the goods it sells and, consequently, its profit margins. This makes them quite susceptible to the pricing decisions of their suppliers.

Given Portugal's significant dependence on imported fuels, ensuring a consistent and stable supply chain for these essential raw materials is of utmost importance. In 2023, Portugal imported approximately 75% of its energy needs, with petroleum products forming a substantial portion of this. This high import reliance underscores the critical nature of supplier relationships and their potential leverage.

- Supplier Concentration: The number of suppliers of crude oil and refined petroleum products to Portugal can influence their bargaining power. A limited number of major global producers or refiners would typically wield more influence.

- Input Differentiation: If the petroleum products Iberol sources are largely undifferentiated commodities, suppliers have greater power as Iberol can switch between them with little impact on product quality or performance.

- Switching Costs: The ease or difficulty for Iberol to switch to alternative suppliers for its petroleum needs plays a significant role. High switching costs, such as long-term contracts or specialized logistics, would empower suppliers.

- Threat of Forward Integration: If suppliers were to consider entering the distribution or retail side of the fuel business in Portugal, it could significantly alter the power dynamic in their favor.

Supplier Forward Integration Potential

The potential for suppliers to integrate forward into Iberol's business operations significantly influences supplier bargaining power. Large, integrated oil companies, for instance, often possess their own extensive distribution networks and retail outlets, enabling them to bypass intermediaries like Iberol.

This capability for forward integration directly challenges Iberol's negotiating leverage by presenting a credible threat of disintermediation. If suppliers can reach end consumers directly, Iberol's role as a crucial link in the supply chain diminishes.

- Supplier Forward Integration Potential: Integrated oil companies can leverage their existing infrastructure to bypass distributors.

- Threat to Iberol: Suppliers moving into retail could reduce Iberol's market access and pricing power.

- Counter-Balance: Iberol's established market presence and logistics in Portugal offer some resilience against this threat.

Suppliers in the petroleum sector, particularly crude oil producers and refiners, hold significant sway over Iberol. This is due to a concentrated global crude oil market and Portugal's heavy reliance on imports, with around 75% of its energy needs met externally in 2023. The limited number of major suppliers and high switching costs for Iberol further amplify this power, making the company susceptible to price fluctuations and supply disruptions.

| Factor | Impact on Iberol | Supporting Data (2023/2024 Estimates) |

|---|---|---|

| Supplier Concentration (Crude Oil) | High leverage for suppliers | Dominated by a few major producing nations and OPEC+ |

| Supplier Concentration (Refined Products) | Limited domestic refining capacity strengthens supplier position | Sines refinery (Galp) is Portugal's sole major domestic facility |

| Input Differentiation | Commoditized products give suppliers power | Petroleum products are largely undifferentiated |

| Switching Costs | High costs limit Iberol's flexibility | Negotiating new terms, quality assurance, logistics |

| Portugal's Import Dependence | Increases vulnerability to supplier pricing | ~75% of energy needs imported in 2023 |

| Supplier Forward Integration Potential | Threat of disintermediation | Integrated oil companies can bypass distributors |

What is included in the product

This Iberol Porter's Five Forces analysis dissects the competitive intensity within its industry, examining supplier and buyer power, the threat of new entrants and substitutes, and the rivalry among existing competitors.

Effortlessly identify and mitigate competitive threats with a visual breakdown of each force, transforming complex market dynamics into actionable insights.

Customers Bargaining Power

Iberol's customer base is spread across various industries like automotive, industrial, agricultural, and maritime. This broad reach naturally breaks down its customer base into many different groups.

While large-volume buyers exist in sectors such as industrial or maritime, the automotive and agricultural markets are characterized by a multitude of smaller, individual customers. This fragmentation means no single group of customers can easily exert significant pressure on Iberol.

For instance, in 2023, Iberol reported that its automotive segment, while significant, comprised numerous smaller orders rather than a few massive contracts. This contrasts with some industrial clients who might place larger, more concentrated orders, but the overall diversity dilutes the collective bargaining strength of any one segment.

Petroleum products, such as gasoline and diesel, are largely seen as commodities, meaning there’s very little to distinguish one supplier’s product from another’s. This lack of differentiation makes customers extremely sensitive to price changes, especially in a market like Portugal’s retail fuel sector, which features many low-cost providers.

Because consumers can readily switch to a competitor offering even a slightly lower price, their ability to negotiate or demand better terms is significantly amplified. For instance, in 2024, a slight dip in global crude oil prices often translates to immediate price adjustments at the pump in Portugal, demonstrating this direct link between commodity pricing and consumer behavior.

For many end-users, particularly within the automotive industry, changing fuel providers is a straightforward process with negligible expense. While loyalty programs are common, price often dictates consumer choices, directly increasing their leverage.

This ease of switching between service stations, for instance, means customers can readily seek out the best prices or promotions, amplifying their bargaining power against fuel companies like Iberol. In 2024, the average price of gasoline in many developed markets saw fluctuations, with consumers actively seeking out stations offering lower per-gallon costs, a trend that underscores this low switching cost dynamic.

Availability of Alternative Distributors

The bargaining power of customers in Portugal's fuel distribution sector is significantly influenced by the availability of alternative distributors. This competitive landscape offers consumers numerous choices, thereby enhancing their leverage.

Major players such as Repsol and Galp, alongside a host of smaller, cost-effective operators, ensure that customers can readily find fuel. This proliferation of options directly translates into increased buyer power, as consumers can easily switch suppliers based on price or service.

The market is set to become even more competitive, with a Spanish low-cost chain, Petroprix, planning to establish 50 new petrol stations across Portugal by 2026. This expansion will further diversify customer choices and intensify pressure on existing distributors.

- High Customer Choice: The Portuguese fuel market features major brands like Repsol and Galp, plus numerous smaller competitors.

- Price Sensitivity: Customers can readily switch suppliers, leading to greater price sensitivity among distributors.

- Market Expansion: Petroprix's planned 50 stations by 2026 will increase competitive intensity and customer options.

- Supplier Power Diminished: The abundance of distributors limits the ability of any single fuel supplier to dictate terms.

Customers' Threat of Backward Integration

While individual consumers rarely possess the leverage to integrate backward, large industrial or commercial clients of companies like Iberol could potentially explore direct sourcing of fuels or investing in their own storage and distribution infrastructure, especially if their consumption volumes are substantial. This threat, however, is significantly mitigated by the substantial capital investment and intricate regulatory hurdles involved, making it an impractical consideration for the majority of Iberol's clientele.

The capital intensity for establishing fuel sourcing and distribution capabilities can be immense. For instance, building even a modest fuel terminal could easily run into tens of millions of dollars, a cost prohibitive for most businesses. Coupled with the complex web of environmental regulations, safety standards, and logistical planning, the barriers to entry for backward integration in the fuel sector are exceptionally high, thereby limiting this particular avenue of customer bargaining power.

Consider a large industrial user that consumes millions of liters of fuel annually. While the idea of owning their supply chain might seem attractive, the upfront investment in storage tanks, pipelines, transportation fleets, and compliance with stringent safety and environmental permits often outweighs the potential cost savings. This reality significantly curtails the threat of backward integration as a potent bargaining tool for most of Iberol's customer base.

- High Capital Costs: Establishing fuel sourcing and distribution requires significant upfront investment, potentially in the tens of millions of dollars for even basic infrastructure.

- Regulatory Complexity: Navigating environmental, safety, and transportation regulations adds substantial cost and time, acting as a major deterrent to backward integration.

- Limited Practicality for Most Customers: The sheer scale of investment and operational expertise needed makes backward integration an unfeasible strategy for the vast majority of Iberol's diverse customer segments.

Iberol's customer base is diverse, spanning automotive, industrial, agricultural, and maritime sectors, which inherently fragments their power. While large industrial buyers exist, the sheer number of smaller customers, particularly in automotive and agriculture, prevents any single group from wielding significant influence. For example, in 2023, Iberol's automotive segment was characterized by numerous smaller orders, diluting the collective bargaining strength of this sector.

The petroleum products Iberol distributes are largely commodities, meaning customers are highly sensitive to price. This sensitivity is amplified by the ease with which consumers can switch between numerous low-cost providers in markets like Portugal's retail fuel sector. In 2024, fluctuations in global crude oil prices directly influenced retail fuel costs, demonstrating this strong link to consumer behavior and their bargaining power.

The Portuguese fuel market's competitiveness, with major players like Repsol and Galp alongside many smaller operators, offers consumers abundant choices. This high degree of choice significantly enhances customer leverage. The planned expansion of 50 new Petroprix stations by 2026 will further intensify competition and bolster customer options, diminishing any single supplier's ability to dictate terms.

Backward integration by customers is largely impractical due to the immense capital investment and complex regulatory hurdles involved in fuel sourcing and distribution. Establishing even basic infrastructure can cost tens of millions of dollars, making it an unfeasible strategy for most of Iberol's varied clientele, thus limiting this avenue of customer bargaining power.

Preview Before You Purchase

Iberol Porter's Five Forces Analysis

This preview showcases the complete Iberol Porter's Five Forces Analysis, offering a thorough examination of industry competition and profitability. The document you see here is precisely what you will receive instantly after purchase, ensuring transparency and immediate access to valuable strategic insights. You can confidently expect this professionally formatted analysis to be ready for your immediate use, providing a detailed breakdown of threats and opportunities within Iberol's market landscape.

Rivalry Among Competitors

The Portuguese fuel distribution market is a crowded space, featuring major international energy companies such as Repsol alongside prominent local brands like Galp. This intense competition also includes a growing presence of lower-cost fuel providers, all vying for market share.

Since the liberalization of the market in 2004, competition has only intensified. This regulatory shift has spurred aggressive pricing tactics among fuel distributors, making it a challenging environment for all participants to maintain margins.

The petroleum market, including fuels sold by companies like Iberol, is characterized by highly commoditized products. This means gasoline and diesel are largely indistinguishable from one brand to another, forcing competition to center almost exclusively on price. This dynamic makes the industry ripe for price wars, especially as new, low-cost competitors emerge.

The increasing presence of hypermarket fuel stations and discount brands intensifies these price wars. These players often operate with lower overheads, enabling them to undercut established brands. For instance, in 2024, reports indicated that hypermarket fuel stations in several European countries were offering prices up to 5 cents per liter lower than traditional service stations, directly impacting the profit margins of all participants, including Iberol.

Slow market growth in Portugal's energy sector, particularly a projected decrease in overall energy consumption and pressure on petroleum products due to the energy transition, significantly heightens competitive rivalry. Companies are forced to fight harder for a smaller market, making organic growth challenging and increasing the likelihood of aggressive pricing or market share grabs.

High Fixed Costs and Storage Requirements

The petroleum distribution sector is characterized by substantial capital outlays for essential infrastructure. This includes vast storage depots, extensive transportation fleets, and widespread retail networks, often demanding billions in initial investment. For example, major oil companies in 2024 continue to invest heavily in upgrading and expanding their terminal and pipeline capacities to meet evolving demand and regulatory standards.

These substantial fixed costs create a strong pressure for companies to maximize their asset utilization. Operating at or near full capacity is crucial to amortize these investments and achieve profitability, directly fueling intense competition among players to secure and maintain market share. This often translates into aggressive pricing strategies to drive sales volume.

- High Capital Investment: The petroleum distribution industry necessitates significant upfront capital for storage tanks, pipelines, and delivery vehicles.

- Capacity Utilization Incentive: Companies are driven to operate at high capacity to spread fixed costs, leading to competitive pressure.

- Aggressive Sales Tactics: To maintain sales volumes and cover operational expenses, firms often engage in price wars or promotional activities.

- Barriers to Entry: The sheer scale of required investment acts as a significant barrier for new entrants, consolidating the market among existing, well-capitalized firms.

Exit Barriers

The fuel distribution industry faces substantial exit barriers, primarily due to the immense capital required for infrastructure, such as storage terminals and transportation fleets. Companies also invest heavily in specialized assets and intricate supply chains, making it challenging and costly to divest or repurpose these resources. For instance, a typical fuel terminal can cost tens of millions of dollars to build and maintain.

These high exit costs mean that companies struggling with profitability find it difficult to leave the market. This inability to exit can lead to persistent overcapacity, as underperforming firms remain operational. Consequently, this sustained oversupply intensifies competitive rivalry, as businesses fight for market share even when margins are thin. In 2024, the average operating margin for fuel distributors in the EU remained tight, often hovering around 1-2%, a testament to the competitive pressures exacerbated by these exit barriers.

- High Capital Investments: Significant upfront costs for terminals, pipelines, and logistics networks.

- Specialized Assets: Infrastructure designed for fuel handling is not easily repurposed.

- Supply Chain Integration: Established relationships and logistical networks are difficult to unwind.

- Market Persistence: Difficulty in exiting leads to prolonged overcapacity and intense competition.

Competitive rivalry in Portugal's fuel distribution sector is fierce, driven by a fragmented market with both international and local players. The liberalization of the market in 2004 intensified this, leading to aggressive pricing strategies as fuel is a highly commoditized product. The rise of hypermarket fuel stations and discount brands in 2024, offering prices up to 5 cents per liter lower, further escalates price wars, squeezing margins for all, including Iberol.

The slow market growth and the energy transition's impact on petroleum demand in Portugal amplify competitive pressures. Companies must fight harder for a shrinking market share, making organic growth difficult and encouraging aggressive tactics. High capital investment in infrastructure like storage depots and transportation fleets creates a strong incentive for capacity utilization, pushing firms to maintain sales volumes through competitive pricing to cover substantial fixed costs.

Exit barriers are also significant, as the immense capital tied up in specialized infrastructure makes it costly to leave the market. This persistence of underperforming firms contributes to overcapacity, intensifying competition even with thin margins, as evidenced by the tight 1-2% average operating margins for EU fuel distributors in 2024.

| Factor | Description | Impact on Rivalry |

|---|---|---|

| Market Structure | Presence of major international and local players, plus discount brands. | High; intense competition for market share. |

| Product Differentiation | Fuel is largely a commoditized product. | High; competition centers almost exclusively on price. |

| Market Growth | Slow growth and pressure from energy transition. | High; companies fight for a smaller market. |

| Capital Investment | Substantial outlays for infrastructure (depots, fleets). | High; drives pressure for capacity utilization and competitive pricing. |

| Exit Barriers | High costs to divest specialized infrastructure. | High; leads to overcapacity and persistent competition. |

SSubstitutes Threaten

The rapid expansion of electric vehicles (EVs) presents a significant threat of substitutes for traditional fuel providers like Iberol. In Portugal, the market share for battery-electric light passenger vehicles surged to a notable 22.5% in January 2025, indicating a clear shift in consumer preference. This increasing adoption of EVs directly diminishes the demand for petroleum-based fuels, Iberol's primary product.

Portugal's aggressive renewable energy goals, aiming for 93% of its electricity from renewables by 2030, present a significant threat of substitution for traditional energy sources. This policy drive, coupled with substantial investment in biofuels like biomethane and green hydrogen for transport and industry, directly erodes demand for conventional petroleum products.

The threat of substitutes for traditional fuels is growing, particularly with advancements in biofuels and renewable methanol production. Iberol itself is a player in this space, but the wider market is experiencing significant investment. For instance, Galp has plans to produce biodiesel and biojet fuel from waste by 2026, and a new €22 million advanced biofuel plant commenced operations in 2024. These developments present direct alternatives to petroleum-based fuels, impacting sectors like industry and potentially maritime shipping.

The European Union's Biomethane Action Plan, covering 2024-2040, further underscores this shift by actively promoting the adoption of renewable gas. This policy environment encourages innovation and investment in alternative fuel sources, intensifying the competitive pressure on conventional fuel markets.

Improvements in Public Transport and Urban Planning

Improvements in public transport and urban planning present a growing threat of substitutes for petroleum fuels. Cities globally are investing heavily in making public transit more appealing and accessible. For instance, by 2024, many major metropolitan areas are expected to have expanded their electric bus fleets and high-speed rail networks significantly, aiming to capture a larger share of commuter travel.

These developments directly impact the demand for private vehicles, which are major consumers of petroleum. As public transportation becomes more efficient, reliable, and comfortable, it offers a viable alternative for daily commutes and even longer journeys. This shift is further encouraged by urban planning initiatives that prioritize pedestrian zones and cycling infrastructure, reducing the necessity and convenience of personal car ownership.

- Increased Public Transit Ridership: Many cities are reporting a steady rise in public transport usage, with some European cities seeing pre-pandemic ridership levels return or even exceed them by late 2023 and early 2024.

- Investment in Electric Mobility: Global investment in electric buses and charging infrastructure is projected to reach hundreds of billions of dollars by 2025, directly competing with gasoline and diesel vehicles.

- Urban Planning Focus: Cities like Copenhagen and Amsterdam continue to lead in cycling infrastructure, with dedicated bike lanes and traffic calming measures making cycling a primary mode of transport for a significant portion of their populations.

Energy Efficiency Improvements

Ongoing advancements in vehicle fuel efficiency significantly reduce the demand for traditional petroleum products. For instance, new passenger cars sold in the EU in 2023 had average CO2 emissions of 121.1 g/km, a decrease from 125.0 g/km in 2022, indicating improved fuel economy.

Industrial sectors are also adopting more energy-efficient practices to cut operational costs. This trend directly impacts the consumption of energy sources like oil and gas, as less fuel is needed to produce the same output.

- Reduced Fuel Consumption: As engines become more efficient, the volume of fuel required for a given task or distance diminishes, directly substituting the need for higher fuel volumes.

- Cost Savings Incentive: Industries actively seek to lower energy expenses, making energy-efficient technologies and practices a compelling alternative to traditional, less efficient methods.

- Technological Advancements: Innovations in areas like electric vehicles and renewable energy sources present viable substitutes for petroleum-based fuels, further intensifying this threat.

The growing popularity of electric vehicles (EVs) poses a significant threat to Iberol's traditional fuel business. By January 2025, battery-electric light passenger vehicles captured 22.5% of the Portuguese market, a clear signal of shifting consumer preferences away from internal combustion engines and, consequently, petroleum fuels.

Portugal's commitment to renewable energy, targeting 93% of its electricity from renewables by 2030, combined with substantial investments in biofuels and green hydrogen, directly challenges the demand for conventional petroleum products. This policy-driven transition is creating viable alternatives across transport and industrial sectors.

Advancements in biofuels and renewable methanol production are also presenting direct substitutes for petroleum-based fuels. For example, Galp plans to produce biodiesel and biojet fuel from waste by 2026, and a new advanced biofuel plant began operations in 2024, further intensifying competition for Iberol.

| Substitute Type | Key Developments/Trends | Impact on Iberol |

|---|---|---|

| Electric Vehicles (EVs) | 22.5% market share for battery-electric light passenger vehicles in Portugal (Jan 2025). | Reduced demand for gasoline and diesel. |

| Renewable Energy & Biofuels | Portugal aiming for 93% renewables by 2030. Galp's biodiesel/biojet fuel plans (by 2026). New advanced biofuel plant operational (2024). | Erosion of demand for petroleum in transport and industry. |

| Public Transportation & Urban Planning | Increased ridership in European cities (late 2023/early 2024). Billions invested in electric buses/charging infrastructure by 2025. | Decreased reliance on private vehicles, impacting fuel consumption. |

| Fuel Efficiency Improvements | EU new passenger cars average CO2 emissions decreased to 121.1 g/km (2023). | Lower overall fuel consumption per vehicle. |

Entrants Threaten

The petroleum trade and distribution sector demands immense upfront capital. Establishing the necessary infrastructure, from vast storage depots and extensive tanker fleets to a widespread network of service stations, can easily run into billions of dollars. For instance, building a single modern refinery can cost upwards of $5 billion, illustrating the scale of investment required. This financial hurdle significantly limits the number of new companies that can realistically enter the market, thereby reducing the threat of new entrants.

The petroleum industry faces substantial regulatory hurdles, acting as a significant deterrent to new entrants. Strict environmental protection laws, rigorous safety protocols, and complex operational standards, as seen in the extensive permitting required for offshore drilling or refinery construction, demand considerable upfront investment and expertise. For instance, in 2024, the average time to secure all necessary permits for a new oil and gas exploration project in many developed nations can extend beyond two to three years, with associated compliance costs often running into millions of dollars.

Established brand loyalty and extensive distribution networks pose a significant barrier to new entrants in the Portuguese energy sector. Companies like Galp and Repsol have cultivated strong brand recognition over many years, fostering customer loyalty that is difficult for newcomers to overcome. In 2024, Galp reported a significant market share in fuel retail, underscoring the depth of its established presence.

The sheer scale of investment required to replicate these distribution capabilities is immense. New entrants would need to build a comparable network of service stations and logistical infrastructure, a process that is both time-consuming and capital-intensive. This existing infrastructure provides incumbents with a substantial competitive advantage, making it challenging for new players to gain immediate traction.

Access to Supply Chains and Refining Capacity

New entrants face significant hurdles in securing consistent access to crude oil and refined products. Establishing these supply chain links often necessitates forging long-term contracts with established international oil companies or gaining entry into a limited pool of domestic refining capacity.

Incumbents leverage their deep-rooted relationships and substantial purchasing power, creating a distinct disadvantage for newcomers. For instance, in 2024, major integrated oil companies continued to dominate global crude oil supply agreements, making it challenging for smaller, independent refiners to compete on price and volume.

- Supply Chain Access: New entrants must navigate complex global logistics and secure reliable crude oil sources, often requiring significant upfront investment in infrastructure or long-term supply agreements.

- Refining Capacity: Limited refining capacity, particularly for specialized products, means new entrants may struggle to find available slots or face higher processing fees compared to established players.

- Economies of Scale: Existing players benefit from economies of scale in purchasing and refining, allowing them to absorb price volatility more effectively than new, smaller operations.

Potential for Retaliation from Incumbents

The Portuguese fuel market is already a battleground. Established companies like Galp Energia, Repsol Portugal, and Cepsa are deeply entrenched, and they are unlikely to welcome new competitors with open arms. Imagine a scenario where a new company tries to enter the market; the existing players might immediately slash prices, making it incredibly difficult for the newcomer to gain any traction.

This aggressive stance isn't just a possibility; it's a strong deterrent. For instance, in 2023, the average operating margin for fuel retailers in Europe hovered around 2-3%, a slim figure that leaves little room for new entrants to compete on price without significant financial backing. The threat of a price war, coupled with increased advertising spend from incumbents, can effectively shut the door on potential new entrants before they even get started.

- High Market Concentration: As of early 2024, the Portuguese fuel market is dominated by a few major players, indicating significant barriers to entry.

- Price Sensitivity: Consumers in Portugal are generally price-sensitive, making them susceptible to price wars initiated by incumbents.

- Incumbent Investment: Existing companies have substantial capital for marketing and operational adjustments to defend their market share.

The threat of new entrants in the Portuguese petroleum sector is significantly low due to immense capital requirements for infrastructure, such as refineries and distribution networks. For example, building a single modern refinery can cost upwards of $5 billion, a prohibitive sum for most potential newcomers. This financial barrier, combined with stringent regulatory compliance and lengthy permitting processes that can take years and cost millions in 2024, effectively deters new companies from entering the market.

Established brand loyalty and extensive distribution networks held by incumbents like Galp Energia and Repsol Portugal present another formidable challenge. These companies have cultivated strong customer relationships, and replicating their market presence requires substantial investment in both marketing and logistics. For instance, in 2024, Galp maintained a significant market share in fuel retail, highlighting the difficulty for new players to gain traction against such deeply entrenched competitors.

Access to crucial supply chain elements, including crude oil and refining capacity, is also a major hurdle. New entrants must secure reliable sources, often through long-term contracts with major international oil companies that leverage their substantial purchasing power. In 2024, integrated oil companies continued to dominate global crude oil supply agreements, making it challenging for smaller operations to compete on price and volume.

The Portuguese fuel market is characterized by intense competition and price sensitivity among consumers. Incumbents are capable of initiating price wars, as evidenced by the slim average operating margins of 2-3% for European fuel retailers in 2023, which leave little room for new entrants to compete without significant financial backing. This aggressive defense strategy by established players, coupled with increased marketing efforts, effectively limits the threat of new entrants.

| Barrier | Description | Impact on New Entrants (2024) |

|---|---|---|

| Capital Requirements | High cost of infrastructure (refineries, depots, stations) | Prohibitive; billions needed for entry. |

| Regulatory Hurdles | Strict environmental, safety, and operational standards | Lengthy permitting (2-3 years) and high compliance costs (millions). |

| Brand Loyalty & Distribution | Strong customer relationships and established networks | Difficult to replicate; incumbents (e.g., Galp) hold significant market share. |

| Supply Chain Access | Securing crude oil and refining capacity | Challenging due to incumbent purchasing power and long-term contracts. |

| Competitive Rivalry | Price wars and incumbent defense strategies | Slim profit margins (2-3% in 2023) make price competition difficult for newcomers. |

Porter's Five Forces Analysis Data Sources

Our Iberol Porter's Five Forces analysis is built upon a robust foundation of data, drawing from Iberol's official investor relations website, annual reports, and financial statements. We also incorporate insights from industry-specific market research reports and news articles that cover the Iberian pulp and paper sector.