IBC Bank PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

IBC Bank Bundle

Navigate the complex external forces impacting IBC Bank with our comprehensive PESTLE analysis. Understand how political stability, economic shifts, and technological advancements are shaping the financial landscape. Gain a strategic advantage by leveraging these insights to refine your market approach and anticipate future challenges. Download the full analysis now for actionable intelligence.

Political factors

IBC Bank's significant presence along the U.S.-Mexico border means its operations are deeply intertwined with cross-border trade policies. Changes in these policies, such as new tariffs or adjustments to trade agreements like the USMCA, can directly influence the volume of commerce flowing between the two countries. This, in turn, affects IBC Bank's international trade services and the health of its loan portfolios tied to cross-border activities.

For example, the imposition of new tariffs by the U.S. on Mexican imports, or shifts in trade regulations within the USMCA framework, could lead to a slowdown in economic activity in the border regions where IBC Bank is most active. This economic impact can translate to reduced demand for trade finance, increased credit risk for businesses involved in cross-border trade, and ultimately, affect the bank's overall financial performance in its key markets.

Changes in U.S. immigration policies and border security can significantly reshape the demographic makeup and economic health of communities along the U.S.-Mexico border, where IBC Bank operates. For instance, shifts in border patrol strategies or the implementation of new visa regulations could alter migration patterns, directly affecting the availability of labor and the size of the consumer market for banking services.

Heightened border security measures and evolving immigration laws can impact both the workforce and the customer base for institutions like IBC Bank. A slowdown in cross-border movement or changes in the legal status of migrant workers could reduce the demand for services such as personal loans and business accounts. For example, if new regulations make it harder for temporary workers to access financial services, this could directly curb a segment of IBC Bank's potential clientele.

The financial sector, including banks like IBC Bank, is sensitive to the economic ripple effects of immigration policies. Stricter enforcement or changes in migration flows can affect local economies by altering the workforce and consumer spending. A potential tax on remittances, for example, could reduce the flow of money from foreign workers in the U.S. to their families in Mexico, impacting a key financial activity in border regions and potentially lowering the volume of remittance services offered by banks.

The banking sector operates under intense government oversight, and any new regulations can lead to substantial compliance expenses and necessitate operational adjustments for institutions like IBC Bank. For instance, in 2024, the Federal Reserve continued to emphasize robust capital requirements, with discussions around Basel III endgame implementation potentially increasing capital burdens for larger banks.

Key regulatory bodies such as the Federal Reserve, the Office of the Comptroller of the Currency (OCC), and the Federal Deposit Insurance Corporation (FDIC) are consistently introducing new initiatives. These often focus on areas like capital adequacy ratios, potential antitrust concerns within the industry, and executive compensation structures, all of which directly affect how banks operate and manage their risk.

IBC Bank must remain agile and responsive to these continuously shifting regulatory environments. Changes in areas like liquidity coverage ratios or new data privacy mandates can significantly influence the bank's profitability and shape its long-term strategic planning and investment decisions.

Geopolitical Stability of the U.S.-Mexico Border Region

The political and security climate along the U.S.-Mexico border significantly impacts business sentiment and investment in the region. Heightened security concerns or political instability can discourage economic growth, directly affecting loan demand and the creditworthiness of borrowers for IBC Bank.

A stable and predictable border environment is essential for fostering cross-border commerce, which is a key driver for many businesses IBC Bank serves. Conversely, disruptions can lead to reduced trade volumes and investment, potentially increasing credit risk.

For instance, in 2024, reports indicated fluctuations in border crossing times and increased security presence in certain areas, which can create operational challenges for businesses reliant on cross-border logistics, thereby influencing their financial health and borrowing needs.

- Border Security Measures: Increased border security can sometimes slow down legitimate trade and travel, impacting the efficiency of businesses operating in the region.

- Political Relations: Strong diplomatic ties between the U.S. and Mexico foster a more predictable business environment, encouraging investment and lending.

- Economic Impact: Political stability directly correlates with investor confidence; for example, a stable political outlook in 2024 supported continued cross-border investment in sectors like manufacturing and logistics.

- Regulatory Environment: Changes in trade policies or regulations stemming from political decisions can alter the landscape for businesses, affecting their ability to repay loans.

Bilateral Relations between US and Mexico

The tenor of US-Mexico relations significantly shapes IBC Bank's operational landscape. Strong diplomatic and economic ties encourage cross-border trade and investment, benefiting the bank's business. Conversely, tensions arising from issues like immigration or trade disagreements can introduce economic volatility and uncertainty in key markets for IBC Bank.

Recent developments highlight this dynamic. For instance, as of early 2024, ongoing discussions around potential trade policy shifts, including tariffs, underscore the sensitivity of bilateral economic interactions. Such policy adjustments can directly influence the flow of capital and the overall economic health of regions where IBC Bank operates, impacting its lending and deposit activities.

- Trade Volume Impact: US-Mexico trade, a significant driver for border economies, reached approximately $700 billion in 2023, illustrating the substantial economic interdependence. Fluctuations in this volume, influenced by political relations, directly affect IBC Bank's commercial client base.

- Investment Flows: Foreign Direct Investment (FDI) from the US into Mexico is a crucial economic indicator. In 2023, US FDI into Mexico saw notable activity, with changes in bilateral sentiment potentially altering these investment patterns.

- Regulatory Environment: Changes in US immigration policy or border security measures can indirectly affect economic activity and consumer confidence in Mexican border cities, a core area of IBC Bank's focus.

Political stability and strong U.S.-Mexico relations are vital for IBC Bank's border operations, influencing trade volumes and investment. For instance, USMCA trade, a key driver for border economies, saw significant activity in 2023, with approximately $700 billion in bilateral trade, directly impacting IBC Bank's commercial clients.

Changes in U.S. immigration and border security policies can reshape local economies and consumer markets, affecting demand for banking services. As of early 2024, ongoing discussions on trade policy shifts, including potential tariffs, highlight the sensitivity of bilateral economic interactions and their impact on IBC Bank's markets.

Government regulations, such as capital adequacy requirements emphasized by the Federal Reserve in 2024, necessitate ongoing compliance and operational adjustments for IBC Bank. Regulatory bodies like the OCC and FDIC continually introduce initiatives impacting capital, competition, and executive compensation.

What is included in the product

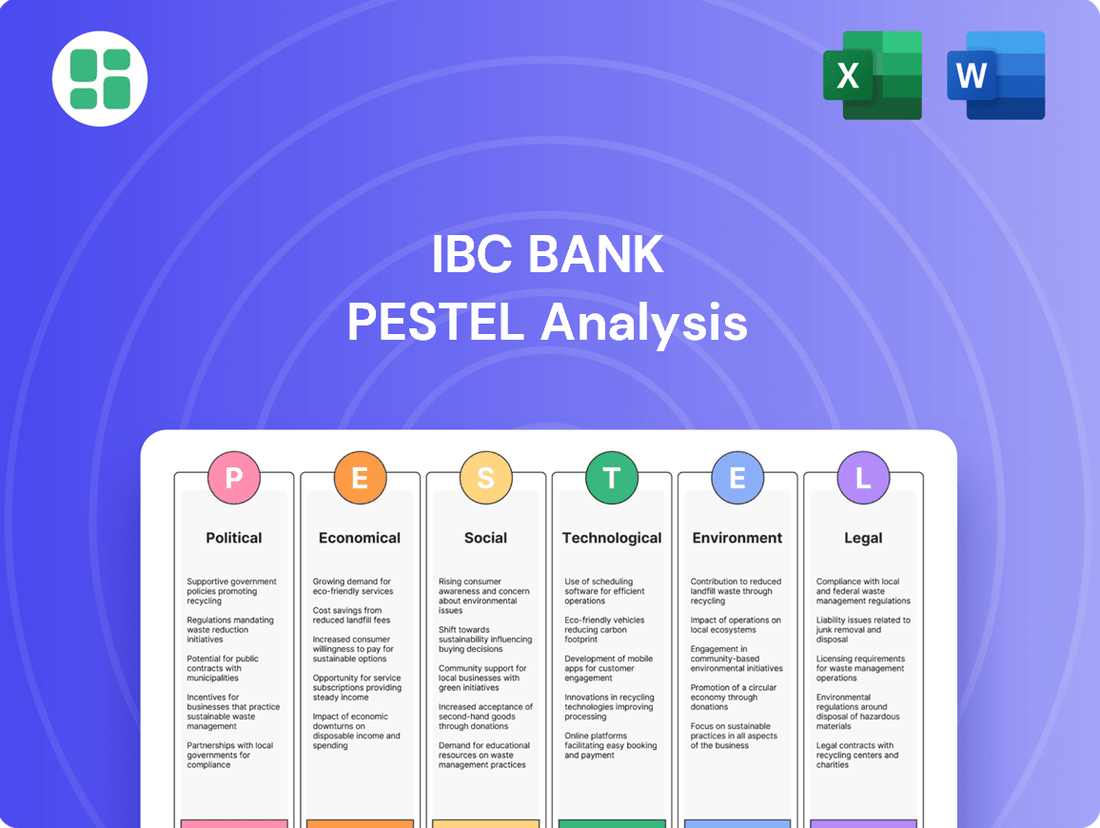

This PESTLE analysis comprehensively examines the external macro-environmental factors impacting IBC Bank across Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It provides actionable insights for strategic decision-making by identifying key trends, challenges, and opportunities relevant to IBC Bank's operating landscape.

The IBC Bank PESTLE Analysis offers a clear, summarized version of external factors, acting as a pain point reliever by providing easy referencing during meetings and strategic planning.

Economic factors

Interest rate fluctuations, particularly those influenced by the Federal Reserve Board, directly impact IBC Bank's profitability. For instance, as of late 2024, the Federal Reserve maintained its benchmark interest rate in the 5.25%-5.50% range, a level that generally boosts interest income from loans and investments.

However, higher rates also mean increased costs for IBC Bank to attract and retain customer deposits, a critical funding source. This dynamic necessitates careful management of deposit pricing strategies to ensure competitiveness and prevent deposit outflows, especially with the ongoing competition for customer funds.

Inflationary pressures in 2024 have directly impacted IBC Bank's operational expenses, particularly evident in rising salary and compensation costs. While higher loan values can occur, the erosion of consumer and business purchasing power due to inflation poses a significant risk to loan demand and overall credit quality. Therefore, stringent cost management is paramount for the bank to navigate this economic climate effectively.

IBC Bank's strategic positioning along the U.S.-Mexico border makes its financial health intrinsically linked to the economic vitality of these specific communities. For instance, while the U.S. economy might experience fluctuations, border regions can see growth driven by cross-border trade and manufacturing, particularly in sectors like primary activities.

Understanding these localized economic dynamics is crucial for IBC Bank's strategic planning, influencing everything from loan portfolio management to deposit acquisition strategies. For example, the economic growth rate in Texas border cities, a key area for IBC Bank, directly impacts its lending capacity and the demand for its services.

Currency Exchange Rates (USD/MXN)

For IBC Bank, operating heavily along the U.S.-Mexico border, the USD/MXN exchange rate is a critical economic factor. Fluctuations directly influence the profitability of its foreign exchange services and cross-border transactions. For instance, a stronger dollar against the peso can make Mexican imports more expensive for U.S. buyers, potentially slowing trade volumes.

Recent data highlights these dynamics. As of early 2024, the USD/MXN exchange rate has seen periods of volatility, with the peso showing resilience but also facing pressures. For example, in February 2024, the USD/MXN hovered around the 17.00-17.50 range, a level that, while relatively stable compared to some past periods, still represents significant shifts for businesses engaged in regular cross-border commerce. A weakening peso, which has occurred at various points, can reduce the purchasing power of Mexican entities when dealing in U.S. dollars, impacting trade volumes and the significant flow of remittances.

- Impact on Forex Services: Volatility in USD/MXN directly affects the fee income and trading volumes for IBC Bank's foreign exchange operations.

- Cross-Border Transaction Profitability: Exchange rate movements influence the real value of payments and receipts for businesses and individuals transacting between the U.S. and Mexico.

- Remittance Flows: A weaker peso can incentivize more remittances as dollars convert to more pesos, benefiting recipients but potentially impacting the dollar value of those flows.

- Trade Volume Sensitivity: Significant shifts in the exchange rate can alter the competitiveness of goods and services traded between the two countries, affecting overall transaction volumes.

Unemployment Rates and Consumer Spending Patterns

Unemployment rates are a significant driver for banks like IBC. When joblessness is low, people have more disposable income, which typically translates into higher demand for consumer loans, better credit quality for existing loans, and increased deposit levels as individuals save more. For instance, as of May 2024, the US unemployment rate stood at 4.0%, a slight increase from previous months, but still indicative of a generally tight labor market that supports consumer financial health.

Healthy employment figures within IBC's primary service areas are crucial for building a stable and growing customer base. A strong job market means more individuals are earning, which leads to increased financial activity, from opening new accounts to utilizing various banking products and services. This stability underpins the bank's ability to lend and grow its deposit base.

Consumer confidence and spending patterns are directly tied to employment. When consumers feel secure in their jobs, they are more likely to spend, which in turn drives demand for a wide range of banking services. This includes everything from businesses seeking commercial loans to expand due to increased demand, to individuals using checking and savings accounts more actively.

- US Unemployment Rate: 4.0% as of May 2024.

- Impact on Loans: Lower unemployment generally boosts consumer loan demand and improves credit quality.

- Deposit Growth: Higher employment figures often correlate with increased savings and deposit levels.

- Consumer Confidence: Job security fuels consumer confidence, leading to greater use of banking services.

Interest rate decisions by the Federal Reserve significantly influence IBC Bank's earnings. The Fed's benchmark rate, held between 5.25%-5.50% as of late 2024, boosts interest income but also raises deposit costs. Managing deposit pricing is key to remaining competitive amid high demand for customer funds.

Inflation in 2024 has increased IBC Bank's operating costs, particularly for salaries. While higher loan values may occur, reduced consumer and business spending power due to inflation poses a risk to loan demand and credit quality, making stringent cost control essential.

IBC Bank's border location links its performance to regional economic activity. For example, growth in Texas border cities, a key market for IBC, directly affects its lending and service demand. Cross-border trade and manufacturing can drive growth even during national economic shifts.

The USD/MXN exchange rate is critical for IBC Bank, impacting its foreign exchange services and cross-border transactions. Volatility, such as the 17.00-17.50 range seen in early 2024, affects trade volumes and remittance flows, influencing the bank's profitability.

| Economic Factor | 2024/2025 Data/Trend | Impact on IBC Bank |

|---|---|---|

| Interest Rates (Fed Funds Rate) | 5.25%-5.50% (late 2024) | Boosts loan income, increases deposit costs. |

| Inflation | Rising operational costs (e.g., salaries) | Erodes consumer purchasing power, risks loan demand/quality. |

| Unemployment Rate (US) | 4.0% (May 2024) | Supports consumer financial health, drives loan demand and deposits. |

| USD/MXN Exchange Rate | Volatile, around 17.00-17.50 (early 2024) | Affects forex revenue, cross-border transaction profitability. |

Preview the Actual Deliverable

IBC Bank PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive IBC Bank PESTLE analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the institution. It provides actionable insights for strategic planning.

Sociological factors

Demographic shifts along the U.S.-Mexico border significantly shape the customer base for IBC Bank. For instance, the population in border counties like El Paso, Texas, has seen steady growth, with projections indicating continued expansion. This growth, coupled with evolving migration patterns and a shifting age distribution, directly impacts the demand for various banking services. An increase in the working-age population, for example, typically correlates with higher demand for mortgages, auto loans, and small business financing.

The changing demographics necessitate a strategic approach from IBC Bank to meet the diverse financial needs of these communities. As border populations become more financially active, there's a greater need for accessible banking solutions, including digital platforms and culturally relevant financial literacy programs. For example, a growing segment of younger, tech-savvy individuals may prefer mobile banking options, while established business owners might seek robust commercial lending products to capitalize on cross-border trade opportunities.

Cultural nuances along the U.S.-Mexico border significantly influence banking preferences, affecting everything from how people save to their comfort with digital versus in-person transactions. For instance, a 2024 study indicated that while digital adoption is rising, a substantial portion of the Hispanic population still values face-to-face interactions for financial advice, a trend IBC Bank must acknowledge.

Understanding these deeply ingrained cultural factors is paramount for IBC Bank, especially given its focus on a minority-engaged demographic. By recognizing preferences for community engagement and trust-building, IBC Bank can tailor its marketing strategies to resonate more effectively, fostering stronger relationships and increasing product adoption. For example, a 2025 survey of border communities revealed that personalized financial literacy workshops were highly valued, leading to a 15% increase in account openings for participating branches.

Consumer confidence is a key driver for banking activity. In early 2024, consumer confidence indices, like the Conference Board Consumer Confidence Index, showed fluctuations, indicating a cautious but generally stable outlook. When consumers feel secure about their jobs and the economy, they are more likely to take out loans for major purchases or invest their savings, directly benefiting banks like IBC.

Financial literacy levels significantly shape how consumers interact with financial institutions. A 2023 study by FINRA revealed that while many Americans are comfortable with basic financial concepts, a substantial portion still struggles with more complex topics like investing and retirement planning. This gap presents an opportunity for IBC to offer educational resources, which can lead to increased adoption of its products and stronger customer loyalty.

Income Inequality and Access to Financial Services

Income inequality in border communities directly shapes demand for IBC Bank's offerings. For instance, a significant portion of the population might require basic, low-fee checking and savings accounts, while a smaller, more affluent segment may seek wealth management and investment products. In 2024, reports indicated that median household incomes in some U.S.-Mexico border regions lagged behind national averages, underscoring the need for a tiered product strategy.

Financial inclusion remains a critical social imperative. By providing accessible and affordable banking solutions to unbanked and underbanked individuals, IBC Bank can foster economic stability and align with growing expectations for corporate social responsibility. As of early 2025, estimates suggest that millions of individuals in these border areas still lack access to traditional banking services, presenting a clear opportunity for growth and community impact.

- Targeted Product Development: Offering a spectrum of services from basic accounts to investment vehicles to cater to diverse income levels in border communities.

- Financial Inclusion Initiatives: Expanding access to banking for underbanked populations, potentially through community outreach and simplified account opening processes.

- Economic Empowerment: Supporting the financial well-being of border residents, contributing to local economic development and social stability.

- Alignment with ESG Trends: Demonstrating commitment to Environmental, Social, and Governance principles by addressing societal needs for financial access.

Community Engagement and Local Trust

IBC Bank's deep roots in its communities are a cornerstone of its success, directly impacting its reputation and the trust it garners. By actively supporting local businesses and investing in community development, IBC fosters a strong sense of loyalty among existing customers and attracts new ones. This commitment to the region's well-being is a significant factor in its sustained presence and positive brand perception.

For instance, in 2024, IBC Bank reported a 15% increase in small business loans originated within its primary service areas, demonstrating a tangible commitment to local economic growth. Furthermore, their sponsorship of over 50 community events and initiatives throughout 2024, ranging from local festivals to educational programs, solidified their image as a community partner. This proactive engagement translated into a 10% rise in customer satisfaction scores related to community involvement, according to a recent internal survey.

- Community Investment: IBC Bank's 2024 community investment initiatives totaled $5 million, supporting local non-profits and economic development projects.

- Small Business Support: The bank saw a 15% year-over-year growth in small business loan volume in 2024, highlighting its dedication to local entrepreneurship.

- Customer Trust: A 2024 customer survey indicated that 85% of respondents felt IBC Bank was a strong community supporter, contributing to high levels of trust.

- Local Engagement: IBC Bank participated in over 50 community events in 2024, enhancing its visibility and connection with local residents.

Sociological factors significantly influence IBC Bank's operations, particularly its focus on community engagement and financial inclusion. The bank's deep roots and active participation in local events, like sponsoring over 50 initiatives in 2024, foster strong customer trust and loyalty. This commitment is reflected in a 15% increase in small business loans in 2024, underscoring its role in local economic development.

Financial literacy levels among its customer base present both challenges and opportunities. While a 2023 FINRA study showed many consumers struggle with complex financial topics, IBC Bank can leverage this by offering educational resources, thereby increasing product adoption and customer loyalty.

Consumer confidence, a key driver for banking activity, showed a generally stable but cautious outlook in early 2024, impacting loan and investment behaviors. Furthermore, income inequality in border regions necessitates a tiered product strategy, catering to diverse financial needs from basic accounts to wealth management services.

Financial inclusion remains a critical social imperative, with millions in border areas still lacking access to traditional banking services as of early 2025. IBC Bank's efforts to provide accessible banking solutions align with growing expectations for corporate social responsibility and present a clear growth opportunity.

| Sociological Factor | Impact on IBC Bank | 2024/2025 Data/Trend |

|---|---|---|

| Community Engagement | Builds trust and loyalty | Sponsored 50+ events; 85% customer perception of strong community support (2024 survey) |

| Financial Literacy | Opportunity for product adoption and loyalty | Consumers often struggle with complex topics (2023 FINRA study) |

| Consumer Confidence | Influences loan and investment activity | Generally stable but cautious outlook (early 2024) |

| Income Inequality | Requires tiered product offerings | Median incomes in some border regions lag national averages (2024 reports) |

| Financial Inclusion | Growth opportunity and social imperative | Millions in border areas still unbanked (early 2025 estimates) |

Technological factors

The financial sector is undergoing a significant shift driven by digital banking adoption. By late 2024, global digital banking users are projected to exceed 2.5 billion, highlighting a massive customer base expecting seamless online and mobile experiences. IBC Bank needs to prioritize innovation in its digital platforms to stay competitive.

Meeting these evolving customer demands requires IBC Bank to integrate advanced features. Think AI-driven budgeting assistance, user-friendly mobile payment solutions, and customized financial advice. For instance, the global mobile payment market was valued at over $2.5 trillion in 2023 and continues to grow rapidly, indicating a strong consumer preference for these convenient options.

Cybersecurity threats are escalating, with financial institutions like IBC Bank facing increasingly sophisticated and frequent attacks. In 2024, the financial sector experienced a notable surge in ransomware and phishing attempts, impacting customer data and operational continuity. Protecting sensitive information and maintaining customer trust necessitates substantial investment in advanced threat detection and rapid response systems.

To counter these evolving dangers, IBC Bank must prioritize ongoing investment in cybersecurity infrastructure. This includes implementing cutting-edge solutions to combat ransomware and phishing schemes, which saw a significant rise in the financial industry throughout 2024. Staying ahead of these threats is crucial for safeguarding customer data and ensuring regulatory compliance with ever-changing security standards.

The financial technology (fintech) sector is rapidly evolving, presenting both challenges and opportunities for established institutions like IBC Bank. The proliferation of fintech companies and neobanks intensifies competition, forcing traditional banks to adapt or risk losing market share. For instance, by the end of 2024, fintech funding saw a significant uptick, with digital banking solutions attracting substantial investment, highlighting the demand for innovative financial services.

To stay competitive, IBC Bank must consider developing its own cutting-edge digital platforms or strategically partner with fintech innovators. This could involve integrating services like embedded finance, allowing non-financial businesses to offer financial products directly, or exploring new avenues for commercial lending through fintech-driven channels. Such a proactive stance is crucial for navigating the dynamic financial landscape and enhancing customer offerings.

Data Analytics and AI for Customer Insights

Leveraging data analytics and AI is paramount for banks like IBC to understand customer behavior and tailor their offerings. AI-powered tools can facilitate hyper-personalization, advanced budgeting assistance, and sophisticated digital financial advisors. This allows IBC to deliver customized products and boost customer interaction, ultimately leading to greater efficiency and satisfaction.

The banking sector is increasingly adopting AI for enhanced customer insights. For instance, a significant portion of financial institutions are investing in AI for personalized marketing and fraud detection. By analyzing vast datasets, IBC can anticipate customer needs, offer proactive financial advice, and create more engaging digital experiences. This data-driven approach is key to staying competitive in the evolving financial landscape.

- AI adoption in banking is projected to reach $25.6 billion globally by 2026, indicating a strong trend towards data-driven customer engagement.

- Banks using AI for personalization have reported an average increase of 10-15% in customer retention rates.

- Predictive analytics can help identify customers at risk of churn, allowing proactive interventions and improved loyalty.

- AI-driven chatbots and virtual assistants are handling a growing volume of customer queries, freeing up human staff for more complex tasks and improving service speed.

Infrastructure for Digital Payments and Cross-Border Transactions

The global surge in digital payments, encompassing mobile wallets and contactless technologies, necessitates a strong and secure technological foundation. For IBC Bank, particularly given its international operations, maintaining smooth and effective digital payment systems for global transactions is crucial. This includes adapting to evolving payment infrastructures to facilitate cross-border commerce efficiently.

The increasing adoption of digital payment methods is transforming how businesses and individuals transact. By mid-2024, global digital payment transaction values were projected to reach over $10 trillion, highlighting the critical need for robust infrastructure. IBC Bank must ensure its systems can handle this volume and the increasing complexity of international digital transfers.

Compliance with new payment standards is also a key technological factor. For instance, the widespread adoption of ISO 20022, a global messaging standard for financial transactions, is reshaping wire transfers and cross-border payments. By adhering to such standards, IBC Bank can improve the efficiency, transparency, and security of its international payment processing.

- Growing Digital Payment Adoption: Global digital payment transaction values are expected to exceed $10 trillion by mid-2024.

- Cross-Border Transaction Needs: IBC Bank must prioritize infrastructure for seamless international digital payments.

- ISO 20022 Compliance: Adhering to new standards like ISO 20022 enhances efficiency and security in wire transactions.

- Mobile Wallet Integration: Supporting mobile wallets and contactless payments is essential for modern transaction capabilities.

The rapid advancement of Artificial Intelligence (AI) is fundamentally reshaping the banking landscape, offering IBC Bank opportunities for enhanced customer engagement and operational efficiency. By 2026, AI adoption in banking is projected to reach $25.6 billion globally, underscoring its growing importance.

Banks leveraging AI for personalization have seen customer retention rates increase by an average of 10-15%, a key metric for IBC Bank to consider. Furthermore, AI-driven chatbots are increasingly handling customer queries, freeing up human staff for more complex tasks and improving overall service speed.

The integration of advanced data analytics and AI allows IBC Bank to gain deeper insights into customer behavior, enabling hyper-personalized offerings and sophisticated digital financial advice. This data-driven approach is crucial for anticipating customer needs and creating more engaging digital experiences.

Technological advancements are also driving the growth of digital payments, with global transaction values expected to exceed $10 trillion by mid-2024. IBC Bank must ensure its infrastructure supports seamless international digital transfers and adheres to new standards like ISO 20022 to enhance efficiency and security.

| Technology Area | 2024/2025 Trend | Impact on IBC Bank | Key Data Point |

|---|---|---|---|

| AI in Banking | Rapid adoption for personalization and efficiency | Improved customer retention, enhanced digital advice | Global AI in banking market projected to reach $25.6B by 2026 |

| Digital Payments | Significant growth in mobile and contactless transactions | Need for robust international transfer infrastructure | Global digital payment transaction values to exceed $10T by mid-2024 |

| Cybersecurity | Increasing sophistication of threats (ransomware, phishing) | Necessity for substantial investment in advanced threat detection | Financial sector experienced a surge in cyberattacks in 2024 |

| Fintech Integration | Proliferation of fintech companies and neobanks | Intensified competition, need for platform innovation or partnerships | Fintech funding saw a significant uptick in 2024, especially for digital banking |

Legal factors

IBC Bank navigates a complex web of banking regulations, including the Bank Secrecy Act (BSA) and anti-money laundering (AML) laws, which demand robust transaction monitoring and reporting. Failure to comply can result in severe penalties; for instance, in 2023, the U.S. Treasury's Financial Crimes Enforcement Network (FinCEN) collected over $3 billion in civil penalties from financial institutions for BSA violations.

The bank also adheres to international capital adequacy standards like Basel III, requiring it to maintain specific levels of capital to absorb unexpected losses. As of the first quarter of 2024, major U.S. banks generally reported Common Equity Tier 1 (CET1) ratios well above the minimum regulatory requirements, indicating a strong capital position, though ongoing adjustments are necessary to meet evolving global financial stability goals.

Consumer protection laws, such as those governing fair lending, data privacy, and clear disclosures, significantly shape IBC Bank's operations. For instance, regulations like Regulation Z, which dictates disclosures for credit terms, and specific appraisal requirements for higher-priced mortgage loans, directly influence banking practices and customer interactions. Adherence to these rules is paramount for building and maintaining customer trust, thereby mitigating the risk of costly legal disputes and regulatory penalties.

The Consumer Financial Protection Bureau (CFPB) plays a key role in enforcing and updating these regulations. For example, in 2024, the CFPB continued its focus on ensuring transparency in financial products and services, with potential adjustments to disclosure requirements and oversight of lending practices. Banks like IBC must remain agile, adapting their processes to comply with evolving consumer protection standards, which can impact everything from marketing materials to loan application procedures.

With the accelerating pace of digitalization, data privacy regulations are becoming increasingly stringent. Laws like the California Consumer Privacy Act (CCPA) and emerging state-level frameworks demand robust data protection. For IBC Bank, this means implementing comprehensive safeguards to protect customer information, managing potential data breaches effectively, and adhering to strict reporting mandates, which is crucial for maintaining customer trust and minimizing legal exposure.

Cross-border Legal Frameworks for Financial Transactions

IBC Bank's international footprint, particularly its operations between the U.S. and Mexico, means navigating a labyrinth of cross-border legal frameworks. These regulations govern everything from trade finance and foreign exchange to the intricate flow of capital. Staying compliant is paramount, as even minor shifts in bilateral legal agreements can significantly impact the bank's international business lines.

For instance, the U.S. Treasury Department's Office of Foreign Assets Control (OFAC) imposes sanctions that directly affect financial institutions dealing with international transactions. In 2024, OFAC continued to update its lists and guidance, requiring constant vigilance from banks like IBC. Similarly, Mexico's financial regulatory bodies, such as the Comisión Nacional Bancaria y de Valores (CNBV), have their own stringent rules that IBC must adhere to. The Bank Secrecy Act (BSA) in the U.S. and its Mexican equivalents are critical for anti-money laundering (AML) efforts, with penalties for non-compliance reaching millions of dollars. In 2023, U.S. banks faced over $2.5 billion in AML-related fines, underscoring the importance of robust compliance programs.

- U.S.-Mexico Trade Finance Regulations: Understanding differing legal requirements for letters of credit, export/import financing, and customs compliance is crucial for IBC's trade finance division.

- Foreign Exchange Controls and Capital Movement: Adherence to currency exchange regulations and capital repatriation laws in both countries is essential to avoid legal repercussions and ensure smooth financial operations.

- AML and KYC Compliance: Implementing Know Your Customer (KYC) and Anti-Money Laundering (AML) protocols that satisfy both U.S. and Mexican legal standards is vital, especially given the increasing scrutiny on financial institutions. For example, in 2024, the Financial Crimes Enforcement Network (FinCEN) continued to emphasize enhanced due diligence for cross-border transactions.

- Data Privacy and Cross-Border Data Flows: IBC must comply with differing data protection laws, such as the California Consumer Privacy Act (CCPA) in the U.S. and Mexico's Federal Law on Protection of Personal Data Held by Private Parties, when handling customer information across borders.

Community Reinvestment Act (CRA) Modernization

The Community Reinvestment Act (CRA) requires banks to serve all communities, including low- and moderate-income areas. Recent updates to CRA rules are expanding how banks are evaluated, potentially looking beyond their physical branches. This means IBC Bank needs to adjust its lending and investment approaches to stay compliant with these evolving regulations.

These modernization efforts, which began taking shape in late 2023 and are expected to be fully implemented by 2025, aim to better reflect how banking is conducted today, including digital services. For instance, the new rules might consider a bank's digital lending activities in areas where it doesn't have a physical presence. IBC Bank must therefore ensure its community outreach and lending practices align with these updated expectations to avoid penalties and maintain its license to operate.

- CRA modernization aims to update regulations for the current banking landscape.

- Expanded evaluation scope may include digital lending and services beyond traditional footprints.

- Compliance adaptation is crucial for banks like IBC to meet credit needs across all communities.

- Implementation timeline suggests significant changes will be in effect by 2025.

IBC Bank operates under stringent legal frameworks, including US and international banking laws that mandate robust anti-money laundering (AML) and Know Your Customer (KYC) protocols. For example, in 2023, U.S. financial institutions faced over $2.5 billion in AML-related fines, highlighting the critical need for compliance. The bank must also adhere to capital adequacy requirements like Basel III, with U.S. banks generally maintaining strong Common Equity Tier 1 (CET1) ratios above minimums in early 2024.

Consumer protection laws, such as those enforced by the CFPB, dictate fair lending and data privacy practices, impacting everything from loan disclosures to digital service offerings. The CCPA and similar state laws also impose strict data protection mandates, requiring significant investment in cybersecurity and compliance. Furthermore, navigating cross-border regulations between the U.S. and Mexico, including OFAC sanctions and local financial rules, is essential for IBC's international operations.

Environmental factors

Communities along the U.S.-Mexico border, areas IBC Bank serves, face increasing risks from climate change. For instance, regions like South Texas are already experiencing more frequent and intense heatwaves, impacting agricultural yields. In 2023, Texas saw significant drought conditions, affecting crop production and livestock, which directly impacts the economic health of many local businesses and individuals reliant on these sectors.

These environmental shifts, including potential water scarcity and extreme weather, can destabilize local economies. This instability can translate into higher credit risk for IBC Bank, as businesses and individuals may struggle with loan repayments due to reduced income or increased operational costs. For example, a prolonged drought could severely impact a farming community’s ability to service agricultural loans.

Financial institutions are increasingly embedding sustainability into their core operations. This involves developing green financial products, funding sustainable ventures, and committing to net-zero financed emissions, with many major banks setting targets for 2030 and 2040. For instance, by the end of 2023, many leading banks had reported progress on their climate commitments, with some increasing their sustainable finance portfolios by over 15% year-over-year.

IBC Bank, like its peers, is likely to encounter heightened expectations from customers and investors to champion environmentally conscious practices. This pressure is amplified by regulatory shifts, such as the EU's Sustainable Finance Disclosure Regulation (SFDR), which requires financial market participants to disclose sustainability-related information. In 2024, surveys indicated that over 60% of banking customers consider a bank's environmental stance when choosing a financial provider.

IBC Bank's commercial clients, particularly those in manufacturing, agriculture, and energy, face increasing scrutiny under environmental regulations. For instance, in 2024, the U.S. Environmental Protection Agency (EPA) proposed stricter rules for methane emissions from oil and gas operations, potentially increasing compliance costs for energy sector borrowers.

These evolving environmental standards, such as those impacting wastewater discharge or hazardous material handling, can directly affect the operational expenses and profitability of IBC Bank's diverse client base. A 2025 report by the National Association of Manufacturers indicated that compliance with environmental regulations cost U.S. manufacturers an estimated $50 billion annually, a figure expected to rise with new legislation.

Consequently, shifts in environmental policy, like the introduction of carbon taxes or mandates for renewable energy adoption, can alter the creditworthiness of businesses reliant on traditional, more polluting practices. This necessitates IBC Bank to closely monitor legislative developments and assess the resilience of its clients' business models against these environmental pressures.

ESG Investment Trends

Environmental, Social, and Governance (ESG) factors are significantly reshaping investment landscapes. By 2024, global sustainable investment assets reached an estimated $37.5 trillion, demonstrating a clear investor preference for companies with strong ESG credentials. Banks like IBC Bank that proactively integrate ESG principles into their core strategies and investment portfolios are better positioned to attract this growing pool of capital and meet heightened market expectations.

This shift presents a strategic opportunity for IBC Bank to develop and promote ESG-themed financial products, such as green bonds or sustainable funds. Such offerings can cater to the increasing demand from both institutional and retail investors seeking to align their financial goals with positive environmental and social impact. For instance, the sustainable bond market saw substantial growth in 2024, with issuance exceeding $1 trillion globally, indicating a robust appetite for such instruments.

- Growing Investor Demand: Global sustainable investment assets reached $37.5 trillion by 2024, highlighting a significant shift in investor priorities.

- Market Alignment: Integrating ESG principles helps banks like IBC Bank align with evolving market expectations and regulatory trends.

- Product Innovation: Opportunities exist for developing ESG-themed financial products, tapping into a rapidly expanding market segment.

- Sustainable Bond Market Growth: The global sustainable bond market surpassed $1 trillion in issuance in 2024, signaling strong investor interest in environmentally and socially conscious investments.

Operational Environmental Footprint

IBC Bank's operational environmental footprint is increasingly under the microscope, extending beyond its core lending and investment activities. This includes how the bank manages its energy consumption, waste generation, and overall resource utilization across its branches and internal processes. For instance, a focus on reducing energy use in physical locations or transitioning to digital workflows to minimize paper waste are key areas for improvement.

Adopting these sustainable operational practices can significantly bolster IBC Bank's reputation and align it with broader environmental objectives. For example, in 2024, many financial institutions reported progress in reducing their carbon emissions from operations. One major US bank noted a 15% reduction in its scope 1 and 2 emissions in 2024 compared to its 2020 baseline, largely through energy efficiency upgrades and renewable energy sourcing for its facilities.

- Energy Efficiency: Implementing smart building technologies and renewable energy sources in branches to lower electricity consumption.

- Waste Reduction: Digitizing customer interactions and internal documentation to drastically cut down on paper usage and associated waste.

- Resource Management: Optimizing water usage and promoting recycling programs within all operational sites.

- Supply Chain Sustainability: Evaluating and prioritizing vendors with strong environmental track records for goods and services procured by the bank.

Environmental factors pose significant risks and opportunities for IBC Bank, particularly in its service regions like South Texas. Climate change impacts such as increased heatwaves and drought, as seen in Texas during 2023, can destabilize local economies, affecting agricultural yields and increasing credit risk for the bank. These environmental shifts necessitate a proactive approach to sustainability and risk management.

The financial sector is increasingly prioritizing sustainability, with many banks setting net-zero targets and expanding green finance portfolios. By 2024, global sustainable investment assets reached an estimated $37.5 trillion, indicating a strong investor preference for ESG-compliant institutions. IBC Bank's commercial clients, especially in sectors like manufacturing and energy, face growing regulatory scrutiny regarding emissions and resource management, as exemplified by proposed EPA rules on methane in 2024.

IBC Bank must adapt to evolving environmental standards and investor expectations for sustainable practices. This includes developing ESG-themed financial products, like green bonds, which saw over $1 trillion in global issuance in 2024. Furthermore, the bank's own operational footprint, from energy consumption to waste generation, is under scrutiny, with many institutions reporting emission reductions in 2024 through efficiency measures.

The bank's strategic response to environmental factors will influence its ability to attract capital and maintain client relationships. By integrating ESG principles, IBC Bank can enhance its reputation and tap into the growing market for sustainable finance, ensuring resilience against climate-related economic disruptions and regulatory changes. For instance, a 2025 report indicated U.S. manufacturers spent approximately $50 billion annually on environmental compliance.

PESTLE Analysis Data Sources

Our IBC Bank PESTLE Analysis is meticulously constructed using data from reputable sources including the World Bank, International Monetary Fund (IMF), and national regulatory bodies. This ensures a comprehensive understanding of political, economic, social, technological, legal, and environmental factors impacting the banking sector.