IBC Bank Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

IBC Bank Bundle

IBC Bank operates within a dynamic financial landscape shaped by intense competition and evolving customer expectations. Understanding the interplay of buyer power, supplier leverage, and the threat of new entrants is crucial for navigating this environment.

The complete report reveals the real forces shaping IBC Bank’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Depositors, from individuals to corporations, are IBC Bank's primary capital suppliers. Their leverage hinges on competitive interest rates from rivals and other investment options. While individual depositors have less sway, large corporate or institutional clients can negotiate more favorable terms due to their substantial deposit volumes.

IBC Bank's reliance on technology and service providers, such as core banking systems and cybersecurity firms, presents a moderate to high supplier bargaining power. This is particularly true for specialized or proprietary solutions where the cost and complexity of switching are substantial, potentially impacting IBC Bank's operational efficiency and data security. For instance, the global cybersecurity market was valued at over $200 billion in 2023, highlighting the significant investment and specialized nature of these services.

Employees, especially those with specialized skills in finance, technology, and risk management, act as key suppliers of labor for IBC Bank. Their bargaining power is shaped by the demand for their expertise, local labor market conditions along the U.S.-Mexico border, and the overall availability of qualified talent. For instance, in 2024, the U.S. unemployment rate hovered around 3.9%, indicating a relatively tight labor market that can empower skilled workers.

Wholesale Funding Sources

Beyond customer deposits, banks like IBC Bank often tap into wholesale funding markets, which include interbank lending and the issuance of debt securities. The entities providing these funds, such as other financial institutions and bond investors, wield significant bargaining power.

This power is directly tied to market liquidity, prevailing interest rates, and IBC Bank's own perceived creditworthiness. For instance, during periods of tight liquidity or rising interest rates, the cost of wholesale funding can escalate sharply. In May 2024, the Federal Funds Rate remained within a target range of 5.25% to 5.50%, influencing borrowing costs across the financial system.

- Market Liquidity: When overall liquidity in the financial system is low, suppliers of funds can demand higher rates.

- Interest Rate Environment: Rising benchmark interest rates, like the Federal Funds Rate, directly increase the cost of wholesale borrowing for banks.

- Creditworthiness: A bank's financial health and credit rating significantly impact its ability to attract wholesale funding and the rates it pays. A lower credit rating means higher borrowing costs.

Regulatory and Compliance Service Providers

The banking sector's stringent regulatory environment significantly enhances the bargaining power of specialized regulatory and compliance service providers. These firms, offering crucial legal, consulting, and compliance expertise, are indispensable for banks navigating complex financial laws. Their specialized knowledge of evolving regulations, such as those related to anti-money laundering (AML) and Know Your Customer (KYC) protocols, makes them essential partners.

Banks are compelled to allocate substantial resources to compliance, often exceeding 10% of their operating expenses, to meet these demands. For instance, in 2023, major global banks reported spending billions on compliance and regulatory technology. This necessity grants these service providers considerable leverage, as banks cannot afford non-compliance, which can lead to hefty fines and reputational damage.

- Essential Expertise: Providers possess unique knowledge of intricate financial regulations, making their services critical.

- High Switching Costs: Banks face significant costs and operational disruption when changing compliance partners.

- Regulatory Dependence: The constant evolution of financial laws ensures ongoing demand for these specialized services.

- Market Concentration: In certain niche compliance areas, a limited number of providers can dominate, further strengthening their position.

For IBC Bank, suppliers of capital, technology, and specialized expertise hold significant bargaining power. Depositors, particularly large institutional clients, can leverage their substantial funds to negotiate better rates. Technology providers for core banking and cybersecurity are critical, with switching costs often being high, as evidenced by the over $200 billion global cybersecurity market in 2023. Skilled employees in finance and tech also benefit from a tight labor market, with the U.S. unemployment rate around 3.9% in 2024.

| Supplier Type | Factors Influencing Bargaining Power | Impact on IBC Bank |

|---|---|---|

| Depositors (Institutional) | Volume of deposits, alternative investment yields | Ability to negotiate higher interest rates |

| Technology Providers (Core Banking, Cybersecurity) | Specialization, switching costs, market concentration | Potential for increased service costs, operational dependency. Cybersecurity market valued at over $200 billion in 2023. |

| Skilled Labor (Finance, Tech) | Demand for expertise, labor market tightness | Pressure on wages and benefits. U.S. unemployment around 3.9% in 2024. |

| Wholesale Funding Providers | Market liquidity, interest rate environment, IBC Bank's creditworthiness | Fluctuations in borrowing costs. Federal Funds Rate target range 5.25%-5.50% in May 2024. |

| Regulatory & Compliance Service Providers | Regulatory complexity, specialization, switching costs | Essential service costs, risk of penalties for non-compliance. Compliance spending can exceed 10% of operating expenses for banks. |

What is included in the product

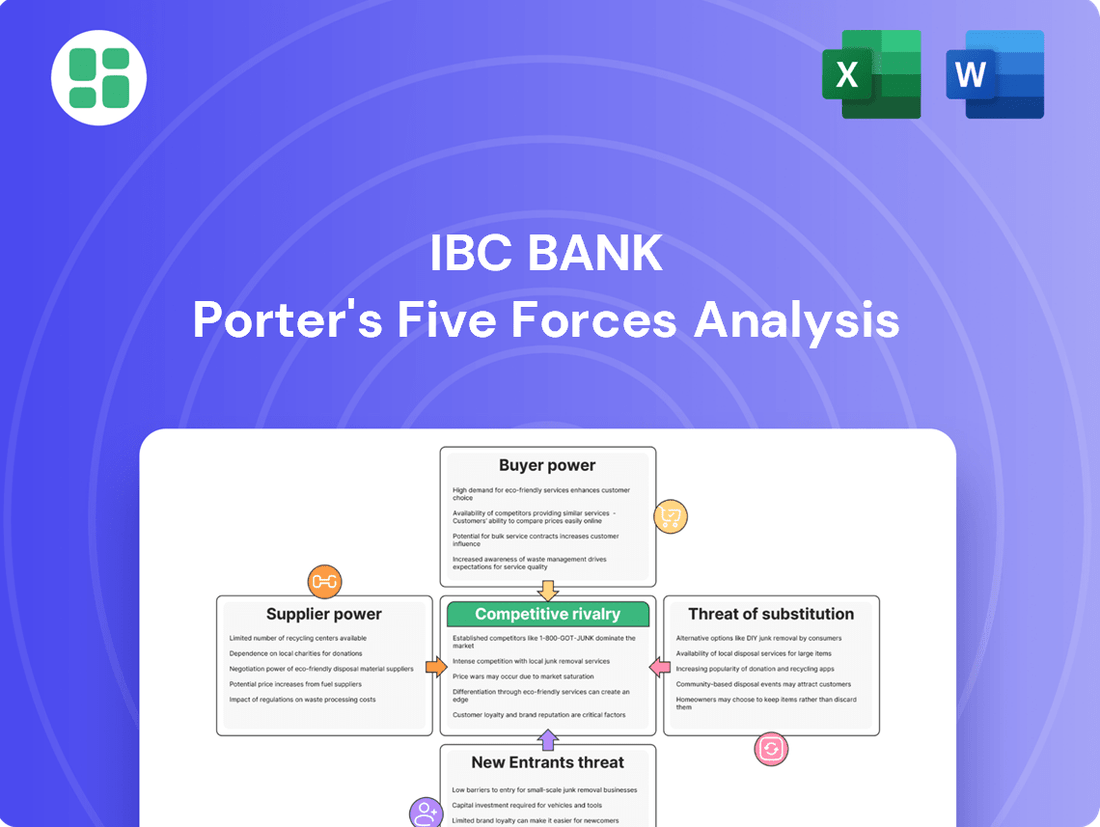

This analysis unpacks the competitive forces impacting IBC Bank, including the threat of new entrants, the bargaining power of buyers and suppliers, the threat of substitutes, and the intensity of rivalry within the banking sector.

Instantly visualize competitive pressures with a dynamic, interactive Porter's Five Forces model, allowing IBC Bank to proactively address market threats and capitalize on opportunities.

Customers Bargaining Power

Individual retail customers typically wield limited bargaining power. This is largely because banking products and services are often standardized, and in today's digital landscape, switching between financial institutions is relatively straightforward, with low associated costs. For instance, in 2023, the average time to open a new bank account online was reported to be under 10 minutes for many institutions, highlighting this ease of transition.

However, the increasing availability of digital-first banking solutions and neobanks does offer customers more choices, subtly enhancing their ability to negotiate or seek better terms. IBC Bank counters this by emphasizing its community-centric approach and a commitment to personalized customer service, fostering stronger relationships and customer loyalty to offset the inherent power of choice.

Commercial and business clients, particularly those with substantial needs for loans, treasury services, or international trade financing, wield considerable bargaining power. These larger clients can leverage their significant business volume to negotiate favorable terms and rates, often with the option to move to competitors or explore alternative funding avenues. For IBC Bank, operating along the U.S.-Mexico border, catering to clients with unique cross-border financial requirements further amplifies their ability to negotiate customized solutions.

Customers now have an unprecedented array of financial products and services at their fingertips. This includes offerings from traditional institutions like IBC Bank, along with a growing number of credit unions and innovative fintech companies. For instance, the global fintech market was valued at approximately $2.4 trillion in 2023 and is projected to grow significantly, offering consumers more choices than ever before.

This expanded access directly amplifies customer bargaining power. With so many options available, individuals and businesses can readily compare interest rates on loans, fees for services, and the overall value proposition of different financial providers. This ease of comparison incentivizes institutions to offer more competitive terms to attract and retain clients.

The ongoing digital transformation further fuels this trend. Online platforms and mobile banking apps make it incredibly simple for customers to research, switch, and negotiate for better financial arrangements. In 2024, it's estimated that over 80% of the global population will have access to the internet, enabling widespread digital comparison shopping for financial services.

Low Switching Costs for Digital Services

The proliferation of digital banking and mobile apps has drastically reduced the effort customers need to exert to switch financial institutions. For instance, in 2024, a significant percentage of consumers reported opening new bank accounts entirely online, bypassing traditional branch visits. This ease of account opening and fund transfer directly diminishes customer loyalty based solely on inertia.

Consequently, customer retention in the banking sector is increasingly driven by factors like superior digital user experience, competitive interest rates, and accessible customer service. Banks that fail to offer seamless digital platforms and compelling value propositions risk losing customers to more agile competitors.

- Digital Account Opening: By 2024, over 60% of new bank accounts were opened through digital channels, highlighting the reduced friction.

- Mobile Banking Adoption: Mobile banking usage continued its upward trend, with a majority of daily banking transactions occurring via smartphone apps.

- Interoperability: Features like easy-to-use payment apps and simplified fund transfer mechanisms between different banks further lower switching barriers.

Information Transparency

Customers today wield significant power due to readily available information on interest rates, fees, and product comparisons via online platforms and financial aggregators. This increased transparency allows them to make more informed choices and capitalize on competitive offers, directly enhancing their bargaining leverage.

For banks like IBC Bank, this means a constant need to remain competitive in pricing and service quality. For instance, in 2024, many neobanks and traditional banks are offering savings accounts with APYs exceeding 4.5%, a direct response to customer access to such data and the resulting pressure to attract and retain deposits.

- Information Accessibility: Online platforms and financial aggregators provide easy access to comparative banking product data.

- Informed Decision-Making: Customers can now readily compare rates, fees, and features, leading to more strategic choices.

- Increased Bargaining Power: Transparency empowers customers to negotiate better terms or switch to more favorable providers.

- Competitive Pressure: Banks must offer compelling value propositions to retain clients in this transparent environment.

Customers' bargaining power is significantly amplified by the vast array of financial products and services available, including those from fintechs. This makes it easier for them to compare rates and fees, forcing institutions to offer more competitive terms. For example, in 2024, the global fintech market's continued expansion, valued in the trillions, directly translates to more customer choices and thus, greater leverage.

The ease of switching between financial institutions, facilitated by digital platforms, further strengthens customer bargaining power. With many banks offering online account opening in under 10 minutes, as seen in 2023 data, customers can readily move to providers with better offers, compelling banks to prioritize customer retention through value and experience.

Large commercial clients, especially those with complex cross-border needs like IBC Bank's clientele along the U.S.-Mexico border, possess substantial bargaining power. They can negotiate favorable terms due to their significant transaction volumes and the availability of alternative financing options, influencing the tailored services banks must provide.

| Customer Segment | Bargaining Power Factors | Impact on Banks |

|---|---|---|

| Individual Retail Customers | Ease of switching (digital), product standardization, access to information | Pressure on fees and rates, need for superior digital experience |

| Commercial/Business Clients | Transaction volume, alternative financing, specialized needs (e.g., cross-border) | Negotiation of custom terms, need for specialized services |

| Overall Market Trend | Fintech growth, information transparency, digital banking adoption | Increased competition, focus on value proposition, reduced customer inertia |

Preview Before You Purchase

IBC Bank Porter's Five Forces Analysis

This preview shows the exact IBC Bank Porter's Five Forces Analysis you'll receive immediately after purchase, offering a comprehensive examination of competitive forces within the banking sector. You'll gain insights into the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry among existing competitors. This detailed report is professionally formatted and ready for your immediate use.

Rivalry Among Competitors

IBC Bank faces significant competitive pressure from large national banks like JPMorgan Chase and Bank of America, which boast substantial capital, extensive branch networks, and a wide array of financial products. For instance, as of the first quarter of 2024, JPMorgan Chase reported total assets exceeding $3.9 trillion, dwarfing regional players.

Regional banks, such as Frost Bank and Zions Bancorporation, also present a formidable challenge, particularly within their respective geographic markets. These institutions often cultivate strong local relationships and offer tailored services, allowing them to effectively compete for both commercial and retail banking customers.

IBC Bank contends with a significant number of credit unions and community banks, particularly in its core markets along the U.S.-Mexico border. These smaller institutions often cultivate strong local ties and offer a more personalized customer experience, appealing to individuals and businesses that value community-centric banking. For example, in 2024, community banks and credit unions collectively held a substantial portion of deposits in many of the regions where IBC Bank operates, demonstrating their persistent competitive presence.

Fintech companies and neobanks are significantly upping the ante in the banking sector. They're rolling out slick, tech-savvy services that often come with lower fees and a much smoother customer journey than what traditional banks offer. This is forcing established players, including IBC Bank, to really step up their game in digital offerings and how they connect with customers.

Product and Service Differentiation

Competitive rivalry in banking intensifies through product and service differentiation. While basic banking functions are largely similar, institutions like IBC Bank aim to stand out by offering specialized loan portfolios, sophisticated treasury management solutions, and robust international trade services. The development of advanced digital platforms also plays a crucial role in attracting and retaining customers.

IBC Bank's strategic concentration on U.S.-Mexico border communities serves as a significant differentiator. This geographic focus allows them to tailor their offerings to the unique financial needs of this vibrant economic region. For instance, as of early 2024, the trade volume between the U.S. and Mexico continues to be a substantial driver of economic activity, with cross-border transactions representing a significant portion of business for many companies in these areas.

- Specialized Offerings: Banks differentiate through niche loan products and advanced treasury management.

- Digital Platforms: Superior digital banking experiences are key competitive advantages.

- Geographic Focus: IBC Bank's specialization in U.S.-Mexico border communities provides a unique market position.

- Trade Services: Expertise in international trade finance is a critical differentiator in border regions.

Market Growth and Concentration

The U.S. banking sector, while generally mature, exhibits pockets of robust growth, particularly in areas like the U.S.-Mexico border region where IBC Bank operates. This localized growth can intensify competition as institutions vie for market share in these expanding economies.

While a few dominant national banks hold significant market share, the landscape is far from static. The presence of numerous community banks and credit unions, alongside the emergence of fintech disruptors, ensures a dynamic and often fierce competitive environment. For instance, as of early 2024, the U.S. banking industry still features thousands of institutions, each seeking to capture customer loyalty.

Economic factors, including shifts in interest rates and overall economic health, directly influence the intensity of competition. When economic conditions are favorable, banks may compete more aggressively on pricing and product offerings to attract customers and capital. Conversely, during downturns, competition might focus more on stability and risk management.

- Regional Growth Pockets: Areas like the U.S.-Mexico border are experiencing growth, fueling competition among banks.

- Market Concentration vs. Agility: While large banks exist, numerous smaller players and new entrants maintain competitive pressure.

- Economic Sensitivity: Interest rate changes and economic conditions significantly impact how intensely banks compete.

Competitive rivalry at IBC Bank is multifaceted, stemming from large national banks, agile regional players, numerous community banks, and innovative fintech companies. These diverse competitors vie for market share through product differentiation, digital innovation, and localized customer relationships, especially in growth areas like the U.S.-Mexico border.

| Competitor Type | Key Strengths | Impact on IBC Bank | Example (Q1 2024 Data) |

|---|---|---|---|

| National Banks | Capital, Branch Networks, Product Breadth | Price competition, customer acquisition | JPMorgan Chase Total Assets: ~$3.9 trillion |

| Regional Banks | Local Relationships, Tailored Services | Market share erosion in specific geographies | Frost Bank, Zions Bancorporation |

| Community Banks & Credit Unions | Personalized Service, Community Ties | Deposit capture, niche market loyalty | Substantial deposit share in border regions |

| Fintech/Neobanks | Digital Experience, Lower Fees | Pressure for digital transformation, customer churn | Rapid growth in digital-only banking services |

SSubstitutes Threaten

The growing presence of fintech lending platforms, such as peer-to-peer (P2P) lenders and online direct lenders, poses a substantial threat of substitution to traditional bank lending services. These innovative platforms frequently provide faster loan approvals, more adaptable repayment schedules, and a pathway to funding for underserved individuals and small enterprises.

In 2024, the fintech lending sector continued its robust expansion, with global fintech lending volume projected to reach over $3.5 trillion, demonstrating a clear alternative for borrowers seeking efficient and accessible credit solutions. Many of these platforms leverage advanced algorithms and streamlined digital processes, allowing them to undercut traditional banks on both speed and sometimes cost.

Digital payment systems and e-wallets like PayPal, Venmo, and Zelle present a significant threat of substitutes to traditional banking services for everyday transactions. These platforms offer streamlined, often instant, peer-to-peer transfers and online payment capabilities, directly competing with checking accounts and debit cards.

The increasing adoption of these digital solutions means consumers may rely less on traditional bank accounts for daily spending and money movement. For instance, in 2023, the global digital payments market was valued at over $2.4 trillion and is projected to grow substantially, indicating a clear shift in consumer behavior away from traditional methods.

Alternative investment vehicles pose a significant threat to traditional banking. Investors can readily access options like brokerage accounts, mutual funds, and exchange-traded funds (ETFs), which often provide the potential for higher returns than standard savings accounts. For instance, as of early 2024, the S&P 500 index had seen substantial growth, attracting capital that might otherwise have been held in bank deposits.

Cryptocurrencies and Blockchain-based Finance

The rise of cryptocurrencies and blockchain-based finance presents a growing threat of substitutes for traditional banking. These decentralized platforms offer alternative methods for value storage, fund transfers, and financial services, bypassing conventional intermediaries. As of early 2024, the total market capitalization of cryptocurrencies hovered around $1.5 trillion, indicating significant adoption and a tangible alternative for some financial activities.

Decentralized Finance (DeFi) applications, built on blockchain technology, are increasingly providing services like lending, borrowing, and trading, directly competing with bank offerings. For instance, the total value locked (TVL) in DeFi protocols reached over $50 billion in early 2024, demonstrating a substantial shift of assets away from traditional financial systems. This trend suggests that as these technologies mature and regulatory clarity improves, they could capture a larger share of the financial services market.

- Growing Market Share: The cryptocurrency market, valued at approximately $1.5 trillion in early 2024, represents a significant alternative asset class and payment network.

- DeFi Adoption: Over $50 billion in assets were locked in DeFi protocols by early 2024, showcasing a tangible shift towards decentralized financial services.

- Reduced Intermediation: Blockchain technology enables peer-to-peer transactions, potentially reducing the reliance on banks for services like remittances and payments.

- Innovation in Services: DeFi platforms are continuously innovating, offering yield generation, staking, and other services that directly substitute for traditional banking products.

Internal Corporate Finance Departments

For large corporations, the presence of robust internal corporate finance departments significantly impacts the banking sector by acting as a substitute for certain services. These departments can manage treasury functions, optimize cash flow, and even facilitate internal lending, thereby lessening the need for external banking partnerships for these specific activities.

This internal capacity means that banks may see reduced demand for services like sophisticated treasury management solutions. For instance, in 2023, a survey of Fortune 500 companies revealed that over 60% had expanded their in-house treasury operations, indicating a trend toward greater self-sufficiency in managing financial complexities.

- Reduced reliance on banks for treasury management.

- Internal lending capabilities reduce demand for certain credit products.

- Companies with strong finance departments may negotiate less favorable terms with banks.

- The trend toward in-house financial management is growing.

The threat of substitutes for IBC Bank is significant, driven by the rise of fintech, digital payments, alternative investments, and cryptocurrencies. These alternatives offer convenience, speed, and potentially higher returns, directly challenging traditional banking services.

Fintech lending platforms, for example, are projected to facilitate over $3.5 trillion in loans globally in 2024, providing a swift alternative to bank loans. Similarly, digital payment systems handled over $2.4 trillion in 2023, indicating a consumer shift away from traditional banking for daily transactions.

| Substitute Area | Key Players/Examples | Market Size/Growth (2023-2024 Data) | Impact on Banks |

|---|---|---|---|

| Lending | Fintech Lenders (P2P, Online Direct) | Global volume projected > $3.5 trillion (2024) | Faster approvals, adaptable terms, alternative for underserved |

| Payments | Digital Wallets (PayPal, Venmo, Zelle) | Global market value > $2.4 trillion (2023) | Streamlined P2P transfers, competition for checking/debit |

| Investments | Brokerage Accounts, ETFs, Mutual Funds | S&P 500 substantial growth (early 2024) | Higher potential returns than savings accounts |

| Value Storage/Transfers | Cryptocurrencies, DeFi | Crypto market cap ~$1.5 trillion (early 2024); DeFi TVL > $50 billion (early 2024) | Decentralized alternatives, reduced intermediation |

Entrants Threaten

The banking sector faces formidable regulatory hurdles and substantial capital demands. For instance, in 2024, the Basel III framework continues to mandate stringent capital adequacy ratios, with Common Equity Tier 1 (CET1) ratios often needing to exceed 4.5% of risk-weighted assets, alongside additional capital buffers. These requirements, coupled with the complex licensing processes and the need for continuous compliance with evolving financial regulations, create a significant barrier for any new entity aiming to enter the market and challenge established players like IBC Bank.

Established banks like IBC Bank benefit from strong brand recognition and customer trust, built over decades. For instance, in 2024, major banks continued to see high customer retention rates, often exceeding 90% for core services, a testament to this loyalty.

New entrants face a significant hurdle in overcoming this ingrained loyalty and building credibility. In the banking sector, where financial security and reliability are paramount, acquiring new customers requires substantial investment in marketing and establishing a proven track record, which can take years.

This makes it considerably harder for new players to attract a significant customer base quickly, as consumers often prefer the perceived safety and familiarity of established institutions, especially for critical financial needs.

Existing banks, like IBC Bank, leverage significant economies of scale. This allows them to spread the high costs of technology, compliance, and marketing over a larger customer base, leading to lower per-unit costs. For instance, in 2024, major banks reported operating expenses that were a fraction of their total assets compared to smaller institutions, a direct result of this scale advantage.

Network effects further solidify the position of incumbents. A larger customer base and a wider branch network mean more convenient access for customers and greater opportunities for cross-selling. In 2024, banks with extensive digital platforms and physical footprints saw higher customer engagement and loyalty, making it challenging for new entrants to replicate this reach and value proposition quickly.

Technological Investment and Infrastructure

The threat of new entrants in the banking sector, particularly concerning technological investment and infrastructure, is significantly influenced by the substantial capital required. Developing and maintaining cutting-edge banking technology, encompassing secure online and mobile platforms, advanced data analytics, and robust cybersecurity systems, demands considerable financial outlay. For instance, major banks are investing billions annually in digital transformation initiatives. In 2024, global spending on banking IT is projected to reach over $200 billion, highlighting the scale of investment needed to compete.

While many fintech startups are born digital, possessing agile and modern technological stacks, traditional institutions like IBC Bank often operate with legacy systems that require significant upgrades or replacements. This creates a substantial barrier to entry for newcomers who must either build entirely new, costly technological frameworks or acquire existing, often expensive, infrastructure. The sheer cost of developing and integrating these sophisticated systems can deter potential new players from entering the market.

- High Capital Expenditure: Developing secure online and mobile platforms, data analytics, and cybersecurity requires massive upfront investment, often in the hundreds of millions or even billions of dollars for comprehensive systems.

- Legacy System Integration: Traditional banks face the challenge and cost of integrating new technologies with existing, often outdated, core banking systems.

- Talent Acquisition Costs: The demand for skilled IT professionals in areas like cybersecurity and data science drives up recruitment and retention costs for new entrants.

- Regulatory Compliance Technology: Implementing and maintaining technology to meet stringent financial regulations adds another layer of significant expense for any new banking entity.

Niche Market Focus and Geographic Concentration

New entrants could target specific niche markets or underserved geographic areas, potentially bypassing direct competition with established institutions like IBC Bank. However, IBC's established footprint and specialized services along the U.S.-Mexico border present a significant barrier to entry for broad-based newcomers.

IBC Bank's deep roots and extensive network in its core geographic markets, particularly along the U.S.-Mexico border, create a formidable moat. For instance, in 2024, IBC Bank continued to emphasize its community-focused approach, which is crucial in these specific regions where local trust and understanding are paramount for customer acquisition and retention.

- Niche Market Penetration: New entrants might focus on specific customer segments within the border region, such as small businesses engaged in cross-border trade or specific immigrant communities, offering tailored financial products.

- Geographic Specialization: A new entrant could concentrate its efforts on a particular city or county along the border, aiming to gain significant market share in a smaller, manageable area before expanding.

- IBC's Competitive Advantage: IBC Bank's long-standing presence and its comprehensive suite of services, including international banking and remittance solutions, cater directly to the unique needs of its border communities, making it difficult for new, less specialized entrants to gain traction.

The threat of new entrants for IBC Bank is moderately low due to significant barriers. High capital requirements for technology and compliance, estimated in the hundreds of millions for robust systems, deter many potential players. Established customer loyalty and brand recognition, with retention rates often exceeding 90% in 2024, also present a formidable challenge for newcomers seeking to build trust and market share.

Porter's Five Forces Analysis Data Sources

Our IBC Bank Porter's Five Forces analysis is built upon a foundation of robust data, including the bank's annual reports, investor presentations, and regulatory filings with entities like the SEC. We also incorporate insights from reputable financial news outlets and industry-specific publications to capture current market dynamics.