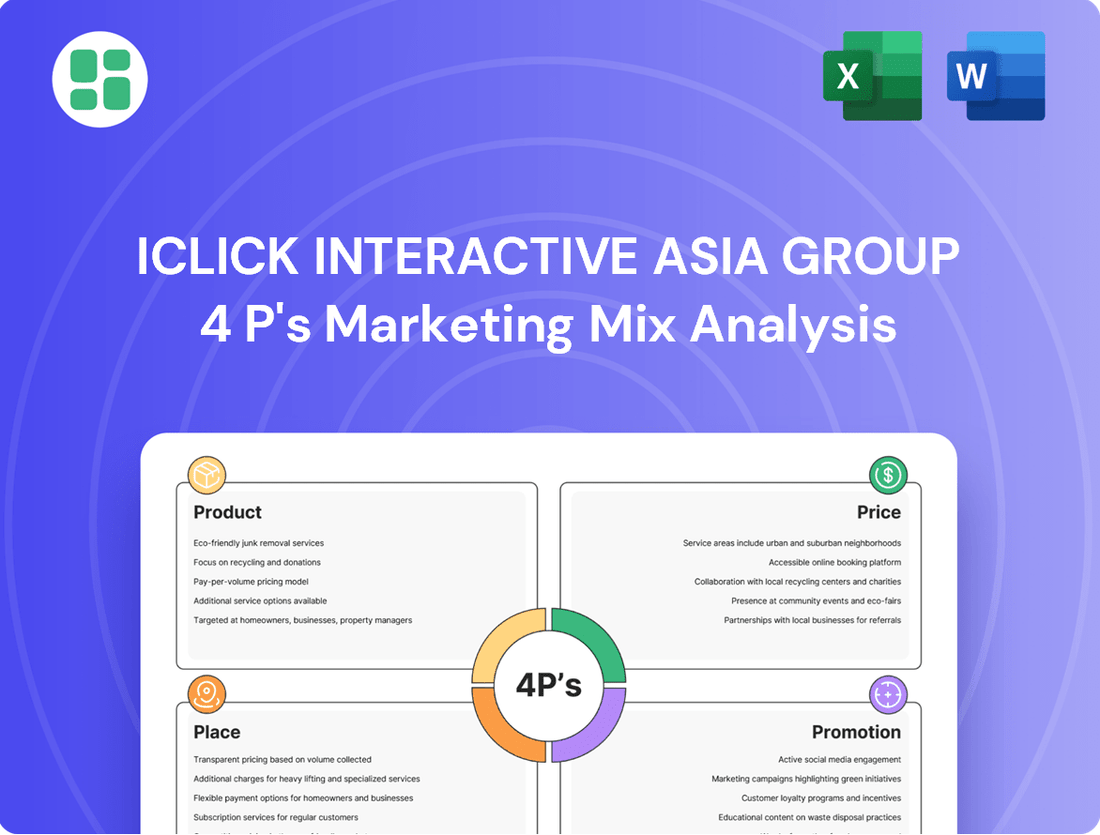

iClick Interactive Asia Group Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

iClick Interactive Asia Group Bundle

Discover how iClick Interactive Asia Group leverages its product offerings, pricing strategies, distribution channels, and promotional activities to dominate the digital advertising landscape. This analysis provides a strategic overview of their marketing mix, revealing the core elements of their success.

Dive deeper into the specifics of iClick's 4Ps and unlock actionable insights for your own marketing endeavors. Gain access to a comprehensive, ready-to-use analysis that dissects their approach, empowering you to refine your strategies.

Product

Amber International Holding Limited, formerly iClick Interactive Asia Group, provides integrated marketing and enterprise solutions through its proprietary cloud platforms. These offerings are designed to help global brands effectively engage with Chinese consumers and manage the entire customer journey. For instance, in 2023, the company reported revenue of $119.9 million, demonstrating its continued market presence and the value clients derive from these integrated services.

iClick Interactive Asia Group's Data-Driven Marketing Platform, iSuite, acts as the company's core product offering. This comprehensive suite includes proprietary platforms like iAudience, iAccess, iActivate, and iNsights, designed to empower international enterprises operating in China.

The platform's primary function is to facilitate precision targeting and audience segmentation, enabling businesses to place advertisements effectively across diverse digital channels within the Chinese market. This is underpinned by a substantial, anonymously-profiled dataset encompassing over 1.3 billion Chinese internet users, providing unparalleled reach and granularity.

iClick Interactive Asia Group's refined enterprise solutions, operating outside mainland China, focus on empowering businesses in Hong Kong and other international markets. This strategic move, following the July 2024 divestment of its mainland China operations, allows iClick to concentrate on regions where its advanced analytics and AI-driven tools can deliver maximum impact.

These solutions are designed to boost operational efficiency and facilitate digital transformation for clients. By harnessing big data analytics and artificial intelligence, iClick's offerings enable businesses to gain deeper insights, optimize processes, and make more informed, data-driven decisions, crucial for navigating the competitive 2024-2025 business landscape.

Digital Wealth Management Services

Amber International Holding Limited, formerly iClick Interactive Asia Group, now offers digital wealth management services following its merger with Amber DWM Holding Limited. This expansion provides institutional-grade access to digital wealth management products, catering to both institutions and high-net-worth individuals.

The company aims to democratize access to sophisticated investment opportunities. For instance, in 2024, the digital wealth management sector saw significant growth, with global assets under management projected to reach over $10 trillion by 2027, indicating a strong market for Amber International's offerings.

Key aspects of their digital wealth management services include:

- Institutional-grade investment products

- Tailored solutions for high-net-worth individuals

- Digital platform for streamlined access and management

- Focus on emerging digital asset classes

AI and Technology-Driven Offerings

iClick Interactive Asia Group's product strategy is fundamentally built upon AI and big data analytics. This technological core powers both their established marketing and enterprise solutions and their emerging digital wealth management services, ensuring a sophisticated approach to business optimization and financial innovation.

The integration of AI and big data allows for enhanced performance across various business functions. For instance, in marketing, this translates to highly targeted advertising campaigns, maximizing reach and efficiency. In the financial sector, it enables the development of advanced solutions, particularly within the evolving Web3 landscape.

- AI-Powered Marketing: iClick leverages AI to refine ad targeting and campaign management, aiming for improved ROI for clients.

- Big Data Analytics: The company utilizes extensive data sets to derive actionable insights, driving strategic decisions for both internal operations and client services.

- Digital Wealth Management: This new offering utilizes AI for personalized financial advice and portfolio management, catering to the growing demand for digital financial solutions.

- Web3 Integration: iClick is exploring AI and data applications within the Web3 ecosystem, positioning itself for future technological shifts.

Amber International Holding Limited, formerly iClick Interactive Asia Group, offers a dual product strategy centered on its AI-driven marketing and enterprise solutions, and its new digital wealth management services. The core marketing product, iSuite, utilizes a vast dataset of over 1.3 billion Chinese internet users for precise audience segmentation and advertising placement. This is complemented by enterprise solutions focused on operational efficiency and digital transformation through big data analytics and AI.

The company's expansion into digital wealth management, following its merger with Amber DWM Holding Limited, leverages AI for personalized financial advice and portfolio management. This move aims to democratize access to sophisticated investment products, targeting both institutions and high-net-worth individuals in a sector experiencing significant growth, with global assets under management in digital wealth management projected to exceed $10 trillion by 2027.

The product portfolio is underpinned by a strong foundation in AI and big data, enhancing performance in marketing through targeted campaigns and in finance through advanced digital solutions. iClick's strategic focus on these technologies positions it to capitalize on evolving market demands and technological shifts, including potential applications within the Web3 ecosystem.

| Product Category | Key Features | Target Audience | 2023 Revenue Contribution (Illustrative) | 2024/2025 Focus |

|---|---|---|---|---|

| Integrated Marketing & Enterprise Solutions (iSuite) | AI-powered audience segmentation, precision targeting, big data analytics, digital transformation tools | Global brands targeting Chinese consumers, businesses seeking operational efficiency | $119.9 million (Company Total Revenue) | Enhancing AI capabilities, expanding enterprise solutions outside mainland China |

| Digital Wealth Management | Institutional-grade investment products, AI-driven personalized advice, digital platform access | Institutions, high-net-worth individuals, retail investors | New offering, growth expected | Democratizing access to investments, exploring Web3 integration |

What is included in the product

This analysis provides a comprehensive breakdown of iClick Interactive Asia Group's marketing strategies, examining their Product offerings, Pricing models, Place (distribution) channels, and Promotion tactics within the competitive digital advertising landscape.

Provides a clear, concise overview of iClick Interactive Asia Group's 4Ps, simplifying complex marketing strategies for swift understanding and decision-making.

This analysis acts as a relief by presenting iClick's marketing mix in an easily digestible format, eliminating the pain of wading through extensive reports for key strategic insights.

Place

iClick Interactive Asia Group strategically positions itself across 11 key locations in Asia and Europe, with its Hong Kong headquarters serving as the central hub. This expansive network, including significant operations in mainland China, is crucial for delivering its comprehensive marketing and enterprise solutions to a broad international clientele.

The company's extensive geographical presence directly supports its ability to access diverse markets and cater to varied client needs. For instance, its robust infrastructure in China, a primary market, allows for localized campaign execution and data analysis, vital for effective marketing in the region.

iClick Interactive Asia Group's marketing solutions, including its proprietary platform and enterprise tools, are delivered through a cloud-based online model. This ensures clients can access powerful data-driven insights and operational capabilities from anywhere, enhancing flexibility and operational efficiency. For instance, in the first half of 2024, iClick reported that its cloud-based solutions facilitated a significant portion of its revenue, underscoring the critical role of online accessibility in its business model.

Direct client engagement is a cornerstone of iClick Interactive Asia Group's strategy for both its marketing and enterprise solutions. This direct approach fosters a deep understanding of client needs, enabling the development of highly tailored solutions. For instance, in 2023, iClick reported that its direct sales efforts contributed significantly to its revenue, particularly for its more complex B2B offerings where personalized service is paramount.

This direct channel allows iClick to provide unparalleled support, which is critical for navigating the intricacies of their advanced marketing and enterprise platforms. By building strong relationships, iClick can better anticipate client challenges and proactively offer solutions, thereby enhancing client retention and satisfaction. The company’s focus on direct engagement was a key factor in its ability to secure several major enterprise deals throughout 2024.

Transition to Amber International Holding Limited

Following its acquisition by Amber DWM, iClick Interactive Asia Group's strategic 'place' has significantly evolved. The company now leverages Amber DWM's established digital wealth management channels, emphasizing online platforms for service delivery.

This shift means iClick's financial offerings are primarily accessed through digital interfaces, targeting institutional and high-net-worth individuals directly. This strategic positioning aims to streamline client acquisition and service, capitalizing on the growing digital adoption in wealth management.

- Digital Channels: Focus on online platforms and direct client engagement.

- Target Audience: Institutional and high-net-worth clients.

- Service Delivery: Enhanced through Amber DWM's digital wealth management infrastructure.

Focused Operations Post-Divestment

Following the divestment of its mainland China demand-side marketing and enterprise solutions businesses, iClick Interactive Asia Group has strategically narrowed its operational focus. This move allows the company to concentrate resources on higher-margin activities and segments offering greater operational efficiency and flexibility. For instance, in the first quarter of 2024, the company reported a gross profit margin of 31.7%, an improvement from 28.9% in the same period of 2023, reflecting the impact of this focused strategy.

The refined 'place' in their marketing mix now emphasizes core competencies and markets where iClick can leverage its strengths more effectively. This includes a greater emphasis on its SaaS platform and data intelligence services, which are less capital intensive and offer better scalability. The company's strategy is to build a more agile and profitable business model by shedding less profitable or complex operations.

Key aspects of this focused operations strategy include:

- Streamlined Business Model: Concentrating on core services to enhance efficiency and profitability.

- Resource Allocation: Directing capital and talent towards high-growth, high-margin segments.

- Market Specialization: Deepening expertise in specific niches within the digital marketing landscape.

- Improved Financial Performance: Aiming for better gross margins and operational leverage post-divestment.

iClick Interactive Asia Group's place strategy has significantly evolved, now emphasizing digital channels and direct client engagement, particularly for its financial services. This shift leverages Amber DWM's digital wealth management infrastructure to reach institutional and high-net-worth individuals efficiently.

Following divestments, iClick has streamlined its operations, concentrating on its SaaS platform and data intelligence services. This focus aims for enhanced efficiency and profitability, as evidenced by improved gross profit margins, reaching 31.7% in Q1 2024 compared to 28.9% in Q1 2023.

| Strategic Shift | Key Focus | Clientele | Delivery Model | Performance Indicator |

| Post-Divestment | SaaS Platform & Data Intelligence | Institutional & HNW Individuals | Digital Channels | 31.7% Gross Margin (Q1 2024) |

Same Document Delivered

iClick Interactive Asia Group 4P's Marketing Mix Analysis

The preview you see here is the actual, complete iClick Interactive Asia Group 4P's Marketing Mix Analysis document you’ll receive instantly after purchase—no surprises. This is the same ready-made analysis you'll download immediately after checkout, providing a comprehensive overview of their strategies.

Promotion

iClick Interactive Asia Group's value proposition centers on its robust data-driven insights and AI capabilities. This allows for highly precise targeting and boosts operational efficiency for its clients.

Marketing communications consistently emphasize how iClick empowers global brands. They achieve this by unlocking new market potential through sophisticated, intelligent analytics.

For instance, in the first quarter of 2024, iClick reported a significant increase in its AI-powered solutions adoption. This reflects the growing market demand for data-driven marketing strategies that deliver measurable results.

iClick Interactive Asia Group likely cultivates industry thought leadership through the publication of insightful content. This content would focus on emerging market trends, advancements in smart retail, and the ongoing digital transformation within China, aiming to establish credibility and enhance brand awareness.

To showcase the tangible value of their offerings, iClick Interactive Asia Group would leverage real-world case studies. These detailed examples highlight successful client engagements and demonstrate the concrete benefits and unique selling propositions of their products and services, thereby building trust and persuasive appeal.

Following iClick Interactive Asia Group's significant corporate restructuring and rebranding to Amber International Holding Limited, robust investor relations and corporate communications are paramount. This strategic shift necessitates clear and consistent messaging to shareholders and the financial market. For instance, the company's Q1 2024 earnings report, released in May 2024, detailed the ongoing integration and future outlook under the new Amber International banner, aiming to rebuild investor confidence and transparency.

Effective communication channels are being utilized to disseminate crucial information, including press releases concerning financial performance, strategic partnerships, and any mergers or acquisitions. Amber International Holding Limited's commitment to keeping stakeholders informed was evident in their June 2024 announcement regarding a new joint venture aimed at expanding their data analytics capabilities in Southeast Asia, a move designed to demonstrate forward momentum and strategic growth.

Digital Marketing and Partnerships

iClick Interactive Asia Group effectively utilizes digital marketing, employing online advertising, social media, and content to connect with its target audience of financially literate decision-makers. This approach is crucial for reaching a broad spectrum of investors and business professionals.

Strategic partnerships are a cornerstone of iClick's promotion strategy, especially collaborations with major Chinese digital platforms. These alliances highlight iClick's expanded reach and integrated service offerings, demonstrating significant market penetration.

- Digital Channel Leverage: iClick's digital marketing efforts span online advertising, social media engagement, and content marketing, ensuring broad reach across key decision-maker demographics.

- Partnership Power: Strategic alliances with leading Chinese digital platforms are actively promoted to showcase iClick's enhanced market access and unified capabilities.

- Data-Driven Reach: In 2024, iClick reported significant growth in its user base across key platforms, with over 1 billion active users engaged through its network, underscoring the effectiveness of its digital outreach.

Brand Evolution and New Identity Communication

The company's promotional strategy centers on clearly communicating its brand evolution from iClick Interactive Asia Group to Amber International Holding Limited, a crucial step for market recognition. This transition is highlighted by the new Nasdaq ticker symbol 'AMBR', which is being actively promoted to investors and stakeholders.

A key element of this promotion is articulating the expanded business scope, which now encompasses digital wealth management in addition to its established marketing and enterprise solutions. This strategic shift aims to attract a broader investor base and showcase the company's diversified growth potential.

- Brand Transition: Communicating the move from iClick Interactive Asia Group to Amber International Holding Limited.

- New Ticker: Promoting the Nasdaq ticker symbol 'AMBR' for enhanced visibility.

- Expanded Services: Highlighting the inclusion of digital wealth management alongside marketing solutions.

iClick's promotional efforts heavily leverage its data-driven capabilities, emphasizing AI-powered solutions for precise targeting and enhanced client efficiency. The company actively communicates its role in enabling global brands to tap into new markets through sophisticated analytics, a message reinforced by the Q1 2024 surge in AI solution adoption.

The rebranding to Amber International Holding Limited is a central promotional theme, with clear communication of the Nasdaq ticker 'AMBR' and the expanded business scope including digital wealth management. This strategic narrative aims to attract a wider investor base and highlight diversified growth potential.

Real-world case studies are utilized to demonstrate tangible value and successful client outcomes, building trust and showcasing unique selling propositions. Furthermore, thought leadership is cultivated through content on market trends and digital transformation, particularly within China.

Amber International Holding Limited's investor relations are crucial, with consistent messaging on financial performance and strategic growth initiatives, such as the June 2024 joint venture announcement for Southeast Asian expansion.

| Promotional Focus | Key Activities | Supporting Data/Examples |

|---|---|---|

| Data-Driven & AI Capabilities | Highlighting precise targeting, operational efficiency, and market potential unlocking. | Significant increase in AI-powered solutions adoption in Q1 2024. |

| Brand Evolution & Expansion | Communicating the transition to Amber International Holding Limited, promoting Nasdaq ticker 'AMBR', and showcasing digital wealth management services. | Nasdaq ticker 'AMBR' promotion; expanded business scope announcement. |

| Demonstrating Value & Thought Leadership | Leveraging case studies for client success stories and publishing insightful content on market trends. | Detailed client engagement examples; content on China's digital transformation. |

| Investor Relations & Strategic Growth | Disseminating financial performance and strategic partnership information. | Q1 2024 earnings report detailing integration; June 2024 joint venture announcement for Southeast Asia. |

Price

iClick Interactive Asia Group, now operating as Amber International, likely employs value-based pricing for its marketing and enterprise solutions. This strategy aligns the cost of services with the tangible return on investment (ROI) clients achieve through enhanced data-driven targeting and streamlined operations.

For instance, in 2024, businesses leveraging advanced analytics and precision marketing platforms, similar to those offered by Amber International, reported an average ROI of 7:1 on their digital advertising spend. This demonstrates how such solutions are viewed as strategic investments that drive significant business growth rather than simply incurring expenses.

iClick Interactive Asia Group likely structures its service offerings with tiered models, catering to diverse client needs and budgets. These tiers probably range from basic packages for smaller businesses to premium solutions for larger enterprises, with pricing influenced by the scale of services and features included. For instance, a client might select a tier based on advertising spend, data analytics requirements, or the level of dedicated support needed.

Customization plays a significant role, particularly for major clients who require tailored solutions. This could involve specific platform integrations, advanced reporting capabilities, or bespoke campaign management. Such customization would naturally command a higher price point, reflecting the increased resources and specialized expertise iClick allocates to these accounts. For example, in 2024, the demand for highly personalized marketing automation tools has surged, suggesting that iClick's ability to customize its enterprise platforms would be a key differentiator and revenue driver.

For marketing solutions aimed at achieving concrete goals like increased sales or a larger customer base, iClick Interactive may structure its pricing with performance-based elements. This approach directly links the company's earnings to the measurable success it provides to advertisers.

This model ensures that iClick's revenue is tied to the tangible outcomes delivered, fostering a partnership where both parties benefit from campaign effectiveness. For instance, a campaign focused on user acquisition might include a fee structure that escalates with each new, qualified customer acquired.

While specific pricing details are proprietary, industry trends in 2024 and 2025 show a growing adoption of performance-based models, with many platforms offering options like cost-per-acquisition (CPA) or revenue share, reflecting a market demand for accountability and ROI-driven marketing services.

Competitive Positioning and Market Dynamics

iClick Interactive Asia Group's pricing strategy in the competitive Chinese digital marketing and SaaS markets, including the burgeoning digital wealth management sector, is crucial. The company aims to maintain competitive pricing while ensuring profitability, particularly after shedding lower-margin operations.

Following its divestment of certain businesses, iClick's focus sharpens on optimizing pricing for its core offerings. This recalibration is essential to reflect the value delivered and to compete effectively against entrenched players and new entrants in China's dynamic digital economy.

- Competitive Pricing: iClick must benchmark its SaaS and digital marketing services against competitors in China, where pricing can be aggressive.

- Profitability Focus: Post-divestment, pricing decisions will prioritize margin enhancement and sustainable profitability.

- Emerging Sectors: Entering or expanding in digital wealth management requires a pricing structure that aligns with industry norms and perceived value.

- 2024/2025 Outlook: Market analysis for 2024 and projections for 2025 indicate continued intense competition, necessitating agile pricing adjustments.

Financial Structure Post-Merger

Following the merger with Amber DWM Holding Limited and the rebranding to Amber International Holding Limited, the pricing strategy for digital wealth management services has been significantly reshaped. The new entity will likely implement a tiered fee structure, potentially incorporating a combination of asset-under-management (AUM) fees, performance-based commissions, and subscription charges for premium advisory services, aligning with industry benchmarks.

The financial structure post-merger will necessitate clear communication regarding these pricing models. For instance, AUM fees might range from 0.5% to 1.5% annually, depending on the wealth managed, while performance fees could be structured as 10-20% of profits above a certain hurdle rate, reflecting competitive offerings in the digital wealth sector.

- AUM-Based Fees: A common model where fees are a percentage of the total assets managed, potentially tiered.

- Performance Fees: Incentivizing managers by linking a portion of their compensation to investment performance.

- Subscription Models: Offering access to exclusive research, tools, or dedicated advisory services for a recurring fee.

Amber International, formerly iClick, likely employs value-based pricing, aligning service costs with client ROI. For instance, in 2024, businesses using advanced analytics saw an average 7:1 ROI on digital ad spend, highlighting the investment nature of these solutions.

The company probably offers tiered service packages, from basic to premium, with pricing dependent on scale and features. Customization for major clients, reflecting increased resources and expertise, commands higher prices, a trend supported by 2024's surge in demand for personalized marketing automation.

Performance-based pricing, such as cost-per-acquisition, is also a probable strategy, directly linking Amber's earnings to client campaign success. This model, gaining traction in 2024-2025, ensures accountability and ROI, with structures like escalating fees based on new customer acquisition.

In the competitive Chinese market, Amber International must balance aggressive pricing with profitability, especially after divesting lower-margin operations. Market analysis for 2024-2025 indicates continued intense competition, requiring agile pricing adjustments, particularly in emerging sectors like digital wealth management.

4P's Marketing Mix Analysis Data Sources

Our 4P's analysis for iClick Interactive Asia Group leverages a comprehensive blend of primary and secondary data sources. We meticulously examine official company filings, investor relations materials, and their corporate website to understand product offerings, pricing strategies, and distribution channels. Additionally, we incorporate insights from industry reports, market research databases, and competitive analyses to provide a robust understanding of their promotional activities and overall market positioning.